Guest Post by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

The stock market has favored growth stocks, and has not been kind to defensive stocks in the first half of the year. Utilities, Health Care, Consumer Staples, and Energy have been mediocre at best.

But there are still risks to consider.

Inflation could be stickier, and the Fed could be more hawkish than currently anticipated. Many economists are still predicting a recession later this year or early next year.

For this reason, Sure Dividend recommends investors buy high-quality dividend stocks such as the Dividend Aristocrats, a group of 68 stocks in the S&P 500 Index that have raised their dividends for at least 25 consecutive years.

You can download the full Dividend Aristocrats list by clicking on the link below:

Even if a recession does not happen, it’s reasonable to expect that the economy will slow in the second half of the year.

The relative performance of defensive stocks historically thrives in a slowing economy. If the rally broadens in such an environment, it will need participation from the defensive sectors. If the market pulls back, defense should be the best place to be.

Sector performance tends to rotate. Things might look a whole lot different by the end of the year. In the meantime, many of these stocks are undervalued ahead of a likely period of relative outperformance.

Here are two great defensive stocks to consider picking up.

Defensive Dividend Stock #1: Brookfield Infrastructure Corporation (BIPC)

- Dividend Yield: 4.2%

Bermuda-based Brookfield Infrastructure Corporation owns and operates infrastructure assets all over the world. The company focuses on high-quality, long-life properties that generate stable cash flows, have low maintenance expenses and are virtual monopolies with high barriers to entry.

Infrastructure is defined as the basic physical structures and facilities needed for the operation of a society or enterprise. It includes things like roads, power supplies and water facilities.

Not only are these some of the most defensive and reliable income-generating assets on the planet but infrastructure is rapidly becoming a popular subsector.

The world is in desperate need of updated infrastructure. The private sector is filling the need as governments don’t have all those trillions lying around.

Limited partnerships, giant sovereign-wealth funds, and multilateral and development-finance institutions are raising billions of dollars a year for infrastructure investments. It’s almost becoming a new asset class.

As one of the very few tested and tried hands, Brookfield is right there. It’s been successfully acquiring and managing these properties for more than a decade in a way that delivers for shareholders.

Since its IPO in 2008, the original BIP has provided a total return of 679% (with dividends reinvested) compared to a return of 440% for the S&P 500 over the same period. And those returns came with considerably less risk and volatility than the overall market.

Brookfield operates a current portfolio of over 1,000 properties in more than 30 countries on five continents.

Source: Investor Presentation

The company operates four segments: Utilities (30%), Transport (30%), Midstream (30%) and Data (10%).

Assets include:

- Toll roads in South America

- Telecom towers in India and France

- Railroads in Australia and North America

- Utilities in Brazil

- Natural gas pipelines in North America

- Ports in Europe, Australia and North America

- Data centers on five continents

The dividend is rock solid with a history of steady growth, and the payout was recently raised by 6% on strong earnings.

BIPC is a good long-term investment anytime, as the above numbers illustrate, but it is particularly attractive now because it’s relatively cheap and can well navigate both inflation and recession.

Roughly 85% of revenues are hedged to inflation with automatic adjustments built into its long-term contracts and its crucial service assets are very recession resistant, and earnings should remain strong.

It also helps that the stock pays a solid and growing dividend.

Defensive Dividend Stock #2: NextEra Energy, Inc. (NEE)

- Dividend Yield: 2.9%

Utility stocks fill a great niche in any investment portfolio, especially in an economy and market this uncertain. The sector is the most defensive on the market as earnings are virtually immune to economic cycles. Stocks also pay high dividends and typically hold up very well in down markets.

NextEra Energy provides all those advantages plus exposure to the fast-growing and highly sought-after alternative energy market.

NextEra Energy is the world’s largest utility. It’s a monster with over $20 billion in annual revenue and a $147 billion market capitalization.

Ordinarily, when you think of a huge utility you probably think it has lackluster growth and a stable dividend. But that’s not true in this case. Earnings growth and stock returns have well exceeded what is normally expected of a utility.

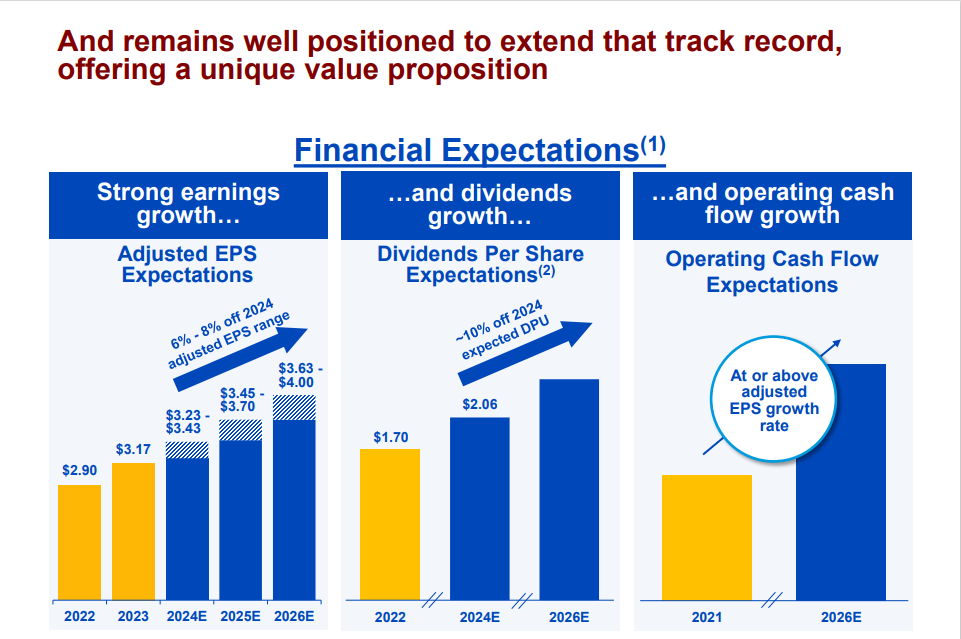

Source: Investor Presentation

For the last 15-, 10-, and five-year periods, NEE has not only vastly outperformed the Utility Index. It has also blown away the returns of the overall market.

How can that be?

It’s because it isn’t a regular utility. NEE is two companies in one. It owns Florida Power and Light Company, which is one of the very best regulated utilities in the country, accounting for about 55% of revenues.

It also owns NextEra Energy Resources, the world’s largest generator of renewable energy from wind and solar and a world leader in battery storage. It accounts for about 45% of earnings and provides a higher level of growth.

Florida Power and Light is the largest regulated utility in the U.S. It has about 6 million customers in Florida. It is one of the very best electrical utilities in the country. There are a few good reasons why Florida is a great place to operate a utility.

The state has a growing population. Utilities have a limited geographical range, and a stagnant population can make it tough to grow. Plus, it is one of the most regulatorily friendly areas in the country. That’s huge for getting approvals for periodic expansions and price hikes. It also doesn’t hurt that Floridians run their air conditioners like crazy, and just about all year long.

The alternative energy company, NextEra Energy Resources, is the world’s largest generator of renewable energy from wind and solar. Alternative energy is the future, and this company is at the top of the heap. The government and regulators love them for it. It’s also a huge benefit that the cost of clean energy generation constantly gets cheaper as technology advances.

NEE has been on fire since early March and has soared 40% since. That’s a big move in a short time for a utility stock. The company posted solid earnings in the recent quarter, which also added to the stock’s revitalization. I expect solid performance going forward over the longer term, but it may have peaked in the short term after such a fast run higher.

These two defensive stocks both look attractive in a choppy market.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more