Updated on December 4th, 2025 by Bob Ciura

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

For this reason, we created a full list of 83 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

In addition, stocks that have high dividend yields are also attractive for income investors.

With the average S&P 500 yield hovering around 1.3%, investors can generate much more income with high-yield stocks. Screening for monthly dividend stocks that also have high dividend yields makes for an appealing combination.

This article will list the 20 highest-yielding monthly dividend stocks.

Table Of Contents

The following 20 monthly dividend stocks have high dividend yields above 5%. Stocks are listed by their dividend yields, from lowest to highest.

The list excludes oil and gas royalty trust, which have extreme fluctuations in their dividend payouts from one quarter to the next due to the underlying volatility of commodity prices.

You can instantly jump to an individual section of the article by utilizing the links below:

- High-Yield Monthly Dividend Stock #20: Atrium Mortgage Investment Corp. (AMIVF)

- High-Yield Monthly Dividend Stock #19: InPlay Oil Corp. (IPOOF)

- High-Yield Monthly Dividend Stock #18: SIR Royalty Income Fund (SIRZF)

- High-Yield Monthly Dividend Stock #17: Gladstone Capital (GLAD)

- High-Yield Monthly Dividend Stock #16: Firm Capital Property Trust (FRMUF)

- High-Yield Monthly Dividend Stock #15: Timbercreek Financial Corp. (TBCRF)

- High-Yield Monthly Dividend Stock #14: Bridgemarq Real Estate (BREUF)

- High-Yield Monthly Dividend Stock #13: Capital Southwest Corp. (CSWC)

- High-Yield Monthly Dividend Stock #12: Gladstone Commercial (GOOD)

- High-Yield Monthly Dividend Stock #11: Ellington Financial (EFC)

- High-Yield Monthly Dividend Stock #10: Stellus Capital (SCM)

- High-Yield Monthly Dividend Stock #9: PennantPark Floating Rate Capital (PFLT)

- High-Yield Monthly Dividend Stock #8: AGNC Investment Corporation (AGNC)

- High-Yield Monthly Dividend Stock #7: Dynex Capital (DX)

- High-Yield Monthly Dividend Stock #6: ARMOUR Residential REIT (ARR)

- High-Yield Monthly Dividend Stock #5: Ellington Credit Co. (EARN)

- High-Yield Monthly Dividend Stock #4: Orchid Island Capital (ORC)

- High-Yield Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

- High-Yield Monthly Dividend Stock #2: Prospect Capital (PSEC)

- High-Yield Monthly Dividend Stock #1: Oxford Square Capital (OXSQ)

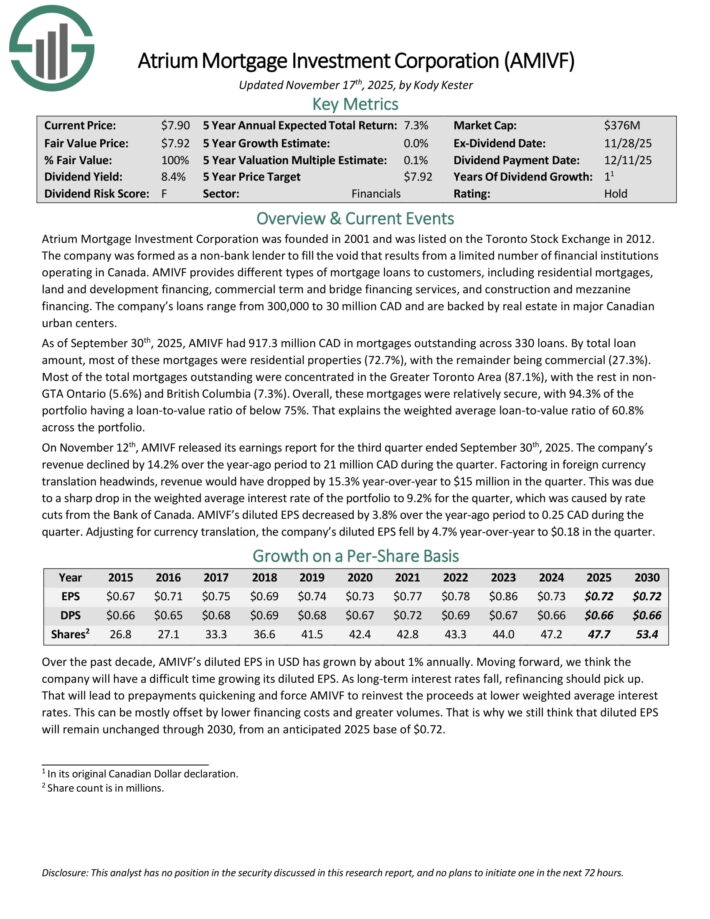

High-Yield Monthly Dividend Stock #20: Atrium Mortgage Investment Corp. (AMIVF)

- Dividend Yield: 8.1%

Atrium Mortgage Investment Corporation was founded in 2001 and was listed on the Toronto Stock Exchange in 2012. AMIVF provides different types of mortgage loans to customers, including residential mortgages, land and development financing, commercial term and bridge financing services, and construction and mezzanine financing.

As of September 30th, 2025, AMIVF had 917.3 million CAD in mortgages outstanding across 330 loans. By total loan amount, most of these mortgages were residential properties (72.7%), with the remainder being commercial (27.3%).

Most of the total mortgages outstanding were concentrated in the Greater Toronto Area (87.1%), with the rest in non-GTA Ontario (5.6%) and British Columbia (7.3%).

Overall, these mortgages were relatively secure, with 94.3% of the portfolio having a loan-to-value ratio of below 75%. That explains the weighted average loan-to-value ratio of 60.8% across the portfolio.

On November 12th, AMIVF released its earnings report for the third quarter ended September 30th, 2025. The company’s revenue declined by 14.2% over the year-ago period to 21 million CAD during the quarter.

Factoring in foreign currency translation headwinds, revenue would have dropped by 15.3% year-over-year to $15 million in the quarter. This was due to a sharp drop in the weighted average interest rate of the portfolio to 9.2% for the quarter, which was caused by rate cuts from the Bank of Canada.

AMIVF’s diluted EPS decreased by 3.8% over the year-ago period to 0.25 CAD during the quarter. Adjusting for currency translation, the company’s diluted EPS fell by 4.7% year-over-year to $0.18 in the quarter.

Click here to download our most recent Sure Analysis report on AMIVF (preview of page 1 of 3 shown below):

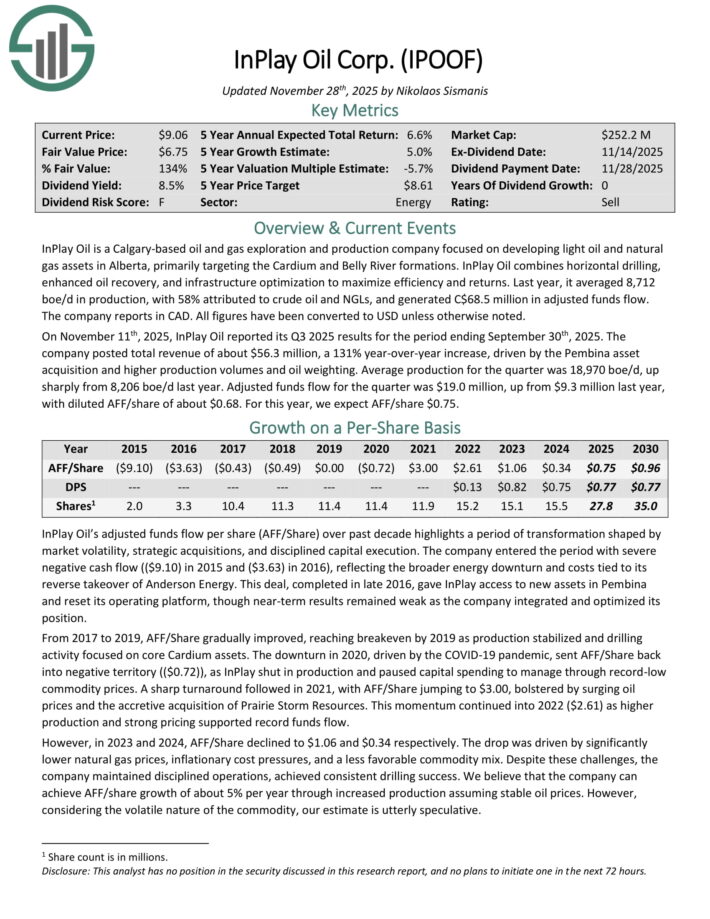

High-Yield Monthly Dividend Stock #19: InPlay Oil Corp. (IPOOF)

- Dividend Yield: 8.3%

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations. InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns.

Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

InPlay Oil is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily targeting the Cardium and Belly River formations.

InPlay Oil combines horizontal drilling, enhanced oil recovery, and infrastructure optimization to maximize efficiency and returns. Last year, it averaged 8,712 boe/d in production, with 58% attributed to crude oil and NGLs, and generated C$68.5 million in adjusted funds flow.

On November 11th, 2025, InPlay Oil reported its Q3 2025 results. The company posted total revenue of about $56.3 million, a 131% year-over-year increase, driven by the Pembina asset acquisition and higher production volumes and oil weighting.

Average production for the quarter was 18,970 boe/d, up sharply from 8,206 boe/d last year. Adjusted funds flow for the quarter was $19.0 million, up from $9.3 million last year, with diluted AFF/share of about $0.68.

Click here to download our most recent Sure Analysis report on IPOOF (preview of page 1 of 3 shown below):

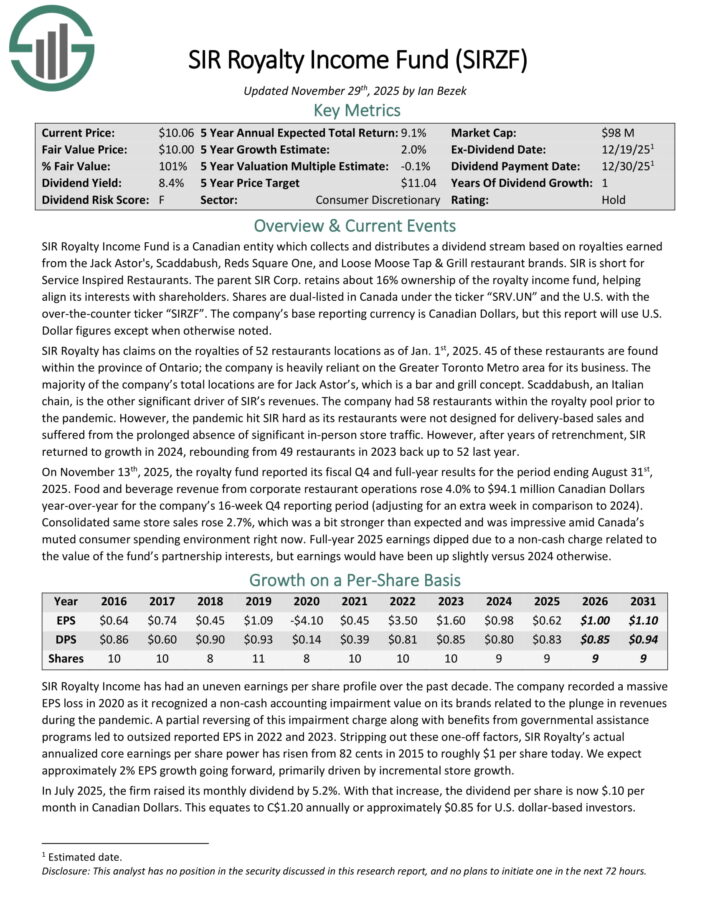

High-Yield Monthly Dividend Stock #18: SIR Royalty Income Fund (SIRZF)

- Dividend Yield: 8.4%

SIR Royalty Income Fund is a Canadian entity which collects and distributes a dividend stream based on royalties earned from the Jack Astor’s, Scaddabush, Reds Square One, and Loose Moose Tap & Grill restaurant brands.

The parent SIR Corp. retains about 16% ownership of the royalty income fund, helping align its interests with shareholders.

SIR Royalty has claims on the royalties of 52 restaurants locations as of Jan. 1st, 2025. 45 of these restaurants are found within the province of Ontario; the company is heavily reliant on the Greater Toronto Metro area for its business.

The majority of the company’s total locations are for Jack Astor’s, which is a bar and grill concept. Scaddabush, an Italian chain, is the other significant driver of SIR’s revenues.

On November 13th, 2025, the royalty fund reported its fiscal Q4 and full-year results. Food and beverage revenue from corporate restaurant operations rose 4.0% to $94.1 million Canadian Dollars year-over-year for the company’s 16-week Q4 reporting period (adjusting for an extra week in comparison to 2024).

Consolidated same store sales rose 2.7%, which was a bit stronger than expected and was impressive amid Canada’s muted consumer spending environment right now.

Click here to download our most recent Sure Analysis report on SIRZF (preview of page 1 of 3 shown below):

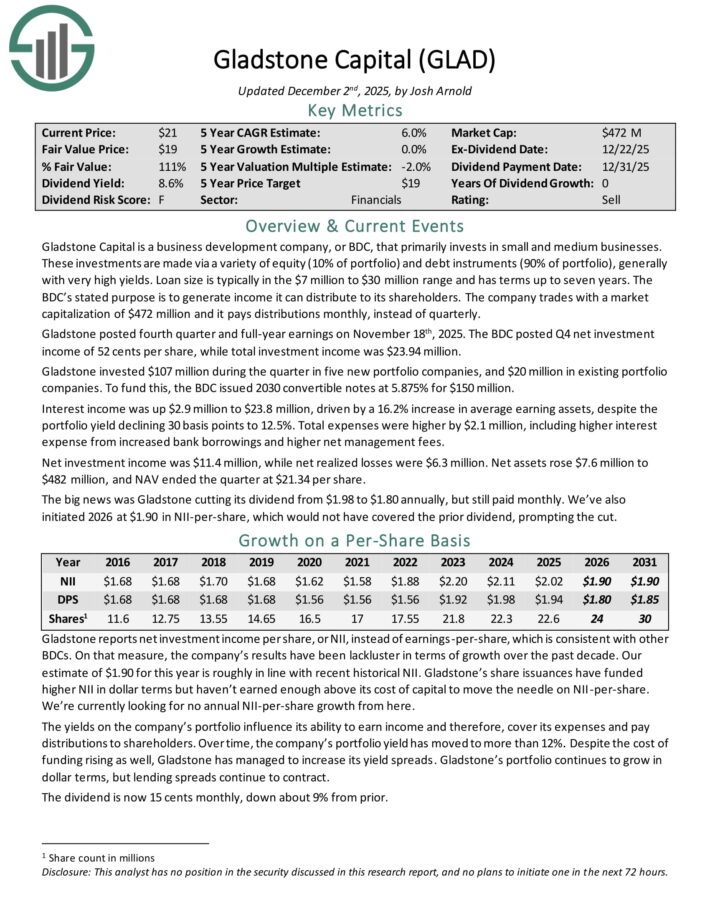

High-Yield Monthly Dividend Stock #17: Gladstone Capital Corp. (GLAD)

- Dividend Yield: 8.5%

Gladstone Capital is a business development company, or BDC, that primarily invests in small and medium businesses. These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields.

Loan size is typically in the $7 million to $30 million range and has terms up to seven years. The BDC’s stated purpose is to generate income it can distribute to its shareholders.

Gladstone posted fourth quarter and full-year earnings on November 18th, 2025. The BDC posted Q4 net investment income of 52 cents per share, while total investment income was $23.94 million.

Gladstone invested $107 million during the quarter in five new portfolio companies, and $20 million in existing portfolio companies. To fund this, the BDC issued 2030 convertible notes at 5.875% for $150 million.

Interest income was up $2.9 million to $23.8 million, driven by a 16.2% increase in average earning assets, despite the portfolio yield declining 30 basis points to 12.5%. Total expenses were higher by $2.1 million, including higher interest expense from increased bank borrowings and higher net management fees.

Net investment income was $11.4 million, while net realized losses were $6.3 million. Net assets rose $7.6 million to $482 million, and NAV ended the quarter at $21.34 per share.

Click here to download our most recent Sure Analysis report on GLAD (preview of page 1 of 3 shown below):

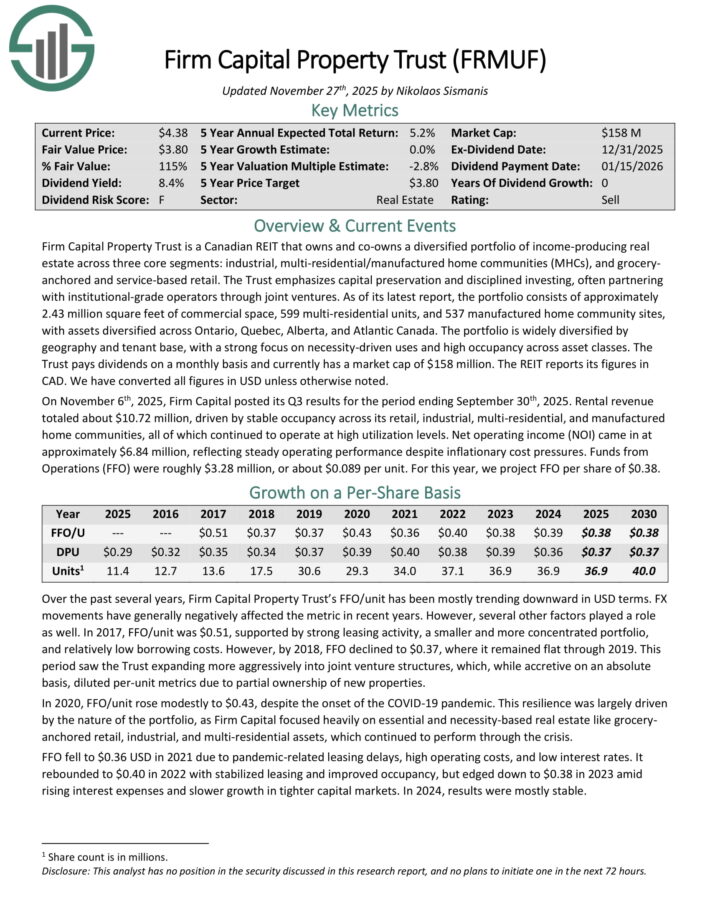

High-Yield Monthly Dividend Stock #16: Firm Capital Property Trust (FRMUF)

- Dividend Yield: 8.8%

Firm Capital Property Trust is a Canadian REIT that owns and co-owns a diversified portfolio of income-producing real estate across three core segments: industrial, multi-residential/manufactured home communities (MHCs), and grocery anchored and service-based retail.

The Trust emphasizes capital preservation and disciplined investing, often partnering with institutional-grade operators through joint ventures.

As of its latest report, its portfolio has over 2.5 million square feet of commercial space, alongside nearly 600 apartment units and 537 MHC sites, with properties located in necessity based markets across Ontario, Quebec, Alberta, and the Maritimes.

On November 6th, 2025, Firm Capital posted its Q3 results. Rental revenue totaled about $10.72 million, driven by stable occupancy across its retail, industrial, multi-residential, and manufactured home communities, all of which continued to operate at high utilization levels.

Net operating income (NOI) came in at approximately $6.84 million, reflecting steady operating performance despite inflationary cost pressures. Funds from Operations (FFO) were roughly $3.28 million, or about $0.089 per unit.

Click here to download our most recent Sure Analysis report on FRMUF (preview of page 1 of 3 shown below):

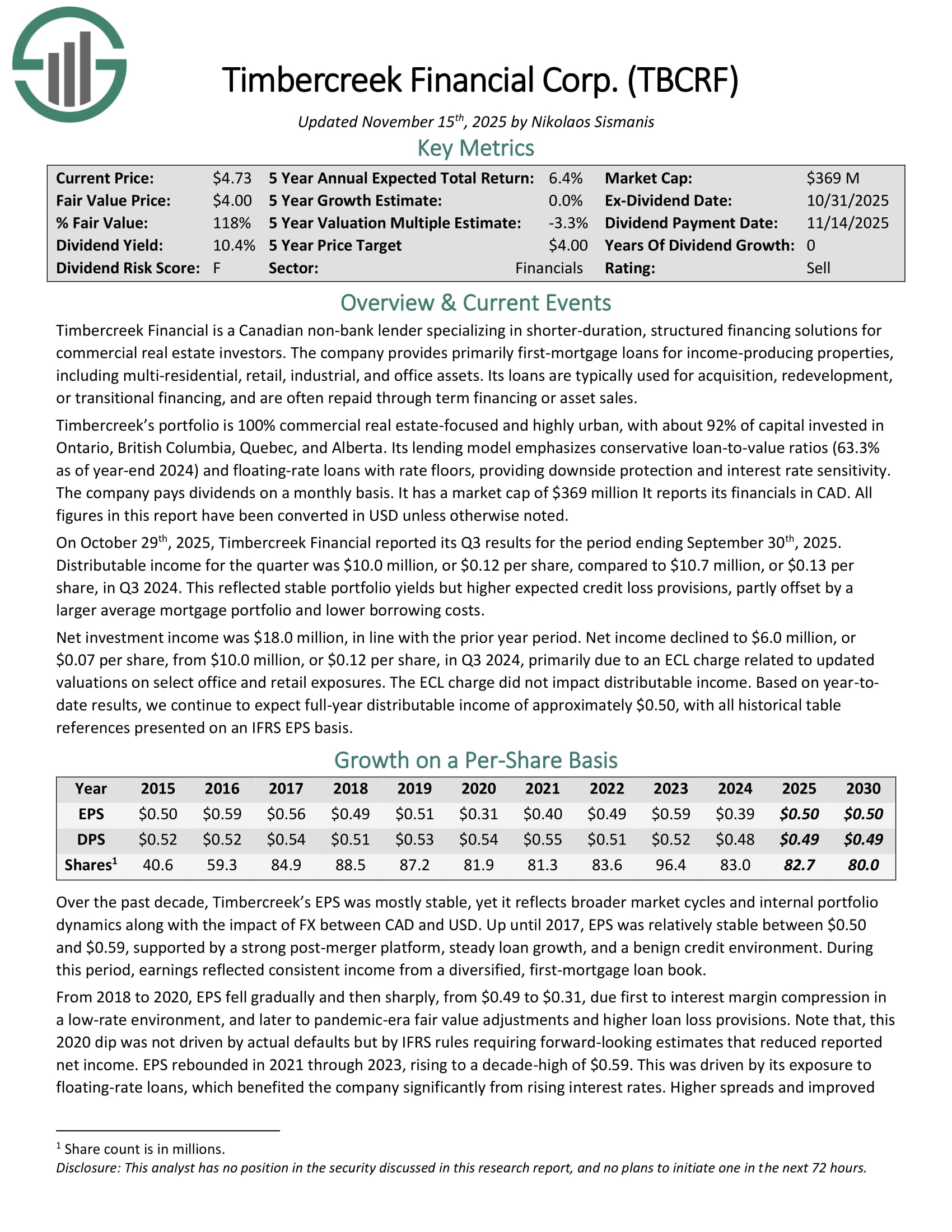

High-Yield Monthly Dividend Stock #15: Timbercreek Financial Corp. (TBCRF)

- Dividend Yield: 10.2%

Timbercreek Financial is a Canadian non-bank lender specializing in shorter-duration, structured financing solutions for commercial real estate investors.

The company provides primarily first-mortgage loans for income-producing properties, including multi-residential, retail, industrial, and office assets. Its loans are typically used for acquisition, redevelopment, or transitional financing, and are often repaid through term financing or asset sales.

Timbercreek’s portfolio is 100% commercial real estate-focused and highly urban, with about 92% of capital invested in Ontario, British Columbia, Quebec, and Alberta.

On October 29th, 2025, Timbercreek Financial reported its Q3 results. Distributable income for the quarter was $10.0 million, or $0.12 per share, compared to $10.7 million, or $0.13 per share, in Q3 2024.

This reflected stable portfolio yields but higher expected credit loss provisions, partly offset by a larger average mortgage portfolio and lower borrowing costs.

Net investment income was $18.0 million, in line with the prior year period. Net income declined to $6.0 million, or $0.07 per share, from $10.0 million, or $0.12 per share, in Q3 2024, primarily due to an ECL charge related to updated valuations on select office and retail exposures. The ECL charge did not impact distributable income.

Click here to download our most recent Sure Analysis report on TBCRF (preview of page 1 of 3 shown below):

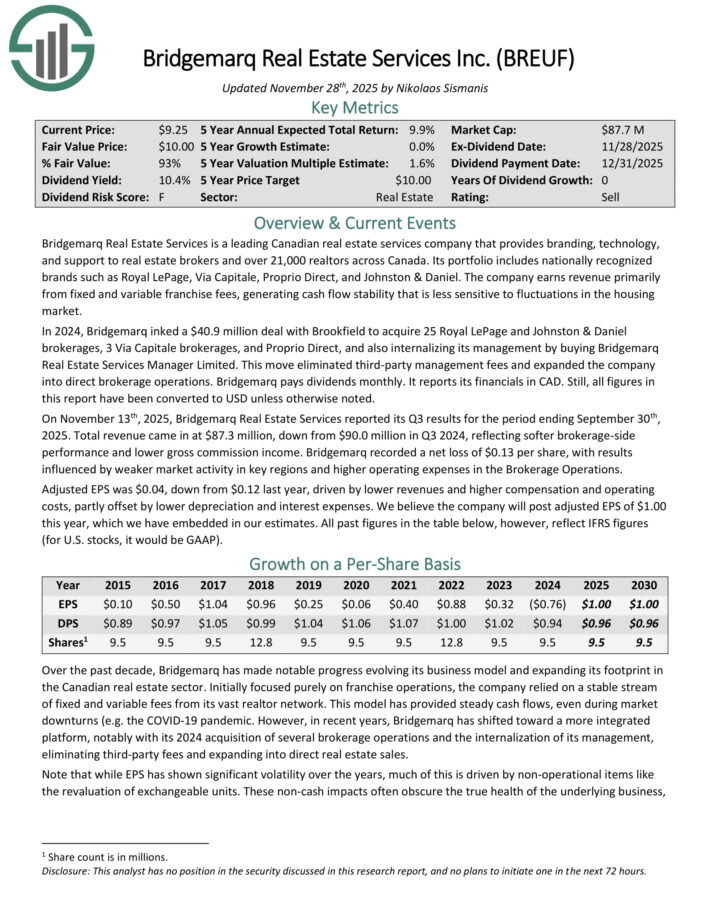

High-Yield Monthly Dividend Stock #14: Bridgemarq Real Estate (BREUF)

- Dividend Yield: 10.3%

Bridgemarq Real Estate Services is a leading Canadian real estate services company that provides branding, technology, and support to real estate brokers and over 21,000 realtors across Canada.

Its portfolio includes nationally recognized brands such as Royal LePage, Via Capitale, Proprio Direct, and Johnston & Daniel.

The company earns revenue primarily from fixed and variable franchise fees, generating cash flow stability that is less sensitive to fluctuations in the housing market.

On November 13th, 2025, Bridgemarq Real Estate Services reported its Q3 results for the period ending September 30th, 2025. Total revenue came in at $87.3 million, down from $90.0 million in Q3 2024, reflecting softer brokerage-side performance and lower gross commission income.

Bridgemarq recorded a net loss of $0.13 per share, with results influenced by weaker market activity in key regions and higher operating expenses in the Brokerage Operations.

Adjusted EPS was $0.04, down from $0.12 last year, driven by lower revenues and higher compensation and operating costs, partly offset by lower depreciation and interest expenses.

Click here to download our most recent Sure Analysis report on BREUF (preview of page 1 of 3 shown below):

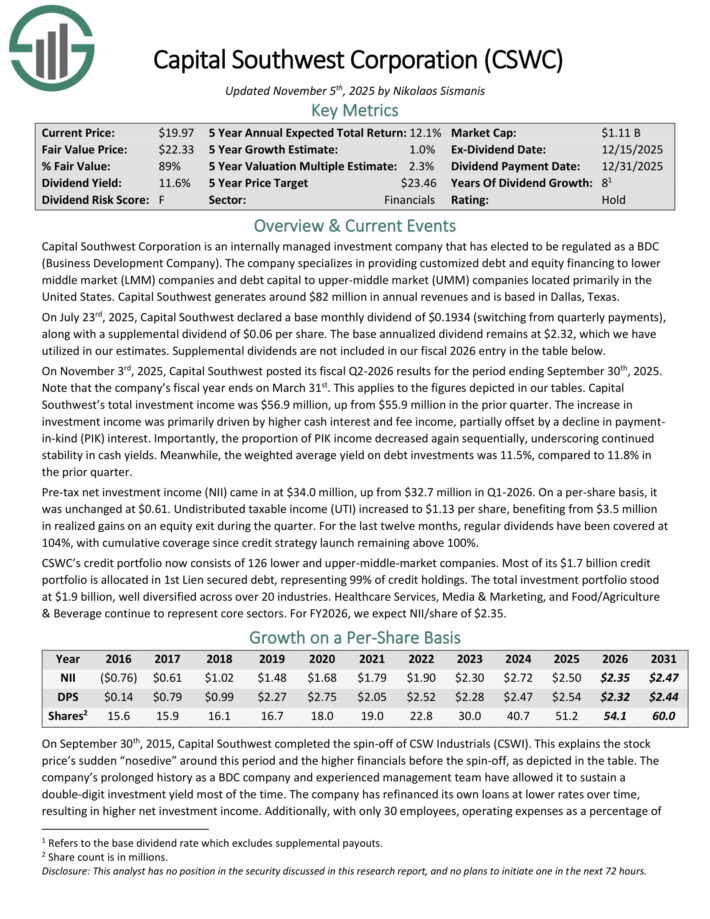

High-Yield Monthly Dividend Stock #13: Capital Southwest Corp. (CSWC)

- Dividend Yield: 10.6%

Capital Southwest Corporation is an internally managed investment company that has elected to be regulated as a BDC.

The company specializes in providing customized debt and equity financing to lower middle market (LMM) companies and debt capital to upper-middle market (UMM) companies located primarily in the United States. Capital Southwest generates around $82 million in annual revenue.

On November 3rd, 2025, Capital Southwest posted its fiscal Q2-2026 results for the period ending September 30th, 2025. Total investment income was $56.9 million, up from $55.9 million in the prior quarter.

The increase in investment income was primarily driven by higher cash interest and fee income, partially offset by a decline in payment-in-kind (PIK) interest.

The proportion of PIK income decreased again sequentially, underscoring continued stability in cash yields. Meanwhile, the weighted average yield on debt investments was 11.5%, compared to 11.8% in the prior quarter.

Pre-tax net investment income (NII) came in at $34.0 million, up from $32.7 million in Q1-2026. On a per-share basis, it was unchanged at $0.61. Undistributed taxable income (UTI) increased to $1.13 per share, benefiting from $3.5 million in realized gains on an equity exit during the quarter.

Click here to download our most recent Sure Analysis report on CSWC (preview of page 1 of 3 shown below):

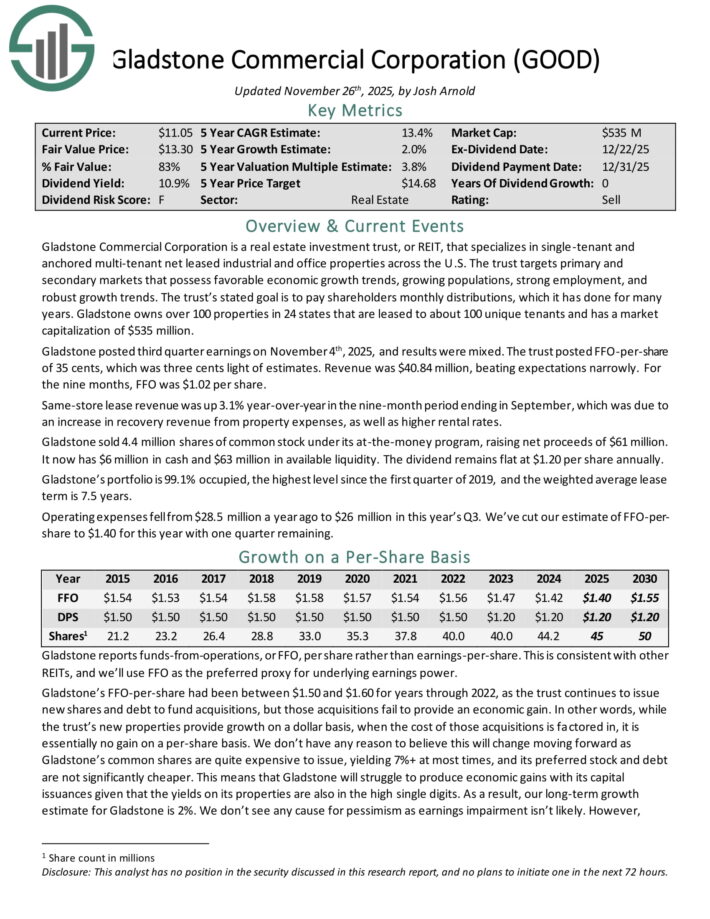

High-Yield Monthly Dividend Stock #12: Gladstone Commercial (GOOD)

- Dividend Yield: 11.1%

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S.

The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants.

Gladstone posted third quarter earnings on November 4th, 2025, and results were mixed. The trust posted FFO-per-share of 35 cents, which was three cents light of estimates. Revenue was $40.84 million, beating expectations narrowly. For the nine months, FFO was $1.02 per share.

Same-store lease revenue was up 3.1% year-over-year in the nine-month period ending in September, which was due to an increase in recovery revenue from property expenses, as well as higher rental rates.

Gladstone sold 4.4 million shares of common stock under its at-the-money program, raising net proceeds of $61 million. It now has $6 million in cash and $63 million in available liquidity.

The dividend remains flat at $1.20 per share annually. Gladstone’s portfolio is 99.1% occupied, the highest level since the first quarter of 2019, and the weighted average lease term is 7.5 years.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

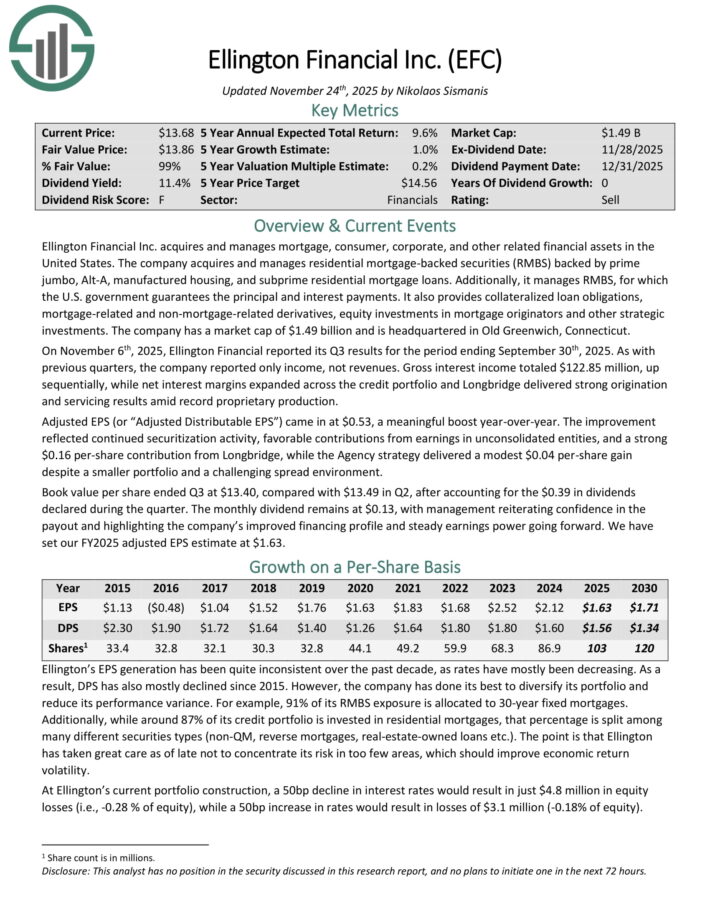

High-Yield Monthly Dividend Stock #11: Ellington Financial (EFC)

- Dividend Yield: 11.4%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States.

The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

On November 6th, 2025, Ellington Financial reported its Q3 results. As with previous quarters, the company reported only income, not revenues.

Gross interest income totaled $122.85 million, up sequentially, while net interest margins expanded across the credit portfolio and Longbridge delivered strong origination and servicing results amid record proprietary production. Adjusted EPS came in at $0.53, a meaningful boost year-over-year.

The improvement reflected continued securitization activity, favorable contributions from earnings in unconsolidated entities, and a strong $0.16 per-share contribution from Longbridge, while the Agency strategy delivered a modest $0.04 per-share gain despite a smaller portfolio and a challenging spread environment.

Book value per share ended Q3 at $13.40, compared with $13.49 in Q2.

Click here to download our most recent Sure Analysis report on Ellington Financial (EFC) (preview of page 1 of 3 shown below):

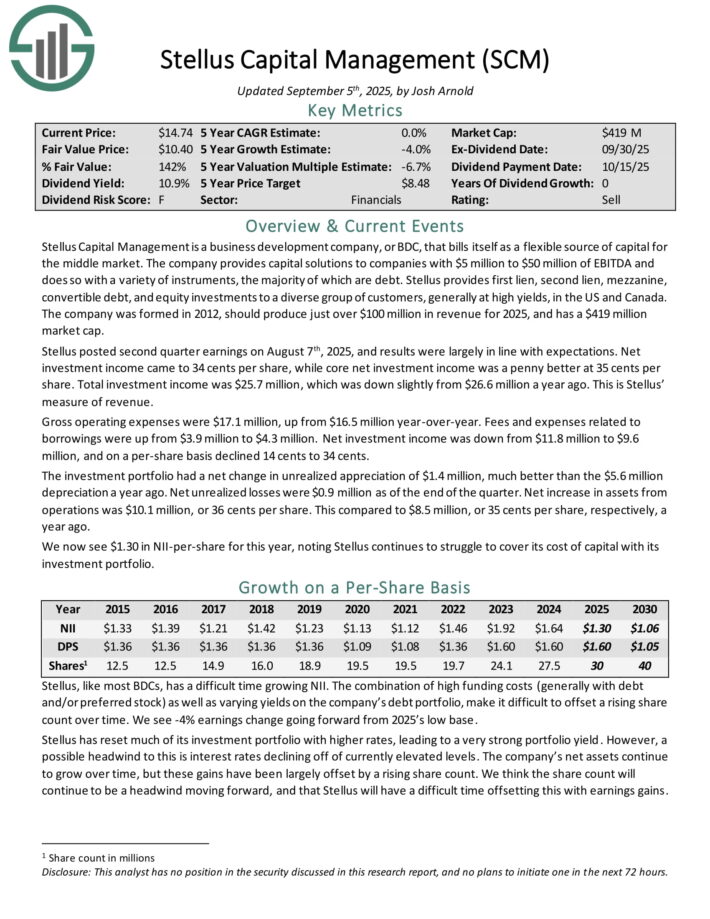

High-Yield Monthly Dividend Stock #10: Stellus Capital (SCM)

- Dividend Yield: 13.0%

Stellus Capital Management provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Stellus posted second quarter earnings on August 7th, 2025, and results were largely in line with expectations. Net investment income came to 34 cents per share, while core net investment income was a penny better at 35 cents per share.

Total investment income was $25.7 million, which was down slightly from $26.6 million a year ago. This is Stellus’ measure of revenue.

Gross operating expenses were $17.1 million, up from $16.5 million year-over-year. Fees and expenses related to borrowings were up from $3.9 million to $4.3 million. Net investment income was down from $11.8 million to $9.6 million, and on a per-share basis declined 14 cents to 34 cents.

The investment portfolio had a net change in unrealized appreciation of $1.4 million, much better than the $5.6 million depreciation a year ago.

Click here to download our most recent Sure Analysis report on SCM (preview of page 1 of 3 shown below):

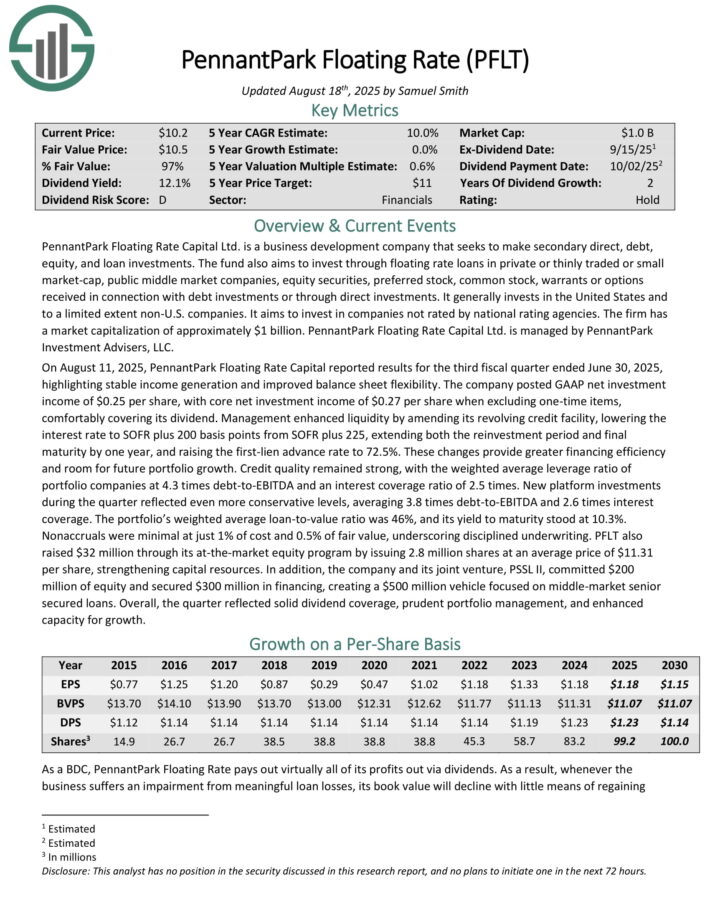

High-Yield Monthly Dividend Stock #9: PennantPark Floating Rate Capital (PFLT)

- Dividend Yield: 13.1%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On August 11, 2025, PennantPark Floating Rate Capital reported results for the third fiscal quarter ended June 30, 2025, highlighting stable income generation and improved balance sheet flexibility.

The company posted GAAP net investment income of $0.25 per share, with core net investment income of $0.27 per share when excluding one-time items, comfortably covering its dividend.

Management enhanced liquidity by amending its revolving credit facility, lowering the interest rate to SOFR plus 200 basis points from SOFR plus 225, extending both the reinvestment period and final maturity by one year, and raising the first-lien advance rate to 72.5%.

These changes provide greater financing efficiency and room for future portfolio growth. Credit quality remained strong, with the weighted average leverage ratio of portfolio companies at 4.3 times debt-to-EBITDA and an interest coverage ratio of 2.5 times.

New platform investments during the quarter reflected even more conservative levels, averaging 3.8 times debt-to-EBITDA and 2.6 times interest coverage. The portfolio’s weighted average loan-to-value ratio was 46%, and its yield to maturity stood at 10.3%.

Nonaccruals were minimal at just 1% of cost and 0.5% of fair value, underscoring disciplined underwriting. PFLT also raised $32 million through its at-the-market equity program by issuing 2.8 million shares at an average price of $11.31 per share, strengthening capital resources.

In addition, the company and its joint venture, PSSL II, committed $200 million of equity and secured $300 million in financing, creating a $500 million vehicle focused on middle-market senior secured loans.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

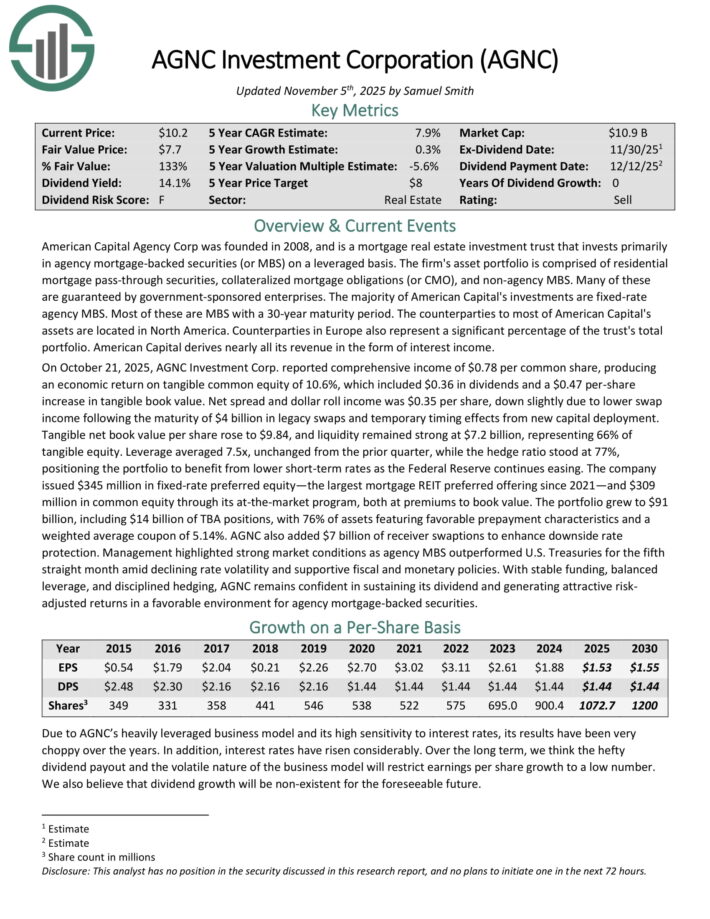

High-Yield Monthly Dividend Stock #8: AGNC Investment Corporation (AGNC)

- Dividend Yield: 13.8%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

On October 21, 2025, AGNC Investment Corp. reported comprehensive income of $0.78 per common share, producing an economic return on tangible common equity of 10.6%, which included $0.36 in dividends and a $0.47 per-share increase in tangible book value.

Net spread and dollar roll income was $0.35 per share, down slightly due to lower swap income following the maturity of $4 billion in legacy swaps and temporary timing effects from new capital deployment.

Tangible net book value per share rose to $9.84, and liquidity remained strong at $7.2 billion, representing 66% of tangible equity.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

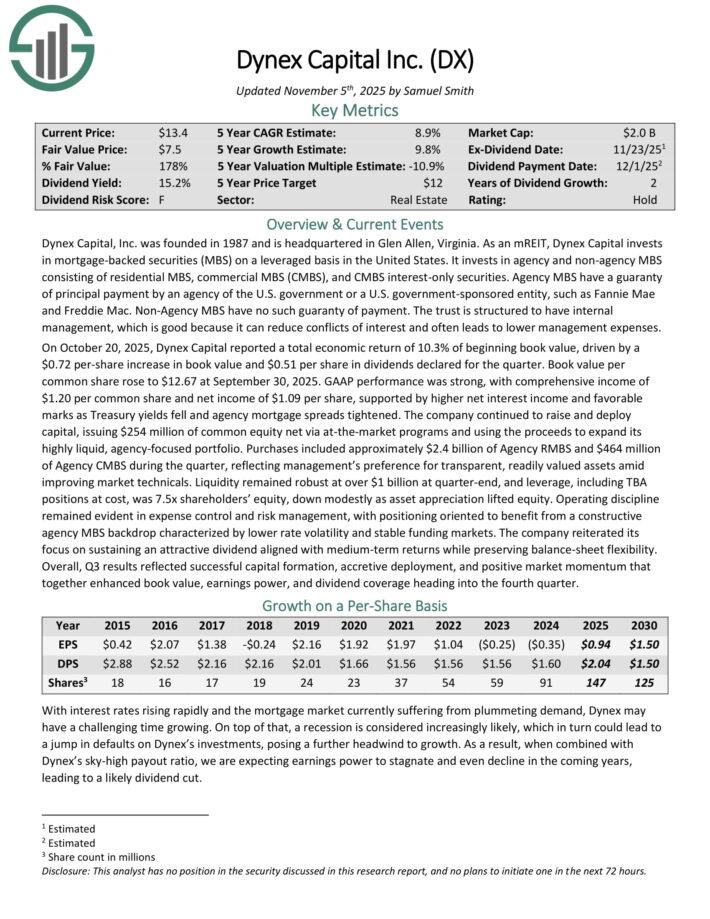

High-Yield Monthly Dividend Stock #7: Dynex Capital (DX)

- Dividend Yield: 14.6%

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

On October 20, 2025, Dynex Capital reported a total economic return of 10.3% of beginning book value, driven by a $0.72 per-share increase in book value and $0.51 per share in dividends declared for the quarter.

Book value per common share rose to $12.67 at September 30, 2025. GAAP performance was strong, with comprehensive income of $1.20 per common share and net income of $1.09 per share, supported by higher net interest income and favorable marks as Treasury yields fell and agency mortgage spreads tightened.

The company continued to raise and deploy capital, issuing $254 million of common equity net via at-the-market programs and using the proceeds to expand its highly liquid, agency-focused portfolio.

Purchases included approximately $2.4 billion of Agency RMBS and $464 million of Agency CMBS during the quarter, reflecting management’s preference for transparent, readily valued assets amid improving market technicals.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

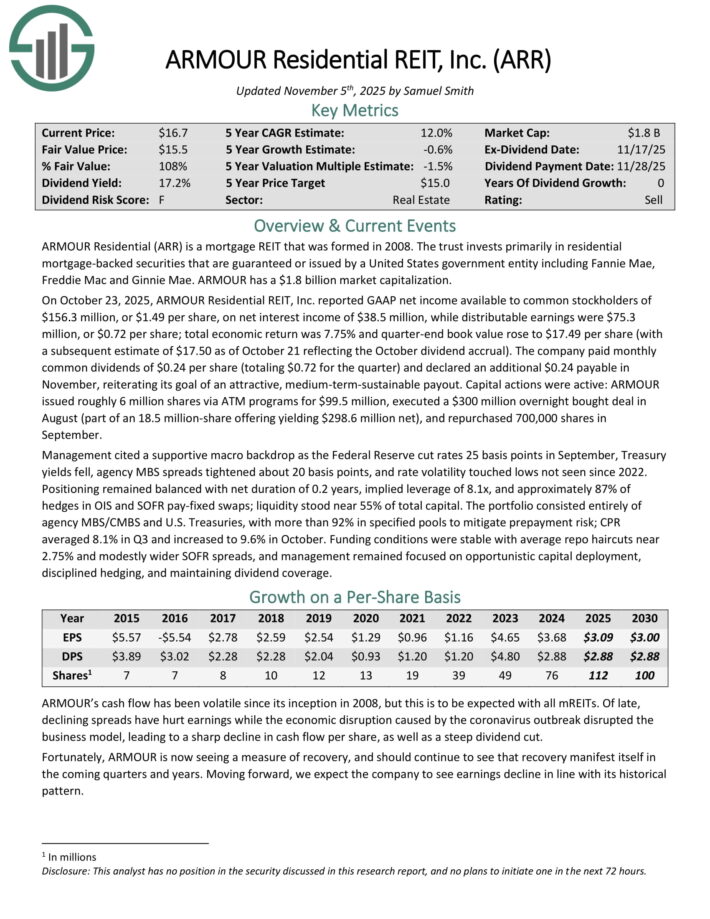

High-Yield Monthly Dividend Stock #6: ARMOUR Residential REIT (ARR)

- Dividend Yield: 16.4%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On October 23, 2025, ARMOUR Residential REIT reported GAAP net income available to common stockholders of $156.3 million, or $1.49 per share, on net interest income of $38.5 million, while distributable earnings were $75.3 million, or $0.72 per share.

Total economic return was 7.75% and quarter-end book value rose to $17.49 per share. The company paid monthly common dividends of $0.24 per share (totaling $0.72 for the quarter) and declared an additional $0.24 payable in November.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

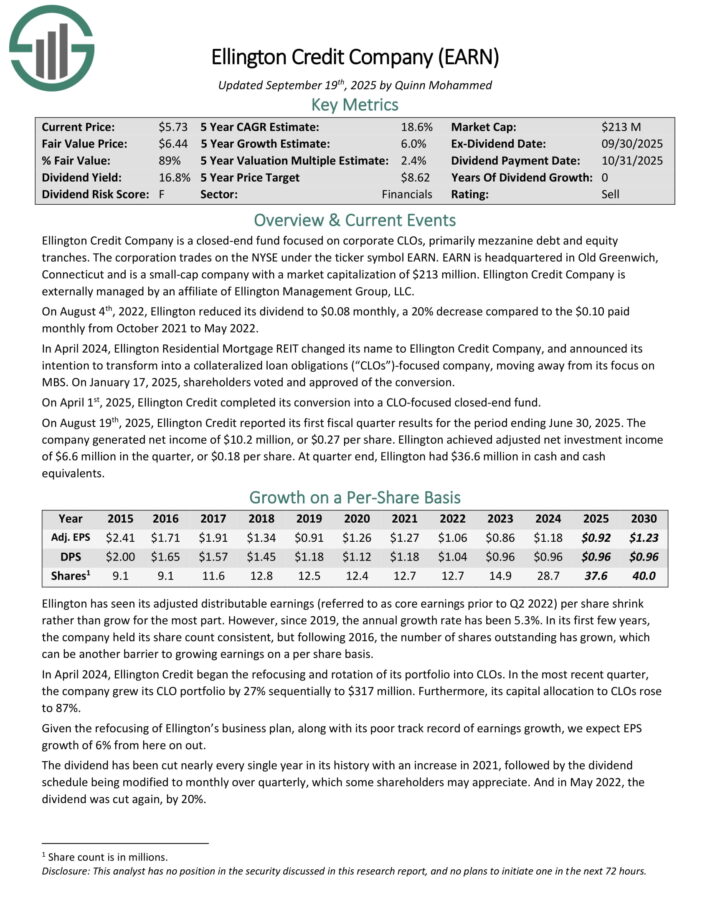

High-Yield Monthly Dividend Stock #5: Ellington Credit Co. (EARN)

- Dividend Yield: 18.1%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #4: Orchid Island Capital (ORC)

- Dividend Yield: 19.6%

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated net income of $0.53 per common share for Q3 2025, with book value per share estimated at $7.33 as of September 30, 2025.

The company declared a monthly dividend of $0.12 per share for October, keeping consistent with its monthly payout strategy.

The RMBS portfolio and derivatives portfolio evolved as the company remained focused on agency residential mortgage-backed securities paired with hedging strategies.

Orchid Island highlighted that the investment backdrop remains attractive with improving spreads and prepayment risk manageable given the portfolio’s coupon distribution and hedges.

Prepayment activity remained a focal point, with management noting the need for continued vigilance given higher coupon pools and refinancing dynamics.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

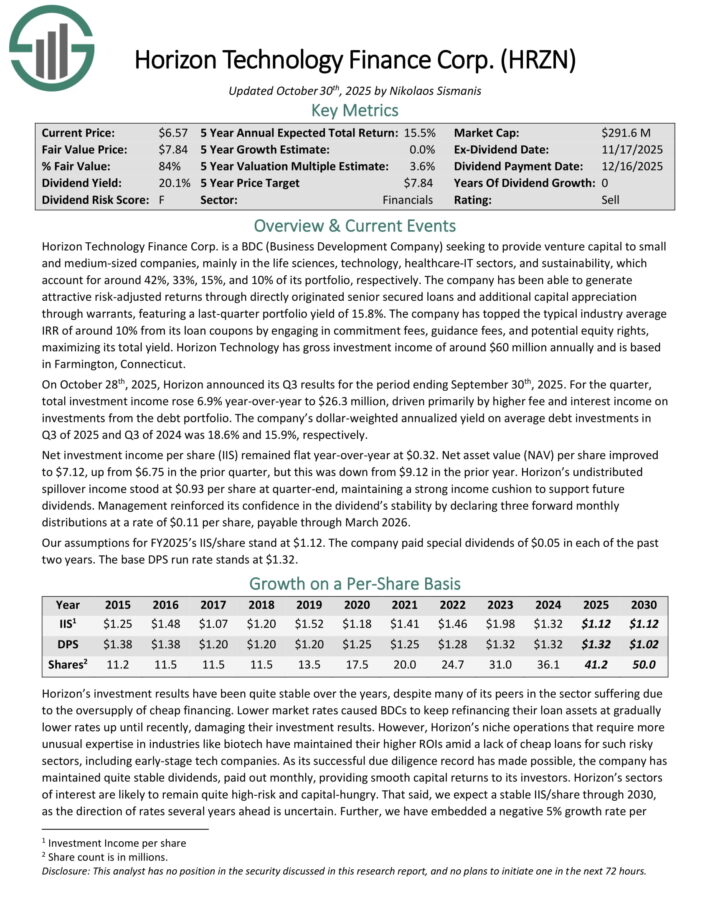

High-Yield Monthly Dividend Stock #3: Horizon Technology (HRZN)

- Dividend Yield: 19.8%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

On October 28th, 2025, Horizon announced its Q3 results. For the quarter, total investment income rose 6.9% year-over-year to $26.3 million, driven primarily by higher fee and interest income on investments from the debt portfolio.

The company’s dollar-weighted annualized yield on average debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Net investment income per share (IIS) remained flat year-over-year at $0.32. Net asset value (NAV) per share improved to $7.12, up from $6.75 in the prior quarter, but this was down from $9.12 in the prior year.

Horizon’s undistributed spillover income stood at $0.93 per share at quarter-end, maintaining a strong income cushion to support future dividends.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

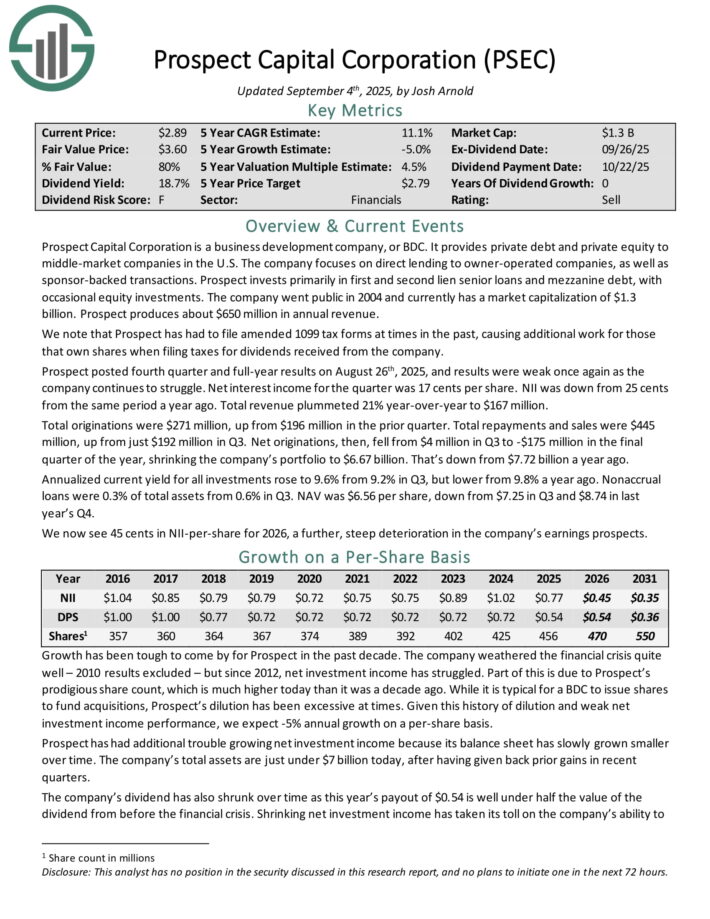

High-Yield Monthly Dividend Stock #2: Prospect Capital (PSEC)

- Dividend Yield: 20.5%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

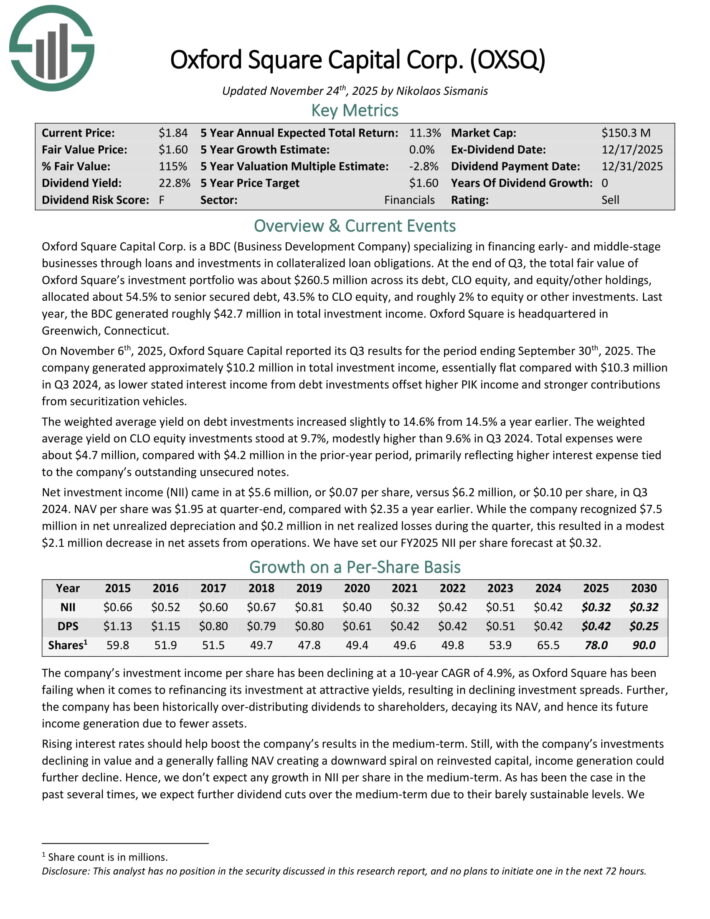

High-Yield Monthly Dividend Stock #1: Oxford Square Capital (OXSQ)

- Dividend Yield: 22.7%

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of Q3, the total fair value of Oxford Square’s investment portfolio was about $260.5 million across its debt, CLO equity, and equity/other holdings, allocated about 54.5% to senior secured debt, 43.5% to CLO equity, and roughly 2% to equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On November 6th, 2025, Oxford Square Capital reported its Q3. The company generated approximately $10.2 million in total investment income, essentially flat compared with $10.3 million in Q3 2024, as lower stated interest income from debt investments offset higher PIK income and stronger contributions from securitization vehicles.

The weighted average yield on debt investments increased slightly to 14.6% from 14.5% a year earlier. The weighted average yield on CLO equity investments stood at 9.7%, modestly higher than 9.6% in Q3 2024.

Total expenses were about $4.7 million, compared with $4.2 million in the prior-year period, primarily reflecting higher interest expense tied to the company’s outstanding unsecured notes.

Net investment income (NII) came in at $5.6 million, or $0.07 per share, versus $6.2 million, or $0.10 per share, in Q3 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks could be more appealing to income investors than quarterly or semi-annual dividend stocks. This is because monthly dividend stocks make 12 dividend payments per year, instead of the usual 4 or 2.

Furthermore, monthly dividend stocks with high yields above 5% are even more attractive for income investors.

The 20 stocks on this list have not been vetted for dividend safety, meaning each investor should understand the unique risk factors of each company.

That said, these 20 dividend stocks make monthly payments to shareholders, and all have high dividend yields.

Further Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Monthly Dividend Stock Individual Security Research

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500