Published on February 11th, 2026 by Bob Ciura

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less established stocks.

We define blue chip stocks as having raised their dividends for at least 10 consecutive years.

This research report has the following resources to help you invest in blue chip stocks:

There are currently more than 500 securities in our blue chip stocks list.

Meanwhile, dividend growth stocks could be even bigger bargains, when trading at rock bottom prices.

The following 10 blue-chip dividend stocks have yields above 5%, and are trading within 10% of their 52-week lows.

The list is sorted by expected annual returns over the next 5 years, in ascending order.

Table of Contents

The table of contents below allows for easy navigation.

- Dividend Stock Trading At Lows: Robert Half Inc. (RHI)

- Dividend Stock Trading At Lows: RELX plc ADR (RELX)

- Dividend Stock Trading At Lows: H&R Block Inc. (HRB)

- Dividend Stock Trading At Lows: Thomson-Reuters Corp. (TRI)

- Dividend Stock Trading At Lows: UnitedHealth Group (UNH)

- Dividend Stock Trading At Lows: Insperity Inc. (NSP)

- Dividend Stock Trading At Lows: Perrigo Company plc (PRGO)

- Dividend Stock Trading At Lows: Intuit Inc. (INTU)

- Dividend Stock Trading At Lows: Factset Research Systems (FDS)

- Dividend Stock Trading At Lows: Morningstar Inc. (MORN)

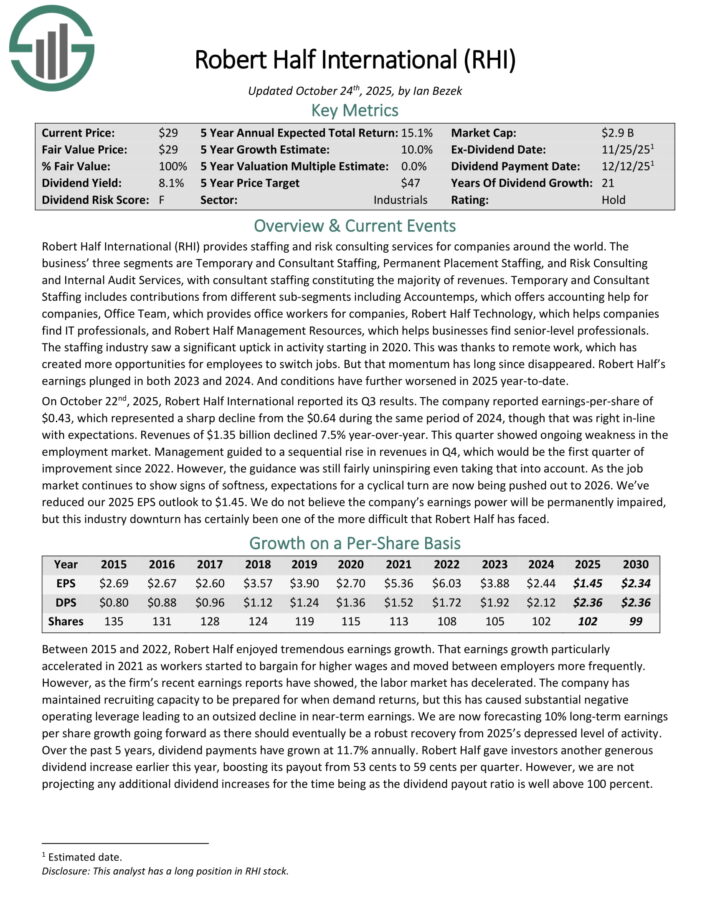

Dividend Stock Trading At Lows: Robert Half Inc. (RHI)

- Expected Total Return: 17.2%

Robert Half International provides staffing and risk consulting services for companies around the world.

Its three segments are Temporary and Consultant Staffing, Permanent Placement Staffing, and Risk Consulting and Internal Audit Services, with consultant staffing constituting the majority of revenues.

Temporary and Consultant Staffing includes contributions from different sub-segments including Accountemps, which offers accounting help for companies, Office Team, which provides office workers for companies, Robert Half Technology, which helps companies find IT professionals, and Robert Half Management Resources, which helps businesses find senior-level professionals.

Robert Half’s earnings plunged in both 2023 and 2024, and conditions further worsened in 2025.

On October 22nd, 2025, Robert Half International reported its Q3 results. The company reported earnings-per-share of $0.43, which represented a sharp decline from the $0.64 during the same period of 2024.

Revenue of $1.35 billion declined 7.5% year-over-year. This quarter showed ongoing weakness in the employment market. Management guided to a sequential rise in revenues in Q4, which would be the first quarter of improvement since 2022.

However, the guidance was still fairly uninspiring even taking that into account. As the job market continues to show signs of softness, expectations for a cyclical turn are now being pushed out to 2026.

Click here to download our most recent Sure Analysis report on RHI (preview of page 1 of 3 shown below):

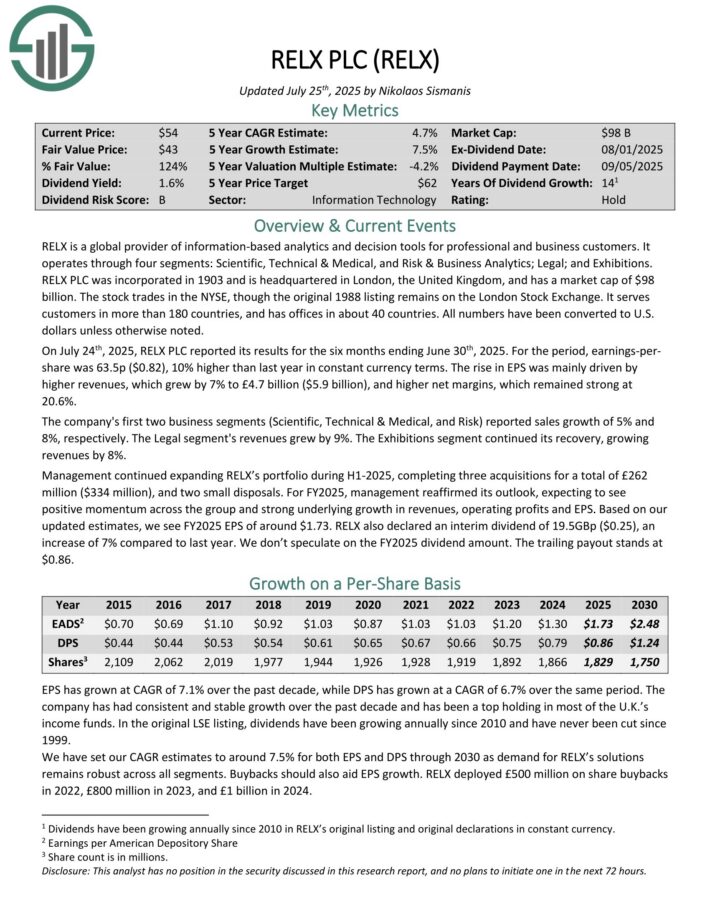

Dividend Stock Trading At Lows: RELX plc ADR (RELX)

- Expected Total Return: 18.0%

RELX is a global provider of information-based analytics and decision tools for professional and business customers.

It operates through four segments: Scientific, Technical & Medical, and Risk & Business Analytics; Legal; and Exhibitions.

RELX PLC was incorporated in 1903 and is headquartered in London, the United Kingdom. It serves customers in more than 180 countries, and has offices in about 40 countries.

On July 24th, 2025, RELX PLC reported its results for the six months ending June 30th, 2025. For the period, earnings-per-share was 63.5p ($0.82), 10% higher than last year in constant currency terms.

The rise in EPS was mainly driven by higher revenues, which grew by 7% to £4.7 billion ($5.9 billion), and higher net margins, which remained strong at 20.6%.

The company’s first two business segments (Scientific, Technical & Medical, and Risk) reported sales growth of 5% and 8%, respectively. The Legal segment’s revenues grew by 9%. The Exhibitions segment continued its recovery, growing revenues by 8%.

Management continued expanding RELX’s portfolio during H1-2025, completing three acquisitions for a total of £262 million ($334 million), and two small disposals.

For FY 2025, management reaffirmed its outlook, expecting to see positive momentum across the group and strong underlying growth in revenues, operating profits and EPS.

Based on our updated estimates, we see FY2025 EPS of around $1.73. RELX also declared an interim dividend of 19.5GBp ($0.25), an increase of 7% compared to last year.

Click here to download our most recent Sure Analysis report on RELX (preview of page 1 of 3 shown below):

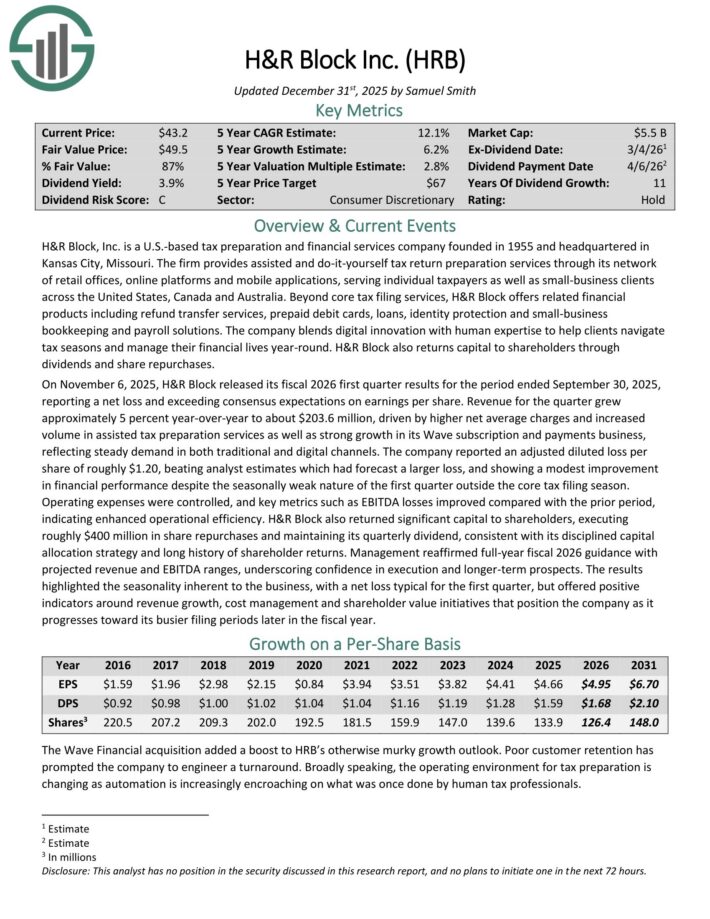

Dividend Stock Trading At Lows: H&R Block Inc. (HRB)

- Expected Total Return: 18.6%

H&R Block, Inc. is a U.S.-based tax preparation that provides assisted and do-it-yourself tax return preparation services through its network of retail offices, online platforms and mobile applications.

Beyond core tax filing services, H&R Block offers related financial products including refund transfer services, prepaid debit cards, loans, identity protection and small-business bookkeeping and payroll solutions.

On November 6, 2025, H&R Block released its fiscal 2026 first quarter results. Revenue for the quarter grew approximately 5% year-over-year to about $203.6 million.

Growth was driven by higher net average charges and increased volume in assisted tax preparation services as well as strong growth in its Wave subscription and payments business, reflecting steady demand in both traditional and digital channels.

The company reported an adjusted diluted loss per share of roughly $1.20, beating analyst estimates which had forecast a larger loss, and showing a modest improvement in financial performance despite the seasonally weak nature of the first quarter outside the core tax filing season.

Operating expenses were controlled, and key metrics such as EBITDA losses improved compared with the prior period, indicating enhanced operational efficiency.

H&R Block also returned significant capital to shareholders, executing roughly $400 million in share repurchases and maintained its quarterly dividend.

Click here to download our most recent Sure Analysis report on HRB (preview of page 1 of 3 shown below):

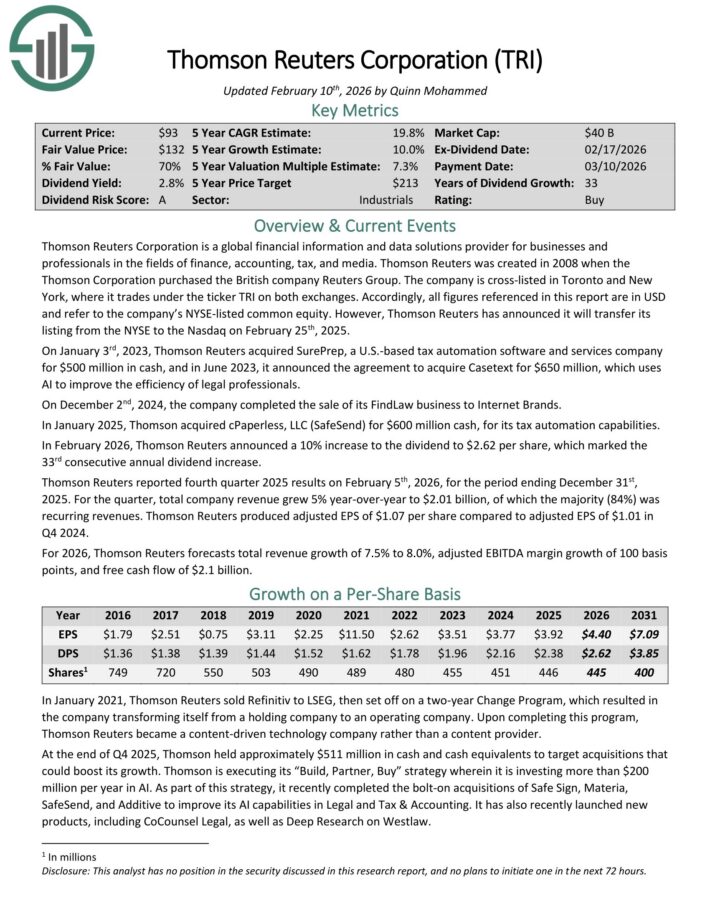

Dividend Stock Trading At Lows: Thomson-Reuters Corp. (TRI)

- Expected Total Return: 19.6%

Thomson Reuters Corporation is a global financial information and data solutions provider for businesses and professionals in the fields of finance, accounting, tax, and media.

In January 2025, Thomson acquired cPaperless, LLC (SafeSend) for $600 million cash, for its tax automation capabilities.

In February 2026, Thomson Reuters announced a 10% increase to the dividend to $2.62 per share, which marked the 33rd consecutive annual dividend increase.

Thomson Reuters reported fourth quarter 2025 results on February 5th, 2026. For the quarter, total company revenue grew 5% year-over-year to $2.01 billion, of which the majority (84%) was recurring revenues. Thomson Reuters produced adjusted EPS of $1.07 per share compared to adjusted EPS of $1.01 in Q4 2024.

For 2026, Thomson Reuters forecasts total revenue growth of 7.5% to 8.0%, adjusted EBITDA margin growth of 100 basis points, and free cash flow of $2.1 billion.

Click here to download our most recent Sure Analysis report on TRI (preview of page 1 of 3 shown below):

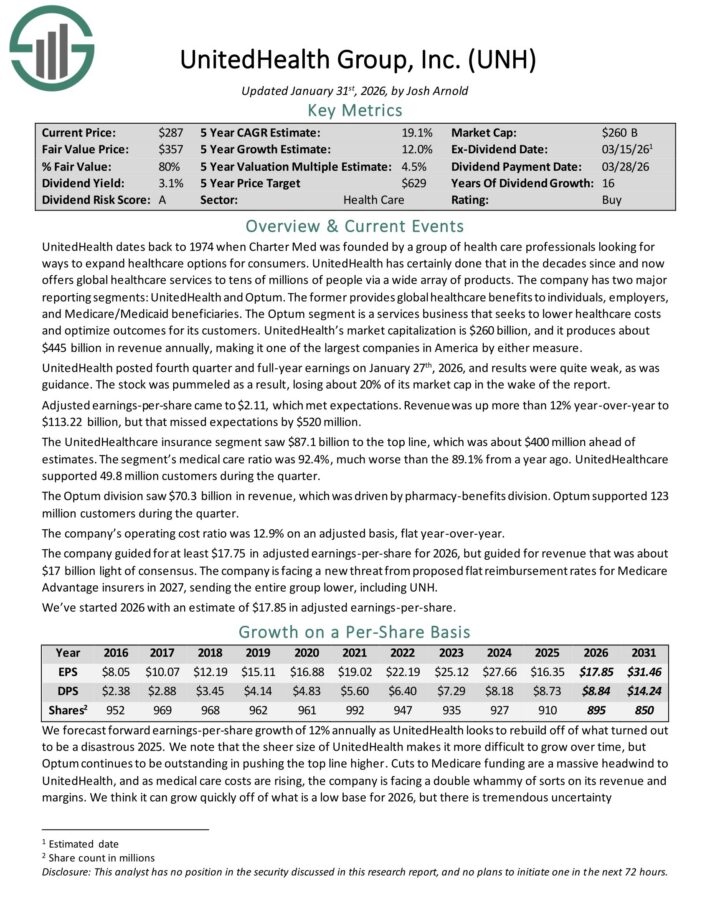

Dividend Stock Trading At Lows: UnitedHealth Group (UNH)

- Expected Total Return: 20.3%

UnitedHealth offers global healthcare services to tens of millions of people via a wide array of products. The company has two major reporting segments: UnitedHealth and Optum.

It provides global healthcare benefits to individuals, employers, and Medicare/Medicaid beneficiaries. The Optum segment is a services business that seeks to lower healthcare costs and optimize outcomes for its customers.

UnitedHealth posted fourth quarter and full-year earnings on January 27th, 2026. Adjusted earnings-per-share came to $2.11, which met expectations. Revenue was up more than 12% year-over-year to $113.22 billion, but that missed expectations by $520 million.

The UnitedHealthcare insurance segment saw $87.1 billion to the top line, which was about $400 million ahead of estimates.

The segment’s medical care ratio was 92.4%, much worse than the 89.1% from a year ago. UnitedHealthcare supported 49.8 million customers during the quarter.

The Optum division saw $70.3 billion in revenue, which was driven by pharmacy-benefits division. Optum supported 123 million customers during the quarter. The company’s operating cost ratio was 12.9% on an adjusted basis, flat year-over-year.

The company guided for at least $17.75 in adjusted earnings-per-share for 2026, but guided for revenue that was about $17 billion light of consensus.

Click here to download our most recent Sure Analysis report on UNH (preview of page 1 of 3 shown below):

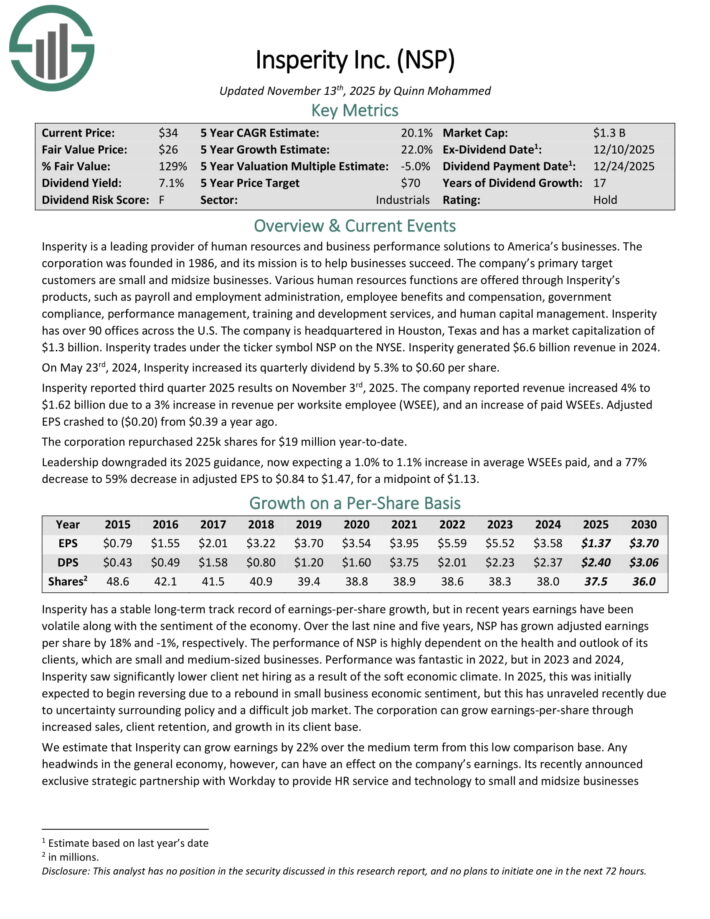

Dividend Stock Trading At Lows: Insperity Inc. (NSP)

- Expected Total Return: 21.1%

Insperity is a leading provider of human resources and business performance solutions to businesses. The company’s primary target customers are small and midsize businesses.

Various human resources functions are offered through Insperity’s products, such as payroll and employment administration, employee benefits and compensation, government compliance, performance management, training and development services, and human capital management.

Insperity has over 90 offices across the U.S. and generated $6.6 billion revenue in 2024.

Insperity reported third quarter 2025 results on November 3rd, 2025. The company reported revenue increased 4% to $1.62 billion due to a 3% increase in revenue per worksite employee (WSEE), and an increase of paid WSEEs. Adjusted EPS crashed to ($0.20) from $0.39 a year ago.

The corporation repurchased 225k shares for $19 million year-to-date.

Leadership downgraded its 2025 guidance, now expecting a 1.0% to 1.1% increase in average WSEEs paid, and a 77% decrease to 59% decrease in adjusted EPS to $0.84 to $1.47, for a midpoint of $1.13.

NSP’s payout ratio is elevated at 175% of forecast earnings. The company has never cut its dividend, but this year it is not likely to earn enough to cover it.

Click here to download our most recent Sure Analysis report on NSP (preview of page 1 of 3 shown below):

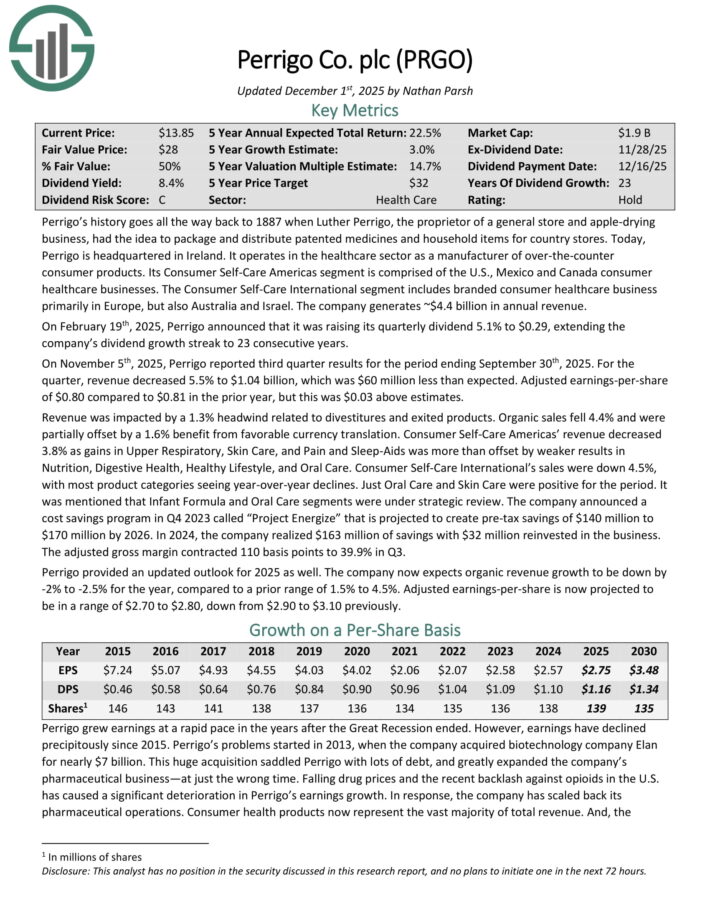

Dividend Stock Trading At Lows: Perrigo Company plc (PRGO)

- Expected Total Return: 22.2%

Perrigo is headquartered in Ireland. It operates in the healthcare sector as a manufacturer of over-the-counter consumer products.

Its Consumer Self-Care Americas segment is comprised of the U.S., Mexico and Canada consumer healthcare businesses.

The Consumer Self-Care International segment includes branded consumer healthcare business primarily in Europe, but also Australia and Israel.

On February 19th, 2025, Perrigo announced that it was raising its quarterly dividend 5.1% to $0.29, extending the company’s dividend growth streak to 23 consecutive years.

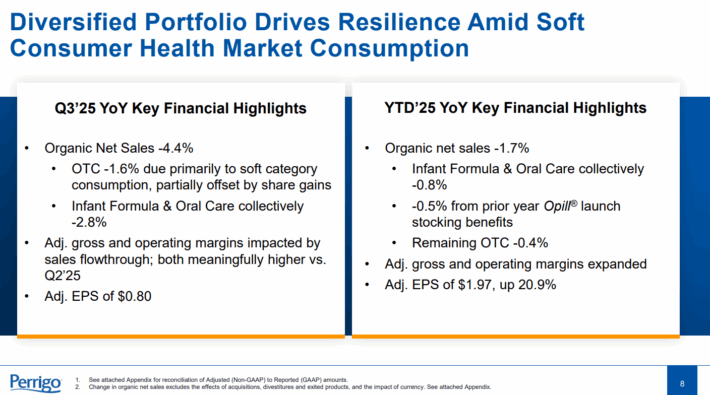

On November 5th, 2025, Perrigo reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue decreased 5.5% to $1.04 billion, which was $60 million less than expected.

Adjusted earnings-per-share of $0.80 compared to $0.81 in the prior year, but this was $0.03 above estimates.

Source: Investor Presentation

Revenue was impacted by a 1.3% headwind related to divestitures and exited products. Organic sales fell 4.4% and were partially offset by a 1.6% benefit from favorable currency translation.

Consumer Self-Care Americas’ revenue decreased 3.8% as gains in Upper Respiratory, Skin Care, and Pain and Sleep-Aids was more than offset by weaker results in Nutrition, Digestive Health, Healthy Lifestyle, and Oral Care.

Consumer Self-Care International’s sales were down 4.5%, with most product categories seeing year-over-year declines. Just Oral Care and Skin Care were positive for the period. Infant Formula and Oral Care segments are under strategic review.

Click here to download our most recent Sure Analysis report on PRGO (preview of page 1 of 3 shown below):

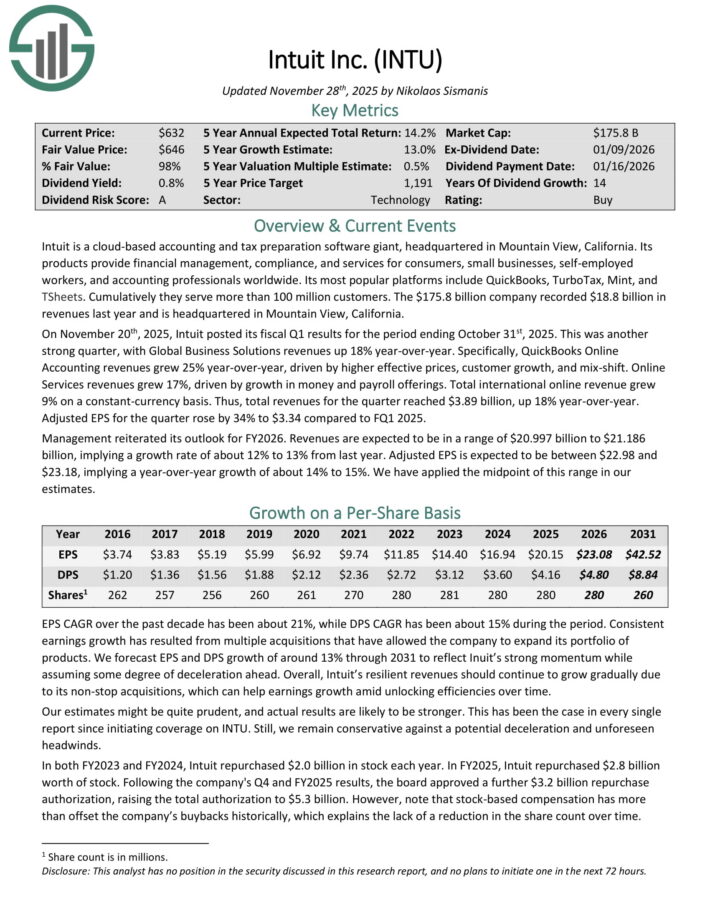

Dividend Stock Trading At Lows: Intuit Inc. (INTU)

- Expected Total Return: 23.7%

Intuit is a cloud-based accounting and tax preparation software giant. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide.

Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers. The company recorded $18.8 billion in revenues last year and is headquartered in Mountain View, California.

On November 20th, 2025, Intuit posted its fiscal Q1 results for the period ending October 31st, 2025. This was another strong quarter, with Global Business Solutions revenues up 18% year-over-year.

QuickBooks Online Accounting revenues grew 25% year-over-year, driven by higher effective prices, customer growth, and mix-shift.

Online Services revenues grew 17%, driven by growth in money and payroll offerings. Total international online revenue grew 9% on a constant-currency basis. Thus, total revenues for the quarter reached $3.89 billion, up 18% year-over-year.

Adjusted EPS for the quarter rose by 34% to $3.34 compared to FQ1 2025.

Management reiterated its outlook for FY2026. Revenues are expected to be in a range of $20.997 billion to $21.186 billion, implying a growth rate of about 12% to 13% from last year.

Adjusted EPS is expected to be between $22.98 and $23.18, implying a year-over-year growth of about 14% to 15%.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

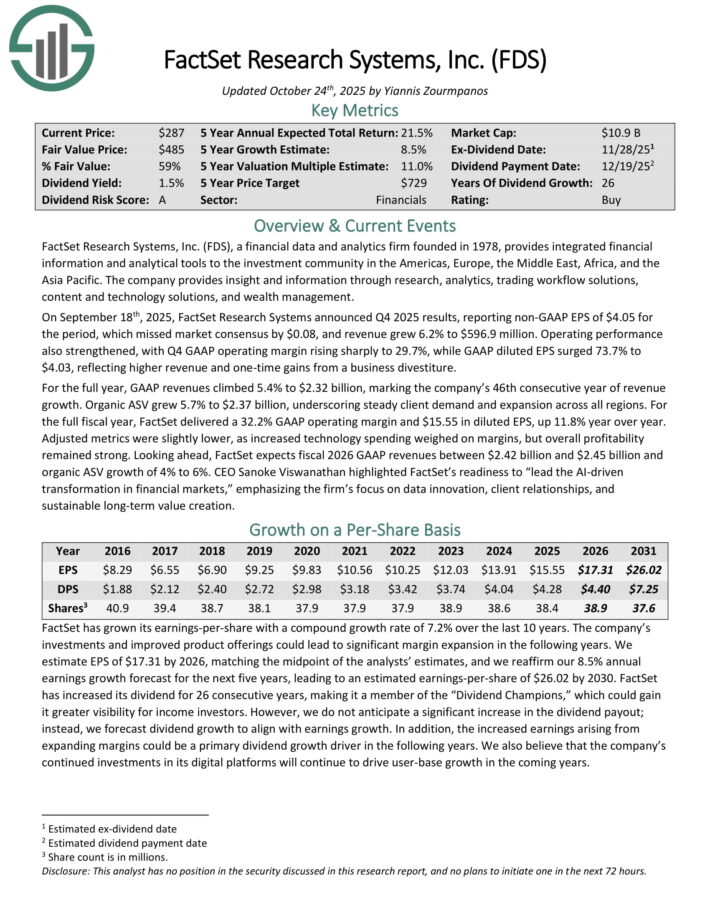

Dividend Stock Trading At Lows: Factset Research Systems (FDS)

- Expected Total Return: 30.4%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On September 18th, 2025, FactSet Research Systems announced Q4 2025 results, reporting non-GAAP EPS of $4.05 for the period, which missed market consensus by $0.08, and revenue grew 6.2% to $596.9 million. Operating performance also strengthened, with Q4 GAAP operating margin rising sharply to 29.7%.

GAAP diluted EPS surged 73.7% to $4.03, reflecting higher revenue and one-time gains from a business divestiture. For the full year, GAAP revenues climbed 5.4% to $2.32 billion, marking the company’s 46th consecutive year of revenue growth.

Organic ASV grew 5.7% to $2.37 billion, underscoring steady client demand and expansion across all regions. For the full fiscal year, FactSet delivered a 32.2% GAAP operating margin and $15.55 in diluted EPS, up 11.8% year over year.

Adjusted metrics were slightly lower, as increased technology spending weighed on margins, but overall profitability remained strong. Looking ahead, FactSet expects fiscal 2026 GAAP revenues between $2.42 billion and $2.45 billion and organic ASV growth of 4% to 6%.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

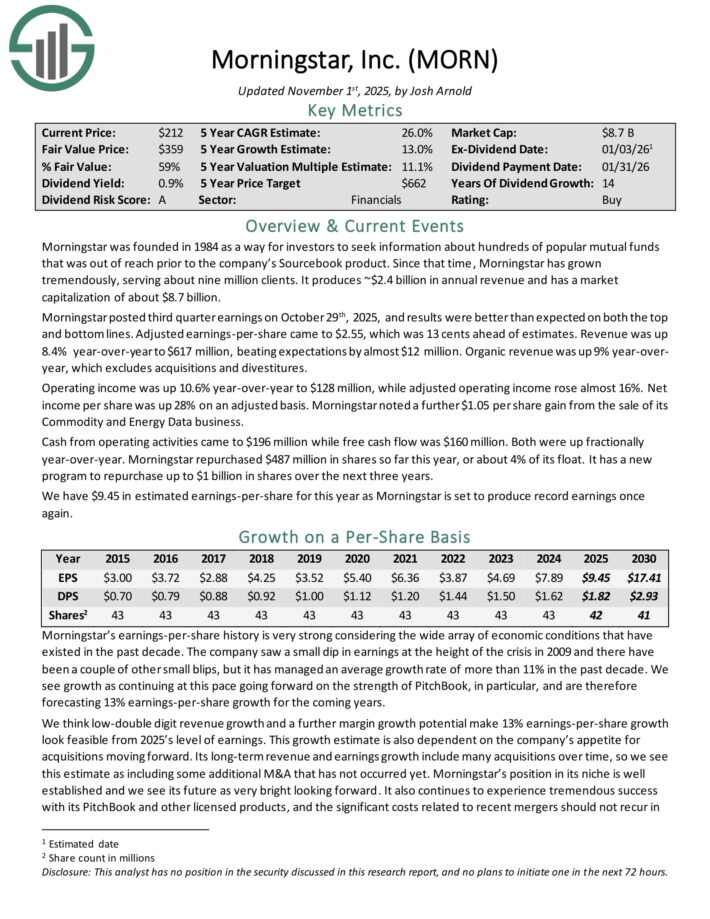

Dividend Stock Trading At Lows: Morningstar Inc. (MORN)

- Expected Total Return: 33.2%

Morningstar was founded in 1984 as a way for investors to seek information about hundreds of popular mutual funds that was out of reach prior to the company’s Sourcebook product.

Since that time, Morningstar has grown tremendously, serving about nine million clients. It produces ~$2.4 billion in annual revenue.

Morningstar posted third quarter earnings on October 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.55, which was 13 cents ahead of estimates.

Revenue was up 8.4% year-over-year to $617 million, beating expectations by almost $12 million. Organic revenue was up 9% year-over-year, which excludes acquisitions and divestitures.

Operating income was up 10.6% year-over-year to $128 million, while adjusted operating income rose almost 16%. Net income per share was up 28% on an adjusted basis.

Morningstar noted a further $1.05 per share gain from the sale of its Commodity and Energy Data business.

Cash from operating activities came to $196 million while free cash flow was $160 million. Both were up fractionally year-over-year.

Morningstar repurchased $487 million in shares so far this year, or about 4% of its float. It has a new program to repurchase up to $1 billion in shares over the next three years.

Click here to download our most recent Sure Analysis report on MORN (preview of page 1 of 3 shown below):

Other Blue Chip Stock Resources

Blue chip stocks could make excellent investments for the long-run. Their strength and reliability make them compelling investments for investors of all experience levels, from beginners to experts.

The resources below will give you a better understanding of dividend growth investing:

Dividend Growth Investing

- Dividend Kings: 50+ Consecutive years of dividend increases

- Dividend Champions: 25+ Consecutive years of dividend increases

- The Best DRIP Stocks: The top 15 Dividend Champions with no-fee dividend reinvestment plans