Updated on July 12th, 2025 by Nathan Parsh

W.W. Grainger, Inc. (GWW) recently increased its dividend for the 53rd consecutive year. This means Grainger is on the exclusive list of Dividend Kings, who have raised their dividend payouts for at least 50 years.

We believe quality dividend growth stocks like the Dividend Kings are attractive for long-term investors. For this reason, we compiled a complete list of all Dividend Kings.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Grainger has maintained its Dividend King status thanks to its superior position in its industry. Its competitive advantages have fueled the company’s long-term growth.

Grainger should keep growing its dividend for many more years as we see continued growth in the business-to-business distributors of the maintenance, repair, and operations (“MRO”) supplies industry.

This article will discuss Grainger’s business model, growth catalysts, and expected returns.

Business Overview

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business supply distributors of maintenance, repair, and operations (“MRO”).

Grainger, founded in 1927, generated sales of $17.2 billion in 2024. It has a market capitalization of $50.9 billion and is a member of the Dividend Aristocrats Index and the Dividend Kings.

Grainger has more than 4.5 million active customers, with more than 30 million products offered globally.

It has also adjusted swiftly to the boom of e-commerce, as more than 75% of its orders in the U.S. are placed via digital channels.

Growth Prospects

Grainger’s earnings per share increased at an average annual compound rate of 14% between 2015 and 2024. This result was driven by 6.2% annual revenue growth, an expanding profit margin, and a 2.6% average annual decrease in the share count.

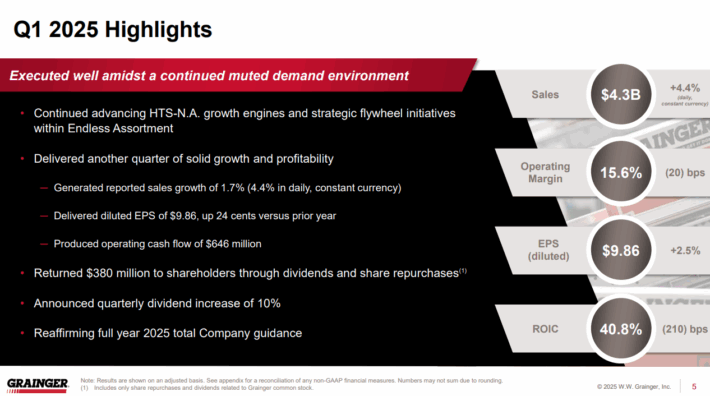

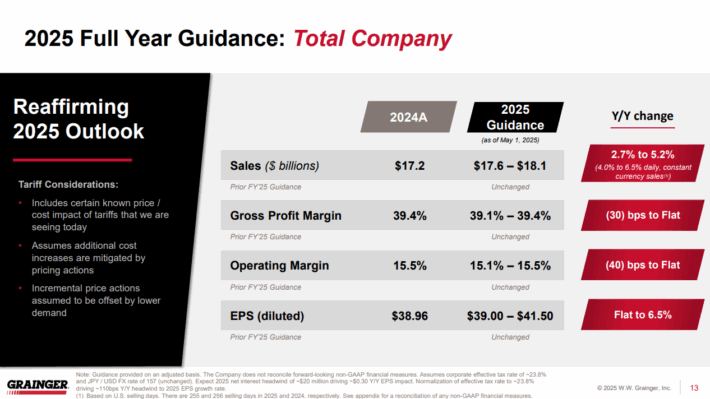

Earnings per share decreased 6% in 2020 due to the pandemic, from $17.29 in 2019 to $16.18 in 2020. Such a small decrease during a fierce recession is certainly satisfactory and confirms the resilience of the company to downturns. The company has recovered strongly from the pandemic, with record results in 2021, 2022, 2023, and 2024. The company is on track for another record in earnings per share this year.

Moreover, Grainger has ample room for future growth. It is the largest player in High-Tech Solutions, but its market share in the North American market is only ~7%.

Grainger also has plenty of room to grow its Endless Assortment business. The company is expanding its addressable market with new products and new customer segments.

Moreover, the company will deepen customer relationships through service-based offerings, which should help increase same-customer sales and total revenue.

Overall, we expect Grainger to grow its earnings per share by 10% per year over the next five years.

Competitive Advantages & Recession Performance

Grainger’s most significant competitive advantage is its strong position as an industry leader in MRO products. We believe that the company has a solid ability to resist pressures from new (e.g., Amazon) and existing businesses in the MRO market.

Solid supplier relationships build this exclusivity. As Grainger is the largest MRO industrial distributor in North America, it benefits from volume-based discounts and other sales incentives that would be unattainable by smaller distributors.

These competitive advantages provide the company with consistent growth, even during economic downturns. Grainger’s earnings increased during the Great Recession.

Grainger’s earnings-per-share during the recession are as follows:

- 2007 adjusted earnings-per-share: $4.94

- 2008 adjusted earnings-per-share: $6.04 (22% increase)

- 2009 adjusted earnings-per-share: $5.25 (13% decline)

- 2010 adjusted earnings-per-share: $6.80 (30% increase)

This growth during the Great Recession speaks volumes about the company’s resilience in the face of economic downturns. As mentioned above, the company performed well during the COVID-19 pandemic, with a 6% earnings decline in 2020.

Overall, the company boasts an A+ credit rating from S&P, with a net leverage ratio of 1.0, which is very solid. Consequently, Grainger has the balance sheet strength to withstand another recession.

Valuation & Expected Returns

We expect Grainger to earn $42.00 per share this year, so the stock is currently trading at a price-to-earnings ratio of 25.2.

Over the past decade, the shares of Grainger have traded with an average price-to-earnings ratio of 19.3. We are using 24 times earnings as a fair value baseline, considering a slightly higher expected growth rate and stellar performance against difficult economic environments.

As a result, we view the stock as slightly overvalued.

If the price-to-earnings ratio declines from 25.2 to 24.0 over the next five years, shareholder returns will be reduced by 1% per year.

However, dividends and earnings-per-share growth will boost shareholder returns. Grainger has a current dividend yield of 0.9%. Given our projected 10% annual growth in earnings-per-share over the next five years, the stock of Grainger is expected to generate an average annual total return of 9.6% over the next five years.

Final Thoughts

Grainger is a solid company with a tremendous history of earnings and dividend growth. It has grown its dividend for 53 consecutive years and is a relatively new member of the Dividend King list.

However, the shares are trading somewhat higher than our fair value estimate. As a result, the total return potential is less than 10% per year over the next five years.

Although the total return proposition does not appear compelling, the company’s resilience, low dividend payout ratio (22%), and impressive dividend growth streak are notable. Nevertheless, shares are rated a hold at the current price.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.