Published on December 15th, 2025 by Bob Ciura

Low interest rates and high valuations have made it difficult to find quality high-yield investments for retirement income.

Difficult, but not impossible.

That is where the Dividend Kings can be useful.

Sure Dividend helps investors live a more comfortable and stress-free retirement (or early retirement) by finding quality, high-yield investments.

We believe the Dividend Kings are among the best stocks to buy and hold for the long run.

The Dividend Kings are a group of just 56 stocks that have all increased their dividends for at least 50 consecutive years.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

This article will discuss 10 top Dividend Kings that match the following criteria:

- Current yields of at least 2.5% (double the average yield of the S&P 500)

- Dividend Risk Scores of A or B

- Trading below fair value

Read on to discover 10 top dividend stocks to build retirement income.

Table of Contents

The table of contents below allows for easy navigation. The stocks are listed by expected total returns over the next five years, in ascending order.

- Dividend King To Build Retirement Income #10: Consolidated Edison (ED)

- Dividend King To Build Retirement Income #9: Target Corporation (TGT)

- Dividend King To Build Retirement Income #8: National Fuel Gas (NFG)

- Dividend King To Build Retirement Income #7: Hormel Foods (HRL)

- Dividend King To Build Retirement Income #6: Kimberly-Clark Corp. (KMB)

- Dividend King To Build Retirement Income #5: Sysco Corp. (SYY)

- Dividend King To Build Retirement Income #4: Automatic Data Processing (ADP)

- Dividend King To Build Retirement Income #3: PepsiCo Inc. (PEP)

- Dividend King To Build Retirement Income #2: PPG Industries (PPG)

- Dividend King To Build Retirement Income #1: H2O America (HTO)

Dividend King To Build Retirement Income #10: Consolidated Edison (ED)

- Expected annual returns: 9.6%

Consolidated Edison is a holding company that delivers electricity, natural gas, and steam to its customers in New York City and Westchester County. The company has annual revenues of more than $16 billion.

On November 6th, 2025, Consolidated Edison reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue increased 10.7% to $4.5 billion, which was $310 million ahead of estimates.

Adjusted earnings of $686 million, or $1.90 per share, compared to adjusted earnings of $583 million, or $1.68 per share, in the previous year. Adjusted earnings-per-share were also $0.15 better than expected.

Average rate base balances are still projected to grow by 8.2% annually through 2029 based off 2025 levels. This is up from the company’s prior forecast of 6.4%. The company will update its forecast through 2030 in February of next year.

Consolidated Edison still expects capital investments of $38 billion for the 2025 to 2029 period, which was up from $28 billion previously. The company also expects capital investments of ~$72 billion over the next decade.

Consolidated Edison provided updated guidance for 2025 as well, with the company now expecting earnings-per-share in a range of $5.60 to $5.70 for the year, up from $5.50 to $5.70 previously.

The company expects 5% to 7% earnings growth from 2025 levels through 2029.

Click here to download our most recent Sure Analysis report on ED (preview of page 1 of 3 shown below):

Dividend King To Build Retirement Income #9: Target Corporation (TGT)

- Expected annual returns: 9.8%

Target is a major retailer with operations solely in the U.S. market. Its business consists of about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s burgeoning e-commerce business.

Target should produce more than $100 billion in total revenue this year. The company also sports an extremely impressive dividend increase streak of 57 years.

Target posted third quarter earnings on November 19th, 2025, and results were slightly better than expected. Adjusted earnings-per-share came to $1.78, which was seven cents ahead of estimates.

Revenue was $25.3 billion, meeting expectations, but declining just over 1% year-over-year. Sales were off 1.5% year-over-year, reflecting merchandise sales declines of 1.9%, partially offset by a 17.7% increase in non-merchandise sales.

Comparable sales were off 2.7%, missing estimates for a 2.1% decline. Physical store sales fell 3.8% on a comparable basis, partially offset by digital comparable sales growth of 2.4%.

Operating income was $1.1 billion on an adjusted basis, with gross margin off 10 basis points to 28.2% of revenue. This reflected merchandising pressure from increased markdowns.

Share repurchases were $152 million during the quarter at an average price of $91.59. The company has about $8.3 billion in remaining repurchase capacity under the 2021 authorization that is still incomplete.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

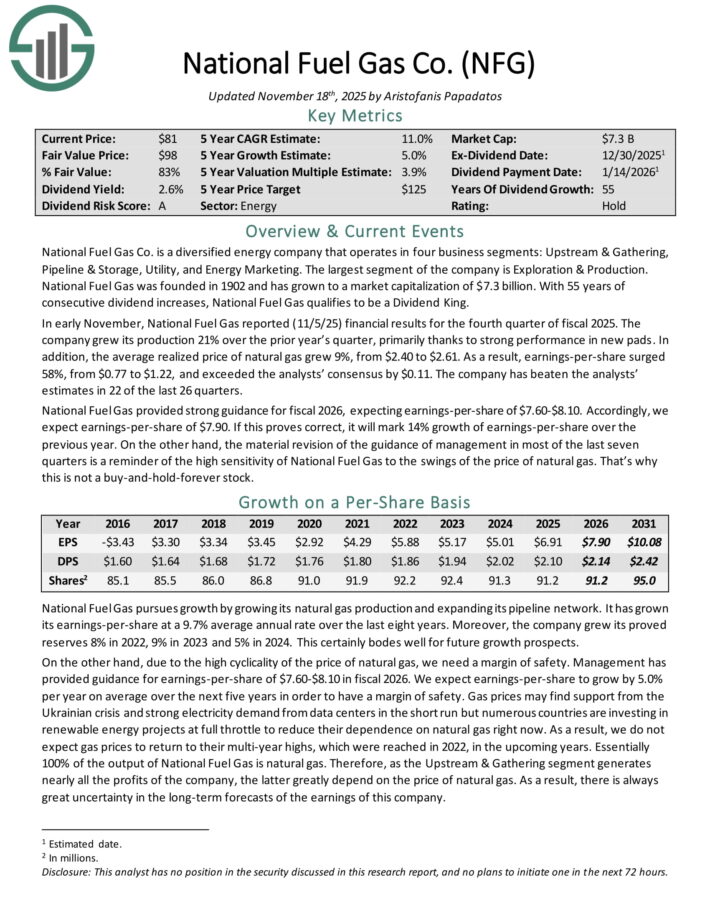

Dividend King To Build Retirement Income #8: National Fuel Gas (NFG)

- Expected annual returns: 10.7%

National Fuel Gas Co. is a diversified energy company that operates in four business segments: Upstream & Gathering, Pipeline & Storage, Utility, and Energy Marketing.

The largest segment of the company is Exploration & Production. With 55 years of consecutive dividend increases, National Fuel Gas qualifies to be a Dividend King.

In early November, National Fuel Gas reported (11/5/25) financial results for the fourth quarter of fiscal 2025. The company grew its production 21% over the prior year’s quarter, primarily thanks to strong performance in new pads.

In addition, the average realized price of natural gas grew 9%, from $2.40 to $2.61. As a result, earnings-per-share surged 58%, from $0.77 to $1.22, and exceeded the analysts’ consensus by $0.11.

The company has beaten the analysts’ estimates in 22 of the last 26 quarters. National Fuel Gas provided strong guidance for fiscal 2026, expecting earnings-per-share of $7.60-$8.10.

Accordingly, we expect earnings-per-share of $7.90. If this proves correct, it will mark 14% growth of earnings-per-share over the previous year.

Click here to download our most recent Sure Analysis report on NFG (preview of page 1 of 3 shown below):

Dividend King To Build Retirement Income #7: Hormel Foods (HRL)

- Expected annual returns: 12.2%

Hormel was founded back in 1891 in Minnesota. Since that time, the company has grown into a juggernaut in the food products industry with nearly $10 billion in annual revenue.

Hormel has kept with its core competency as a processor of meat products for well over a hundred years, but has also grown into other business lines through acquisitions.

Hormel has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

Hormel posted third quarter earnings on August 28th, 2025, and results were very weak, including disappointing guidance for the fourth quarter.

Adjusted earnings-per-share came to 35 cents, which was six cents light of estimates. Revenue was up 4.5% year-over-year to $3.03 billion, beating estimates by $50 million. Organic net sales were up 6% year-over-year on volume gains of 4%, with price and mix comprising the other 2%.

The company also noted its cost savings program is working and helping save about $125 million annually. Gross profit was flat year-on-year, with inflationary headwinds offset by top line gains. The company noted 400 basis points of raw material cost inflation, a massive headwind to margins.

Cash flow from operations were $157 million, while capex was $72 million, and dividends paid were $159 million. Guidance for Q4 was for net sales of ~$3.2 billion, about $50 million light of consensus. Earnings are expected at ~39 cents.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

Dividend King To Build Retirement Income #6: Kimberly-Clark Corp. (KMB)

- Expected annual returns: 12.4%

The Kimberly-Clark Corporation is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating about $20 billion in annual revenue.

Kimberly-Clark posted third quarter earnings on October 30th, 2025, and results were better than expected on both the top and bottom lines.

Adjusted earnings-per-share came to $1.82, which was seven cents ahead of estimates. Revenue was flat year-over-year at $4.15 billion, but did best estimates by $50 million.

Sales included negative impacts of about 2.2% from the exit of the private label diaper business in the US. Organic sales were up 2.5%, which was driven by a 2.4% gain in volume, while portfolio mix and price were flat.

Gross margin was 36.8% of revenue on an adjusted basis, off 170 basis points year-over-year. This reflected strong productivity gains that were more than offset by unfavorable pricing net of cost inflation.

Operating profit was $683 million on an adjusted basis, driven by lower marketing and R&D costs, as well as efficiency efforts. Net interest expense was $59 million, up from $49 million a year ago.

We now see $7.50 in adjusted earnings-per-share for this year, which would be the highest since 2020, if achieved. Separately, Kimberly-Clark announced its intention to buy Kenvue (KVUE) for $48.7 billion in a cash and stock deal.

Click here to download our most recent Sure Analysis report on KMB (preview of page 1 of 3 shown below):

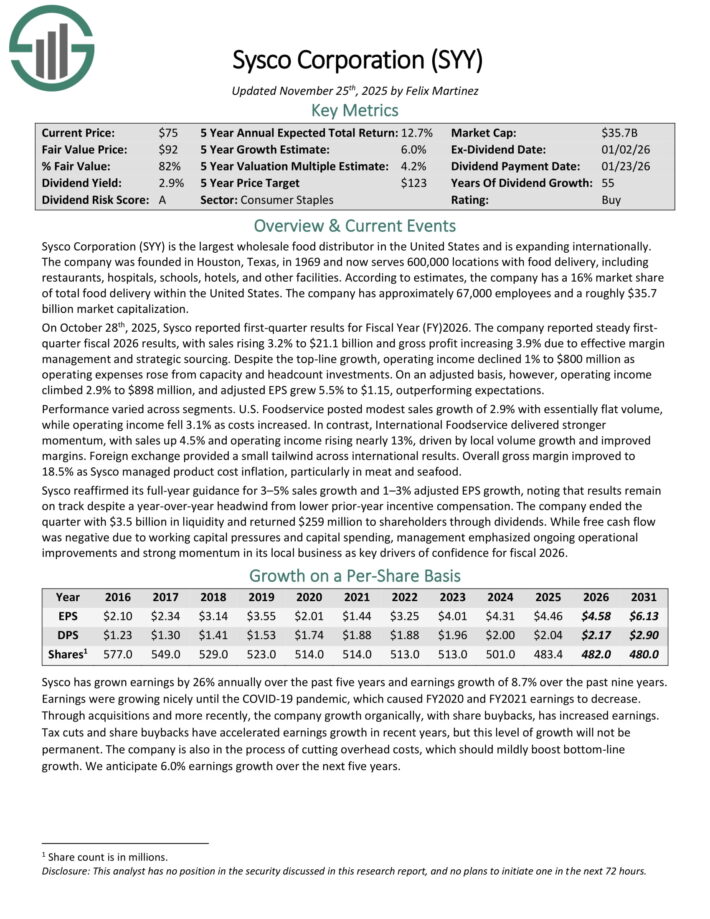

Dividend King To Build Retirement Income #5: Sysco Corp. (SYY)

- Expected annual returns: 12.9%

Sysco Corporation is the largest wholesale food distributor in the United States and is expanding internationally. The company serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities.

According to estimates, the company has a 16% market share of total food delivery within the United States. The company has approximately 67,000 employees.

On October 28th, 2025, Sysco reported first-quarter results for Fiscal Year 2026. The company reported steady first-quarter fiscal 2026 results, with sales rising 3.2% to $21.1 billion and gross profit increasing 3.9% due to effective margin management and strategic sourcing.

Despite the top-line growth, operating income declined 1% to $800 million as operating expenses rose from capacity and headcount investments. On an adjusted basis, however, operating income climbed 2.9% to $898 million, and adjusted EPS grew 5.5% to $1.15, outperforming expectations.

Sysco reaffirmed its full-year guidance for 3–5% sales growth and 1–3% adjusted EPS growth, noting that results remain on track despite a year-over-year headwind from lower prior-year incentive compensation.

Click here to download our most recent Sure Analysis report on SYY (preview of page 1 of 3 shown below):

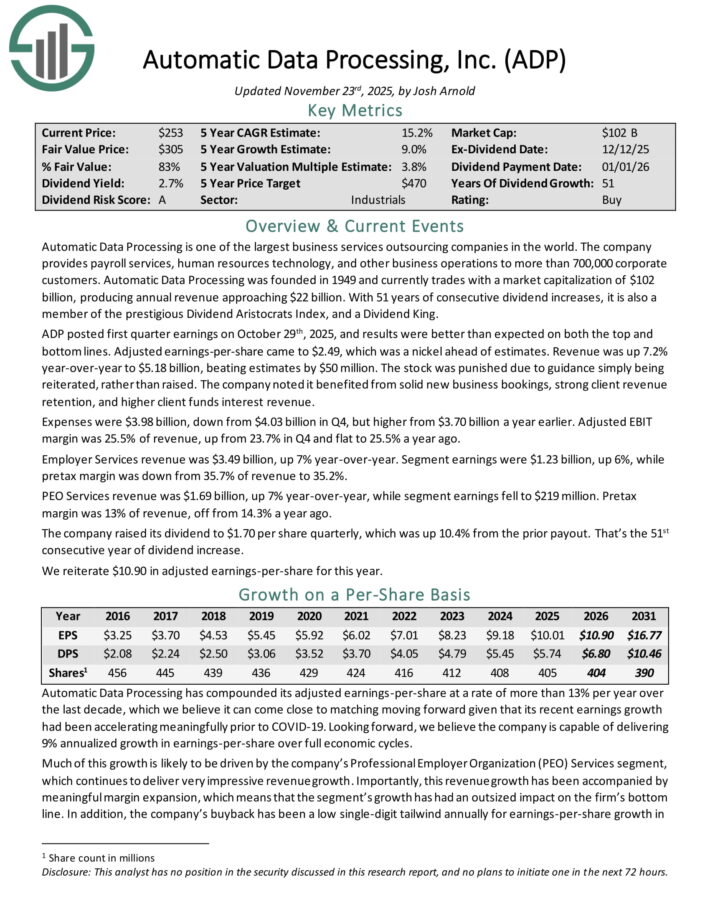

Dividend King To Build Retirement Income #4: Automatic Data Processing (ADP)

- Expected annual returns: 14.0%

Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers.

ADP posted first quarter earnings on October 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.49, which was a nickel ahead of estimates.

Revenue was up 7.2% year-over-year to $5.18 billion, beating estimates by $50 million. Expenses were $3.98 billion, down from $4.03 billion in Q4, but higher from $3.70 billion a year earlier.

Adjusted EBIT margin was 25.5% of revenue, up from 23.7% in Q4 and flat to 25.5% a year ago. Employer Services revenue was $3.49 billion, up 7% year-over-year. Segment earnings were $1.23 billion, up 6%, while pretax margin was down from 35.7% of revenue to 35.2%.

PEO Services revenue was $1.69 billion, up 7% year-over-year, while segment earnings fell to $219 million. Pretax margin was 13% of revenue, off from 14.3% a year ago.

The company raised its dividend to $1.70 per share quarterly, which was up 10.4% from the prior payout. That’s the 51st consecutive year of dividend increase.

Click here to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

Dividend King To Build Retirement Income #3: PepsiCo Inc. (PEP)

- Expected annual returns: 14.5%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

The company has more than 20 $1 billion brands in its portfolio. On February 4th, 2025, PepsiCo increased its annualized dividend by 5.0% to $5.69 starting with the payment that was made in June 2025, extending the company’s dividend growth streak to 53 consecutive years.

On October 9th, 2025, PepsiCo reported third quarter earnings results for the period ending September 30th, 2025. For the quarter, revenue grew 2.7% to $23.9 billion, which beat estimates by $90 million. Adjusted earnings-per-share of $2.29 compared unfavorably to $2.31 the prior year, but this was $0.03 better than expected.

Organic sales grew 1.3% for the third quarter. For the period, volumes for both beverages and foods were down 1%. PepsiCo Beverages North America’s organic revenue grew 2% for the period even as volume declined by 3%.

Revenue for PepsiCo Foods North America decreased 3%, largely due to divestitures. Food volume decreased 4%. The International Beverages segment fell 1%, primarily due to lower volume. Revenues in Europe/Middle East/Africa were up 5.5%. Food volume declined 1%, but this was offset by a 1.5% gain in beverages.

PepsiCo reaffirmed prior guidance for 2025, with the company still expecting organic sales in the low single-digit range.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

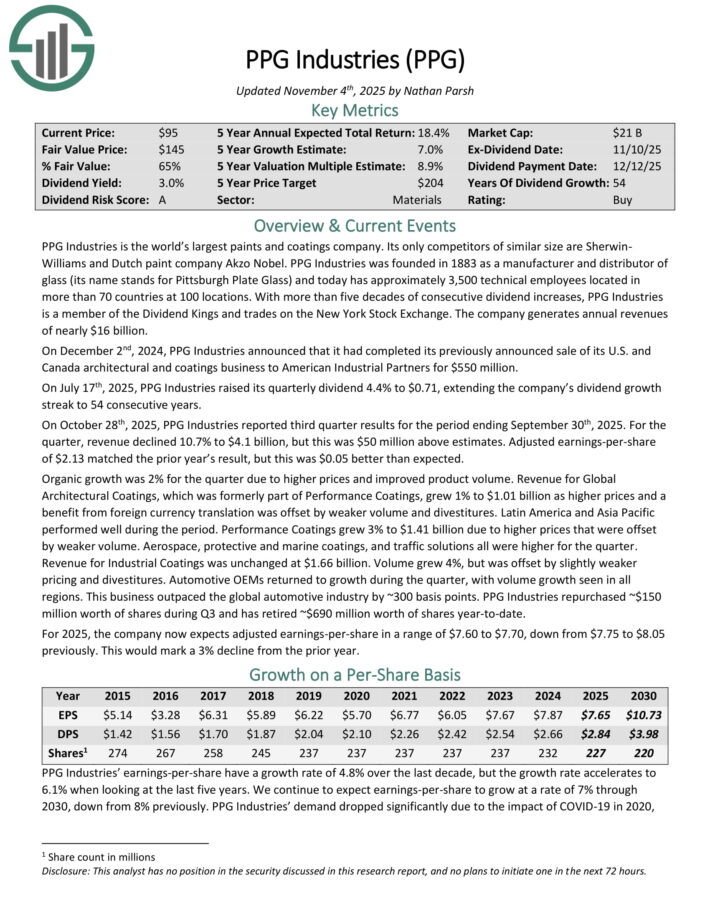

Dividend King To Build Retirement Income #2: PPG Industries (PPG)

- Expected annual returns: 16.4%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

On July 17th, 2025, PPG Industries raised its quarterly dividend 4.4% to $0.71, extending the company’s dividend growth streak to 54 consecutive years.

On October 28th, 2025, PPG Industries reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue declined 10.7% to $4.1 billion, but this was $50 million above estimates. Adjusted earnings-per-share of $2.13 matched the prior year’s result, but this was $0.05 better than expected.

Organic growth was 2% for the quarter due to higher prices and improved product volume. Revenue for Global Architectural Coatings, which was formerly part of Performance Coatings, grew 1% to $1.01 billion as higher prices and a benefit from foreign currency translation was offset by weaker volume and divestitures.

Latin America and Asia Pacific performed well during the period. Performance Coatings grew 3% to $1.41 billion due to higher prices that were offset by weaker volume. Aerospace, protective and marine coatings, and traffic solutions all were higher for the quarter.

Revenue for Industrial Coatings was unchanged at $1.66 billion. Volume grew 4%, but was offset by slightly weaker pricing and divestitures. Automotive OEMs returned to growth during the quarter, with volume growth seen in all regions. This business outpaced the global automotive industry by ~300 basis points.

PPG Industries repurchased ~$150 million worth of shares during Q3 and has retired ~$690 million worth of shares year-to-date.

For 2025, the company now expects adjusted earnings-per-share in a range of $7.60 to $7.70.

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

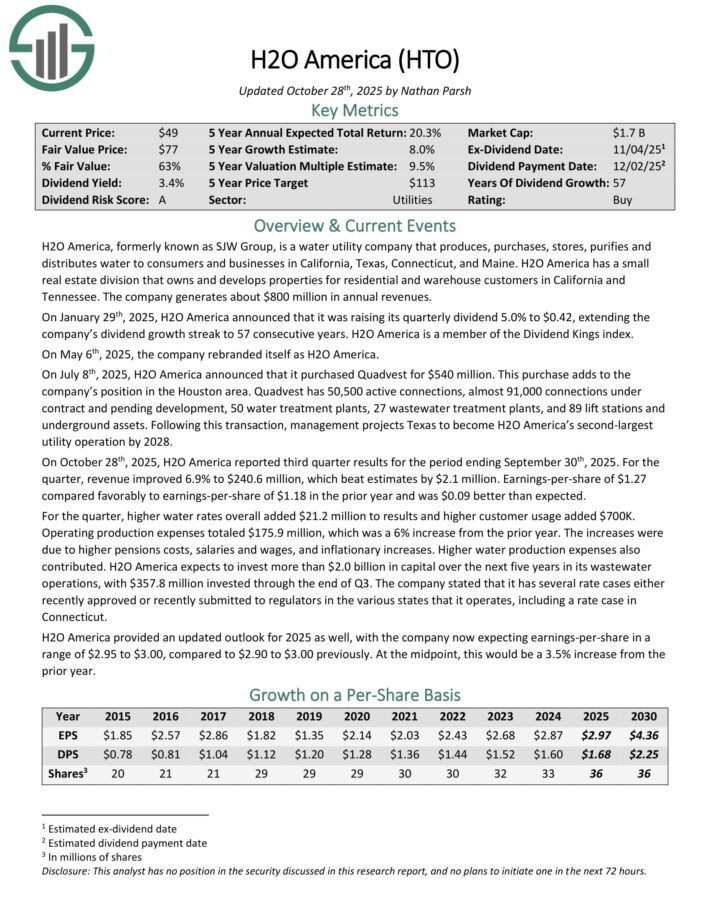

Dividend King To Build Retirement Income #1: H2O America (HTO)

- Expected annual returns: 20.3%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On October 28th, 2025, H2O America reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue improved 6.9% to $240.6 million, which beat estimates by $2.1 million.

Earnings-per-share of $1.27 compared favorably to earnings-per-share of $1.18 in the prior year and was $0.09 better than expected.

For the quarter, higher water rates overall added $21.2 million to results and higher customer usage added $700K. Operating production expenses totaled $175.9 million, which was a 6% increase from the prior year.

The increases were due to higher pensions costs, salaries and wages, and inflationary increases.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.