Updated on June 28th, 2024 by Bob Ciura

Kinder Morgan (KMI) is an attractive dividend stock that is currently offering a 5.8% yield, making it one of the high-yield stocks in our database.

Kinder Morgan is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Kinder Morgan in greater detail.

Business Overview

Kinder Morgan is among the largest energy companies in the U.S. It is engaged in storing and transporting oil and gas, and other products. It owns an interest in or operates approximately 83,000 miles of pipelines and 144 terminals.

Its pipelines transport natural gas, refined petroleum products, crude oil, carbon dioxide (CO2), and more.

Kinder Morgan’s transportation assets operate like a toll road, whereby the company receives a fee for its services, which generally avoids commodity price risk. Approximately 90% of Kinder Morgan’s cash flow is fee-based.

Source: Investor Presentation

The company reported first quarter earnings per share (EPS) of $0.33 and distributable cash flow (DCF) per share of $0.64, marking a 10% and 5% increase, respectively, compared to the first quarter of 2023.

Net income attributable to KMI reached $746 million, up from $679 million in the same quarter last year, while DCF amounted to $1,422 million, compared to $1,374 million in the first quarter of 2023.

Growth Prospects

Kinder Morgan’s biggest growth catalysts for the future are new pipeline and terminal projects. Natural gas is a compelling growth catalyst and continued to drive growth in the first half of this year.

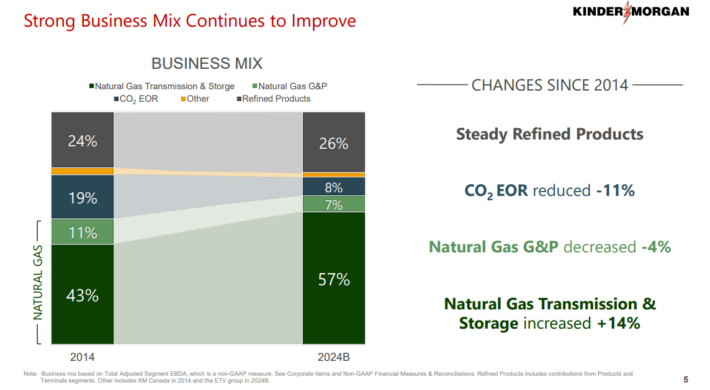

Natural gas is rapidly replacing coal, which gives Kinder Morgan a major advantage. In turn, the company has shifted its business mix heavily toward natural gas in the past decade.

Approximately 64% of KMI’s cash flows now come from natural gas, and the company itself transports around 40% of U.S. natural gas production.

Source: Investor Presentation

The company plans to continue investing in growth projects and joint ventures in 2024 and expects to fully fund them with internally generated cash flow without needing to access capital markets.

For 2024, we expect Kinder Morgan to generate DCF per share of approximately $2.25. The company grew its dividend by 1.9% in 2021, and analysts expected a $1.11 per share dividend in 2022.

We expect the company’s DCF per share to increase steadily over the next half-decade due to continued incremental growth projects and occasional share repurchases.

KMI has a $3.3 billion committed growth capital project backlog as of March 31st. The company expects 40% of backlog capital to be placed into service in 2024, another 45% next year, and 15% beyond 2024.

Overall, we expect annual DCF-per-share growth of 2%-3% per year for KMI going forward.

Competitive Advantages

Kinder Morgan operates in the cyclical energy sector, but its business model still enables it to generate fairly stable cash flows.

This stems from the fact that it owns North America’s largest CO2 transportation, independent refined products transportation, independent terminal, and natural gas transmission businesses.

Kinder Morgan also enjoys a very stable cash flow profile, with 68% of its cash flow stemming from take-or-pay (or hedged) contracts and 27% from fee-based contracts, leaving only 5% as commodity-price sensitive.

Kinder Morgan has been deleveraging in recent years. It now has a net-debt-to-adjusted-EBITDA ratio of 3.9x, down from 4.2x at the end of 2023.

Dividend Analysis

Kinder Morgan has been growing its dividend at a slow but steady pace in recent years, with the dividend growing by ~2% per year for the past several years.

While not a fast dividend grower, Kinder Morgan’s dividend appears to be secure. The company generates enough DCF to maintain the dividend, while it has also reduced debt to shore up its financial position.

The balance sheet is in solid shape with a BBB credit rating from S&P. KMI’s dividend payout level seems to be secure, with a DCF payout ratio of 50% expected for 2024.

Final Thoughts

Kinder Morgan is a compelling high-yield dividend stock given its leadership position in the midstream energy industry, stable cash flow, and high yield of 5.8%.

While growth prospects are not overly strong, the company has numerous avenues to generate growth in the coming years. This should allow KMI to fuel consistent dividend increases.

Overall, we view Kinder Morgan as an attractive dividend stock for income investors.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List