Updated on May 30th, 2025 by Bob Ciura

Master Limited Partnerships, otherwise known as MLPs, have obvious appeal for income investors. This is because MLPs widely offer yields of 5% or even higher in some cases.

With this in mind, we created a full downloadable list of nearly 100 Master Limited Partnerships.

You can download the Excel spreadsheet (along with relevant financial metrics like dividend yield and payout ratios) by clicking on the link below:

This article covers the 15 highest-yielding MLPs today that are covered in the Sure Analysis Research Database.

The table of contents below allows for easy navigation of the article:

Table of Contents

- High-Yield MLP #15: Genesis Energy LP (GEL)

- High-Yield MLP #14: Brookfield Infrastructure Partners LP (BIP)

- High-Yield MLP #13: Cheniere Energy Partners LP (CQP)

- High-Yield MLP #12: Star Group LP (SGU)

- High-Yield MLP #11: Brookfield Renewable Partners LP (BEP)

- High-Yield MLP #10: Sunoco LP (SUN)

- High-Yield MLP #9: Enterprise Products Partners LP (EPD)

- High-Yield MLP #8: Energy Transfer LP (ET)

- High-Yield MLP #7: MPLX LP (MPLX)

- High-Yield MLP #6: Hess Midstream LP (HESM)

- High-Yield MLP #5: Alliance Bernstein Holding LP (AB)

- High-Yield MLP #4: USA Compression Partners LP (USAC)

- High-Yield MLP #3: Plains GP Holdings LP (PAGP)

- High-Yield MLP #2: Plains All American Pipeline LP (PAA)

- High-Yield MLP #1: Delek Logistics Partners LP (DLK)

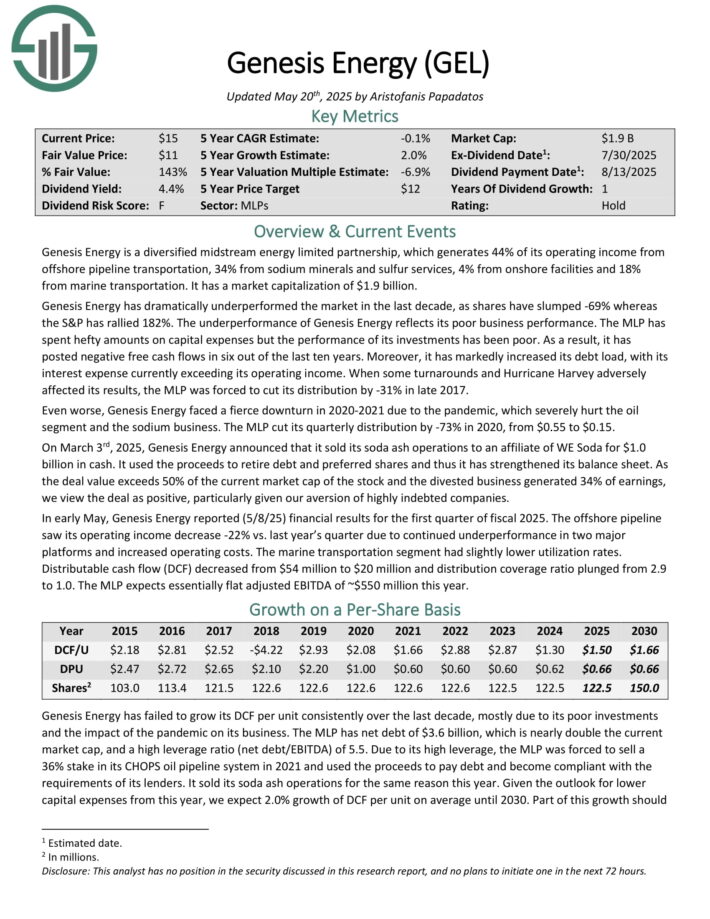

High Yield MLP #15: Genesis Energy LP (GEL)

- Distribution yield: 4.2%

Genesis Energy is a diversified midstream energy limited partnership, which generates 44% of its operating income from offshore pipeline transportation, 34% from sodium minerals and sulfur services, 4% from onshore facilities and 18% from marine transportation.

On March 3rd, 2025, Genesis Energy announced that it sold its soda ash operations to an affiliate of WE Soda for $1.0 billion in cash. It used the proceeds to retire debt and preferred shares and thus it has strengthened its balance sheet.

As the deal value exceeds 50% of the current market cap of the stock and the divested business generated 34% of earnings, we view the deal as positive, particularly given our aversion of highly indebted companies.

In early May, Genesis Energy reported (5/8/25) financial results for the first quarter of fiscal 2025. The offshore pipeline saw its operating income decrease -22% vs. last year’s quarter due to continued underperformance in two major platforms and increased operating costs. The marine transportation segment had slightly lower utilization rates.

Distributable cash flow (DCF) decreased from $54 million to $20 million.

Click here to download our most recent Sure Analysis report on GEL (preview of page 1 of 3 shown below):

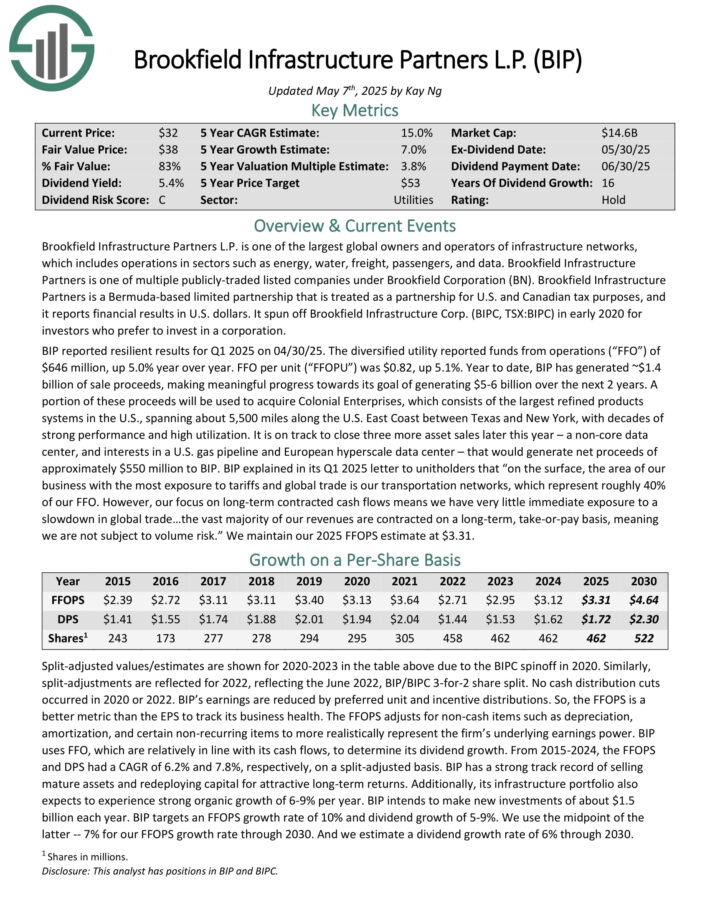

High Yield MLP #14: Brookfield Infrastructure Partners LP (BIP)

- Distribution yield: 5.2%

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management (BAM).

BIP has delivered 8% compound annual distribution growth over the past 10 years.

Source: Investor Presentation

BIP reported resilient results for Q1 2025 on 04/30/25. The diversified utility reported funds from operations of $646 million, up 5.0% year over year. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

Year to date, BIP has generated ~$1.4 billion of sale proceeds, making meaningful progress towards its goal of generating $5-6 billion over the next 2 years.

A portion of these proceeds will be used to acquire Colonial Enterprises, which consists of the largest refined products systems in the U.S., spanning about 5,500 miles along the U.S. East Coast between Texas and New York.

Click here to download our most recent Sure Analysis report on Brookfield Infrastructure Partners (preview of page 1 of 3 shown below):

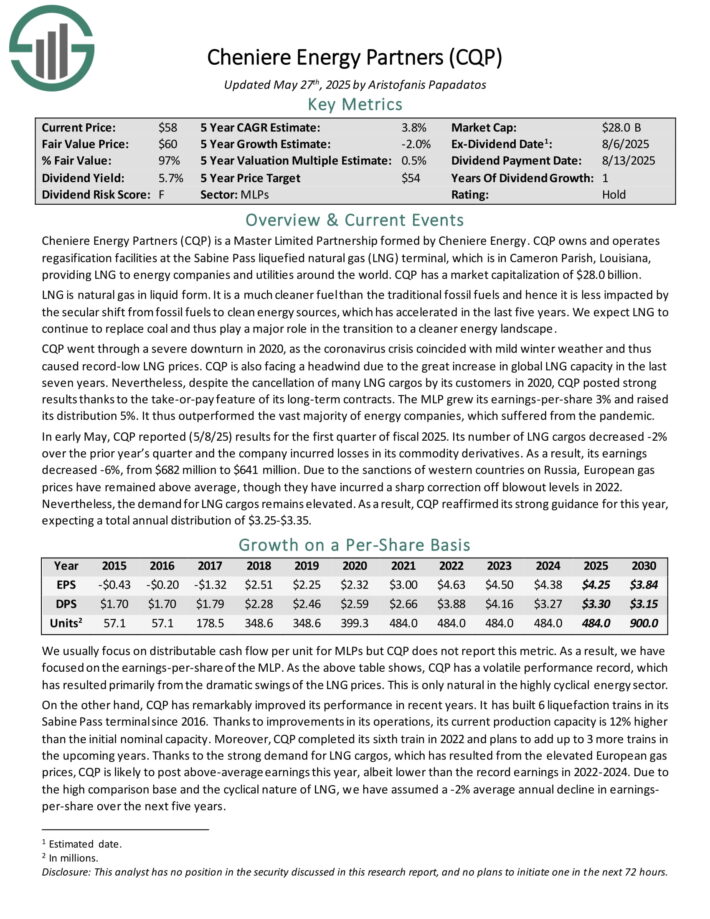

High Yield MLP #13: Cheniere Energy Partners LP (CQP)

- Distribution yield: 5.7%

Cheniere Energy Partners owns and operates regasification facilities at the Sabine Pass liquefied natural gas (LNG) terminal, which is in Cameron Parish, Louisiana, providing LNG to energy companies and utilities around the world.

LNG is natural gas in liquid form. It is a much cleaner fuel than the traditional fossil fuels and hence it is less impacted by the secular shift from fossil fuels to clean energy sources, which has accelerated in the last five years. We expect LNG to continue to replace coal and thus play a major role in the transition to a cleaner energy landscape.

In early May, CQP reported (5/8/25) results for the first quarter of fiscal 2025. Its number of LNG cargos decreased -2% over the prior year’s quarter and the company incurred losses in its commodity derivatives. As a result, its earnings decreased -6%, from $682 million to $641 million.

Nevertheless, the demand for LNG cargos remains elevated. As a result, CQP reaffirmed its strong guidance for this year, expecting a total annual distribution of $3.25-$3.35.

Click here to download our most recent Sure Analysis report on CQP (preview of page 1 of 3 shown below):

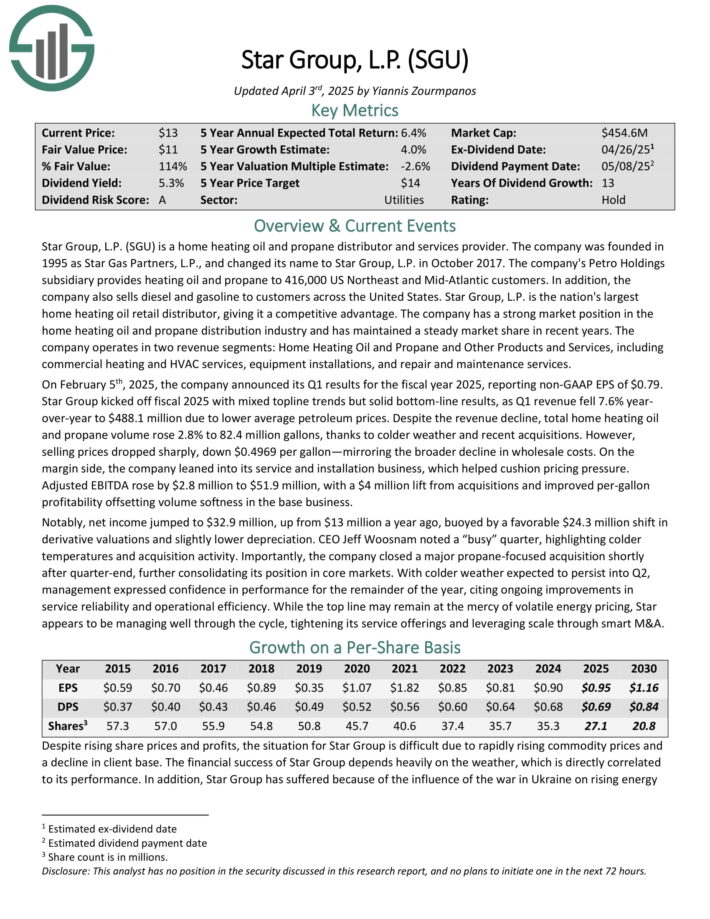

High Yield MLP #12: Star Group LP (SGU)

- Distribution yield: 6.2%

Star Group, L.P. is a home heating oil and propane distributor and services provider. The company’s Petro Holdings subsidiary provides heating oil and propane to 416,000 US Northeast and Mid-Atlantic customers. In addition, the company also sells diesel and gasoline to customers across the United States.

It operates two segments: Home Heating Oil and Propane and Other Products and Services, including commercial heating and HVAC services, equipment installations, and repair and maintenance services.

On February 5th, 2025, the company announced its Q1 results for the fiscal year 2025, reporting non-GAAP EPS of $0.79. Star Group kicked off fiscal 2025 with mixed top-line trends but solid bottom-line results, as Q1 revenue fell 7.6% year-over-year to $488.1 million due to lower average petroleum prices.

Despite the revenue decline, total home heating oil and propane volume rose 2.8% to 82.4 million gallons, thanks to colder weather and recent acquisitions.

However, selling prices dropped sharply, down $0.4969 per gallon—mirroring the broader decline in wholesale costs. On the margin side, the company leaned into its service and installation business, which helped cushion pricing pressure.

Click here to download our most recent Sure Analysis report on SGU (preview of page 1 of 3 shown below):

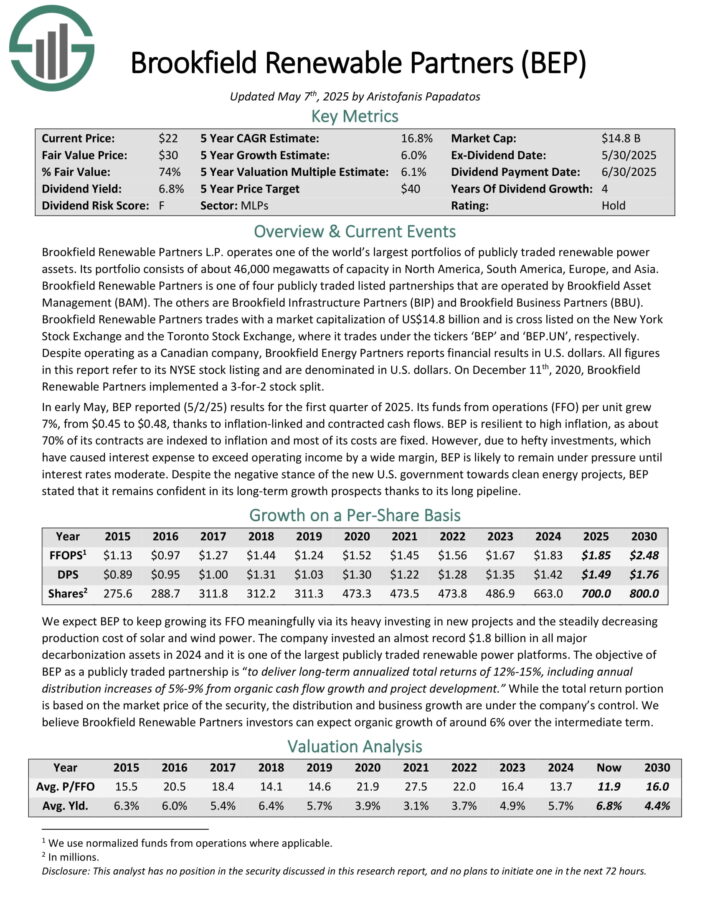

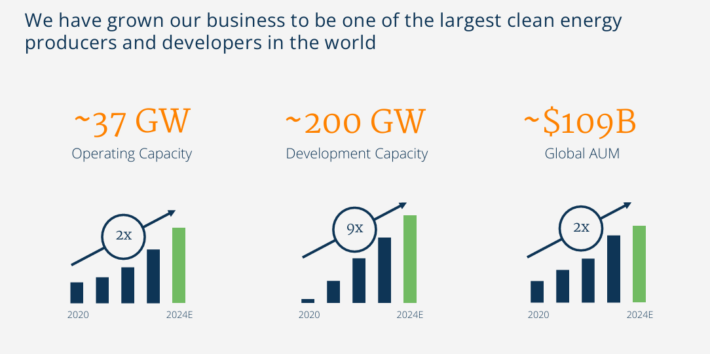

High Yield MLP #11: Brookfield Renewable Partners LP (BEP)

- Distribution yield: 6.2%

Brookfield Renewable Partners L.P. operates one of the world’s largest portfolios of publicly traded renewable power assets. Its portfolio consists of about 33,000 megawatts of capacity in North America, South America, Europe, and Asia.

Brookfield Renewable Partners is one of four publicly traded listed partnerships that are operated by Brookfield Asset Management (BAM). The others are Brookfield Infrastructure Partners (BIP) and Brookfield Business Partners (BBU).

Source: Investor Presentation

In early May, BEP reported (5/2/25) results for the first quarter of 2025. Its funds from operations (FFO) per unit grew 7%, from $0.45 to $0.48, thanks to inflation-linked and contracted cash flows.

BEP is resilient to high inflation, as about 70% of its contracts are indexed to inflation and most of its costs are fixed.

However, due to hefty investments, which have caused interest expense to exceed operating income by a wide margin, BEP is likely to remain under pressure until interest rates moderate.

Click here to download our most recent Sure Analysis report on Brookfield Renewable Partners (preview of page 1 of 3 shown below):

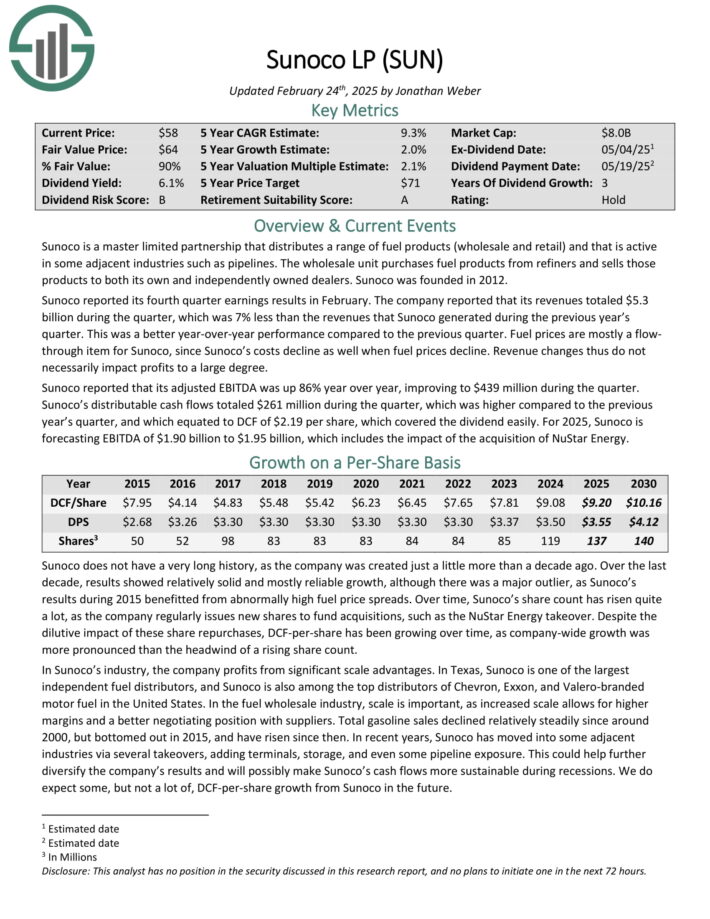

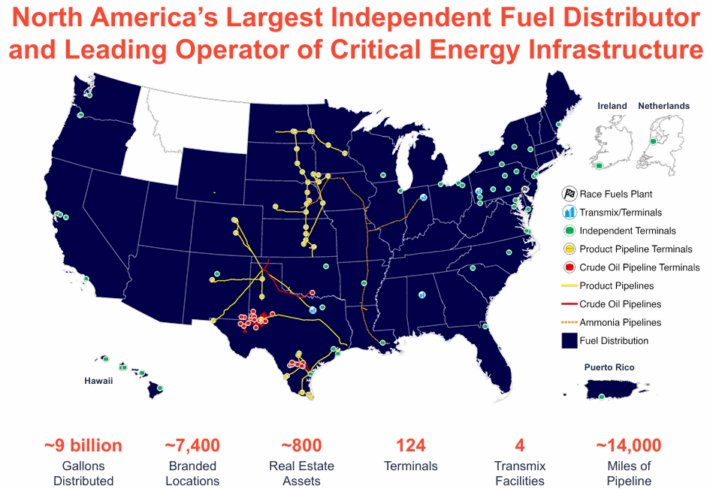

High Yield MLP #10: Sunoco LP (SUN)

- Distribution yield: 6.5%

Sunoco is a master limited partnership that distributes a range of fuel products (wholesale and retail) and that is active in some adjacent industries such as pipelines.

The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Source: Investor Presentation

Sunoco reported its fourth quarter earnings results in February. The company reported that its revenues totaled $5.3 billion during the quarter, which was 7% less than the revenues that Sunoco generated during the previous year’s quarter.

Fuel prices are mostly a flow through item for Sunoco, since Sunoco’s costs decline as well when fuel prices decline. Revenue changes thus do not necessarily impact profits to a large degree.

Sunoco reported that its adjusted EBITDA was up 86% year over year, improving to $439 million during the quarter. Distributable cash flows totaled $261 million during the quarter, which was higher compared to the previous year’s quarter, and which equated to DCF of $2.19 per share.

Click here to download our most recent Sure Analysis report on SUN (preview of page 1 of 3 shown below):

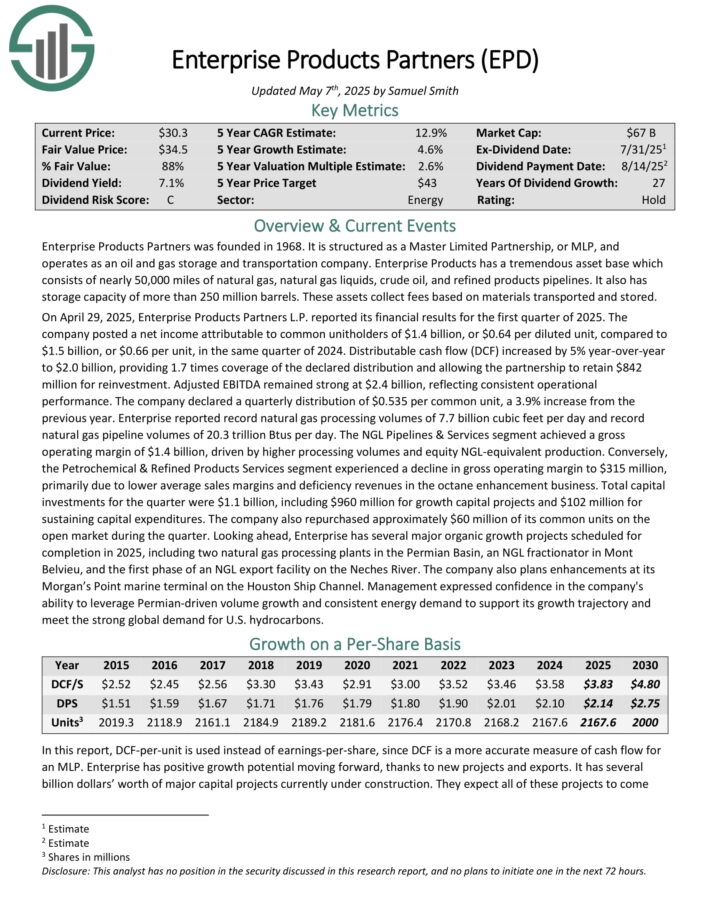

High Yield MLP #9: Enterprise Products Partners LP (EPD)

- Distribution yield: 6.9%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

On April 29, 2025, Enterprise Products Partners L.P. reported its financial results for the first quarter of 2025. The company posted a net income attributable to common unitholders of $1.4 billion, or $0.64 per diluted unit, compared to $1.5 billion, or $0.66 per unit, in the same quarter of 2024.

Distributable cash flow (DCF) increased by 5% year-over-year to $2.0 billion, providing 1.7 times coverage of the declared distribution and allowing the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained strong at $2.4 billion, reflecting consistent operational performance. The company declared a quarterly distribution of $0.535 per common unit, a 3.9% increase from the previous year.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

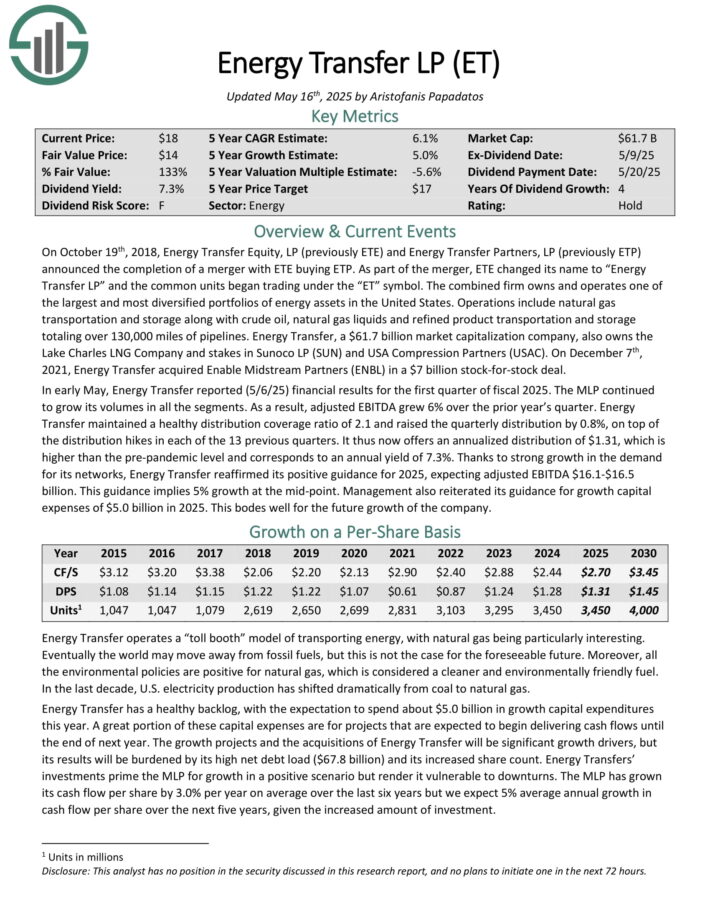

High Yield MLP #8: Energy Transfer LP (ET)

- Distribution yield: 7.4%

Energy Transfer LP owns and operates one of the largest and most diversified portfolios of energy assets in the United States. Operations include natural gas transportation and storage along with crude oil, natural gas liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Energy Transfer also owns the Lake Charles LNG Company and stakes in Sunoco LP (SUN) and USA Compression Partners (USAC).

In early May, Energy Transfer reported (5/6/25) financial results for the first quarter of fiscal 2025. Adjusted EBITDA grew 6% over the prior year’s quarter. Energy Transfer maintained a healthy distribution coverage ratio of 2.1 and raised the quarterly distribution by 0.8%, on top of the distribution hikes in each of the 13 previous quarters.

Thanks to strong growth in the demand for its networks, Energy Transfer reaffirmed its positive guidance for 2025, expecting adjusted EBITDA $16.1-$16.5 billion. This guidance implies 5% growth at the mid-point.

Click here to download our most recent Sure Analysis report on ET (preview of page 1 of 3 shown below):

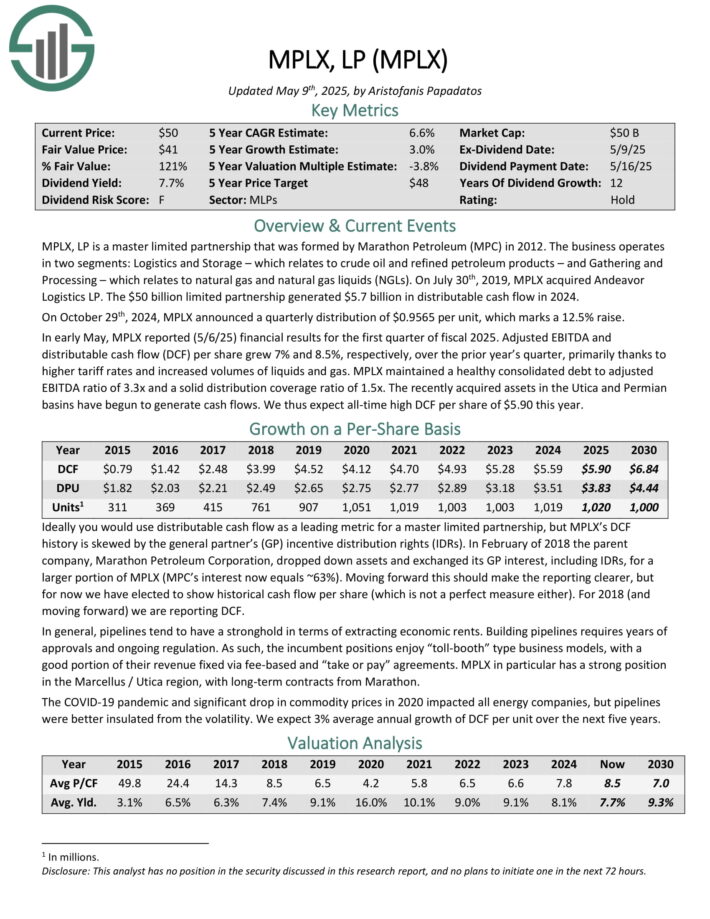

High Yield MLP #7: MPLX LP (MPLX)

- Distribution yield: 7.5%

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

- Logistics and Storage, which relates to crude oil and refined petroleum products

- Gathering and Processing, which relates to natural gas and natural gas liquids (NGLs)

In early May, MPLX reported (5/6/25) financial results for the first quarter of fiscal 2025. Adjusted EBITDA and distributable cash flow (DCF) per share grew 7% and 8.5%, respectively, over the prior year’s quarter, primarily thanks to higher tariff rates and increased volumes of liquids and gas.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.3x and a solid distribution coverage ratio of 1.5x.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

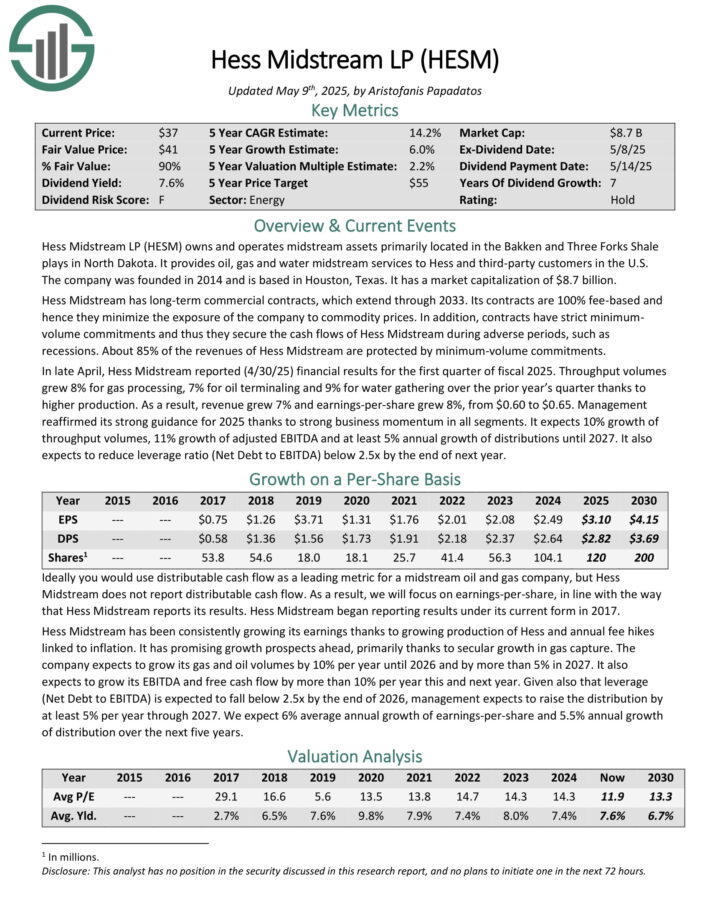

High Yield MLP #6: Hess Midstream LP (HESM)

- Distribution yield: 7.6%

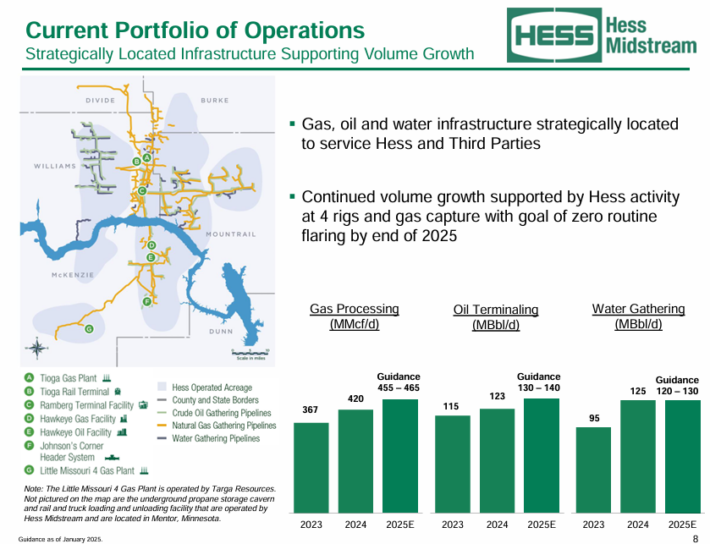

Hess Midstream LP owns and operates midstream assets primarily located in the Bakken and Three Forks Shale plays in North Dakota. It provides oil, gas and water midstream services to Hess and third-party customers in the U.S.

Hess Midstream has long-term commercial contracts, which extend through 2033. Its contracts are 100% fee-based and minimize the exposure of the company to commodity prices.

Source: Investor Presentation

In late April, Hess Midstream reported (4/30/25) financial results for the first quarter of fiscal 2025. Throughput volumes grew 8% for gas processing, 7% for oil terminaling and 9% for water gathering over the prior year’s quarter thanks to higher production.

As a result, revenue grew 7% and earnings-per-share grew 8%, from $0.60 to $0.65. Management reaffirmed its strong guidance for 2025 thanks to strong business momentum in all segments.

It expects 10% growth of throughput volumes, 11% growth of adjusted EBITDA and at least 5% annual growth of distributions until 2027.

Click here to download our most recent Sure Analysis report on HESM (preview of page 1 of 3 shown below):

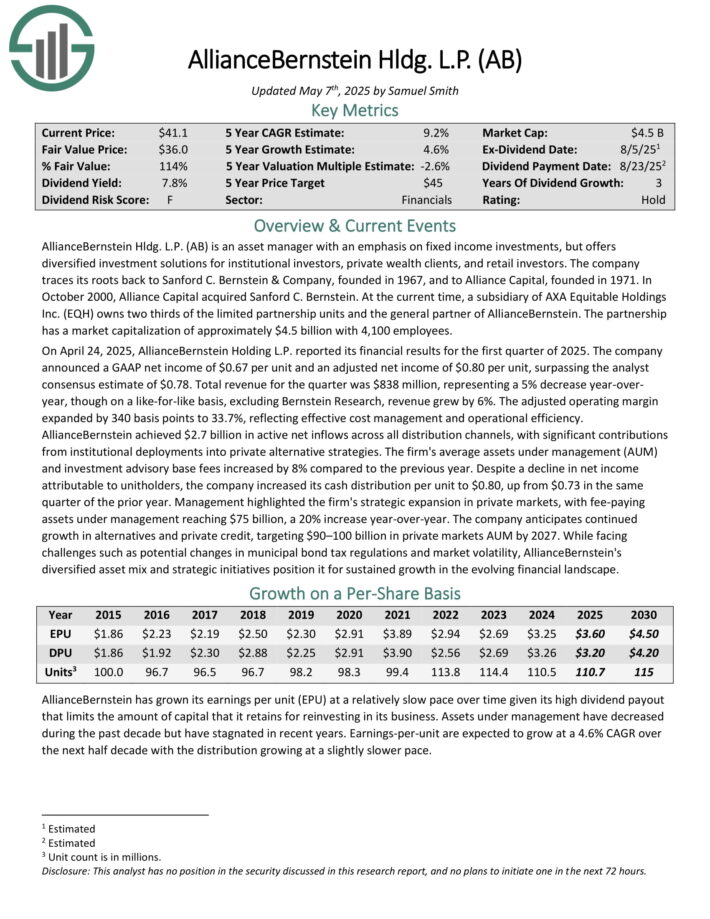

High Yield MLP #5: Alliance Bernstein Holding LP (AB)

- Distribution yield: 8.0%

AllianceBernstein Hldg. L.P. is an asset manager with an emphasis on fixed income investments, but offers diversified investment solutions for institutional investors, private wealth clients, and retail investors.

On April 24, 2025, AllianceBernstein Holding L.P. reported its financial results for the first quarter of 2025. The company announced a GAAP net income of $0.67 per unit and an adjusted net income of $0.80 per unit, surpassing the analyst consensus estimate of $0.78.

Total revenue for the quarter was $838 million, representing a 5% decrease year-over-year, though on a like-for-like basis, excluding Bernstein Research, revenue grew by 6%. The adjusted operating margin expanded by 340 basis points to 33.7%, reflecting effective cost management and operational efficiency.

AllianceBernstein achieved $2.7 billion in active net inflows across all distribution channels, with significant contributions from institutional deployments into private alternative strategies. The firm’s average assets under management (AUM) and investment advisory base fees increased by 8% compared to the previous year.

Despite a decline in net income attributable to unitholders, the company increased its cash distribution per unit to $0.80, up from $0.73 in the same quarter of the prior year.

Click here to download our most recent Sure Analysis report on AB (preview of page 1 of 3 shown below):

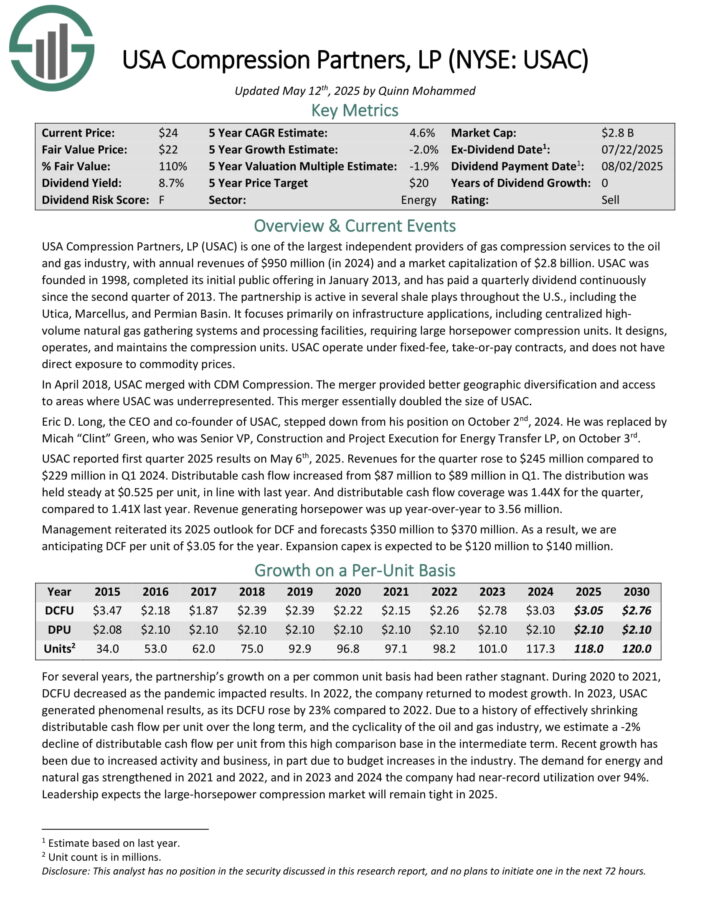

High Yield MLP #4: USA Compression Partners LP (USAC)

- Distribution yield: 8.3%

USA Compression Partners, LP is one of the largest independent providers of gas compression services to the oil and gas industry, with annual revenues of $950 million in 2024.

The partnership is active in several shale plays throughout the U.S., including the Utica, Marcellus, and Permian Basin. It focuses primarily on infrastructure applications, including centralized high-volume natural gas gathering systems and processing facilities, requiring large horsepower compression units.

It designs, operates, and maintains the compression units. USAC operate under fixed-fee, take-or-pay contracts, and does not have direct exposure to commodity prices.

USAC reported first quarter 2025 results on May 6th, 2025. Revenues for the quarter rose to $245 million compared to $229 million in Q1 2024. Distributable cash flow increased from $87 million to $89 million in Q1. The distribution was held steady at $0.525 per unit, in line with last year.

Distributable cash flow coverage was 1.44X for the quarter, compared to 1.41X last year. Revenue generating horsepower was up year-over-year to 3.56 million. Management reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click here to download our most recent Sure Analysis report on USAC (preview of page 1 of 3 shown below):

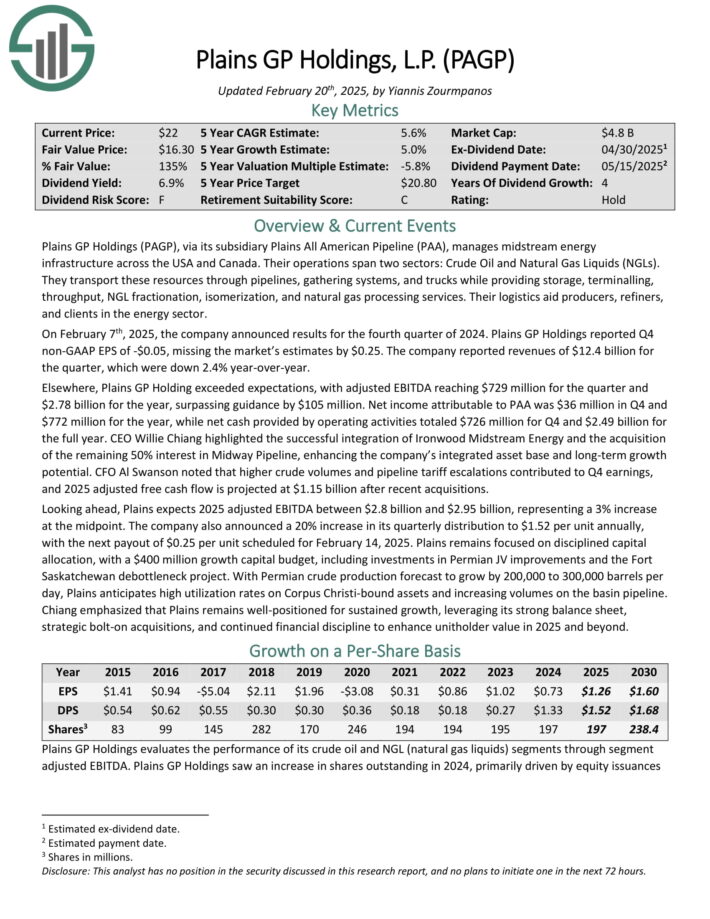

High Yield MLP #3: Plains GP Holdings LP (PAGP)

- Distribution yield: 8.6%

Plains GP Holdings via its subsidiary Plains All American Pipeline (PAA), manages midstream energy infrastructure across the USA and Canada. Their operations span two sectors: Crude Oil and Natural Gas Liquids (NGLs).

They transport these resources through pipelines, gathering systems, and trucks while providing storage, terminalling, throughput, NGL fractionation, isomerization, and natural gas processing services. Their logistics aid producers, refiners, and clients in the energy sector.

On February 7th, 2025, the company announced results for the fourth quarter of 2024. Plains GP Holdings reported Q4 non-GAAP EPS of -$0.05, missing the market’s estimates by $0.25. The company reported revenues of $12.4 billion for the quarter, which were down 2.4% year-over-year.

Looking ahead, Plains expects 2025 adjusted EBITDA between $2.8 billion and $2.95 billion, representing a 3% increase at the midpoint. The company also announced a 20% increase in its quarterly distribution to $1.52 per unit annually, with the next payout of $0.25 per unit scheduled for February 14, 2025.

With Permian crude production forecast to grow by 200,000 to 300,000 barrels per day, Plains anticipates high utilization rates on Corpus Christi-bound assets and increasing volumes on the basin pipeline.

Click here to download our most recent Sure Analysis report on PAGP (preview of page 1 of 3 shown below):

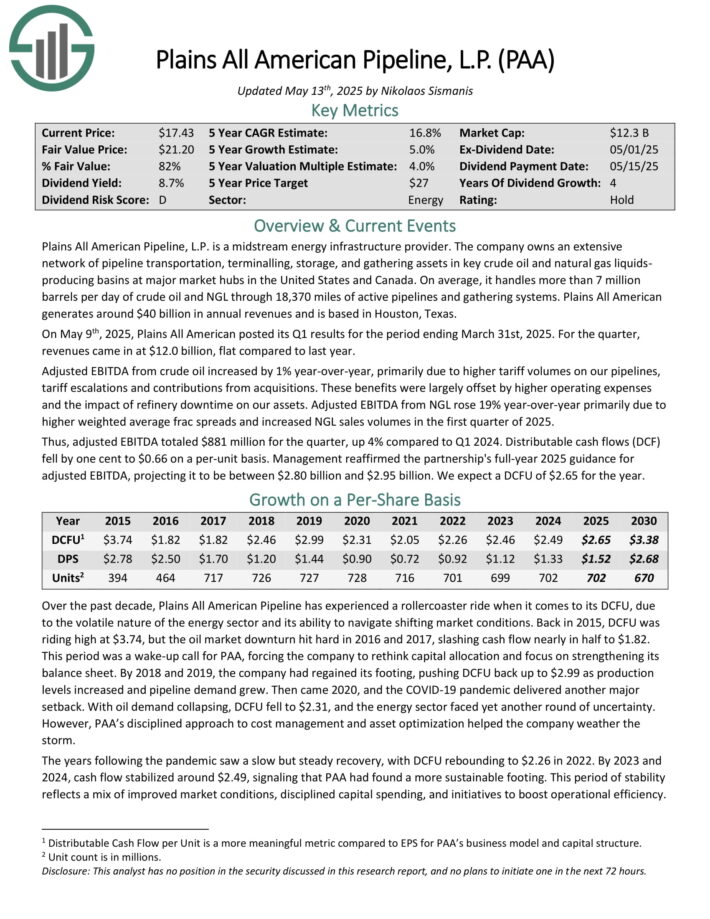

High Yield MLP #2: Plains All American Pipeline LP (PAA)

- Distribution yield: 9.2%

Plains All American Pipeline, L.P. is a midstream energy infrastructure provider. The company owns an extensive network of pipeline transportation, terminalling, storage, and gathering assets in key crude oil and natural gas liquids producing basins at major market hubs in the United States and Canada.

On average, it handles more than 7 million barrels per day of crude oil and NGL through 18,370 miles of active pipelines and gathering systems. Plains All American generates around $40 billion in annual revenues and is based in Houston, Texas.

On May 9th, 2025, Plains All American posted its Q1 results for the period ending March 31st, 2025. For the quarter, revenues came in at $12.0 billion, flat compared to last year. Adjusted EBITDA from crude oil increased by 1% year-over-year, primarily due to higher tariff volumes on our pipelines, tariff escalations and contributions from acquisitions.

These benefits were largely offset by higher operating expenses and the impact of refinery downtime on our assets. Adjusted EBITDA from NGL rose 19% year-over-year primarily due to higher weighted average frac spreads and increased NGL sales volumes in the first quarter of 2025.

Click here to download our most recent Sure Analysis report on PAA (preview of page 1 of 3 shown below):

High Yield MLP #1: Delek Logistics Partners LP (DKL)

- Distribution yield: 10.7%

Delek Logistics Partners, LP is a publicly traded master limited partnership (MLP) headquartered in Brentwood, Tennessee. Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a network of midstream energy infrastructure assets.

These assets include approximately 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily located in the southeastern United States and west Texas.

The company’s operations are integral to Delek US’s refining activities, particularly supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics provides services such as gathering, transporting, and storing crude oil, as well as marketing, distributing, and storing refined products for both Delek US and third-party customers.

DLK has increased its distribution for 10 consecutive years and currently yields over 10%, making it a high-yield blue chip.

Click here to download our most recent Sure Analysis report on DKL (preview of page 1 of 3 shown below):

Final Thoughts

Income investors will find a lot to like about Master Limited Partnerships. Specifically, MLPs tend to have very high yields.

Of course, investors should always do their own research to understand the unique tax implications and risk factors of MLPs.

But for income investors primarily looking for high yields, these 20 MLPs may be attractive.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources

resources will be useful:

High-Yield Individual Security Research:

Other Sure Dividend Resources:

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Monthly Dividend Stocks: Individual securities that pay out every month