Updated on July 13th, 2025 by Nathan Parsh

Companies with long track records of dividend growth are among our favorite stocks. Long dividend growth streaks demonstrate a company’s ability to increase its distributions during a recession.

Investors’ income needs don’t disappear during recessions, so they have to be as confident as possible that their investments will continue to pay dividends.

Companies with more than 50 years of dividend growth have managed to navigate multiple recessions and still increase their payments.

You can see all 55 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

This milestone is impressive for any company, but it is even more so for those that are extremely sensitive to economic conditions.

One of the more cyclical Dividend Kings is Stanley Black & Decker (SWK), which has raised its dividend for 57 consecutive years.

This article will examine the company’s business, prospects for growth, and future returns to determine if now is the right time to purchase this Dividend King.

Business Overview

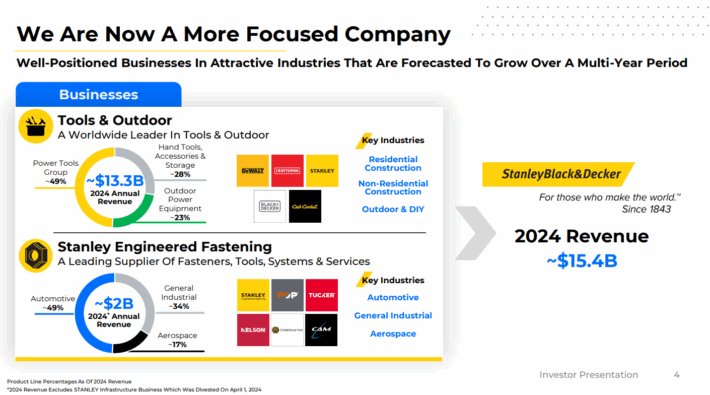

Stanley Black & Decker is a global leader in the area of power tools, hand tools, and related products. The company maintains the top position in tools and storage sales worldwide. SWK operates in the industrial sector.

The company is composed of two segments: Tools & Outdoor and Industrial.

Source: Investor Presentation

On April 30th, 2025, Stanley Black & Decker reported first-quarter earnings results, with the company producing revenue of $3.74 billion, which was 3.4% less than the prior year, but $20 million above estimates. Adjusted earnings-per-share of $0.75 compared favorably to $0.56 for the previous year and were $0.08 more than expected.

Companywide organic revenue grew 1% for the period, but this was negatively impacted by currency exchange and divestitures. Tools & Outdoor grew 1% organically due to strength in North America, which was offset by the rest of the world. Weaker results in Consumer and Auto Production offset gains for DEWALK, Outdoor, and Aerospace. The Industrial segment fell 21%, primarily as a result of divestitures. Organic growth was lower by just 1%.

Adjusted gross margin improved 140 basis points to 30.4% for the quarter.

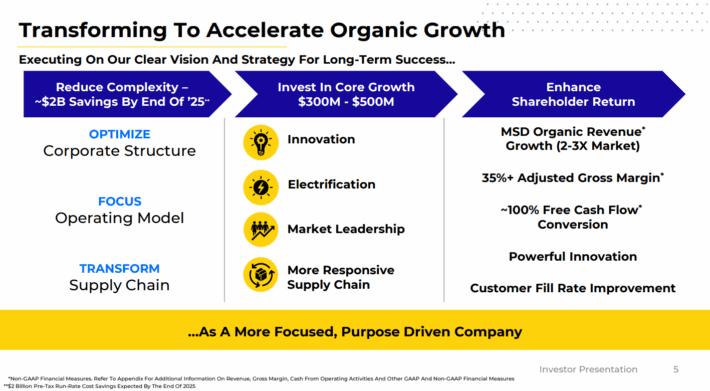

The company’s ongoing cost reduction initiatives are expected to deliver $2.0 billion in pre-tax run-rate savings by the end of 2025. These efforts focus on supply chain transformation, strategic sourcing, and operational efficiency to restore adjusted gross margins to over 35%. Total pre-tax run-rate savings reached $1.7 billion since the program’s 2022 inception.

Looking ahead, Stanley Black & Decker has revised its full-year earnings guidance, now forecasting GAAP EPS between $3.15 and $3.45 and lowering adjusted EPS to between $4.35 and $4.65. The revision in adjusted earnings-per-share is largely tied to tariffs. The company expects free cash flow of at least $500 million for the year. Stanley Black & Decker aims to leverage its cost savings to fund growth initiatives in its core markets, focusing on brand strength, product innovation, and enhanced customer engagement to drive long-term growth and shareholder value.

Growth Prospects

Stanley Black & Decker’s earnings per share have been flat over the last decade. In the years since, however, they have generally risen consistently before 2022.

We now expect the company to grow earnings-per-share at a rate of 8% annually going forward, as Stanley Black & Decker’s results are starting from a low base.

Stanley Black & Decker has become the worldwide leader in tools and related products because of its iconic brands, such as Stanley, DeWalt, and Black & Decker. These names are known and trusted by professional contractors and do-it-yourself customers.

This should help propel growth once supply chain constraints and higher inflationary pressures ease.

Source: Investor Presentation

While organic growth has been solid during the past decade, the company also benefited from strategic acquisitions. In fact, the company has allocated around $10 billion in acquisitions since 2005 to advance growth opportunities.

Perhaps its most significant acquisition was the $900 million purchase of the Craftsman brand from Sears Holdings in 2017.

We expect the company to grow earnings-per-share by 8% per year over the next five years.

Competitive Advantages & Recession Performance

Stanley Black & Decker’s key competitive advantage remains its well-established brands. The company also invests heavily in research and development to bring new products to market.

Like most cyclical companies, Stanley Black & Decker needs a financially healthy consumer and a solid economy to deliver bottom-line growth.

This was not the case during the Great Recession. The company’s adjusted earnings-per-share results are listed below before, during, and after the last recession.

- 2007 adjusted earnings-per-share: $4.00 (15.3% increase)

- 2008 adjusted earnings-per-share: $3.41 (14.8% decrease)

- 2009 adjusted earnings-per-share: $2.72 (20.2% decrease)

- 2010 adjusted earnings-per-share: $3.96 (45.6% increase)

As you can see, Stanley Black & Decker was far from immune to the last recession. Adjusted EPS fell more than 30% from 2007 to 2009. However, the company quickly recovered and posted a new high for adjusted EPS in 2010.

Valuation & Expected Returns

Stanley Black & Decker’s current share price is ~$73. The company expects adjusted earnings per share of $4.50 for the year. SWK stock has a 2025 price-to-earnings ratio of 16.2. We have a five-year target P/E of 15 times earnings, which is well below its long-term average P/E of more than 22.

If the P/E ratio decreases from 16.2 to 15 over the next five years, annual shareholder returns would decrease by 1.6% annually.

Including 8% expected EPS growth and the 4.5% dividend yield, total returns will reach 9.8% per year over the next five years.

Final Thoughts

Stanley Black & Decker is the undisputed leader in its industry. The company continues to invest in R&D and pursue acquisitions that should enable it to continue growing.

Stanley Black & Decker also has more than five decades of dividend growth, proving itself capable of growing its dividend even under adverse economic conditions.

The stock appears to be overvalued, with a five-year expected return of 9.8% per year. As a result, we rate Stanley Black & Decker a blue-chip stock to hold for dividend growth and total returns.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.