Published on February 22nd, 2024 by Bob Ciura

The Dividend Kings consist of companies that have raised their dividends for at least 50 years in a row. Because of their unparalleled streak of annual dividend increases, it is common to view the Dividend Kings as among the best dividend growth stocks in the stock market.

You can see the full list of all 56 Dividend Kings here.

We also created a full list of all Dividend Kings, along with relevant financial statistics like dividend yields and price-to-earnings ratios. You can download the full list of Dividend Kings by clicking on the link below:

Telephone & Data Systems (TDS) recently increased its dividend for the 50th consecutive year. As a result, the company now joins the exclusive list of Dividend Kings.

This article will analyze the company’s business overview, future growth prospects, competitive advantages, and more.

Business Overview

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across the United States. The company’s Cellular Division accounts for more than 75% of total operating revenue. TDS started in 1969 as a collection of 10 rural telephone companies. Today the company has a market cap of $1.7 billion and more than $5.4 billion in annual revenues.

TDS posted fourth-quarter earnings on February 16th. Quarterly revenue of $1.32 billion beat estimates by $40 million, while adjusted earnings-per-share came to a loss of $0.11 per share. Revenue declined 3.2% from the 2022 fourth quarter. The net loss of $0.38 per share for the fourth quarter was due primarily to a $547 million non-cash impairment charge at TDS Telecom.

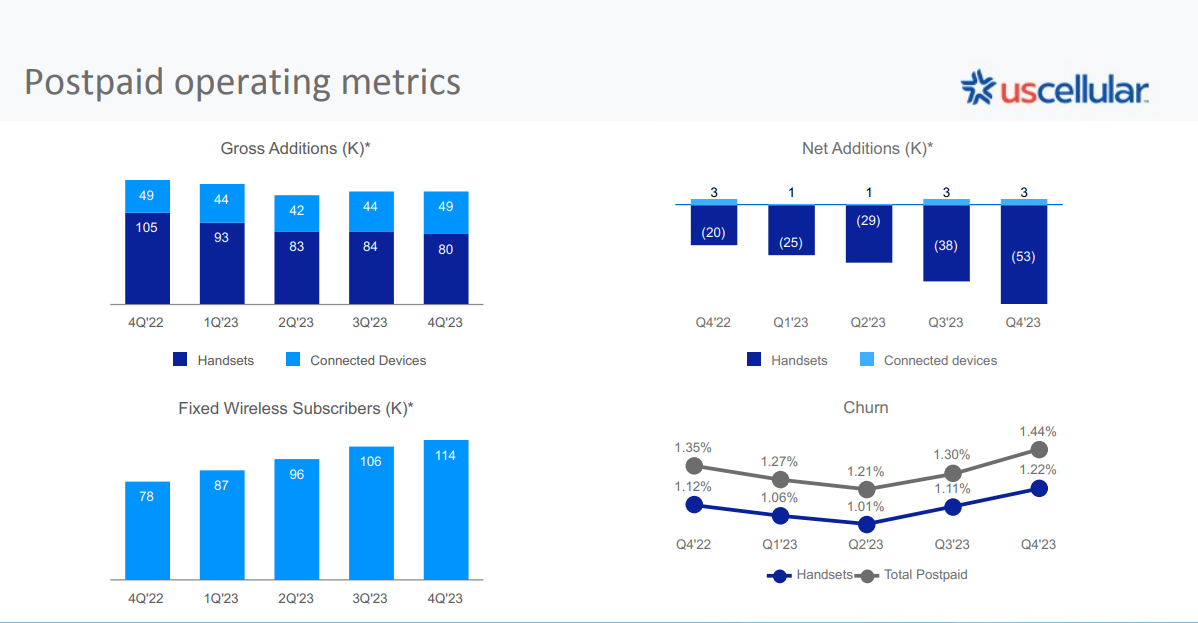

At US Cellular, postpaid average revenue per user grew 2% for the full year 2023. Fixed wireless customers grew 46% to 114,000 while tower rental revenues grew 8% to $100 million.

Along with quarterly results, the company raised its dividend by 2.7% to $0.19 per share.

Growth Prospects

TDS operates a very low-growth business, as it is a very small player in a highly competitive industry that is dominated by Verizon and AT&T. That has led to repeated years of negative earnings growth. TDS has an 82% stake in U.S. Cellular and essentially relies on this stake to achieve growth.

In recent years, U.S. Cellular focused on connecting customers in under-served areas with their high-quality network, as well as market share expansion, increasing business with government customers in 5G and IoT, and improving network modernization and 5G programs.

TDS Telecom grew broadband revenue with an increase in customer connections and expanded the reach of their fiber and 1Gig services. TDS has made investments towards growing its client base, expanding into new territories, as well as improving their network technologies, in an effort to boost the company’s competitiveness.

However, rising operating expenses and impairments are taking some of that advantage away over time, as we saw with 2023 results. In addition to that, the company is trying to build out its offerings in broadband service through its fiber infrastructure, which helps deliver faster and more reliable internet to residences in its service area.

Operating revenue has been roughly flat for some time, and we expect it will remain as such for the foreseeable future. While TDS is trying to invest for growth, we believe the company is facing an uphill battle when it comes to growing earnings in the years to come. We estimate 2% annual EPS growth for the company over the next five years.

Competitive Advantages & Recession Performance

TDS’ competitive advantage, if it has one, is that it has a captive audience of sorts in its service areas. Broadband operators tend to have service areas analogous to power utilities in that choice for consumers is usually limited. That can help protect TDS’ internet-based revenue over time, but we see less of a value proposition for consumers on wireless revenue.

Consumers have much more choice when it comes to wireless revenue, and while TDS hasn’t faced a user exodus, growth is low and we attribute that to the intense competition in the wireless service space. The fact is that Verizon and AT&T have scale advantages that TDS does not, and we think that its competitive position is potentially at risk as a result.

To its credit, TDS has weathered multiple recessions in the past, raising its dividend through all of them. Even if we get a recession in 2024, we don’t think that alone would put the dividend at risk, as the company’s revenue and earnings are not necessarily beholden to economic conditions. Rather, TDS is more susceptible to company-specific risk factors, as discussed above.

Valuation & Expected Returns

To value TDS, we cannot use EPS as the company reported a net loss for 2023. Therefore, we will use book value per share as a proxy for EPS, and price-to-book ratio instead of P/E. Using the current share price of ~$14 and book value per share of $47.90, the stock trades with a price-to-book ratio of 0.30.

The 10-year average P/B ratio is 0.64, but we peg fair value at a P/B ratio of 0.45 by 2029. Still, an expansion of the valuation multiple could boost annual returns by 8.4% per year over the next five years.

Separately, estimated business growth of 2% will boost shareholder returns. Finally, the stock has a 5.3% current dividend yield.

Putting it all together, TDS is expected to return over 15% annually over the next five years, making the stock a buy.

TDS has raised its dividend for 50 consecutive years. It has grown its dividend by ~3% per year on average over the past 5 years. Today, its 5.3% dividend yield is significantly higher than the yield of the S&P. However, the dividend is not backed by positive EPS, making it a relatively risky dividend payout.

As TDS and U.S. Cellular operate in a highly competitive business, the corporation lacks a meaningful competitive advantage. As U.S. Cellular generates the vast majority of the revenues and earnings of TDS and is currently its most important growth driver, any headwind that may show up in the way of U.S. Cellular will have an impact on TDS.

In other words, there is no guarantee that TDS will be able to continue its dividend increase streak indefinitely, given its negative EPS and cloudy growth outlook.

Final Thoughts

TDS relies on the performance of U.S. Cellular, and it is now undergoing a strategic review to determine its best course of action to unlock shareholder value, which could result in the sale of the company or its assets. TDS stock could still offer strong annual return potential over the next five years.

We currently rate TDS stock a buy due to its high projected returns, although we acknowledge the high level of risk to the dividend and the volatility of the company’s results.

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more