Updated on January 22nd, 2024

Utilities are often a favorite of dividend growth investors as they can provide high income.

Companies in this sector can do so because they often hold regulatory-based competitive advantages limiting competition. Utilities can typically apply and receive approval for rate base increases as they make upgrades and investments in their infrastructure. This can lead to dependable cash flows that then be distributed to shareholders in the form of dividends.

As such, many utility stocks typically have dividend yields that are several times that of the average stock in the S&P 500 Index.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU, and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Electric utilities are one of the most common types in the sector, as these companies provide energy to consumers that are needed daily.

Most electricity consumption in the U.S. is due to lighting, appliances, heating, ventilation, and air conditioning. But besides powering homes, businesses, and industrial facilities, electricity will be needed to meet the rising demand from the increased adoption of electric vehicles.

This article will examine 10 of our favorite electric utility names, ranked in order of potential returns over the next five years.

Table of Contents

- Top Utility Stock #10: Alliant Energy (LNT)

- Top Utility Stock #9: NextEra Energy (NEE)

- Top Utility Stock #8: Allete, Inc. (ALE)

- Top Utility Stock #7: Black Hills Corporation (BKH)

- Top Utility Stock #6: Portland General Electric (POR)

- Top Utility Stock #5: Brookfield Renewable Partners LP (BEP)

- Top Utility Stock #4: Ameren Corp. (AEE)

- Top Utility Stock #3: Evergy Inc. (EVRG)

- Top Utility Stock #2: Eversource Energy (ES)

- Top Utility Stock #1: NextEra Energy Partners LP (NEP)

Top Utility Stock #10: Alliant Energy (LNT)

- 5-year expected annual returns: 12.6%

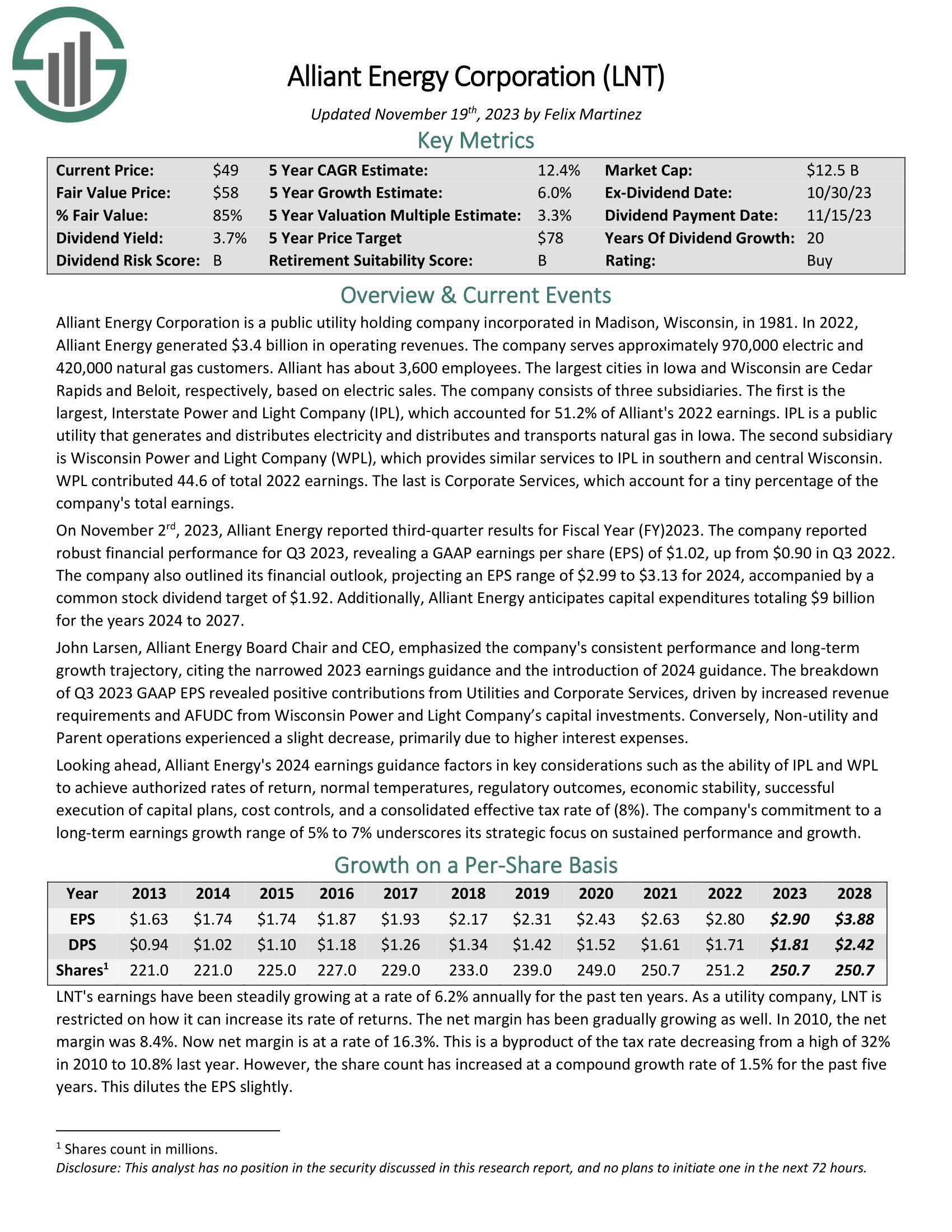

Alliant Energy Corporation is a public utility holding company incorporated in Madison, Wisconsin, in 1981. In 2022, Alliant Energy generated $3.4 billion in operating revenues. The company serves approximately 970,000 electric and 420,000 natural gas customers. Alliant has about 3,600 employees.

On November 2rd, 2023, Alliant Energy reported third-quarter results for Fiscal Year (FY) 2023. The company reported robust financial performance for Q3 2023, revealing a GAAP earnings per share (EPS) of $1.02, up from $0.90 in Q3 2022. The company also outlined its financial outlook, projecting an EPS range of $2.99 to $3.13 for 2024, accompanied by a common stock dividend target of $1.92. Additionally, Alliant Energy anticipates capital expenditures totaling $9 billion for the years 2024 to 2027.

Click here to download our most recent Sure Analysis report on LNT (preview of page 1 of 3 shown below):

Top Utility Stock #9: NextEra Energy (NEE)

- 5-year expected annual returns: 12.7%

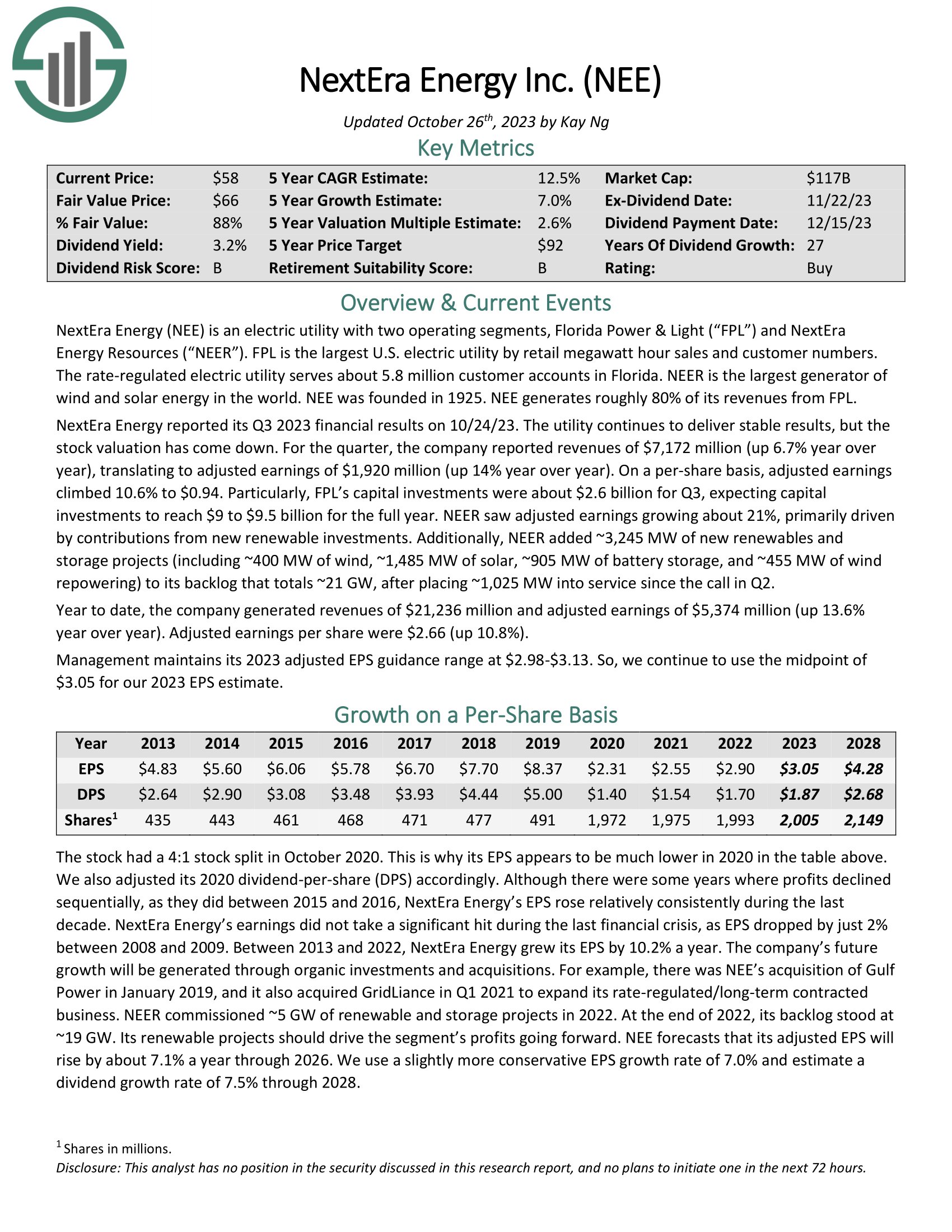

NextEra Energy is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers.

The rate-regulated electric utility serves about 5.8 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE generates roughly 80% of its revenues from FPL.

NextEra Energy reported its Q3 2023 financial results on 10/24/23. The utility continues to deliver stable results, but the stock valuation has come down. For the quarter, the company reported revenues of $7,172 million (up 6.7% year over year), translating to adjusted earnings of $1,920 million (up 14% year over year). On a per-share basis, adjusted earnings climbed 10.6% to $0.94.

Click here to download our most recent Sure Analysis report on NEE (preview of page 1 of 3 shown below):

Top Utility Stock #8: Allete, Inc. (ALE)

- 5-year expected annual returns: 14.1%

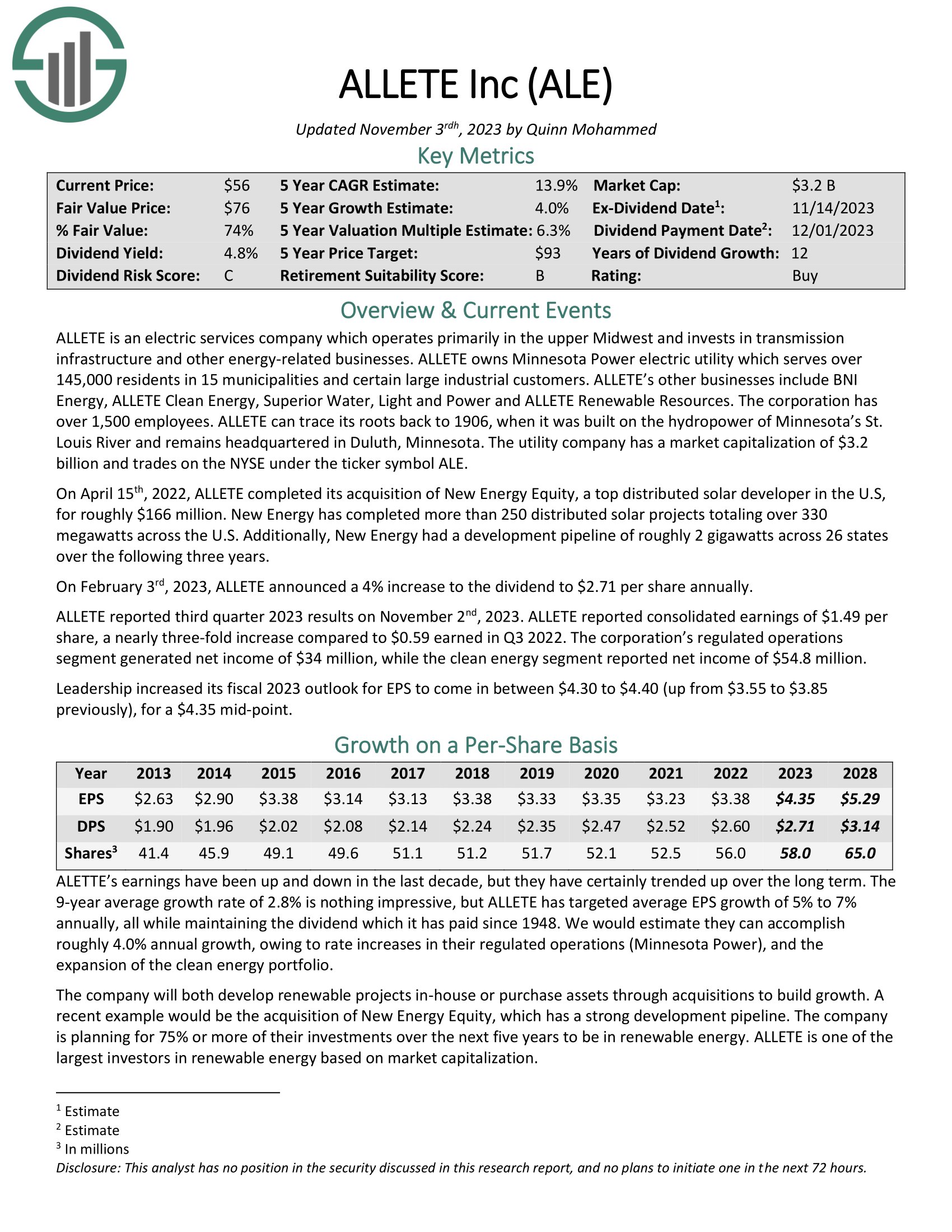

ALLETE is an electric services company which operates primarily in the upper Midwest and invests in transmission infrastructure and other energy-related businesses. ALLETE owns Minnesota Power electric utility which serves over 145,000 residents in 15 municipalities and certain large industrial customers. ALLETE’s other businesses include BNI Energy, ALLETE Clean Energy, Superior Water, Light and Power and ALLETE Renewable Resources.

ALLETE reported third quarter 2023 results on November 2nd, 2023. ALLETE reported consolidated earnings of $1.49 per share, a nearly three-fold increase compared to $0.59 earned in Q3 2022. The corporation’s regulated operations segment generated net income of $34 million, while the clean energy segment reported net income of $54.8 million.

Click here to download our most recent Sure Analysis report on Allete, Inc. (preview of page 1 of 3 shown below):

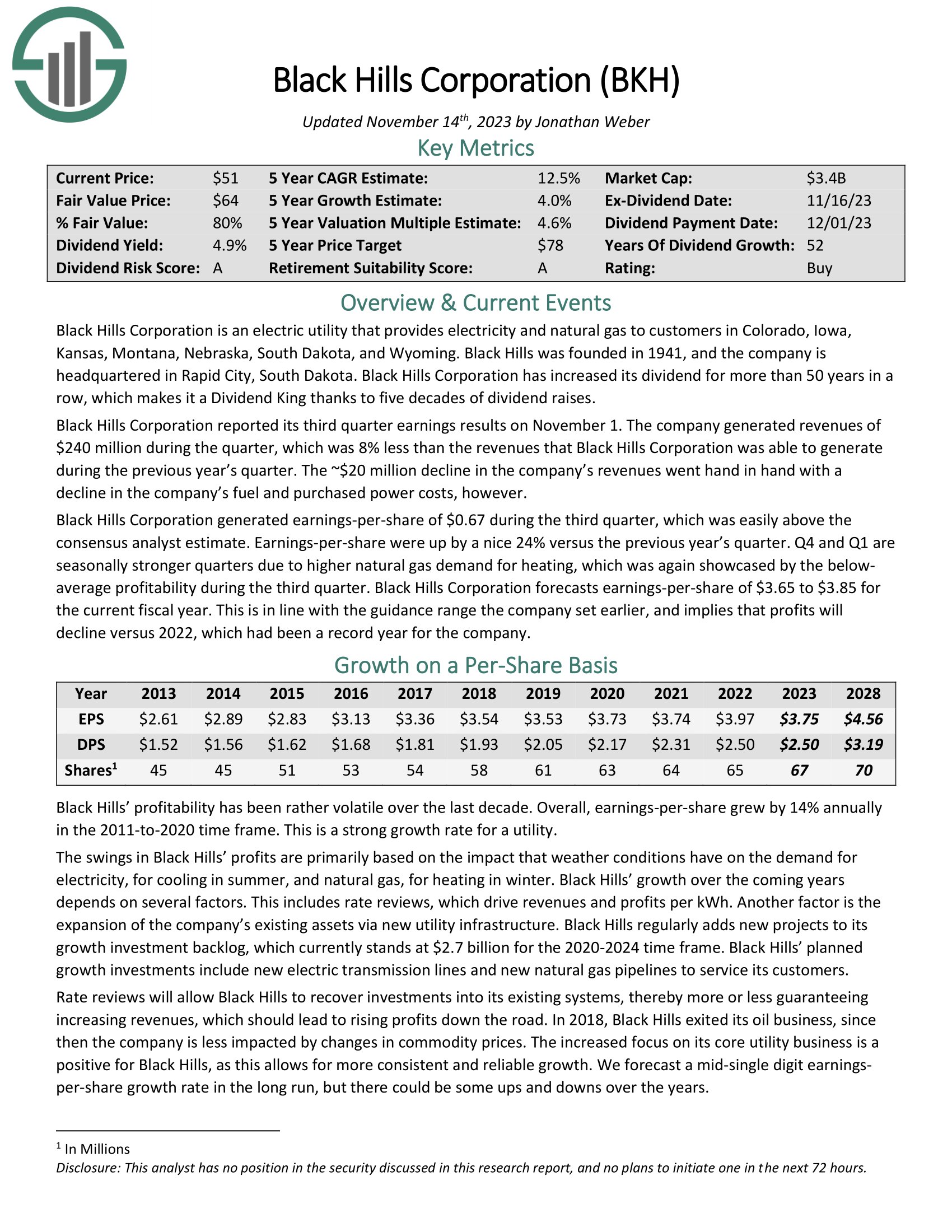

Top Utility Stock #7: Black Hills Corporation (BKH)

- 5-year expected annual returns: 15.0%

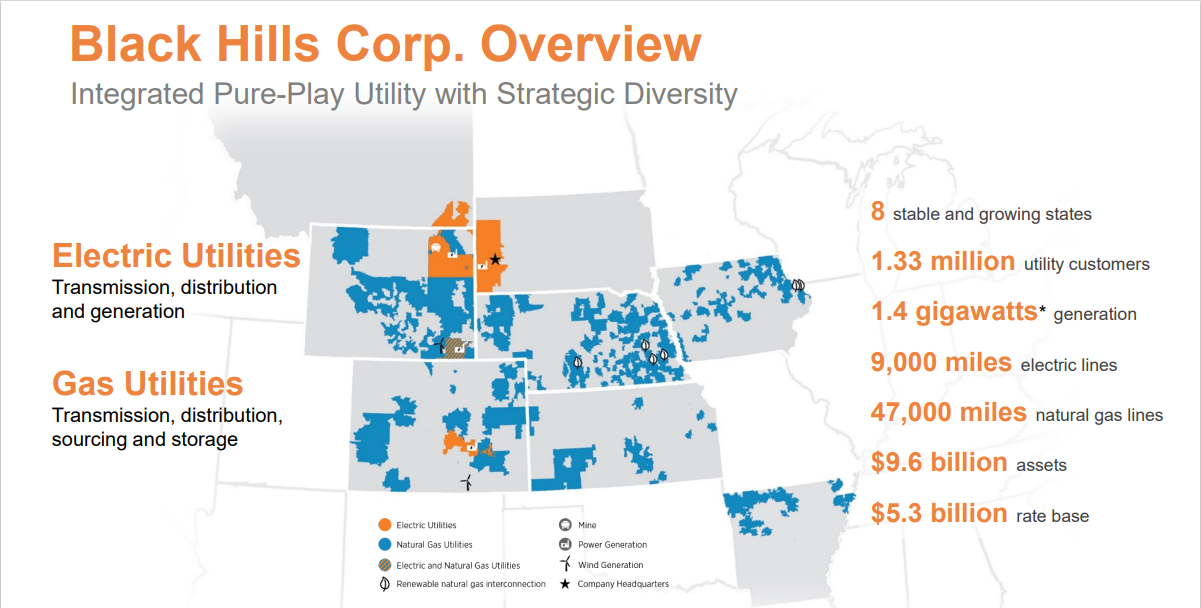

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.33 million utility customers in eight states. Its natural gas assets include 47,000 miles of natural gas lines. Separately, it has ~9,000 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its third quarter earnings results on November 1. The company generated revenues of $240 million during the quarter, which was 8% less than the revenues that Black Hills Corporation was able to generate during the previous year’s quarter. The ~$20 million decline in the company’s revenues went hand in hand with a decline in the company’s fuel and purchased power costs.

Black Hills Corporation generated earnings-per-share of $0.67 during the third quarter, which was easily above the consensus analyst estimate. Earnings-per-share were up by 24% versus the previous year’s quarter.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

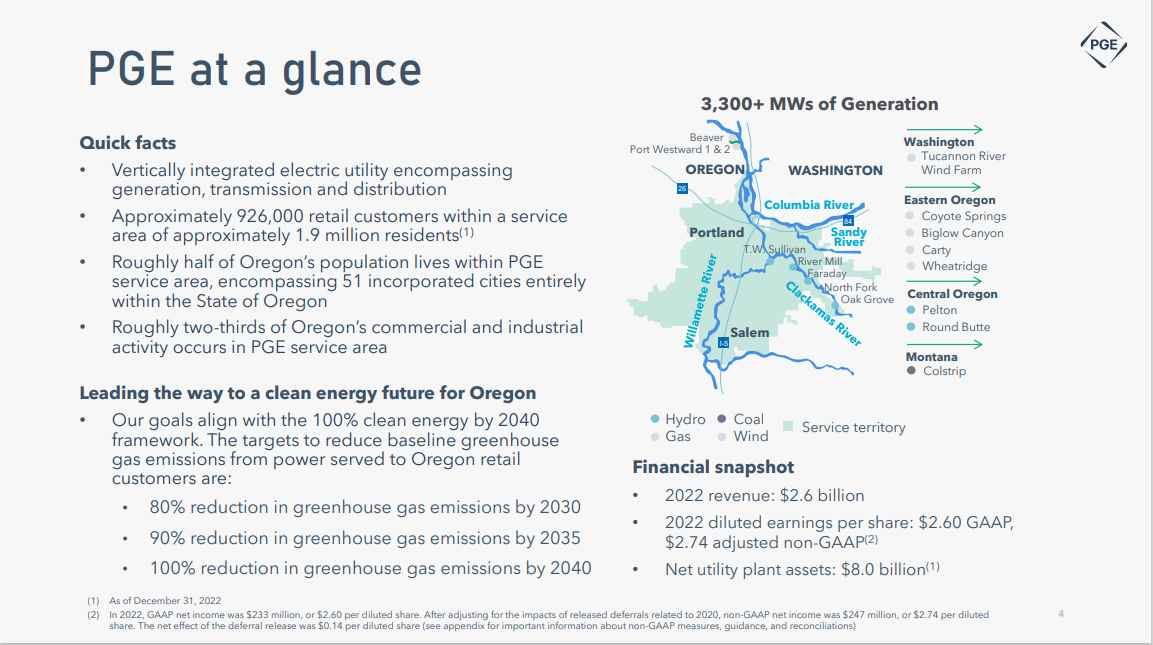

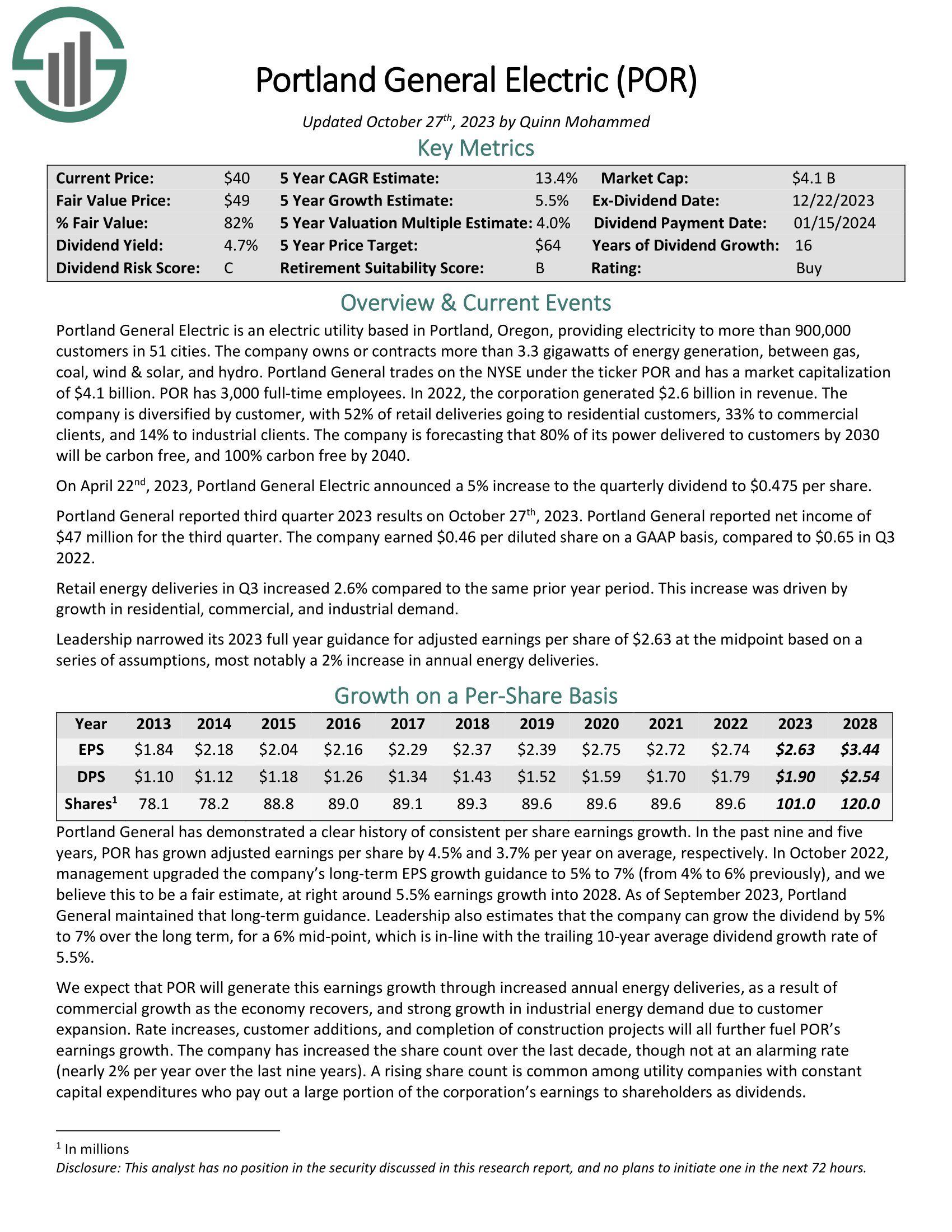

Top Utility Stock #6: Portland General Electric Company (POR)

- 5-year expected annual returns: 13.2%

Portland General Electric is an electric utility based in Portland, Oregon, providing electricity to more than 900,000 customers in 51 cities. The company owns or contracts more than 3.3 gigawatts of energy generation, between gas, coal, wind & solar, and hydro.

Source: Investor Presentation

The company is diversified by customer, with 52% of retail deliveries going to residential customers, 33% to commercial clients, and 14% to industrial clients. The company is forecasting that 80% of its power delivered to customers by 2030 will be carbon free, and 100% carbon free by 2040.

Portland General reported third quarter 2023 results on October 27th, 2023. Portland General reported net income of $47 million for the third quarter. The company earned $0.46 per diluted share on a GAAP basis, compared to $0.65 in Q3 2022. Retail energy deliveries in Q3 increased 2.6% compared to the same prior year period. This increase was driven by growth in residential, commercial, and industrial demand.

Click here to download our most recent Sure Analysis report on Portland General Electric Company (preview of page 1 of 3 shown below):

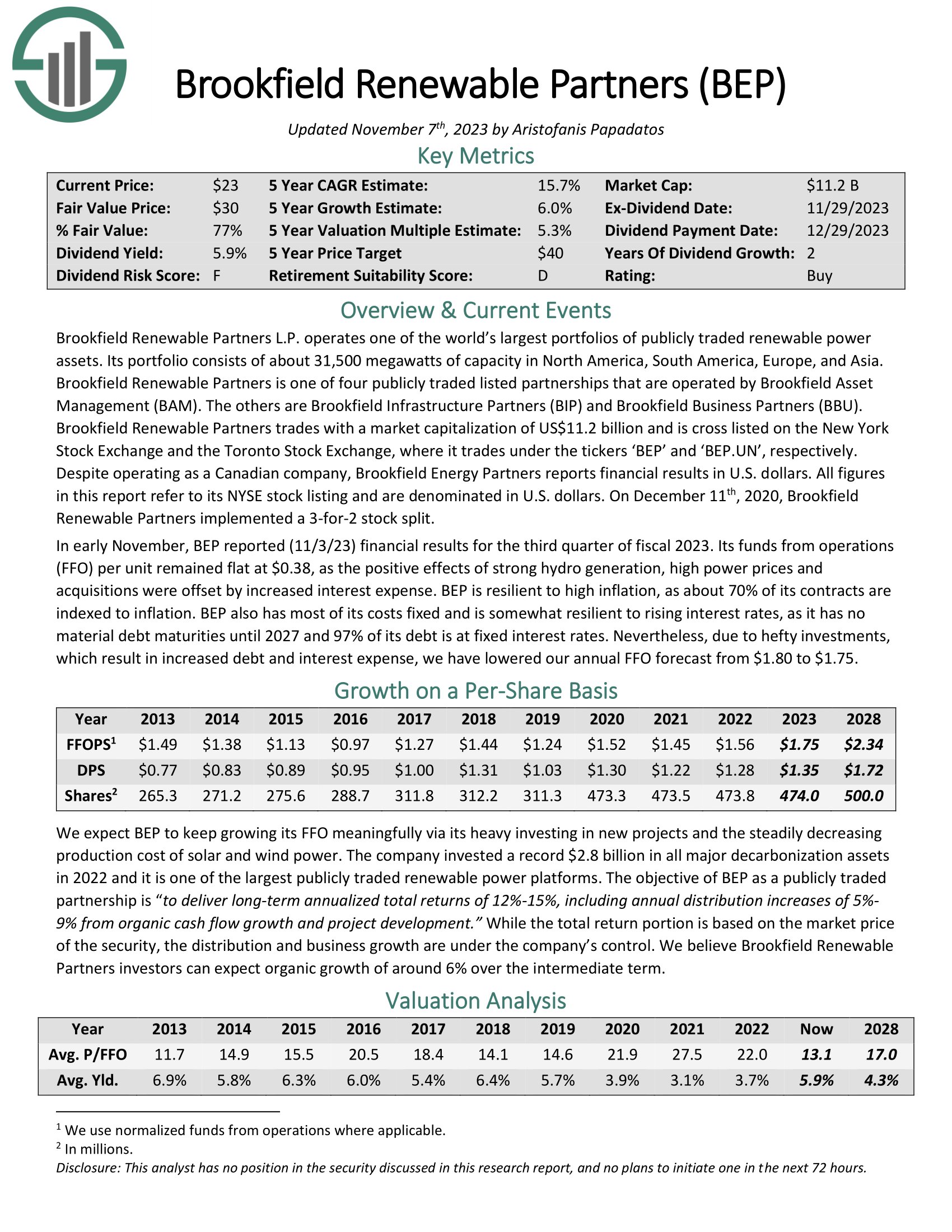

Top Utility Stock #5: Brookfield Renewable Partners LP (BEP)

- 5-year expected annual returns: 13.3%

Brookfield Renewable Partners L.P. operates one of the world’s largest portfolios of publicly traded renewable power assets. Its portfolio consists of about 31,300 megawatts of capacity in North America, South America, Europe, and Asia.

Brookfield Renewable Partners is one of four publicly traded listed partnerships that are operated by Brookfield Asset Management (BAM). The others are Brookfield Infrastructure Partners (BIP) and Brookfield Business Partners (BBU).

In early November, BEP reported (11/3/23) financial results for the third quarter of fiscal 2023. Its funds from operations (FFO) per unit remained flat at $0.38, as the positive effects of strong hydro generation, high power prices and acquisitions were offset by increased interest expense.

BEP is resilient to high inflation, as about 70% of its contracts are indexed to inflation. BEP also has most of its costs fixed and is somewhat resilient to rising interest rates, as it has no material debt maturities until 2027 and 97% of its debt is at fixed interest rates.

Click here to download our most recent Sure Analysis report on Brookfield Renewable Partners (preview of page 1 of 3 shown below):

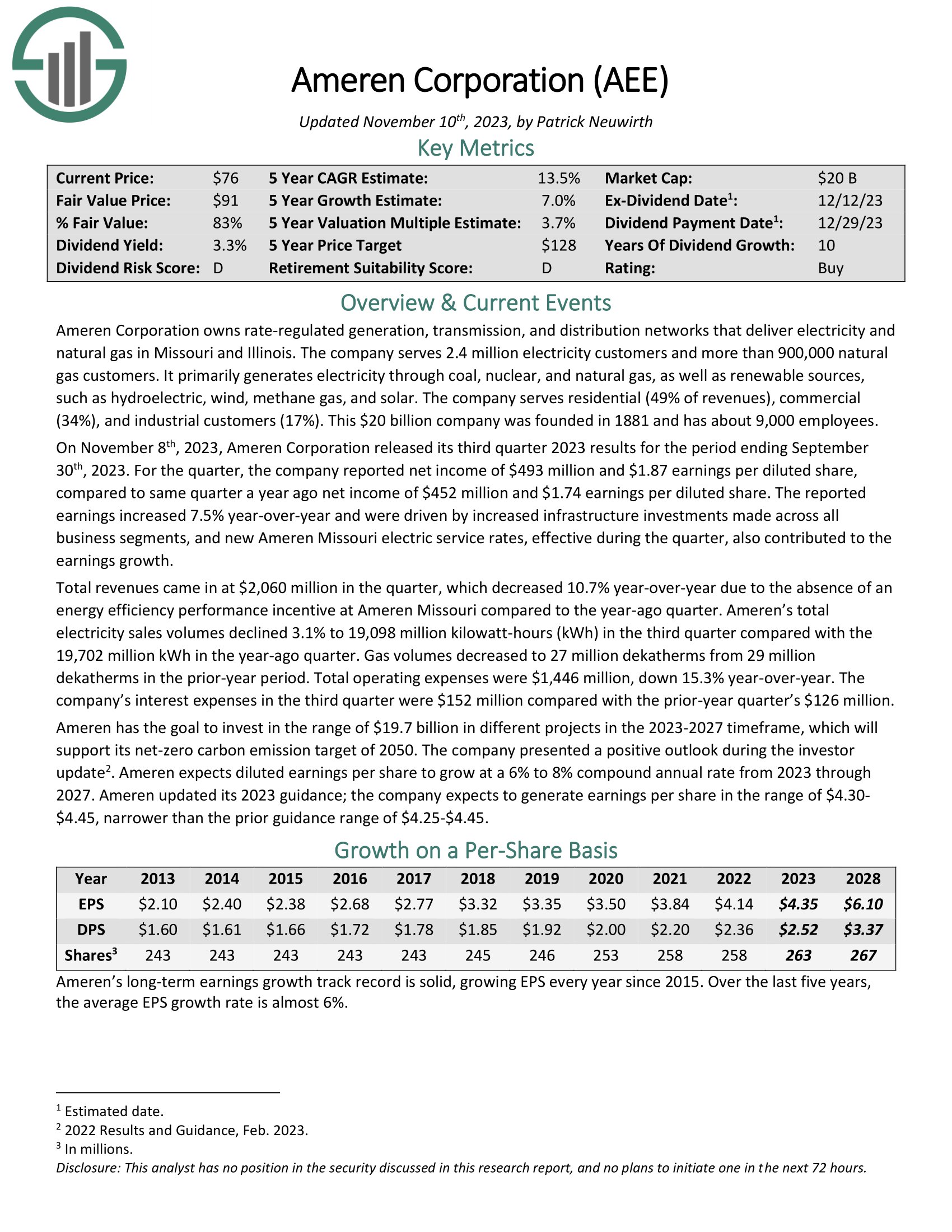

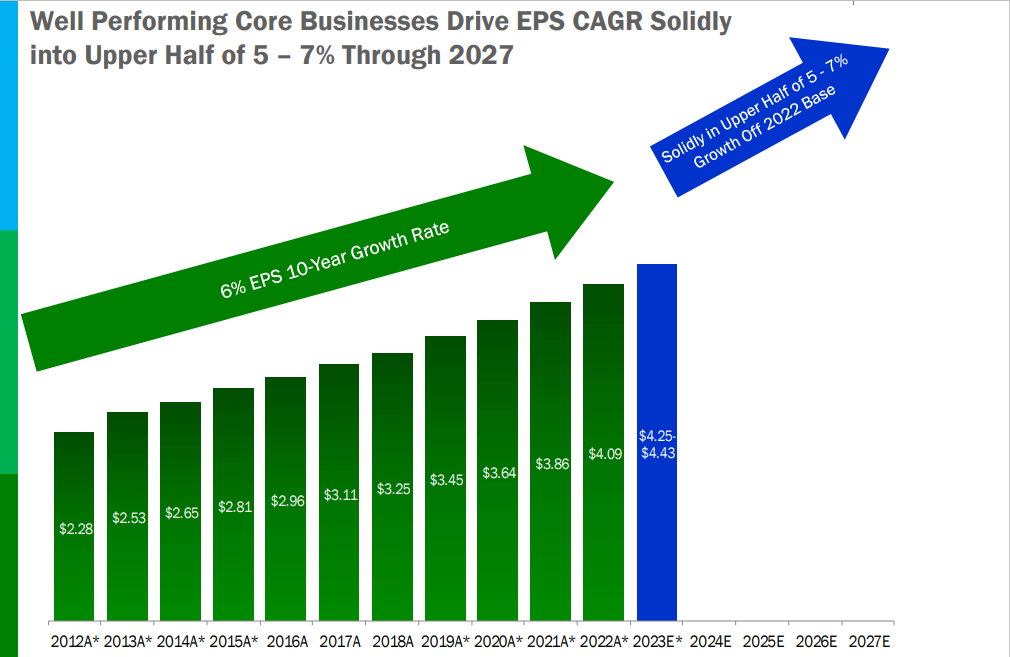

Top Utility Stock #4: Ameren Corp. (AEE)

- 5-year expected annual returns: 15.5%

Ameren Corporation owns rate-regulated generation, transmission, and distribution networks that deliver electricity and natural gas in Missouri and Illinois. The company serves 2.4 million electricity customers and more than 900,000 natural gas customers.

It primarily generates electricity through coal, nuclear, and natural gas, as well as renewable sources, such as hydroelectric, wind, methane gas, and solar. The company serves residential (49% of revenues), commercial (34%), and industrial customers (17%). This $20 billion company was founded in 1881 and has about 9,000 employees.

On November 8th, 2023, Ameren Corporation released its third quarter 2023 results for the period ending September 30th, 2023. For the quarter, the company reported net income of $493 million and $1.87 earnings per diluted share, compared to same quarter a year ago net income of $452 million and $1.74 earnings per diluted share.

The reported earnings increased 7.5% year-over-year and were driven by increased infrastructure investments made across all business segments, and new Ameren Missouri electric service rates, effective during the quarter, also contributed to the earnings growth.

Click here to download our most recent Sure Analysis report on AEE (preview of page 1 of 3 shown below):

Top Utility Stock #3: Evergy Inc. (EVRG)

- 5-year expected annual returns: 16.9%

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri. Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and 6,900 industrial customers and municipalities in Kansas and Missouri.

In early November, Evergy reported (11/7/23) financial results for the third quarter of fiscal 2023. The company was hurt by unfavorable weather, lower weather-normalized demand and higher interest expense and depreciation. As a result, its adjusted earnings-per-share dipped -6% over the prior year’s quarter, from $2.00 to $1.88, though they exceeded the analysts’ consensus by $0.04.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

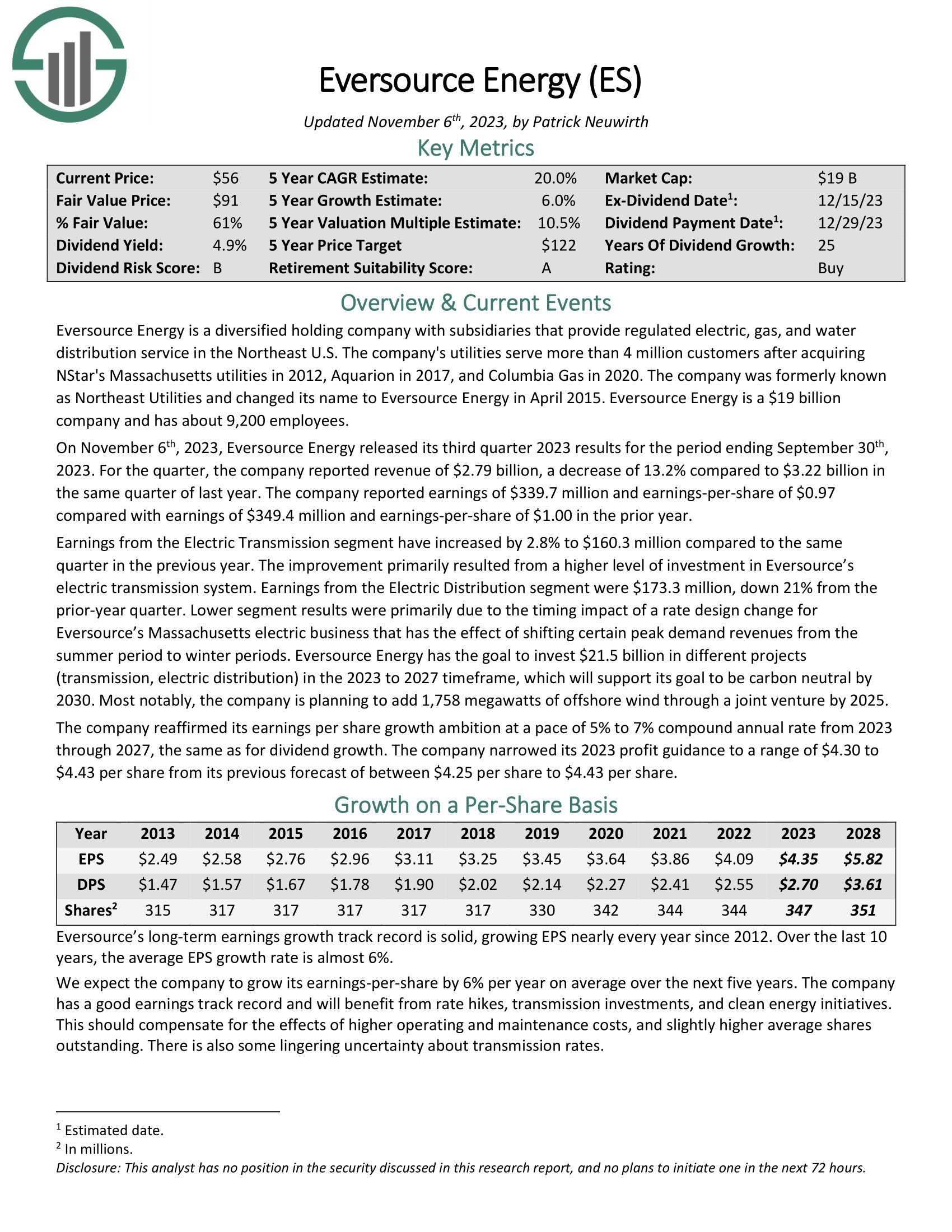

Top Utility Stock #2: Eversource Energy (ES)

- 5-year expected annual returns: 20.9%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S. The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has a long history of generating steady growth over time.

Source: Investor Presentation

On November 6th, 2023, Eversource Energy released its third quarter 2023 results for the period ending September 30th, 2023. For the quarter, the company reported revenue of $2.79 billion, a decrease of 13.2% compared to $3.22 billion in the same quarter of last year. The company reported earnings of $339.7 million and earnings-per-share of $0.97 compared with earnings of $349.4 million and earnings-per-share of $1.00 in the prior year.

The company reported earnings of $15 million and earnings-per-share of $0.04 compared with earnings of $292 million and earnings-per-share of $0.84 in the prior year.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Top Utility Stock #1: NextEra Energy Partners (NEP)

- 5-year expected annual returns: 22.9%

NextEra Energy Partners was formed in 2014 as Delaware Limited Partnership by NextEra Energy to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows. The company’s strategy is to capitalize on the energy industry’s favorable trends in North America of clean energy projects replacing uneconomic projects.

NextEra Energy Partners operates 34 contracted renewable generation assets consisting of wind and solar projects in 12 states across the United States. The company also operates contracted natural gas pipelines in Texas which accounts for about a fifth of NextEra Energy Partners’ income.

On October 24, 2023, NextEra Energy Partners released its earnings report for the third quarter of 2023. The company reported quarterly earnings of $0.57 per share, surpassing the consensus estimate of $0.48 per share, but falling short of the $0.93 per share reported a year ago.

Click here to download our most recent Sure Analysis report on NEP (preview of page 1 of 3 shown below):

Final Thoughts

The need for electricity isn’t going away significantly as the popularity and growth of electric vehicles accelerate. Combining this need with the typical uses of electricity and those utility companies focused on this area of power generation should have further growth ahead due to rising demand.

Utility stocks can make significant income-generating positions because of their generally stable business models that allow for generous dividend yields.

While not all stocks listed in this article have a buy rating, they all have at least a high single-digit total return potential and very safe dividend yields. Investors looking for exposure to the utility sector and reliable income could do well adding these names to their portfolios.

If you’re willing to venture outside of the utility industry for investment opportunities, the following Sure Dividend databases are very useful:

- The Dividend Aristocrats: dividend growth stocks with 25+ years of consecutive dividend increases

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.