Updated on July 17th, 2024 by Bob Ciura

Until this year, Walgreens Boots Alliance (WBA) had an exceptional dividend growth record. Heading into 2024, the company had a track record of 47 consecutive years of dividend increases.

However, Walgreens Boots Alliance cut its dividend in January 2024, ending its streak.

Still, due to its declining share price, WBA stock currently yields 8.5%. As a result, it is once again part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Walgreens stock.

Business Overview

Walgreens Boots Alliance is the largest retail pharmacy in both the U.S. and Europe. Through its flagship Walgreens business and other business ventures, the company is present in more than 9 countries, with about 12,500 stores in the U.S., Europe and Latin America.

Walgreens is in a difficult position. It was a beneficiary of the coronavirus pandemic, which boosted its core U.S. pharmacy business.

But in the years since the pandemic ended, the company has faced declines in its retail business.

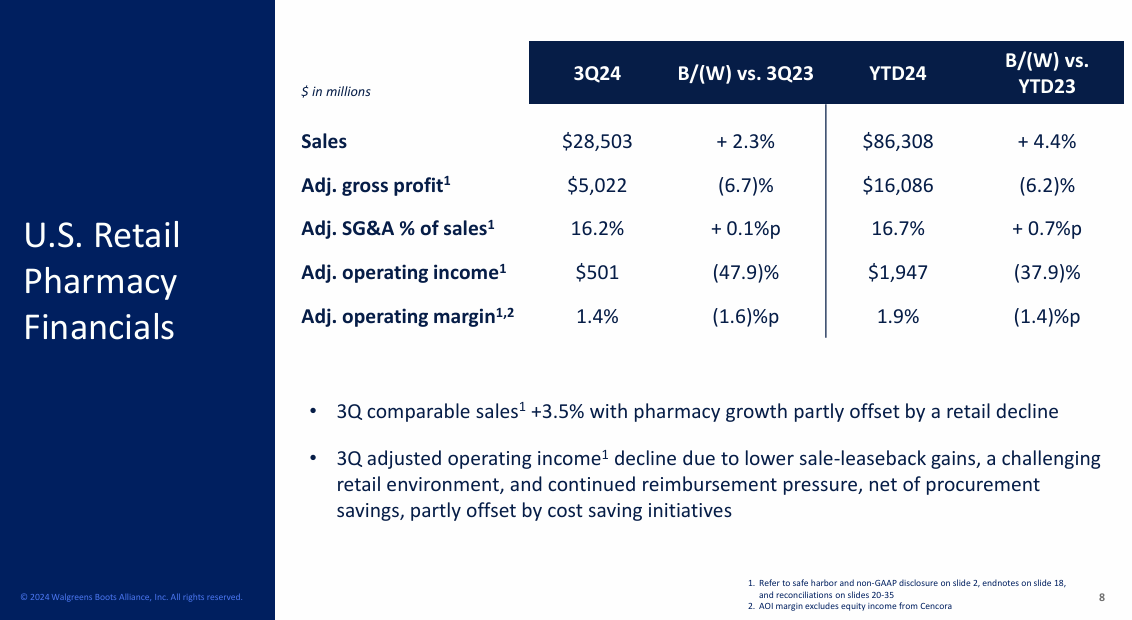

On June 27th, 2024, Walgreens reported results for the third quarter of fiscal 2024. Sales grew 3% but earnings-per-share decreased 36% over last year’s quarter, from $0.99 to $0.63.

Source: Investor Presentation

Declining EPS was due to intense competition, which has eroded profit margin. Earnings-per-share missed the analysts’ consensus by $0.08.

Walgreens has exceeded the analysts’ estimates in 13 of the last 16 quarters. However, as the pandemic has subsided and competition has heated in the retail pharmaceutical industry, Walgreens is facing tough comparisons.

It lowered its guidance for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have lowered our forecast from $3.28 to $2.87.

Growth Prospects

During the last decade, Walgreens has grown its earnings per share at a 3.6% average annual rate. It achieved this from revenue growth, a steady net profit margin, and modest share repurchases.

The retailer is currently facing some business headwinds. Apart from the fading boost from the pandemic, the company is facing intense competition as a pharmacy retailer.

Moreover, the profit margins in the pharmaceutical industry have come under scrutiny in recent years. As a result, it is prudent not to expect meaningful margin expansion going forward.

The three factors of Walgreen’s success in the past – revenue growth, steady margins, and a lower share count – are simultaneously being challenged in the short-term.

On the other hand, Walgreens has some long-term growth drivers, which are intact. An aging population should remain a material growth driver.

Overall, we expect Walgreens to grow its earnings per share by about 4% per year on average over the next five years off this year’s somewhat low comparison base.

Competitive Advantages

Walgreens’ competitive advantage lies in its vast scale and network in an important and growing industry. The immense scale of the network of Walgreens renders the company highly efficient and thus constitutes a major competitive advantage. The retailer also enjoys great synergies across its vast healthcare portfolio.

Another advantage of Walgreens is its resilience to recessions, as the demand for drugs does not decrease even during the fiercest economic periods. Furthermore, it should be noted that Walgreens has put together a strong record in economic downturns, such as the Great Recession of 2008-2009.

Walgreens’ earnings dipped just -6.9% in 2009, as an illustration. The resilience of a company to recessions is important for investors, as recessions are inevitable which makes it critical for companies to remain firm during such periods.

Dividend Analysis

In January 2024, WBA cut its dividend by nearly half, after 47 years of consecutive increases. As a result, it will be removed from the list of Dividend Aristocrats when the official constituents are updated in 2025.

Management had repeatedly confirmed its commitment to keep raising the dividend for years. On the other hand, we view the dividend cut as a wise decision from a long-term perspective amid a challenging business landscape.

Notably, the stock is currently offering a nearly 10-year high dividend yield of 8.5%, even after the dividend reduction. That is due to the crashing share price–WBA stock has declined by nearly 80% in the past five years.

Due to the dividend cut, the dividend payout ratio of the stock is 35% for 2024. The payout ratio is healthy and should continue to add an income ballast for investors. The current dividend rate appears sustainable.

However, the balance sheet is a lingering concern. Its net debt is $62 billion, which is nearly 5 times the market cap of the stock.

Overall, the dividend yield is attractive for income investors looking for high yields, but investors should closely monitor future quarterly earnings reports.

Final Thoughts

Walgreens is offering a nearly 10-year high dividend yield of 8.5% as the share price is trading at a 10-year low. The primary reasons behind the exceptionally cheap valuation of the stock are the fading tailwind from the pandemic, and eroding profit margins.

Given a healthy payout ratio, the reduced dividend of Walgreens can be considered safe for the foreseeable future. This makes WBA an attractive dividend stock, with an elevated level of uncertainty.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more