Published on June 20th, 2024 by Nathan Parsh

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.3%, which is quite low on an absolute basis, but also on a historical basis.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates $500 a month in dividends.

The First of Long Island Corporation (FLIC) is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze the prospects of The First of Long Island stock.

Business Overview

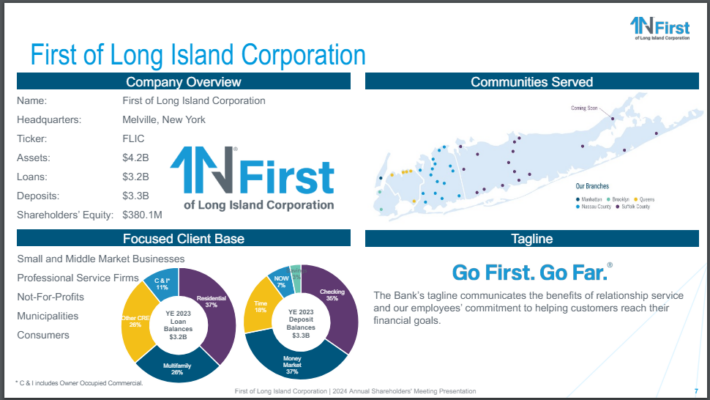

The First of Long Island is the holding company for The First National Bank of Long Island, which is a small-sized bank.

The company was founded in 1927 and has a market capitalization of $217 million, making it one of the smallest financial institutions that Sure Dividend covers.

Source: Investor Presentation

The First of Long Island provides a range of financial services to consumers and small to medium-sized businesses. These offerings include savings accounts, mortgages, and business and consumer loans, among others.

The First of Long Island has approximately 50 branches in two Long Island counties and several NYC burrows, including Brooklyn, Manhattan, and Queens.

The First of Long Island reported first quarter earnings results on April 25th, 2024, with results showing weakness for the period. Revenue fell 8% to $21 million while earnings-per-share of $0.20 compared unfavorably to $0.29 in the prior year. Both figures were below what the market had expected.

The primary headwind that the company faced during the quarter was a decline in net interest income, which fell 23.2% to $18.2 million. Net interest expense climbed $5.5 million. Net interest margin contracted 55 basis points to 1.79%.

Also impacting results was higher provision for credit losses. The First of Long Island’s PCLs increased $377,000, or 72%, to $901,000.

Total deposits fell $162.6 million, or 4.7%, to $3.3 billion, but increased $55.5 million on a sequential basis. Total average loans declined 1.3% to $3.2 billion.

The First of Long Island posted record earnings-per-share of $2.04 in 2022, before pulling back 43% to $1.16 last year. We expect that earnings will further decrease this year to $0.80. We do anticipate earnings growth of 4% annually through 2029.

Growth Prospects

Prior to last year, The First of Long Island had generated solid, if not spectacular, growth. For the 2014 to 2023 period, earnings-per-share had a compound annual growth rate of ~6.0%. Growth had been uneven for that time frame.

This improvement was largely due to a solid pace of business growth. The company’s revenue almost doubled over the last decade, as the bank was able to expand its presence in its markets while also generating higher revenues per branch location.

Low interest rates, which are typically seen as a impairment to banks since they usually lead to low net interest margins, have not been a major headwind for the company . This occurred during the worst of the Covid-19 pandemic as the First of Long Island was able to expand its net interest margin during this period.

Also impacting results over the last 10 years has been an increase in the share count, which has caused earnings-per-share growth to lag gains in net income. More recently, The First of Long Island has initiated share buybacks, though this impact has been muted.

The First of Long Island’s total asset base has compounded at a solid rate of 4.5% annually over the last decade, with much of this improvement coming from the company’s loan portfolio.

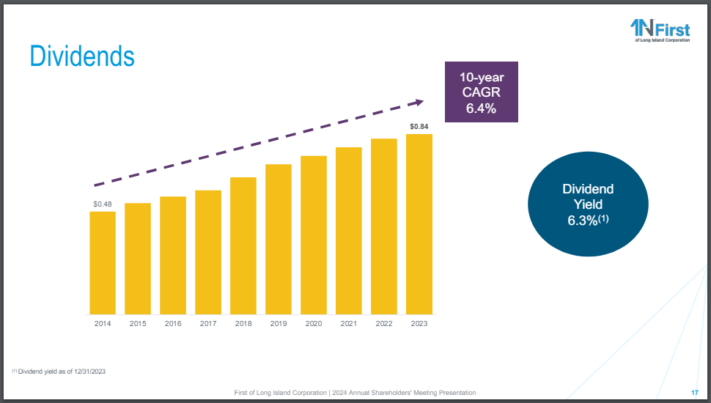

Source: Investor Presentation

The First of Long Island’s loan portfolio is very balanced, with just residential loans accounting for more than a third of total loans.

This is down meaningfully from five years ago, meaning the loan portfolio is much more diversified than it was just a few years ago.

Competitive Advantages & Recession Performance

The First of Long Island is a small regional bank that is focused on Long Island and several New York City burrows. Given its area of operations, the bank is in an attractive geographic market.

However, we do not find that The First of Long Island enjoys serious advantages over its large competitors in the financial sector. All the services the bank offers can be provided by its larger peers, most of which have more size and scale.

That said, the company outperformed its peer group during the Great Recession:

- 2007 earnings-per-share: $1.52

- 2008 earnings-per-share: $1.79 (18% increase)

- 2009 earnings-per-share: $1.87 (4.5% increase)

- 2010 earnings-per-share: $2.33 (25% increase)

Earnings grew before and after the worst of the financial crisis. The First of Long Island also demonstrated growth during 2020 despite the headwinds of the pandemic.

The company also raised its dividend through both periods of time, as the First of Long Island showed that it can successfully navigate an economic downturn.

Dividend Analysis

Shares of the First of Long Island yield a generous 8.7%, which is nearly seven times the average yield of the S&P 500 Index. The current yield is also well ahead of what the stock usually provides.

The company has an impressive dividend growth streak of 45 consecutive years.

Source: Investor Presentation

Over the last decade, the dividend has a CAGR of more than 6%, with the most recent increase of 5% occurring in October of 2022.

Investors should note that the dividend has been held constant for seven consecutive quarters.

The likely reason behind this decision is that earnings growth has been lackluster in recent years. The payout ratio has typically been in the low 40% range, which offered the company plenty of margin of safety to continue to grow its dividend. That payout ratio surged to 72% last year. With an annual dividend of $0.84, the projected payout ratio for 2024 is 105%.

This is unsustainable long-term, but we do expect that it will be lower in the years to come as earnings growth far outpaces dividend growth.

Final Thoughts

The First of Long Island is a small company, but operates in a densely populated geographic region. This has allowed the company to perform decently over the long-term. The bank has also held up well under challenging economic conditions.

The stock is also offering a yield of almost 9%, which is very attractive to income investors. The main issue is that growth has been stagnant as an elevated payout ratio has prevented the company from raising its dividend since 2022.

The First of Long Island appears to be a solid investment, but the high payout ratio and lack of recent growth does make us more cautious on the name. We rate the stock a hold until the bank has shown the ability to improve its business results.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more