Updated on December 10th, 2024 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs.

These are companies that own real estate properties and lease them to tenants, or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends.

You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are also very important factors.

We urge investors to use the analysis below as informative but to do significant due diligence before buying into any security – especially high-yield securities.

Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- High-Yield REIT No. 10: Arbor Realty Trust (ABR)

- High-Yield REIT No. 9: New York Mortgage REIT (NYMT)

- High-Yield REIT No. 8: Annally Capital (NLY)

- High-Yield REIT No. 7: Ellington Credit Co. (EARN)

- High-Yield REIT No. 6: Ares Commercial Real Estate (ACRE)

- High-Yield REIT No. 5: Dynex Capital (DX)

- High-Yield REIT No. 4: ARMOUR Residential REIT (ARR)

- High-Yield REIT No. 3: AGNC Investment Corp. (AGNC)

- High-Yield REIT No. 2: Two Harbors Investment Corp. (TWO)

- High-Yield REIT No. 1: Orchid Island Capital (ORC)

High-Yield REIT No. 10: Arbor Realty Trust (ABR)

- Dividend Yield: 13.1%

Arbor Realty Trust is a nationwide mortgage real estate investment trust (REIT) that acts as a direct lender and operates in two reporting segments: Agency Business and Structured Business. The trust provides loan origination and servicing for multifamily, seniors housing, healthcare, and other diverse commercial real estate assets.

Arbor Realty’s specific focus is government-sponsored enterprise products, although its platform also includes commercial mortgage backed securities (CMBS), bridge and mezzanine loans, and preferred equity issuances.

Arbor Realty Trust, Inc. (ABR) reported third-quarter 2024 results with net income of $0.31 per diluted common share, matching expectations, and distributable earnings of $0.43 per share. Revenue reached $88.81 million, a 17.23% year-over-year decrease but still beating estimates by $3.10 million.

The company declared a cash dividend of $0.43 per share and announced agency loan originations totaling $1.1 billion, supporting a $33.01 billion servicing portfolio, which grew 10% year-over-year. Structured loan originations reached $258.5 million, contributing to a $11.57 billion portfolio.

Click here to download our most recent Sure Analysis report on ABR (preview of page 1 of 3 shown below):

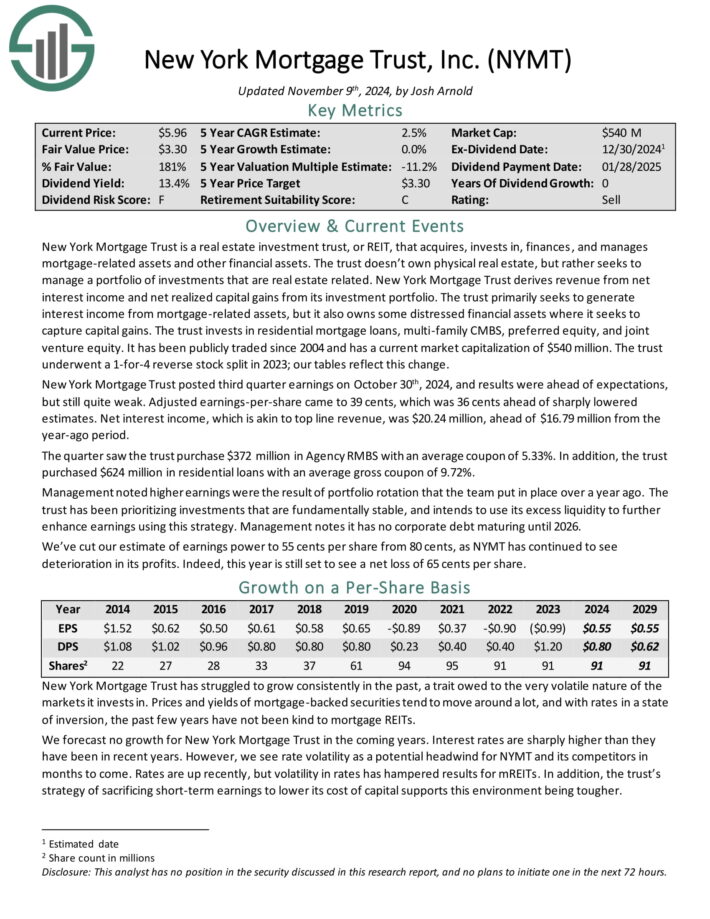

High-Yield REIT No. 9: New York Mortgage REIT (NYMT)

- Dividend Yield: 13.6%

New York Mortgage Trust acquires, invests in, finances, and manages mortgage-related assets and other financial assets. The trust doesn’t own physical real estate, but rather seeks to manage a portfolio of investments that are real estate related.

The trust invests in residential mortgage loans, multi family CMBS, preferred equity, and joint venture equity.

New York Mortgage Trust posted third quarter earnings on October 30th, 2024, and results were ahead of expectations, but still quite weak.

Adjusted earnings-per-share came to 39 cents, which was 36 cents ahead of sharply lowered estimates. Net interest income, which is akin to top line revenue, was $20.24 million, ahead of $16.79 million from the year-ago period.

The quarter saw the trust purchase $372 million in Agency RMBS with an average coupon of 5.33%. In addition, the trust purchased $624 million in residential loans with an average gross coupon of 9.72%.

Click here to download our most recent Sure Analysis report on NYMT (preview of page 1 of 3 shown below):

High-Yield REIT No. 8: Annally Capital (NLY)

- Dividend Yield: 13.3%

Annaly Capital Management, Inc., a diversified capital manager, invests in and finances residential and commercial assets. The trust invests in various types of agency mortgage-backed securities, non-agency residential mortgage assets, and residential mortgage loans.

It also originates and invests in commercial mortgage loans, securities, and other commercial real estate investments. Annaly provides financing to private equity-backed middle market businesses and operates as a broker-dealer.

Annaly Capital Management reported its third-quarter 2024 financial results on October 23, 2024, revealing an EPS for distribution of $0.66, slightly below the consensus estimate of $0.67 and unchanged from the same quarter last year.

The book value per common share rose to $19.54 from $19.25 in Q2 but fell just short of the expected $19.57.

Notably, the economic return surged to 4.9% from 0.9% in the prior quarter, while economic leverage slightly decreased to 5.7x.

Total assets expanded to $101.5 billion, up from $93.7 billion in Q2, driven by a robust portfolio of $81.8 billion, which includes a highly liquid agency portfolio of $7.25 billion, marking a $6.4 billion increase quarter-over-quarter.

Click here to download our most recent Sure Analysis report on NLY (preview of page 1 of 3 shown below):

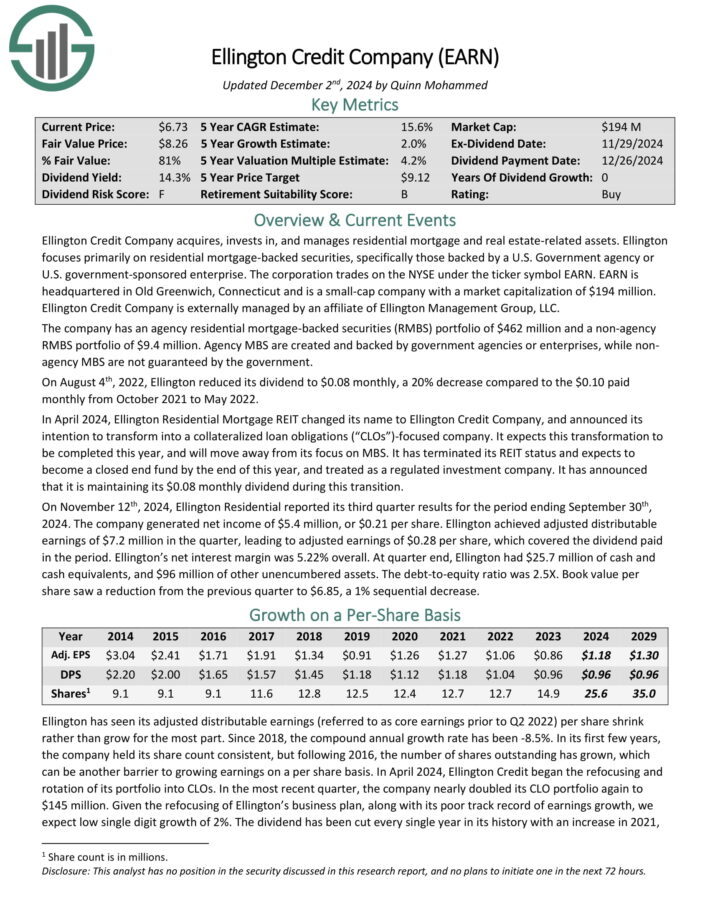

High-Yield REIT No. 7: Ellington Credit Co. (EARN)

- Dividend Yield: 14.3%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period. Ellington’s net interest margin was 5.22% overall.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

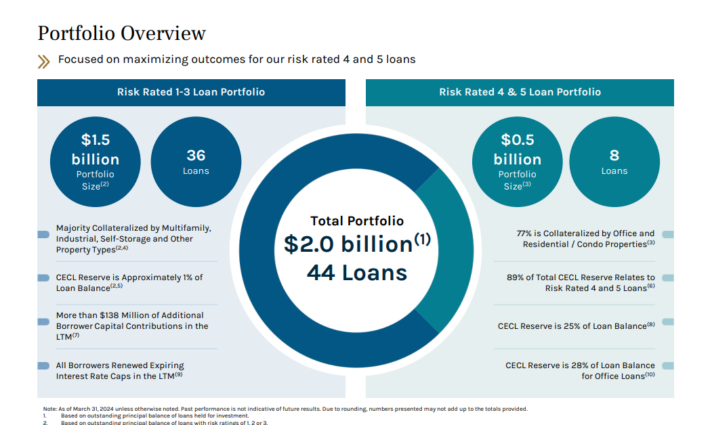

High-Yield REIT No. 6: Ares Commercial Real Estate (ACRE)

- Dividend Yield: 14.0%

Ares Commercial Real Estate Corporation is a specialty finance company primarily engaged in originating and investing in commercial real estate (“CRE”) loans and related investments. ACRE generated around $198.6 million in interest income last year.

The company’s loan portfolio (98% of which are senior loans) comprises 44 market loans across 8 asset types, with an outstanding principal balance of $2 billion. The majority of the loans are tied to multifamily, office, and mixed-use properties.

Source: Investor Presentation

In terms of geographical diversification, ACRE’s exposure features a healthy mix between the Southeast, West, and Midwest.

On November 7th, 2024, ACRE reported its Q3 results for the period ending September 30th, 2024. Interest income came in at $39.3 million, 26% lower year-over-year, with commercial real estate continuing to struggle.

In the meantime, interest expense fell by 8% to about $27.4 million. Thus, total revenues (interest income – interest expenses + $4.7 million in revenue from ACRE’s own real estate) fell by about 30% to roughly $16.7 million. Total expenses rose by about 41% to $9.3 million, primarily due to higher expenses from real estate owned previously absent.

Click here to download our most recent Sure Analysis report on ACRE (preview of page 1 of 3 shown below):

High-Yield REIT No. 5: Dynex Capital (DX)

- Dividend Yield: 14.5%

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor presentation

Dynex Capital announced its second-quarter 2024 financial results on July 22, 2024. The company reported a total economic loss of $(0.31) per common share, which represents a decrease of 2.4% of the beginning book value. The book value per common share was $12.50 as of June 30, 2024.

The comprehensive loss was $(0.18) per common share, and the net loss was $(0.15) per common share. Despite these losses, Dynex declared dividends of $0.39 per common share for the second quarter.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

High-Yield REIT No. 4: ARMOUR Residential REIT (ARR)

- Dividend Yield: 14.8%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor presentation

On October 23, 2024, ARMOUR Residential REIT announced its unaudited third-quarter 2024 financial results, reporting a GAAP net income available to common stockholders of $62.9 million, or $1.21 per common share. The company generated a net interest income of $1.8 million and distributable earnings of $52.0 million, equivalent to $1.00 per common share.

ARMOUR achieved an average interest income of 4.89% on interest-earning assets and an interest cost of 5.51% on average interest-bearing liabilities. The economic net interest spread stood at 2.00%, calculated from an economic interest income of 4.44% minus an economic interest expense of 2.44%.

During the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of common stock through an at-the-market offering program and paid common stock dividends of $0.72 per share for Q3.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

High-Yield REIT No. 3: AGNC Investment Corp. (AGNC)

- Dividend Yield: 14.2%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

High-Yield REIT No. 2: Two Harbors Investment Corp. (TWO)

- Dividend Yield: 15.3%

Two Harbors Investment Corp. is a residential mortgage real estate investment trust (mREIT). As such, it focuses on residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and commercial real estate.

The trust derives nearly all of its revenue in the form of interest through available-for-sale securities.

Two Harbors Investment Corp. (TWO) reported its second-quarter 2024 financial results, showing earnings per share (EPS) of $0.17, missing estimates by $0.27. Revenue for the quarter was -$38.25 million, down 8.48% year-over-year, missing expectations by $328,000.

Despite the challenging market conditions, the company delivered stable results, maintaining a book value of $15.19 per common share and declaring a second-quarter common stock dividend of $0.45 per share. For the first six months of 2024, Two Harbors generated a 5.8% total economic return on book value.

The company generated comprehensive income of $0.5 million, or $0.00 per weighted average basic common share, and repurchased $10.0 million in convertible senior notes due 2026.

Click here to download our most recent Sure Analysis report on TWO (preview of page 1 of 3 shown below):

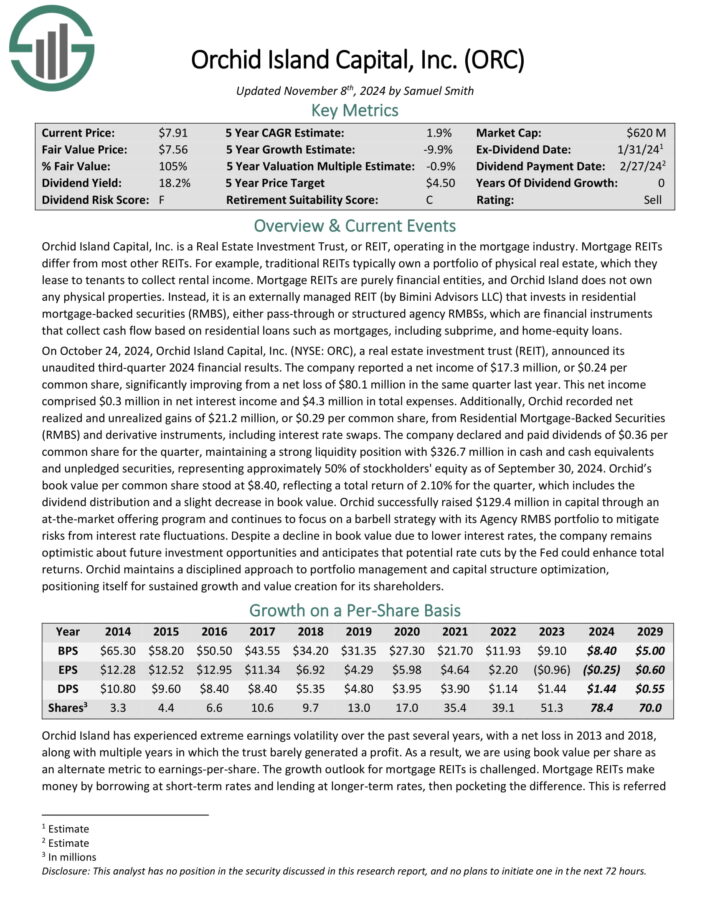

High-Yield REIT No. 1: Orchid Island Capital Inc (ORC)

- Dividend Yield: 18.6%

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

REITs have significant appeal for income investors due to their high yields. These 10 extremely high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Monthly Dividend Stocks: Individual securities that pay out every month