Published on July 2nd 2024 by Nathan Parsh

High-yield stocks can be very helpful in generating enough income to cover expenses in retirement.

For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

TFS Financial Corporation (TFSL) is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

Shares of the company are down 15% year-to-date, which has driven the yield higher to more than 9%, making TFS Financial Corporation one of the highest yielding stocks in our coverage universe.

In this article, we’ll take a look at TFS Financial Corporation’s prospects as a potential investment.

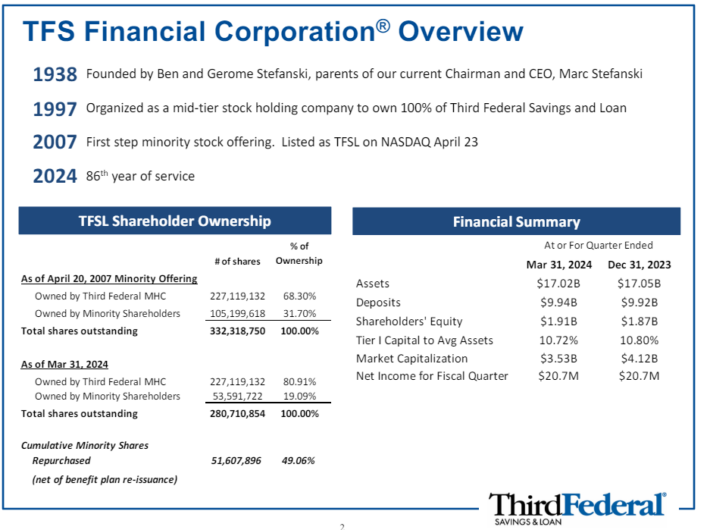

Business Overview

TFS Financial Corporation is the holding company of Third Federal Savings and Loan Association of Cleveland. The company has been in business for 86 years and has a market capitalization of $3.5 billion today.

Source: Investor Relations

TFS Financial Corporation offers a range of retail consumer banking services within the U.S., including savings accounts, money market accounts, checking accounts, individual retirement accounts, qualified plan accounts, and certificates of deposit.

Additionally, the company extends residential real estate mortgage loans, residential construction loans, home equity loans, lines of credit, purchase mortgages, and first mortgage refinance loans.

TFS Financial Corporation reported second quarter earnings results on April 30th, 2024 that topped what the market had anticipated. Revenue grew 3.1% to $71.4 million, which was $2.75 million more than expected. Earnings-per-share totaled $0.07, which compared favorably to $0.06 in the prior year and was $0.02 above estimates.

Net interest income improved 3.3% to $71.4 million due to higher yields on cash equivalents and loans. As a result, the net interest margin expanded 3 basis points to 1.71%.

Net loans declined 0.4% to $15.1 billion on a sequential basis, but allowances for credit losses on loans fell 1.3% to $68.2 million.

TFS Financial Corporation is projected to earn $0.24 this year, which would be a 7.7% decrease from the prior year.

Growth Prospects

TFS Financial Corporation does not have the size and scale of the largest names in the banking industry. The company has 21 full-service branches in Ohio and another 16 such branches in Florida.

The company’s service offerings are similar to its larger peers, which doesn’t provide additional benefit to the business.

TFS Financial Corporation does provide savings products to customers in all 50 U.S. states and first mortgage refinances loans in 26 states and the District of Columbia.

This gives the company a slightly more pronounced reach than the typical community bank.

However, TFS Financial Corporation has performed poorly over the long-term. Earnings-per-share have barely budged over the last decade, with the company earning $0.22 per share in 2014 and just $0.26 per share last year.

We believe the company to be capable of 4% earnings growth over the next five years.

Competitive Advantages

We do not believe that TFS Financial Corporation has any significant competitive advantage, though it does have more of a presence than many community banks.

The fact that the company offers some services to 26 U.S. states shows that it has more reach than many banks its size.

While many financial institutions have seen net interest margin contract as the cost of higher yields have increased, TFS Financial Corporation did see some expansion in its most recent quarter.

The company also has a very strong loan portfolio, as provisions for credit losses declined quarter-over-quarter. TFS Financial Corporation’s PCLs represent just 0.5% of the entire loan portfolio, showing that the company’s loan book is very healthy.

The company has also taken steps to lower its overall expenses. Total expenses have held mostly steady over the last two quarters.

Finally, TFS Financial Corporation has more than $17 billion in total assets, a sizeable figure for a company of its size.

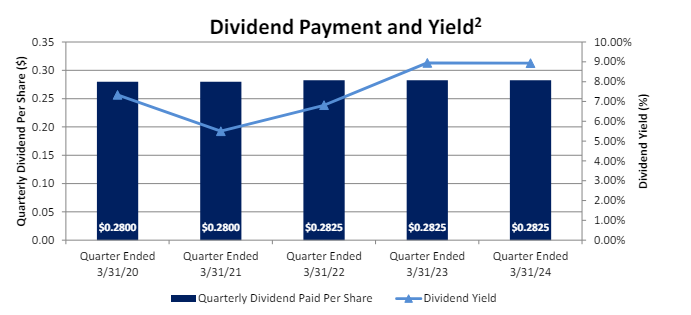

Dividend Analysis

TFS Financial Corporation’s dividend yield is very attractive at 9.1%, which is seven times the average yield of the S&P 500 Index.

Source: Investor Relations

Prior to 2022, TFS Financial Corporation had an eight-year dividend growth streak, but the company paused its increases at that time. Shareholders have received the same payment of $0.2825 for 14 consecutive quarters.

Even with the dividend pause, the growth rate has ben 32% annually for the 2014 to 2023 period as the company aggressively raised its dividend in the middle of the last decade. We do not expect more than nominal raises over the next five years.

The current yield has rarely been this high over the last decade, but this has become more of its typical yield for the stock for the past few years.

High yields can often be a warning signal that something is wrong with the underlying business. This could be the case for TFS Financial Corporation. With an annualized dividend of $1.13, TFS Financial Corporation is expected to have a payout ratio of 481% for 2024.

This is an incredibly high payout ratio and one the is unstainable long-term. We note that the stock has an average payout ratio of 400% over the last five years so an extremely high payout ratio has yet to result in a dividend reduction.

That said, we believe that earnings growth will have to be significant going forward for the company to be able to maintain its current dividend amount.

Therefore, shareholders should be weary of TFS Financial Corporation’s ability to continue to pay a very high yield.

Final Thoughts

There are some attractive characteristics of TFS Financial Corporation. First, its dividend yield is very generous and well above what the average stock in the S&P 500 Index offers.

Second, for a community bank, it has a sizeable presence and more than $17 billion in total assets. The company has also seen its net interest income and margin expand in the most recent quarter.

However, the dividend payout ratio is very high and the company has also kept its payments stagnant after an aggressive period of growth.

These are both warning signs that the dividend could be at risk for being cut. Income investors will likely want to look elsewhere if they are seeking secure sources of income.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Kings: 50+ years of rising dividends

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List