Updated on July 23rd, 2024 by Bob Ciura

Master Limited Partnerships, otherwise known as MLPs, have obvious appeal for income investors. This is because MLPs widely offer yields of 5% or even higher in some cases.

With this in mind, we created a full downloadable list of nearly 100 Master Limited Partnerships in our coverage universe.

You can download the Excel spreadsheet (along with relevant financial metrics like dividend yield and payout ratios) by clicking on the link below:

This article covers the 20 highest-yielding MLPs today.

The table of contents below allows for easy navigation of the article:

Table of Contents

- High-Yield MLP #20: Cheniere Energy Partners LP (CQP)

- High-Yield MLP #19: Sunoco LP (SUN)

- High-Yield MLP #18: Global Partners LP (GLP)

- High-Yield MLP #17: Plains All America Pipeline LP (PAA)

- High-Yield MLP #16: Hess Midstream LP (HESM)

- High-Yield MLP #15: Suburban Propane Partners LP (SPH)

- High-Yield MLP #14: Enterprise Products Partners LP (EPD)

- High-Yield MLP #13: Energy Transfer LP (ET)

- High-Yield MLP #12: MPLX LP (MPLX)

- High-Yield MLP #11: Westlake Chemical Partners LP (WLKP)

- High-Yield MLP #10: AllianceBernstein Holdings LP (AB)

- High-Yield MLP #9: USA Compression Partners LP (USAC)

- High-Yield MLP #8: Dorchester Minerals LP (DMLP)

- High-Yield MLP #7: Delek Logistics Partners LP (DLK)

- High-Yield MLP #6: CrossAmerica Partners LP (CAPL)

- High-Yield MLP #5: Alliance Resource Partners LP (ARLP)

- High-Yield MLP #4: Black Stone Minerals LP (BSM)

- High-Yield MLP #3: CVR Partners LP (UAN)

- High-Yield MLP #2: NextEra Energy Partners LP (NEP)

- High-Yield MLP #1: Icahn Enterprises LP (IEP)

- Final Thoughts

High Yield MLP #20: Cheniere Energy Partners LP (CQP)

- Distribution yield: 7.1%

Cheniere Energy Partners owns and operates regasification facilities at the Sabine Pass liquefied natural gas terminal, which is in Cameron Parish, Louisiana, providing LNG to energy companies and utilities around the world.

In early May, CQP reported (5/3/24) results for the first quarter of fiscal 2024. Its number of LNG cargos rose 2% over the prior year’s quarter but the company incurred material losses in its commodity derivatives. As a result, earnings plunged 65%, from $1.935 billion to $682 million.

Demand for LNG cargos remains strong but it has somewhat moderated. As a result, CQP reiterated its guidance for an annual distribution of $3.15-$3.35 in 2024, which is lower than the record distribution of $4.16 offered last year.

Click here to download our most recent Sure Analysis report on CQP (preview of page 1 of 3 shown below):

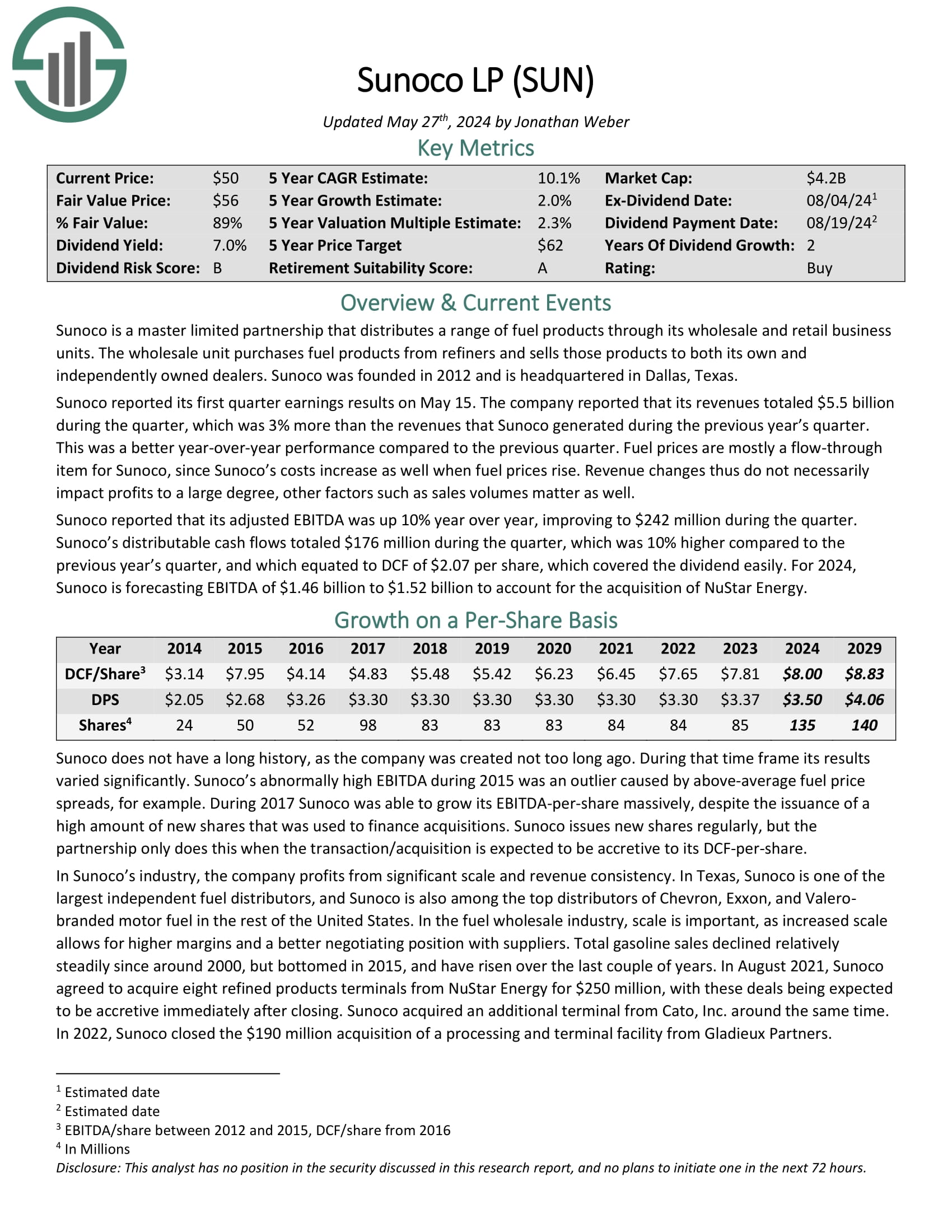

High Yield MLP #19: Sunoco LP (SUN)

- Distribution yield: 6.1%

Sunoco LP distributes a range of fuel products through its wholesale and retail business units. The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Sunoco reported its first quarter earnings results on May 15. The company reported that its revenues totaled $5.5 billion during the quarter, which was 3% more than the 2023 first quarter.

The company reported that its first-quarter adjusted EBITDA rose 10% year over year, improving to $242 million during the quarter. Distributable cash flow totaled $176 million during the quarter, 10% higher year-over-year.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion to account for the acquisition of NuStar Energy.

Click here to download our most recent Sure Analysis report on Sunoco (preview of page 1 of 3 shown below):

High Yield MLP #18: Global Partners LP (GLP)

- Distribution yield: 6.5%

Global Partners LP is an owner, supplier, and operator of liquid energy terminals, fueling locations, and retail experiences.

It operates or maintains dedicated storage at 53 liquid energy terminals spanning from Maine to Florida and into the U.S. Gulf States.

The company distributes gasoline, distillates, residual oil, and renewable fuels to wholesalers, retailers, and commercial customers.

Source: Investor Presentation

In addition, Global owns, supplies, and operates more than 1,700 retail locations across 12 Northeast states, the Mid-Atlantic, and Texas.

In the 2024 first quarter, GLP reported a net loss of $0.37 per common limited partner unit, down from $0.70 per diluted common limited partner unit in the same period of 2023.

Adjusted EBITDA was $56.0 million in the first quarter of 2024 versus $76.0 million in the same period of 2023. Distributable cash flow (DCF) was $15.8 million in the first quarter of 2024 compared with $46.3 million in the same period of 2023.

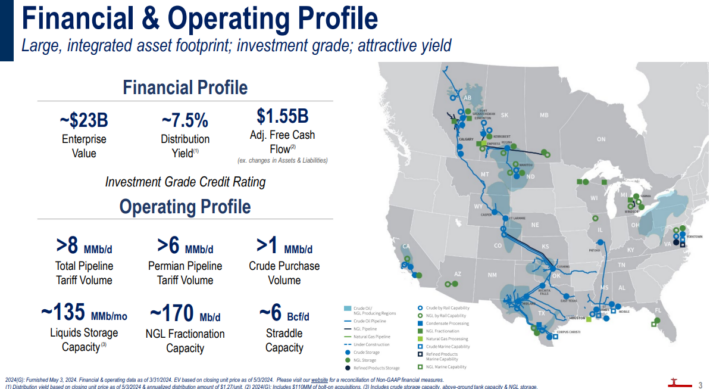

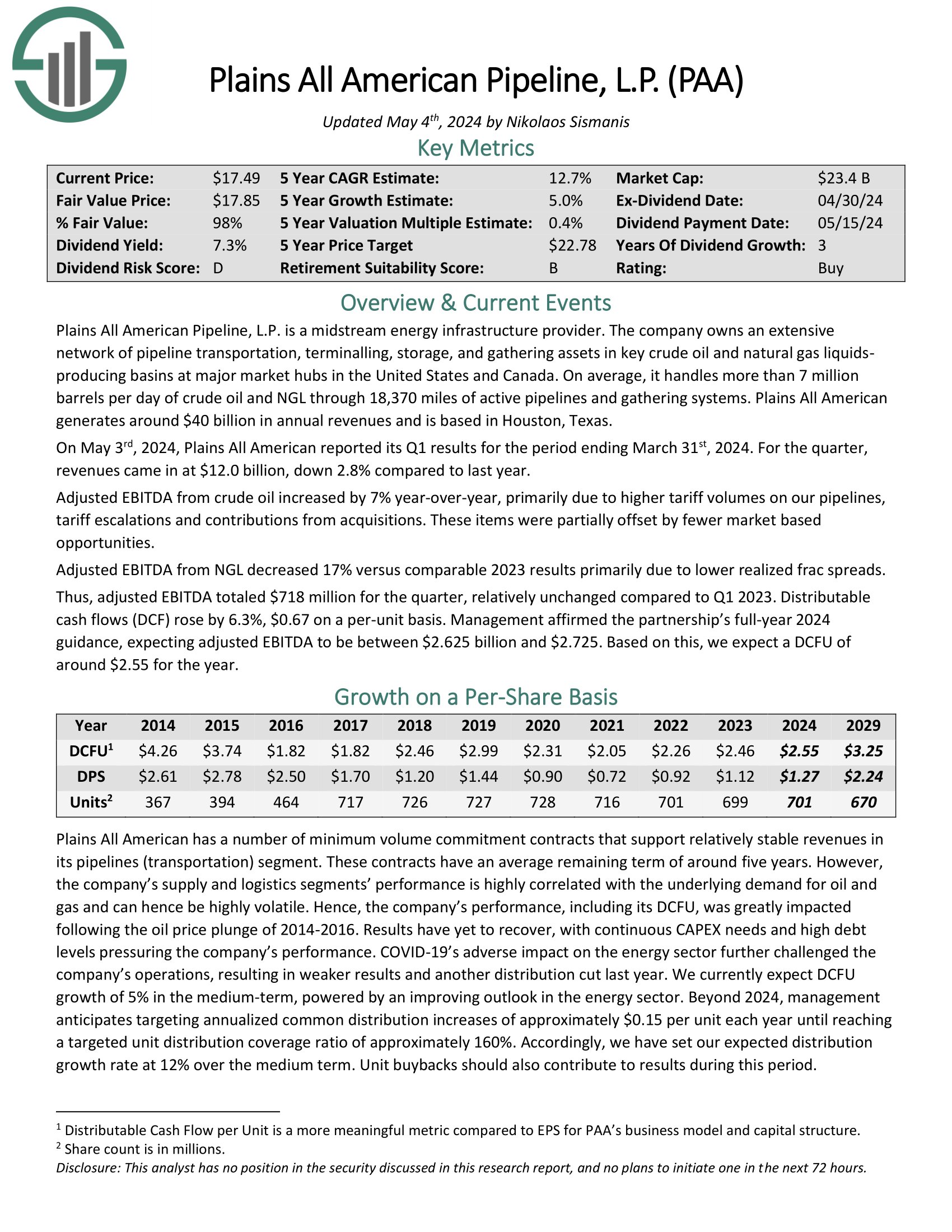

High Yield MLP #17: Plains All American Pipeline LP (PAA)

- Distribution yield: 6.7%

Plains All American Pipeline, L.P. is a midstream energy infrastructure provider. The company owns an extensive network of pipeline transportation, terminaling, storage, and gathering assets in key crude oil and natural gas liquids-producing basins at major market hubs in the United States and Canada.

Source: Investor Presentation

On average, it handles more than 7 million barrels per day of crude oil and NGL through 18,370 miles of active pipelines and gathering systems.

On May 3rd, 2024, Plains All American reported its Q1 results for the period ending March 31st, 2024. For the quarter, revenues came in at $12.0 billion, down 2.8% compared to last year.

Adjusted EBITDA from crude oil increased by 7% year-over-year, primarily due to higher tariff volumes on our pipelines, tariff escalations and contributions from acquisitions.

Click here to download our most recent Sure Analysis report on PAA (preview of page 1 of 3 shown below):

High Yield MLP #16: Hess Midstream LP (HESM)

- Distribution yield: 6.8%

Hess Midstream LP owns and operates midstream assets primarily located in the Bakken and Three Forks Shale plays in North Dakota. It provides oil, gas and water midstream services to Hess and third-party customers in the U.S.

Hess Midstream has long-term commercial contracts, which extend through 2033. Its contracts are 100% fee-based and minimize the exposure of the company to commodity prices.

About 85% of the revenues of Hess Midstream are protected by minimum-volume commitments in 2024.

Source: Investor Presentation

In late April, Hess Midstream reported (4/25/24) financial results for the first quarter of fiscal 2024. Throughput volumes grew 16% for gas processing, 13% for oil terminaling and 47% for water gathering over the prior year’s quarter, primarily thanks to higher production and higher gas capture. As a result, revenue grew 17% and earnings-per-share grew 28%, from $0.47 to $0.60.

Management provided positive guidance for the full year thanks to strong business momentum in all segments. It expects 12.5% growth of adjusted EBITDA this year, adjusted free cash flow of $685-$735 million and at least 5% annual growth of distributions until 2026.

Click here to download our most recent Sure Analysis report on HESM (preview of page 1 of 3 shown below):

High Yield MLP #15: Suburban Propane Partners LP (SPH)

- Distribution yield: 6.8%

Suburban Propane services most of the U.S. with propane and other energy sources, with propane making up around ~90% of total revenue.

The partnership has over 3,200 full–time employees in 41 states, serving approximately 1 million customers.

Source: Investor Presentation

Suburban posted second-quarter earnings on May 9th, 2024. Earnings-per-share came to $1.72, which was $0.07 below analyst estimates.

Revenue also fell more than 5% year-over-year to $498 million, missing estimates by almost $13 million.

Adjusted EBITDA was $147 million for the quarter, down very slightly from $149 million a year ago. Retail propane gallons sold fell 2.7% to 140 million gallons.

Average propane prices were up 2.8% from the year-ago period. That helped drive gross margin of $308 million, up $13 million, or 4.4%, year-over-year.

Click here to download our most recent Sure Analysis report on SPH (preview of page 1 of 3 shown below):

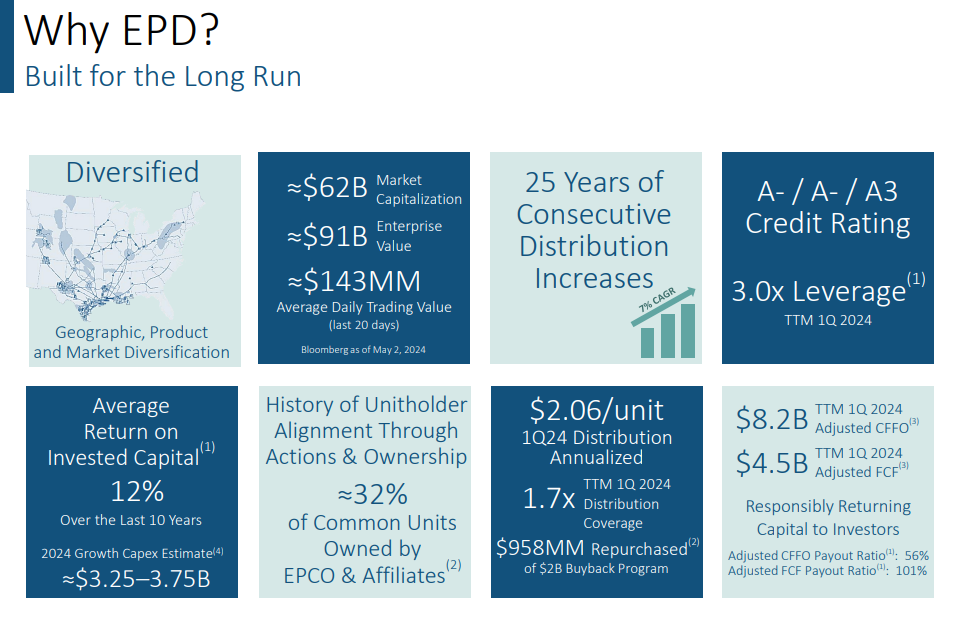

High Yield MLP #14: Enterprise Products Partners LP (EPD)

- Distribution yield: 6.9%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise reported net income attributable to common unitholders of $1.5 billion, or $0.66 per unit on a fully diluted basis, for the first quarter of 2024, marking a 5 percent increase from the first quarter of 2023. Distributable Cash Flow (DCF) remained steady at $1.9 billion for both quarters.

Distributions declared for the first quarter of 2024 increased by 5.1% compared to the same period in 2023, reaching $0.515 per common unit. DCF covered this distribution 1.7 times, with $786 million retained.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

High Yield MLP #13: Energy Transfer LP (ET)

- Distribution yield: 7.8%

Energy Transfer owns and operates one of the largest and most diversified portfolios of energy assets in the United States.

Operations include natural gas transportation and storage along with crude oil, natural gas liquids, refined product transportation, and storage totaling 83,000 miles of pipelines.

Energy Transfer operates with a primarily fee-based model, which somewhat mitigates the sensitivity of the MLP to commodity prices.

Source: Investor Presentation

In early May, Energy Transfer reported (5/8/24) financial results for the first quarter of fiscal 2024. It grew its volumes in all the segments and achieved record crude oil transportation volumes.

As a result, distributable cash flow grew 17% over the prior year’s quarter. Energy Transfer posted a healthy distribution coverage ratio of 2.2x for the quarter.

Click here to download our most recent Sure Analysis report on ET (preview of page 1 of 3 shown below):

High Yield MLP #12: MPLX LP (MPLX)

- Distribution yield: 7.9%

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

- Logistics and Storage, which relates to crude oil and refined petroleum products

- Gathering and Processing, which relates to natural gas and natural gas liquids (NGLs)

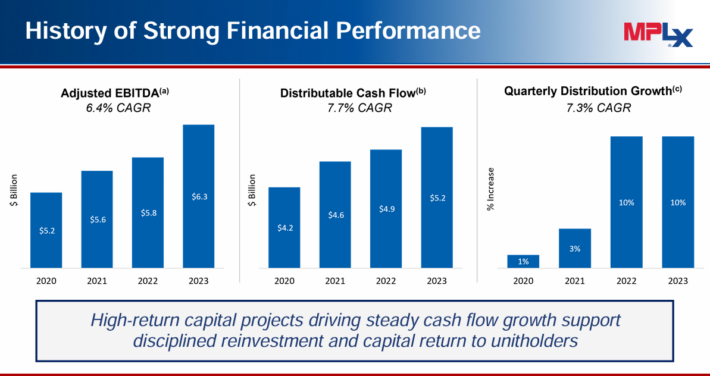

MPLX has generated strong growth since the coronavirus pandemic ended.

Source: Investor Presentation

In late April, MPLX reported (4/30/24) financial results for the first quarter of fiscal 2024. Adjusted EBITDA and distributable cash flow (DCF) per share both grew 8% over the prior year’s quarter, primarily thanks to higher tariff rates, but also thanks to increased gas volumes.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.2x and a solid distribution coverage ratio of 1.6.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

High Yield MLP #11: Westlake Chemical Partners LP (WLKP)

- Distribution yield: 7.9%

Westlake Chemical Partners acquires, operates, and develops ethylene production facilities and related assets. It has production capacity of approximately 3.7 billion pounds.

In the 2024 first quarter, WLKP reported net income of $0.42 per limited partner unit, which was in-line with first quarter 2023 results.

Cash flows from operating activities in the first quarter of 2024 were $104.6 million, a decrease of $40.3 million compared to first quarter 2023, due to less favorable working capital changes.

First-quarter distributable cash flow was $16.9 million, a decrease of $0.7 million year-over-year. The decrease in distributable cash flow was primarily due to lower production and sales volume.

On April 30, 2024, WLKP approved a quarterly distribution of $0.4714 per unit, representing the 39th consecutive quarterly distribution. The MLP had a distributable cash flow coverage ratio of 0.93x in the trailing 12-month period.

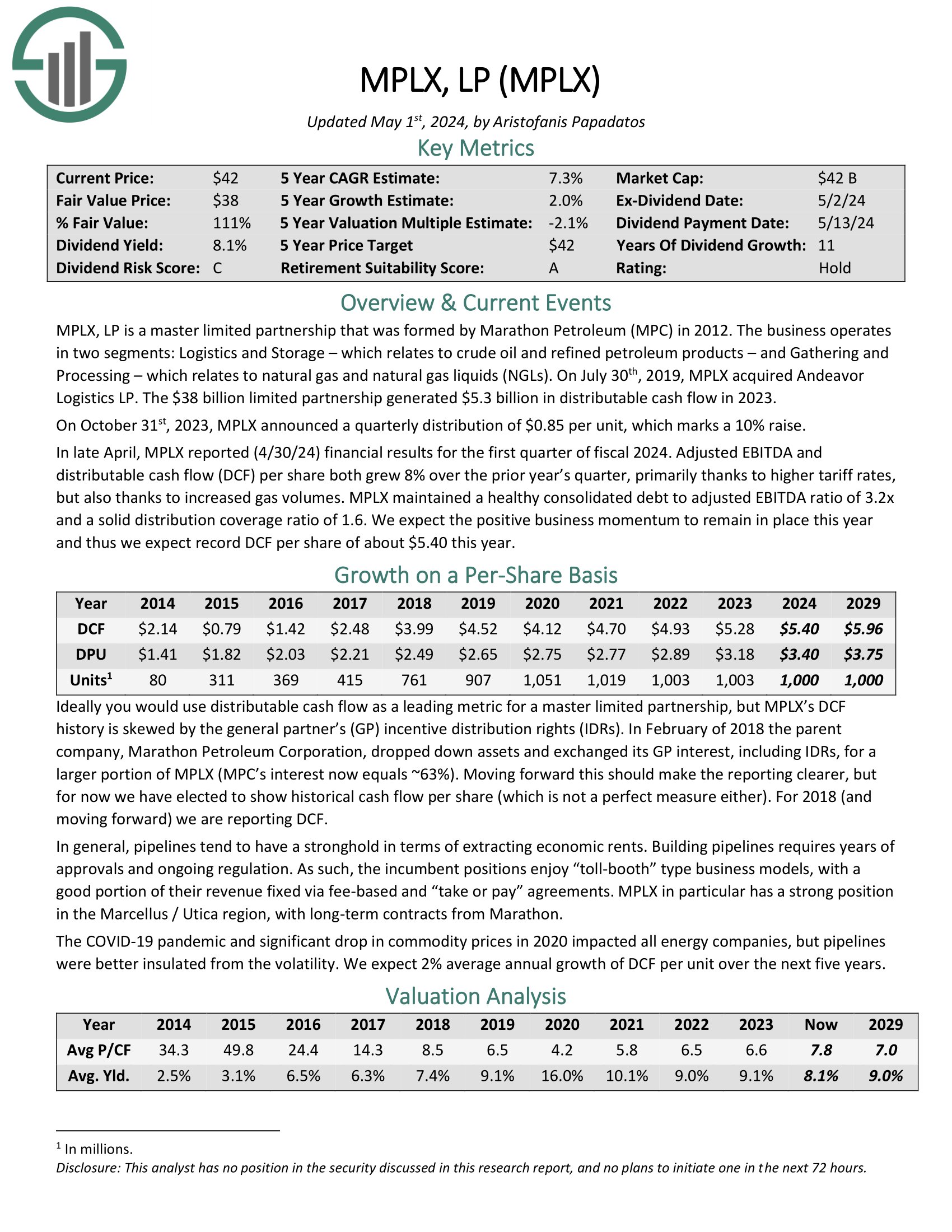

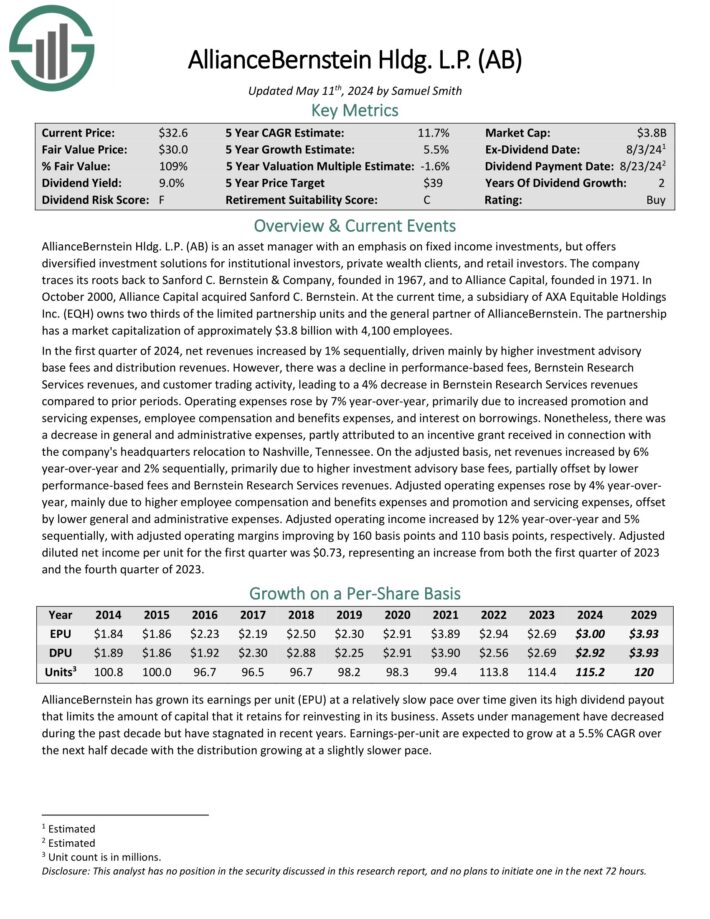

High Yield MLP #10: AllianceBernstein Holding LP (AB)

- Distribution yield: 8.5%

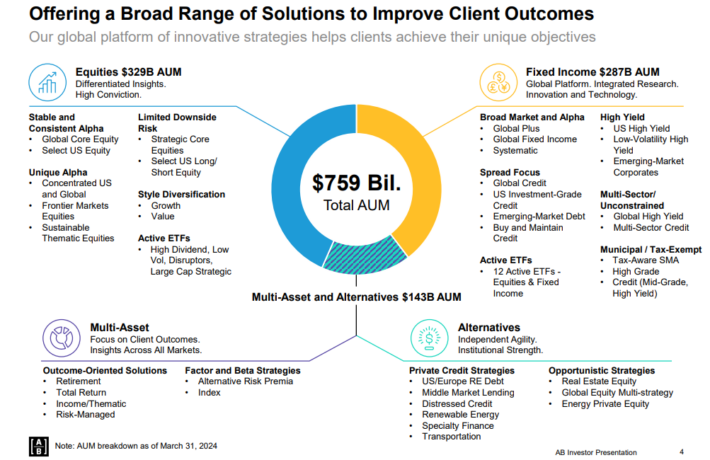

AllianceBernstein Hldg. L.P. is an asset manager with an emphasis on fixed income investments, but offers diversified investment solutions for institutional investors, private wealth clients, and retail investors.

AllianceBernstein has total assets under management of more than $750 billion.

Source: Investor Presentation

In the first quarter of 2024, net revenues increased by 1% sequentially, driven mainly by higher investment advisory base fees and distribution revenues.

However, there was a decline in performance-based fees, Bernstein Research Services revenues, and customer trading activity, leading to a 4% decrease in Bernstein Research Services revenues compared to prior periods.

On an adjusted basis, net revenues increased by 6% year-over-year and 2% sequentially, primarily due to higher investment advisory base fees, partially offset by lower performance-based fees and Bernstein Research Services revenues.

Click here to download our most recent Sure Analysis report on AB (preview of page 1 of 3 shown below):

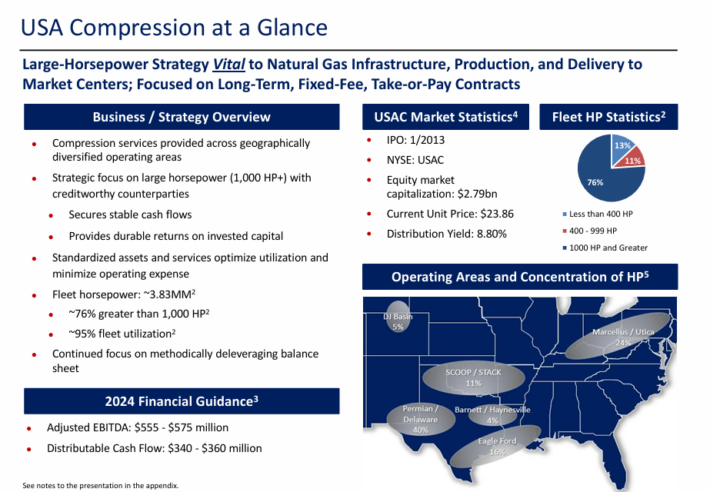

High Yield MLP #9: USA Compression Partners LP (USAC)

- Distribution yield: 8.9%

USA Compression Partners, LP is one of the largest independent providers of gas compression services to the oil and gas industry.

The partnership is active in several shale plays throughout the U.S., including the Utica, Marcellus, and Permian Basins.

It focuses primarily on infrastructure applications, including centralized high-volume natural gas gathering systems and processing facilities, requiring large horsepower compression units.

Source: Investor Presentation

USAC operates under fixed–fee, take–or–pay contracts and does not have direct exposure to commodity prices.

In April 2018, USAC merged with CDM Compression. The merger provided better geographic diversification and access to areas where USAC was underrepresented. This merger essentially doubled the size of USAC.

Click here to download our most recent Sure Analysis report on USAC (preview of page 1 of 3 shown below):

High Yield MLP #8: Dorchester Minerals LP (DMLP)

- Distribution yield: 9.7%

Dorchester Minerals, L.P. owns producing and non-producing crude oil and natural gas mineral, royalty, overriding royalty, net profits, and leasehold interests in 28 states.

In the 2024 first quarter, DMLP reported net income of $0.44 per common unit, down from $0.71 per unit in the same quarter last year.

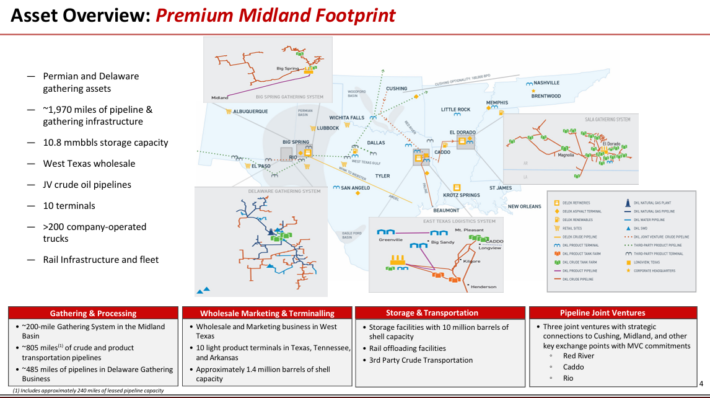

High Yield MLP #7: Delek Logistics Partners LP (DLK)

- Distribution yield: 9.9%

Delek Logistics is a midstream energy MLP that owns assets primarily in the Permian Basin, the Delaware Basin, and the Gulf Coast region.

It provides gathering, pipeline and other transportation services primarily for crude oil and natural gas customers. In all, DLK owns about 850 miles of transportation pipelines, and a 700-mile crude gathering system.

DLK also provides storage, wholesale marketing, and terminalling services primarily for intermediate and refined product customers, and water disposal and recycling services.

Source: Investor Presentation

In the 2024 first quarter, net income was $0.73 per diluted common limited partner unit, down from $0.86 per diluted common limited partner unit in the first quarter 2023. The decrease in net income was driven by higher interest expense.

Distributable cash flow was $68.0 million in the first quarter 2024, compared to $61.8 million in the first quarter of 2023.

High Yield MLP #6: CrossAmerica Partners LP (CAPL)

- Distribution yield: 10.4%

CrossAmerica Partners LP is a leading wholesale distributor of motor fuels, convenience store operator, and owner and lessee of real estate used in the retail distribution of motor fuels.

CrossAmerica Partners distributes branded petroleum for motor vehicles in the United States. It distributes fuel to approximately 1,800 locations and owns or leases approximately 1,100 sites. Its geographic footprint covers 34 states.

In the 2024 first quarter, CAPL reported a first-quarter net loss of $17.5 million, including a $15.9 million loss on lease terminations. Distributable cash flow of $11.7 million declined from $19.1 million in the same quarter last year.

CAPL had a first-quarter distribution coverage ratio of 1.37x, down from 1.7x in the 2023 first quarter. CAPL ended the first quarter with a leverage ratio of 4.49x, compared with 4.21x at the end of 2023.

High Yield MLP #5: Alliance Resource Partners LP (ARLP)

- Distribution yield: 11.0%

Alliance Resource Partners is the second–largest coal producer in the eastern United States. Its primary operations are producing and marketing coal to major domestic and international utility users.

However, the company also owns mineral and royalty interests in premier oil & gas regions, like the Permian, Anadarko, and Williston Basins.

Finally, the company provides terminal services, including transporting and loading coal and technology products and services.

Source: Investor Presentation

On April 27th, 2024, Alliance Resource Partners reported its Q1 and full year results. For the quarter, revenues declined by 1.7% year-over-year to $651.7 million.

Lower revenues were primarily the result of lower average coal sales prices, partially offset by higher oil & gas royalties and other revenues. Net income came in at $158.1 million, or $1.21 per unit, compared to $191.2 million, or $1.45 per unit last year.

Click here to download our most recent Sure Analysis report on ARLP (preview of page 1 of 3 shown below):

High Yield MLP #4: Black Stone Minerals LP (BSM)

- Distribution yield: 11.0%

Black Stone Minerals is one of the largest owners of oil and natural gas mineral interests in the United States. The company owns mineral interests and royalty interests in 41 states.

In the 2024 first quarter, Black Stone reported mineral and royalty production of 38.1 MBoe/d, a decrease of 2% from the prior quarter.

Net income for the first quarter was $63.9 million, and Adjusted EBITDA for the quarter totaled $104.1 million.

Distributable cash flow was $96.4 million for the first quarter. Distribution coverage for all units was 1.22x, indicating solid coverage.

The company also had no debt at the end of the first quarter, along with approximately $89 million of cash on hand.

High Yield MLP #3: CVR Partners LP (UAN)

- Distribution yield: 11.3%

CVR Partners produces and distributes nitrogen fertilizer products. It primarily produces urea ammonium nitrate, or UAN, as well as ammonia, which are predominantly used by farmers to improve the yield and quality of their crops.

In the 2024 first quarter, CVR Partners announced net income of $13 million, or $1.19 per common unit, a steep decline from $9.64 per unit in the year-ago period. Net sales of $128 million declined from $226 million year-over-year.

EBITDA was $40 million for the first quarter of 2024, down from $124 million in the same quarter last year.

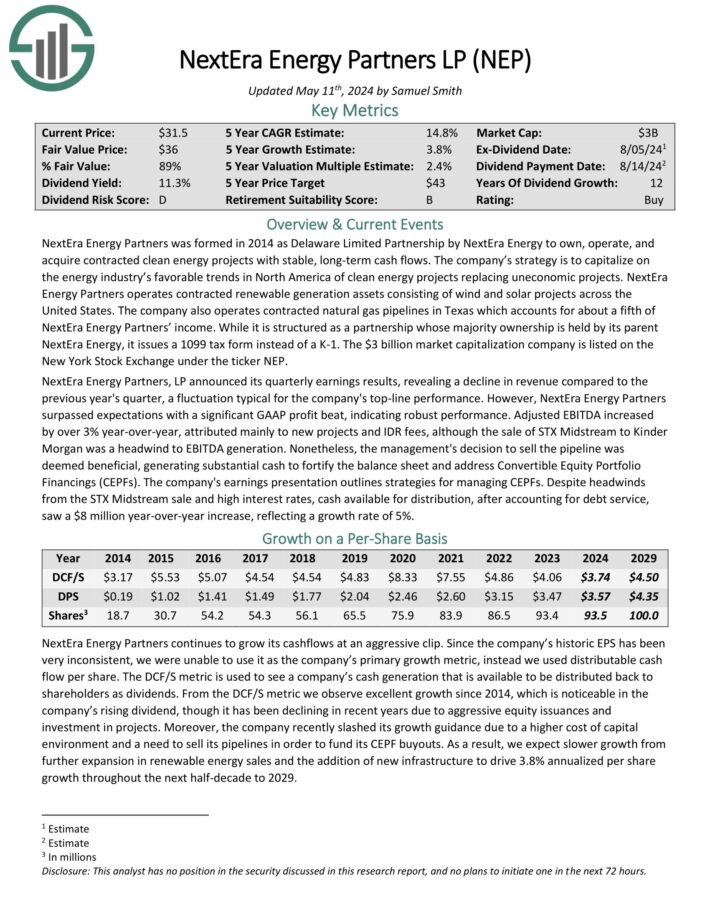

High Yield MLP #2: NextEra Energy Partners LP (NEP)

- Distribution yield: 12.9%

NextEra Energy Partners was formed in 2014 as Delaware Limited Partnership by NextEra Energy to own, operate, and acquire contracted clean energy projects with stable, long-term cash flows.

NextEra Energy Partners operates contracted renewable generation assets consisting of wind and solar projects across the United States. The company also operates contracted natural gas pipelines in Texas.

NextEra Energy Partners, LP announced its quarterly earnings results, revealing a decline in revenue compared to the previous year’s quarter, a fluctuation typical for the company’s top-line performance.

However, NextEra Energy Partners surpassed expectations with a significant GAAP profit beat, indicating robust performance. Adjusted EBITDA increased by over 3% year-over-year, attributed mainly to new projects and IDR fees.

Click here to download our most recent Sure Analysis report on NEP (preview of page 1 of 3 shown below):

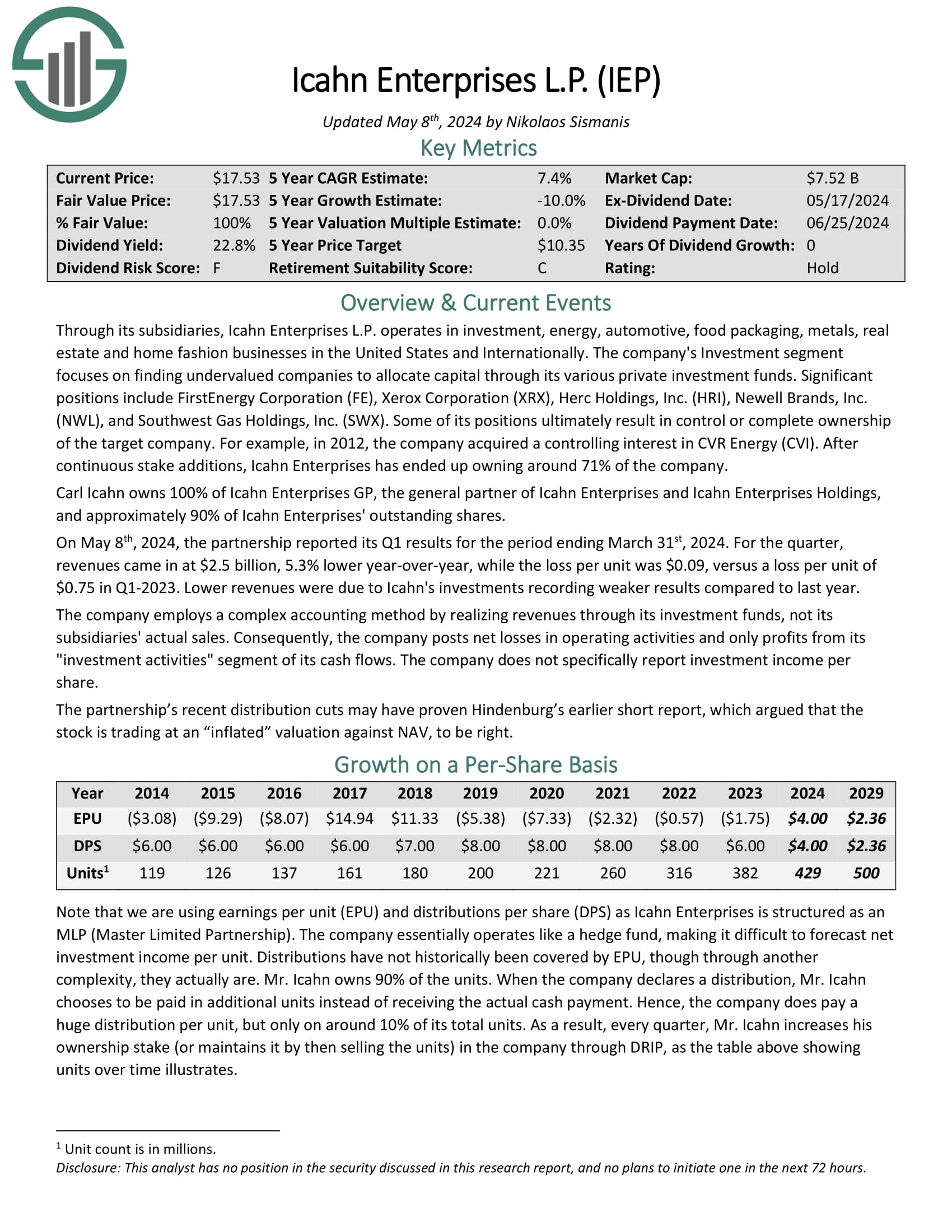

High Yield MLP #1: Icahn Enterprises LP (IEP)

- Distribution yield: 22.9%

Icahn Enterprises L.P. operates in investment, energy, automotive, food packaging, metals, real estate, and home fashion businesses in the United States and Internationally.

The company’s Investment segment focuses on finding undervalued companies to allocate capital through its various private investment funds.

Significant positions include FirstEnergy Corporation (FE), Xerox Corporation (XRX), Herc Holdings, Inc. (HRI), Newell Brands, Inc. (NWL), and Southwest Gas Holdings, Inc. (SWX).

Carl Icahn owns 100% of Icahn Enterprises GP, the general partner of Icahn Enterprises and Icahn Enterprises Holdings, and approximately 95% of Icahn Enterprises’ outstanding shares.

On May 8th, 2024, the partnership reported its Q1 results for the period ending March 31st, 2024. For the quarter, revenues came in at $2.5 billion, 5.3% lower year-over-year, while the loss per unit was $0.09, versus a loss per unit of $0.75 in Q1-2023.

Click here to download our most recent Sure Analysis report on IEP (preview of page 1 of 3 shown below):

Final Thoughts

Income investors will find a lot to like about Master Limited Partnerships. Specifically, MLPs tend to have very high yields.

Of course, investors should always do their own research to understand the unique tax implications and risk factors of MLPs.

But for income investors primarily looking for high yields, these 20 MLPs may be attractive.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more