Updated on November 21st, 2024 by Bob Ciura

We are highly focused on stocks with strong dividend growth prospects. To that end, we have identified several recession-proof stocks whose dividend prospects should remain solid, even if a bear market occurs.

Of course, there is no such thing as a totally recession-proof stock, as all types of securities are subject to some degree of market risk.

Nevertheless, some stocks may be less sensitive to harsh economic conditions. In turn, they may be less likely to experience as much of an impact in their financial performance during a recession.

Recession-poof stocks should enjoy better longevity qualities when it comes to their dividend payouts.

Some examples are found among the Dividend Aristocrats. The Dividend Aristocrats are a select group of 66 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

In this article, we are examining 12 dividend stocks covered in our Sure Analysis Research Database, whose recession-proof characteristics should enable them to keep growing their dividends in a bear market and beyond.

To narrow down our entire coverage universe, all 12 stocks featured here have been assigned an ‘A’ rating in their Dividend Risk Score.

They also have at least 15 years of consecutive annual dividend increases, meaning they have already proven their ability to withstand recessions.

Lastly, they have dividend yields above 1%, making them more appealing for income investors.

The stocks are listed according to their 5-year expected total returns, from lowest to highest.

Table of Contents

- Recession-Proof Stock #12: Comcast Corp. (CMCSA)

- Recession-Proof Stock #11: Tennant Co. (TNC)

- Recession-Proof Stock #10: Qualcomm Inc. (QCOM)

- Recession-Proof Stock #9: Quaker Chemical (KWR)

- Recession-Proof Stock #8: Hillenbrand Inc. (HI)

- Recession-Proof Stock #7: PepsiCo Inc. (PEP)

- Recession-Proof Stock #6: Farmers & Merchants Bancorp (FMCB)

- Recession-Proof Stock #5: Sysco Corp. (SYY)

- Recession-Proof Stock #4: PPG Industries (PPG)

- Recession-Proof Stock #3: SJW Group (SJW)

- Recession-Proof Stock #2: Sonoco Products (SON)

- Recession-Proof Stock #1: Target Corp. (TGT)

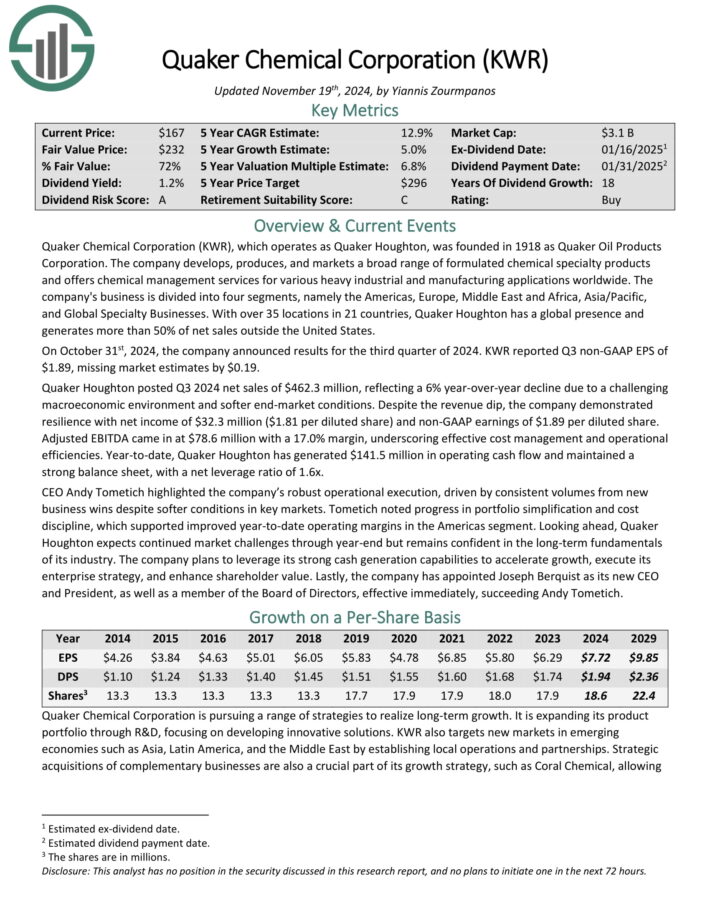

Recession-Proof Stock #12: Comcast Corp. (CMCSA)

- Dividend Yield: 2.9%

- 5-year Expected Annual Returns: 13.1%

Comcast is a media, entertainment and communications company. Its business units include Cable Communications (High–Speed Internet, Video, Business Services, Voice, Advertising, Wireless), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Entertainment), and Sky, a leading entertainment company in Europe.

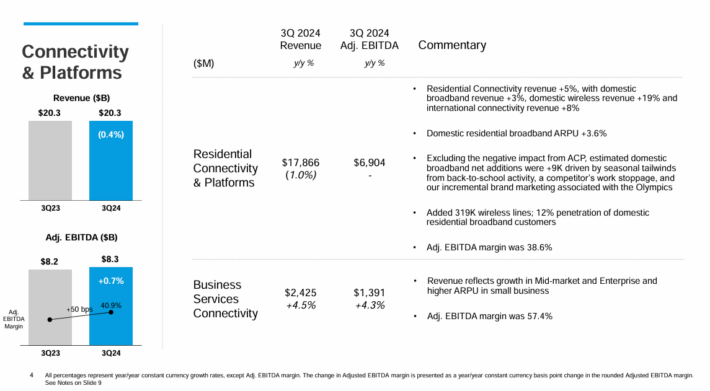

Comcast reported its Q3 2024 results on Oct. 31st, 2024. For the quarter, the company’s revenue rose 6.5% to $32.1 billion year over year. Adjusted EBITDA (a cash flow proxy) was down 2.3% to $9.7 billion.

Source: Investor Presentation

However, it was able to increase adjusted earnings-per-share (EPS) by 3.3% to $1.12. And Comcast generated free cash flow (FCF) of $3.4 billion.

The Connectivity & Platforms segment’s revenues were down 0.4% to $20.3 billion. The segment experienced adjusted EBITDA growing marginally by 0.7% to $8.3 billion, helped by margins expansion of 0.5% to 40.9%.

The Content & Experiences segment saw revenue grow 19% to $12.6 billion, while its adjusted EBITDA fell 8.7% to $1.8 billion.

Click here to download our most recent Sure Analysis report on Comcast (preview of page 1 of 3 shown below):

Recession-Proof Stock #11: Tennant Co. (TNC)

- Dividend Yield: 1.4%

- 5-year Expected Annual Returns: 13.1%

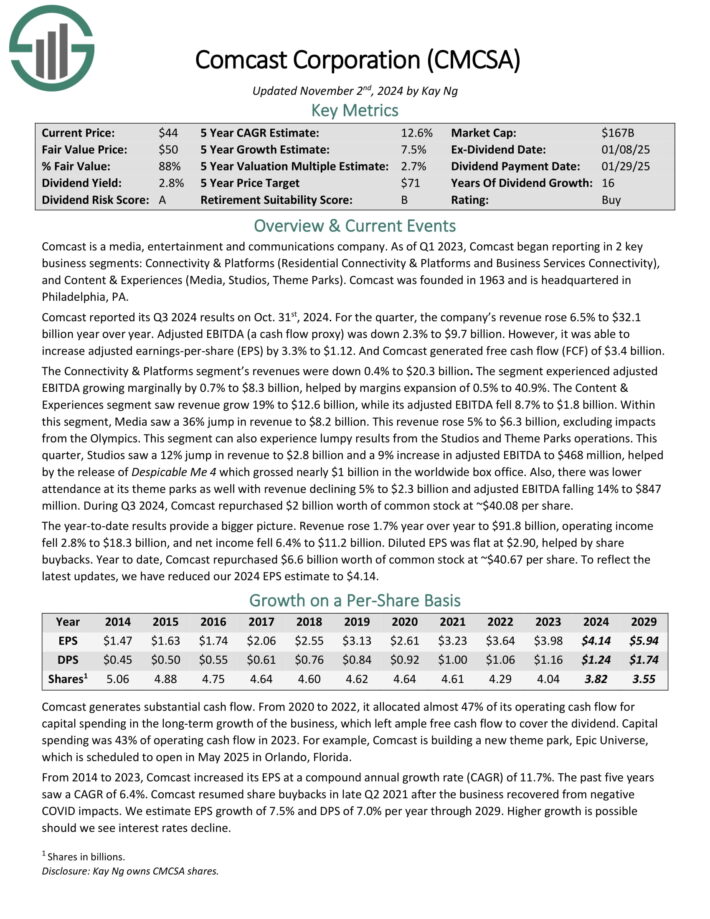

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers.

In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its third quarter earnings results on October 31st. The company announced that it generated revenues of $316 million during the quarter, which was 4% more than the top line number from the previous year’s quarter.

This was slightly better than the recent trend, as revenue had grown less on a year-over-year basis during the previous quarter. Revenues were lower compared to what the analyst community had forecasted.

Tennant Company generated adjusted earnings-per-share of $1.39 during the third quarter, which was less than what the analyst community had forecasted, and which was down 10% compared to the previous year.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

Recession-Proof Stock #10: Qualcomm Inc. (QCOM)

- Dividend Yield: 2.2%

- 5-year Expected Annual Returns: 13.1%

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm has annual sales of ~$39 billion.

On November 6th, 2024, Qualcomm reported results for the fourth quarter and fiscal year 2024 for the period ending September 29th, 2024.

For the quarter, revenue increased 18.1% to $10.24 billion, which was $310 million ahead of estimates. Adjusted earnings-per-share of $2.69 compared very favorably to $2.02 in the previous year and was $0.12 more than expected.

For the year, revenue grew 9% to just under $39 billion while adjusted earnings-per-share of $10.22 compared to $8.43 in the prior year.

Click here to download our most recent Sure Analysis report on QCOM (preview of page 1 of 3 shown below):

Recession-Proof Stock #9: Quaker Chemical (KWR)

- Dividend Yield: 1.2%

- 5-year Expected Annual Returns: 13.2%

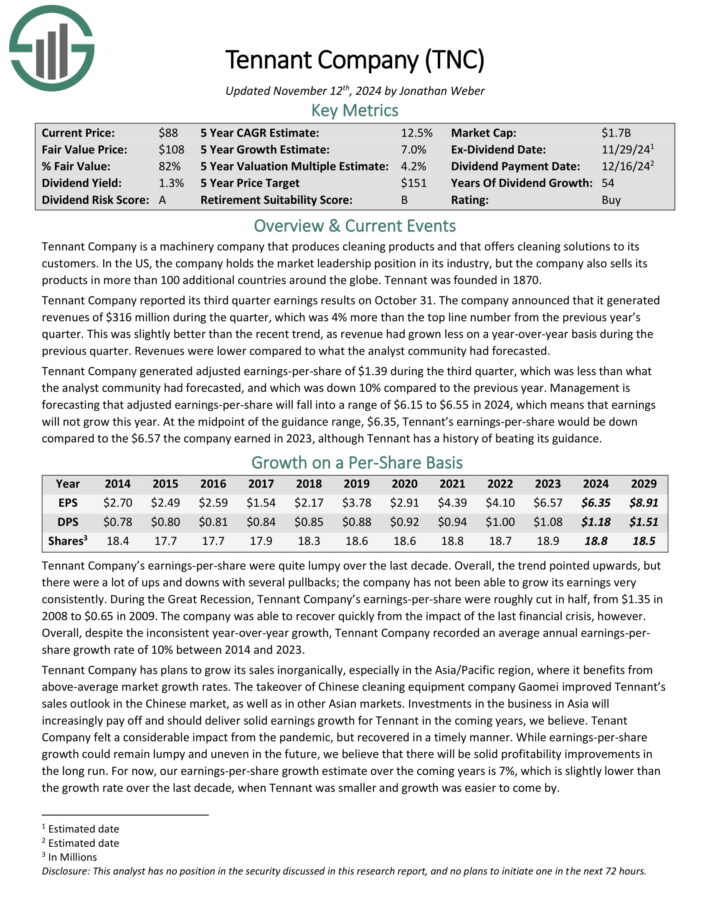

Quaker Chemical Corporation, which operates as Quaker Houghton, develops, produces, and markets a broad range of formulated chemical specialty products and offers chemical management services for various heavy industrial and manufacturing applications worldwide.

The company’s business is divided into four segments, namely the Americas, Europe, Middle East and Africa, Asia/Pacific, and Global Specialty Businesses. With over 35 locations in 21 countries, Quaker Houghton has a global presence and generates more than 50% of net sales outside the United States.

On October 31st, 2024, the company announced results for the third quarter of 2024. KWR reported Q3 non-GAAP EPS of $1.89, missing market estimates by $0.19.

Quaker Houghton posted Q3 2024 net sales of $462.3 million, reflecting a 6% year-over-year decline due to a challenging macroeconomic environment and softer end-market conditions.

Despite the revenue dip, the company demonstrated resilience with net income of $32.3 million ($1.81 per diluted share) and non-GAAP earnings of $1.89 per diluted share.

Click here to download our most recent Sure Analysis report on KWR (preview of page 1 of 3 shown below):

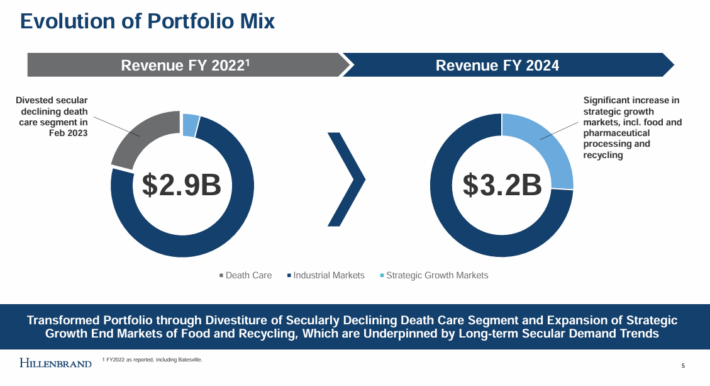

Recession-Proof Stock #8: Hillenbrand Inc. (HI)

- Dividend Yield: 2.8%

- 5-year Expected Annual Returns: 13.3%

Hillenbrand is an industrial conglomerate that operates through its two segments: Advanced Process Solutions and Molding Technology Solutions.

Advanced Process Solutions provides a variety of industrial solutions for companies’ manufacturing systems. Molding Technology Solutions is heavily involved in plastic processing and is exposed to the oil industry.

Source: Investor Presentation

On November 13th, 2024, Hillenbrand reported fourth quarter and FY 2024 results for the period ending September 30th, 2024. Total revenue increased 10% year-over-year to $838 million. Adjusted earnings-per-share declined 11%

year-over-year, to $1.01.

For FY 2024, Hillenbrand’s revenue rose 13% to $3.18 billion but adjusted EPS fell 6% to $3.32. Hillenbrand provided FY 2025 guidance which expects $2.95 billion to $3.09 billion in revenue and $2.80 to $3.15 in adjusted earnings-per-share.

Click here to download our most recent Sure Analysis report on HI (preview of page 1 of 3 shown below):

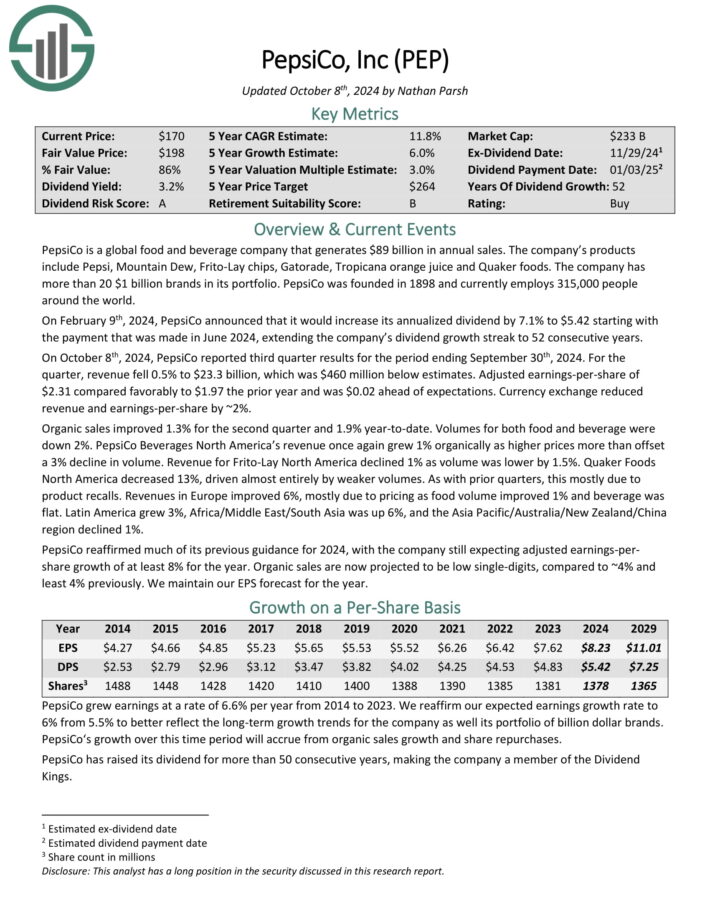

Recession-Proof Stock #7: PepsiCo Inc. (PEP)

- Dividend Yield: 3.4%

- 5-year Expected Annual Returns: 13.3%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On October 8th, 2024, PepsiCo reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 0.5% to $23.3 billion, which was $460 million below estimates.

Adjusted earnings-per-share of $2.31 compared favorably to $1.97 the prior year and was $0.02 ahead of expectations. Currency exchange reduced revenue and earnings-per-share by ~2%.

Organic sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for both food and beverage were down 2%.

PepsiCo Beverages North America’s revenue once again grew 1% organically as higher prices more than offset a 3% decline in volume.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

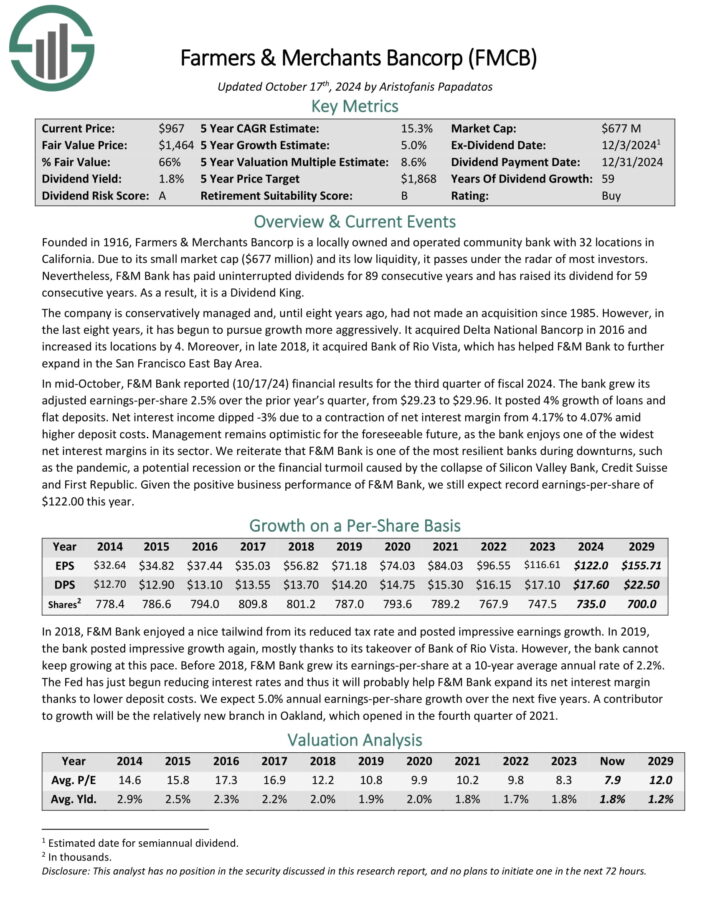

Recession-Proof Stock #6: Farmers & Merchants Bancorp (FMCB)

- Dividend Yield: 1.7%

- 5-year Expected Annual Returns: 13.7%

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In mid-October, F&M Bank reported (10/17/24) financial results for the third quarter of fiscal 2024. The bank grew its adjusted earnings-per-share 2.5% over the prior year’s quarter, from $29.23 to $29.96.

It posted 4% growth of loans and flat deposits. Net interest income dipped -3% due to a contraction of net interest margin from 4.17% to 4.07% amid higher deposit costs.

F&M Bank is a prudently managed bank, which has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 14.95%, which results in the highest regulatory classification of “well capitalized.”

Moreover, its credit quality remains exceptionally strong, as there are extremely few non-performing loans and leases in its portfolio.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

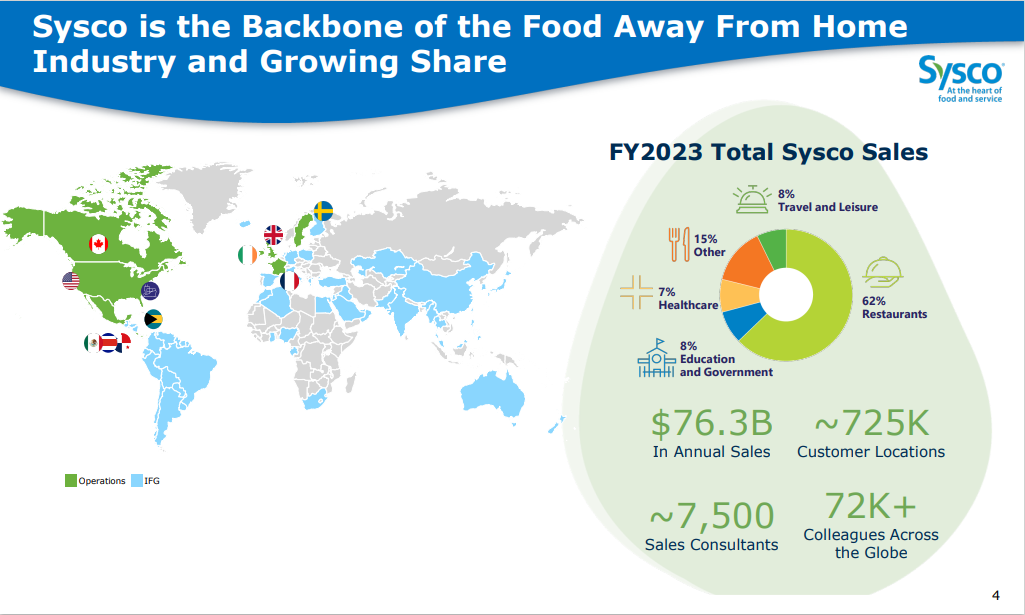

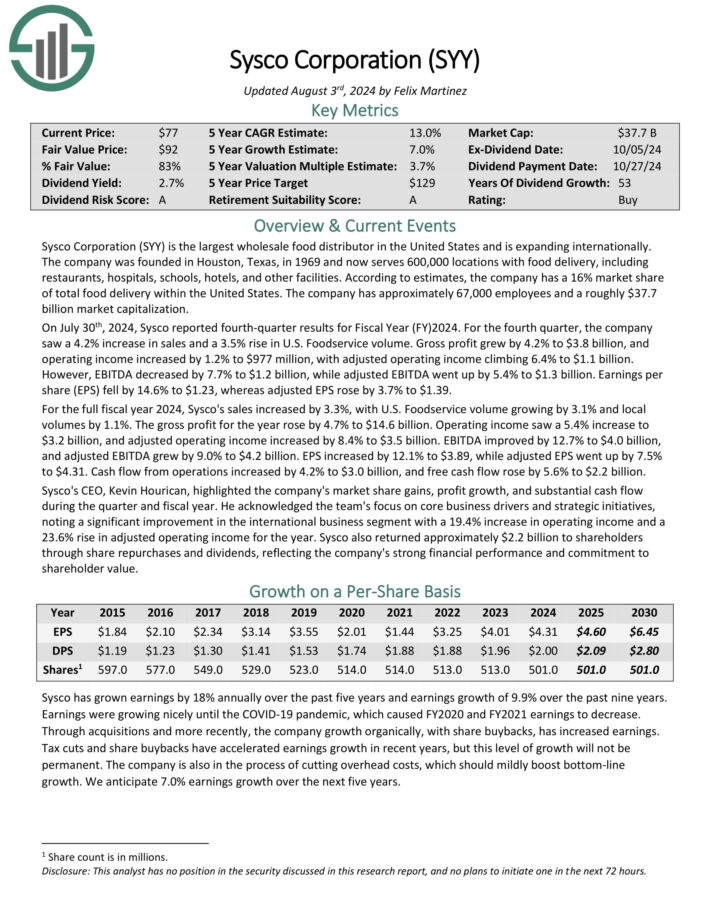

Recession-Proof Stock #5: Sysco Corp. (SYY)

- Dividend Yield: 2.8%

- 5-year Expected Annual Returns: 14.0%

Sysco Corporation is the largest wholesale food distributor in the United States. The company serves 600,000 locations with food delivery, including restaurants, hospitals, schools, hotels, and other facilities.

Source: Investor Presentation

On July 30th, 2024, Sysco reported fourth-quarter results for Fiscal Year (FY) 2024. For the fourth quarter, the company saw a 4.2% increase in sales and a 3.5% rise in U.S. Foodservice volume.

Gross profit grew by 4.2% to $3.8 billion, and operating income increased by 1.2% to $977 million, with adjusted operating income climbing 6.4% to $1.1 billion.

However, EBITDA decreased by 7.7% to $1.2 billion, while adjusted EBITDA went up by 5.4% to $1.3 billion. Earnings per share (EPS) fell by 14.6% to $1.23, whereas adjusted EPS rose by 3.7% to $1.39.

Click here to download our most recent Sure Analysis report on SYY (preview of page 1 of 3 shown below):

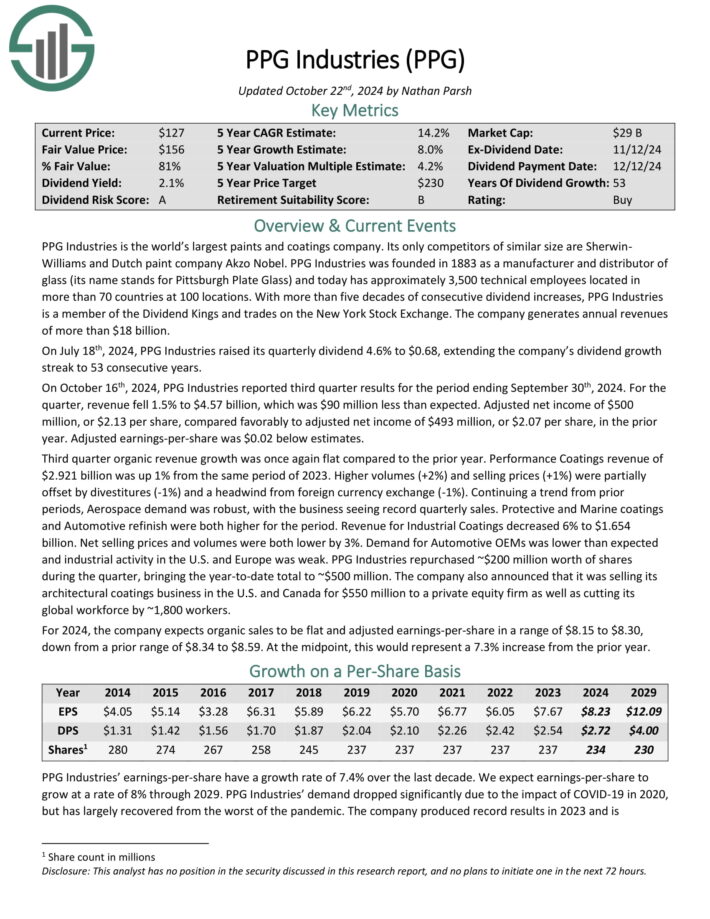

Recession-Proof Stock #4: PPG Industries (PPG)

- Dividend Yield: 2.2%

- 5-year Expected Annual Returns: 15.2%

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

PPG Industries was founded in 1883 as a manufacturer and distributor of glass (its name stands for Pittsburgh Plate Glass) and today has approximately 3,500 technical employees located in more than 70 countries at 100 locations.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

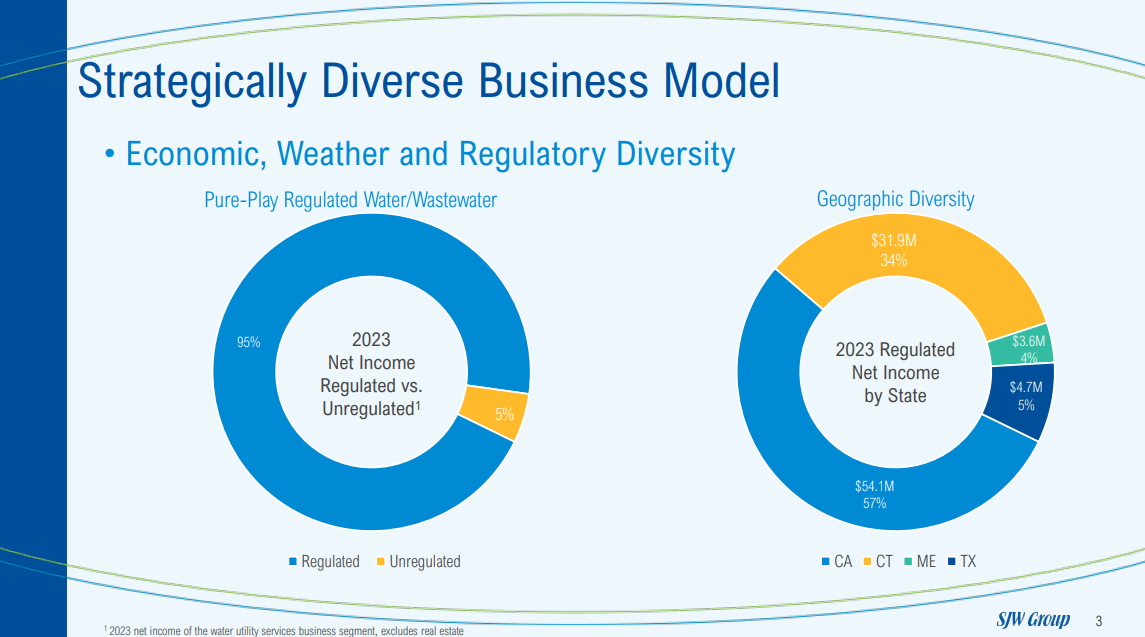

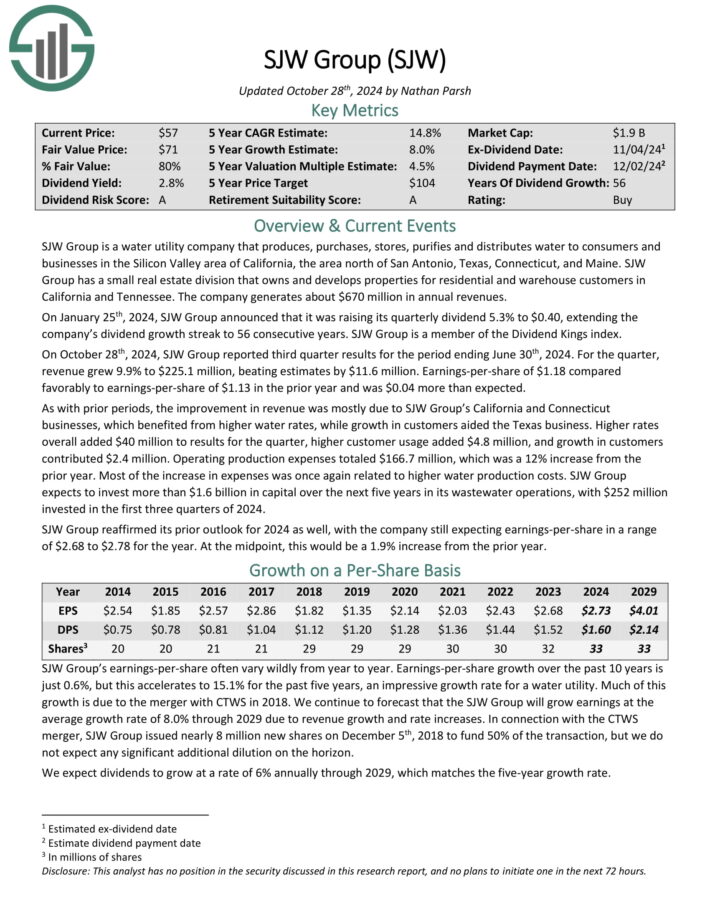

Recession-Proof Stock #3: SJW Group (SJW)

- Dividend Yield: 2.9%

- 5-year Expected Annual Returns: 15.6%

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

Source: Investor Presentation

On October 28th, 2024, SJW Group reported third quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 compared favorably to earnings-per-share of $1.13 in the prior year and was $0.04 more than expected.

As with prior periods, the improvement in revenue was mostly due to SJW Group’s California and Connecticut businesses, which benefited from higher water rates, while growth in customers aided the Texas business.

Higher rates overall added $40 million to results for the quarter, higher customer usage added $4.8 million, and growth in customers contributed $2.4 million. Operating production expenses totaled $166.7 million, which was a 12% increase from the prior year.

Click here to download our most recent Sure Analysis report on SJW (preview of page 1 of 3 shown below):

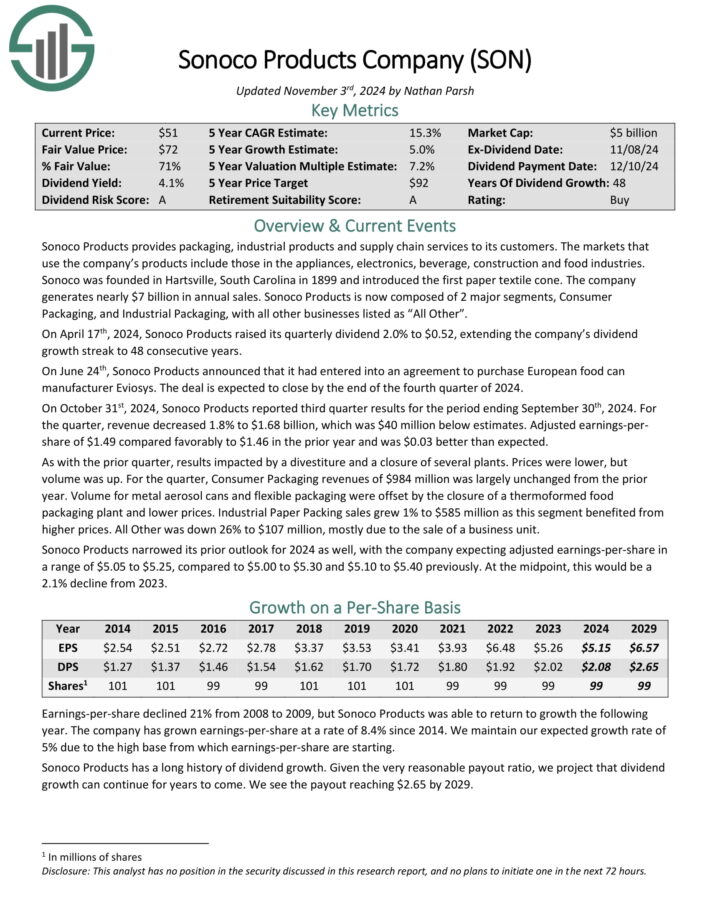

Recession-Proof Stock #2: Sonoco Products (SON)

- Dividend Yield: 4.2%

- 5-year Expected Annual Returns: 15.8%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates nearly $7 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

Source: Investor Presentation

On October 31st, 2024, Sonoco Products reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue decreased 1.8% to $1.68 billion, which was $40 million below estimates.

Adjusted earnings-per share of $1.49 compared favorably to $1.46 in the prior year and was $0.03 better than expected.

As with the prior quarter, results impacted by a divestiture and a closure of several plants. Prices were lower, but volume was up.

For the quarter, Consumer Packaging revenues of $984 million was largely unchanged from the prior year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

Recession-Proof Stock #1: Target Corp. (TGT)

- Dividend Yield: 3.7%

- 5-year Expected Annual Returns: 17.7%

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target posted second quarter earnings on August 21st, 2024, and results were quite strong, sending the stock jumping after the report. Adjusted earnings-per-share came to $2.57, which was 39 cents ahead of estimates. Revenue was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable sales were up 2% year-over-year, making up most of the total sales gain. Consensus was for a gain of 1.1%. Traffic was up 3% year-over-year with all six core merchandising categories seeing positive growth. Digital comparable sales were up 8.7%, once again driving growth.

Target has grown its dividend for more than five decades, making it a Dividend King. The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 47% of earnings for this year,

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

Final Thoughts

While no stock is ultimately recession-proof, there are certain sectors and industries that tend to be more resilient during economic downturns.

In general, essential goods and services, such as healthcare, utilities, and consumer staples, have a better history in terms of generating solid results and continuing to grow their dividends during tough economic conditions.

The stocks we have selected for this article have already proven they can stand tall during recessionary environments quite sufficiently, as proven by their extended dividend growth track records.

Looking for more high quality dividend stocks? These other Sure Dividend databases could be very useful:

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks: Monthly dividend stocks with the highest current yields.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.