Published on November 10th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Slate Grocery REIT (SRRTF) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Slate Grocery REIT (SRRTF).

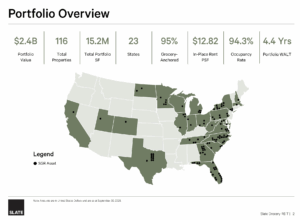

Business Overview

Slate Grocery REIT (OTC: SRRTF) is a real estate investment trust that owns and operates grocery-anchored shopping centers across the United States. The REIT focuses on properties anchored by essential, necessity-based retailers, such as major grocery chains, which provide stable, recurring rental income even during economic downturns. Its portfolio comprises over 100 properties strategically located in major metro areas, valued at approximately $2.4 billion. This focus on essential retail tenants helps ensure high occupancy levels, consistent cash flow, and strong tenant retention.

The REIT’s strategy centers on long-term value creation through active leasing, redevelopment, and maintaining rents below market averages to capture future upside. As of late 2025, Slate Grocery REIT maintained an occupancy rate above 94%, a weighted-average interest rate near 5%, and solid financial stability, with mostly fixed-rate debt. Trading at a discount to its net asset value, SRRTF offers investors an attractive opportunity for steady income and potential capital appreciation backed by a resilient, grocery-anchored real estate portfolio.

Source: Investor Relations

Slate Grocery REIT reported strong third-quarter 2025 results, supported by steady leasing activity and consistent tenant demand. The REIT completed over 417,000 square feet of leases during the quarter with double-digit rent increases. Renewals were signed 15.1% above prior rents, and new leases averaged 34.8% higher. Same-property net operating income (NOI) rose 2.7% on a trailing twelve-month basis, while portfolio occupancy remained stable at 94.3%. CEO Blair Welch noted that resilient grocery spending continues to support the REIT’s high-quality, grocery-anchored portfolio.

Financially, rental revenue grew 1.9% year over year to $53.3 million, and NOI rose 2.6% to $43 million. Net income increased 55% to $11.2 million, but funds from operations (FFO) and adjusted FFO (AFFO) declined 6.1% and 9.2%, respectively, due to higher financing costs. The REIT maintained a stable debt profile, with 90.4% of borrowings fixed at an average rate of 5.0%, limiting exposure to interest rate changes.

As of September 30, 2025, Slate Grocery REIT held $2.26 billion in assets across 116 U.S. grocery-anchored properties. With average in-place rents of $12.82 per square foot—well below the $24.09 market average—the REIT has room for continued rent growth. Management remains confident in the portfolio’s ability to generate steady income and long-term value for unitholders.

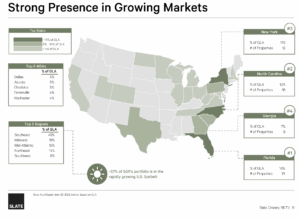

Growth Prospects

Source: Investor Relations

Competitive Advantages & Recession Performance

Source: Investor Relations

Dividend Analysis

Slate Grocery’s steady growth supports its ability to maintain its dividend, which currently yields 8.2% annually. However, the REIT has kept its dividend unchanged over the past five years.

While investors seeking dividend increases may be disappointed, it is important to note that the dividend has never been cut since the second monthly payout in 2014, and the annualized dividend stands at $0.864. With a high payout ratio of 80%, the dividend is aggressive for a REIT, but combined with a strong balance sheet and modest growth prospects, it appears to have a reasonable margin of safety barring a severe economic downturn.

Final Thoughts

Slate Grocery REIT provides investors with reliable income through a portfolio of necessity-based retail properties anchored by major national grocers. Strong tenant demand, below-market rents, and disciplined financial management support steady distributions and offer defensive exposure to the U.S. real estate market.

Despite this stability, the REIT has seen little dividend growth in recent years, leading us to rate the stock a sell. We project annualized returns of approximately 6.5% from the current price, driven mainly by the high starting dividend yield and modest growth potential, partially offset by valuation pressures.

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more