Updated on August 21st, 2024 by Bob Ciura

Due to the surge of inflation to a 40-year high last year, the Federal Reserve raised interest rates at a rapid pace over the past two years to cool the economy.

But with economic growth slowing, economists now expect the Fed to lower interest rates once again, perhaps as soon as September.

Apartment REITs have proved resilient to recessions thanks to the essential nature of their business. They also widely have high dividend yields well above the S&P 500 Index average.

And, apartment REITs would benefit from falling interest rates, which would lower their cost of capital.

You can download our full REIT list, along with important metrics such as dividend yields and market caps, by clicking on the link below:

As a result, apartment REITs are interesting candidates for income investors.

This article will discuss the prospects of the top 10 apartment REITs in our Sure Analysis Research Database.

The following 10 apartment REITs are listed by five-year expected annual returns, in order of lowest to highest:

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- Apartment REITs #10: Camden Property Trust (CPT)

- Apartment REITs #9: Essex Property Trust (ESS)

- Apartment REITs #8: Equity LifeStyle Properties (ELS)

- Apartment REITs #7: AvalonBay Communities (AVB)

- Apartment REITs #6: American Homes 4 Rent (AMH)

- Apartment REITs #5: UMH Properties (UMH)

- Apartment REITs #4: Equity Residential (EQR)

- Apartment REITs #3: UDR, Inc. (UDR)

- Apartment REITs #2: Mid-America Apartment Communities (MAA)

- Apartment REITs #1: American Assets Trust (AAT)

- Final Thoughts

Apartment REITs #10: Camden Property Trust (CPT)

Founded in 1993 and headquartered in Houston, Texas, Camden Property Trust is one of the largest publicly traded multifamily real estate companies in the U.S. The REIT owns, manages and develops multifamily apartment communities. It currently owns 172 properties that contain over 58,000 apartments.

On August 1st, 2024 Camden reported its Q2 results for the period ending June 30th, 2024. For the quarter, the company reported property revenue of $387.2 million, a 0.4% increase compared to Q2 2023.

Increased revenues were primarily driven by same-property revenue growth, which came in at 2.0%, offset by slightly lower occupancy, which fell from 95.5% to 95.3% between the two periods. However, due to same-property expenses growing by 2.7% during the period, same-property net operating income (NOI) grew by 1.6%.

Funds from Operations (FFO) totaled $187.7 million, or $1.61 per share, compared to $184.0 million, or $1.67 per share, in Q2 2023.

Click here to download our most recent Sure Analysis report on Camden Property Trust (CPT) (preview of page 1 of 3 shown below):

Apartment REITs #9: Essex Property Trust (ESS)

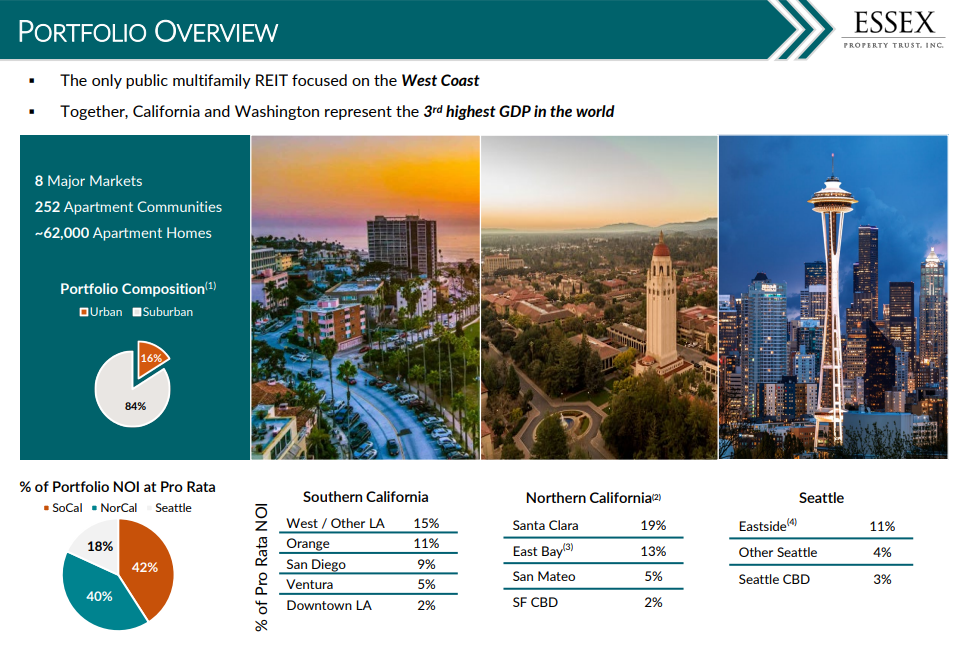

Essex Property Trust was founded in 1971. The trust invests in West Coast multi-family residential proprieties where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties.

Essex has ownership interests in several hundred apartment communities consisting of over 60,000 apartment homes. The trust has about 1,800 employees and produces approximately $1.6 billion in annual revenue.

Essex is concentrated on the West Coast of the U.S., including cities like Seattle and San Francisco.

Source: Investor Presentation

On May 1, 2024, Essex Property Trust reported strong first quarter results, reflecting significant growth and strategic advancements. The company announced a notable increase in core Funds from Operations (FFO) per share by 4.9%, which exceeded the initial guidance expectations.

This performance was bolstered by a growth in blended lease rates of 2.2%, with renewal leases rising by 3.9% and new leases by 10 basis points. Regionally, Seattle experienced a 3.6% increase in blended rates, while Northern California saw a 2.1% rise, and Southern California reported a 1.7% increase.

Click here to download our most recent Sure Analysis report on ESS (preview of page 1 of 3 shown below):

Apartment REITs #8: Equity LifeStyle Properties (ELS)

Equity LifeStyle Properties, Inc is a real estate investment trust which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home and recreational vehicle communities.

Equity LifeStyle Properties operates through the following segments: Property Operations; and Home Sales and Rentals Operations. The Property Operations segment owns and operates land lease properties. The Home Sales and Rentals Operations segment purchases, sells, and leases homes at the properties.

Today, Equity LifeStyle Properties, Inc. owns or has a controlling interest in more than 400 communities and resorts in 33 states and British Columbia, with more than 165,000 sites.

On July 22nd, 2024, Equity LifeStyle Properties reported second-quarter earnings for Fiscal Year (FY)2024. The company net income per common share for the quarter increased to $0.42, a 24.3% rise from $0.34 in 2023. Funds from Operations (FFO) per common share and OP unit grew to $0.69, up 13.5%, while Normalized FFO reached $0.66, a 2.9% increase.

For the six-month period, net income per common share rose by 29.4% to $1.01, and FFO per common share and OP unit increased by 16.6% to $1.55. Normalized FFO saw a 5.9% rise to $1.44. .

Click here to download our most recent Sure Analysis report on ELS (preview of page 1 of 3 shown below):

Apartment REITs #7: AvalonBay Communities (AVB)

AvalonBay Communities is a $25 billion multifamily REIT that owns a portfolio of several hundred apartment communities and is also an active developer of apartment communities. The strategy of the REIT involves owning top-tier properties in the major metropolitan areas of New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

AvalonBay Communities reported its earnings for the first quarter of 2024, showcasing positive growth across various metrics compared to the same period in 2023. Earnings per share (EPS) rose by 16.2% to $1.22, while Funds from Operations attributable to common stockholders (FFO) per share increased by 7.5% to $2.73, and Core FFO per share grew by 5.1% to $2.70.

The company’s Same Store total revenue increased by 4.3%, reaching $677.2 million, primarily driven by a 4.2% increase in Same Store Residential revenue, which totaled $669.2 million.

Click here to download our most recent Sure Analysis report on AvalonBay Communities (AVB) (preview of page 1 of 3 shown below):

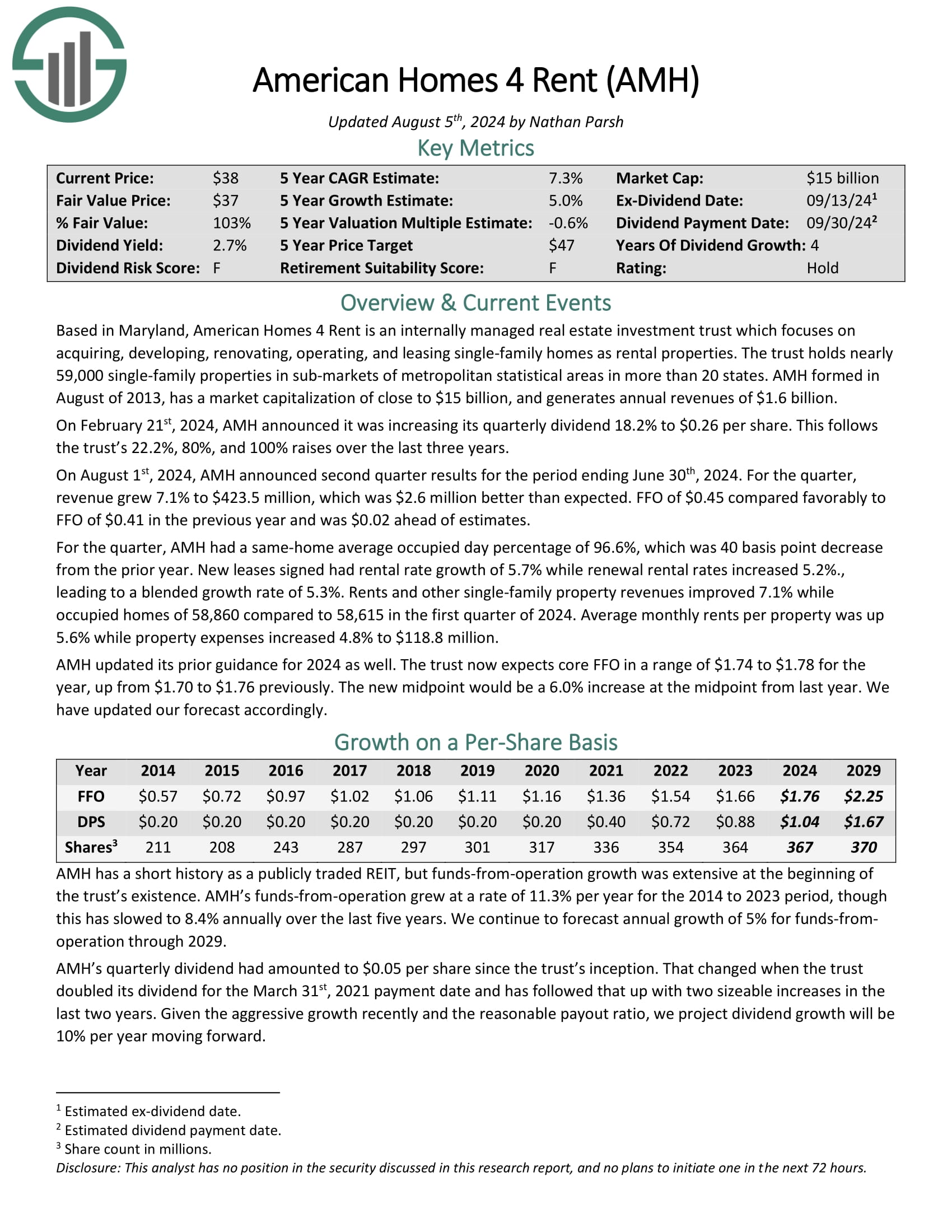

Apartment REITs #6: American Homes 4 Rent (AMH)

Based in Maryland, American Homes 4 Rent is an internally managed REIT that focuses on acquiring, developing, renovating, operating and leasing single-family homes as rental properties. AMH was formed in 2013 and has a market capitalization of $14 billion.

The REIT holds nearly 58,000 single-family properties in more than 30 sub-markets of metropolitan statistical areas in 21 states.

On August 1st, 2024, AMH announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 7.1% to $423.5 million, which was $2.6 million better than expected. FFO of $0.45 compared favorably to FFO of $0.41 in the previous year and was $0.02 ahead of estimates.

For the quarter, AMH had a same-home average occupied day percentage of 96.6%, which was 40 basis point decrease from the prior year. New leases signed had rental rate growth of 5.7% while renewal rental rates increased 5.2%., leading to a blended growth rate of 5.3%.

Rents and other single-family property revenues improved 7.1% while occupied homes of 58,860 compared to 58,615 in the first quarter of 2024. Average monthly rents per property was up 5.6% while property expenses increased 4.8% to $118.8 million.

Click here to download our most recent Sure Analysis report on American Homes 4 Rent (AMH) (preview of page 1 of 3 shown below):

Apartment REITs #5: UMH Properties (UMH)

UMH Properties is a REIT that is one of the largest manufactured housing landlords in the U.S. It was founded in 1968 and currently owns tens of thousands of developed sites and 135 communities located across the midwestern and northeastern U.S.

As manufactured homes are cheaper than conventional homes, UMH Properties has proved resilient to recessions. This was evident in the severe recession caused by the coronavirus crisis in 2020, as the REIT grew its FFO per share by 11% in that year. UMH Properties has grown its FFO per share by 3.8% per year on average over the last decade.

UMH Properties, Inc. (UMH) posted Total Income of $57.7 million for the quarter ending March 31, 2024, marking a 10% increase from the same period in 2023, where Total Income stood at $52.6 million. However, the company reported a Net Loss Attributable to Common Shareholders of $6.3 million or $0.09 per diluted share for Q1 2024, compared to a Net Loss of $5.3 million or $0.09 per diluted share for Q1 2023.

Despite the net loss, Funds from Operations Attributable to Common Shareholders (FFO) showed significant improvement, reaching $14.0 million or $0.20 per diluted share for Q1 2024, compared to $10.6 million or $0.18 per diluted share for Q1 2023, representing an 11% per diluted share increase.

Click here to download our most recent Sure Analysis report on UMH Properties (UMH) (preview of page 1 of 3 shown below):

Apartment REITs #4: Equity Residential (EQR)

Equity Residential is one of the largest U.S. publicly-traded owners and operators of high-quality rental apartment properties with a portfolio primarily located in urban and dense suburban communities. The properties of the trust are located in affluent areas around Boston, New York, Washington, D.C., Southern California, San Francisco, Seattle, and Denver.

Equity Residential greatly benefits from the favorable characteristics of its target group. Affluent renters are highly educated, well employed and earn high incomes. As a result, they pay approximately 20% of their incomes on rent and hence they are not burdened by their rent. Thanks to their strong earnings potential, the REIT can easily grow its rent rates year after year.

On April 23, 2024, Equity Residential (EQR) released its Q1 2024 results, showcasing a robust financial performance that exceeded market expectations. The company reported earnings per share (EPS) of $0.93, surpassing the analyst estimates which were pegged at $0.91.

This performance represents a significant increase compared to the previous year’s EPS of $0.56. Revenue for the quarter stood at $730.82 million, slightly above the analyst forecast of $729.83 million, marking a year-over-year growth of 3.7%.

Click here to download our most recent Sure Analysis report on Equity Residential (EQR) (preview of page 1 of 3 shown below):

Apartment REITs #3: UDR (UDR)

UDR, also known as United Dominion Realty Trust, is a luxury apartment REIT. The trust owns, operates, acquires, renovates, and develops multifamily apartment communities in high barrier-to-entry markets in the U.S.

A high barrier-to-entry market consists of limited land for new construction, complicated entitlement processes, low single-family home affordability and strong employment growth potential. The majority of UDR’s real estate property value is established in Washington D.C., New York City, Orange County, California, and San Francisco. UDR owns or has an ownership interest in 58,411 apartment homes, 415 of which are homes under development.

On February 6th, 2024, UDR announced its 2024 dividend will be $1.70 per share, which represents a 1.2% increase and marks the company’s 13th consecutive annual dividend increase.

UDR reported second quarter 2024 results on July 30th, 2024. The company announced adjusted funds from operations of $0.55 in the second quarter, flat year-over-year.

The quarterly AFFO payout ratio of 77% is relatively safe for a REIT that must pay out the majority of its earnings to shareholders. Physical occupancy of the real estate portfolio rose 20 basis points compared to the prior year period, to 96.8%.

Click here to download our most recent Sure Analysis report on UDR (UDR) (preview of page 1 of 3 shown below):

Apartment REITs #2: Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities is a REIT that owns, operates and acquires apartment communities in the Southeast, Southwest and mid-Atlantic regions of the U.S. It currently has ownership interest in 101,986 apartment units across 16 states and the District of Columbia.

MAA is focused on the Sunbelt Region of the U.S., which has exhibited superior population growth and economic growth in the long run. In early May, MAA reported (5/1/24) financial results for the first quarter of fiscal 2024. Same store net operating income grew 1.4% over the prior year’s quarter, primarily thanks to growth in average rent per unit in new leases.

Core funds from operations (FFO) per share dipped -3%, from $2.28 to $2.22, due to higher interest expense, in line with the analysts’ consensus. MAA has missed the analysts’ FFO estimates only once in the last 24 quarters.

MAA has ample room to expand its asset portfolio while it will also grow its bottom line by enhancing the value to its customers via the rollout of smart home technology in its units.

Click here to download our most recent Sure Analysis report on Mid-America Apartment Communities (MAA) (preview of page 1 of 3 shown below):

Apartment REITs #1: American Assets Trust (AAT)

American Assets Trust is a REIT that was formed in 2011 as a successor of American Assets, a privately held company founded in 1967.

AAT has great experience in acquiring, improving and developing office, retail and residential properties throughout the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii. Its office portfolio and its retail portfolio comprise of approximately 4.0 million and 3.1 million square feet, respectively. AAT also owns more than 2,000 multifamily units.

In late April, AAT reported (4/30/24) financial results for the first quarter of fiscal 2024. Adjusted same-store net operating income grew 2.3% and funds from operations (FFO) per share grew 8% over last year’s quarter, thanks to rent hikes and increased tourism in Hawaii. Thanks to positive business trends, AAT raised its guidance for FFO per share in 2024 from $2.19-$2.33 to $2.24-$2.34.

We note that AAT has beaten the analysts’ estimates for 13 consecutive quarters and raise our forecast from $2.25 to $2.30, in line with the revised guidance.

Click here to download our most recent Sure Analysis report on American Assets Trust (AAT) (preview of page 1 of 3 shown below):

Final Thoughts

Many apartment REITs pass under the radar of the majority of investors due to their mundane business model.

However, some of these REITs have offered exceptionally high returns to their shareholders. In addition, apartment REITs have proved resilient to recessions, as the demand for housing remains strong even during rough economic periods.

The above 10 apartment REITs are interesting candidates for the portfolios of income-oriented investors, especially given the increasing risk of an upcoming recession.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- BDCs: List of BDCs and more