Updated on April 16th, 2024 by Bob Ciura

At Sure Dividend, we recommend investors focus on quality dividend stocks over the long run. In addition to dividends, investors should also be focused on total returns.

In short, the total expected return of a stock is the sum of its future earnings-per-share growth, dividends, as well as any net change in the valuation multiple. Ultimately, total returns matter most for investors.

With this in mind, we’ve compiled a list of the 50 best dividend stocks based on 5-year expected returns (along with important investing metrics like price-to-earnings ratios and dividend yields) which you can download below:

This article lists the 7 best dividend stocks now in the Sure Analysis Research Database. The top 7 stocks are listed below by 5-year expected annual returns, from lowest to highest.

Table Of Contents

The seven best dividend stocks are listed below in order of total expected returns over the next five years, from lowest to highest. You can instantly jump to any individual stock analysis by clicking on the links below:

- Best Dividend Stock #7: Clipper Realty (CLPR)

- Best Dividend Stock #6: EOG Resources (EOG)

- Best Dividend Stock #5: Brandywine Realty Trust (BDN)

- Best Dividend Stock #4: Oaktree Specialty Lending (OCSL)

- Best Dividend Stock #3: V.F. Corp. (VFC)

- Best Dividend Stock #2: Office Properties Income Trust (OPI)

- Best Dividend Stock #1: Yum China (YUMC)

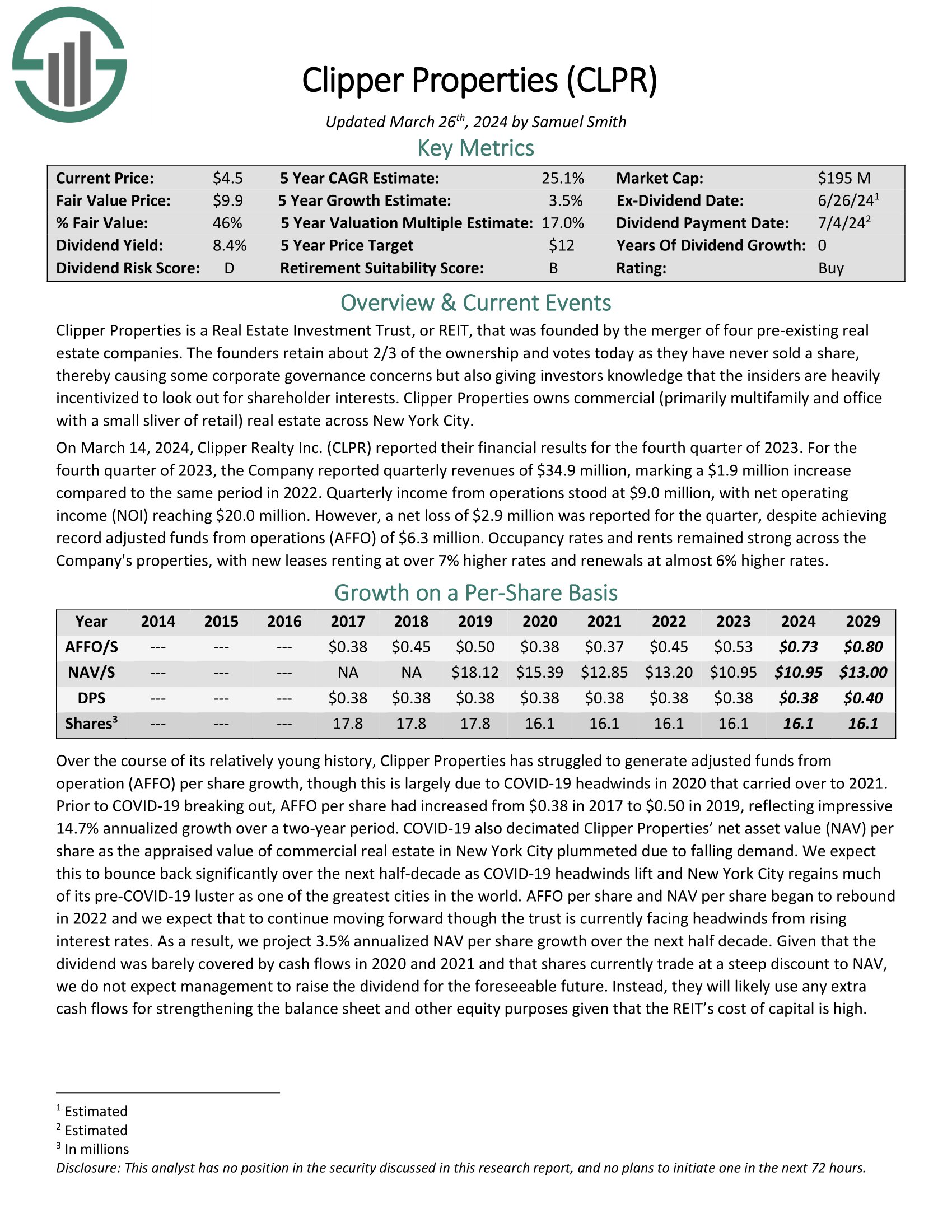

Best Dividend Stock #7: Clipper Realty (CLPR)

- 5-year expected annual returns: 20.6%

Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

On March 14, 2024, Clipper Realty reported their financial results for the fourth quarter of 2023. For the fourth quarter of 2023, the company reported quarterly revenues of $34.9 million, marking a $1.9 million increase compared to the same period in 2022.

Quarterly income from operations stood at $9.0 million, with net operating income (NOI) reaching $20.0 million. However, a net loss of $2.9 million was reported for the quarter, despite achieving record adjusted funds from operations (AFFO) of $6.3 million.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

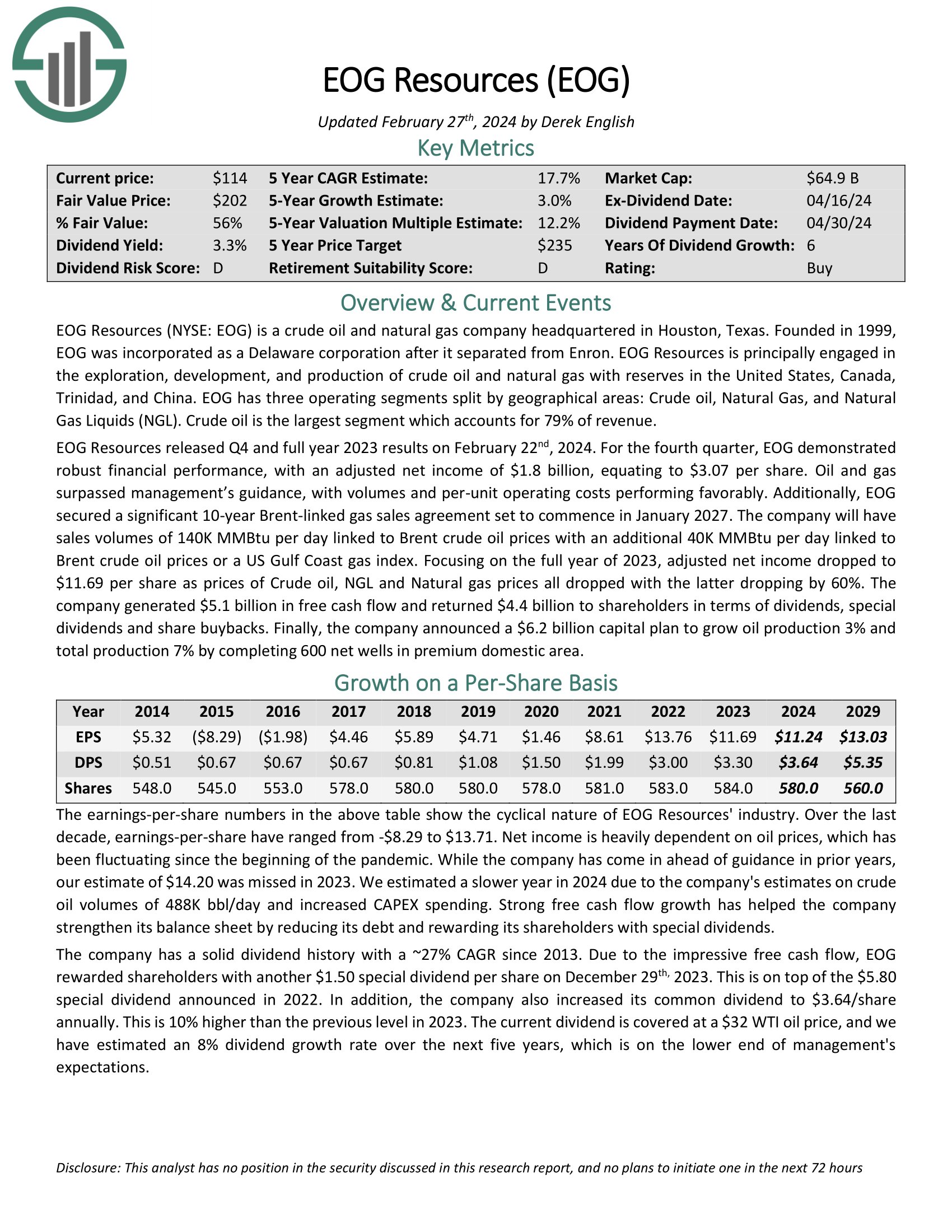

Best Dividend Stock #6: EOG Resources (EOG)

- 5-year expected annual returns: 21.2%

EOG Resources is a crude oil and natural gas company headquartered in Houston, Texas. EOG Resources is principally engaged in the exploration, development, and production of crude oil and natural gas with reserves in the United States, Canada, Trinidad, and China.

EOG has three operating segments split by geographical areas: Crude oil, Natural Gas, and Natural Gas Liquids (NGL). Crude oil is the largest segment which accounts for 79% of revenue.

EOG Resources released Q4 and full year 2023 results on February 22nd, 2024. For the fourth quarter, EOG demonstrated robust financial performance, with an adjusted net income of $1.8 billion, equating to $3.07 per share. Oil and gas surpassed management’s guidance, with volumes and per-unit operating costs performing favorably.

Focusing on the full year of 2023, adjusted net income dropped to $11.69 per share as prices of Crude oil, NGL and Natural gas prices all dropped with the latter dropping by 60%. The company generated $5.1 billion in free cash flow and returned $4.4 billion to shareholders in terms of dividends, special dividends and share buybacks.

Click here to download our most recent Sure Analysis report on EOG (preview of page 1 of 3 shown below):

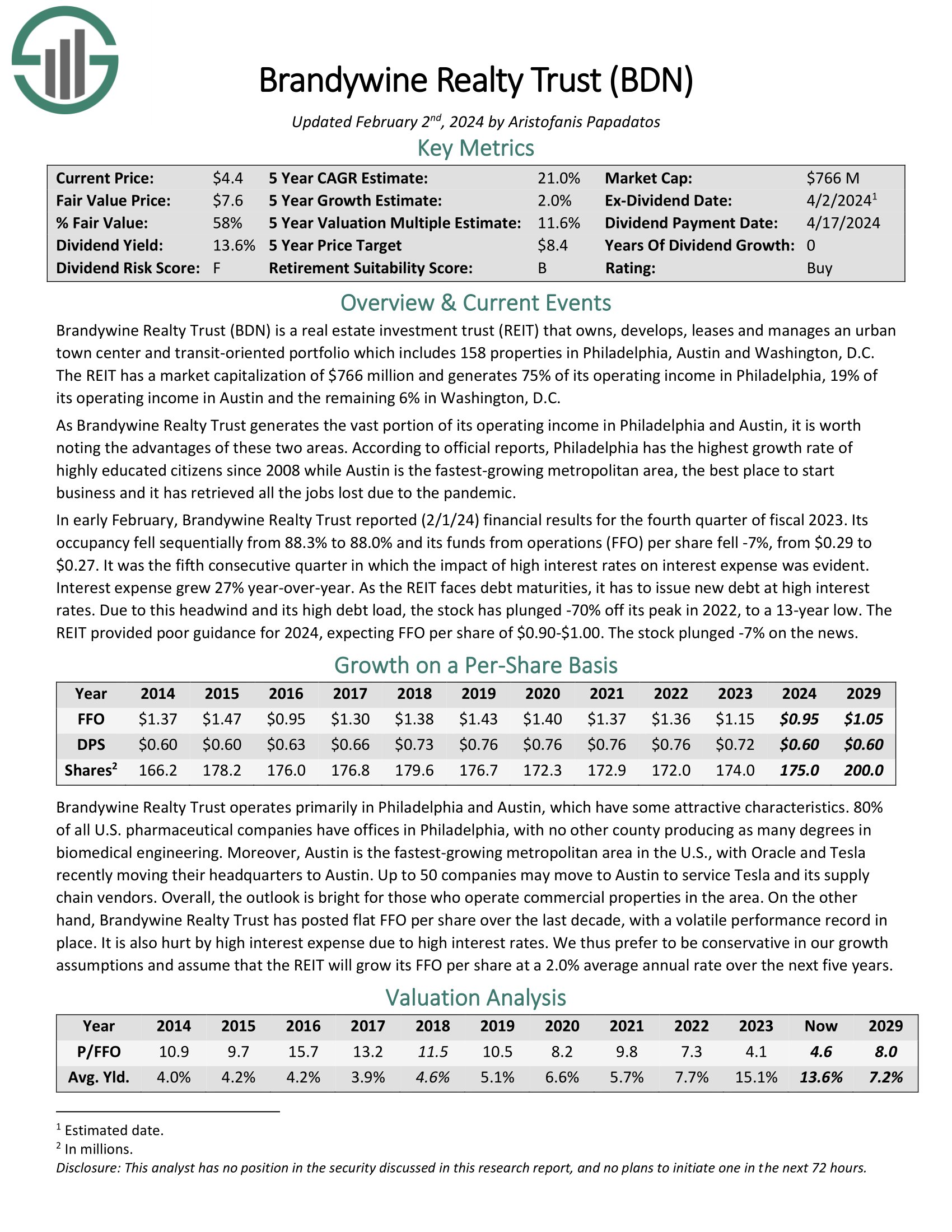

Best Dividend Stock #6: Brandywine Realty Trust (BDN)

- 5-year expected annual returns: 21.4%

Brandywine Realty owns, develops, leases and manages an urban town center and transit-oriented portfolio which includes 163 properties in Philadelphia, Austin and Washington, D.C. The REIT has a market capitalization of $1.1 billion and generates 74% of its operating income in Philadelphia, 22% of its operating income in Austin and the remaining 4% in Washington, D.C.

In early February, Brandywine Realty Trust reported (2/1/24) financial results for the fourth quarter of fiscal 2023. Its occupancy fell sequentially from 88.3% to 88.0% and its funds from operations (FFO) per share fell -7%, from $0.29 to $0.27. It was the fifth consecutive quarter in which the impact of high interest rates on interest expense was evident. Interest expense grew 27% year-over-year.

Click here to download our most recent Sure Analysis report on BDN (preview of page 1 of 3 shown below):

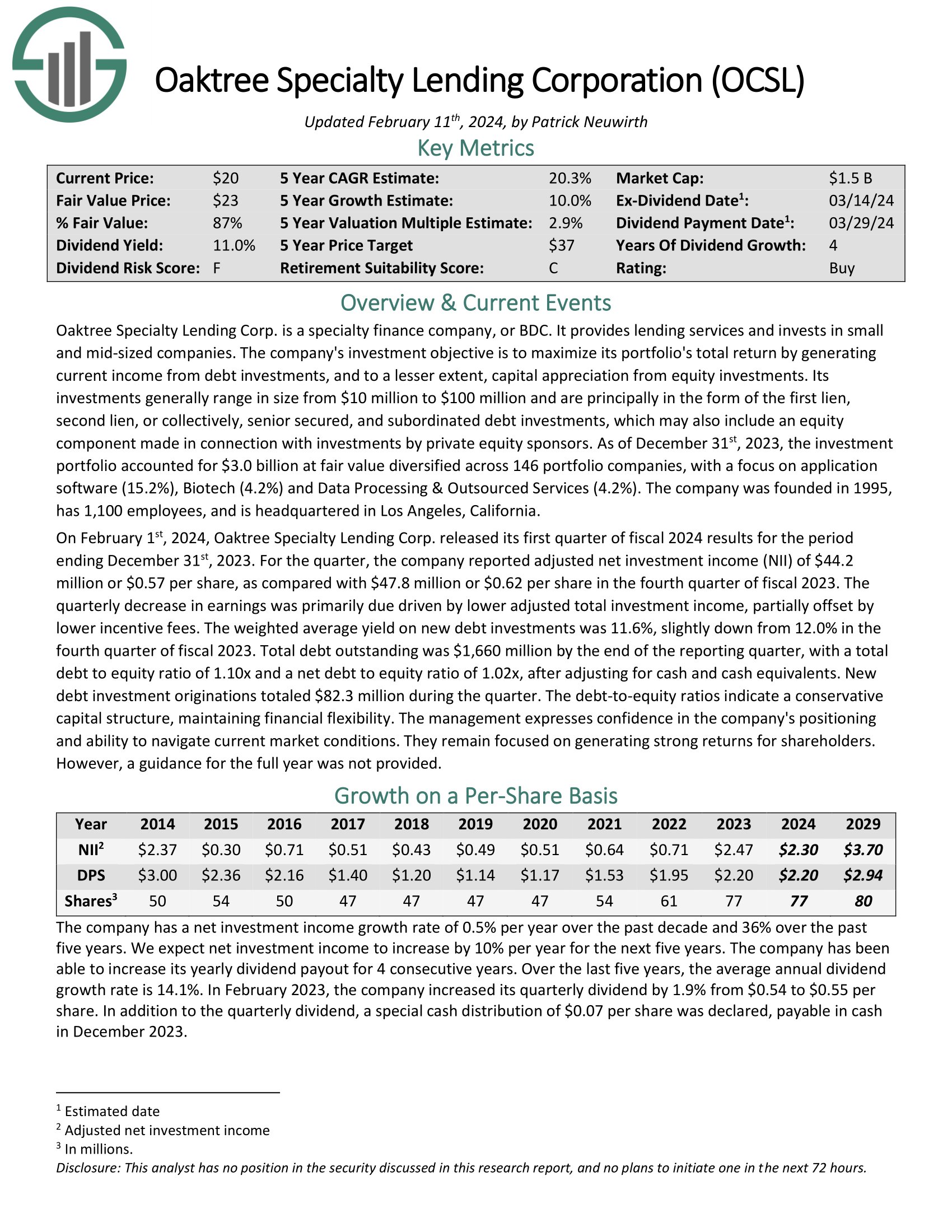

Best Dividend Stock #5: Oaktree Specialty Lending (OCSL)

- 5-year expected annual returns: 21.5%

Oaktree Specialty Lending Corp. is a business development company, or BDC. It provides lending services and invests in small and mid-sized companies.

On February 1st, 2024, Oaktree Specialty Lending Corp. released its first quarter of fiscal 2024 results for the period ending December 31st, 2023. For the quarter, the company reported adjusted net investment income (NII) of $44.2 million or $0.57 per share, as compared with $47.8 million or $0.62 per share in the fourth quarter of fiscal 2023.

The quarterly decrease in earnings was primarily due driven by lower adjusted total investment income, partially offset by lower incentive fees. The weighted average yield on new debt investments was 11.6%, slightly down from 12.0% in the fourth quarter of fiscal 2023.

Click here to download our most recent Sure Analysis report on OCSL (preview of page 1 of 3 shown below):

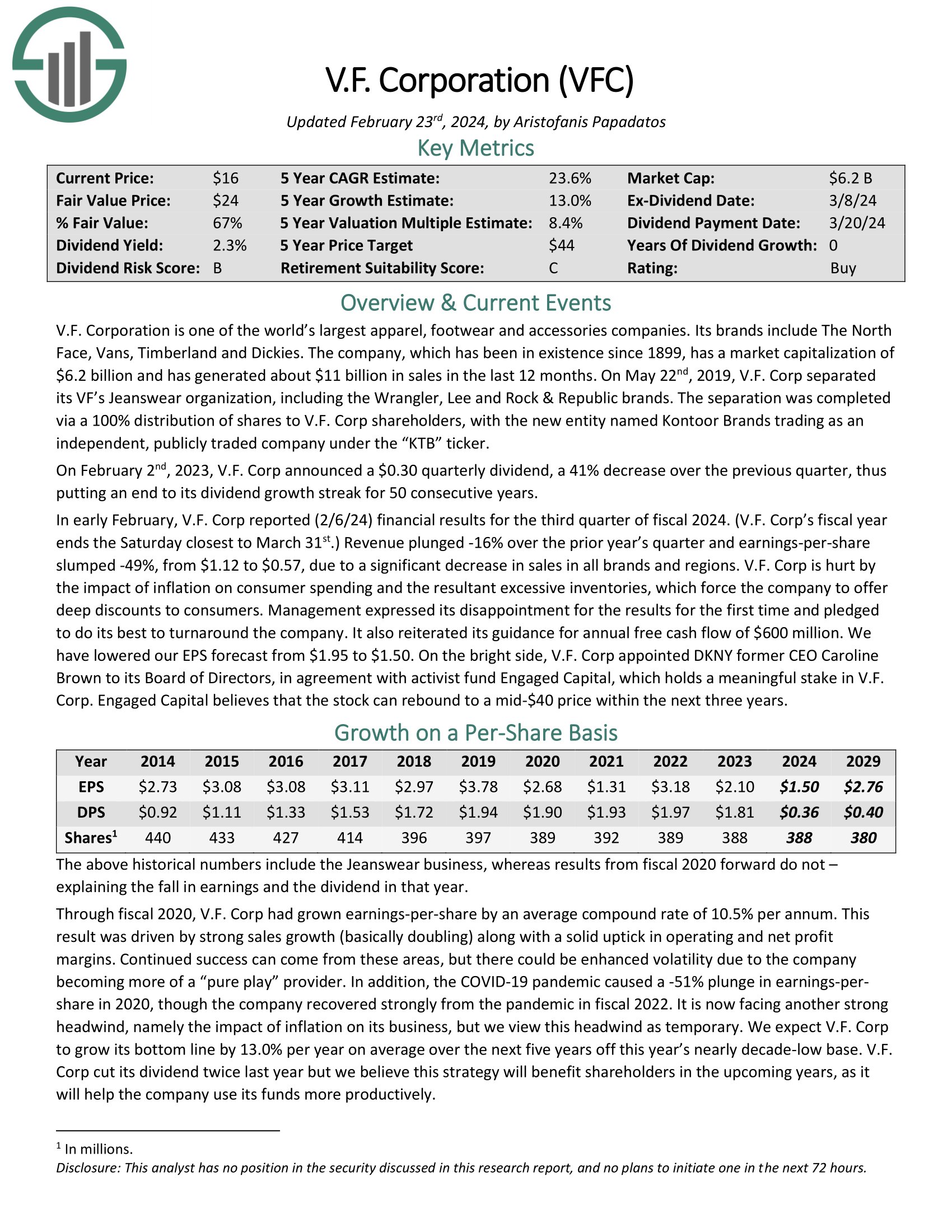

Best Dividend Stock #4: V.F. Corp. (VFC)

- 5-year expected annual returns: 22.6%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. Its brands include The North Face, Vans, Timberland and Dickies.

In early February, V.F. Corp reported (2/6/24) financial results for the third quarter of fiscal 2024. (V.F. Corp’s fiscal year ends the Saturday closest to March 31st.) Revenue plunged -16% over the prior year’s quarter and earnings-per-share slumped -49%, from $1.12 to $0.57, due to a significant decrease in sales in all brands and regions.

V.F. Corp is hurt by the impact of inflation on consumer spending and the resultant excessive inventories, which force the company to offer deep discounts to consumers.

Click here to download our most recent Sure Analysis report on VFC (preview of page 1 of 3 shown below):

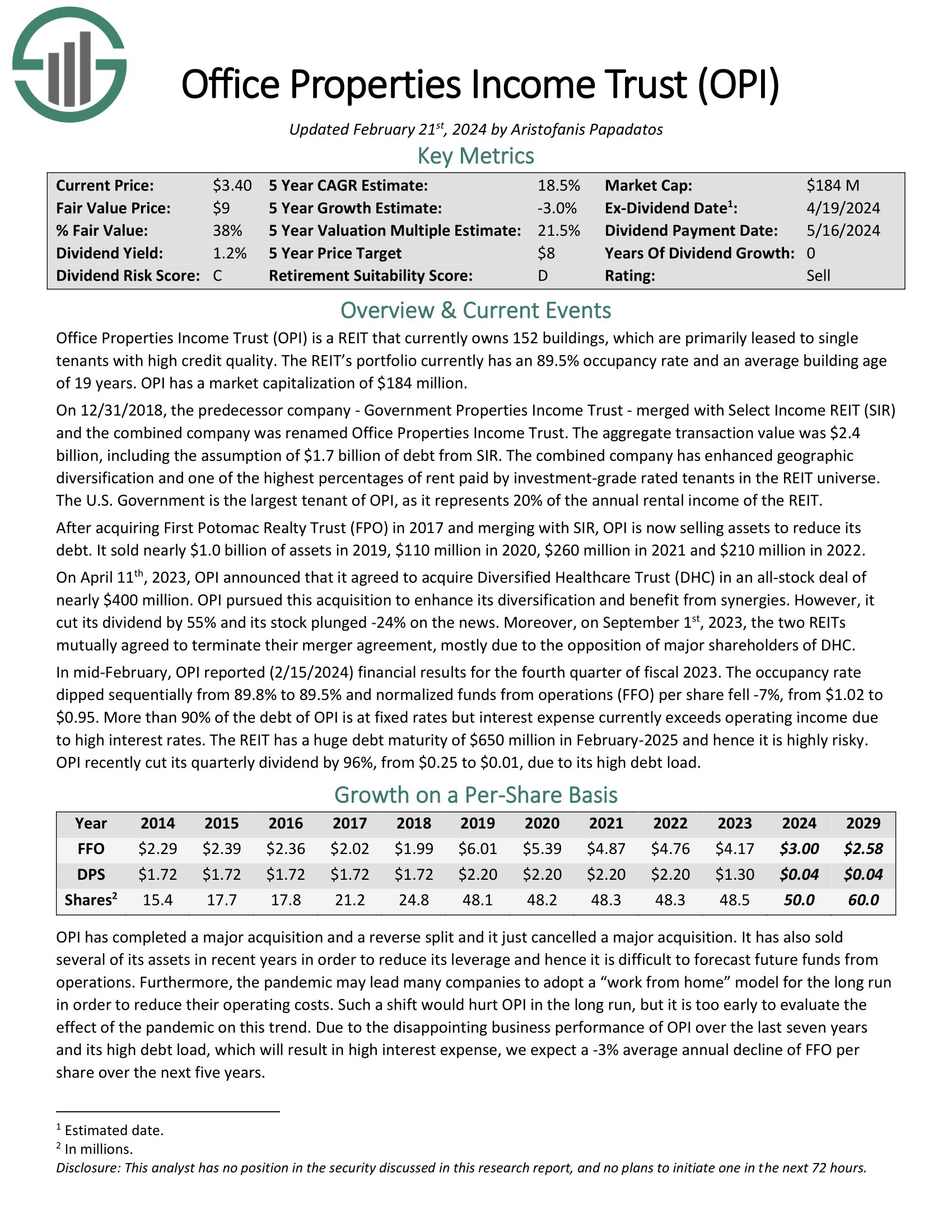

Best Dividend Stock #3: Office Properties Income Trust (OPI)

- 5-year expected annual returns: 24.2%

Office Properties Income Trust is a REIT that currently owns 157 buildings, which are primarily leased to single tenants with high credit quality. The REIT’s portfolio currently has a 90.5% occupancy rate.

In mid-February, OPI reported (2/15/2024) financial results for the fourth quarter of fiscal 2023. The occupancy rate dipped sequentially from 89.8% to 89.5% and normalized funds from operations (FFO) per share fell -7%, from $1.02 to $0.95.

More than 90% of the debt of OPI is at fixed rates but interest expense currently exceeds operating income due to high interest rates. The REIT has a huge debt maturity of $650 million in February-2025 and hence it is highly risky.

Click here to download our most recent Sure Analysis report on OPI (preview of page 1 of 3 shown below):

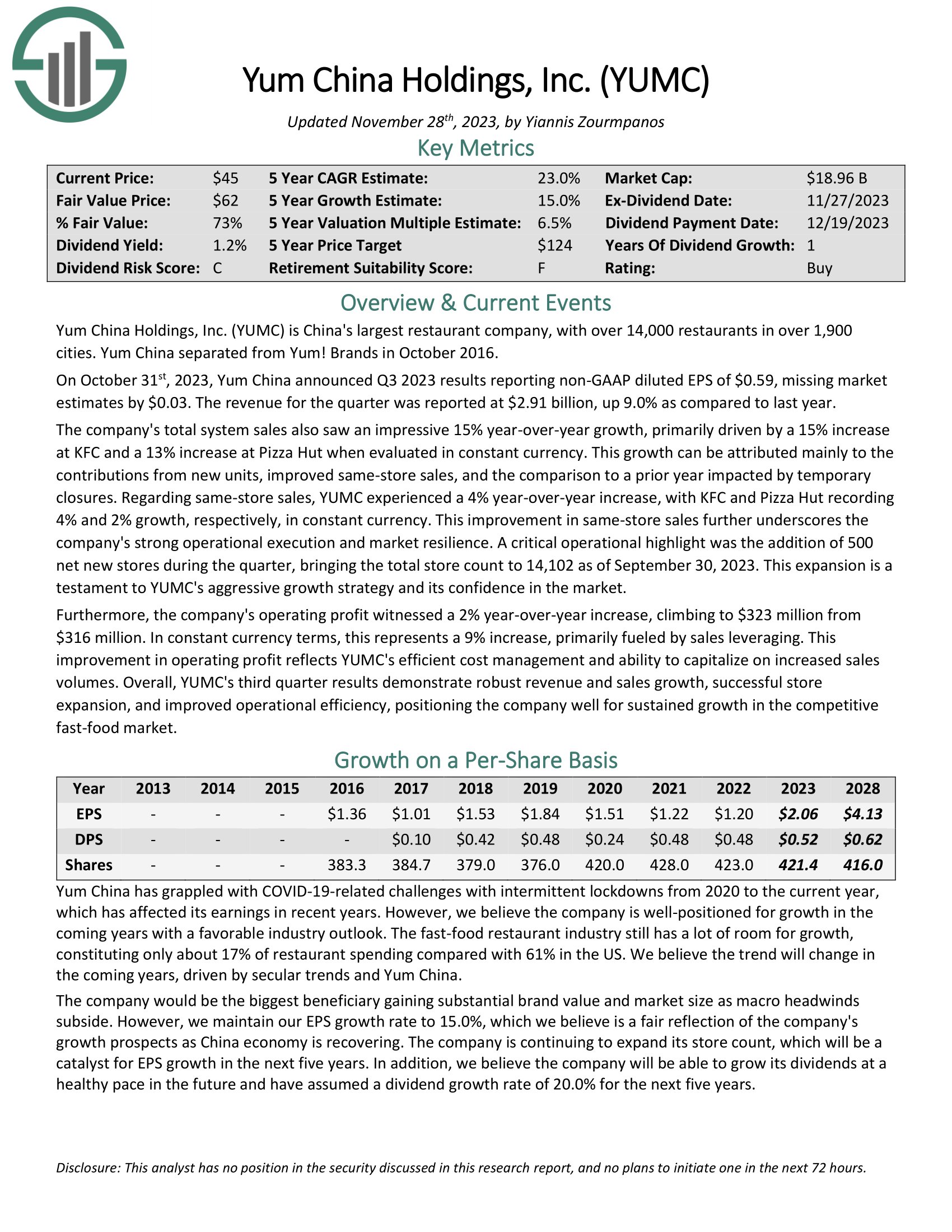

Best Dividend Stock #1: Yum China (YUMC)

- 5-year expected annual returns: 25.8%

Yum China Holdings is China’s largest restaurant company, with over 14,000 restaurants in over 1,900 cities. Yum China separated from Yum! Brands in October 2016.

On October 31st, 2023, Yum China announced Q3 2023 results reporting non-GAAP diluted EPS of $0.59, missing estimates by $0.03. The revenue for the quarter was reported at $2.91 billion, up 9.0% as compared to last year. The company’s total system sales also saw an impressive 15% year-over-year growth, primarily driven by a 15% increase at KFC and a 13% increase at Pizza Hut when evaluated in constant currency.

Regarding same-store sales, YUMC experienced a 4% year-over-year increase, with KFC and Pizza Hut recording 4% and 2% growth, respectively, in constant currency. This improvement in same-store sales further underscores the company’s strong operational execution and market resilience.

Click here to download our most recent Sure Analysis report on YUMC (preview of page 1 of 3 shown below):

Additional Reading

Investors looking for additional dividend stock ideas can find additional reading below:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of rising dividends.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.