Published on January 6th, 2026 by Bob Ciura

Monthly dividend stocks can be an attractive investment option for those seeking stable income.

Monthly dividends allow investors to receive more frequent payments than stocks which pay quarterly or semi-annual dividend payouts.

As a result, monthly dividend stocks can help to cover living expenses, or supplement other sources of income.

There are over 80 monthly dividend stocks that currently offer a monthly dividend payment.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

However, not all monthly dividend stocks are equally safe. There are many examples of monthly dividend stocks reducing or eliminating their dividends.

Therefore, investors with a long time horizon should focus on stocks with sustainable dividends, not just those with the highest yields.

The 10 monthly dividend stocks below were found based on a qualitative assessment of their individual business models and future growth prospects.

Table of Contents

- Monthly Dividend Stock For The Long Run #10: Dynacor Group (DNGDF)

- Monthly Dividend Stock For The Long Run #9: Richards Packaging Income Fund (RPKIF)

- Monthly Dividend Stock For The Long Run #8: Diversified Royalty Corp. (BEVFF)

- Monthly Dividend Stock For The Long Run #7: SIR Royalty Income Fund (SIRZF)

- Monthly Dividend Stock For The Long Run #6: Savaria Corporation (SISXF)

- Monthly Dividend Stock For The Long Run #5: Healthpeak Properties (DOC)

- Monthly Dividend Stock For The Long Run #4: STAG Industrial (STAG)

- Monthly Dividend Stock For The Long Run #3: Main Street Capital (MAIN)

- Monthly Dividend Stock For The Long Run #2: Agree Realty (ADC)

- Monthly Dividend Stock For The Long Run #1: Realty Income (O)

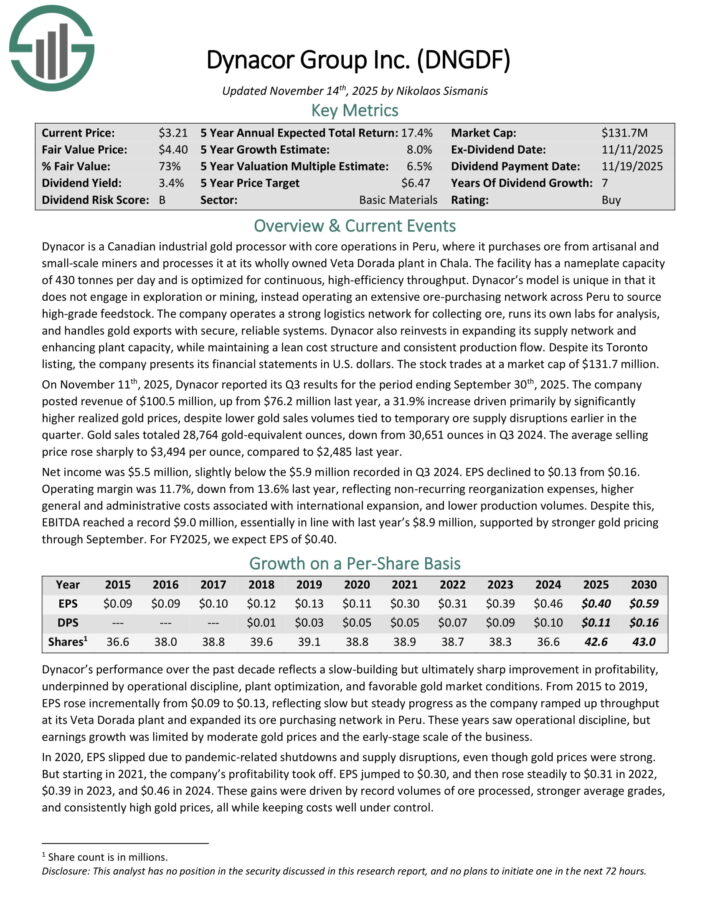

Monthly Dividend Stock For The Long Run #10: Dynacor Group (DNGDF)

Dynacor is a Canadian industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tonnes per day and is optimized for continuous, high-efficiency throughput.

Dynacor’s model is unique in that it does not engage in exploration or mining, instead operating an extensive ore purchasing network across Peru to source high-grade feedstock.

The company operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems.

Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow.

On November 11th, 2025, Dynacor reported its Q3 results. The company posted revenue of $100.5 million, up from $76.2 million last year, a 31.9% increase driven primarily by significantly higher realized gold prices, despite lower gold sales volumes tied to temporary ore supply disruptions earlier in the quarter.

Gold sales totaled 28,764 gold-equivalent ounces, down from 30,651 ounces in Q3 2024. The average selling price rose sharply to $3,494 per ounce, compared to $2,485 last year.

Net income was $5.5 million, slightly below the $5.9 million recorded in Q3 2024. EPS declined to $0.13 from $0.16. Operating margin was 11.7%, down from 13.6% last year, reflecting non-recurring reorganization expenses, higher general and administrative costs associated with international expansion, and lower production volumes.

Click here to download our most recent Sure Analysis report on DNGDF (preview of page 1 of 3 shown below):

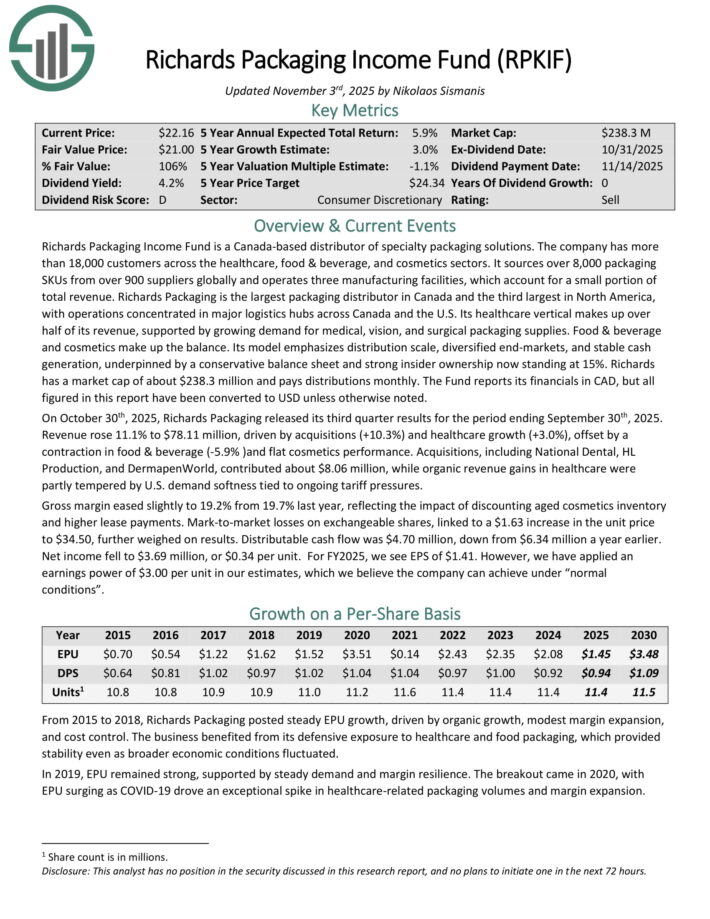

Monthly Dividend Stock For The Long Run #9: Richards Packaging Income Fund (RPKIF)

Richards Packaging Income Fund is a Canada-based distributor of specialty packaging solutions. The company has more than 18,000 customers across the healthcare, food & beverage, and cosmetics sectors.

It sources over 8,000 packaging SKUs from over 900 suppliers globally and operates three manufacturing facilities, which account for a small portion of total revenue.

Richards Packaging is the largest packaging distributor in Canada and the third largest in North America, with operations concentrated in major logistics hubs across Canada and the U.S.

Its healthcare vertical makes up over half of its revenue, supported by growing demand for medical, vision, and surgical packaging supplies. Food & beverage and cosmetics make up the balance.

Its model emphasizes distribution scale, diversified end-markets, and stable cash generation, underpinned by a conservative balance sheet and strong insider ownership now standing at 15%.

On October 30th, 2025, Richards Packaging released its third quarter results. Revenue rose 11.1% to $78.11 million, driven by acquisitions (+10.3%) and healthcare growth (+3.0%), offset by a contraction in food & beverage (-5.9% )and flat cosmetics performance.

Distributable cash flow was $4.70 million, down from $6.34 million a year earlier. Net income fell to $3.69 million, or $0.34 per unit.

Click here to download our most recent Sure Analysis report on RPKIF (preview of page 1 of 3 shown below):

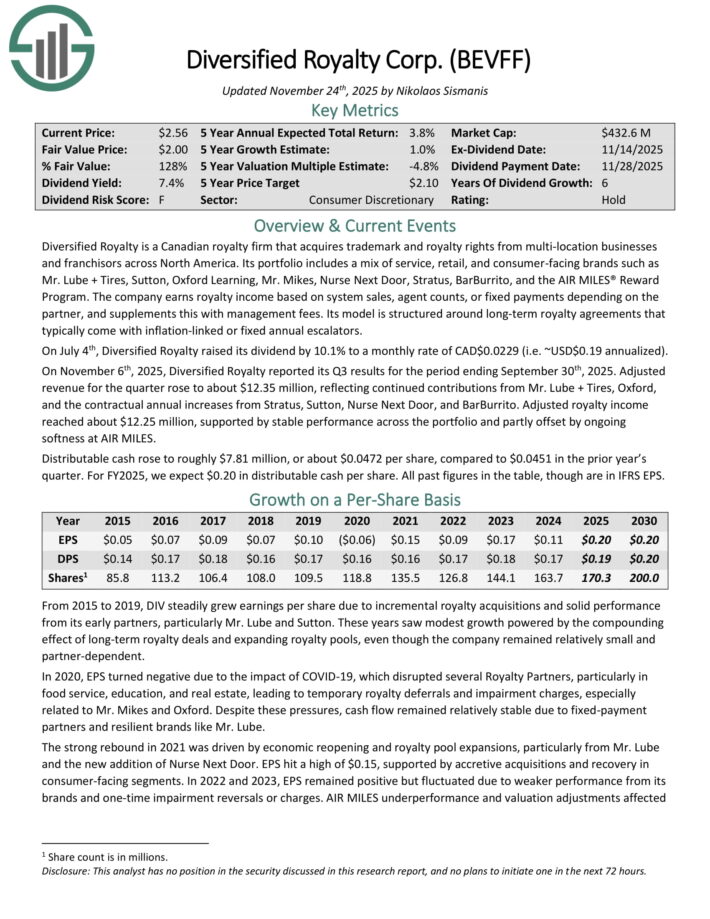

Monthly Dividend Stock For The Long Run #8: Diversified Royalty Corp. (BEVFF)

Diversified Royalty is a Canadian royalty firm that acquires trademark and royalty rights from multi-location businesses and franchisors across North America.

Its portfolio includes a mix of service, retail, and consumer-facing brands such as Mr. Lube + Tires, Sutton, Oxford Learning, Mr. Mikes, Nurse Next Door, Stratus, BarBurrito, and the AIR MILES Reward Program.

The company earns royalty income based on system sales, agent counts, or fixed payments depending on the partner, and supplements this with management fees. Its model is structured around long-term royalty agreements that typically come with inflation-linked or fixed annual escalators.

On July 4th, Diversified Royalty raised its dividend by 10.1% to a monthly rate of CAD$0.0229.

On November 6th, 2025, Diversified Royalty reported its Q3 results for the period ending September 30th, 2025. Adjusted revenue for the quarter rose to about $12.35 million, reflecting continued contributions from Mr. Lube + Tires, Oxford, and the contractual annual increases from Stratus, Sutton, Nurse Next Door, and BarBurrito.

Adjusted royalty income reached about $12.25 million, supported by stable performance across the portfolio and partly offset by ongoing softness at AIR MILES.

Distributable cash rose to roughly $7.81 million, or about $0.0472 per share, compared to $0.0451 in the prior year’s quarter.

Click here to download our most recent Sure Analysis report on BEVFF (preview of page 1 of 3 shown below):

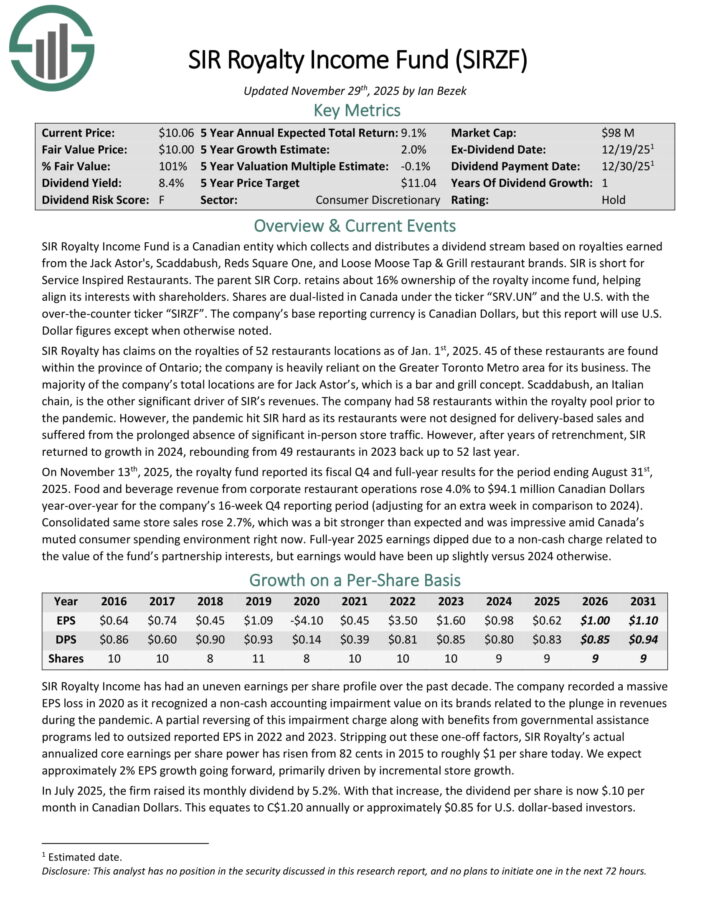

Monthly Dividend Stock For The Long Run #7: SIR Royalty Income Fund (SIRZF)

SIR Royalty Income Fund is a Canadian entity which collects and distributes a dividend stream based on royalties earned from the Jack Astor’s, Scaddabush, Reds Square One, and Loose Moose Tap & Grill restaurant brands.

The parent SIR Corp. retains about 16% ownership of the royalty income fund, helping align its interests with shareholders.

SIR Royalty has claims on the royalties of 52 restaurants locations as of Jan. 1st, 2025. 45 of these restaurants are found within the province of Ontario; the company is heavily reliant on the Greater Toronto Metro area for its business.

The majority of the company’s total locations are for Jack Astor’s, which is a bar and grill concept. Scaddabush, an Italian chain, is the other significant driver of SIR’s revenues.

On November 13th, 2025, the royalty fund reported its fiscal Q4 and full-year results. Food and beverage revenue from corporate restaurant operations rose 4.0% to $94.1 million Canadian Dollars year-over-year for the company’s 16-week Q4 reporting period (adjusting for an extra week in comparison to 2024).

Consolidated same store sales rose 2.7%, which was a bit stronger than expected and was impressive amid Canada’s muted consumer spending environment right now.

Click here to download our most recent Sure Analysis report on SIRZF (preview of page 1 of 3 shown below):

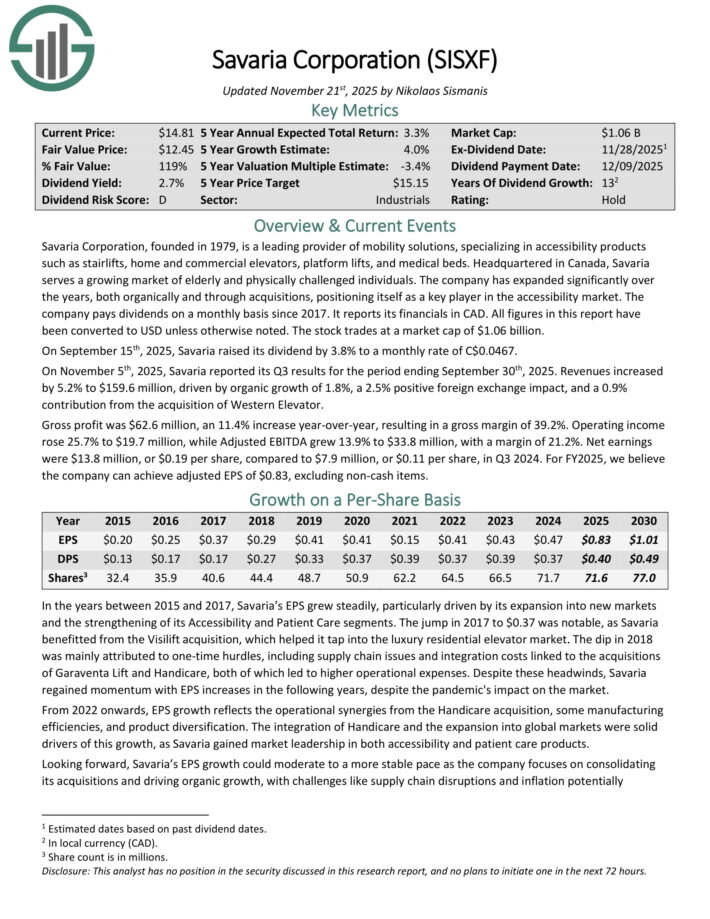

Monthly Dividend Stock For The Long Run #6: Savaria Corporation (SISXF)

Savaria Corporation is a leading provider of mobility solutions, specializing in accessibility products such as stairlifts, home and commercial elevators, platform lifts, and medical beds.

Headquartered in Canada, Savaria serves a growing market of elderly and physically challenged individuals. The company has expanded significantly over the years, both organically and through acquisitions, positioning itself as a key player in the accessibility market.

On September 15th, 2025, Savaria raised its dividend by 3.8% to a monthly rate of C$0.0467. On November 5th, 2025, Savaria reported its Q3 results for the period ending September 30th, 2025.

Revenues increased by 5.2% to $159.6 million, driven by organic growth of 1.8%, a 2.5% positive foreign exchange impact, and a 0.9% contribution from the acquisition of Western Elevator.

Gross profit was $62.6 million, an 11.4% increase year-over-year, resulting in a gross margin of 39.2%. Operating income rose 25.7% to $19.7 million, while Adjusted EBITDA grew 13.9% to $33.8 million, with a margin of 21.2%. Net earnings were $13.8 million, or $0.19 per share, compared to $7.9 million, or $0.11 per share, in Q3 2024.

Click here to download our most recent Sure Analysis report on SISXF (preview of page 1 of 3 shown below):

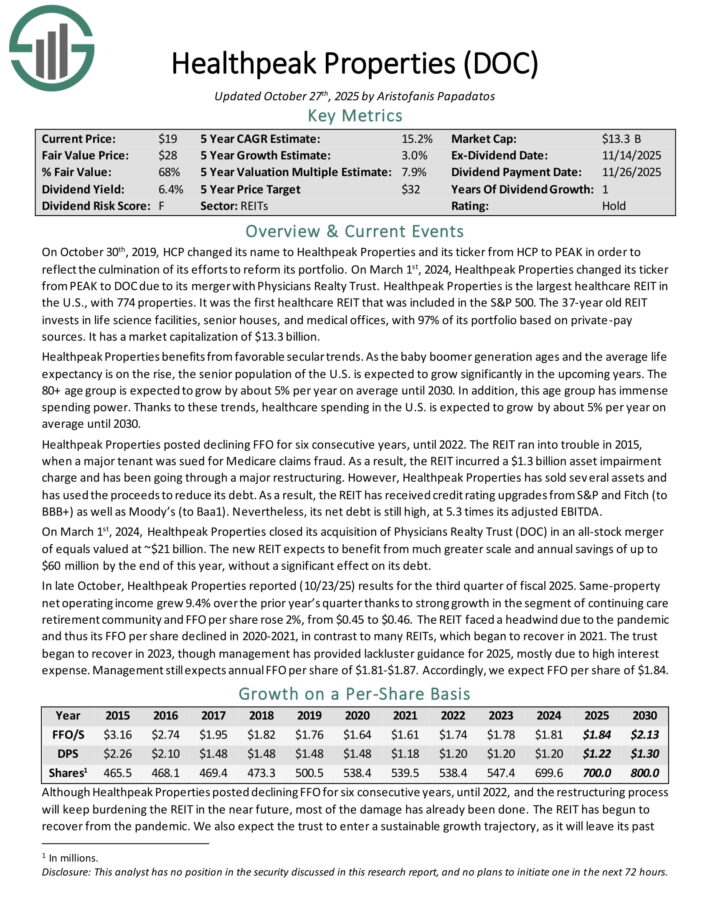

Monthly Dividend Stock For The Long Run #5: Healthpeak Properties (DOC)

Healthpeak Properties is the largest healthcare REIT in the U.S., with 774 properties. It was the first healthcare REIT that was included in the S&P 500.

The REIT invests in life science facilities, senior houses, and medical offices, with 97% of its portfolio based on private-pay sources.

In late October, Healthpeak Properties reported (10/23/25) results for the third quarter of fiscal 2025. Same-property net operating income grew 9.4% over the prior year’s quarter thanks to strong growth in the segment of continuing care retirement community and FFO per share rose 2%, from $0.45 to $0.46.

Management still expects annual FFO per share of $1.81-$1.87.

The payout ratio is standing at a nearly 10-year low while the REIT did not have any debt maturities in 2025. The REIT has begun to recover from the pandemic. We also expect the trust to enter a sustainable growth trajectory.

Click here to download our most recent Sure Analysis report on DOC (preview of page 1 of 3 shown below):

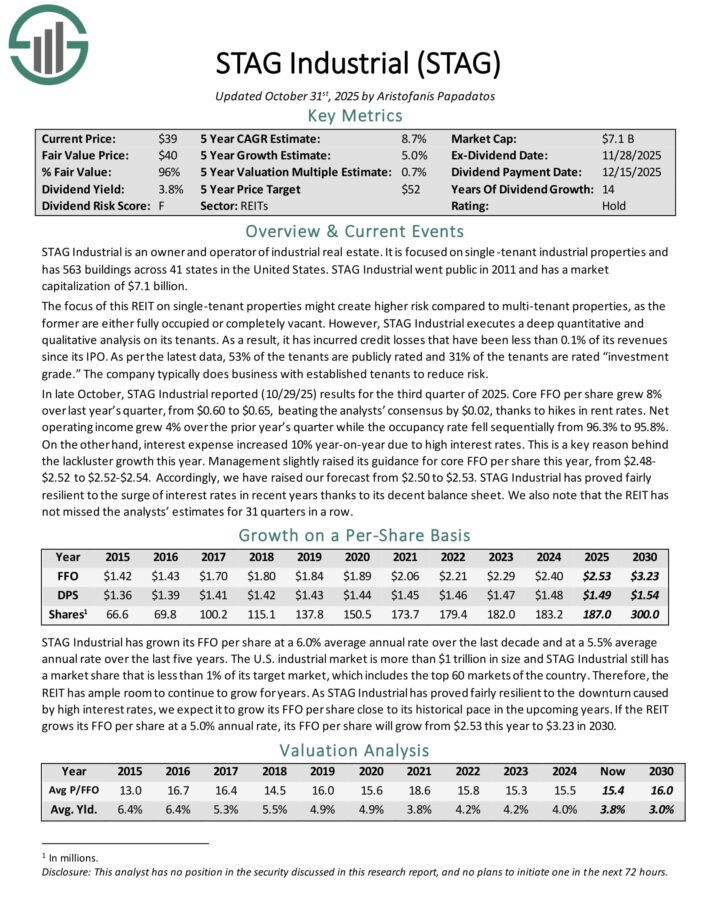

Monthly Dividend Stock For The Long Run #4: STAG Industrial (STAG)

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has 563 buildings across 41 states in the United States.

The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

However, STAG Industrial executes a deep quantitative and qualitative analysis on its tenants. As a result, it has incurred credit losses that have been less than 0.1% of its revenues since its IPO.

As per the latest data, 53% of the tenants are publicly rated and 31% of the tenants are rated “investment grade.” The company typically does business with established tenants to reduce risk.

In late October, STAG Industrial reported (10/29/25) results for the third quarter of 2025. Core FFO per share grew 8% over last year’s quarter, from $0.60 to $0.65, beating the analysts’ consensus by $0.02, thanks to hikes in rent rates.

Net operating income grew 4% over the prior year’s quarter while the occupancy rate fell sequentially from 96.3% to 95.8%.

On the other hand, interest expense increased 10% year-on-year due to high interest rates. This is a key reason behind the lackluster growth this year. Management slightly raised its guidance for core FFO per share this year, from $2.48-$2.52 to $2.52-$2.54.

Click here to download our most recent Sure Analysis report on STAG (preview of page 1 of 3 shown below):

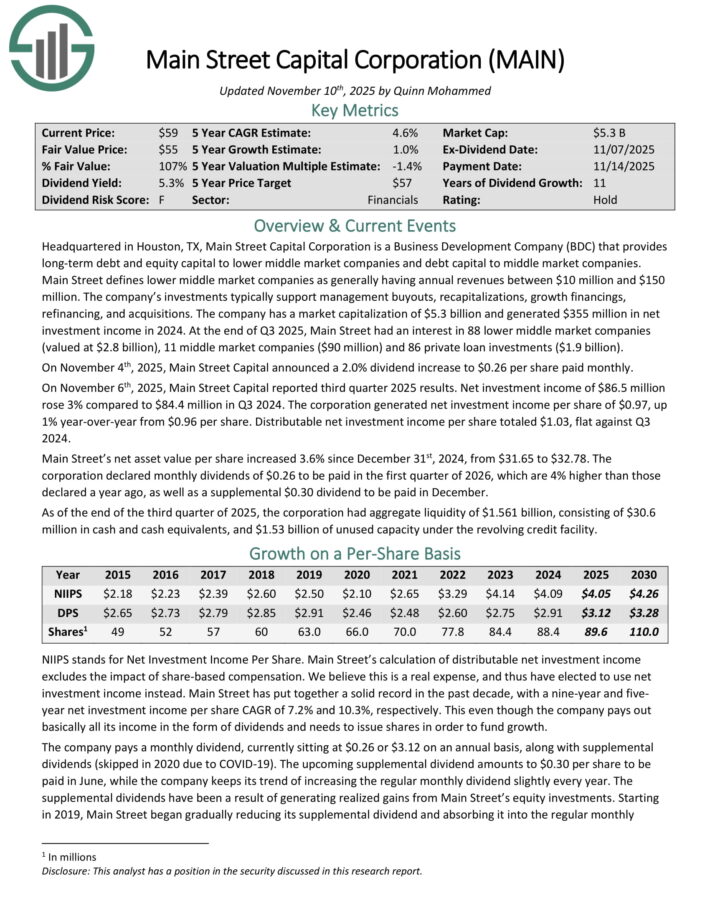

Monthly Dividend Stock For The Long Run #3: Main Street Capital (MAIN)

Main Street Capital Corporation is a Business Development Company (BDC) that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies.

At the end of Q3 2025, Main Street had an interest in 88 lower middle market companies (valued at $2.8 billion), 11 middle market companies ($90 million) and 86 private loan investments ($1.9 billion).

The corporation had aggregate liquidity of $1.561 billion, consisting of $30.6 million in cash and cash equivalents, and $1.53 billion of unused capacity under the revolving credit facility.

On November 6th, 2025, Main Street Capital reported third quarter 2025 results. Net investment income of $86.5 million rose 3% compared to $84.4 million in Q3 2024.

The corporation generated net investment income per share of $0.97, up 1% year-over-year from $0.96 per share. Distributable net investment income per share totaled $1.03, flat against Q3 2024.

Main Street’s net asset value per share increased 3.6% since December 31st, 2024, from $31.65 to $32.78.

The corporation declared monthly dividends of $0.26 to be paid in the first quarter of 2026, which are 4% higher than those declared a year ago, as well as a supplemental $0.30 dividend to be paid in December.

Click here to download our most recent Sure Analysis report on MAIN (preview of page 1 of 3 shown below):

Monthly Dividend Stock For The Long Run #2: Agree Realty (ADC)

Agree Realty is an integrated real estate investment trust (REIT) focused on ownership, acquisition, development, and retail property management.

Agree has developed over 40 community shopping centers throughout the Midwestern and Southeastern United States. At the end of December 2024, the company owned and operated 2,370 properties located in 50 states, containing approximately 48.8 million square feet of gross leasable space.

The company’s business objective is to invest in and actively manage a diversified portfolio of retail properties net leased to industry tenants.

On October 21st, 2025, Agree Realty Corp. reported third quarter results for Fiscal Year (FY)2025. The company reported strong third-quarter results for 2025, with EPS of $0.47, beating estimates by $0.01, and revenue of $183.22 million, up 18.7% year-over-year.

Net income per share rose 7.9% to $0.45, while Core FFO and AFFO per share increased 8.4% and 7.2% to $1.09 and $1.10, respectively.

The company declared a monthly dividend of $0.256 per share, representing a 2.4% increase from the prior year, and raised full-year 2025 AFFO guidance to $4.31–$4.33 per share.

ADC has increased its dividend for 13 consecutive years.

Click here to download our most recent Sure Analysis report on ADC (preview of page 1 of 3 shown below):

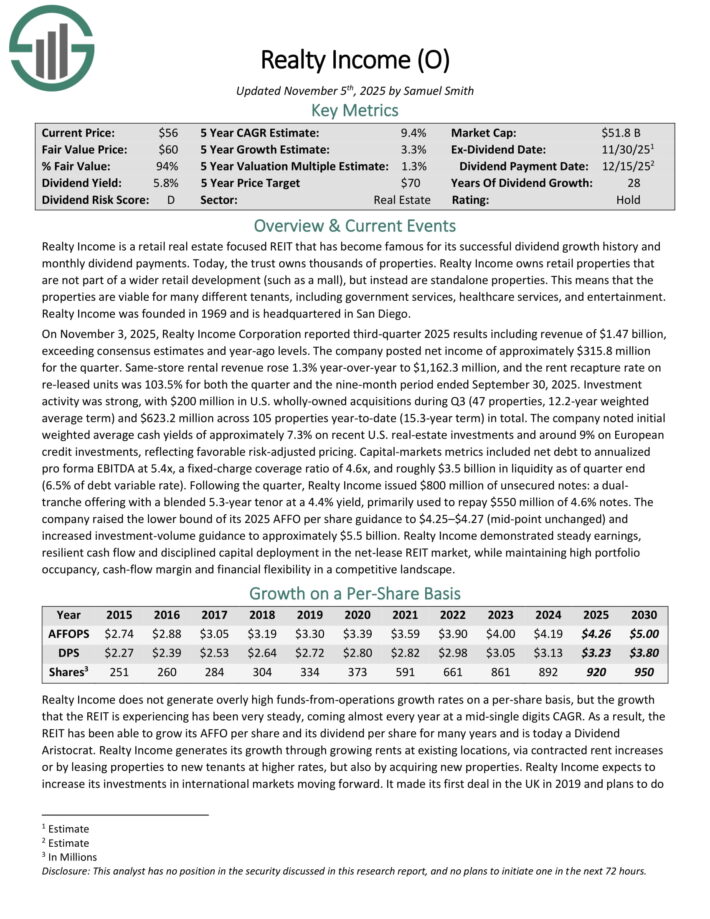

Monthly Dividend Stock For The Long Run #1: Realty Income (O)

Realty Income is a retail real estate focused REIT that has become famous for its successful dividend growth history and monthly dividend payments.

Realty Income owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

On November 3, 2025, Realty Income Corporation reported third-quarter 2025 results including revenue of $1.47 billion, exceeding consensus estimates and year-ago levels.

The company posted net income of approximately $315.8 million for the quarter. Same-store rental revenue rose 1.3% year-over-year to $1,162.3 million, and the rent recapture rate on re-leased units was 103.5% for both the quarter and the nine-month period ended September 30, 2025.

Investment activity was strong, with $200 million in U.S. wholly-owned acquisitions during Q3 (47 properties, 12.2-year weighted average term) and $623.2 million across 105 properties year-to-date (15.3-year term) in total.

Realty Income’s most important competitive advantage is its world-class management team that has successfully guided the trust in the past.

It has increased its dividend for 28 consecutive years, and is on the list of Dividend Aristocrats.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks can be an attractive option for investors seeking a steady source of income throughout the year.

Unfortunately, many monthly dividend stocks with extremely high yields end up cutting or eliminating their dividend payouts.

At the same time, some monthly dividend stocks have demonstrated a history of financial stability, consistent earnings, and reliable dividend payments.

The 10 monthly dividend stocks in this article may not have the highest dividend yields, but they have the best chance at maintaining (and even growing) their dividend payouts over the next decade.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- High Dividend Stocks: 5%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more