Updated on March 19th, 2024 by Bob Ciura

Lowe’s Companies (LOW) has a highly impressive track record of long-term dividend growth. The company has increased its dividend for over 50 years in a row. This makes Lowe’s a rare dividend stock, even among the Dividend Aristocrats, as the company qualifies for Dividend King status thanks to more than 5 decades of annual dividend increases.

Every year, we review each of the Dividend Aristocrats, a group of 68 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

We have built a full list of all 68 Dividend Aristocrats. You can download a free copy of our Dividend Aristocrats list, along with important metrics like dividend yields and payout ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

In addition to being a Dividend Aristocrat, Lowe’s is on the exclusive list of Dividend Kings, which have raised their dividends for an amazing 50+ years in a row. You can see the entire list of Dividend Kings here.

Lowe’s also is a high-growth dividend stock. This article will discuss Lowe’s’ business model, growth potential, and valuation.

Business Overview

Lowe’s was founded in 1946. In the 75 years since, it has grown into the second largest home improvement retailer, behind only The Home Depot (HD).

The company operates more than 1,700 stores in the U.S., Canada, and Mexico. Lowe’s offers a wide range of products, for maintenance, repair, remodeling, and decorating the home. It has a wide selection of leading national brands, as well as a large number of private brands.

Lowe’s reported fourth quarter 2023 results on February 27th, 2024. Total sales came in at $18.6 billion compared to $22.4 billion in the same quarter a year ago. Comparable sales decreased by 6.2%, while net earnings-per-share of $1.77 compared to $1.58 in fourth quarter 2022.

However, adjusted EPS in the year-ago period was $2.28 when excluding the transaction costs related to the sale of the Canadian retail business in the prior year. The company continues to be negatively impacted from a reduction in DIY discretionary spending.

The company repurchased 1.9 million shares in the fourth quarter for $404 million. Additionally, it paid out $633 million in dividends.

Lowe’s initiated its fiscal 2024 outlook and expects to earn adjusted diluted EPS of $12.00 to $12.30 on total sales of $84 to $85 billion. Capex will likely come in at $2 billion, and Lowe’s expects an operating margin of 12.6% to 12.7%.

Growth Prospects

We believe that Lowe’s will deliver 9% annual earnings-per-share growth over the next five years. Lowe’s has a long runway of growth up ahead.

Lowe’s has made a concerted effort in recent years to improve its in-store experience for customers through merchandising and inventory practice optimization, as well as investing in the capabilities to fulfill orders outside of its stores.

This includes special features for Pro customers that drive recurring revenue, as well as making it easier for DIY customers to order their products online, and pick them up or have them delivered. This is a strategic shift from the old model Lowe’s operated under, and it has worked well in recent years.

Lowe’s generally opens a small number of new stores each year, so that is not a meaningful driver of growth. However, it continues to find ways to capitalize on rising housing and construction spending, and we see these as growth drivers moving forward due to still relatively low mortgage rates, whether or not the store count rises.

The U.S. economy continues to grow, despite growth headwinds such as high inflation rates. Positive GDP growth is arguably the most important economic indicator for Lowe’s, as the company is highly reliant on consumer spending. The continued U.S. economic growth is a positive catalyst for Lowe’s.

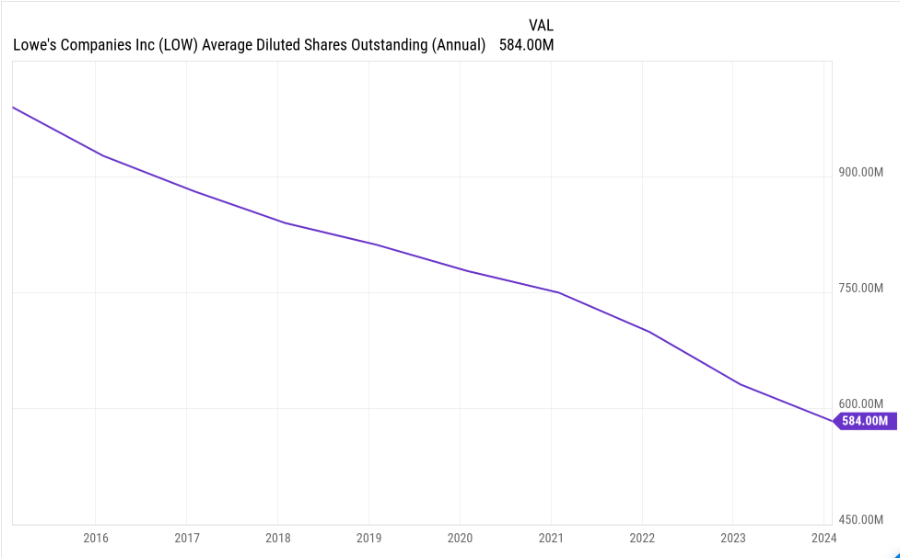

Lowe’s has steadily been repurchasing shares on the open market in recent years. These buybacks shrink the company’s share count, which translates into a growing portion of the overall profits that the company generates for each remaining share.

Buybacks have been a major driver in the compelling earnings-per-share growth that Lowe’s enjoyed, and we believe the same will hold true in the future:

Source: YCharts

The combination of continued expansion in e-commerce, overall economic growth in the long run, and operating should drive profits for Lowe’s. With the impact of buybacks added, we believe annual earnings-per-share growth in the mid-single-digit range is very much achievable.

Competitive Advantages & Recession Performance

The retail industry typically does not offer many competitive advantages. This is a highly challenging retail environment, as the rise of Amazon and other Internet retailers threatens to undercut brick-and-mortar stores. Consumers have shifted spending dollars toward e-commerce for the convenience and low prices.

However, Lowe’s is a specialty retailer, which provides it with a competitive advantage. Home improvement projects are often complex. Consumers are willing to travel to stores, to inspect products in person, and to ask questions to staff members. This has helped protect home improvement retailers from Amazon (AMZN).

That said, Lowe’s is not immune from recessions. The consumer is at risk of declining during economic downturns. Lowe’s depends on a financially-healthy consumer, with solid housing and construction markets. The Great Recession was a particularly steep downturn, which took a significant toll on Lowe’s bottom line.

Lowe’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $1.86

- 2008 earnings-per-share of $1.49 (20% decline)

- 2009 earnings-per-share of $1.21 (19% decline)

- 2010 earnings-per-share of $1.44 (19% increase)

Lowe’s earnings fell sharply during the recession, but the company still remained profitable. This helped it continue increasing its dividend each year. And, it bounced back reasonably quick, as by 2013, Lowe’s earnings-per-share had surpassed 2007 levels.

Valuation & Expected Returns

Lowe’s is expected to generate adjusted EPS of $12.15 for 2024. As a result, the stock trades at a price-to-earnings ratio of 20.2. This is above our fair value estimate of 19, so we see the stock as slightly overvalued. As a result, a contracting price-to-earnings ratio could reduce future returns by approximately 1.2% per year for the next five years.

In addition to valuation changes, Lowe’s returns will consist of earnings growth and dividends.

We see annual earnings-per-share growth at 9% annually, plus the current 1.8% yield, offset somewhat by a declining valuation multiple. That would produce overall total annual returns of approximately 9.6%, which is an attractive potential rate of return.

The dividend payout ratio remains near 36% of earnings, so there is certainly plenty of room for additional dividend growth in the coming years.

Final Thoughts

Lowe’s has increased its dividend for 60 consecutive years. The current environment is difficult for retail, but Lowe’s operates in a niche that should withstand competitive threats from online retailers.

Lowe’s is still growing sales and earnings, which should allow for continued dividend growth. And, it has a conservative dividend payout ratio, which also supports high dividend increases. With a solid expected rate of return of around 10% per year, Lowe’s stock receives a buy rating at current prices.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.