Updated on November 9th, 2023

The Dividend Kings are a selective group of stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

One of the newest members to join this list is S&P Global (SPGI). S&P Global, like all Dividend Kings, has a very impressive dividend track record. It has paid a dividend every year since 1937 and has raised its dividend for 50 years in a row.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

S&P Global is a worldwide provider of financial services and business information. The company traces its roots back to 1917 when McGraw Publishing Company and the Hill Publishing Company came together. The company was first named McGraw Hill Financial. In 1957, McGraw Hill introduced the S&P 500, the most widely-recognized index of all large-cap U.S. stocks.

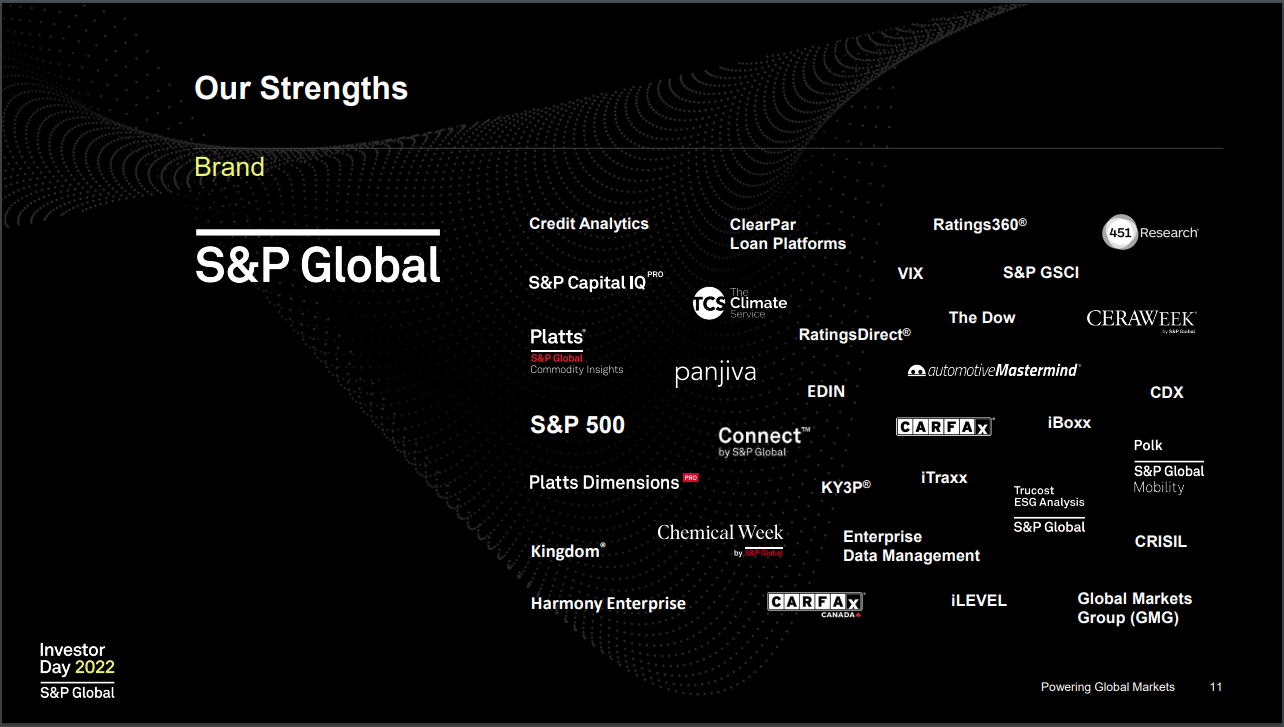

S&P Global offers financial services to the global capital and commodity markets, including credit ratings, benchmarks, analytics, and other data to commodity market participants, capital markets, and automotive markets. The company’s five divisions are: Ratings, Market Intelligence, Commodity Insights, Mobility, and S&P Dow Jones Indices.

S&P Global has a highly profitable business model. It is the industry leader in credit ratings and stock market indexes, which enables it to generate high-profit margins and growth opportunities.

Source: Investor Presentation

Notably, on February 28th, 2022, S&P Global merged with HIS Markit. The merger allows the company to offer a stronger, more diverse product portfolio on an even larger scale. The company today has a market capitalization of nearly $120 billion and generates $12 billion of annual revenue.

S&P Global posted third quarter earnings on November 2nd, 2023, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $3.21, which was 17 cents ahead of expectations. Revenue was up almost 8% year-over-year to $3.08 billion, which was $50 million ahead of estimates.

Expenses were $2.02 billion, down from $2.08 billion, and roughly flat year-over-year. Adjusted operating profit was $1.47 billion, up from $1.44 billion in Q2, and up from $1.32 billion a year ago.

Growth Prospects

S&P Global has an impressive track record. It has grown its earnings-per-share at a 19% compound annual growth rate over the last eight years.

The company’s past growth has been the result of a series of secular trends, which are, in fact, still present today. Given that corporate debt has been very popular in the last decade, buoyed by low global interest rates, business ratings have been important. With the recent increase in interest rates, investors are likely to keep a close eye on these ratings. However, as a result of increased rates, fewer debt issuances arise, negatively impacting S&P Global’s results.

Furthermore, the increasing demand for financial analysis and ETFs should aid in growing the company’s products and earnings.

Share buybacks will also aid in growth on a per-share basis. The company also noted it was starting a new $1.3 billion accelerated share repurchase program, worth about 1% of the current float.

The company has also been very active in acquisitions and divestments to enhance its business. First, the company completed a significant merger with HIS Market in February 2022. In December 2022, the company acquired the Shades of Green business from the Center for International Climate Research. This acquisition expanded S&P Global Ratings’ second-party opinions (SPOs) offering.

And on January 17th, 2023, S&P Global agreed to sell its Engineering Solutions Business to KKR for $975 million in cash, which would equal roughly $750 million after tax and be utilized to repurchase its own shares.

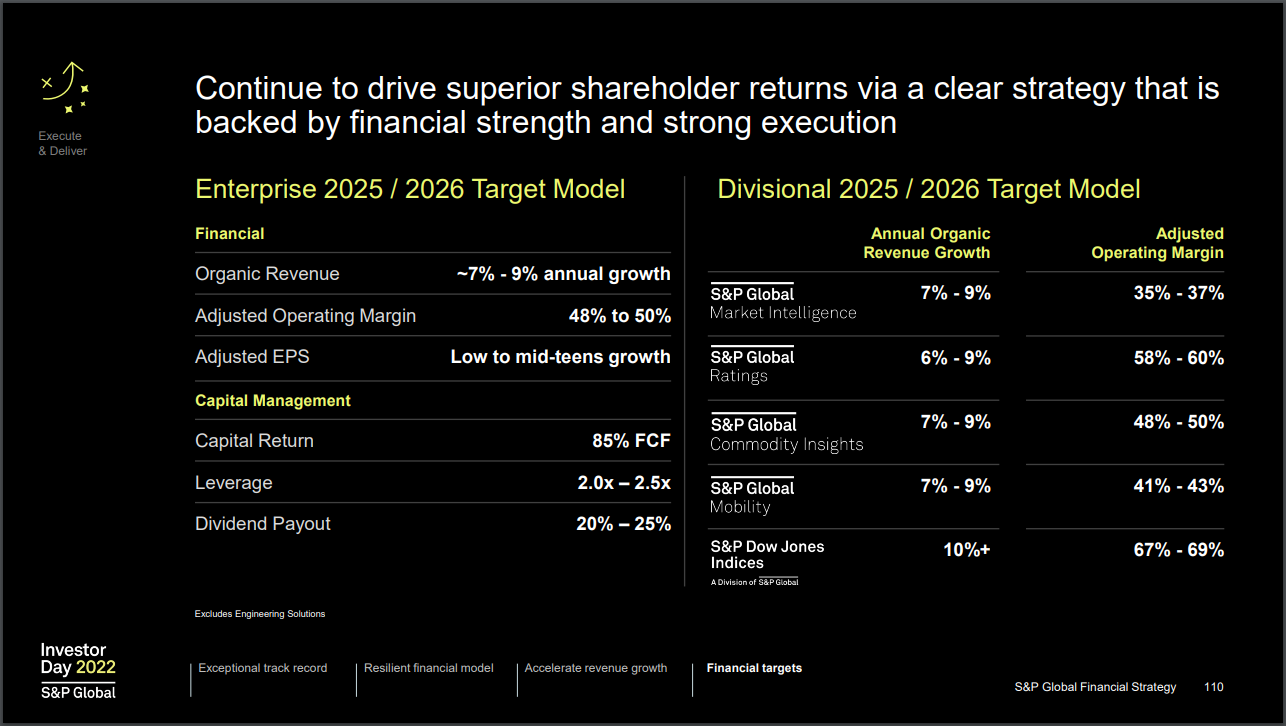

Source: Investor Presentation

Leadership recently stated that they expect to achieve 7% to 9% organic annual revenue growth by 2025 – 2026. The company also expects to achieve an adjusted operating margin between 48% to 50% and low to mid-teens growth in annual adjusted diluted EPS.

We forecast that S&P Global can grow its earnings-per-share by 10% over the next five years.

Competitive Advantages & Recession Performance

S&P Global benefits from multiple competitive advantages. The company operates in the highly concentrated financial ratings industry. It is one of only three major credit rating agencies in the U.S. that control over 90% of global financial debt ratings. The other two are Moody’s (MCO) and Fitch Ratings.

The company possesses a strong moat as there are tremendous barriers to entry in its industry. New entrants would find it difficult, if not impossible, to garner the necessary trust from the financial industry and government to become an accepted rating agency.

S&P Global’s competitive advantage and moat enabled it to remain profitable even during the Great Recession when earnings decreased by -21% to $2.33. While many companies were on the brink of collapse, S&P Global was far from reporting losses.

During the COVID-19 pandemic crisis, S&P Global’s results held up tremendously, and the company achieved new record results year after year.

Valuation & Expected Returns

Based on our estimate for 2023 earnings-per-share of $12.55 and a current share price of $388, shares of S&P Global are trading at a P/E ratio of 30.9.

This valuation is rich for S&P Global, which has traded for an average P/E ratio of about 23 over the last five years. Our fair value estimate for the company is 26 times earnings, considering the company has produced strong results in recent years.

Shares appear to be overvalued, trading well ahead of our estimates. If shares were to retreat to a price-to-earnings ratio of 26.0 over the next five years, investors would see a reduction in annual returns of 3.4%.

The stock also has a current dividend yield of 0.9%. The dividend is highly secure, with a payout ratio of only 29%. However, the yield is not particularly enticing for income investors.

Combined with the estimated 10% earnings-per-share growth rate, S&P Global is forecasted to generate total returns of 7.5% per year through 2028. Given this rate of return, S&P Global shares are rated a hold.

Final Thoughts

S&P Global has experienced tremendous growth in the last decade. Its competitive advantages and strong position in its rating industry oligopoly will continue to protect the company’s downside. Combined with its strong share buyback program and strategic mergers & acquisitions activity, the company has a bright future still.

The company has now achieved Dividend King status following its 50th consecutive annual dividend increase. Still, the low dividend yield is not so appealing.

At the moment, though, shares are trading for a rich valuation, which gravely reduces the attractiveness of the stock.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.