Updated on June 17th, 2024 by Nathan Parsh

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Vector Group Ltd. (VGR) is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database

The company is a high-yield dividend stock that had to cut its dividend during the COVID-19 pandemic in 2020. Because of that dividend cut, the dividend seems to have become safer now.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

For the next high-yield stocks in this series, we will review a diversified holding company, Vector Group , which currently has a dividend yield of 7.6%.

Business Overview

Vector Group is a diversified holding company headquartered in Miami, Florida, with an executive office in Manhattan and tobacco operations in North Carolina.

The company is a combination of a cigarette company and a real estate firm. The company owns and controls two tobacco companies: Liggett Group, LLC and Vector Tobacco, Inc.

Vector Group also owns New Valley LLC, which is a real estate investment business. The company is also a constituent of the S&P SmallCap 600 Index and the Russell 2000 Index.

Vector Group’s tobacco segment primarily sells discount cigarette brands, including Eagle ’20s, Pyramid, Grand Prix, Liggett Select, and Eve. The company is the 4th largest cigarette manufacturer, in terms of volume, in the United States.

The real estate segment New Valley has invested approximately $171 million, as of March 31st, 2024, in a broad portfolio of real estate ventures, including condominium and mixed-used developments, apartment buildings, hotels, and commercial properties. .

Source: Investor Presentation

Vector Group recently reported its Q1 2024 results on May 1st, 2024, with the numbers coming in weaker than expected. The company saw a revenue decrease of 2.9% to $324.6 million. While earnings per share did decrease to $0.24 from $0.22 despite a decline in tobacco volume.

Revenue weakness was caused by Vector’s wholesale shipments recording a significant decline, as wholesale volume fell 10.6% to 2.1 billion from 2.35 billion. This was a higher rate of decline than the 9.8% decrease for the industry.

This led to Vector’s wholesale market share falling to 5.6% from 5.7% in the prior year.

The company’s retail performance was also poor. Retail shipments saw an 8.7% decrease, while the industry experienced a decline of 8.9% Thus, Vector’s retail market share was flat at 5.8% compared to the prior year.

Results would have been worst, but the company’s expanded distribution of Vector Group’s low-price Montego brand helped to maintain market share, but this also impacted overall profitability.

Growth Prospects

Future growth prospects for the company will come from an increase in market share in the tobacco industry. This can be obtained through pricing its products more competitively.

For example, VRG holds a significant advantage when compared to larger companies such as Altria (MO) and Philip Morris (PM). Vector Group can sell cigarettes at a discount due to the Master Settlement Agreement (MSA).

Essentially, it gives the company an $0.80 per-pack advantage over the larger companies.

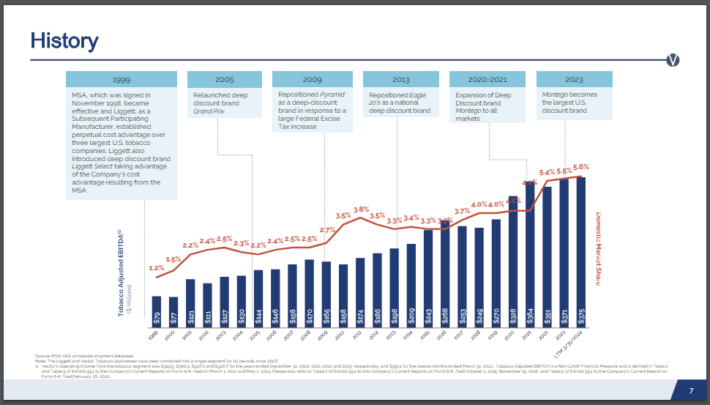

As the bar chart below illustrates, the tobacco segment’s adjusted EBITDA has been gradually growing in line with its market share gains. We note that a decline in market share would likely have the opposite effect.

Another growth driver would be a better marking campaign for its brands. This will help bring new customers to its cheaper products

Source: Investor Presentation

Since the tobacco segment is the company’s biggest contributor to the top and bottom-line, acquiring more real estate will help drive growth for the company.

As mentioned above, the company has approximately $171 million invested, as of March 31st, 2024, in a broad portfolio of real estate ventures. This should help increase revenue and profit.

Competitive Advantages & Recession Performance

Vector Group’s main competitive advantage is the tobacco business, which tends to have stable cash flows. However, e-cigarettes represent a threat, and cigarette volumes are declining.

Recent market share gains in both wholesale and retail are encouraging, but the company will certainly have a bumpy ride when it comes to maintaining/growing its profitability against the industry’s inherent headwinds.

The New Valley business does not have a competitive advantage as well. This is why it is important that the company continues to invest in new high-quality real estate properties to grow its portfolio.

As for recession performance, the company did performer well compared to most during the 2008-2009 Great Recession.

Vector Group’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $0.35

- 2008 earnings-per-share of $0.35 (flat)

- 2009 earnings-per-share of $0.31 (11% decrease)

- 2010 earnings-per-share of $0.37 (17% increase)

As you see, the company did reasonably well during the worst of the Great Recession. Also, the dividend was not cut during this period.

During the COVID-19 pandemic, the company increased earnings from $0.50 per share in 2019 to $0.64 per share in 2020, but the dividend was cut in half to preserve some cash for future investments and improve coverage.

Dividend Analysis

In this section of the article, we will determine if the generous dividend is safe for dividend and income focused investors.

Vector Group pays out a hefty dividend yield of 7.6%. The company had previously raised its dividend from 2004 with a dividend growth rate of 5.4% compounded annually until 2020.

In 2020, the company cut its dividend to allow for free cash flow to breathe easier and preserve some cash. Vector Group cut the dividend even though earnings were growing from 2018 to 2020.

The regular dividend was cut in half from a quarterly rate of $0.80 to $0.40, while the stock dividend was completely suspended. Vector Group has not raised its dividend since it was cut, distributing the same quarterly payment for 18 consecutive quarters.

However, with the increase in earnings in recent years and because of the dividend cut, the current dividend looks to be a lot safer compared to a few years ago.

For example, in 2019, the company earned $0.64 per share while paying a dividend of $0.57 for the year, leading to an elevated payout ratio of 89%. In 2021, the dividend payout ratio was 71%, illustrating the result of the previous year’s cut.

We expect the company will make about $1.16 per share in 2024 with an earnings growth rate of 3% for the next five years. Thus, the dividend payout ratio for the year should be about 69% for this year before our predicted payout ratio of 59% by 2029.

If achieved, this year’s expected payout ratio would be one of the lowest in the last decade, leading to our belief that the dividend should be safe for the foreseeable future.

A threat to the dividend moving forward is the ongoing rise in interest rates, given the company is highly indebted. Interest payments are currently covered by about 4X the company’s operating income, which is not too great of a coverage ratio in case the company needs to refinance at higher rates in the future.

Also, the company has an S&P credit rating of B-, which is not an investment-grade credit rating.

Final Thoughts

Vector’s performance during the first part of 2024 has been rather weak, marked by market share pullbacks that outpaced the industry rate of decline.

With inflation gradually driving consumers to lower-priced brands, Vector’s cigarettes segment could reap some benefits, but that has not occurred so far.

In addition, the company has failed to improve the balance sheet, which is heavily indebted. The overall outlook in the tobacco industry moving forward is not favorable either.

The dividend looks safer than prior to the cut, and income-driven investors can likely benefit from the high dividend yield these days. Still, Vector’s dividend should be approached with caution.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 6 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more