Updated on October 29th, 2025 by Bob Ciura

Investors in the US should not overlook Canadian stocks, many of which have high dividend yields than their U.S. counterparts.

There are many Canadian dividend stocks that have significantly higher yields and lower valuations than comparable U.S. peers.

The TSX 60 Index is a stock market index of the 60 largest companies that trade on the Toronto Stock Exchange.

Because the Canadian stock market is heavily weighted towards large financial institutions and energy companies, the TSX is a reasonable benchmark for Canadian equities performance. It is also a great place to look for investment ideas.

You can download a database of the companies within the TSX 60 (along with relevant financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

The TSX 60 Stocks List available for download above contains the following information for every security within the index:

- Stock Price

- Dividend Yield

- Market Capitalization

- Price-to-Earnings Ratio

All of the financial data in the database are listed in Canadian dollars.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

This article will rank the top 10 Canadian dividend stocks trading on the TSX 60 in the Sure Analysis Research Database, ranked by their annual expected returns over the next five years.

Table of Contents

- Best Canadian Dividend Stock #10: Sun Life Financial (SLF)

- Best Canadian Dividend Stock #9: Waste Connections (WCN)

- Best Canadian Dividend Stock #8: Brookfield Asset Management (BAM)

- Best Canadian Dividend Stock #7: Canadian National Railway (CNI)

- Best Canadian Dividend Stock #6: Canadian Apartment Properties REIT (CDPYF)

- Best Canadian Dividend Stock #5: Magna International Inc. (MGA)

- Best Canadian Dividend Stock #4: Restaurant Brands International (QSR)

- Best Canadian Dividend Stock #3: Telus Corp. (TU)

- Best Canadian Dividend Stock #2: Brookfield Infrastructure Partners LP (BIP)

- Best Canadian Dividend Stock #1: FirstService Corp. (FSV)

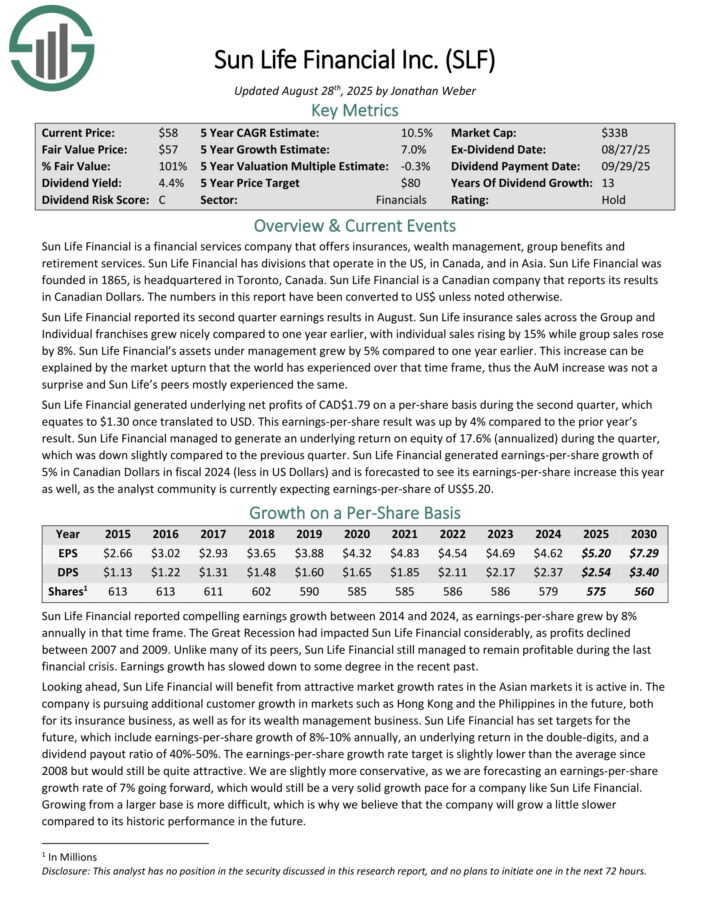

Best Canadian Dividend Stock #10: Sun Life Financial (SLF)

- Annual Expected Returns: 10.6%

Sun Life Financial is a financial services company that offers insurances, wealth management, group benefits and retirement services. Sun Life Financial has divisions that operate in the US, in Canada, and in Asia. Sun Life Financial was founded in 1865, is headquartered in Toronto, Canada.

Sun Life Financial reported its second quarter earnings results in August. Sun Life insurance sales across the Group and Individual franchises grew nicely compared to one year earlier, with individual sales rising by 15% while group sales rose by 8%.

Sun Life Financial’s assets under management grew by 5% compared to one year earlier. This increase can be explained by the market upturn that the world has experienced over that time frame, thus the AuM increase was not a surprise and Sun Life’s peers mostly experienced the same.

Sun Life Financial generated underlying net profits of CAD$1.79 on a per-share basis during the second quarter, which equates to $1.30 once translated to USD. This earnings-per-share result was up by 4% compared to the prior year’s result.

Sun Life Financial managed to generate an underlying return on equity of 17.6% (annualized) during the quarter, which was down slightly compared to the previous quarter. Sun Life Financial generated earnings-per-share growth of 5% in Canadian Dollars in fiscal 2024.

Click here to download our most recent Sure Analysis report on SLF (preview of page 1 of 3 shown below):

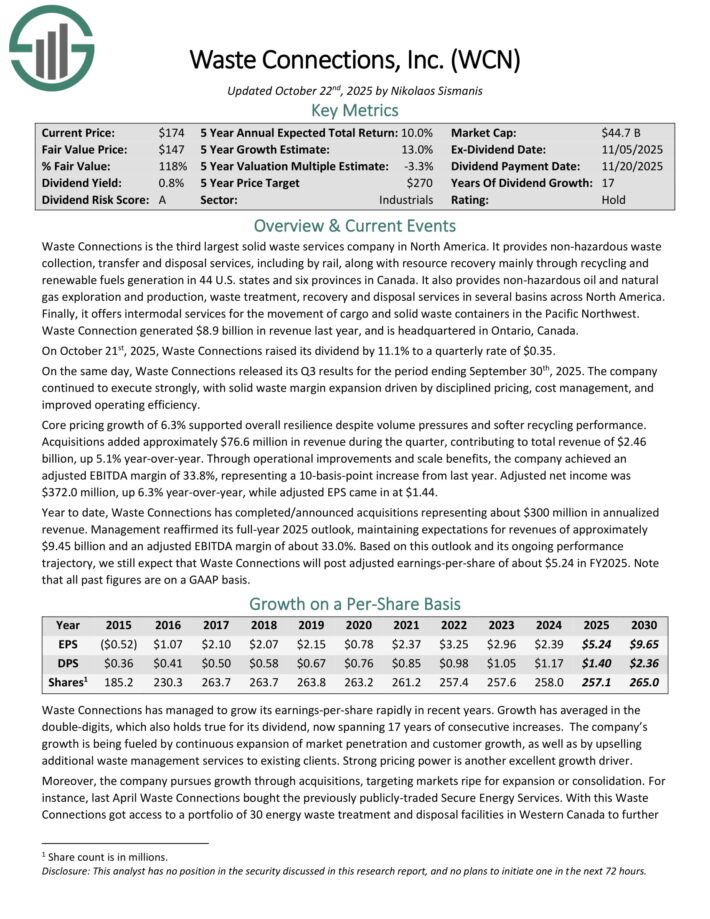

Best Canadian Dividend Stock #9: Waste Connections (WCN)

- Annual Expected Returns: 10.2%

Waste Connections is the third largest solid waste services company in North America. It provides non-hazardous waste collection, transfer and disposal services, including by rail, along with resource recovery mainly through recycling and renewable fuels generation in 44 U.S. states and six provinces in Canada.

It also provides non-hazardous oil and natural gas exploration and production, waste treatment, recovery and disposal services in several basins across North America.

Finally, it offers intermodal services for the movement of cargo and solid waste containers in the Pacific Northwest. Waste Connection generated $8.9 billion in revenue last year, and is headquartered in Ontario, Canada.

On October 21st, 2025, Waste Connections raised its dividend by 11.1% to a quarterly rate of $0.35. On the same day, Waste Connections released its Q3 results for the period ending September 30th, 2025. The company continued to execute strongly, with solid waste margin expansion driven by disciplined pricing, cost management, and improved operating efficiency.

Core pricing growth of 6.3% supported overall resilience despite volume pressures and softer recycling performance. Acquisitions added approximately $76.6 million in revenue during the quarter, contributing to total revenue of $2.46 billion, up 5.1% year-over-year.

Through operational improvements and scale benefits, the company achieved an adjusted EBITDA margin of 33.8%, representing a 10-basis-point increase from last year. Adjusted net income was $372.0 million, up 6.3% year-over-year, while adjusted EPS came in at $1.44.

Click here to download our most recent Sure Analysis report on WCN (preview of page 1 of 3 shown below):

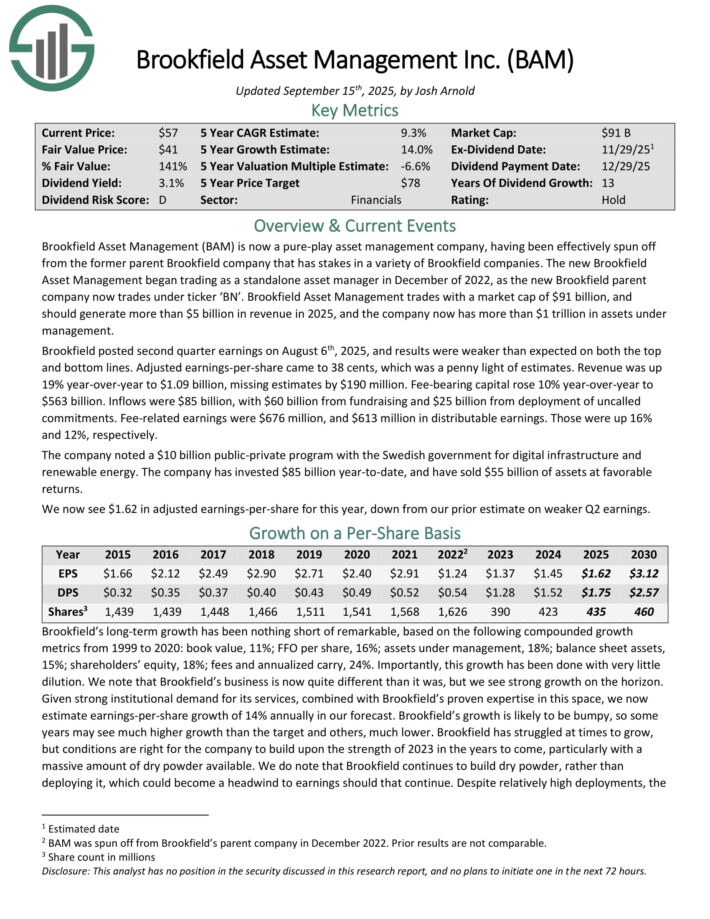

Best Canadian Dividend Stock #8: Brookfield Asset Management (BAM)

- Annual Expected Returns: 11.5%

Brookfield Asset Management is now a pure-play asset management company, having been effectively spun off from the former parent Brookfield company that has stakes in a variety of Brookfield companies.

Brookfield Asset Management should generate more than $5 billion in revenue in 2025, and the company now has more than $1 trillion in assets under management.

Brookfield posted second quarter earnings on August 6th, 2025, and results were weaker than expected on both the top and bottom lines. Adjusted earnings-per-share came to 38 cents, which was a penny light of estimates. Revenue was up 19% year-over-year to $1.09 billion, missing estimates by $190 million.

Fee-bearing capital rose 10% year-over-year to $563 billion. Inflows were $85 billion, with $60 billion from fundraising and $25 billion from deployment of uncalled commitments. Fee-related earnings were $676 million, and $613 million in distributable earnings. Those were up 16% and 12%, respectively.

The company noted a $10 billion public-private program with the Swedish government for digital infrastructure and renewable energy. The company has invested $85 billion year-to-date, and have sold $55 billion of assets at favorable returns.

Click here to download our most recent Sure Analysis report on BAM (preview of page 1 of 3 shown below):

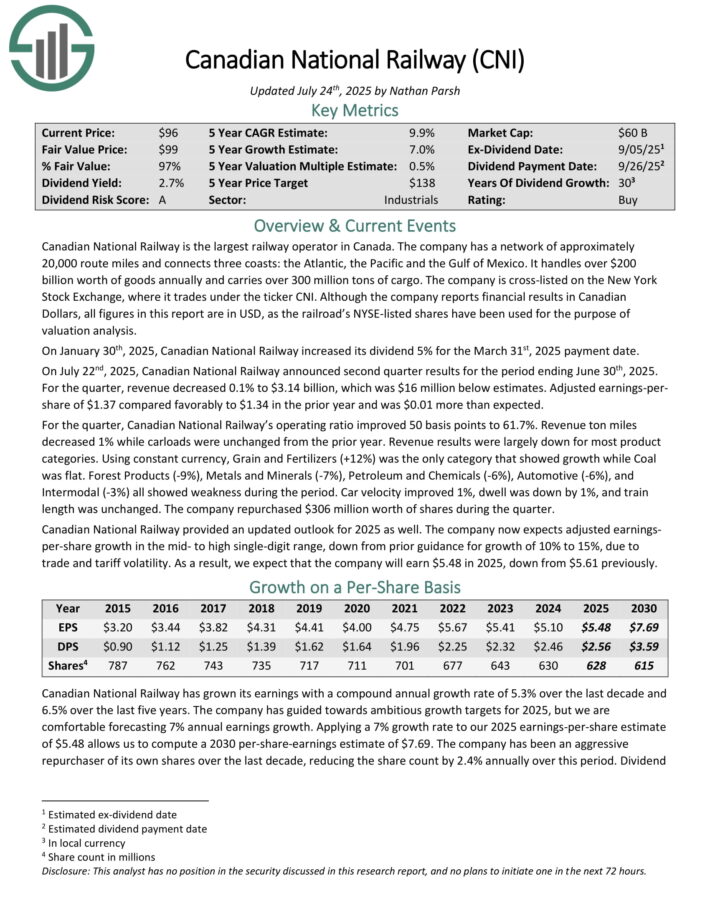

Best Canadian Dividend Stock #7: Canadian National Railway (CNI)

- Annual Expected Returns: 10.3%

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

On July 22nd, 2025, Canadian National Railway announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue decreased 0.1% to $3.14 billion, which was $16 million below estimates. Adjusted earnings-per-share of $1.37 compared favorably to $1.34 in the prior year and was $0.01 more than expected.

For the quarter, Canadian National Railway’s operating ratio improved 50 basis points to 61.7%. Revenue ton miles decreased 1% while carloads were unchanged from the prior year. Revenue results were largely down for most product categories.

Using constant currency, Grain and Fertilizers (+12%) was the only category that showed growth while Coal was flat. Forest Products (-9%), Metals and Minerals (-7%), Petroleum and Chemicals (-6%), Automotive (-6%), and Intermodal (-3%) all showed weakness during the period.

Car velocity improved 1%, dwell was down by 1%, and train length was unchanged. The company repurchased $306 million worth of shares during the quarter.

Click here to download our most recent Sure Analysis report on CNI (preview of page 1 of 3 shown below):

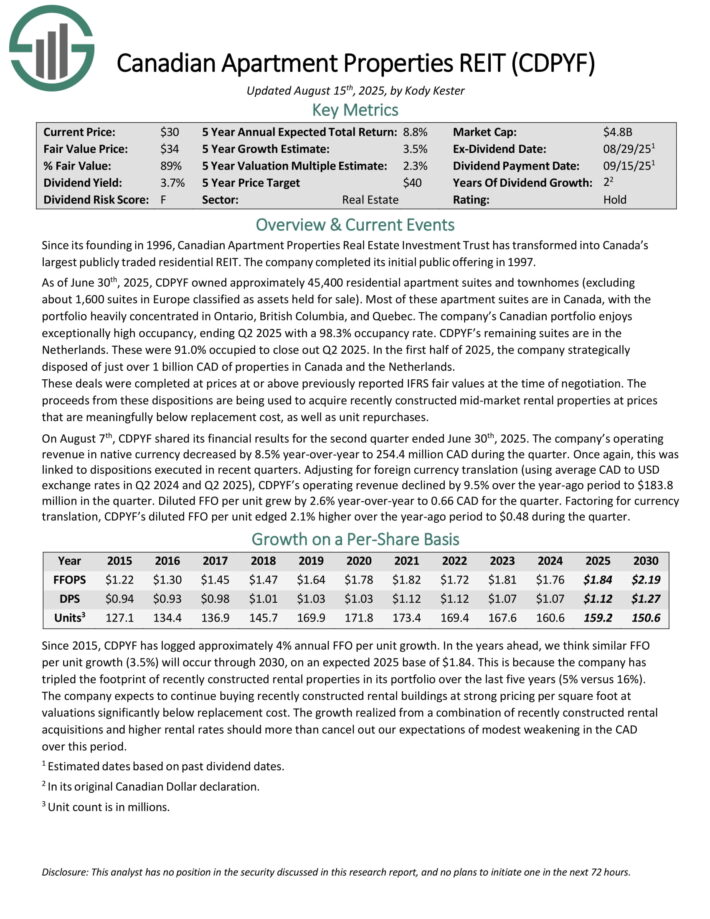

Best Canadian Dividend Stock #6: Canadian Apartment Properties REIT (CDPYF)

- Annual Expected Returns: 14.9%

Since its founding in 1996, Canadian Apartment Properties Real Estate Investment Trust has transformed into Canada’s largest publicly traded residential REIT. The company completed its initial public offering in 1997.

As of June 30th, 2025, CDPYF owned approximately 45,400 residential apartment suites and townhomes (excluding about 1,600 suites in Europe classified as assets held for sale). Most of these apartment suites are in Canada, with the portfolio heavily concentrated in Ontario, British Columbia, and Quebec.

The company’s Canadian portfolio enjoys exceptionally high occupancy, ending Q2 2025 with a 98.3% occupancy rate. CDPYF’s remaining suites are in the Netherlands. These were 91.0% occupied to close out Q2 2025.

In the first half of 2025, the company strategically disposed of just over 1 billion CAD of properties in Canada and the Netherlands. These deals were completed at prices at or above previously reported IFRS fair values at the time of negotiation.

The proceeds from these dispositions are being used to acquire recently constructed mid-market rental properties at prices that are meaningfully below replacement cost, as well as unit repurchases.

On August 7th, CDPYF shared its financial results for the second quarter ended June 30th, 2025. The company’s operating revenue in native currency decreased by 8.5% year-over-year to 254.4 million CAD during the quarter. Once again, this was linked to dispositions executed in recent quarters.

Adjusting for foreign currency translation (using average CAD to USD exchange rates in Q2 2024 and Q2 2025), CDPYF’s operating revenue declined by 9.5% over the year-ago period to $183.8 million in the quarter. Diluted FFO per unit grew by 2.6% year-over-year to 0.66 CAD for the quarter.

Factoring for currency translation, CDPYF’s diluted FFO per unit edged 2.1% higher over the year-ago period to $0.48 during the quarter.

Click here to download our most recent Sure Analysis report on CDPYF (preview of page 1 of 3 shown below):

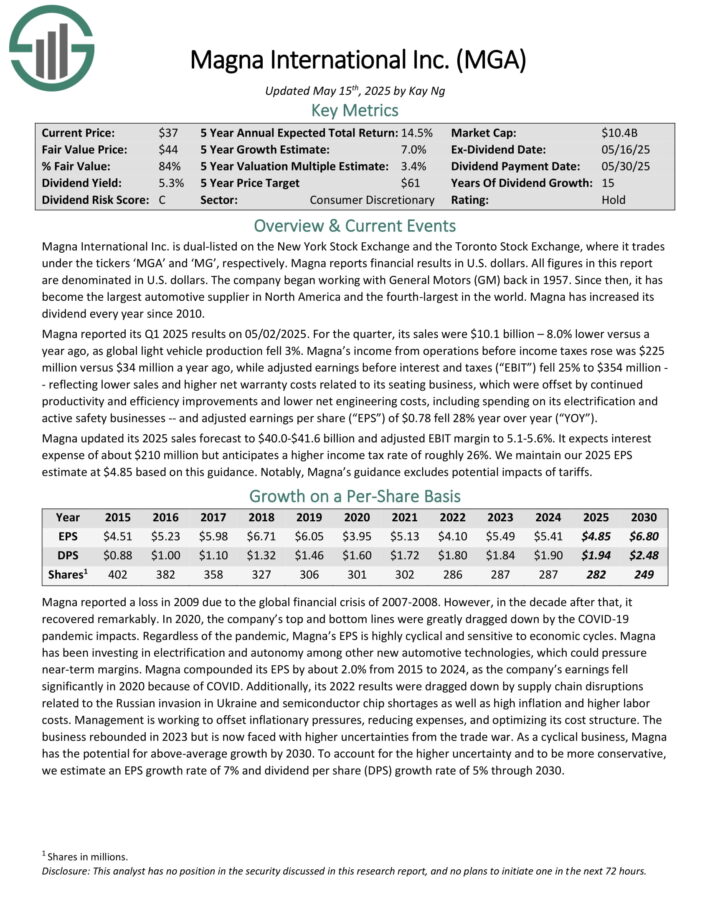

Best Canadian Dividend Stock #5: Magna International Inc. (MGA)

- Annual Expected Returns: 10.8%

Magna International Inc. is dual-listed on the New York Stock Exchange and the Toronto Stock Exchange, where it trades under the tickers ‘MGA’ and ‘MG’, respectively.

It has become the largest automotive supplier in North America and the fourth-largest in the world. Magna has increased its dividend every year since 2010.

Magna reported its Q1 2025 results on 05/02/2025. For the quarter, its sales were $10.1 billion – 8.0% lower versus a year ago, as global light vehicle production fell 3%. Magna’s income from operations before income taxes rose was $225 million versus $34 million a year ago.

Adjusted earnings before interest and taxes (“EBIT”) fell 25% to $354 million — reflecting lower sales and higher net warranty costs related to its seating business, which were offset by continued productivity and efficiency improvements and lower net engineering costs, including spending on its electrification and active safety businesses.

Adjusted earnings per share of $0.78 fell 28% year-over-year. Magna updated its 2025 sales forecast to $40.0-$41.6 billion and adjusted EBIT margin to 5.1-5.6%.

Click here to download our most recent Sure Analysis report on MGA (preview of page 1 of 3 shown below):

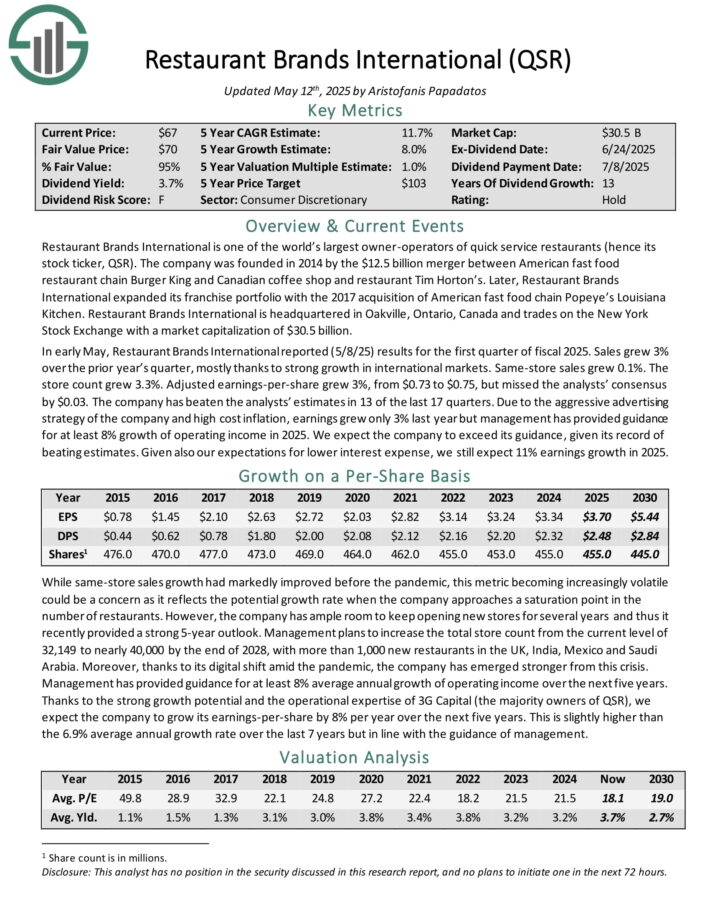

Best Canadian Dividend Stock #4: Restaurant Brands International (QSR)

- Annual Expected Returns: 11.8%

Restaurant Brands International is one of the world’s largest owner-operators of quick service restaurants. The company was founded in 2014 by the $12.5 billion merger between American fast food restaurant chain Burger King and Canadian coffee shop and restaurant Tim Horton’s.

Later, Restaurant Brands International expanded its franchise portfolio with the 2017 acquisition of American fast food chain Popeye’s Louisiana Kitchen.

In early May, Restaurant Brands International reported (5/8/25) results for the first quarter of fiscal 2025. Sales grew 3% over the prior year’s quarter, mostly thanks to strong growth in international markets. Same-store sales grew 0.1%.

The store count grew 3.3%. Adjusted earnings-per-share grew 3%, from $0.73 to $0.75, but missed the analysts’ consensus by $0.03. The company has beaten the analysts’ estimates in 13 of the last 17 quarters.

Due to the aggressive advertising strategy of the company and high cost inflation, earnings grew only 3% last year but management has provided guidance for at least 8% growth of operating income in 2025.

Click here to download our most recent Sure Analysis report on QSR (preview of page 1 of 3 shown below):

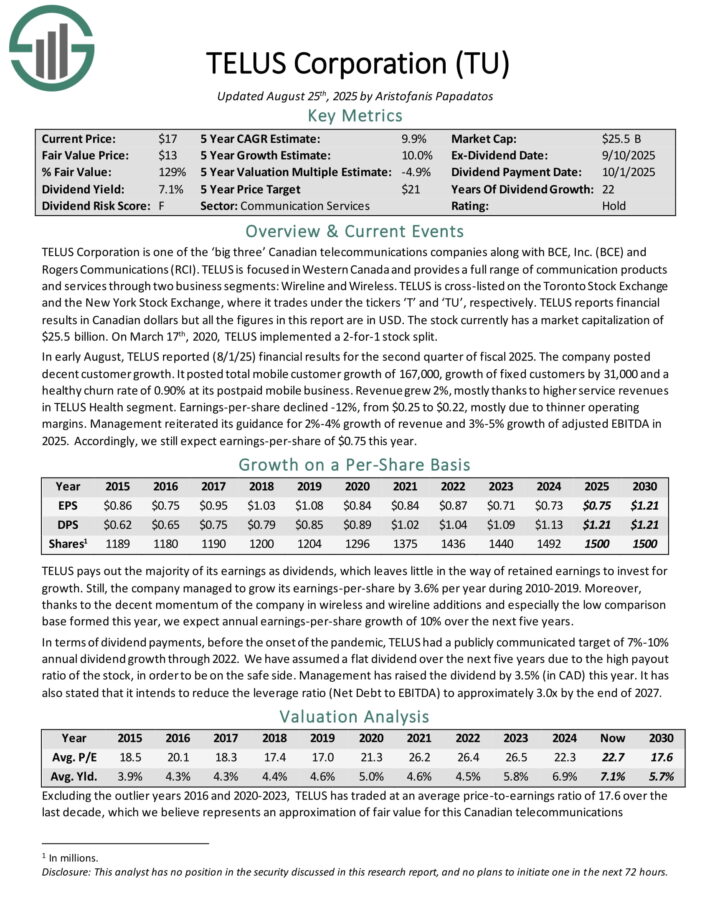

Best Canadian Dividend Stock #3: Telus Corp. (TU)

- Annual Expected Returns: 12.5%

TELUS Corporation is one of the ‘big three’ Canadian telecommunications companies. TELUS is focused in Western Canada and provides a full range of communication products and services through two business segments: Wireline and Wireless.

In early August, TELUS reported (8/1/25) financial results for the second quarter of fiscal 2025. The company posted decent customer growth.

It posted total mobile customer growth of 167,000, growth of fixed customers by 31,000 and a healthy churn rate of 0.90% at its postpaid mobile business.

Revenue grew 2%, mostly thanks to higher service revenues in TELUS Health segment. Earnings-per-share declined -12%, from $0.25 to $0.22, mostly due to thinner operating margins.

Management reiterated its guidance for 2%-4% growth of revenue and 3%-5% growth of adjusted EBITDA in 2025.

Click here to download our most recent Sure Analysis report on TU (preview of page 1 of 3 shown below):

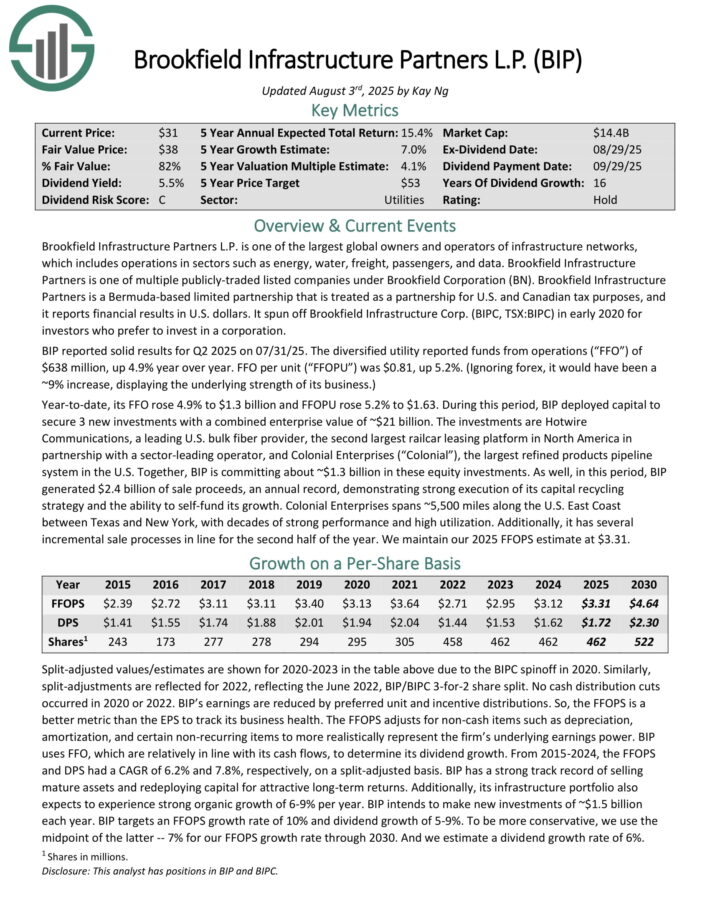

Best Canadian Dividend Stock #2: Brookfield Infrastructure Partners LP (BIP)

- Annual Expected Returns: 12.9%

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data. Brookfield Infrastructure Partners is one of multiple publicly-traded listed companies under Brookfield Corporation (BN).

BIP reported solid results for Q2 2025 on 07/31/25. The diversified utility reported funds from operations of $638 million, up 4.9% year over year. FFO per unit was $0.81, up 5.2%. Year-to-date, its FFO rose 4.9% to $1.3 billion and FFOPU rose 5.2% to $1.63.

During this period, BIP deployed capital to secure 3 new investments with a combined enterprise value of ~$21 billion. The investments are Hotwire Communications, a leading U.S. bulk fiber provider, the second largest railcar leasing platform in North America in partnership with a sector-leading operator, and Colonial Enterprises (“Colonial”), the largest refined products pipeline system in the U.S.

Together, BIP is committing about ~$1.3 billion in these equity investments. As well, in this period, BIP generated $2.4 billion of sale proceeds, an annual record, demonstrating strong execution of its capital recycling strategy and the ability to self-fund its growth.

Colonial Enterprises spans ~5,500 miles along the U.S. East Coast between Texas and New York, with decades of strong performance and high utilization. Additionally, it has several incremental sale processes in line for the second half of the year.

Click here to download our most recent Sure Analysis report on BIP (preview of page 1 of 3 shown below):

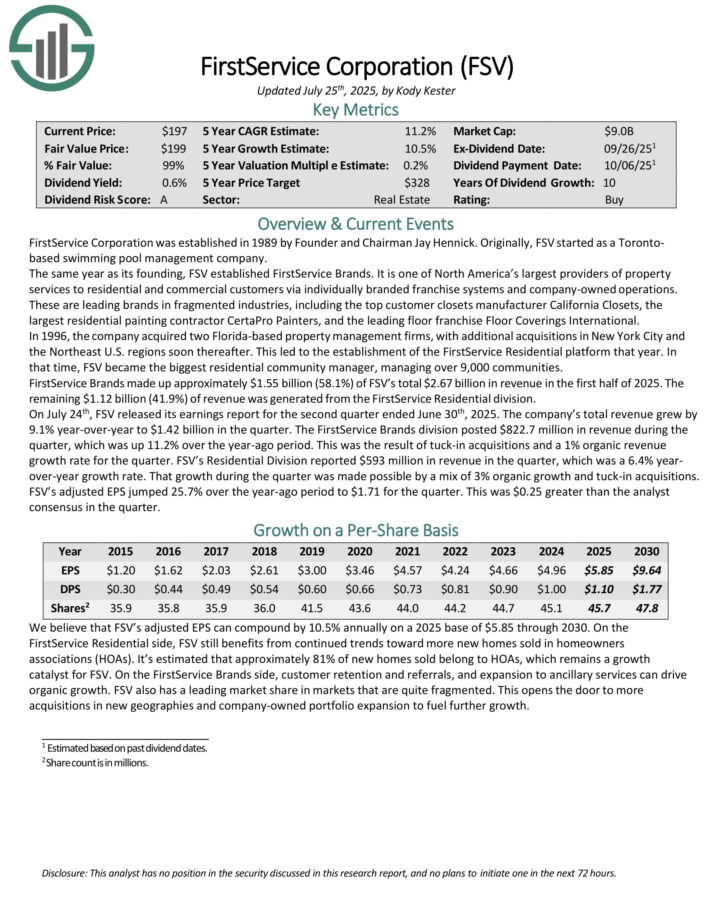

Best Canadian Dividend Stock #1: FirstService Corp. (FSV)

- Annual Expected Returns: 15.3%

FirstService Corporation is one of North America’s largest providers of property services to residential and commercial customers via individually branded franchise systems and company-owned operations.

These are leading brands in fragmented industries, including the top customer closets manufacturer California Closets, the largest residential painting contractor CertaPro Painters, and the leading floor franchise Floor Coverings International.

FirstService Brands made up approximately $1.55 billion (58.1%) of FSV’s total $2.67 billion in revenue in the first half of 2025. The remaining $1.12 billion (41.9%) of revenue was generated from the FirstService Residential division.

On July 24th, FSV released its earnings report for the second quarter ended June 30th, 2025. The company’s total revenue grew by 9.1% year-over-year to $1.42 billion in the quarter. The FirstService Brands division posted $822.7 million in revenue during the quarter, which was up 11.2% over the year-ago period.

This was the result of tuck-in acquisitions and a 1% organic revenue growth rate for the quarter. FSV’s Residential Division reported $593 million in revenue in the quarter, which was a 6.4% year-over-year growth rate.

That growth during the quarter was made possible by a mix of 3% organic growth and tuck-in acquisitions. FSV’s adjusted EPS jumped 25.7% over the year-ago period to $1.71 for the quarter.

Click here to download our most recent Sure Analysis report on FSV (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Canadian Dividend Stocks

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stocks: Kings, Aristocrats, and Achievers