Article updated on November 15th, 2024 by Bob Ciura

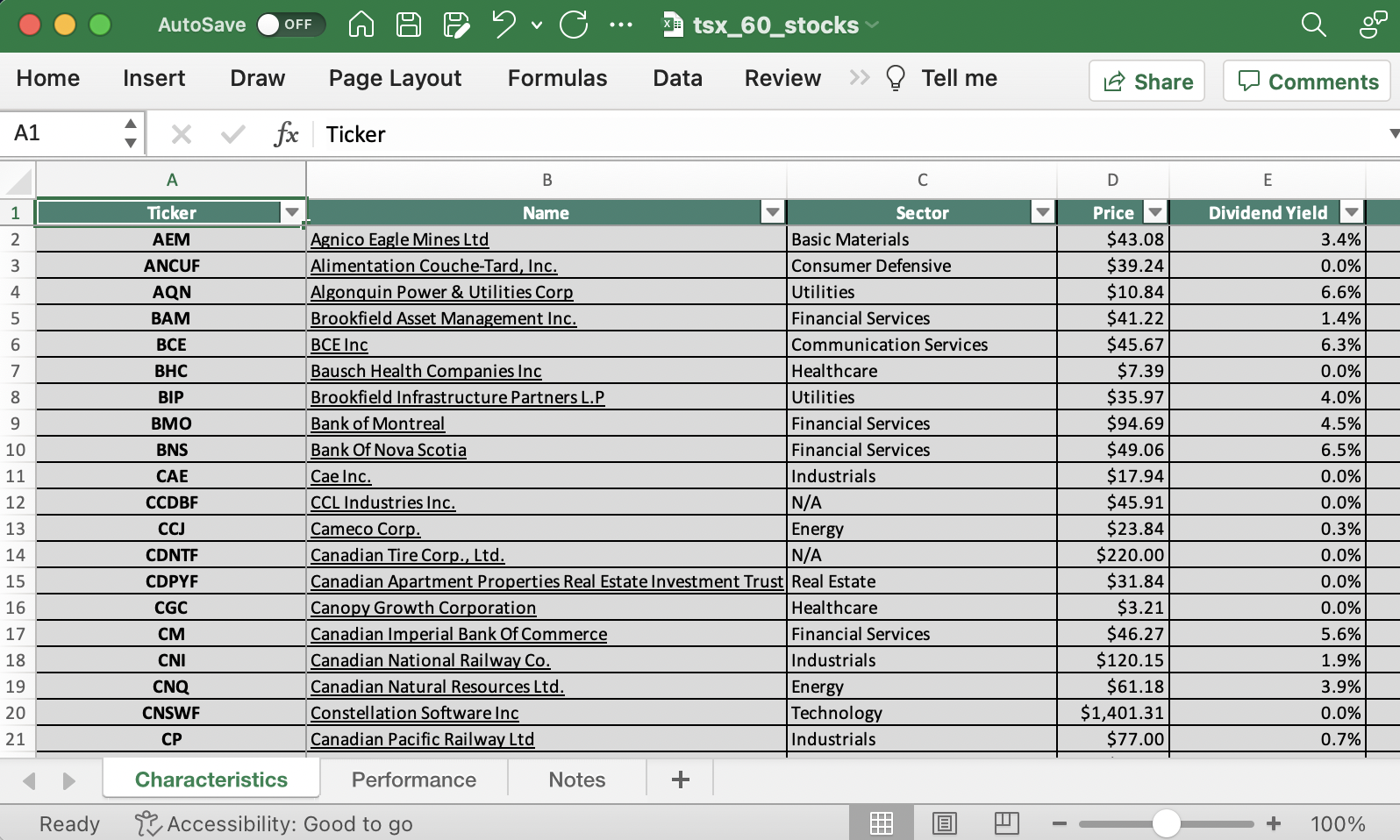

Spreadsheet data updated daily

The TSX 60 Index is a stock market index of the 60 largest companies that trade on the Toronto Stock Exchange.

Because the Canadian stock market is heavily weighted towards large financial institutions and energy companies, the TSX is a reasonable benchmark for Canadian equities performance. It is also a great place to look for investment ideas.

You can download a database of the companies within the TSX 60 (along with relevant financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

The TSX 60 Stocks List available for download above contains the following information for every security within the index:

- Stock Price

- Dividend Yield

- Market Capitalization

- Price-to-Earnings Ratio

All of the financial data in the database are listed in Canadian dollars. Keep reading this article to learn more about maximizing the power of the TSX 60 Stocks List.

How To Use The TSX 60 Stocks List To Find Investment Ideas

Having an Excel document that contains the names, tickers, and financial data for every stock within the TSX 60 Index can be extremely useful.

This document becomes even more powerful when combined with a fundamental knowledge of how to use Microsoft Excel to implement rudimentary investing screens.

With that in mind, the following tutorial will show you how to implement a useful investing screen for the TSX 60 Stocks List.

Excel Spreadsheet Screen Tutorial: TSX 60 Stocks With P/Es < 20 and Dividend Yields > 2%

Step 1: Download the TSX 60 Stocks List by clicking here.

Step 2: Set the spreadsheet’s columns to filter.

Step 3: Change the filter setting for P/E Ratio to find securities with P/E ratios between 0 and 20. This will screen out negative P/E’ ratio stocks that are a result of negative earnings, as well as stocks with P/E ratios of 20 or more.

Step 4: Change the filter setting for Dividend Yield to find securities with dividend yields greater than 2%.

The remaining stocks in this spreadsheet are TSX 60 Index constituents with price-to-earnings ratios below 20 and dividend yields above 2%.

To conclude this article, we’ll share other Sure Dividend resources that you can use to enhance the quality of your investing due diligence.

Final Thoughts: Other Dividend Growth Investing Resources

The TSX 60 Index contains the 60 largest companies that trade on the Toronto Stock Exchange. Because of its exclusivity, it does not contain all of the Canadian stocks.

For investors interested in achieving some Canadian exposure within their investment portfolios, we recommended sifting through the broader S&P/TSX Composite Index.

In addition, we have covered several different aspects of investing in the Canadian market in the articles below:

- Canadian Taxes for US Investors: The Comprehensive Guide

- U.S. Taxes For Canadian Investors: What You Need To Know

Alternatively, you may search through these databases and determine that investing in international stocks is not for you.

Sure Dividend has also created databases of domestic stocks by sector, which we update weekly. These sector-specific stock market resources can be accessed below:

- The Complete List of Financial Stocks

- The Complete List of Energy Stocks

- The Complete List of Consumer Staples Stocks

- The Complete List of Consumer Discretionary Stocks

- The Complete List of Communication Services Stocks

- The Complete List of Technology Stocks

- The Complete List of Industrial Stocks

- The Complete List of Materials Stocks

- The Complete List of Healthcare Stocks

- The Complete List of Utility Stocks

Our last group of stock market databases contains securities that meet certain requirements when it comes to dividend payout schedules, dividend yields, corporate history, or legal structure.

Consider this a catch-all for the Sure Dividend databases that do not group nicely with our other resources:

- The Best High Dividend Stocks List: 300+ companies with 5%+ dividend yields.

- The Best Monthly Dividend Stock List: 70+ companies that pay their dividends every month, instead of quarterly or annually.

- MLP List: master limited partnerships are tax-efficient corporate vehicles whose operations concentrate on the ownership of pipelines and other energy infrastructure assets.

- REIT List: real estate investment trusts are similar to MLPs but focus on owning real estate properties instead of energy infrastructure.

- Dividend Achievers List: NASDAQ stocks with 10+ years of rising dividends.

- Dividend Aristocrats List: S&P 500 stocks with 25+ years of rising dividends.

- Dividend Champions List: Stocks with 25+ years of rising dividends, but do not qualify as Dividend Aristocrats.

- Dividend Kings List: Stocks with 50+ years of rising dividends.

- The Blue Chip Stocks List: A combination of our Dividend Kings, Dividend Aristocrats, and Dividend Achievers lists.