Updated on September 30th, 2025 by Bob Ciura

Water is one of the basic necessities of human life. Life as we know it cannot exist without water. For this simple reason, water may be the most valuable commodity on Earth.

It is only natural for investors to consider purchasing water stocks. There are many different companies that can give investors exposure to the water business, such as water utilities. Some other companies are engaged in water purification.

In all, we have compiled a list of nearly 50 stocks that are in the business of water. The list was derived from two of the top water industry exchange-traded funds:

- Invesco Water Resources ETF (PHO)

- First Trust ISE Water Index Fund (FIW)

You can download a spreadsheet with all 46 water stocks (along with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the link below:

In addition to the Excel spreadsheet above, this article covers our top 10 water stocks today, that we cover in the Sure Analysis Research Database.

The top water stocks are ranked according to their annual expected returns over the next five years, in order of lowest to highest.

Table of Contents

- Water Stock #10: Advanced Drainage Systems (WMS)

- Water Stock #9: Lindsay Corporation (LNN)

- Water Stock #8: Masco Corporation (MAS)

- Water Stock #7: Roper Technologies (ROP)

- Water Stock #6: Artesian Resources (ARTNA)

- Water Stock #5: Tetra Tech (TTEK)

- Water Stock #4: IDEX Corporation (IEX)

- Water Stock #3: Agilent Technologies (A)

- Water Stock #2: Badger Meter Inc. (BMI)

- Water Stock #1: H2O America (HTO)

Water Stock #10: Advanced Drainage Systems (WMS)

- 5-year expected annual returns: 10.4%

Advanced Drainage Systems is a leading manufacturer of innovative storm water and onsite septic wastewater solutions.

The company’s products include single, double, and triple-wall corrugated polypropylene and polyethylene pipes, septic tanks and accessories, water-quality filters and separators, PVC hubs, and stainless-steel bands.

The Pipe segment comprised the majority (53.6%) of ADS’ $2.9 billion in total net sales in its fiscal year 2025 ended March 31.

The Allied Products & Other segment (additional water management products like storm retention/detention and septic chambers) contributed another 24.4% to the company’s FY 2025 net sales.

The Infiltrator segment (e.g., septic tanks and accessories) contributed 20.5% of ADS’ FY 2025 net sales.

Finally, the International segment chipped in the remaining 7.1% of FY 2025 net sales (percentages don’t add up to 100% because of $162.8 million in inter-segment eliminations in FY 2025).

On August 7th, ADS released its fiscal first-quarter earnings report for the period ended June 30th, 2025. The company’s net sales increased by 1.8% year-over-year to $829.9 million during the quarter. ADS’ Pipe segment net sales decreased by 2.8% over the year-ago period to $441.1 million in the quarter.

The International segment’s net sales dropped by 19.3% year-over-year to $49.7 million for the quarter. These declines were more than offset by growth in the Infiltrator and Allied Products & Other segments (+19.3% to $195 million and +1.4% to $191.2 million) during the quarter.

Adjusted diluted EPS decreased by 5.3% over the year-ago period to $1.95 in the quarter. That topped the analyst consensus by $0.19 for the quarter.

Click here to download our most recent Sure Analysis report on WMS (preview of page 1 of 3 shown below):

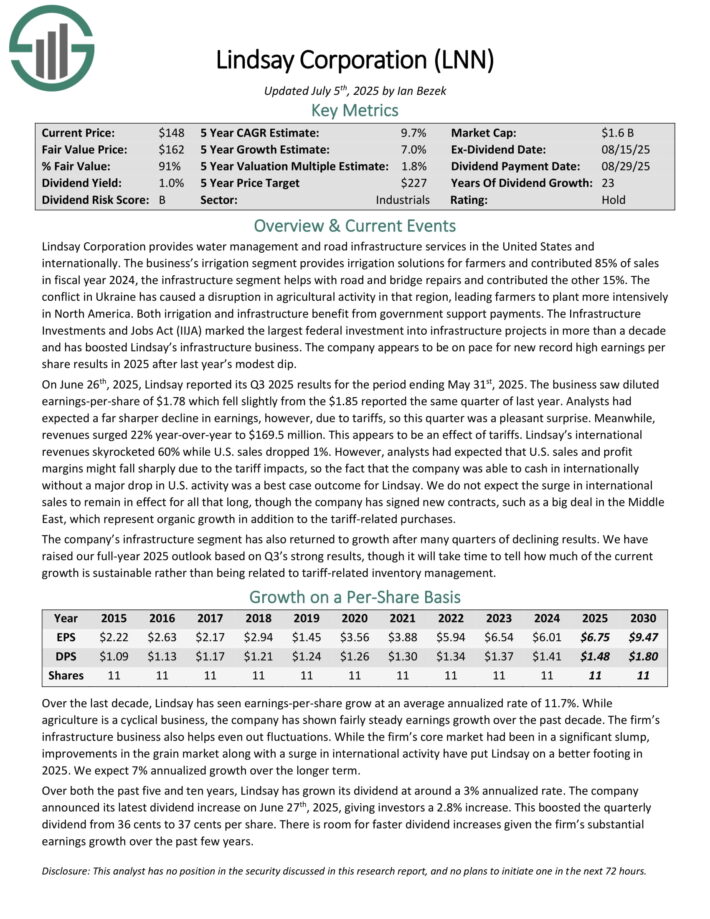

Water Stock #9: Lindsay Corporation (LNN)

- 5-year expected annual returns: 10.9%

Lindsay Corporation provides water management and road infrastructure services in the United States and internationally.

The irrigation segment provides irrigation solutions for farmers and contributed 85% of sales in fiscal year 2024, the infrastructure segment helps with road and bridge repairs and contributed the other 15%.

On June 26th, 2025, Lindsay reported its Q3 2025 results for the period ending May 31st, 2025. The business saw diluted earnings-per-share of $1.78 which fell slightly from the $1.85 reported the same quarter of last year.

Analysts had expected a far sharper decline in earnings, however, due to tariffs, so this quarter was a pleasant surprise. Meanwhile, revenues surged 22% year-over-year to $169.5 million.

This appears to be an effect of tariffs. Lindsay’s international revenues skyrocketed 60% while U.S. sales dropped 1%.

Lindsay has averaged a payout ratio of 41% over the past 10 years. It is far below that today. We project that the dividend will be safe since the low payout ratio signifies that the dividend is well-covered from earnings.

Even though the business is in a cyclical industry, Lindsay has a very safe balance sheet, with minimal net debt. In addition, the company has remained profitable even during down periods for crop prices which speaks to the firm’s stability.

Click here to download our most recent Sure Analysis report on LNN (preview of page 1 of 3 shown below):

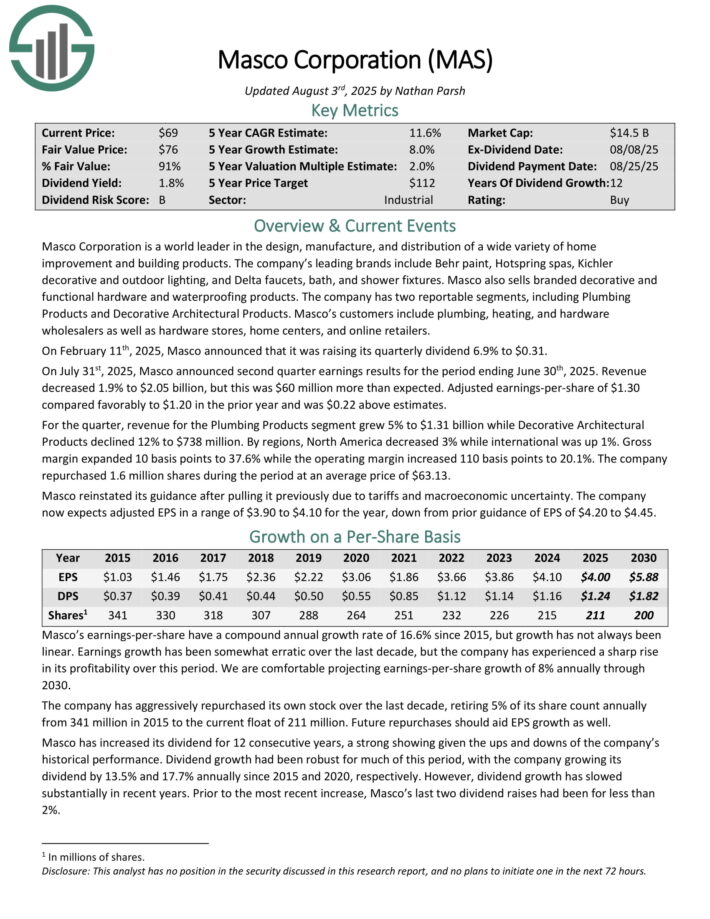

Water Stock #8: Masco Corporation (MAS)

- 5-year expected annual returns: 11.3%

Masco Corporation is a world leader in the design, manufacture, and distribution of a wide variety of home improvement and building products.

Its leading brands include Behr paint, Hotspring spas, Kichler decorative and outdoor lighting, and Delta faucets, bath, and shower fixtures. Masco also sells branded decorative and functional hardware and waterproofing products.

The company has two reportable segments, including Plumbing Products and Decorative Architectural Products. Masco’s customers include plumbing, heating, and hardware wholesalers as well as hardware stores, home centers, and online retailers.

On February 11th, 2025, Masco raised its quarterly dividend 6.9% to $0.31.

On July 31st, 2025, Masco announced second quarter earnings results for the period ending June 30th, 2025. Revenue decreased 1.9% to $2.05 billion, but this was $60 million more than expected. Adjusted earnings-per-share of $1.30 compared favorably to $1.20 in the prior year and was $0.22 above estimates.

For the quarter, revenue for the Plumbing Products segment grew 5% to $1.31 billion while Decorative Architectural Products declined 12% to $738 million. By regions, North America decreased 3% while international was up 1%.

Gross margin expanded 10 basis points to 37.6% while the operating margin increased 110 basis points to 20.1%. The company repurchased 1.6 million shares during the period at an average price of $63.13.

Masco reinstated its guidance after pulling it previously due to tariffs and macroeconomic uncertainty. The company now expects adjusted EPS in a range of $3.90 to $4.10 for the year, down from prior guidance of EPS of $4.20 to $4.45.

Click here to download our most recent Sure Analysis report on MAS (preview of page 1 of 3 shown below):

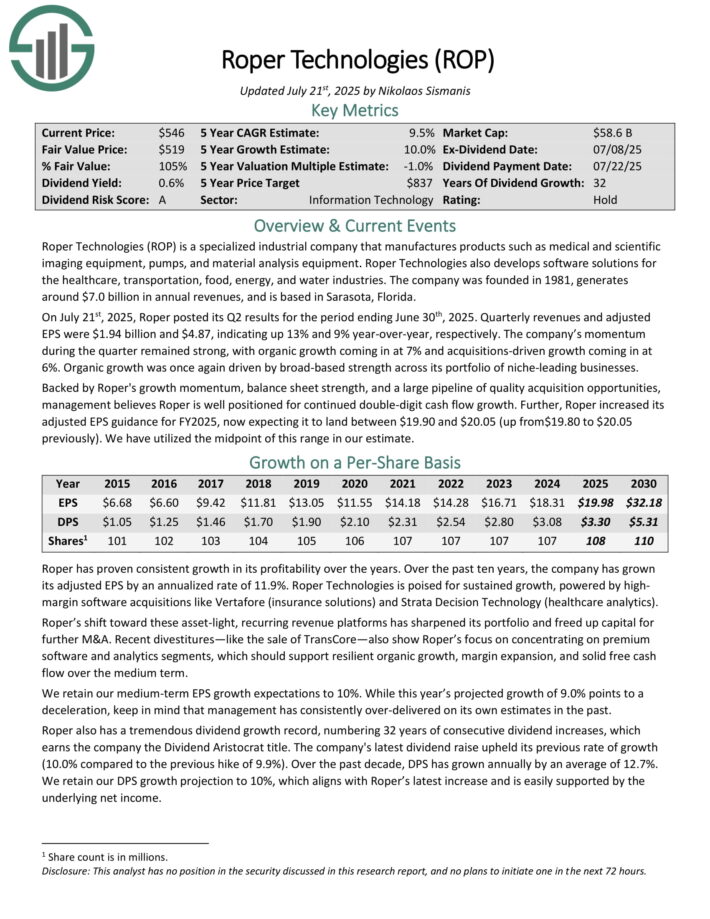

Water Stock #7: Roper Technologies (ROP)

- 5-year expected annual returns: 11.4%

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment.

Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries. The company was founded in 1981, generates around $7.0 billion in annual revenues, and is based in Sarasota, Florida.

On July 21st, 2025, Roper posted its Q2 results for the period ending June 30th, 2025. Quarterly revenues and adjusted EPS were $1.94 billion and $4.87, indicating up 13% and 9% year-over-year, respectively.

The company’s momentum during the quarter remained strong, with organic growth coming in at 7% and acquisitions-driven growth coming in at 6%. Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses.

Backed by Roper’s growth momentum, balance sheet strength, and a large pipeline of quality acquisition opportunities, management believes Roper is well positioned for continued double-digit cash flow growth.

Further, Roper increased its adjusted EPS guidance for FY2025, now expecting it to land between $19.90 and $20.05.

Click here to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

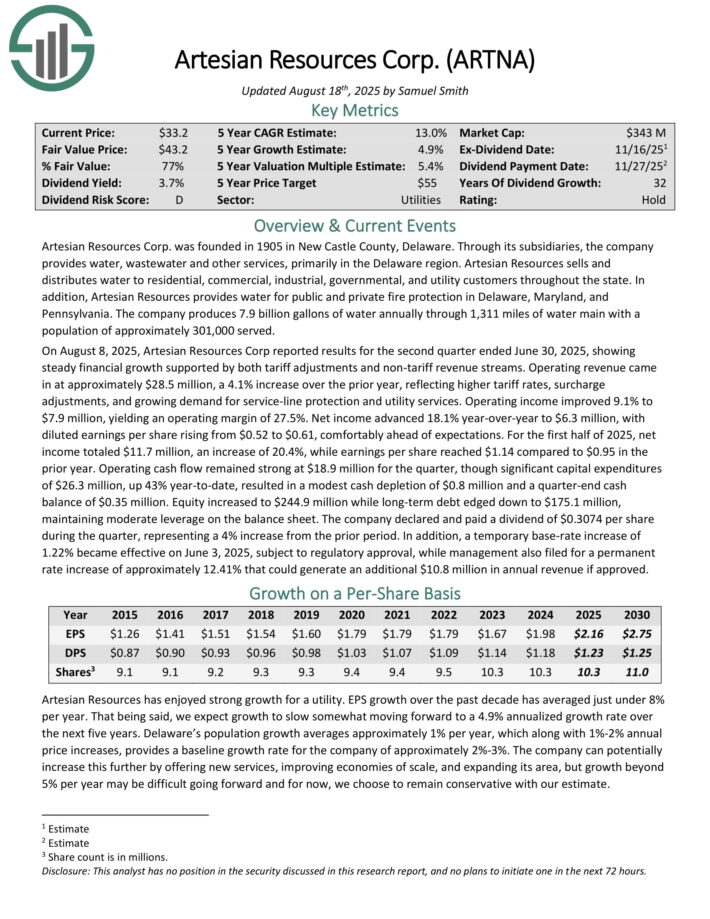

Water Stock #6: Artesian Resources (ARTNA)

- 5-year expected annual returns: 13.6%

Artesian Resources Corp. was founded in 1905 in New Castle County, Delaware. Through its subsidiaries, the company provides water, wastewater and other services, primarily in the Delaware region.

Artesian Resources sells and distributes water to residential, commercial, industrial, governmental, and utility customers throughout the state.

In addition, Artesian Resources provides water for public and private fire protection in Delaware, Maryland, and Pennsylvania.

The company produces 7.9 billion gallons of water annually through 1,311 miles of water main with a population of approximately 301,000 served.

On August 8, 2025, Artesian Resources Corp reported results for the second quarter ended June 30, 2025, showing steady financial growth supported by both tariff adjustments and non-tariff revenue streams.

Operating revenue came in at approximately $28.5 million, a 4.1% increase over the prior year, reflecting higher tariff rates, surcharge adjustments, and growing demand for service-line protection and utility services.

Operating income improved 9.1% to $7.9 million, yielding an operating margin of 27.5%. Net income advanced 18.1% year-over-year to $6.3 million, with diluted earnings per share rising from $0.52 to $0.61, comfortably ahead of expectations.

The company declared and paid a dividend of $0.3074 per share during the quarter, representing a 4% increase from the prior period.

Click here to download our most recent Sure Analysis report on ARTNA (preview of page 1 of 3 shown below):

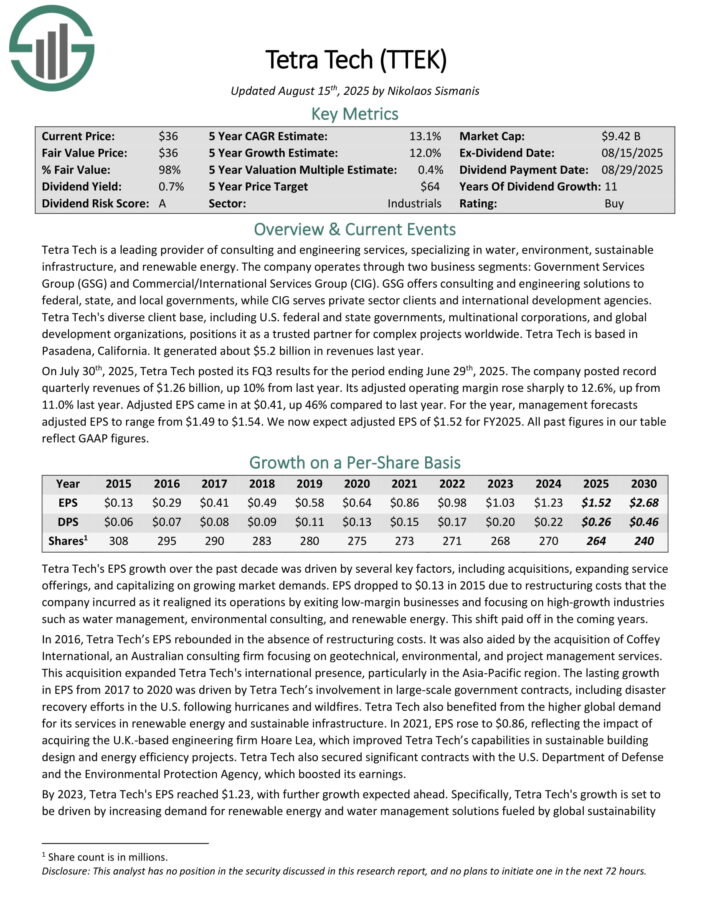

Water Stock #5: Tetra Tech (TTEK)

- 5-year expected annual returns: 14.3%

Tetra Tech is a leading provider of consulting and engineering services, specializing in water, environment, sustainable infrastructure, and renewable energy.

The company operates through two business segments: Government Services Group (GSG) and Commercial/International Services Group (CIG).

GSG offers consulting and engineering solutions to federal, state, and local governments, while CIG serves private sector clients and international development agencies.

On July 30th, 2025, Tetra Tech posted its FQ3 results for the period ending June 29th, 2025. The company posted record quarterly revenues of $1.26 billion, up 10% from last year.

Its adjusted operating margin rose sharply to 12.6%, up from 11.0% last year. Adjusted EPS came in at $0.41, up 46% compared to last year.

For the year, management forecasts adjusted EPS to range from $1.49 to $1.54. We now expect adjusted EPS of $1.52 for FY2025.

Click here to download our most recent Sure Analysis report on TTEK (preview of page 1 of 3 shown below):

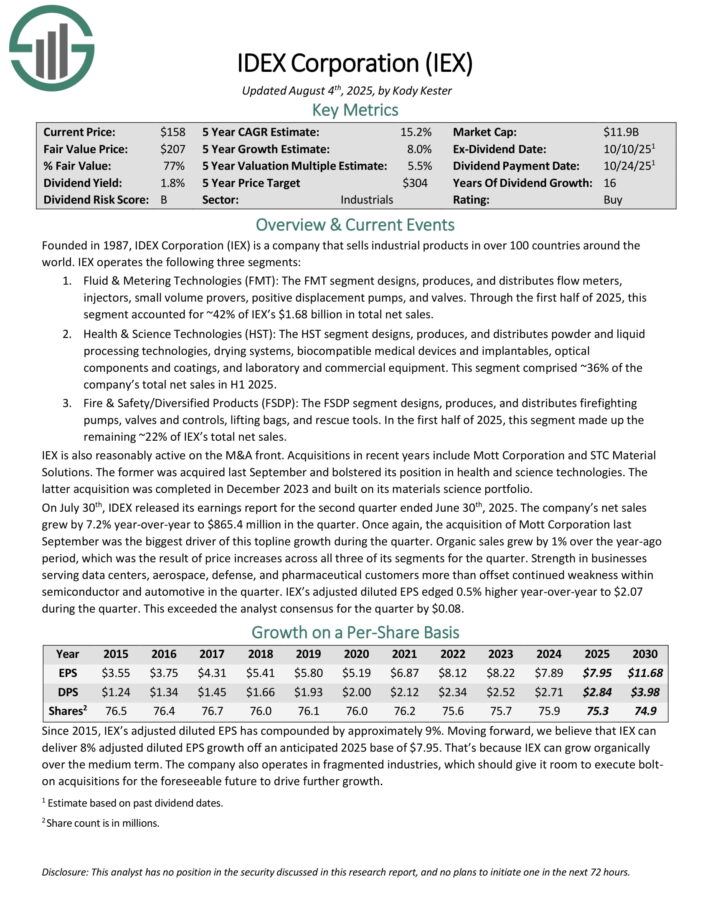

Water Stock #4: IDEX Corporation (IEX)

- 5-year expected annual returns: 14.7%

IDEX Corporation sells industrial products in over 100 countries around the world.

IEX operates the following three segments. The Fluid & Metering Technologies (FMT) segment designs, produces, and distributes flow meters, injectors, small volume provers, positive displacement pumps, and valves.

The Health & Science Technologies segment designs, produces, and distributes powder and liquid processing technologies, drying systems, biocompatible medical devices and implantables, optical components and coatings, and laboratory and commercial equipment.

The Fire & Safety/Diversified Products segment designs, produces, and distributes firefighting pumps, valves and controls, lifting bags, and rescue tools.

On July 30th, IDEX released its earnings report for the second quarter ended June 30th, 2025. The company’s net sales grew by 7.2% year-over-year to $865.4 million in the quarter.

Once again, the acquisition of Mott Corporation last September was the biggest driver of this topline growth during the quarter.

Organic sales grew by 1% over the year-ago period, which was the result of price increases across all three of its segments for the quarter.

Strength in businesses serving data centers, aerospace, defense, and pharmaceutical customers more than offset continued weakness within semiconductor and automotive in the quarter.

Adjusted diluted EPS edged 0.5% higher year-over-year to $2.07 during the quarter. This exceeded the analyst consensus for the quarter by $0.08.

Click here to download our most recent Sure Analysis report on IEX (preview of page 1 of 3 shown below):

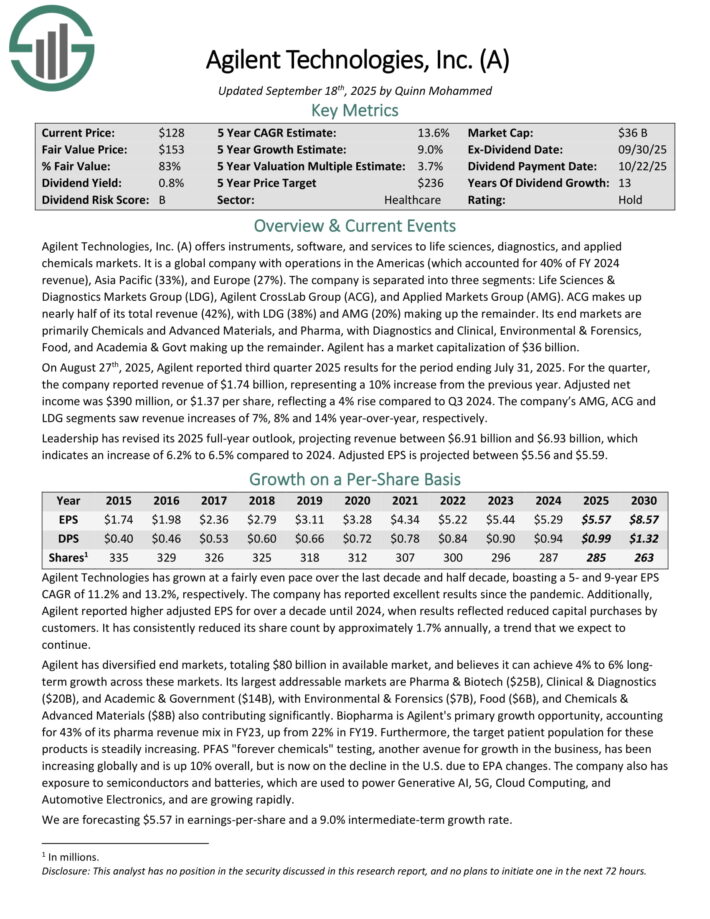

Water Stock #3: Agilent Technologies (A)

- 5-year expected annual returns: 14.8%

Agilent Technologies offers instruments, software, and services to life sciences, diagnostics, and applied chemicals markets. It is a global company with operations in the Americas (which accounted for 40% of FY 2024 revenue), Asia Pacific (33%), and Europe (27%).

The company is separated into three segments: Life Sciences & Diagnostics Markets Group (LDG), Agilent CrossLab Group (ACG), and Applied Markets Group (AMG). ACG makes up nearly half of its total revenue (42%), with LDG (38%) and AMG (20%) making up the remainder.

Its end markets are primarily Chemicals and Advanced Materials, and Pharma, with Diagnostics and Clinical, Environmental & Forensics, Food, and Academia & Govt making up the remainder.

On August 27th, 2025, Agilent reported third quarter 2025 results for the period ending July 31, 2025. For the quarter, the company reported revenue of $1.74 billion, representing a 10% increase from the previous year.

Adjusted net income was $390 million, or $1.37 per share, reflecting a 4% rise compared to Q3 2024. The company’s AMG, ACG and LDG segments saw revenue increases of 7%, 8% and 14% year-over-year, respectively.

Leadership has revised its 2025 full-year outlook, projecting revenue between $6.91 billion and $6.93 billion, which indicates an increase of 6.2% to 6.5% compared to 2024. Adjusted EPS is projected between $5.56 and $5.59.

Click here to download our most recent Sure Analysis report on A (preview of page 1 of 3 shown below):

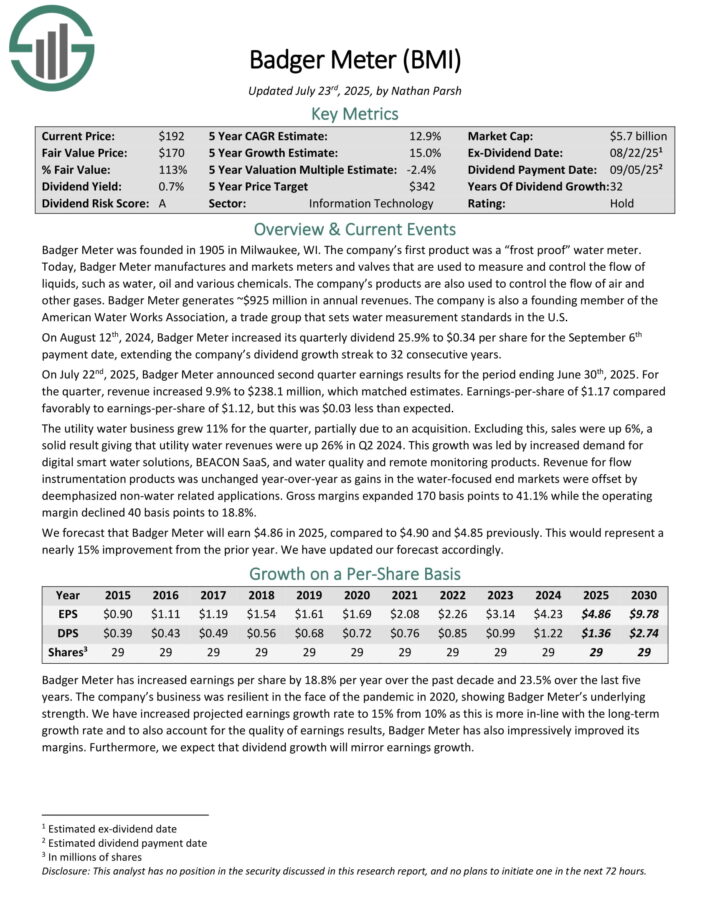

Water Stock #2: Badger Meter (BMI)

- 5-year expected annual returns: 14.8%

Badger Meter manufactures and markets meters and valves that are used to measure and control the flow of liquids, such as water, oil and various chemicals.

Its products are also used to control the flow of air and other gases. Badger Meter generates ~$925 million in annual revenues.

On July 22nd, 2025, Badger Meter announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue increased 9.9% to $238.1 million, which matched estimates.

Earnings-per-share of $1.17 compared favorably to earnings-per-share of $1.12, but this was $0.03 less than expected.

The utility water business grew 11% for the quarter, partially due to an acquisition. Excluding this, sales were up 6%, a solid result giving that utility water revenues were up 26% in Q2 2024.

This growth was led by increased demand for digital smart water solutions, BEACON SaaS, and water quality and remote monitoring products.

Revenue for flow instrumentation products was unchanged year-over-year as gains in the water-focused end markets were offset by de-emphasized non-water related applications.

Gross margins expanded 170 basis points to 41.1% while the operating margin declined 40 basis points to 18.8%.

We forecast that Badger Meter will earn $4.86 in 2025, compared to $4.90 and $4.85 previously. This would represent a nearly 15% improvement from the prior year.

Click here to download our most recent Sure Analysis report on BMI (preview of page 1 of 3 shown below):

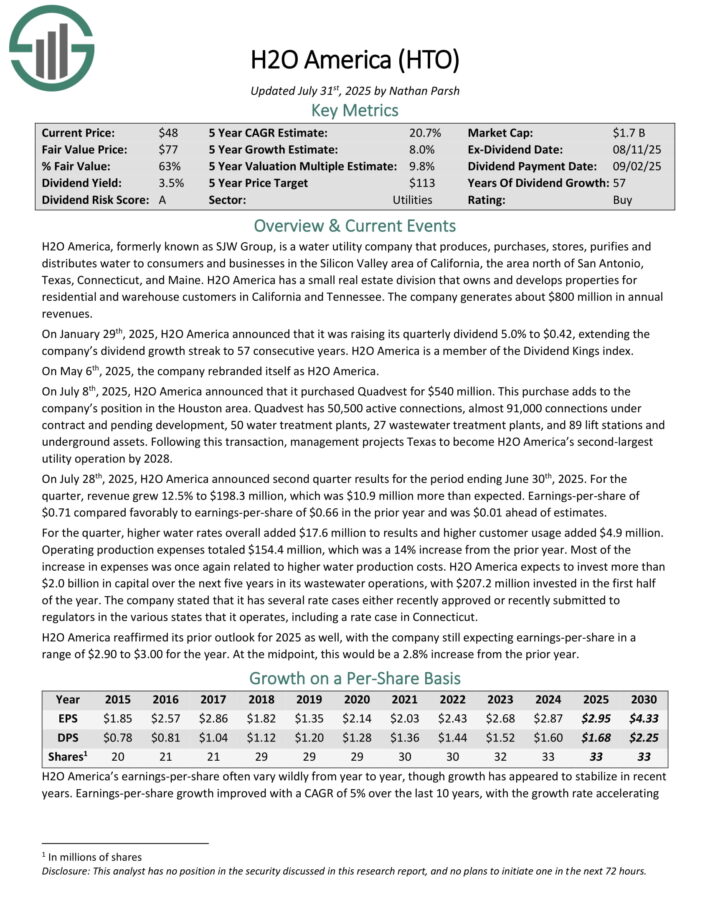

Water Stock #1: H2O America (HTO)

- 5-year expected annual returns: 20.8%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

Final Thoughts

Water could be one of the biggest investing themes over the next several decades. An increasing global population is only going to cause demand for water to rise in the future.

And, given the fact that water is a necessity of human life, demand for water should hold up extremely well, even during the worst recessions.

These factors make water stocks appealing for risk-averse investors looking for stability from their stock investments.

Additional Resources

It may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 56 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: