Updated December 10th, 2024 by Ben Reynolds

The 8 Rules of Dividend Investing help investors determine what dividend stocks to buy and sell for rising portfolio income over time.

This can help you find the right securities to build or grow your retirement portfolio for rising passive income.

All of The 8 Rules are supported by academic research and ‘common sense’ principles from some of the world’s greatest investors.

Each of The 8 Rules of Dividend Investing are listed below:

- Rule #1: The Quality Rule

- Rule #2: The Bargain Rule

- Rule #3: The Safety Rule

- Rule #4: The Growth Rule

- Rule #5: The Peace of Mind Rule

- Rule #6: The Overpriced Rule

- Rule #7: The Survival of the Fittest Rule

- Rule #8: The Hedge Your Bets Rule

Dividend Investing Rules 1 to 5: What to Buy

Rule # 1 – The Quality Rule

“The single greatest edge an investor can have is a long term orientation”

– Seth Klarman

Common Sense Idea: Invest in high quality businesses that have a proven long-term record of stability, growth, and profitability. There is no reason to own a mediocre business when you can own a high quality business.

How We Implement: Dividend history (the longer the better) is a key component of our Dividend Risk scores. The Dividend Risk score factors into the selection process for many of our premium services.

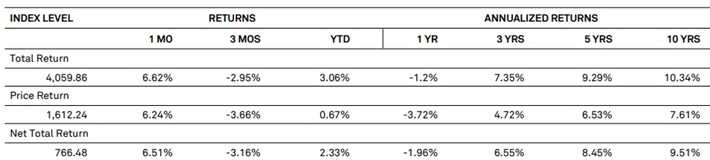

Evidence: The Dividend Aristocrats (S&P 500 stocks with 25+ years of rising dividends) have strong 10%+ annualized total returns over the last decade (as of 11/29/24).

Source: S&P 500 Dividend Aristocrats Factsheet.

Rule # 2 – The Bargain Rule

“Price is what you pay, value is what you get”

– Warren Buffett

Common Sense Idea: Invest in businesses that pay you the most dividends per dollar you invest. All things being equal, the higher the dividend yield, the better. Additionally, only invest in stocks trading below their historical average valuation multiple to avoid investing in overpriced securities.

How We Implement: In the Sure Dividend Newsletter, we only invest in stocks with dividend yields equal to or greater than the S&P 500’s dividend yield. In the Sure Retirement Newsletter, we only invest in stocks with dividend yields of 4% or greater. Dividend yield is one of three components of expected total returns, along with growth returns and valuation multiple changes.

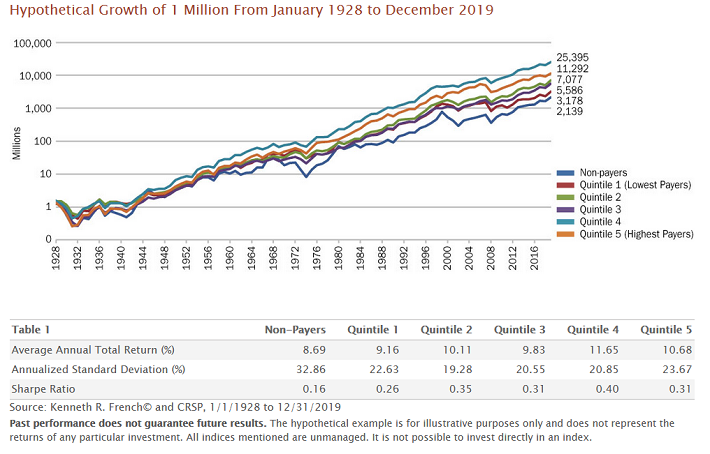

Evidence: The highest yielding quintile of stocks outperformed the lowest yielding quintile of stocks by 1.72% per year from 1928 through 2019.

Source: Dividends: A Review of Historical Returns by Heartland Funds.

Rule # 3 – The Safety Rule

“The secret of sound investment in 3 words; margin of safety”

– Benjamin Graham

Common Sense Idea: If a business is paying out all its income as dividends, it has no margin of safety. When a business downturn occurs, the dividend must be reduced. It therefore makes sense to invest in businesses that are not paying out nearly all of their earnings as dividends.

How We Implement: The payout ratio (the lower the better) is a key component of our Dividend Risk scores. The Dividend Risk score factors into the selection process for many of our premium services.

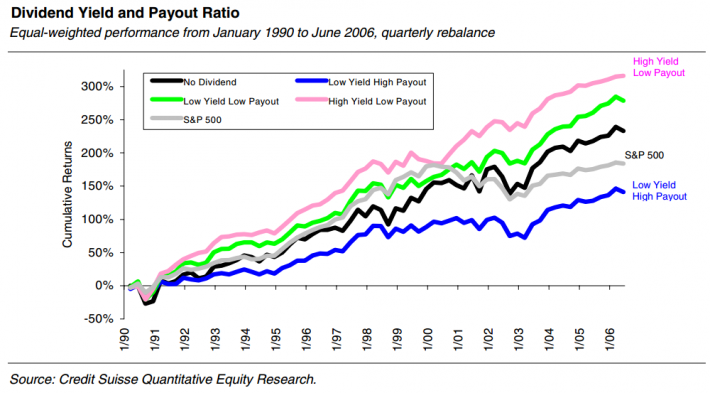

Evidence: High yield low payout ratio stocks outperformed high yield high payout ratio stocks by 8.2% per year from 1990 to 2006.

Source: High Yield, Low Payout by Barefoot, Patel, & Yao.

Rule # 4 – The Growth Rule

“All you need for a lifetime of successful investing is a few big winners”

– Peter Lynch

Common Sense Idea: Invest in businesses that have a history of solid growth (like the Dividend Kings). If a business has maintained a high growth rate for several years, they are likely to continue to do so. The more a business grows, the more profitable your investment will become. Dividends cannot grow over the long run without rising earnings.

How We Implement: We rank stocks by expected total return (the higher the better) to create our Top 10 lists in all of our premium newsletter and report services. Growth rate is one of three components of expected total returns, along with dividend yield and valuation multiple changes. We create five year forward expected growth rates for all the 900+ securities in Sure Analysis, which powers our recommendations in our other premium services.

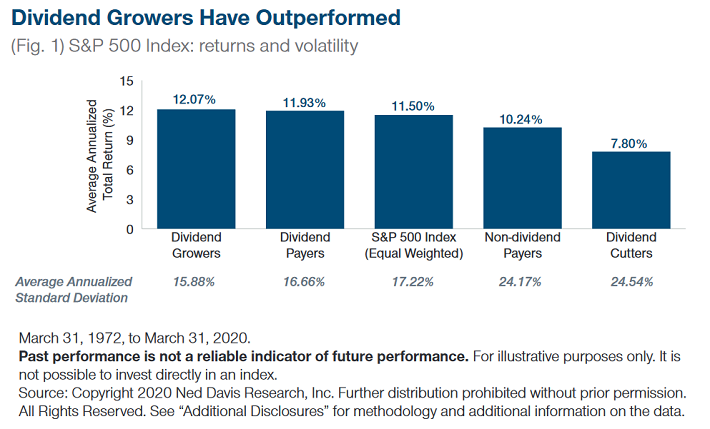

Evidence: Dividend growers have outperformed non-dividend paying stocks by 1.8% annually from March 31st 1972 through March 31st 2020.

Source: The Appeal of a Dividend Strategy Amid Chaotic Markets from T. Rowe Price.

Rule # 5 – The Peace of Mind Rule

“Psychology is probably the most important factor in the market – and one that is least understood”

– David Dreman

Common Sense Idea: Look for businesses that people invest in during recessions and times of panic. These businesses will be more likely to continue paying rising dividends during a recession. We would also expect these securities to, in general, have lower stock price standard deviations.

How We Implement: We assign a qualitative recession score to every security in the Sure Analysis Research Database. This recession score factors in to our Dividend Risk scores. The Dividend Risk score factors into the selection process for many of our premium services.

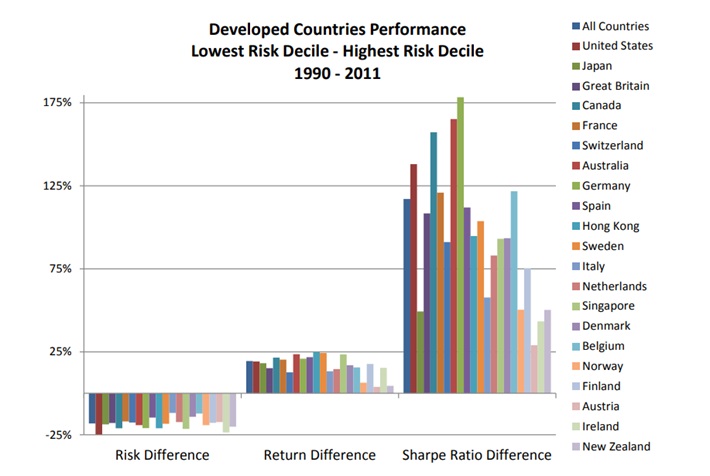

Evidence: Low volatility stocks outperformed high volatility stocks in many developed countries from 1990 through 2011.

Source: Low Risk Stocks Outperform within All Observable Markets of the World, page 5.

Dividend Investing Rules 6 & 7: When to Sell

Rule # 6 – The Overpriced Rule

“Pigs get fat, hogs get slaughtered”

– Unknown

Common Sense Idea: If you are offered $500,000 for a $250,000 house, you take the money. It is the same with a stock. If you can sell a stock for much more than it is worth, you should. Take the money and reinvest it into businesses that pay higher dividends.

How We Implement: We review past recommendations for sells in the Sure Dividend Newsletter and the Sure Retirement Newsletter when their expected total returns are below the minimum threshold of 3%. Low expected total return securities are typically overvalued and tend to have higher P/E ratios.

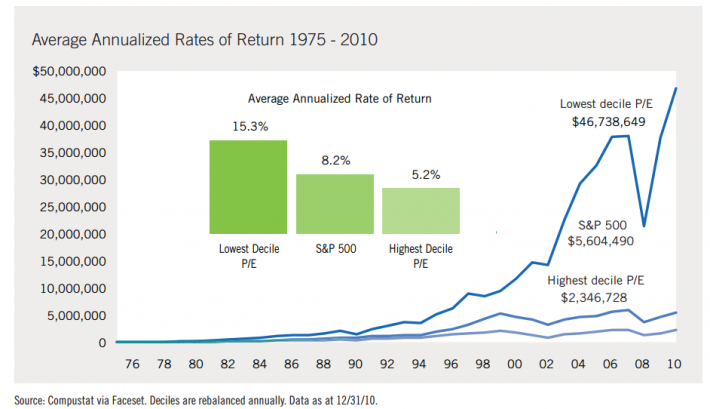

Evidence: The lowest decile of P/E stocks outperformed the highest decile by 9.02% per year from 1975 to 2010.

Source: The Case for Value by Brandes Investment Partners.

Rule # 7 – The Survival of the Fittest Rule

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes

Common Sense Idea: If a stock you own reduces its dividend, it is paying you less over time instead of more. This is the opposite of what should happen. You must admit the business has lost its competitive advantage and reinvest the proceeds of the sale into a more stable business.

Financial Rule: We issue a sell or pending sell rating for past recommendations in the Sure Dividend Newsletter and the Sure Retirement Newsletter when their dividend is reduced or eliminated. We also analyze past recommendations with an “F” Dividend Risk score for potential sells.

Evidence: Stocks that reduced or eliminated their dividends underperformed the S&P 500 and other dividend paying stock cohorts.

Source: The Power Of Dividends by Hartford Funds (data from Ned Davis Research).

Dividend Investing Rule 8: Portfolio Management

Rule # 8 – The Hedge Your Bets Rule

“The only investors who shouldn’t diversify are those who are right 100% of the time”

– John Templeton

Common Sense Idea: No one is right all the time. Spreading your investments over multiple stocks reduces the impact of being wrong on any one stock.

Financial Rule: Build a diversified portfolio over time. Use The 8 Rules of Dividend Investing as applied in our premium services to find great income securities to buy. See the portfolio building guide in our premium newsletters for more on this.

Evidence: 90% of the benefits of diversification come from owning just 12 to 18 stocks.

Source: Frank Reilly and Keith Brown, Investment Analysis and Portfolio Management, page 213.

Start Your Free Trial

The 8 Rules of Dividend Investing as applied through our premium services helps investors determine what dividend stocks to buy and sell for rising portfolio income over time.

This can help you find the right securities to build or grow your financial freedom portfolio for the long run.

We currently have a risk-free trial – pay nothing for 7 days for our premium services. We are offering you this free trial because we know the value tour premium services offer.

If you don’t feel our services are the right fit for you, notify us via email at support@suredividend.com to opt-out within your trial period and you will not be charged.

Sure Dividend Newsletter

Passive Income Newsletter