Updated on April 28th, 2025 by Bob Ciura

At Sure Dividend, we recommend investors focus on the best dividend stocks that can generate the highest returns over time.

When it comes to dividends, investors should also be focused on dividend safety. There have been many stocks with high dividend yields that eventually cut or eliminate their dividends when business conditions deteriorate.

Dividend cuts should be avoided whenever possible.

We have created a unique metric called Dividend Risk Score, which measures a stock’s ability to maintain its dividend during recessions, and increase the dividend over time.

With this in mind, we’ve compiled a free list of the 50 safest dividend stocks based on their payout ratios and Dividend Risk Score, which you can download below:

The safest dividend growth stocks are high-quality businesses that can maintain their dividends, even during recessions. But investing in poor businesses that cut their dividends is a recipe for under-performance over time.

That’s why, in this article, we have analyzed the 10 safest dividend stocks from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The safest dividend stocks below all have Dividend Risk Scores of ‘A’ (our top rating), and have the lowest payout ratios. The 10 safest dividend stocks also have dividend yields of at least 1%, to make them appealing for income investors.

Table of Contents

- Why The Payout Ratio Matters

- Safest Dividend Stock #10: Oshkosh Corp (OSK)

- Safest Dividend Stock #9: Raymond James Financial (RJF)

- Safest Dividend Stock #8: Carlisle Companies (CSL)

- Safest Dividend Stock #7: Chubb Ltd. (CB)

- Safest Dividend Stock #6: Somerset Trust Holding Company (SOME)

- Safest Dividend Stock #5: Ameriprise Financial (AMP)

- Safest Dividend Stock #4: Farmers & Merchants Bancorp (FMCB)

- Safest Dividend Stock #3: Griffon Corp. (GFF)

- Safest Dividend Stock #2: Unity Bancorp (UNTY)

- Safest Dividend Stock #1: Matson, Inc. (MATX)

Why The Payout Ratio Matters

The dividend payout ratio is simply a company’s annual per-share dividend, divided by the company’s annual earnings-per-share. It is a measure of the level of earnings a company distributes to its shareholders via dividends.

The payout ratio is a valuable investing metric because it differentiates the safest dividend stocks that have low payout ratios that room for dividend growth, from companies with high payout ratios whose dividends may not be sustainable.

Indeed, research has shown that companies with higher dividend growth have outperformed companies with lower dividend growth or no dividend growth.

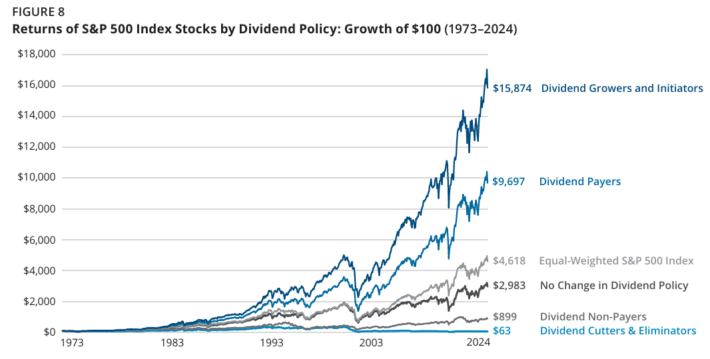

In research performed by Ned Davis and Hartford Funds, it was found that dividend growers and initiators delivered total returns of 10.24% per year from 1973 through 2024, better than the equal-weighted S&P 500’s performance of 7.65% per year.

Interestingly, the dividend growers and initiators analyzed in this study generated outperformance with less volatility – a rarity and a contradiction to what modern academic financial theory tells us.

A summary of this research can be found below.

Source: Hartford Funds – The Power Of Dividends

Outperformance of 2.47% annually might not seem like a game-changer, but it certainly is thanks to the wonder that is compound interest.

Using data from the same piece of research, investors who chose to invest exclusively in dividend growers and initiators turned $100 into $15,874 from 1973-2024. During the same time period, the S&P 500 index turned $100 into $4,618.

Source: Hartford Funds – The Power Of Dividends

Stocks that did not pay dividends could not match the performance of all types of dividend payers, turning $100 into $899 from 1973-2024. Dividend cutters and eliminators fared even worse, turning $100 into just $63–meaning these stocks actually lost investors money.

As a result, investors looking for stocks with better dividend growth (and long-term return potential) could consider these 10 safest dividend stocks with low payout ratios and Dividend Risk Scores of ‘A’.

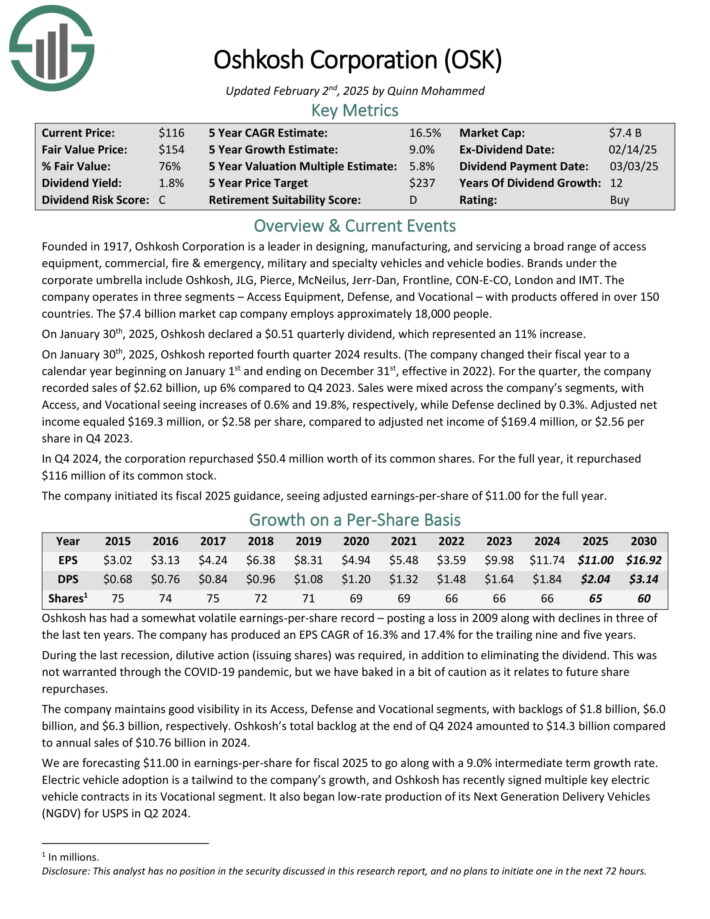

Safest Dividend Stock #10: Oshkosh Corp. (OSK)

- Payout Ratio: 18.5%

Oshkosh Corporation is a leader in designing, manufacturing, and servicing a broad range of access equipment, commercial, fire & emergency, military and specialty vehicles and vehicle bodies.

Brands under the corporate umbrella include Oshkosh, JLG, Pierce, McNeilus, Jerr-Dan, Frontline, CON-E-CO, London and IMT.

The company operates in three segments – Access Equipment, Defense, and Vocational – with products offered in over 150 countries.

On January 30th, 2025, Oshkosh reported fourth quarter 2024 results. For the quarter, the company recorded sales of $2.62 billion, up 6% compared to Q4 2023. Sales were mixed across the company’s segments, with Access, and Vocational seeing increases of 0.6% and 19.8%, respectively, while Defense declined by 0.3%.

Adjusted net income equaled $169.3 million, or $2.58 per share, compared to adjusted net income of $169.4 million, or $2.56 per share in Q4 2023.

Click here to download our most recent Sure Analysis report on OSK (preview of page 1 of 3 shown below):

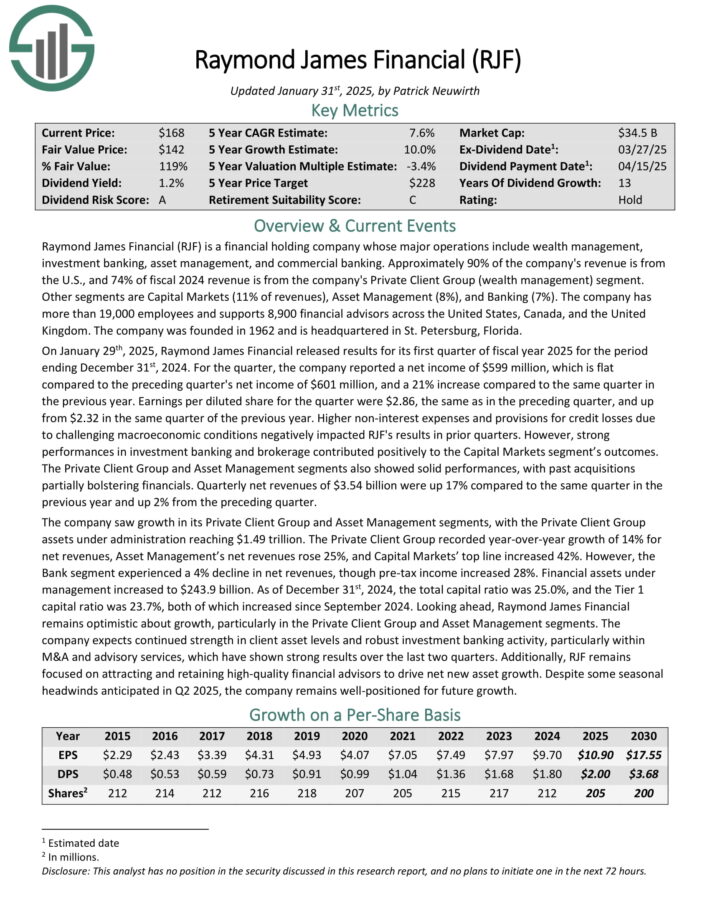

Safest Dividend Stock #9: Raymond James Financial (RJF)

- Payout ratio: 18.3%

Raymond James Financial (RJF) is a financial holding company whose major operations include wealth management, investment banking, asset management, and commercial banking. Approximately 90% of the company’s revenue is from the U.S., and 74% of fiscal 2024 revenue is from the company’s Private Client Group (wealth management) segment.

Other segments are Capital Markets (11% of revenues), Asset Management (8%), and Banking (7%). The company has more than 19,000 employees and supports 8,900 financial advisors across the United States, Canada, and the United Kingdom.

On January 29th, 2025, Raymond James Financial released results for its first quarter of fiscal year 2025 for the period ending December 31st, 2024.

For the quarter, the company reported a net income of $599 million, which is flat compared to the preceding quarter’s net income of $601 million, and a 21% increase compared to the same quarter in the previous year.

Earnings per diluted share for the quarter were $2.86, the same as in the preceding quarter, and up from $2.32 in the same quarter of the previous year. Strong performances in investment banking and brokerage contributed positively to the Capital Markets segment’s outcomes.

Click here to download our most recent Sure Analysis report on RJF (preview of page 1 of 3 shown below):

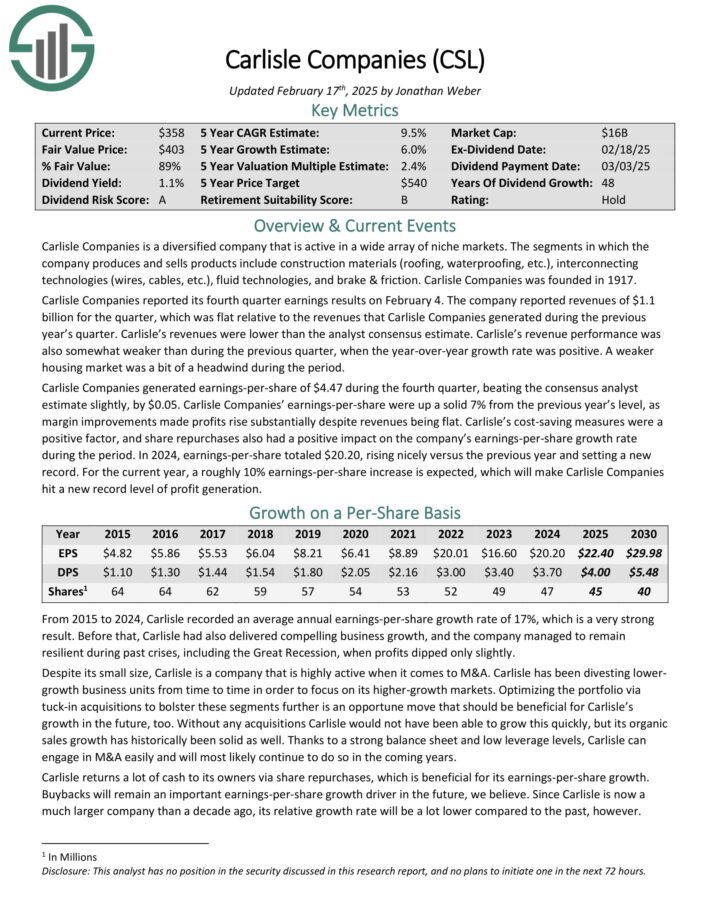

Safest Dividend Stock #8: Carlisle Companies (CSL)

- Payout Ratio: 17.9%

Carlisle Companies is a diversified company that is active in a wide array of niche markets.

The segments in which the company produces and sells products include construction materials (roofing, waterproofing, etc.), interconnecting technologies (wires, cables, etc.), fluid technologies, and brake & friction.

Carlisle Companies reported its fourth quarter earnings results on February 4. The company reported revenues of $1.1 billion for the quarter, which was flat year-over-year. A weaker housing market was a bit of a headwind during the period.

Carlisle Companies generated earnings-per-share of $4.47 during the fourth quarter, beating the consensus analyst estimate slightly, by $0.05. Carlisle Companies’ earnings-per-share were up a solid 7% from the previous year’s level, as margin improvements made profits rise substantially despite revenues being flat.

Cost-saving measures were a positive factor, and share repurchases also had a positive impact on the company’s earnings-per-share growth.

Click here to download our most recent Sure Analysis report on CSL (preview of page 1 of 3 shown below):

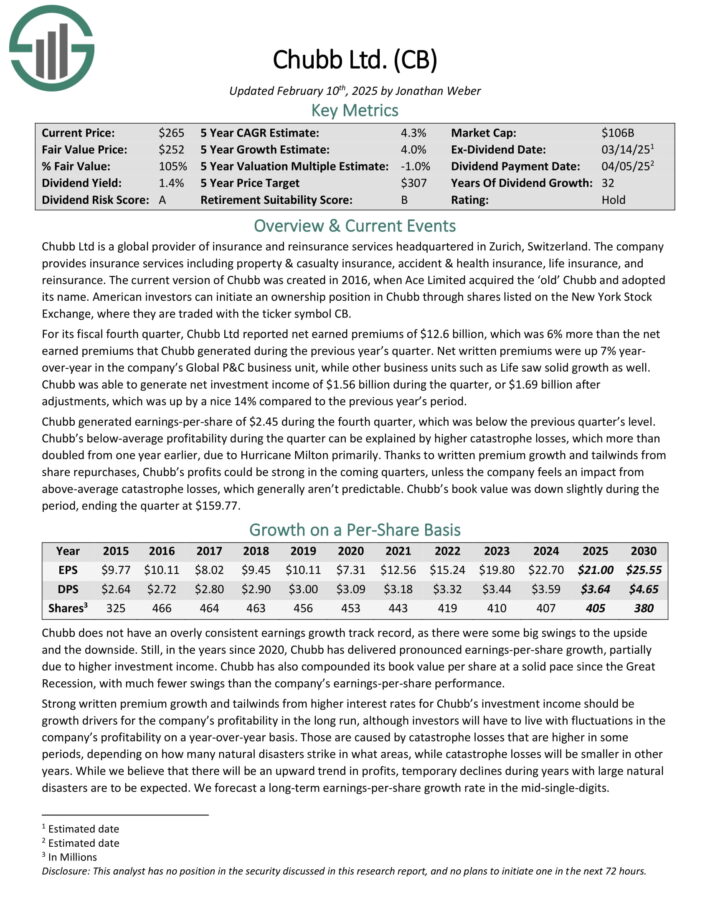

Safest Dividend Stock #7: Chubb Ltd. (CB)

- Payout ratio: 17.3%

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

For its fiscal fourth quarter, Chubb Ltd reported net earned premiums of $12.6 billion, which was 6% more than the net earned premiums that Chubb generated during the previous year’s quarter. Net written premiums were up 7% year-over-year in the company’s Global P&C business unit, while other business units such as Life saw solid growth as well.

Chubb generated net investment income of $1.56 billion during the quarter, or $1.69 billion after adjustments, which was up by 14% compared to the previous year’s period.

Chubb generated earnings-per-share of $2.45 during the fourth quarter, which was below the previous quarter’s level. Chubb’s below-average profitability during the quarter can be explained by higher catastrophe losses, which more than doubled from one year earlier, due to Hurricane Milton primarily.

Click here to download our most recent Sure Analysis report on CB (preview of page 1 of 3 shown below):

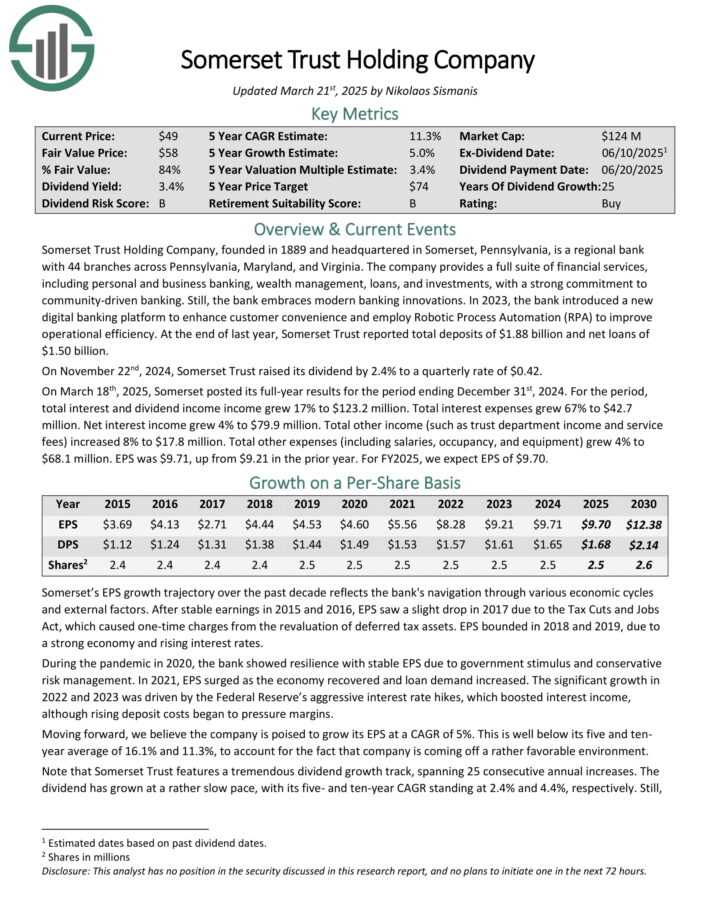

Safest Dividend Stock #6: Somerset Trust Holding Company (SOME)

- Payout Ratio: 17.3%

Somerset Trust Holding Company is a regional bank with 44 branches across Pennsylvania, Maryland, and Virginia. The company provides a full suite of financial services, including personal and business banking, wealth management, loans, and investments.

At the end of last year, Somerset Trust reported total deposits of $1.88 billion and net loans of $1.50 billion.

On March 18th, 2025, Somerset posted its full-year results for the period ending December 31st, 2024. For the period, total interest and dividend income income grew 17% to $123.2 million.

Total interest expenses grew 67% to $42.7 million. Net interest income grew 4% to $79.9 million. Total other income (such as trust department income and service fees) increased 8% to $17.8 million.

Click here to download our most recent Sure Analysis report on SOME (preview of page 1 of 3 shown below):

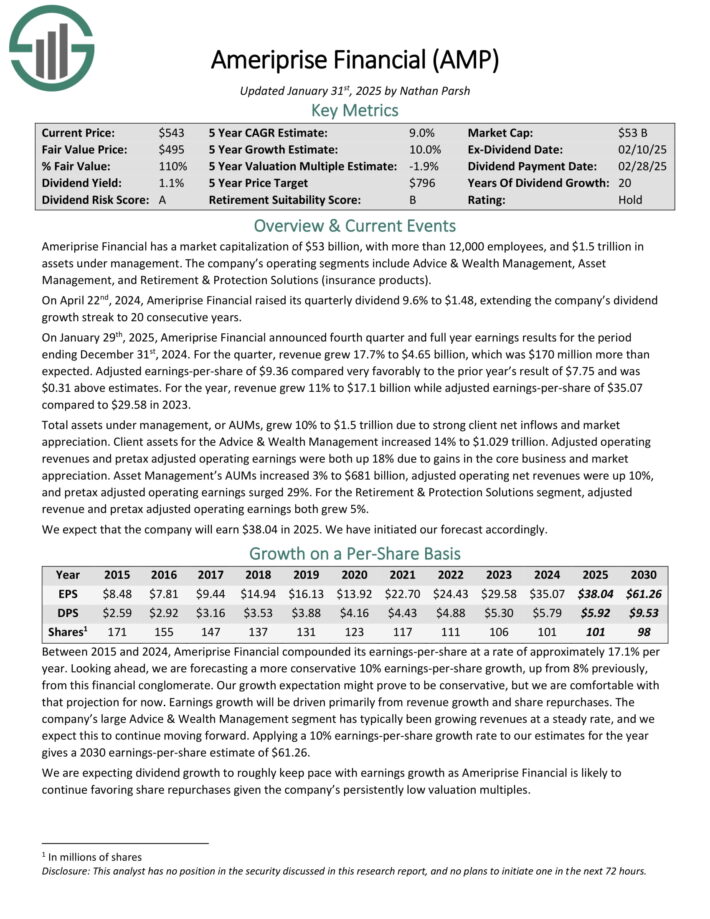

Safest Dividend Stock #5: Ameriprise Financial (AMP)

- Payout Ratio: 15.6%

Ameriprise Financial is an investment management company with more than $1.5 trillion in assets under management. The company’s operating segments include Advice & Wealth Management, Asset Management, and Retirement & Protection Solutions (insurance products).

On January 29th, 2025, Ameriprise Financial announced fourth quarter and full year earnings results for the period ending December 31st, 2024. For the quarter, revenue grew 17.7% to $4.65 billion, which was $170 million more than expected.

Adjusted earnings-per-share of $9.36 compared very favorably to the prior year’s result of $7.75 and was $0.31 above estimates. For the year, revenue grew 11% to $17.1 billion while adjusted earnings-per-share of $35.07 compared to $29.58 in 2023.

Total assets under management, or AUMs, grew 10% to $1.5 trillion due to strong client net inflows and market appreciation. Client assets for the Advice & Wealth Management increased 14% to $1.029 trillion.

Click here to download our most recent Sure Analysis report on AMP (preview of page 1 of 3 shown below):

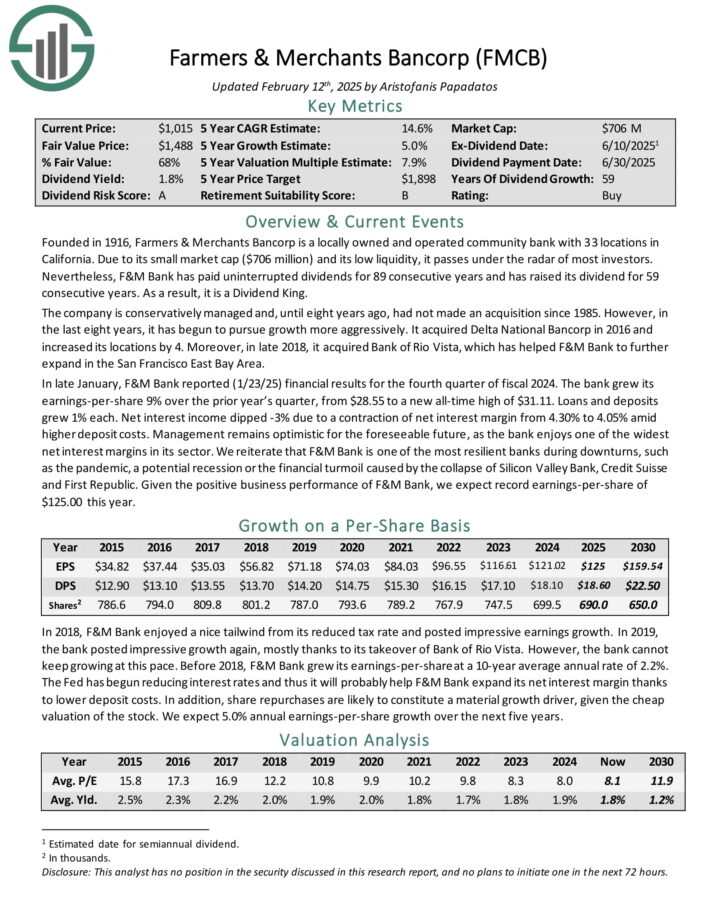

Safest Dividend Stock #4: Farmers & Merchants Bancorp (FMCB)

- Payout Ratio: 14.9%

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In late January, F&M Bank reported (1/23/25) financial results for the fourth quarter of fiscal 2024. The bank grew its earnings-per-share 9% over the prior year’s quarter, from $28.55 to a new all-time high of $31.11. Loans and deposits grew 1% each.

Net interest income dipped -3% due to a contraction of net interest margin from 4.30% to 4.05% amid higher deposit costs. Management remains optimistic for the foreseeable future, as the bank enjoys one of the widest net interest margins in its sector.

We reiterate that F&M Bank is one of the most resilient banks during downturns, such as the pandemic, a potential recession or the financial turmoil caused by the collapse of Silicon Valley Bank, Credit Suisse and First Republic.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

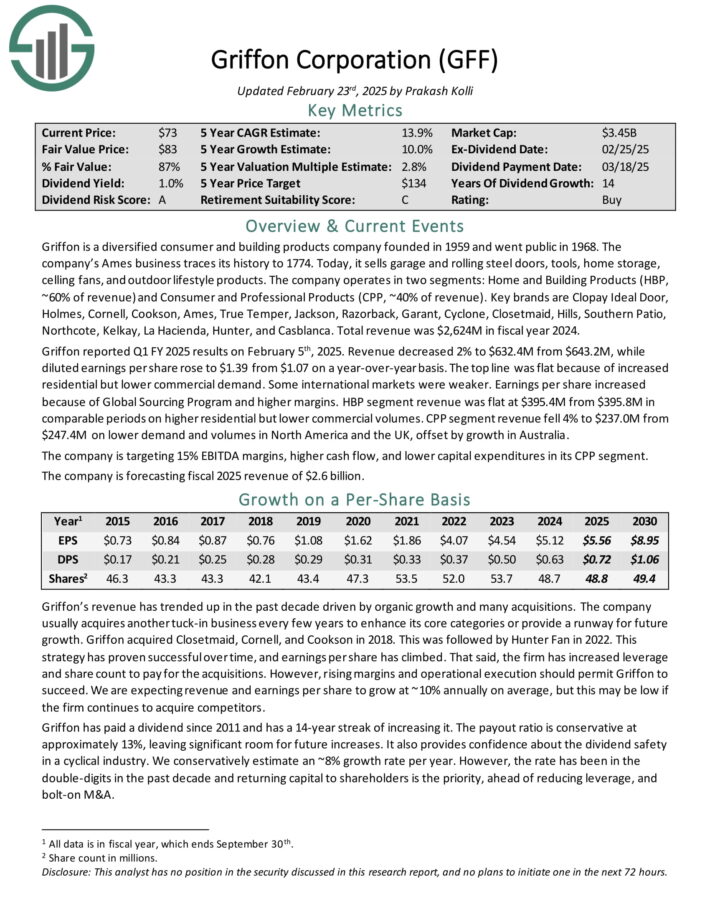

Safest Dividend Stock #3: Griffon Corp. (GFF)

- Payout Ratio: 12.9%

Griffon is a diversified consumer and building products company founded in 1959. Today, it sells garage and rolling steel doors, tools, home storage, ceiling fans, and outdoor lifestyle products.

The company operates in two segments: Home and Building Products (HBP, ~60% of revenue) and Consumer and Professional Products (CPP, ~40% of revenue).

Key brands are Clopay Ideal Door, Holmes, Cornell, Cookson, Ames, True Temper, Jackson, Razorback, Garant, Cyclone, Closetmaid, Hills, Southern Patio, Northcote, Kelkay, La Hacienda, Hunter, and Casblanca. Total revenue was $2,624M in fiscal year 2024.

Griffon reported Q1 FY 2025 results on February 5th, 2025. Revenue decreased 2% to $632.4M from $643.2M, while diluted earnings per share rose to $1.39 from $1.07 on a year-over-year basis.

The top line was flat because of increased residential but lower commercial demand. Some international markets were weaker. Earnings per share increased because of Global Sourcing Program and higher margins.

Click here to download our most recent Sure Analysis report on GFF (preview of page 1 of 3 shown below):

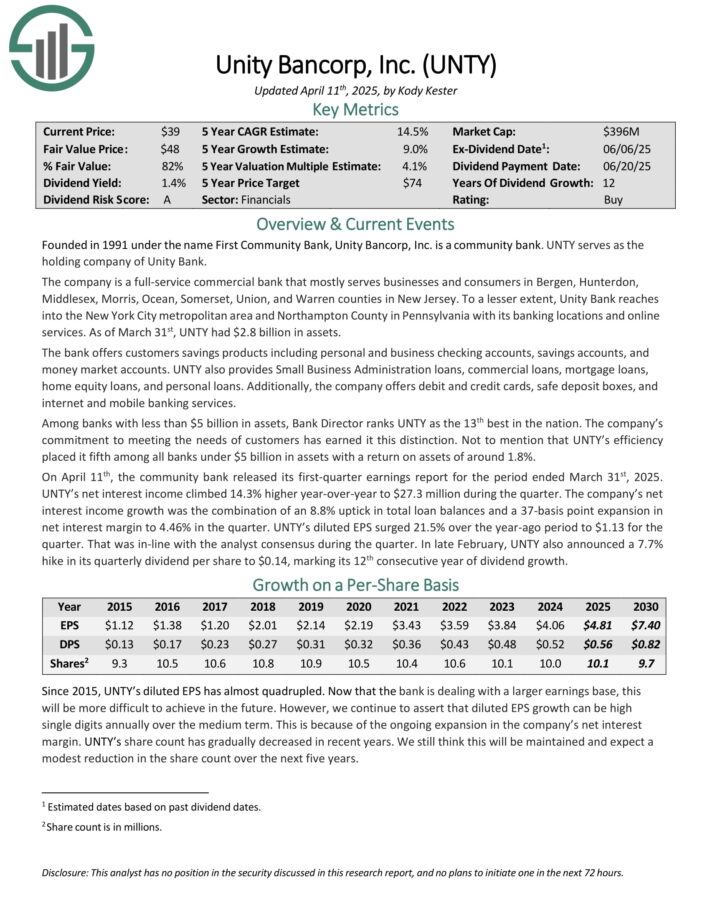

Safest Dividend Stock #2: Unity Bancorp (UNTY)

- Payout Ratio: 11.6%

Unity Bancorp, Inc. is a full-service commercial bank that mostly serves businesses and consumers in Bergen, Hunterdon, Middlesex, Morris, Ocean, Somerset, Union, and Warren counties in New Jersey.

To a lesser extent, Unity Bank reaches into the New York City metropolitan area and Northampton County in Pennsylvania with its banking locations and online services. As of March 31st, UNTY had $2.8 billion in assets.

On April 11th, the community bank released its first-quarter earnings report for the period ended March 31st, 2025. UNTY’s net interest income climbed 14.3% higher year-over-year to $27.3 million during the quarter.

The company’s net interest income growth was the combination of an 8.8% uptick in total loan balances and a 37-basis point expansion in net interest margin to 4.46% in the quarter. UNTY’s diluted EPS surged 21.5% over the year-ago period to $1.13 for the quarter. That was in-line with the analyst consensus during the quarter.

In late February, UNTY also announced a 7.7% hike in its quarterly dividend per share to $0.14, marking its 12th consecutive year of dividend growth.

Click here to download our most recent Sure Analysis report on UNTY (preview of page 1 of 3 shown below):

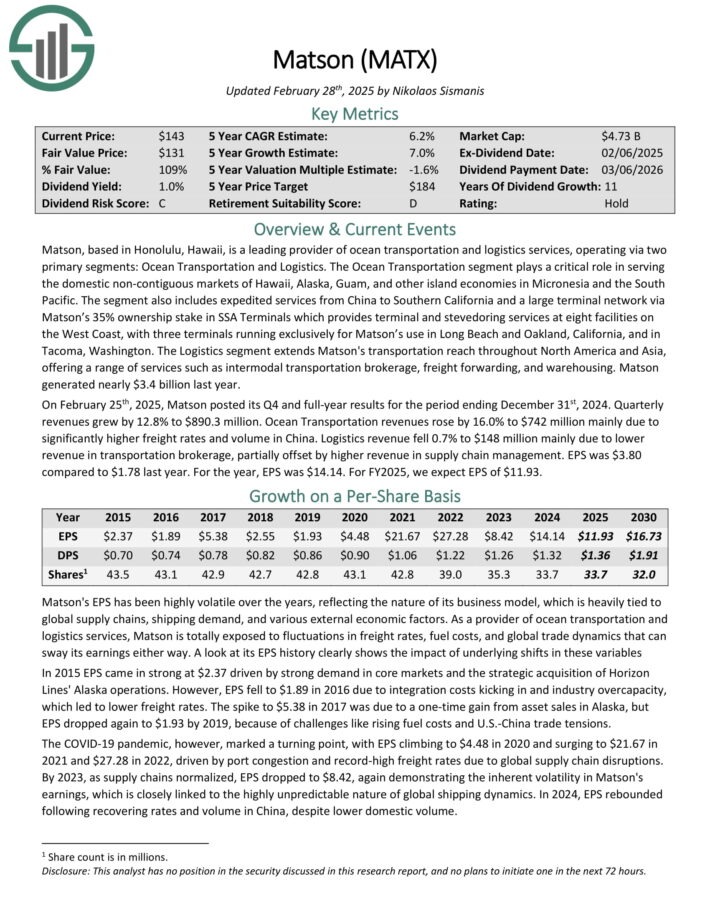

Safest Dividend Stock #1: Matson, Inc. (MATX)

- Payout Ratio: 11.4%

Matson, based in Honolulu, Hawaii, is a leading provider of ocean transportation and logistics services, operating via two primary segments: Ocean Transportation and Logistics.

The Ocean Transportation segment plays a critical role in serving the domestic non-contiguous markets of Hawaii, Alaska, Guam, and other island economies in Micronesia and the South Pacific.

The segment also includes expedited services from China to Southern California and a large terminal network via Matson’s 35% ownership stake in SSA Terminals.

The Logistics segment extends Matson’s transportation reach throughout North America and Asia, offering a range of services such as intermodal transportation brokerage, freight forwarding, and warehousing.

On February 25th, 2025, Matson posted its Q4 and full-year results for the period ending December 31st, 2024. Quarterly revenues grew by 12.8% to $890.3 million. Ocean Transportation revenues rose by 16.0% to $742 million mainly due to significantly higher freight rates and volume in China.

Logistics revenue fell 0.7% to $148 million mainly due to lower revenue in transportation brokerage, partially offset by higher revenue in supply chain management. EPS was $3.80 compared to $1.78 last year. For the year, EPS was $14.14.

Click here to download our most recent Sure Analysis report on MATX (preview of page 1 of 3 shown below):

Additional Reading

Investors looking for more of the safest dividend stocks can find additional reading below:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of rising dividends.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 55 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.