Updated on August 20th, 2024 by Bob Ciura

The best outcome of dividend growth investing is to find stocks with high dividend yields, safe dividends during recessions, and future growth potential.

And yet, this blend of characteristics is difficult to find in the stock market.

The trade-off between growth and dividends makes it difficult to find stocks with both a high dividend yield and long-term growth prospects. The more a company pays out in dividends, the less it has to reinvest in growth.

Finding dividend stocks that consistently pay rising dividends, and also have safe dividends during recessions, is difficult.

For example, there are currently only 68 Dividend Aristocrats.

To be a Dividend Aristocrat, a company must:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet of all 68 Dividend Aristocrats (with important financial metrics such as P/E ratios and dividend yields) by clicking the link below:

The list of Dividend Kings (50+ years of dividend increases) is also relatively short, providing further evidence of the rarity of durable competitive advantages.

This article takes a look at quality dividend stocks with the following characteristics:

- Dividend yields above 4%

- At least 10+ consecutive years of dividend increases

- Dividend Risk Scores of ‘C’ or better

- Market capitalizations above $10 billion

Businesses with long dividend histories have proven the stability of their operations.

This article analyzes 12 consistently high-paying dividend stocks, as ranked using expected total returns from the Sure Analysis Research Database, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- Consistent High Yield Stock #12: Gilead Sciences, Inc. (GILD)

- Consistent High Yield Stock #11: MPLX LP (MPLX)

- Consistent High Yield Stock #10: Pinnacle West Capital Corp. (PNW)

- Consistent High Yield Stock #9: Altria Group (MO)

- Consistent High Yield Stock #8: Franklin Resources (BEN)

- Consistent High Yield Stock #7: T. Rowe Price Group (TROW)

- Consistent High Yield Stock #6: Interpublic Group of Cos. (IPG)

- Consistent High Yield Stock #5: Enterprise Products Partners LP (EPD)

- Consistent High Yield Stock #4: Verizon Communications (VZ)

- Consistent High Yield Stock #3: Evergy, Inc. (EVRG)

- Consistent High Yield Stock #2: United Parcel Service (UPS)

- Consistent High Yield Stock #1: Eversource Energy (ES)

- Final Thoughts

Consistent High Yield Stock #12: Gilead Sciences, Inc. (GILD)

- 5-year expected annual returns: 6.5%

Gilead Sciences is a biotechnology company that operates with a focus on antiviral medication and treatments. Its main products include treatments for HIV, Hepatitis B, and Hepatitis C (HBV/HCV), but Gilead has also ventured into other areas such as oncology.

Gilead’s main sales driver for many years has been its HCV portfolio. Since its HCV drugs cure patients, the patient pool started to shrink very quickly, which has led to a declining number of patients that start treatment with one of Gilead’s HCV drugs. This is why profits peaked in 2015 and have been declining since.

Gilead’s HIV business continues to grow, although right now Gilead still has to invest meaningfully into pipeline drugs. Gilead owns the commercialization rights for Filgotinib, developed by Galapagos, which has a good chance of becoming successful in several immunotherapeutic indications.

Click here to download our most recent Sure Analysis report on GILD (preview of page 1 of 3 shown below):

Consistent High Yield Stock #11: MPLX LP (MPLX)

- 5-year expected annual returns: 7.1%

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

- Logistics and Storage, which relates to crude oil and refined petroleum products

- Gathering and Processing, which relates to natural gas and natural gas liquids (NGLs)

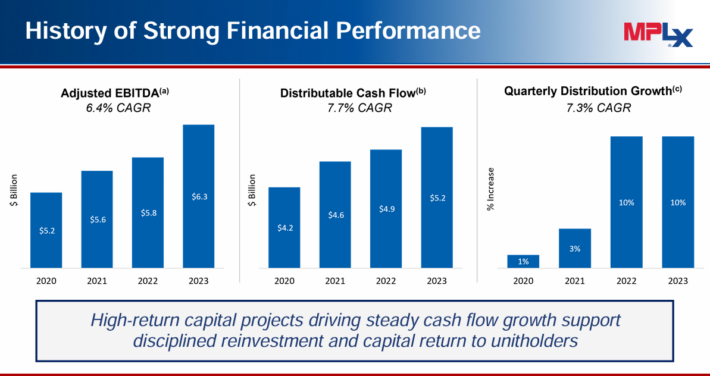

MPLX has generated strong growth since the coronavirus pandemic ended.

Source: Investor Presentation

In late April, MPLX reported (4/30/24) financial results for the first quarter of fiscal 2024. Adjusted EBITDA and distributable cash flow (DCF) per share both grew 8% over the prior year’s quarter, primarily thanks to higher tariff rates, but also thanks to increased gas volumes.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.2x and a solid distribution coverage ratio of 1.6.

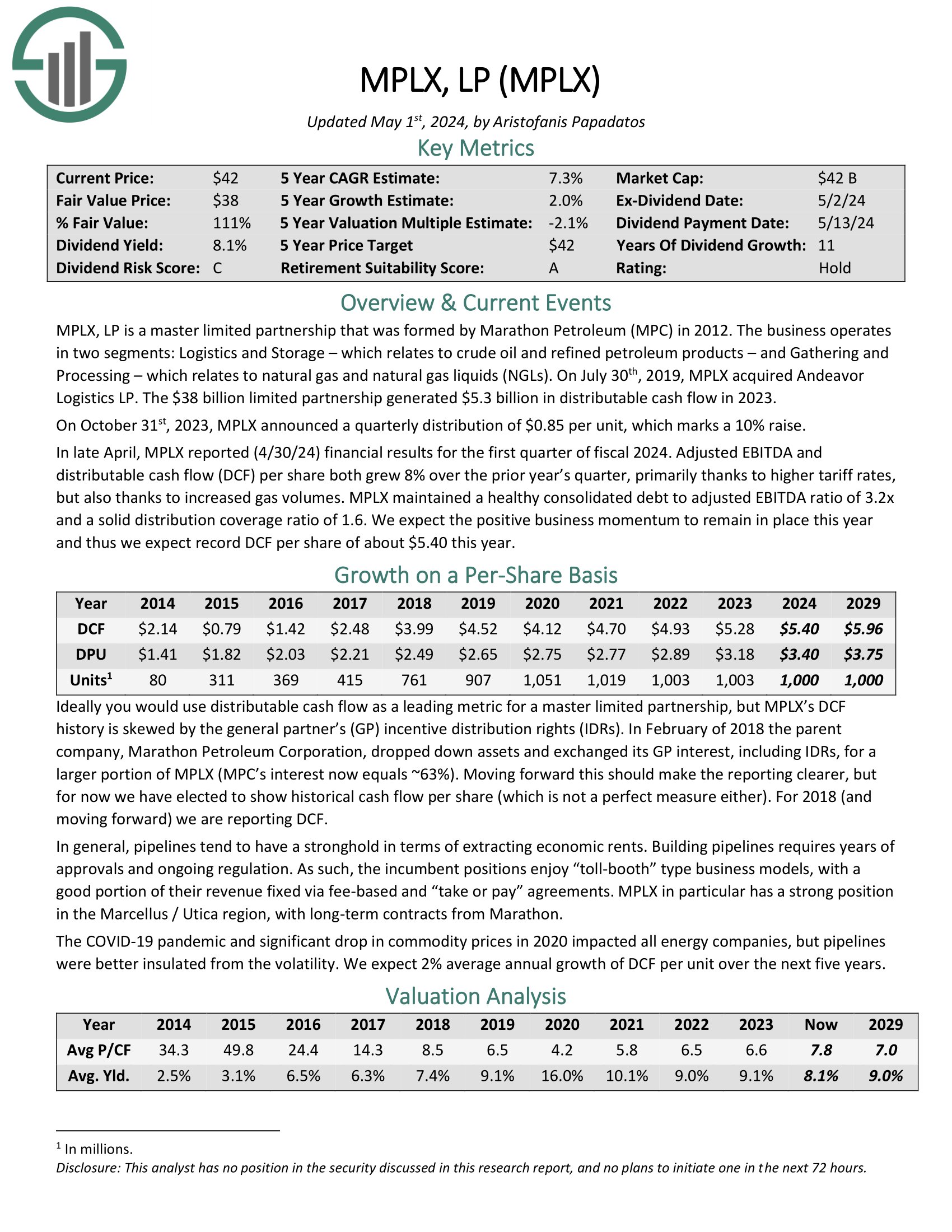

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

Consistent High Yield Stock #10: Pinnacle West Group (PNW)

- 5-year expected annual returns: 7.2%

Pinnacle West Capital is a holding company based in Phoenix, Arizona. Its principal subsidiary, Arizona Public Service (APS), provides electricity service to more than 1.3 million Arizona homes and businesses.

The company has the generating capacity to produce 6,300 megawatts, and it employs more than 6,000 in Arizona and New Mexico. PNW has been paying a dividend for 27 years and growing the dividend consecutively for the past 11 years.

On August 1st , 2024, Pinnacle West Capital reported second-quarter results for Fiscal Year (FY)2024. The company reported a significant increase in net income for the second quarter of 2024, with earnings of $203.8 million, or $1.76 per diluted share, compared to $106.7 million, or $0.94 per diluted share, for the same period in 2023.

This improvement was driven by new customer rates implemented in March 2024, record-high June temperatures, and increased customer usage.

Click here to download our most recent Sure Analysis report on PNW (preview of page 1 of 3 shown below):

Consistent High Yield Stock #9: Altria Group (MO)

- 5-year expected annual returns: 7.3%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

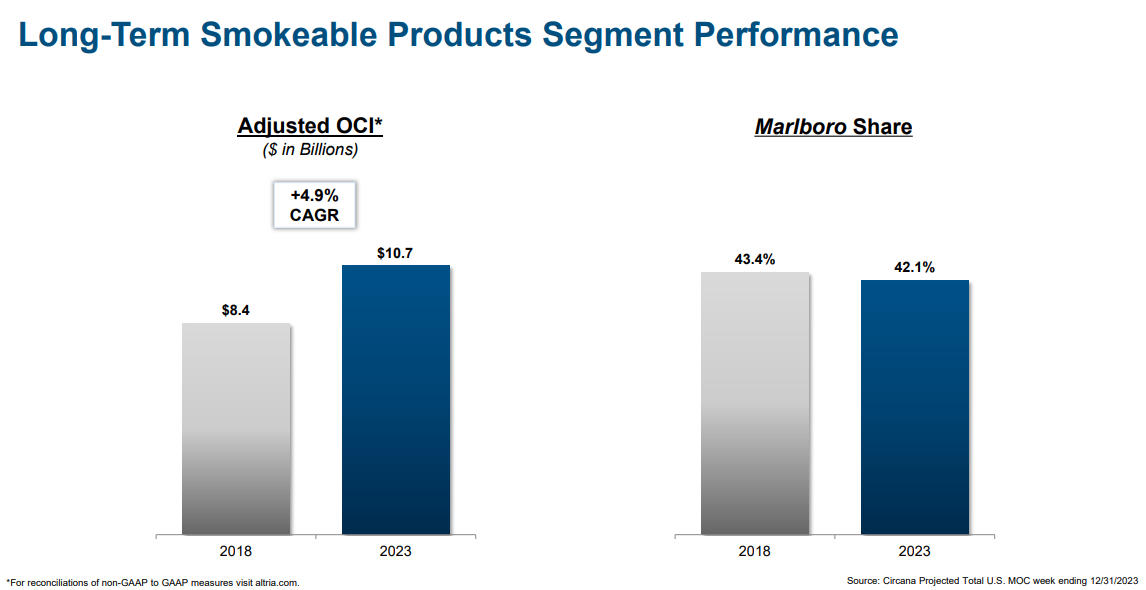

The majority of Altria’s revenue and profit is still made up of smokeable tobacco products. The Marlboro brand still enjoys the leading market share in the U.S. market.

Source: Investor Presentation

In the 2024 first quarter, Altria’s net revenue of $5.576 billion declined 2.5% from the first quarter of 2023, with revenue net of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a decrease of 2.5% compared to the same period last year.

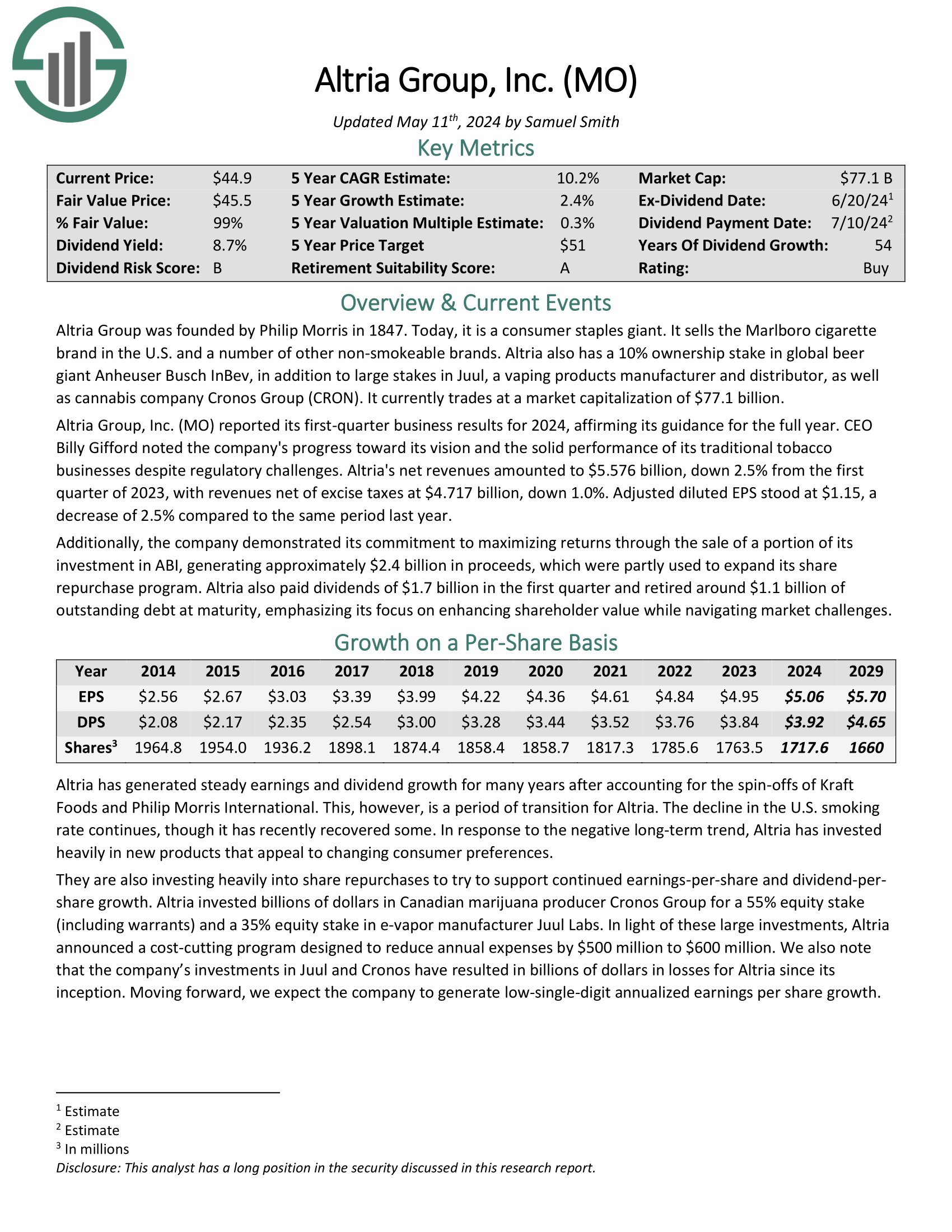

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Consistent High Yield Stock #8: Franklin Resources (BEN)

- 5-year expected annual returns: 8.2%

Franklin Resources is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

On July 26th, 2024, Franklin Resources reported third quarter 2024 results for the period ending June 30th, 2024 (Franklin Resources’ fiscal year ends September 30th.)

Total assets under management equaled $1.647 trillion, up $1.9 billion sequentially, as a result of $3.0 billion of cash management net inflows, and a $2.1 billion of net market change, distributions, and other, partly offset by $3.2 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.123 billion, up 8% year-over-year. On an adjusted basis, net income equaled $326 million or $0.60 per share, flat compared to Q3 2023.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

Consistent High Yield Stock #7: T. Rowe Price Group (TROW)

- 5-year expected annual returns: 9.6%

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

On April 26th, 2024, T. Rowe Price reported first quarter results for the period ending March 31st, 2024. For the quarter, revenue increased 13.6% to $1.75 billion, which was $50 million above estimates. Adjusted earnings-per-share of $2.38 compared to $1.69 in the prior year, which was $0.36 better than expected.

During the quarter, assets under management (AUM) improved $97.7 billion, or 6.8%, to $1.54 trillion. Market appreciation of $105.7 billion was partially offset by $8 billion of net client outflows. Operating expenses of $1.16 billion increased 10.5% year-over-year, but decreased 7.3% on a sequential basis.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

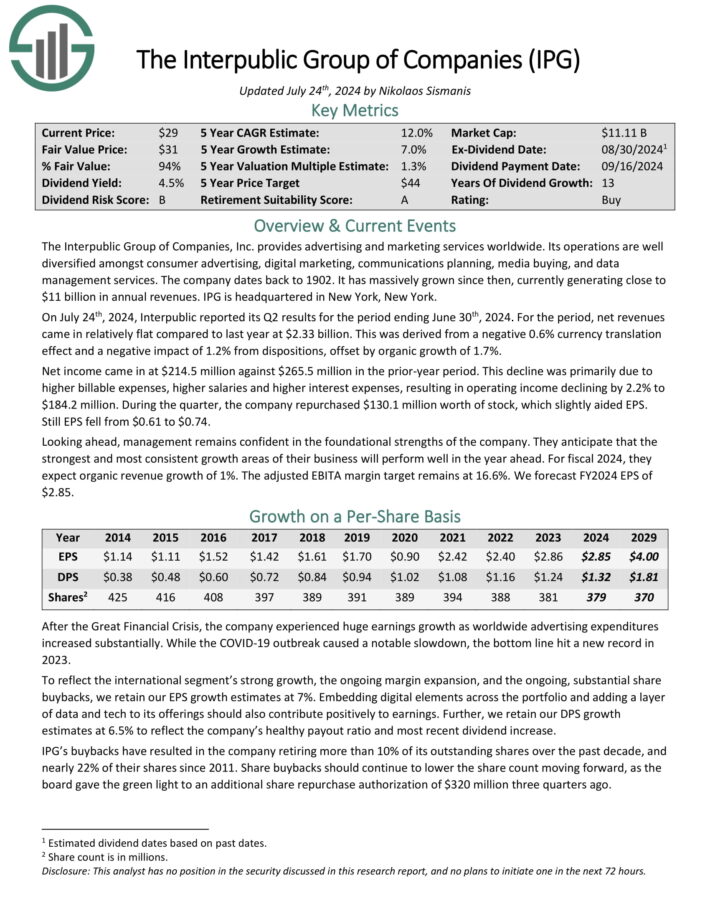

Consistent High Yield Stock #6: Interpublic Group of Cos. (IPG)

- 5-year expected annual returns: 10.4%

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. Its operations are diversified among consumer advertising, digital marketing, communications planning, media buying, and data management services. The company generates close to $11 billion in annual revenues.

On July 24th, 2024, Interpublic reported its Q2 results for the period ending June 30th, 2024. For the period, net revenues came in relatively flat compared to last year at $2.33 billion. This was derived from a negative 0.6% currency translation effect and a negative impact of 1.2% from dispositions, offset by organic growth of 1.7%.

Net income came in at $214.5 million against $265.5 million in the prior-year period. This decline was primarily due to higher billable expenses, higher salaries and higher interest expenses, resulting in operating income declining by 2.2% to $184.2 million. During the quarter, the company repurchased $130.1 million worth of stock.

Click here to download our most recent Sure Analysis report on IPG (preview of page 1 of 3 shown below):

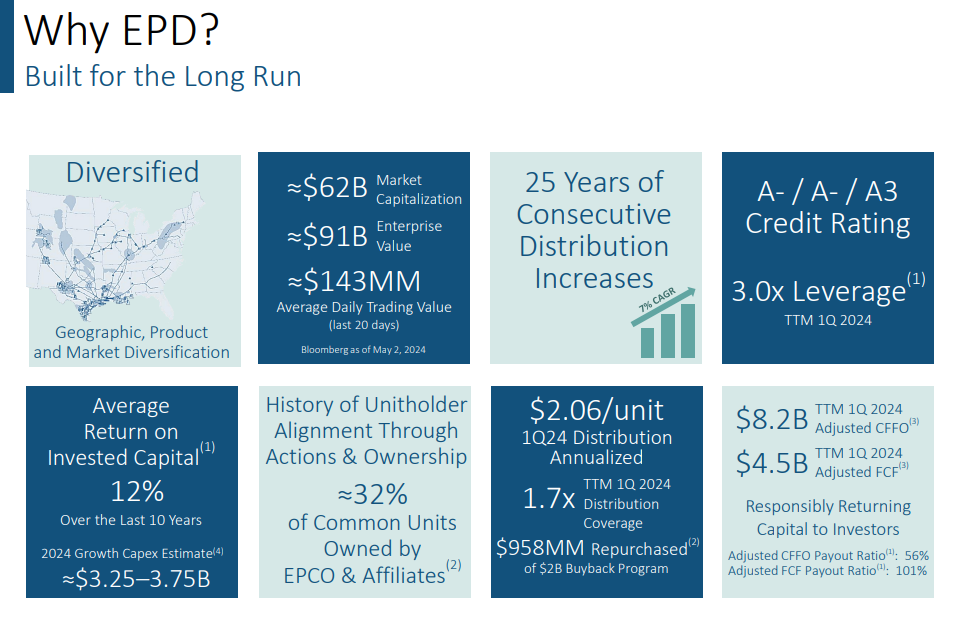

Consistent High Yield Stock #5: Enterprise Products Partners LP (EPD)

- 5-year expected annual returns: 10.6%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise reported net income attributable to common unitholders of $1.5 billion, or $0.66 per unit on a fully diluted basis, for the first quarter of 2024, marking a 5 percent increase from the first quarter of 2023. Distributable Cash Flow (DCF) remained steady at $1.9 billion for both quarters.

Distributions declared for the first quarter of 2024 increased by 5.1% compared to the same period in 2023, reaching $0.515 per common unit. DCF covered this distribution 1.7 times, with $786 million retained.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

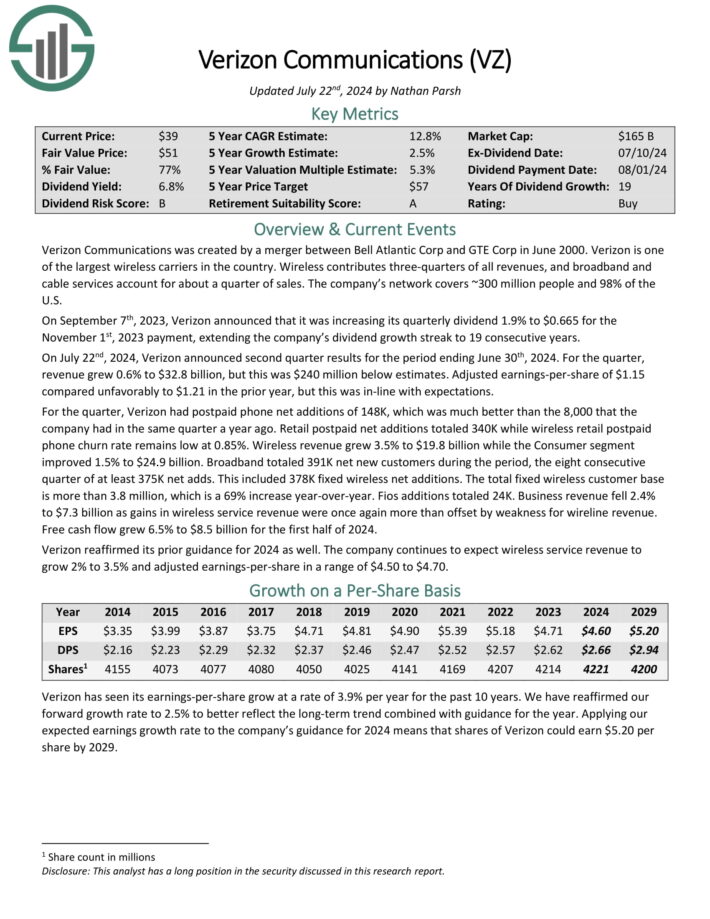

Consistent High Yield Stock #4: Verizon Communications (VZ)

- 5-year expected annual returns: 12.0%

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 22nd, 2024, Verizon announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 0.6% to $32.8 billion, but this was $240 million below estimates. Adjusted earnings-per-share of $1.15 compared unfavorably to $1.21 in the prior year, but this was in-line with expectations.

For the quarter, Verizon had postpaid phone net additions of 148K, which was much better than the 8,000 that the company had in the same quarter a year ago. Retail postpaid net additions totaled 340K while wireless retail postpaid phone churn rate remains low at 0.85%.

Wireless revenue grew 3.5% to $19.8 billion while the Consumer segment improved 1.5% to $24.9 billion. Broadband totaled 391K net new customers during the period, the eight consecutive quarter of at least 375K net adds. This included 378K fixed wireless net additions. The total fixed wireless customer base is more than 3.8 million, which is a 69% increase year-over-year.

Verizon reaffirmed its prior guidance for 2024 as well. The company continues to expect wireless service revenue to grow 2% to 3.5% and adjusted earnings-per-share in a range of $4.50 to $4.70.

Click here to download our most recent Sure Analysis report on Verizon (preview of page 1 of 3 shown below):

Consistent High Yield Stock #3: Evergy, Inc. (EVRG)

- 5-year expected annual returns: 12.1%

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri.

Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and 6,900 industrial customers and municipalities in Kansas and Missouri.

In early May, Evergy reported (5/9/24) financial results for the first quarter of fiscal 2024. The company was negatively affected by unfavorable weather as well as higher interest expense, operating & maintenance costs and depreciation.

As a result, its adjusted earnings-per-share dipped -8% over the prior year’s quarter, from $0.59 to $0.54, and missed the analysts’ consensus by $0.10.

The business outlook of Evergy is positive, as the utility has proved resilient to high interest rates and high inflation. Due to unfavorable weather in the greater part of 2023, Evergy incurred a -5% decrease in earnings-per-share last year, but it reaffirmed its positive guidance for 2024.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

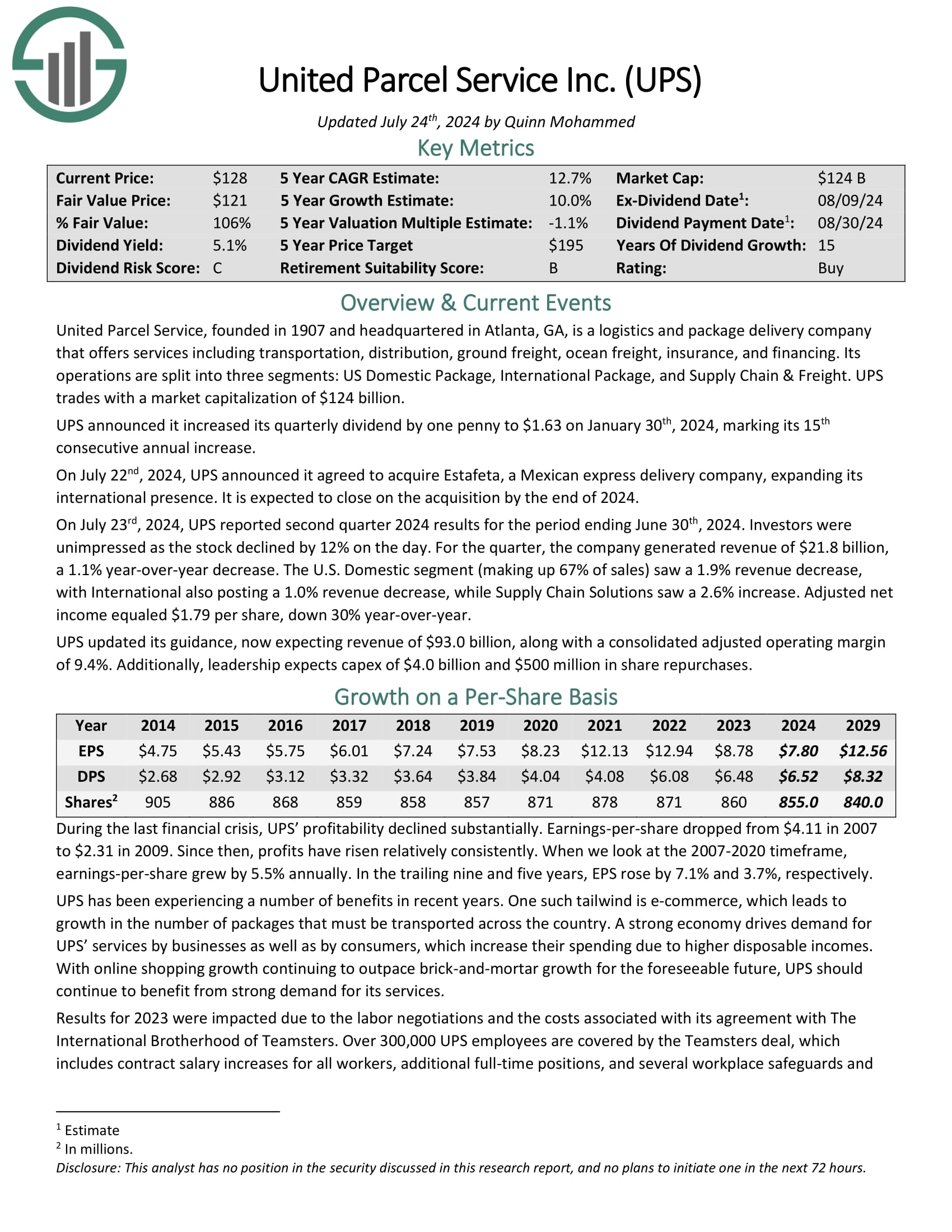

Consistent High Yield Stock #2: United Parcel Service (UPS)

- 5-year expected annual returns: 12.5%

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance, and financing. Its operations are split into three segments: US Domestic Package, International Package, and Supply Chain & Freight.

On July 22nd, 2024, UPS announced it agreed to acquire Estafeta, a Mexican express delivery company, expanding its international presence. It is expected to close on the acquisition by the end of 2024.

On July 23rd, 2024, UPS reported second quarter 2024 results for the period ending June 30th, 2024. Investors were unimpressed as the stock declined by 12% on the day. For the quarter, the company generated revenue of $21.8 billion, a 1.1% year-over-year decrease.

The U.S. Domestic segment (making up 67% of sales) saw a 1.9% revenue decrease, with International also posting a 1.0% revenue decrease, while Supply Chain Solutions saw a 2.6% increase. Adjusted net income equaled $1.79 per share, down 30% year-over-year.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

Consistent High Yield Stock #1: Eversource Energy (ES)

- 5-year expected annual returns: 17.4%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

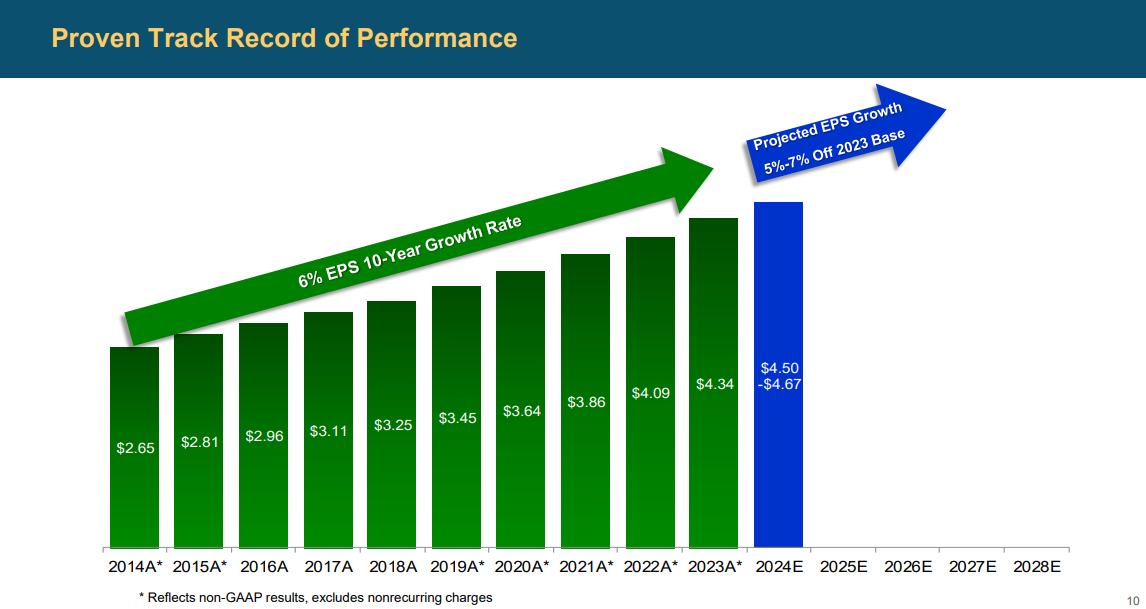

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On May 1st, 2024, Eversource Energy released its first quarter 2024 results. For the quarter, the company reported earnings of $521.8 million, an increase from $491.2 million in the same quarter of last year. Earnings-per-share of $1.49 compared with earnings-per-share of $1.41 in the prior year.

Earnings from the Electric Transmission segment increased to $176.7 million, up from $155.1 million in the prior year, primarily due to a higher level of investment in Eversource’s electric transmission system needed to address system capacity growth and deliver clean energy resources for the region.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Final Thoughts

Finding stocks that have high dividend yields, long histories of steadily increasing dividend payments, and strong growth prospects can be challenging. While continuous interest rate hikes have resulted in the share prices of many high-dividend stocks declining, boosting their yields, there are still not many stocks matching our specific criteria.

The stocks featured in this article all have impressive dividend growth histories, attractive yields, and prospects for high total returns over the next five years. Each company is well-known among dividend growth investors and all stocks receive a buy recommendation from Sure Dividend at this time.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month