Updated on August 20th, 2024 by Bob Ciura

Investors looking for higher levels of income should consider high dividend stocks. We define high dividend stocks as having current yields above 5%.

If interest rates decline in the months ahead, high dividend stocks still provide investors with more income than most alternatives.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

However, not all high-yield stocks make equally good investments.

Many stocks with extremely high yields are at risk of cutting their dividends if their underlying fundamentals, such as earnings or free cash flow, do not support the dividend payout.

This is particularly true during recessions, when many cyclical companies struggle with declining revenue and profits.

Therefore, it is important for income investors to assess whether a high dividend yield is sustainable.

The following 12 stocks with high dividend yields above 5%, also have strong business models and established track records of maintaining their dividends.

Table Of Contents

All stocks in this list have dividend yields above 5%, making them very appealing for income investors, and Dividend Risk scores of ‘A’ or ‘B’ to focus on sustainable dividends.

The 12 high dividend stocks are listed in order by dividend yield, from lowest to highest, from the Sure Analysis Research Database.

- High Dividend Stock For Decades: NNN REIT Inc. (NNN)

- High Dividend Stock For Decades: Organon & Co. (OGN)

- High Dividend Stock For Decades: Franklin Resources (BEN)

- High Dividend Stock For Decades: Auburn National Bancorp (AUBN)

- High Dividend Stock For Decades: Universal Corp. (UVV)

- High Dividend Stock For Decades: UGI Corp. (UGI)

- High Dividend Stock For Decades: Verizon Communications (VZ)

- High Dividend Stock For Decades: Sunoco LP (SUN)

- High Dividend Stock For Decades: Universal Health Realty Income Trust (UHT)

- High Dividend Stock For Decades: Enterprise Products Partners (EPD)

- High Dividend Stock For Decades: Altria Group (MO)

- High Dividend Stock For Decades: Walgreens Boots Alliance (WBA)

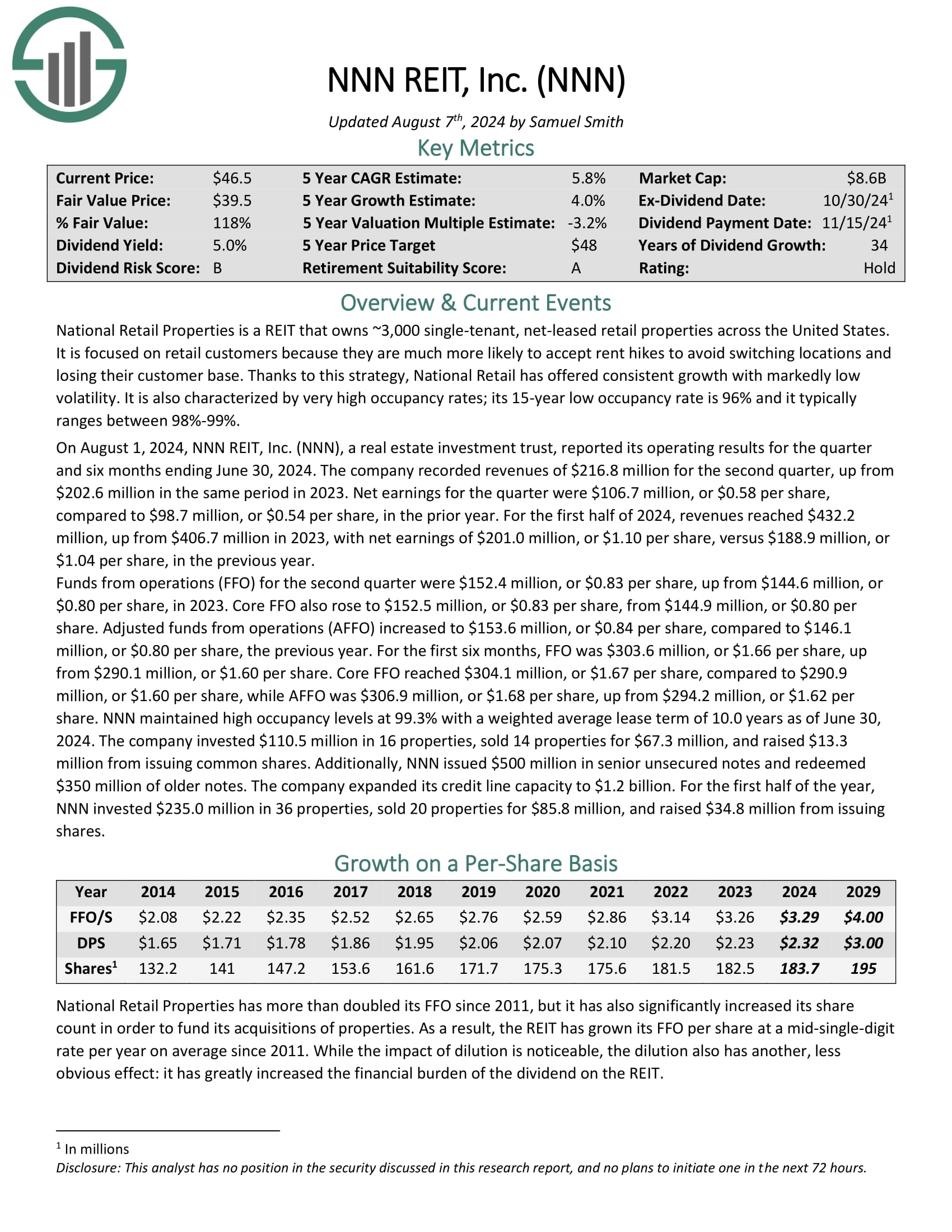

High Dividend Stock For Decades: NNN REIT Inc. (NNN)

- Dividend Yield: 5.0%

National Retail Properties is a REIT that owns ~3,000 single-tenant, net-leased retail properties across the United States. It is focused on retail customers because they are much more likely to accept rent hikes to avoid switching locations and losing their customer base.

Thanks to this strategy, National Retail has offered consistent growth with markedly low volatility. It is also characterized by very high occupancy rates; its 15-year low occupancy rate is 96% and it typically ranges between 98%-99%.

On August 1, 2024, NNN reported its operating results for the quarter and six months ending June 30, 2024. The company recorded revenues of $216.8 million for the second quarter, up from $202.6 million in the same period in 2023.

Net earnings for the quarter were $106.7 million, or $0.58 per share, compared to $98.7 million, or $0.54 per share, in the prior year. For the first half of 2024, revenues reached $432.2 million, up from $406.7 million in 2023, with net earnings of $201.0 million, or $1.10 per share, versus $188.9 million, or $1.04 per share, in the previous year.

Funds from operations (FFO) for the second quarter were $152.4 million, or $0.83 per share, up from $144.6 million, or $0.80 per share, in 2023.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

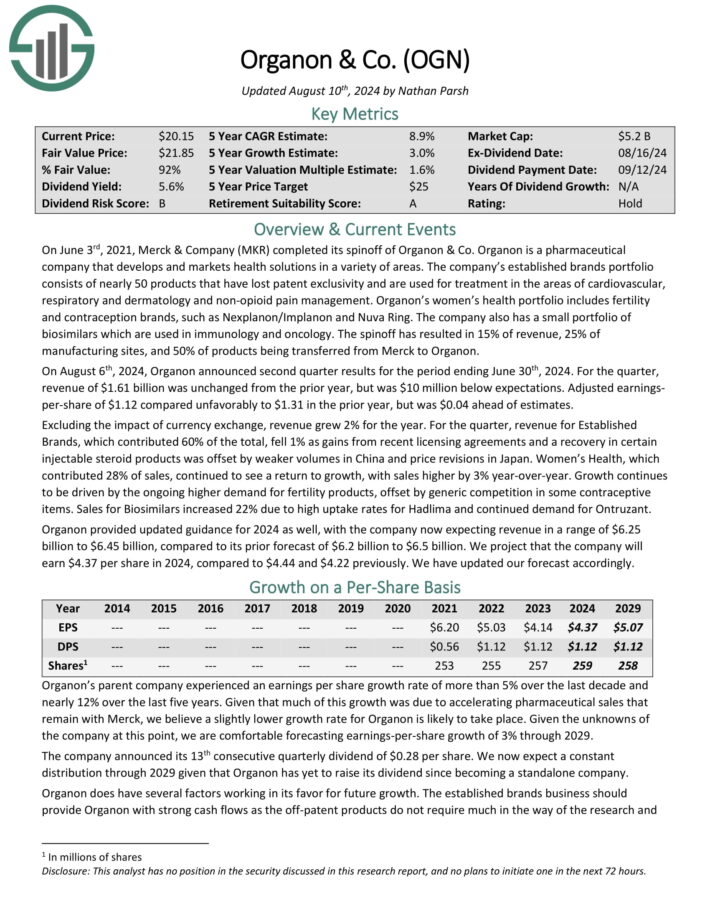

High Dividend Stock For Decades: Organon & Co. (OGN)

- Dividend Yield: 5.3%

Source: Investor Presentations

On August 6th, 2024, Organon announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue of $1.61 billion was unchanged from the prior year, but was $10 million below expectations.

Adjusted earnings per-share of $1.12 compared unfavorably to $1.31 in the prior year, but was $0.04 ahead of estimates. Excluding the impact of currency exchange, revenue grew 2% for the year.

Click here to download our most recent Sure Analysis report on Organon (preview of page 1 of 3 shown below):

High Dividend Stock For Decades: Franklin Resources (BEN)

- Dividend Yield: 5.5%

Franklin Resources is a global asset manager with a long and successful history. The company offers investment management (which makes up the bulk of fees the company collects) and related services to its customers, including sales, distribution, and shareholder servicing.

On July 26th, 2024, Franklin Resources reported third quarter 2024 results for the period ending June 30th, 2024 (Franklin Resources’ fiscal year ends September 30th.)

Total assets under management equaled $1.647 trillion, up $1.9 billion sequentially, as a result of $3.0 billion of cash management net inflows, and a $2.1 billion of net market change, distributions, and other, partly offset by $3.2 billion of long-term net outflows.

For the quarter, operating revenue totaled $2.123 billion, up 8% year-over-year. On an adjusted basis, net income equaled $326 million or $0.60 per share, flat compared to Q3 2023.

Click here to download our most recent Sure Analysis report on Franklin Resources (preview of page 1 of 3 shown below):

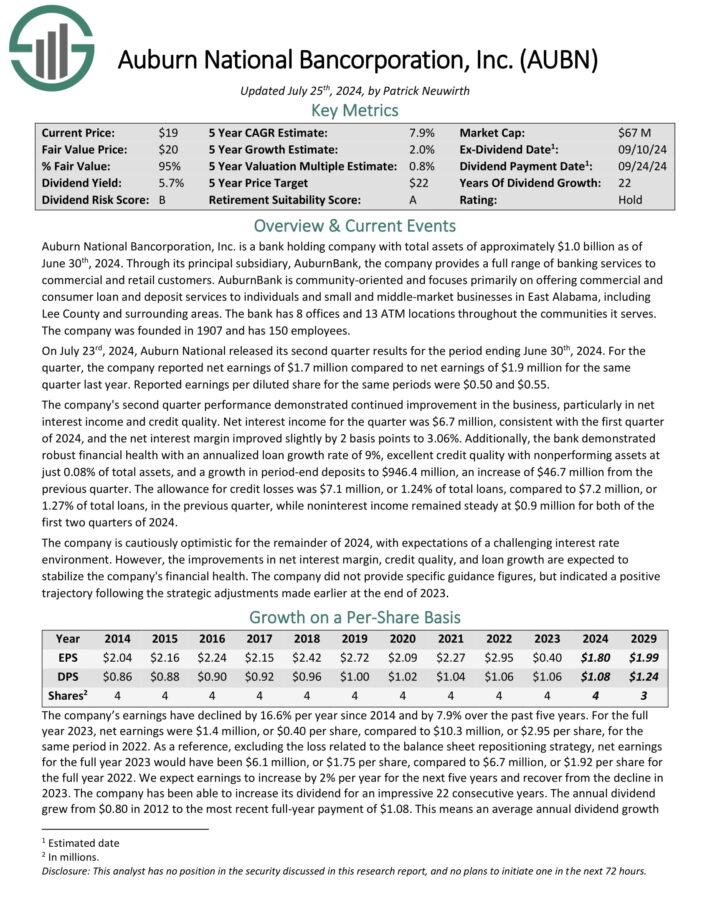

High Dividend Stock For Decades: Auburn National Bancorp (AUBN)

- Dividend Yield: 6.0%

Auburn National Bancorporation is a bank holding company. Through its principal subsidiary, AuburnBank, the company provides a full range of banking services to commercial and retail customers.

AuburnBank is community oriented and focuses primarily on offering commercial and consumer loan and deposit services to individuals, and small and middle market businesses in East Alabama, including Lee County and surrounding areas.

On July 23rd, 2024, Auburn National released its second quarter results for the period ending June 30th, 2024. For the quarter, the company reported net earnings of $1.7 million compared to net earnings of $1.9 million for the same quarter last year. Reported earnings per diluted share for the same periods were $0.50 and $0.55.

The company’s second quarter performance demonstrated continued improvement in the business, particularly in net interest income and credit quality. Net interest income for the quarter was $6.7 million, consistent with the first quarter of 2024, and the net interest margin improved slightly by 2 basis points to 3.06%.

Click here to download our most recent Sure Analysis report on AUBN (preview of page 1 of 3 shown below):

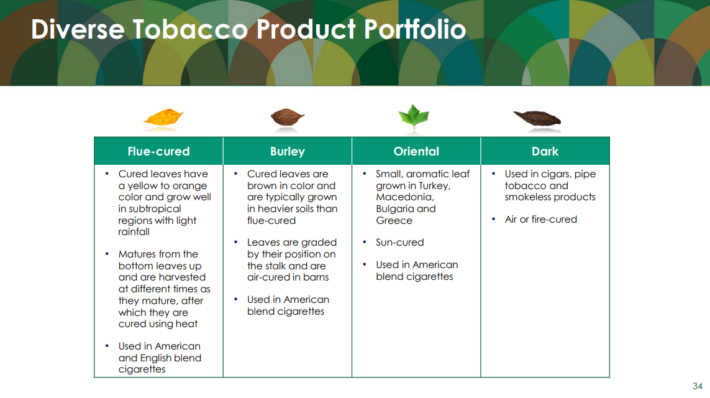

High Dividend Stock For Decades: Universal Corp. (UVV)

- Dividend Yield: 6.1%

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its fourth-quarter earnings results at the end of May. The company generated revenues of $770 million during the quarter, which was 11% more than the revenues that Universal Corporation generated during the previous year’s period.

Revenues were positively impacted by product mix changes, and growth was weaker than during the previous quarter. Universal’s gross margin was up compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

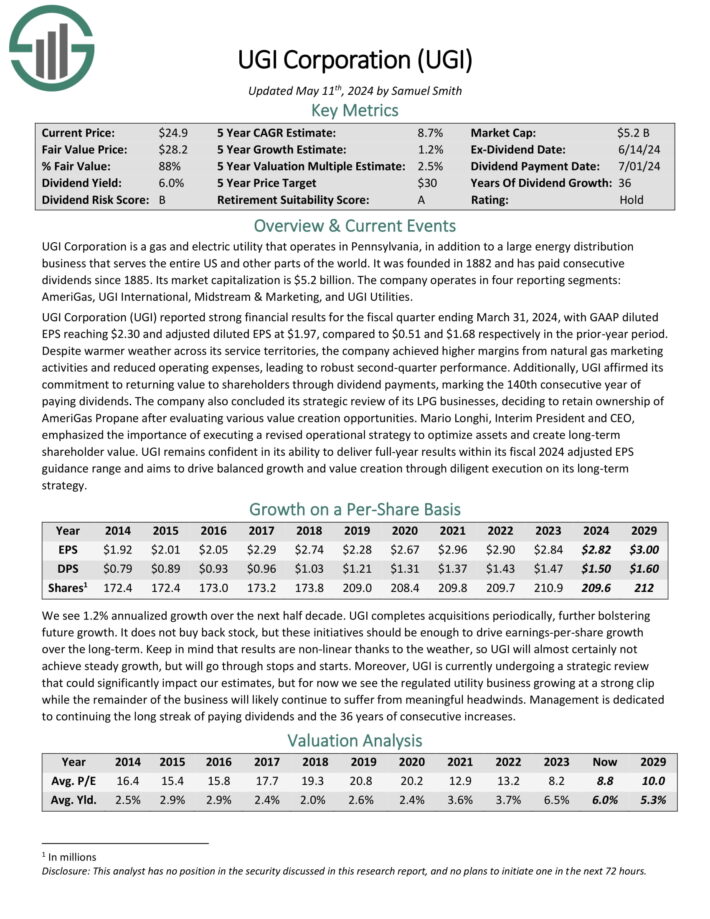

High Dividend Stock For Decades: UGI Corp. (UGI)

- Dividend Yield: 6.1%

UGI is a diversified distributor of energy products and services in 17 countries, but primarily in the US.

Source: Investor presentation

UGI traces its roots back 142 years, and extraordinarily, has paid dividends for all but two of those years. In terms of increasing its dividend, as mentioned before, it’s done so since the late-1980s.

The company serves commercial and residential customers with products such as propane and natural gas distribution, as well as pipeline and storage services, among others.

The stock trades with a market cap of just under $5 billion, and the company produces annual revenue of more than $8 billion.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

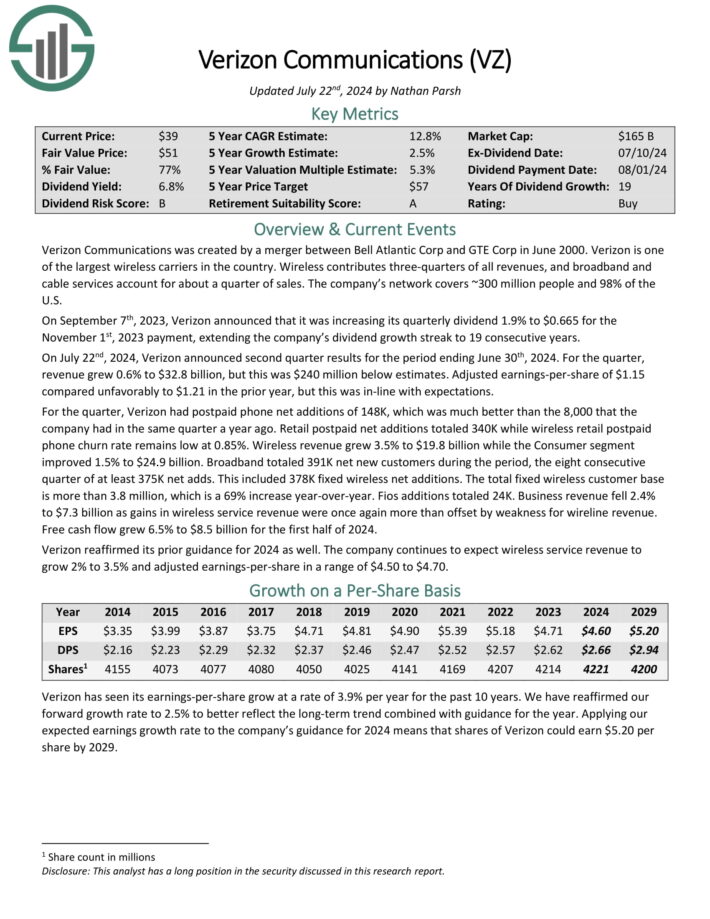

High Dividend Stock For Decades: Verizon Communications (VZ)

- Dividend Yield: 6.5%

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 22nd, 2024, Verizon announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 0.6% to $32.8 billion, but this was $240 million below estimates. Adjusted earnings-per-share of $1.15 compared unfavorably to $1.21 in the prior year, but this was in-line with expectations.

For the quarter, Verizon had postpaid phone net additions of 148K, which was much better than the 8,000 that the company had in the same quarter a year ago. Retail postpaid net additions totaled 340K while wireless retail postpaid phone churn rate remains low at 0.85%.

Wireless revenue grew 3.5% to $19.8 billion while the Consumer segment improved 1.5% to $24.9 billion. Broadband totaled 391K net new customers during the period, the eight consecutive quarter of at least 375K net adds. This included 378K fixed wireless net additions. The total fixed wireless customer base is more than 3.8 million, which is a 69% increase year-over-year.

Verizon reaffirmed its prior guidance for 2024 as well. The company continues to expect wireless service revenue to grow 2% to 3.5% and adjusted earnings-per-share in a range of $4.50 to $4.70.

Click here to download our most recent Sure Analysis report on Verizon (preview of page 1 of 3 shown below):

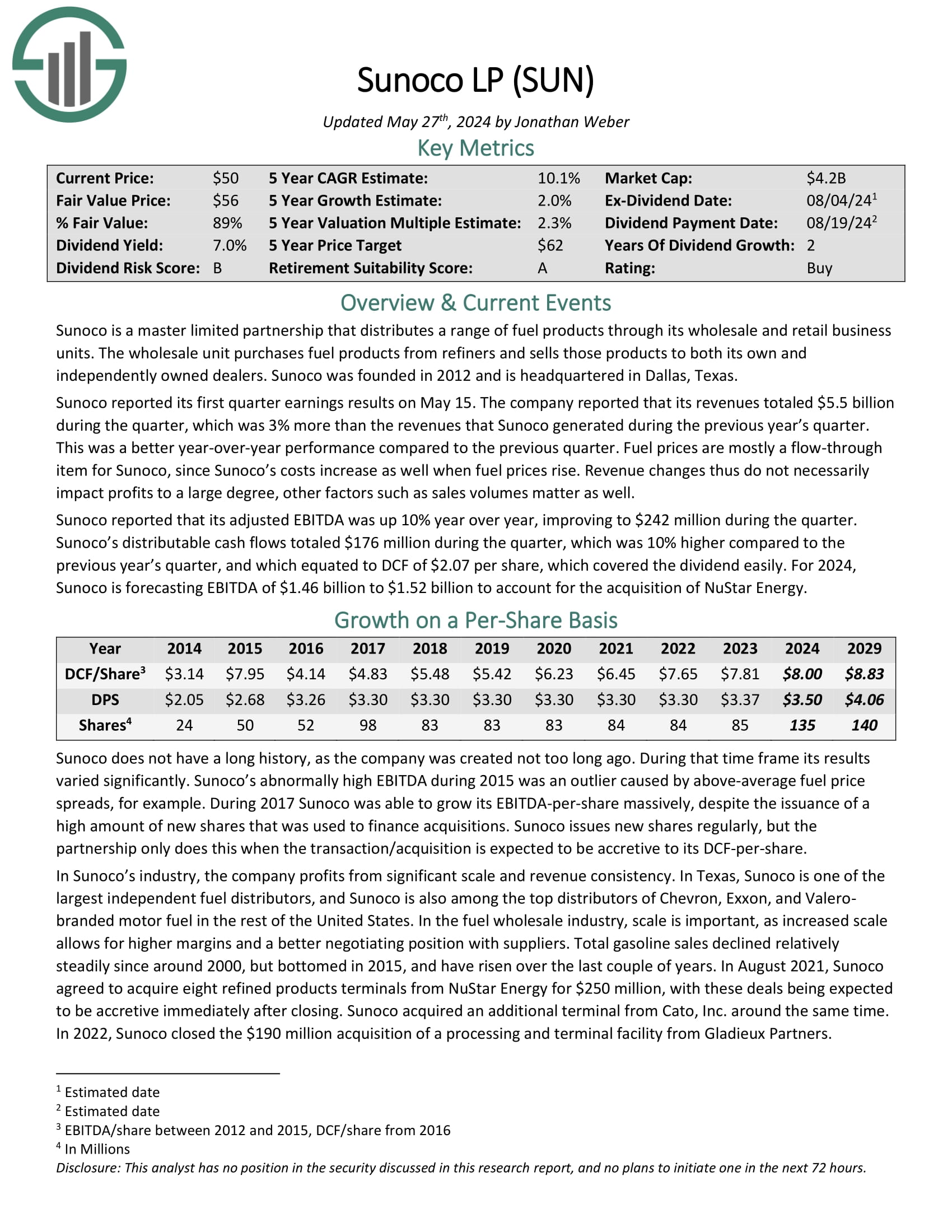

High Dividend Stock For Decades: Sunoco LP (SUN)

- Dividend Yield: 6.6%

Sunoco LP distributes a range of fuel products through its wholesale and retail business units. The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Sunoco reported its first quarter earnings results on May 15. The company reported that its revenues totaled $5.5 billion during the quarter, which was 3% more than the 2023 first quarter.

The company reported that its first-quarter adjusted EBITDA rose 10% year over year, improving to $242 million during the quarter. Distributable cash flow totaled $176 million during the quarter, 10% higher year-over-year.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion to account for the acquisition of NuStar Energy.

Click here to download our most recent Sure Analysis report on Sunoco (preview of page 1 of 3 shown below):

High Dividend Stock For Decades: Universal Health Realty Income Trust (UHT)

- Dividend Yield: 6.8%

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector.

The trust owns healthcare and human service-related facilities. Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers.

UHT reported net income of $5.3 million, or $0.38 per diluted share, for the three-month period ending March 31, 2024, compared to $4.5 million, or $0.32 per diluted share, for the same period in 2023.

The $841,000 increase in net income during the first quarter of 2024, compared to the first quarter of 2023, primarily stemmed from a rise in income generated at various properties, including reduced building expenses relate to vacant facilities.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

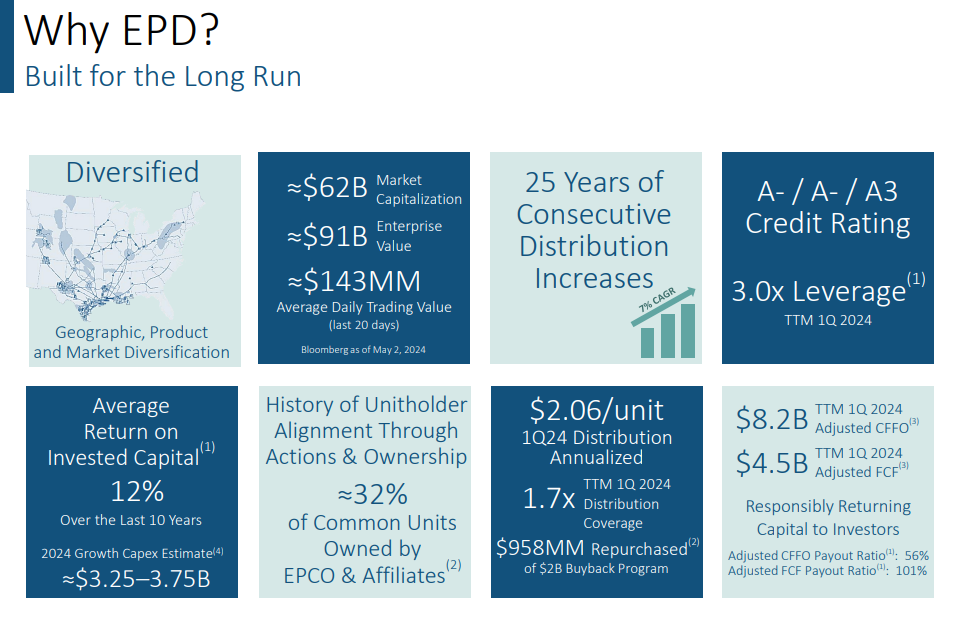

High Dividend Stock For Decades: Enterprise Products Partners (EPD)

- Dividend Yield: 7.0%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise reported net income attributable to common unitholders of $1.5 billion, or $0.66 per unit on a fully diluted basis, for the first quarter of 2024, marking a 5 percent increase from the first quarter of 2023. Distributable Cash Flow (DCF) remained steady at $1.9 billion for both quarters.

Distributions declared for the first quarter of 2024 increased by 5.1% compared to the same period in 2023, reaching $0.515 per common unit. DCF covered this distribution 1.7 times, with $786 million retained.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

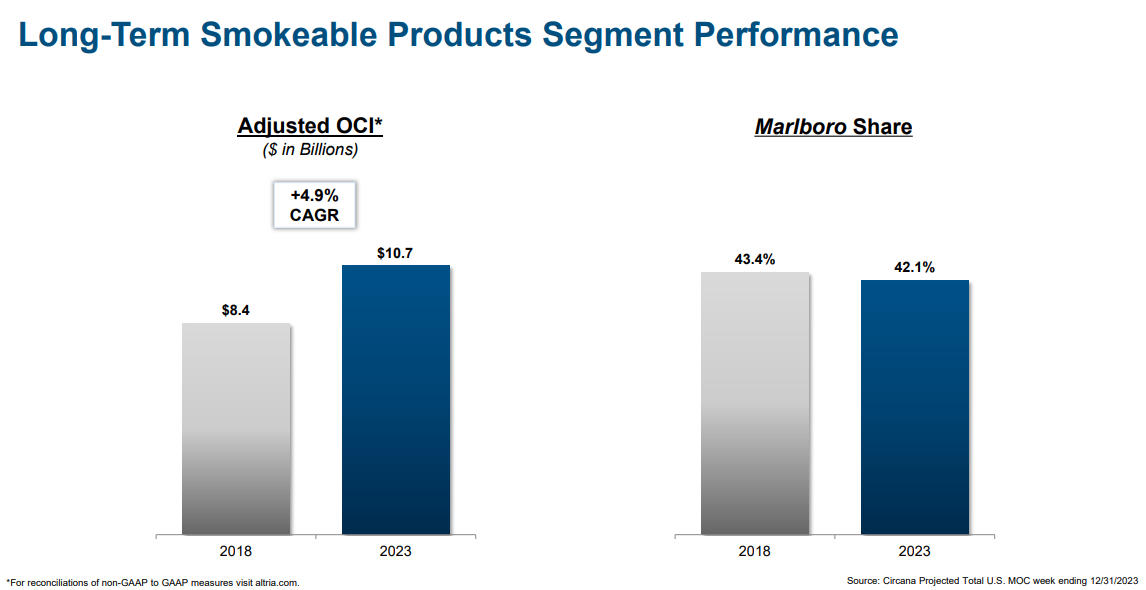

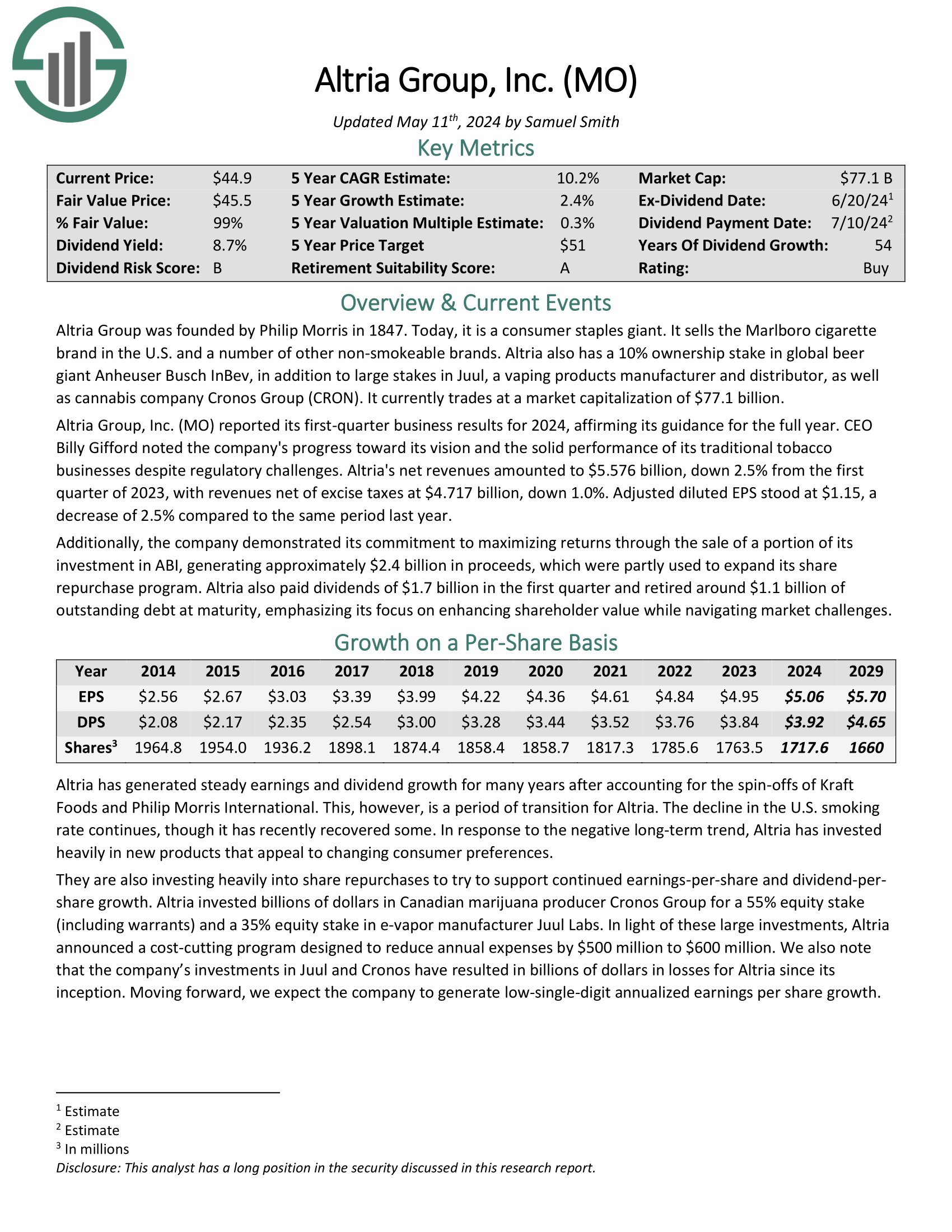

High Dividend Stock For Decades: Altria Group (MO)

- Dividend Yield: 7.6%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

The majority of Altria’s revenue and profit is still made up of smokeable tobacco products. The Marlboro brand still enjoys the leading market share in the U.S. market.

Source: Investor Presentation

In the 2024 first quarter, Altria’s net revenue of $5.576 billion declined 2.5% from the first quarter of 2023, with revenue net of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a decrease of 2.5% compared to the same period last year.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

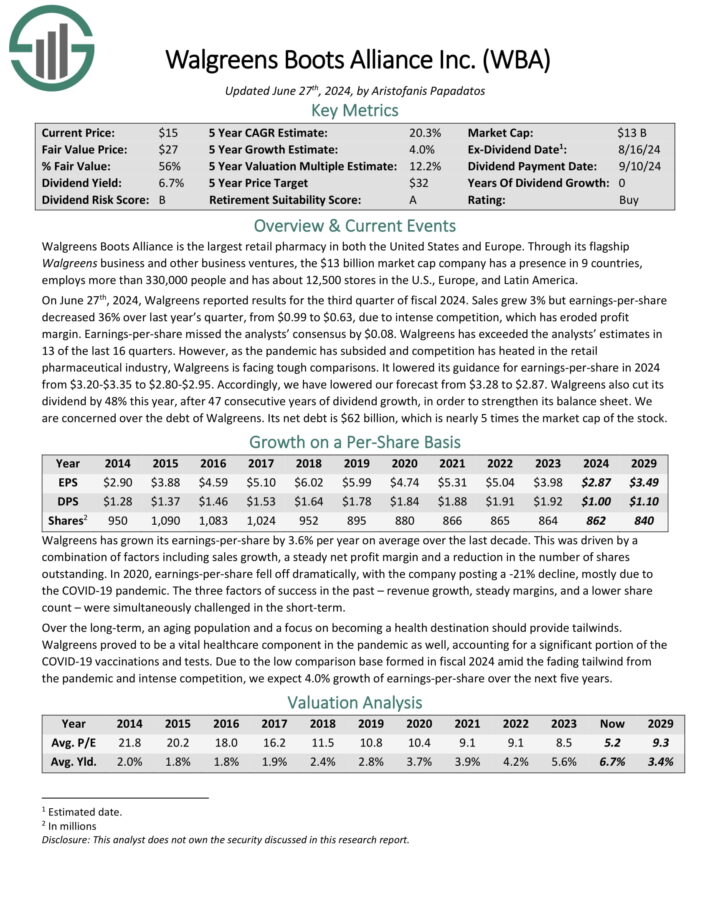

High Dividend Stock For Decades: Walgreens Boots Alliance (WBA)

- Dividend Yield: 9.2%

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the $13 billion market cap company has a presence in 9 countries, employs more than 330,000 people and has about 12,500 stores in the U.S., Europe, and Latin America.

On June 27th, 2024, Walgreens reported results for the third quarter of fiscal 2024. Sales grew 3% but earnings-per share decreased 36% over last year’s quarter, from $0.99 to $0.63, due to intense competition, which has eroded profit margin.

Source: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the last 16 quarters.

However, as the pandemic has subsided and competition has heated in the retail pharmaceutical industry, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have lowered our forecast from $3.28 to $2.87.

Click here to download our most recent Sure Analysis report on WBA (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

The 12 high dividend stocks analyzed above all have dividend yields of 5% or higher. And importantly, these securities generally have better risk profiles than the average high-yield stock.

That said, a dividend is never guaranteed, and high dividend stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more