Updated on February 24th, 2026 by Bob Ciura

In the world of investing, volatility matters. Investors are reminded of this every time there is a downturn in the broader market and individual stocks that are more volatile than others experience enormous swings in price.

Volatility is a proxy for risk; more volatility generally means a riskier portfolio. The volatility of a security or portfolio against a benchmark is called Beta.

In short, Beta is measured via a formula that calculates the price risk of a security or portfolio against a benchmark, which is typically the broader market as measured by the S&P 500.

Here’s how to read stock betas:

- A beta of 1.0 means the stock moves equally with the S&P 500

- A beta of 2.0 means the stock moves twice as much as the S&P 500

- A beta of 0.0 means the stocks moves don’t correlate with the S&P 500

- A beta of -1.0 means the stock moves precisely opposite the S&P 500

Interestingly, low beta stocks have historically outperformed the market… But more on that later.

You can download a spreadsheet of the 100 lowest beta S&P stocks (along with important financial metrics like price-to-earnings ratios and dividend yields) below:

This article will discuss beta more thoroughly, why low-beta stocks tend to outperform, and provide a discussion of the 5 lowest-beta dividend stocks in the Sure Analysis Research Database.

The table of contents below allows for easy navigation.

Table of Contents

- The Evidence for Low Beta Outperformance

- How To Calculate Beta

- Beta & The Capital Asset Pricing Model (CAPM)

- Analysis On The Top 5 Low Beta Stocks

- Final Thoughts

The Evidence for Low Beta Stocks Outperformance

Beta is helpful in understanding the overall price risk level for investors during market downturns in particular. The lower the Beta value, the less volatility the stock or portfolio should exhibit against the benchmark.

This is beneficial for investors for obvious reasons, particularly those that are close to or already in retirement, as drawdowns should be relatively limited against the benchmark.

Importantly, low or high Beta simply measures the size of the moves a security makes; it does not mean necessarily that the price of the security stays nearly constant.

Securities can be low Beta and still be caught in long-term downtrends, so this is simply one more tool investors can use when building a portfolio.

The conventional wisdom would suggest that lower Beta stocks should underperform the broader markets during uptrends and outperform during downtrends, offering investors lower prospective returns in exchange for lower risk.

However, history would suggest that simply isn’t the case.

Indeed, this paper from Harvard Business School suggests that not only do low Beta stocks not underperform the broader market over time – including all market conditions – they actually outperform.

A long-term study wherein the stocks with the lowest 30% of Beta scores in the US were pitted against stocks with the highest 30% of Beta scores suggested that low Beta stocks outperform by several percentage points annually.

Over time, this sort of outperformance can mean the difference between a comfortable retirement and having to continue working.

While low Beta stocks aren’t a panacea, the case for their outperformance over time – and with lower risk – is quite compelling.

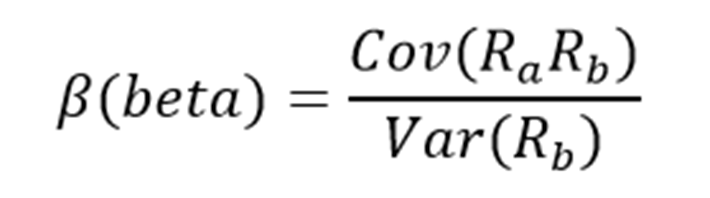

How To Calculate Beta

The formula to calculate a security’s Beta is fairly straightforward. The result, expressed as a number, shows the security’s tendency to move with the benchmark.

For example, a Beta value of 1.0 means that the security in question should move in lockstep with the benchmark. A Beta of 2.0 means that moves in the security should be twice as large in magnitude as the benchmark and in the same direction, while a negative Beta means that movements in the security and benchmark tend to move in opposite directions or are negatively correlated.

Related: The S&P 500 Stock With Negative Beta.

In other words, negatively correlated securities would be expected to rise when the overall market falls, or vice versa. A small value of Beta (something less than 1.0) indicates a stock that moves in the same direction as the benchmark, but with smaller relative changes.

Here’s a look at the formula:

The numerator is the covariance of the asset in question with the market, while the denominator is the variance of the market. These complicated-sounding variables aren’t actually that difficult to compute – especially in Excel.

Additionally, Beta can also be calculated as the correlation coefficient of the security in question and the market, multiplied by the security’s standard deviation divided by the market’s standard deviation.

Finally, there’s a greatly simplified way to calculate Beta by manipulating the capital asset pricing model formula (more on Beta and the capital asset pricing model later in this article).

Here’s an example of the data you’ll need to calculate Beta:

- Risk-free rate (typically Treasuries at least two years out)

- Your asset’s rate of return over some period (typically one year to five years)

- Your benchmark’s rate of return over the same period as the asset

To show how to use these variables to do the calculation of Beta, we’ll assume a risk-free rate of 2%, our stock’s rate of return of 7% and the benchmark’s rate of return of 8%.

You start by subtracting the risk-free rate of return from both the security in question and the benchmark. In this case, our asset’s rate of return net of the risk-free rate would be 5% (7% – 2%).

The same calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 5% and 6%, respectively – are the numerator and denominator for the Beta formula. Five divided by six yields a value of 0.83, and that is the Beta for this hypothetical security.

On average, we’d expect an asset with this Beta value to be 83% as volatile as the benchmark.

Thinking about it another way, this asset should be about 17% less volatile than the benchmark while still having its expected returns correlated in the same direction.

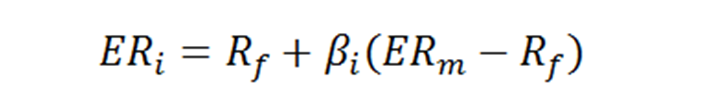

Beta & The Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model, or CAPM, is a common investing formula that utilizes the Beta calculation to account for the time value of money as well as the risk-adjusted returns expected for a particular asset.

Beta is an essential component of the CAPM because without it, riskier securities would appear more favorable to prospective investors. Their risk wouldn’t be accounted for in the calculation.

The CAPM formula is as follows:

The variables are defined as:

- ERi = Expected return of investment

- Rf = Risk-free rate

- βi = Beta of the investment

- ERm = Expected return of market

The risk-free rate is the same as in the Beta formula, while the Beta that you’ve already calculated is simply placed into the CAPM formula. The expected return of the market (or benchmark) is placed into the parentheses with the market risk premium, which is also from the Beta formula. This is the expected benchmark’s return minus the risk-free rate.

To continue our example, here is how the CAPM actually works:

ER = 2% + 0.83(8% – 2%)

In this case, our security has an expected return of 6.98% against an expected benchmark return of 8%. That may be okay depending upon the investor’s goals as the security in question should experience less volatility than the market thanks to its Beta of less than 1.

While the CAPM certainly isn’t perfect, it is relatively easy to calculate and gives investors a means of comparison between two investment alternatives.

Now, we’ll take a look at five stocks that not only offer investors low Beta scores, but attractive prospective returns as well.

Analysis On The Top 5 Low Beta Stocks

The following 5 low beta stocks have the lowest Beta values, in ascending order from lowest to highest. They also pay dividends to shareholders.

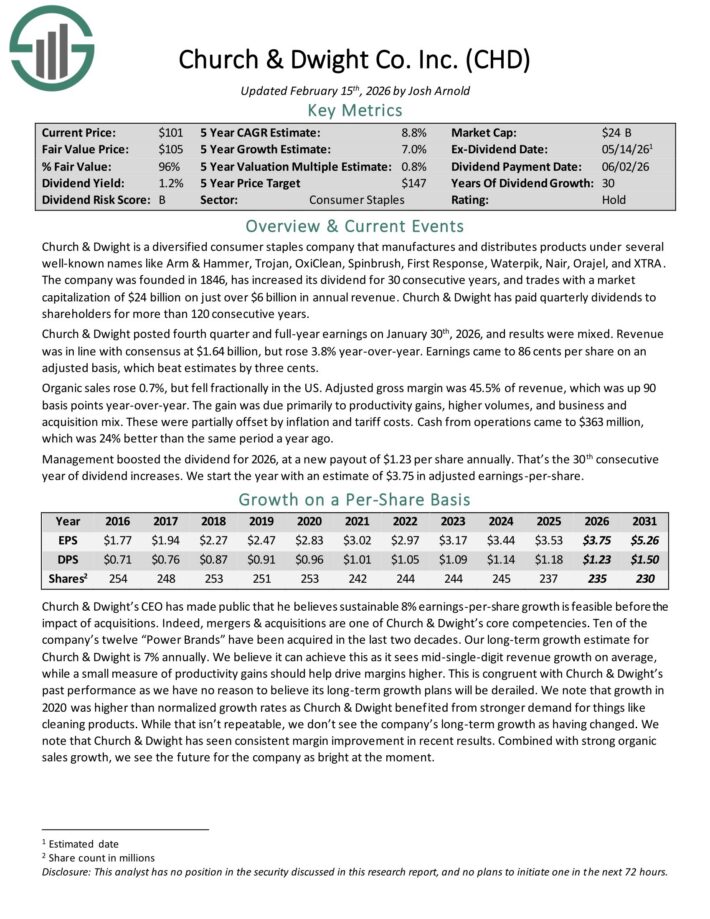

5. Church & Dwight (CHD)

- Beta: 0.07

Church & Dwight is a diversified consumer staples company that manufactures and distributes products under several well-known names like Arm & Hammer, Trojan, OxiClean, Spinbrush, First Response, Waterpik, Nair, Orajel, and XTRA.

The company was founded in 1846, has increased its dividend for 30 consecutive years, and generates just over $6 billion in annual revenue. Church & Dwight has paid quarterly dividends to shareholders for more than 120 consecutive years.

Church & Dwight posted fourth quarter and full-year earnings on January 30th, 2026, and results were mixed. Revenue was in line with consensus at $1.64 billion, but rose 3.8% year-over-year. Earnings came to 86 cents per share on an adjusted basis, which beat estimates by three cents.

Organic sales rose 0.7%, but fell fractionally in the US. Adjusted gross margin was 45.5% of revenue, which was up 90 basis points year-over-year. The gain was due primarily to productivity gains, higher volumes, and business and acquisition mix.

These were partially offset by inflation and tariff costs. Cash from operations came to $363 million, which was 24% better than the same period a year ago.

Management boosted the dividend for 2026, at a new payout of $1.23 per share annually. That’s the 30th consecutive year of dividend increases.

Click here to download our most recent Sure Analysis report on CHD (preview of page 1 of 3 shown below):

4. ConAgra Brands (CAG)

- Beta: 0.02

Conagra traces its roots back to Gilbert Van Camp’s new canned product – pork and beans – in 1861.

The company was incorporated as Nebraska Consolidated Mills in 1919, changed to ConAgra in 1971, ConAgra Foods in 1993, and has now become Conagra Brands, moving its headquarters from Omaha to Chicago and spinning off its Lamb Weston business in 2016. In 2018 Conagra acquired Pinnacle Foods.

The company has well-known brands like Slim Jim, Healthy Choice, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

After paying the same $0.2125 quarterly payout for 13 consecutive quarters, Conagra increased its dividend 29.4% in 2020, 13.6% in 2021, 5.6% in 2022, and 6.1% in 2023 to $0.35 per quarter.

On July 10th, 2025, Conagra reported fourth quarter results for the period ending May 25, 2025. (Conagra’s fiscal year ends the last Sunday in May). For the quarter, net sales declined 4.3% year-over-year to $2.8 billion, the result of a 3.5% reduction in organic net sales, a 0.6% decline due to currency exchange, and a negative impact of -0.2% due to M&A.

Volume declined 2.5%. Adjusted EPS decreased 8% to $0.56, missing analyst estimates by $0.05. At fiscal year-end, the company had net debt of $8.0 billion, and a net leverage ratio of 3.6x.

Conagra provided its fiscal 2026 guidance, expecting organic net sales growth of (1)% to 1% compared to FY 2025. Adjusted operating margin is likely to come in between 11.0% to 11.5%, and adjusted EPS is expected to decline sharply from FY 2025 to $1.70 to $1.85.

Capex is expected to be $450 million, and interest expense is expected to equal $400 million. Furthermore, it expects its net leverage ratio to degrade further to 3.85x.

Click here to download our most recent Sure Analysis report on CAG (preview of page 1 of 3 shown below):

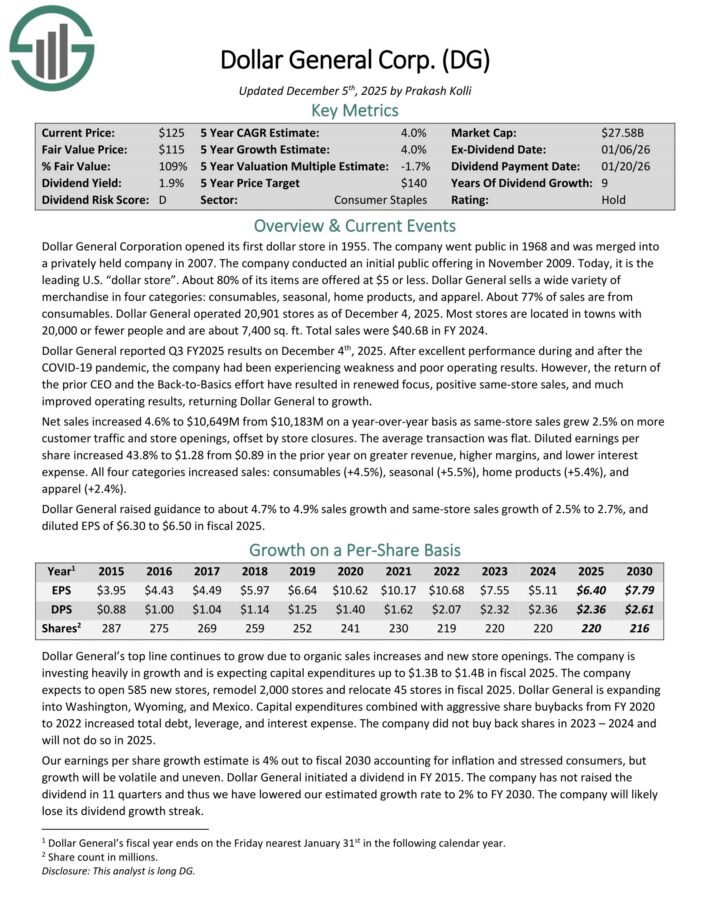

3. Dollar General (DG)

- Beta: -0.07

Dollar General Corporation opened its first dollar store in 1955. Today, it is the leading U.S. “dollar store”. About 80% of its items are offered at $5 or less.

Dollar General sells a wide variety of merchandise in four categories: consumables, seasonal, home products, and apparel. About 77% of sales are from consumables. Dollar General operated 20,594 stores as of August 1, 2025.

Most stores are located in towns with 20,000 or fewer people and are about 7,400 sq. ft. Total sales were $40.6B in FY 2024.

Dollar General reported Q3 FY2025 results on December 4th, 2025. Net sales increased 4.6% on a year-over-year basis as same-store sales grew 2.5% on more customer traffic and store openings, offset by store closures.

The average transaction was flat. Diluted earnings per share increased 43.8% to $1.28 from $0.89 in the prior year on greater revenue, higher margins, and lower interest expense.

All four categories increased sales: consumables (+4.5%), seasonal (+5.5%), home products (+5.4%), and apparel (+2.4%).

Dollar General raised guidance to about 4.7% to 4.9% sales growth and same-store sales growth of 2.5% to 2.7%, and diluted EPS of $6.30 to $6.50 in fiscal 2025.

Click here to download our most recent Sure Analysis report on DG (preview of page 1 of 3 shown below):

2. Consolidated Edison (ED)

- Beta: -0.10

Consolidated Edison is a holding company that delivers electricity, natural gas, and steam to its customers in New York City and Westchester County. The company has annual revenues of more than $16 billion.

On November 6th, 2025, Consolidated Edison reported third quarter results for the period ending September 30th, 2025. For the quarter, revenue increased 10.7% to $4.5 billion, which was $310 million ahead of estimates.

Adjusted earnings of $686 million, or $1.90 per share, compared to adjusted earnings of $583 million, or $1.68 per share, in the previous year. Adjusted earnings-per-share were also $0.15 better than expected.

Average rate base balances are still projected to grow by 8.2% annually through 2029 based off 2025 levels. This is up from the company’s prior forecast of 6.4%. The company will update its forecast through 2030 in February of next year.

Consolidated Edison still expects capital investments of $38 billion for the 2025 to 2029 period, which was up from $28 billion previously. The company also expects capital investments of ~$72 billion over the next decade.

Consolidated Edison provided updated guidance for 2025 as well, with the company now expecting earnings-per-share in a range of $5.60 to $5.70 for the year, up from $5.50 to $5.70 previously.

The company expects 5% to 7% earnings growth from 2025 levels through 2029.

Click here to download our most recent Sure Analysis report on ED (preview of page 1 of 3 shown below):

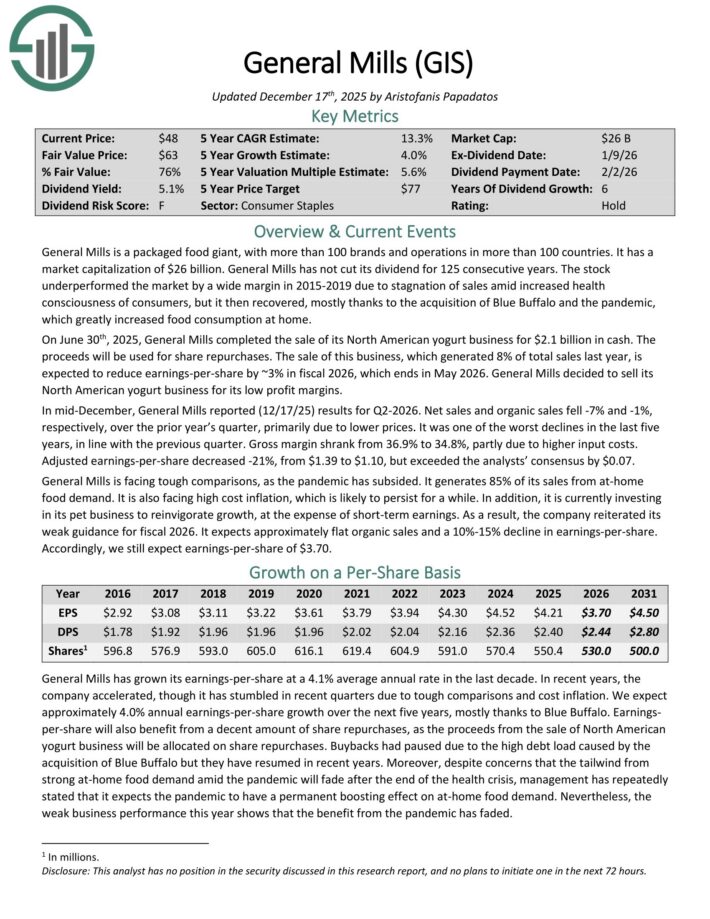

1. General Mills (GIS)

- Beta: -0.12

General Mills is a packaged food giant, with more than 100 brands and operations in more than 100 countries. It has a market capitalization of $26 billion. General Mills has not cut its dividend for 125 consecutive years.

In mid-December, General Mills reported (12/17/25) results for Q2-2026. Net sales and organic sales fell -7% and -1%, respectively, over the prior year’s quarter, primarily due to lower prices.

It was one of the worst declines in the last five years, in line with the previous quarter. Gross margin shrank from 36.9% to 34.8%, partly due to higher input costs.

Adjusted earnings-per-share decreased -21%, from $1.39 to $1.10, but exceeded the analysts’ consensus by $0.07.

General Mills is facing tough comparisons, as the pandemic has subsided. It generates 85% of its sales from at-home food demand. It is also facing high cost inflation, which is likely to persist for a while.

In addition, it is currently investing in its pet business to reinvigorate growth, at the expense of short-term earnings.

As a result, the company reiterated its weak guidance for fiscal 2026. It expects approximately flat organic sales and a 10%-15% decline in earnings-per-share.

Click here to download our most recent Sure Analysis report on GIS (preview of page 1 of 3 shown below):

Final Thoughts

Investors must take risk into account when selecting from prospective investments. After all, if two securities are otherwise similar in terms of expected returns but one offers a much lower Beta, the investor would do well to select the low Beta security as they may offer better risk-adjusted returns.

Using Beta can help investors determine which securities will produce more volatility than the broader market and which ones may help diversify a portfolio, such as the ones listed here.

The five stocks we’ve looked at not only offer low Beta scores, but they also offer attractive dividend yields. Sifting through the immense number of stocks available for purchase to investors using criteria like these can help investors find the best stocks to suit their needs.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: dividend stocks with 25+ years of consecutive dividend increases

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 57 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.