Updated on May 14th, 2024

Spreadsheet data updated daily

In the world of investing, volatility matters. Investors are reminded of this every time there is a downturn in the broader market and individual stocks that are more volatile than others experience enormous swings in price in both directions. That volatility can increase the risk in an individual’s stock portfolio relative to the broader market.

The volatility of a security or portfolio against a benchmark – is called Beta. In short, Beta is measured via a formula that calculates the price risk of a security or portfolio against a benchmark, which is typically the broader market as measured by the S&P 500 Index.

When stock markets are rising, high-beta stocks could outperform. With that in mind, we created a list of S&P 500 stocks with the highest beta values.

You can download your free High Beta stocks list (along with relevant financial metrics such as dividend yields and price-to-earnings ratios) by clicking on the link below:

It is helpful in understanding the overall price risk level for investors during market downturns in particular.

High Beta stocks are not a sure bet during bull markets to outperform, so investors should be judicious when adding high Beta stocks to a portfolio, as the weight of the evidence suggests they are more likely to under-perform during periods of market weakness.

However, for those investors interested in adding a bit more risk to their portfolio, we’ve put together a list to help investors find the best high beta stocks.

This article will provide an overview of Beta. In addition, we will discuss how to calculate Beta, incorporating Beta into the Capital Asset Pricing Model, and provide analysis on the top 5 highest-Beta dividend stocks in our coverage database.

The table of contents below provides for easy navigation:

Table of Contents

- High Beta Stocks Versus Low Beta Stocks

- How To Calculate Beta

- Beta & The Capital Asset Pricing Model (CAPM)

- Analysis On The 5 Highest-Beta Dividend Stocks

- Final Thoughts

High Beta Stocks Versus Low Beta

Here’s how to read stock betas:

- A beta of 1.0 means the stock moves equally with the S&P 500

- A beta of 2.0 means the stock moves twice as much as the S&P 500

- A beta of 0.0 means the stocks moves don’t correlate with the S&P 500

- A beta of -1.0 means the stock moves precisely opposite the S&P 500

The higher the Beta value, the more volatility the stock or portfolio should exhibit against the benchmark. This can be beneficial for those investors that prefer to take a bit more risk in the market as stocks that are more volatile – that is, those with higher Beta values – should outperform the benchmark (in theory) during bull markets.

However, Beta works both ways and can certainly lead to larger draw-downs during periods of market weakness. Importantly, Beta simply measures the size of the moves a security makes.

Intuitively, it would make sense that high Beta stocks would outperform during bull markets. After all, these stocks should be achieving more than the benchmark’s returns given their high Beta values. While this can be true over short periods of time – particularly the strongest parts of the bull market – the high Beta names are generally the first to be sold heavily by investors.

One potential theory for this, is that investors are able to use leverage to bid up momentum names with high Beta values and thus, on average, these stocks have lower prospective returns at any given time. In addition, leveraged positions are among the first to be sold by investors during weak periods because of margin requirements or other financing concerns that come up during bear markets.

In other words, while high Beta names may outperform while the market is strong, as signs of weakness begin to show, high Beta names are the first to be sold and generally, much more strongly than the benchmark.

Indeed, evidence suggests that during good years for the market, high Beta names capture 138% of the market’s total returns. In other words, if the market returned 10% in a year, high Beta names would, on average, produce 13.8% returns. However, during down years, high Beta names capture 243% of the market’s returns.

In a similar example, if the market lost 10% during a year, the group of high Beta names would have returned -24.3%. Given this relatively small outperformance during good times and vast underperformance during weak periods, it is easy to see why we prefer low Beta stocks.

Related: The S&P 500 Stocks With Negative Beta.

While low Beta stocks aren’t a vaccine against downturns in the market, it is much easier to make the case over the long run for low Beta stocks versus high Beta given how each group performs during bull and bear markets.

How To Calculate Beta

The formula to calculate a security’s Beta is fairly straightforward. The result, expressed as a number, shows the security’s tendency to move with the benchmark.

In other words, a Beta value of 1.00 means that the security in question should move virtually in lockstep with the benchmark (as discussed briefly in the introduction of this article). A Beta of 2.00 means moves should be twice as large in magnitude while a negative Beta means that returns in the security and benchmark are negatively correlated; these securities tend to move in the opposite direction from the benchmark.

This sort of security would be helpful to mitigate broad market weakness in one’s portfolio as negatively correlated returns would suggest the security in question would rise while the market falls.

For those investors seeking high Beta, stocks with values in excess of 1.3 would be the ones to seek out. These securities would offer investors at least 1.3X the market’s returns for any given period.

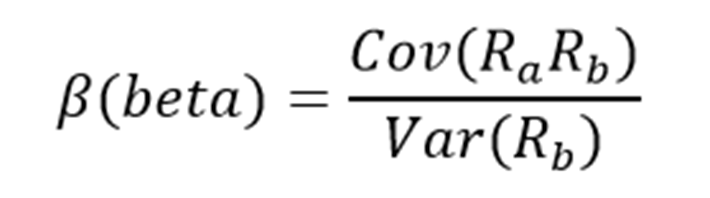

Here’s a look at the formula to compute Beta:

The numerator is the covariance of the asset in question while the denominator is the variance of the market. These complicated-sounding variables aren’t actually that difficult to compute.

Here’s an example of the data you’ll need to calculate Beta:

- Risk-free rate (typically Treasuries at least two years out)

- Your asset’s rate of return over some period (typically one year to five years)

- Your benchmark’s rate of return over the same period as the asset

To show how to use these variables to do the calculation of Beta, we’ll assume a risk-free rate of 2%, our stock’s rate of return of 14% and the benchmark’s rate of return of 8%.

You start by subtracting the risk-free rate of return from both the security in question and the benchmark. In this case, our asset’s rate of return net of the risk-free rate would be 12% (14% – 2%). The same calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 12% and 6%, respectively – are the numerator and denominator for the Beta formula. Twelve divided by six yields a value of 2.00, and that is the Beta for this hypothetical security. On average, we’d expect an asset with this Beta value to be 200% as volatile as the benchmark.

Thinking about it another way, this asset should be about twice as volatile as the benchmark while still having its expected returns correlated in the same direction. That is, returns would be correlated with the market’s overall direction, but would return double what the market did during the period. This would be an example of a very high Beta stock and would offer a significantly higher risk profile than an average or low Beta stock.

Beta & The Capital Asset Pricing Model

The Capital Asset Pricing Model, or CAPM, is a common investing formula that utilizes the Beta calculation to account for the time value of money as well as the risk-adjusted returns expected for a particular asset. Beta is an essential component of the CAPM because without it, riskier securities would appear more favorable to prospective investors. Their risk wouldn’t be accounted for in the calculation.

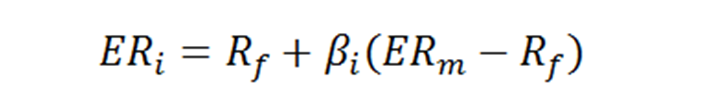

The CAPM formula is as follows:

The variables are defined as:

- ERi = Expected return of investment

- Rf = Risk-free rate

- βi = Beta of the investment

- ERm = Expected return of market

The risk-free rate is the same as in the Beta formula, while the Beta that you’ve already calculated is simply placed into the CAPM formula. The expected return of the market (or benchmark) is placed into the parentheses with the market risk premium, which is also from the Beta formula. This is the expected benchmark’s return minus the risk-free rate.

To continue our example, here is how the CAPM actually works:

ER = 2% + 2.00(8% – 2%)

In this case, our security has an expected return of 14% against an expected benchmark return of 8%. In theory, this security should vastly outperform the market to the upside but keep in mind that during downturns, the security would suffer significantly larger losses than the benchmark. Indeed, if we changed the expected return of the market to -8% instead of +8%, the same equation yields expected returns for our hypothetical security of -18%.

This security would theoretically achieve stronger returns to the upside but certainly much larger losses on the downside, highlighting the risk of high Beta names during anything but strong bull markets. While the CAPM certainly isn’t perfect, it is relatively easy to calculate and gives investors a means of comparison between two investment alternatives.

Analysis On The 5 Highest-Beta Dividend Stocks

Now, we’ll take a look at the 5 dividend stocks with the highest Beta scores (in ascending order from lowest to highest) in the Sure Analysis Research Database:

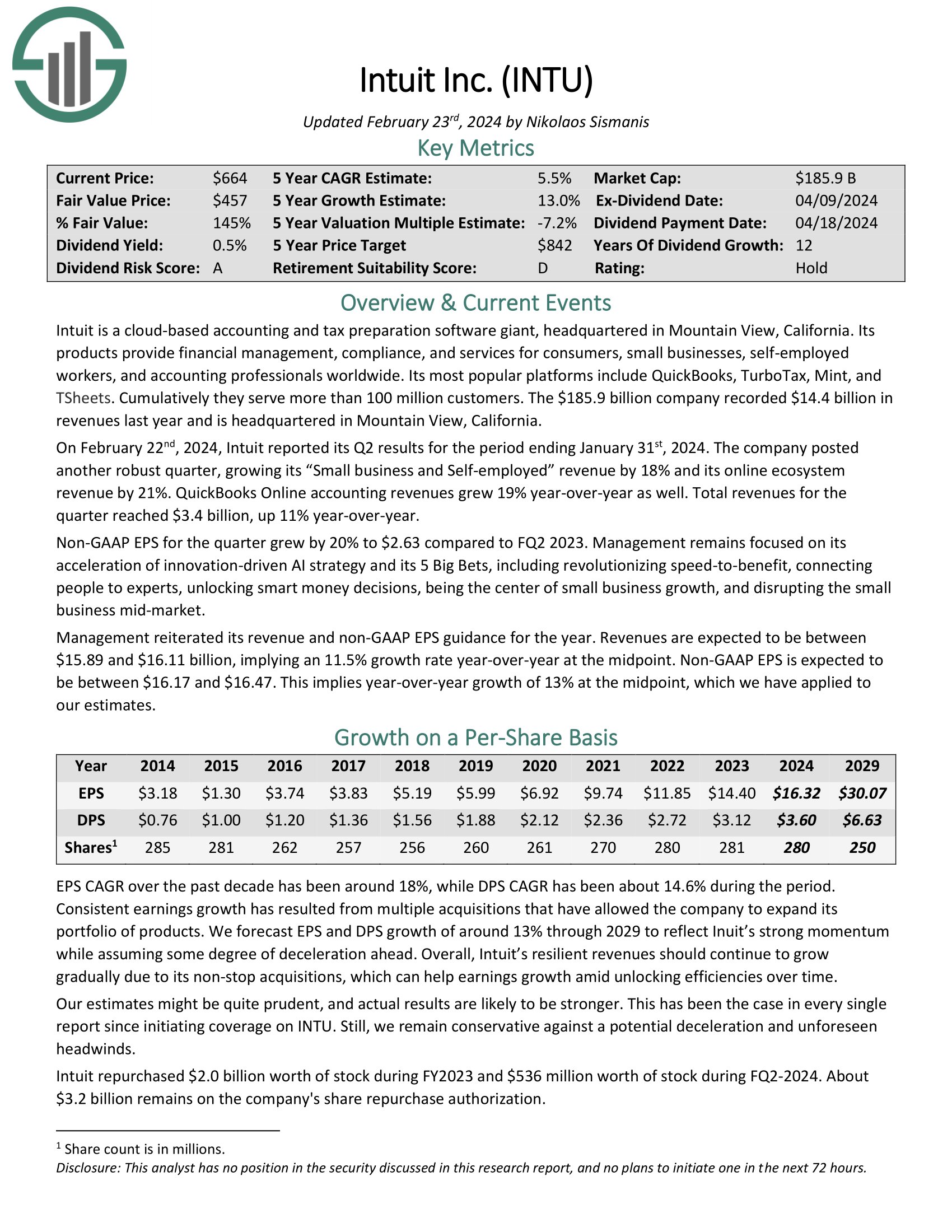

#5: Intuit Inc. (INTU)

Intuit is a cloud-based accounting and tax preparation software giant, headquartered in Mountain View, California. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide. Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers.

On February 22nd, 2024, Intuit reported its Q2 results for the period ending January 31st, 2024. The company posted another robust quarter, growing its “Small business and Self-employed” revenue by 18% and its online ecosystem revenue by 21%. QuickBooks Online accounting revenues grew 19% year-over-year as well. Total revenues for the quarter reached $3.4 billion, up 11% year-over-year.

Non-GAAP EPS for the quarter grew by 20% to $2.63 compared to FQ2 2023.

INTU has a Beta value of 1.51.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

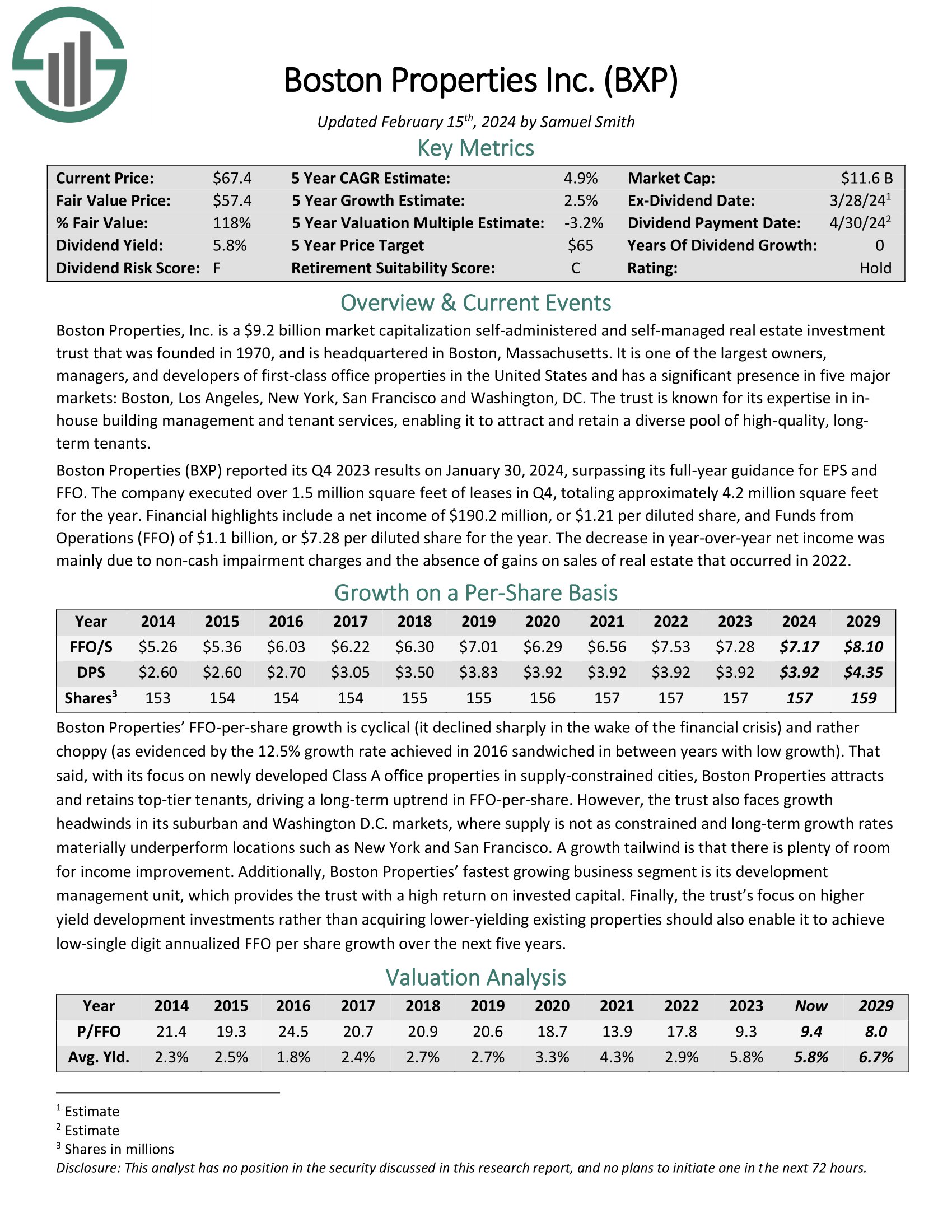

#4: Boston Properties, Inc. (BXP)

Boston Properties, Inc. is a self-administered and self-managed Real Estate Investment Trust, or REIT, headquartered in Boston, Massachusetts. It is one of the largest owners, managers, and developers of office properties in the United States and has a significant presence in Boston, Los Angeles, New York, San Francisco and Washington, DC.

Boston Properties (BXP) reported its Q4 2023 results on January 30, 2024, surpassing its full-year guidance for EPS and FFO. The company executed over 1.5 million square feet of leases in Q4, totaling approximately 4.2 million square feet for the year.

Financial highlights include a net income of $190.2 million, or $1.21 per diluted share, and FFO of $1.1 billion, or $7.28 per diluted share for the year. The decrease in year-over-year net income was mainly due to non-cash impairment charges and the absence of gains on sales of real estate that occurred in 2022.

BXP has a Beta value of 1.66.

Click here to download our most recent Sure Analysis report on BXP (preview of page 1 of 3 shown below):

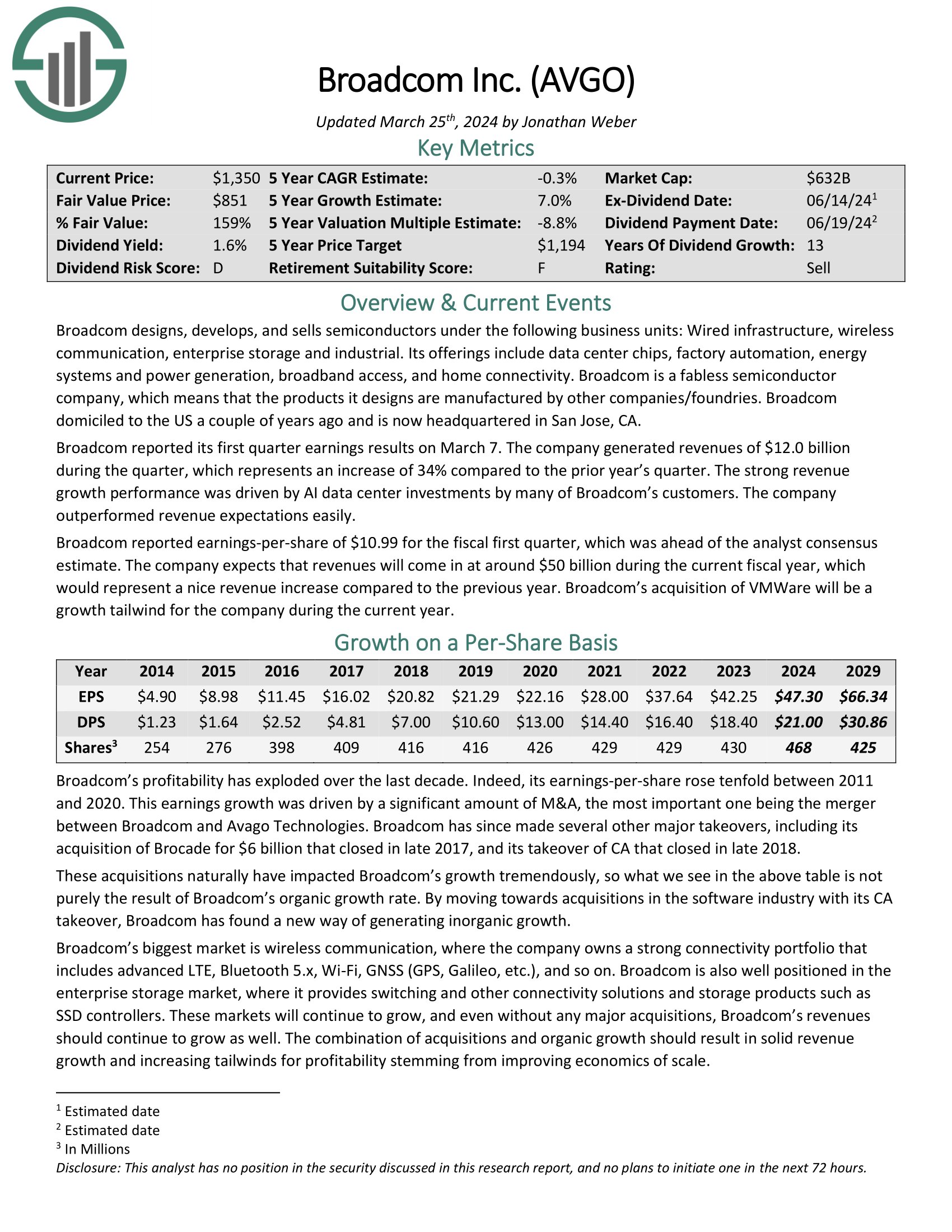

#3: Broadcom Inc. (AVGO)

Broadcom designs, develops, and sells semiconductors under the following business units: Wired infrastructure, wireless communication, enterprise storage and industrial. Its offerings include data center chips, factory automation, energy systems and power generation, broadband access, and home connectivity.

Broadcom is a fabless semiconductor company, which means that the products it designs are manufactured by other companies/foundries.

Broadcom reported its first quarter earnings results on March 7. The company generated revenues of $12.0 billion during the quarter, which represents an increase of 34% compared to the prior year’s quarter. The strong revenue growth performance was driven by AI data center investments by many of Broadcom’s customers.

The company outperformed revenue expectations easily. Broadcom reported earnings-per-share of $10.99 for the fiscal first quarter, which was ahead of the analyst consensus estimate.

AVGO has a Beta value of 1.97.

Click here to download our most recent Sure Analysis report on AVGO (preview of page 1 of 3 shown below):

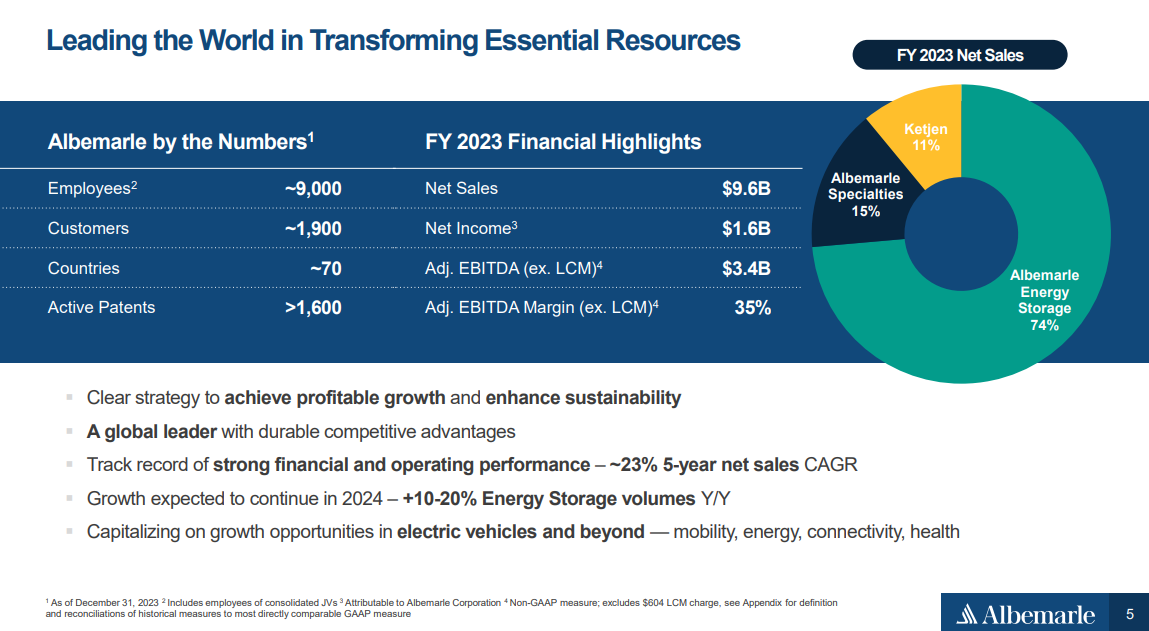

#2: Albemarle Corporation (ALB)

Albemarle is the largest producer of lithium and second-largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium. The company operates in nearly 100 countries.

Source: Investor Presentation

On May 1st, 2024, Albemarle reported first quarter results for the period ending March 31st, 2024. For the quarter, revenue decreased 47.3% to $1.36 billion, which was in-line with expectations. Adjusted earnings-per-share of $0.26 compared very unfavorably to $10.32 in the prior year, but topped estimates by $0.03.

ALB has a Beta value of 2.15.

Click here to download our most recent Sure Analysis report on ALB (preview of page 1 of 3 shown below):

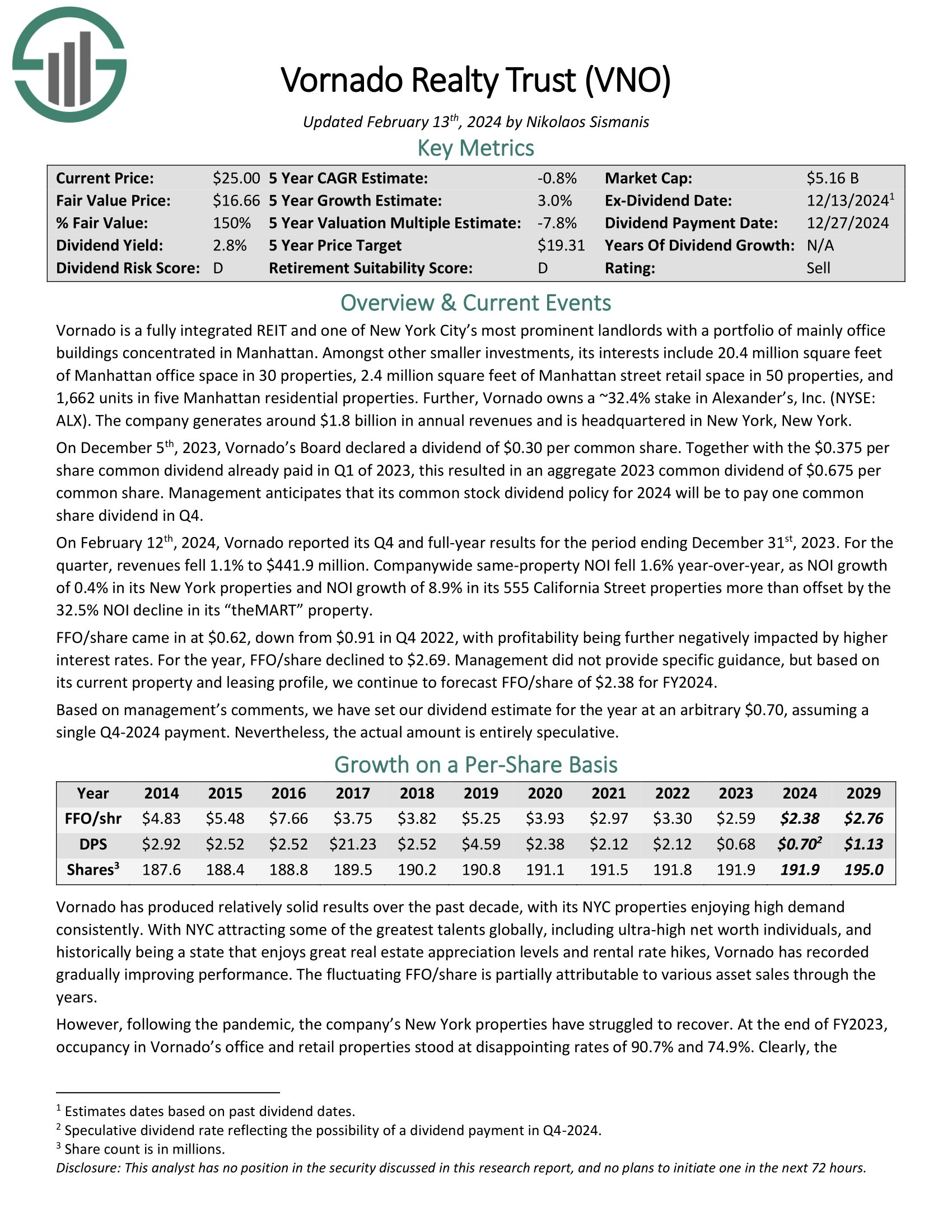

#1: Vornado Realty Trust (VNO)

Vornado is a fully integrated REIT and one of New York City’s most prominent landlords with a portfolio of mainly office buildings concentrated in Manhattan. Amongst other smaller investments, its interests include 20.4 million square feet of Manhattan office space in 30 properties, 2.4 million square feet of Manhattan street retail space in 50 properties, and 1,662 units in five Manhattan residential properties.

Further, Vornado owns a ~32.4% stake in Alexander’s, Inc. (ALX). The company generates around $1.8 billion in annual revenues and is headquartered in New York.

On February 12th, 2024, Vornado reported its Q4 and full-year results for the period ending December 31st, 2023. For the quarter, revenues fell 1.1% to $441.9 million. Companywide same-property NOI fell 1.6% year-over-year. For the year, FFO/share declined to $2.69.

VNO has a Beta value of 2.26.

Click here to download our most recent Sure Analysis report on VNO (preview of page 1 of 3 shown below):

Final Thoughts

Investors must take risk into account when selecting prospective investments. After all, if two securities are otherwise similar in terms of expected returns but one offers a much lower Beta, the investor would do well to select the low Beta security as it would offer better risk-adjusted returns.

Using Beta can help investors determine which securities will produce more volatility than the broader market, such as the ones listed here.

The five stocks we’ve looked at offer investors high Beta scores along with very strong prospective returns.

For investors who want to take some additional risk in their portfolio, these names and others like them in our list of the 100 best high Beta stocks can help determine what to look for when selecting a high Beta stock to buy.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 dividend stocks with 25+ years of consecutive dividend increases

- The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.