Updated on February 23rd, 2024 by Bob Ciura

The “Dogs of the Dow” investing strategy is a very simple way for investors to achieve diversification and income in their portfolios while remaining in the sphere of more conservative blue chip stocks.

The strategy consists of investing in the 10 highest-yielding stocks in the Dow Jones Industrial Average, an index of 30 U.S. stocks.

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.6%.

With that in mind, we have created a free list of over 200 high dividend stocks with dividend yields above 5%. You can download your copy of the high dividend stocks list below:

The “Dogs of the Dow” strategy produces above-average income and concentrates on stocks that typically trade at lower valuations relative to the rest of the DJIA. Given that the DJIA represents some of the largest companies in the world, its “dogs” are typically companies with strong track records that have hit temporary problems.

This is a great and simple strategy for value investors looking to purchase good businesses that are currently out of favor.

To implement this strategy, take the amount of money you have to invest and then divide it equally among the 10 highest-yielding stocks in the DJIA. Hold these stocks for a whole year and then at the end of 12 months, look at the 30 Dow stocks again and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the process. In addition to the simplicity and focus on quality, value, and income that this strategy generates, it also improves discipline by preventing excessive emotion-driven trading.

It also encourages investors to reap the tax benefits from holding positions for at least one year before selling, thereby being taxed at the long-term capital gains tax rate instead of the short-term rate.

The 2024 Dogs of the Dow

The list of the 2024 Dogs of the Dow is below, along with the current dividend yield of the top-ten yielding DJIA stocks. Click on a company’s name to jump directly to analysis on that company.

- Dog of the Dow #10: Goldman Sachs (GS)

- Dog of the Dow #9: Johnson & Johnson (JNJ)

- Dog of the Dow #8: Coca-Cola (KO)

- Dog of the Dow #7: Amgen Inc. (AMGN)

- Dog of the Dow #6: Cisco Systems (CSCO)

- Dog of the Dow #5: International Business Machines (IBM)

- Dog of the Dow #4: Chevron Corporation (CVX)

- Dog of the Dow #3: Dow Inc. (DOW)

- Dog of the Dow #2: 3M Company (MMM)

- Dog of the Dow #1: Verizon Communications (VZ)

- Final Thoughts

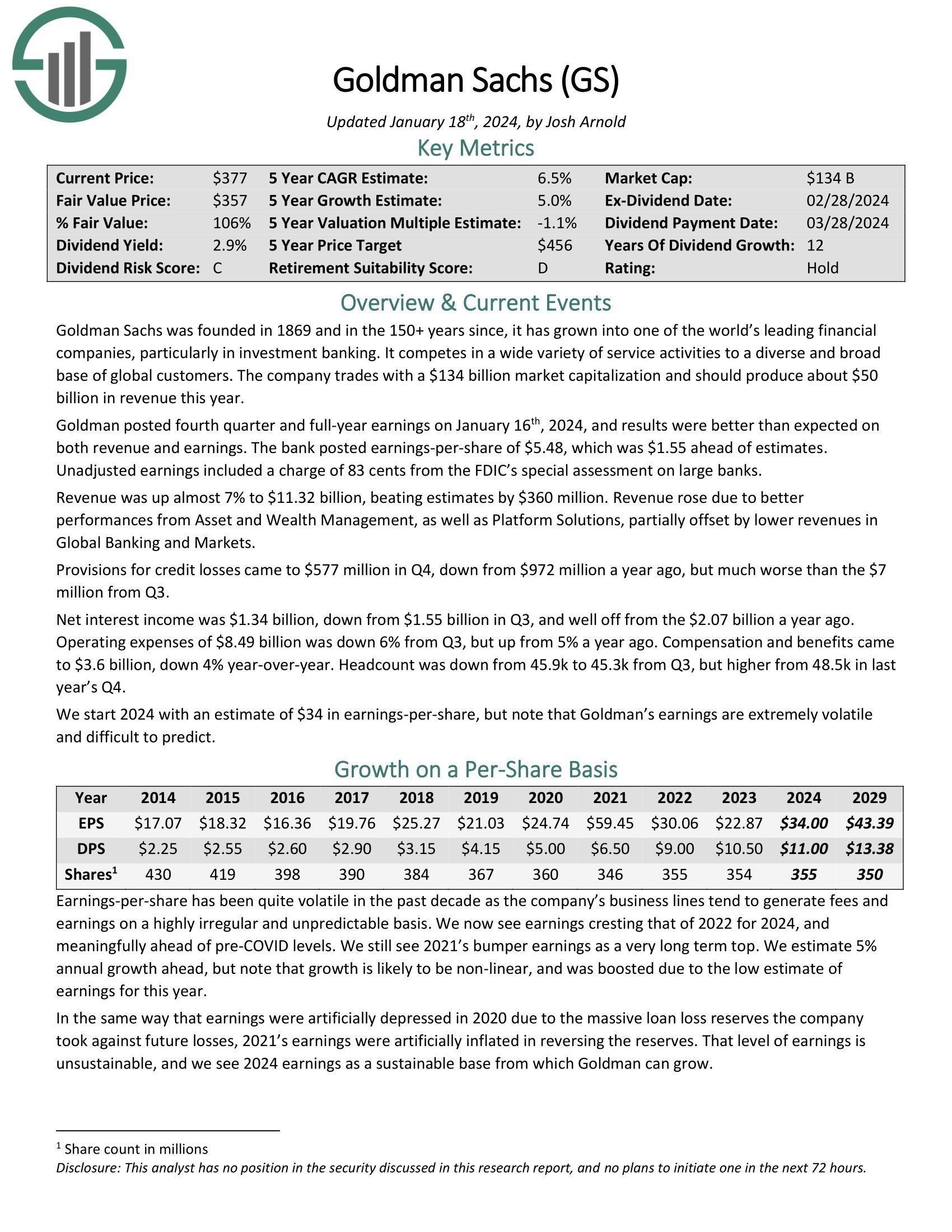

Dog of the Dow #10: Goldman Sachs (GS)

- Dividend Yield: 2.9%

Goldman Sachs was founded in 1869 and in the 150+ years since, it has grown into one of the world’s leading financial companies, particularly in investment banking. It competes in a wide variety of service activities to a diverse and broad base of global customers. The company trades with a $134 billion market capitalization and should produce about $50 billion in revenue this year.

Goldman posted fourth quarter and full-year earnings on January 16th, 2024, and results were better than expected on both revenue and earnings. The bank posted earnings-per-share of $5.48, which was $1.55 ahead of estimates. Unadjusted earnings included a charge of 83 cents from the FDIC’s special assessment on large banks.

Revenue was up almost 7% to $11.32 billion, beating estimates by $360 million. Revenue rose due to better performances from Asset and Wealth Management, as well as Platform Solutions, partially offset by lower revenues in Global Banking and Markets.

Click here to download our most recent Sure Analysis report on GS (preview of page 1 of 3 shown below):

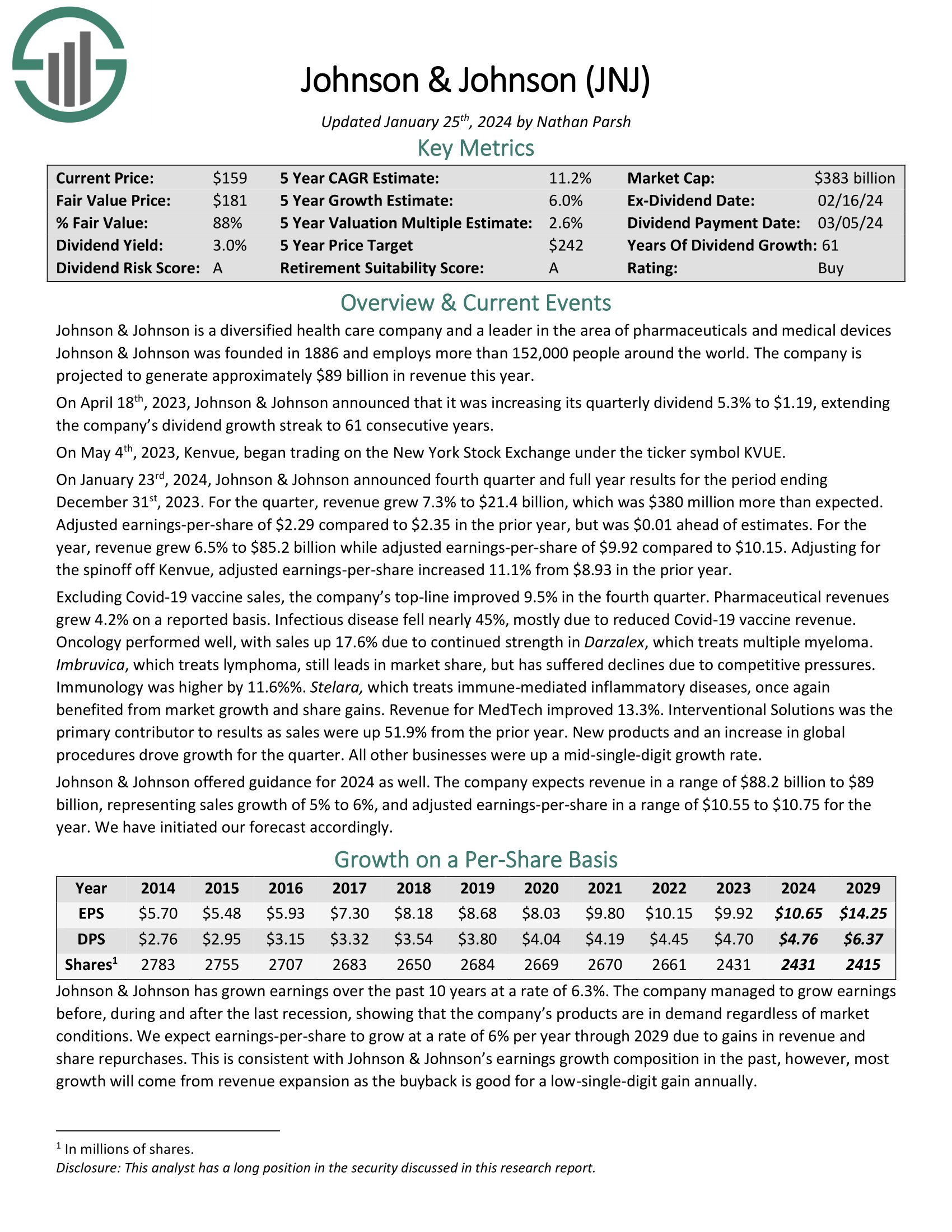

Dog of the Dow #9: Johnson & Johnson (JNJ)

- Dividend Yield: 3.0%

Johnson & Johnson is a global healthcare giant. The company currently operates two segments: Pharmaceutical, and Medical Devices & Diagnostics. The corporation includes roughly 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries.

On January 23rd, 2024, Johnson & Johnson announced fourth quarter and full year results for the period ending December 31st, 2023. For the quarter, revenue grew 7.3% to $21.4 billion, which was $380 million more than expected. Adjusted earnings-per-share of $2.29 compared to $2.35 in the prior year, but was $0.01 ahead of estimates.

For the year, revenue grew 6.5% to $85.2 billion while adjusted earnings-per-share of $9.92 compared to $10.15. Adjusting for the spinoff off Kenvue, adjusted earnings-per-share increased 11.1% from $8.93 in the prior year.

The company has increased its dividend for 60 consecutive years, making it a Dividend King. The stock is owned by many well-known money managers. For example, J&J is a Kevin O’Leary dividend stock.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

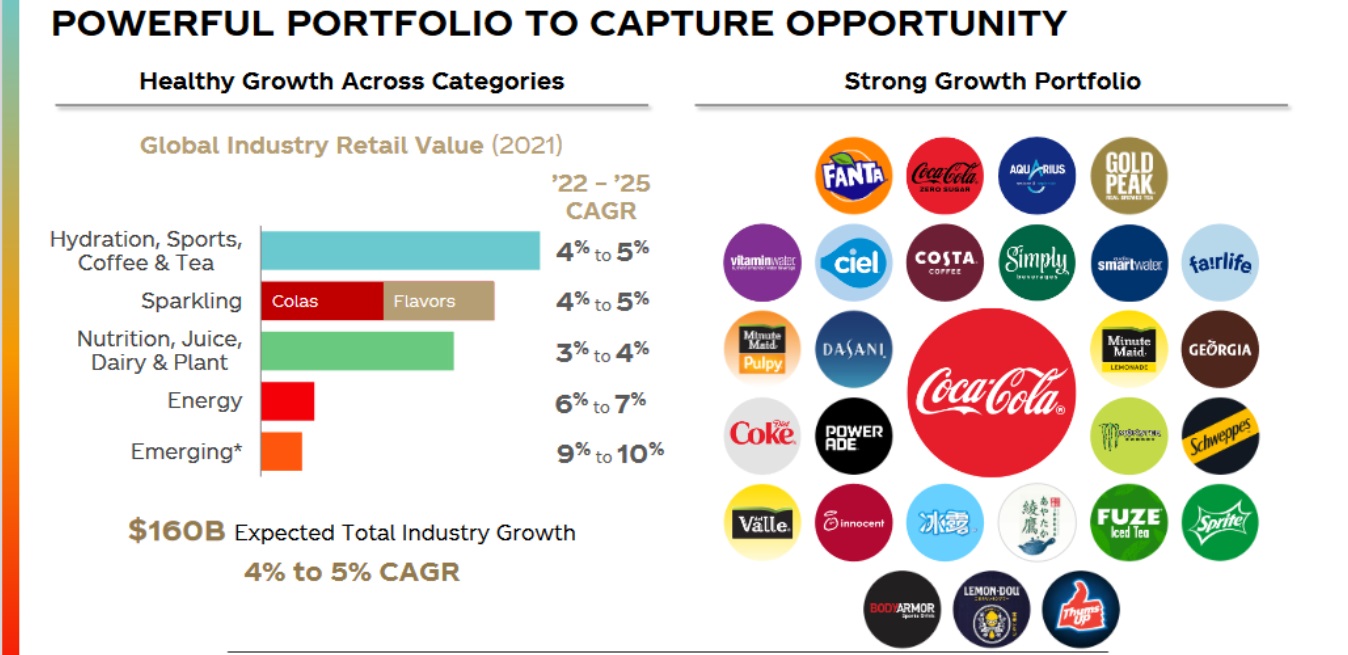

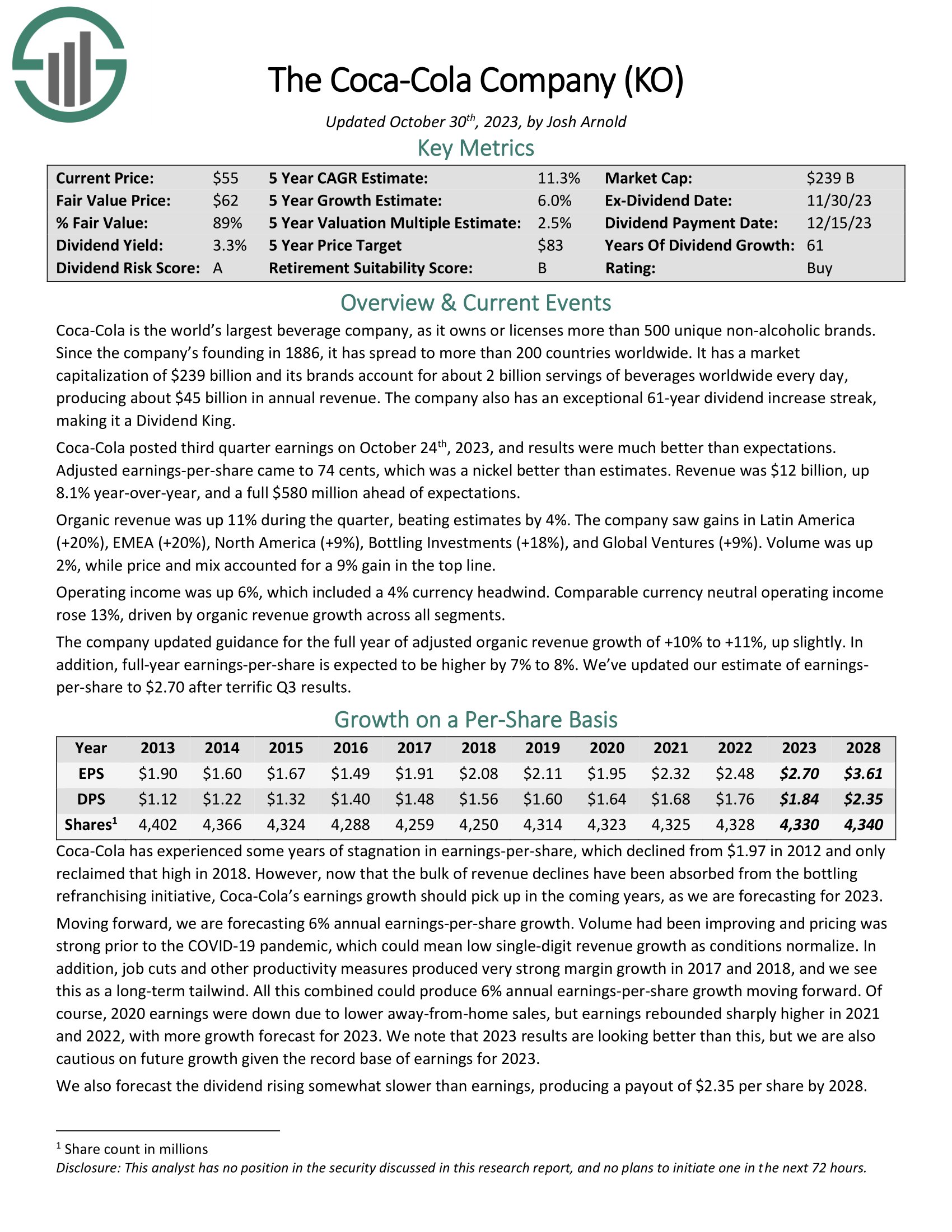

Dog of the Dow #8: Coca-Cola (KO)

- Dividend Yield: 3.2%

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Source: Investor Presentation

The company also has an exceptional 59-year dividend increase streak.

Coca-Cola posted third quarter earnings on October 24th, 2023, and results were much better than expectations. Adjusted earnings-per-share came to 74 cents, which was a nickel better than estimates. Revenue was $12 billion, up 8.1% year-over-year, and a full $580 million ahead of expectations.

Organic revenue was up 11% during the quarter, beating estimates by 4%. The company saw gains in Latin America (+20%), EMEA (+20%), North America (+9%), Bottling Investments (+18%), and Global Ventures (+9%). Volume was up 2%, while price and mix accounted for a 9% gain in the top line.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

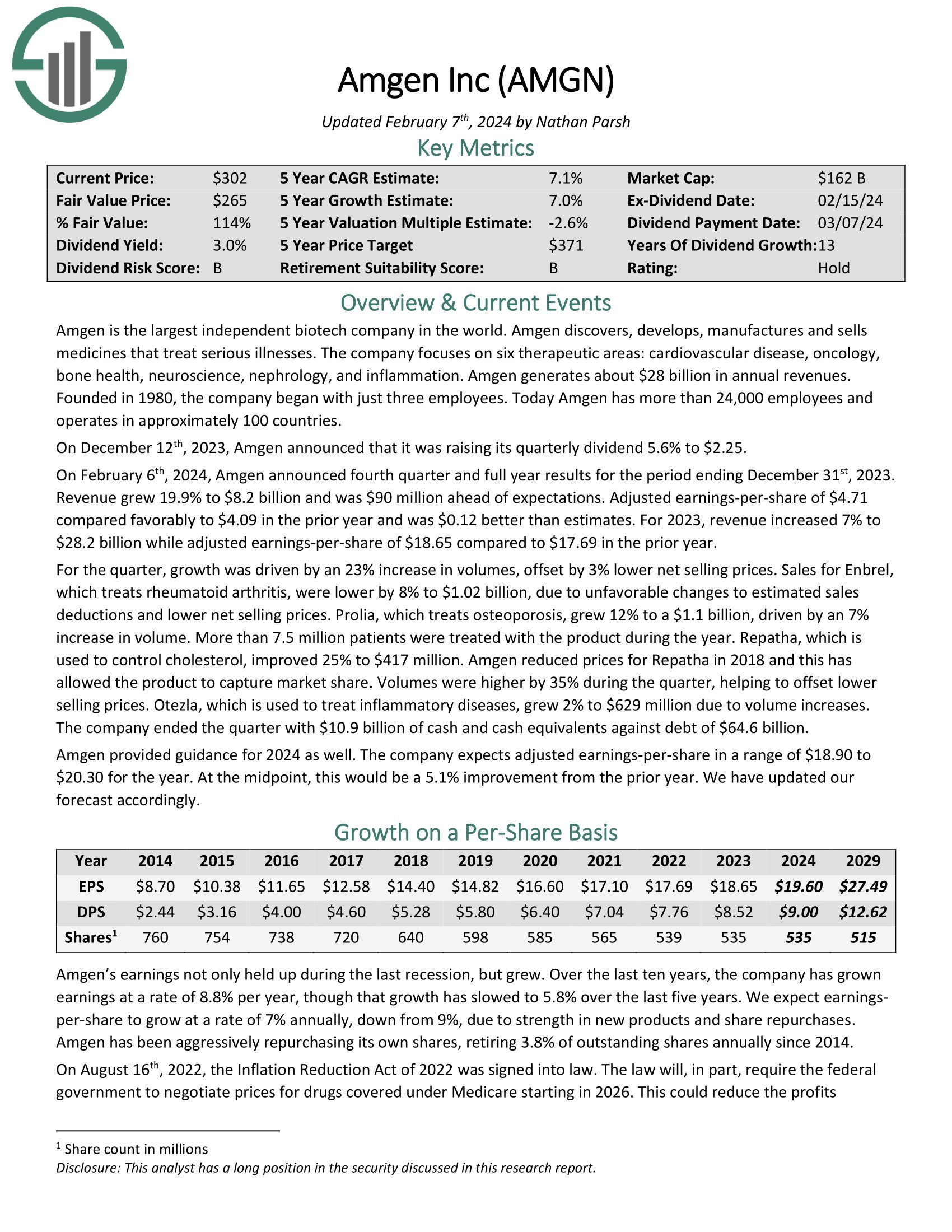

Dog of the Dow #7: Amgen Inc. (AMGN)

- Dividend Yield: 3.2%

Amgen is the largest independent biotech company in the world. Amgen discovers, develops, manufactures, and sells medicines that treat serious illnesses. The company focuses on six therapeutic areas: cardiovascular disease, oncology, bone health, neuroscience, nephrology, and inflammation.

On February 6th, 2024, Amgen announced fourth quarter and full year results for the period ending December 31st, 2023. Revenue grew 19.9% to $8.2 billion and was $90 million ahead of expectations. Adjusted earnings-per-share of $4.71 compared favorably to $4.09 in the prior year and was $0.12 better than estimates. For 2023, revenue increased 7% to $28.2 billion while adjusted earnings-per-share of $18.65 compared to $17.69 in the prior year.

Click here to download our most recent Sure Analysis report on Amgen Inc. (AMGN) (preview of page 1 of 3 shown below):

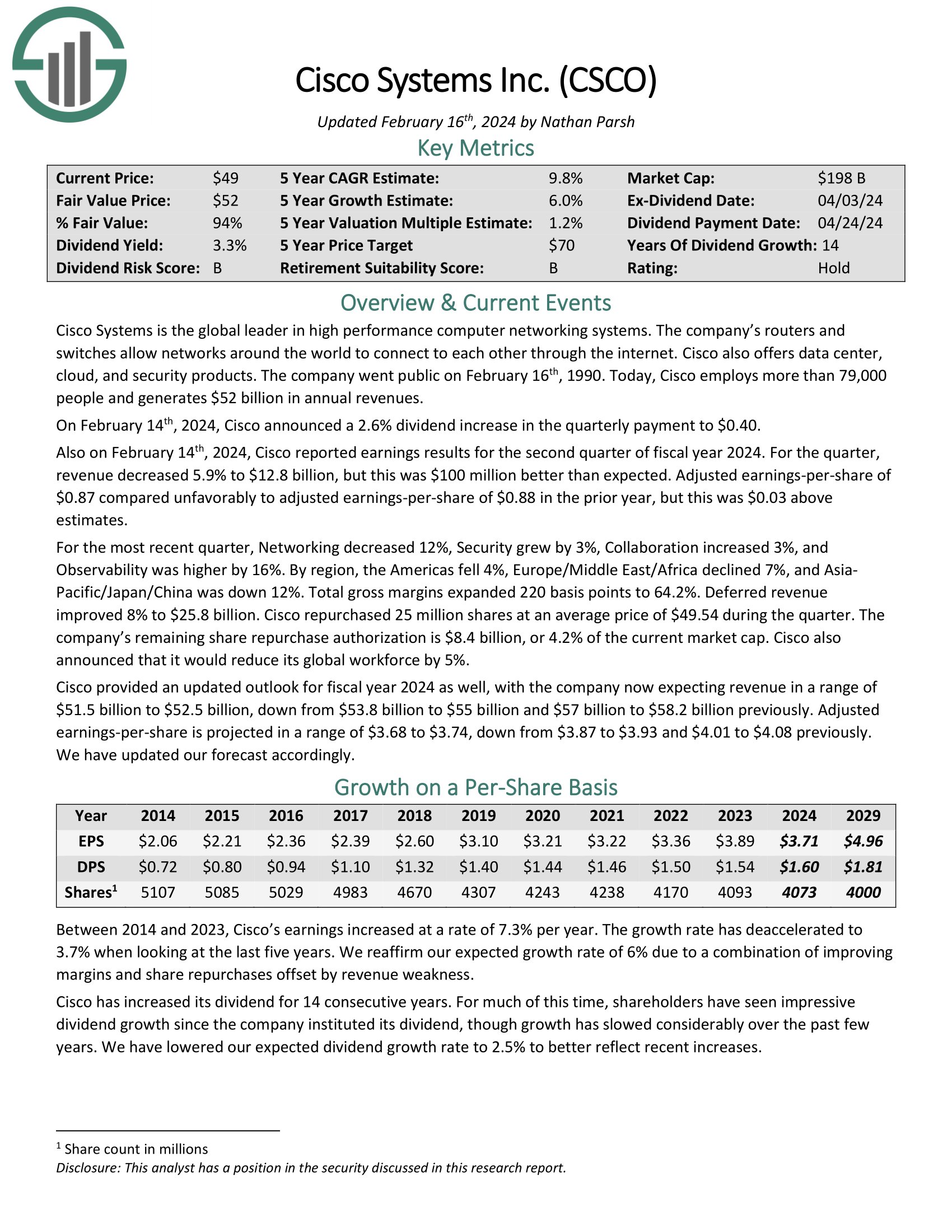

Dog of the Dow #6: Cisco Systems (CSCO)

- Dividend Yield: 3.2%

Cisco Systems is the global leader in high performance computer networking systems. The company’s routers and switches allow networks around the world to connect to each other through the internet. Cisco also offers data center, cloud, and security products. The company went public on February 16th, 1990. Today, Cisco employs more than 79,000 people and generates $54 billion in annual revenues.

On February 14th, 2024, Cisco reported earnings results for the second quarter of fiscal year 2024. For the quarter, revenue decreased 5.9% to $12.8 billion, but this was $100 million better than expected. Adjusted earnings-per-share of $0.87 compared unfavorably to adjusted earnings-per-share of $0.88 in the prior year, but this was $0.03 above estimates.

Click here to download our most recent Sure Analysis report on Cisco Systems (CSCO) (preview of page 1 of 3 shown below):

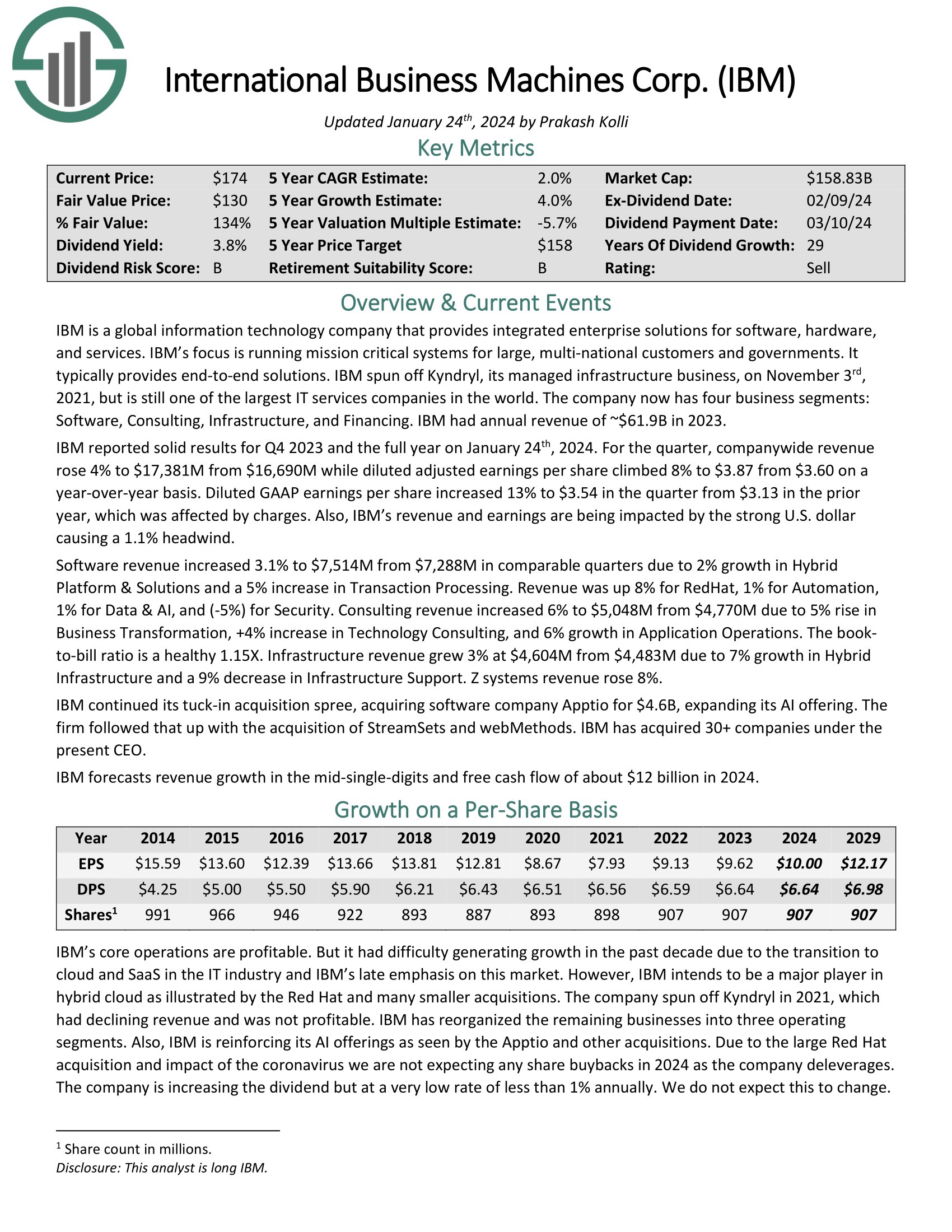

Dog of the Dow #5: International Business Machines (IBM)

- Dividend Yield: 3.7%

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. IBM’s focus is running mission-critical systems for large, multi-national customers and governments. IBM typically provides end-to-end solutions. The company now has four business segments: Software, Consulting, Infrastructure, and Financing.

IBM reported solid results for Q4 2023 and the full year on January 24th, 2024. For the quarter, company-wide revenue rose 4% to $17,381M from $16,690M while diluted adjusted earnings per share climbed 8% to $3.87 from $3.60 on a year-over-year basis. Diluted GAAP earnings per share increased 13% to $3.54 in the quarter from $3.13 in the prior year, which was affected by charges. Also, IBM’s revenue and earnings are being impacted by the strong U.S. dollar causing a 1.1% headwind.

Click here to download our most recent Sure Analysis report on International Business Machines (IBM) (preview of page 1 of 3 shown below):

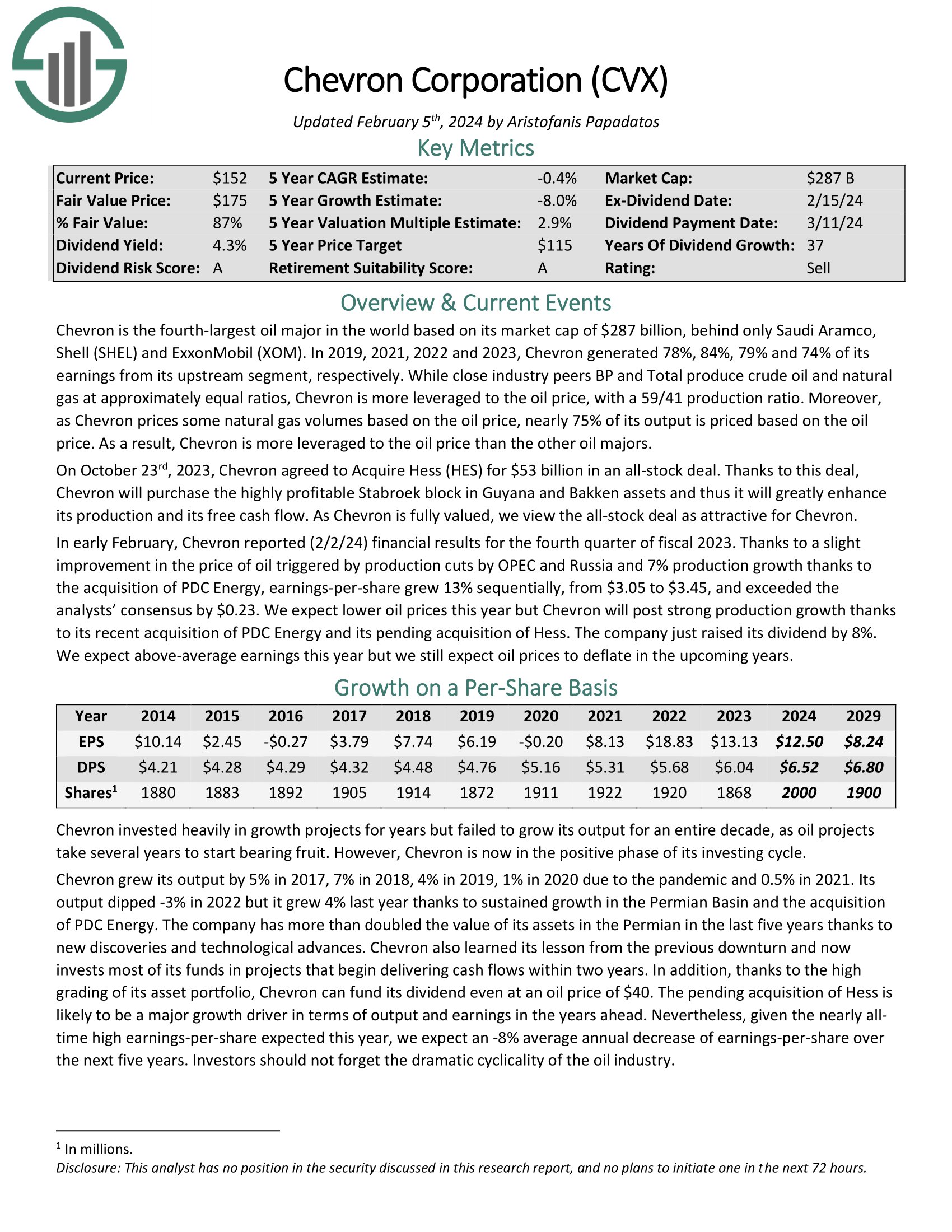

Dog of the Dow #4: Chevron Corporation (CVX)

- Dividend Yield: 4.2%

Chevron is one of the largest oil majors in the world. The company sees the bulk of its earnings from its upstream segment and has a higher crude oil and natural gas production ratio at 61/39 than most of its peers. Chevron also prices some natural gas volumes based on the oil price. In the end, the company is more leveraged to the oil price than the other oil majors.

In early February, Chevron reported (2/2/24) financial results for the fourth quarter of fiscal 2023. Thanks to a slight improvement in the price of oil triggered by production cuts by OPEC and Russia and 7% production growth thanks to the acquisition of PDC Energy, earnings-per-share grew 13% sequentially, from $3.05 to $3.45, and exceeded the analysts’ consensus by $0.23.

Click here to download our most recent Sure Analysis report on Chevron Corporation (CVX) (preview of page 1 of 3 shown below):

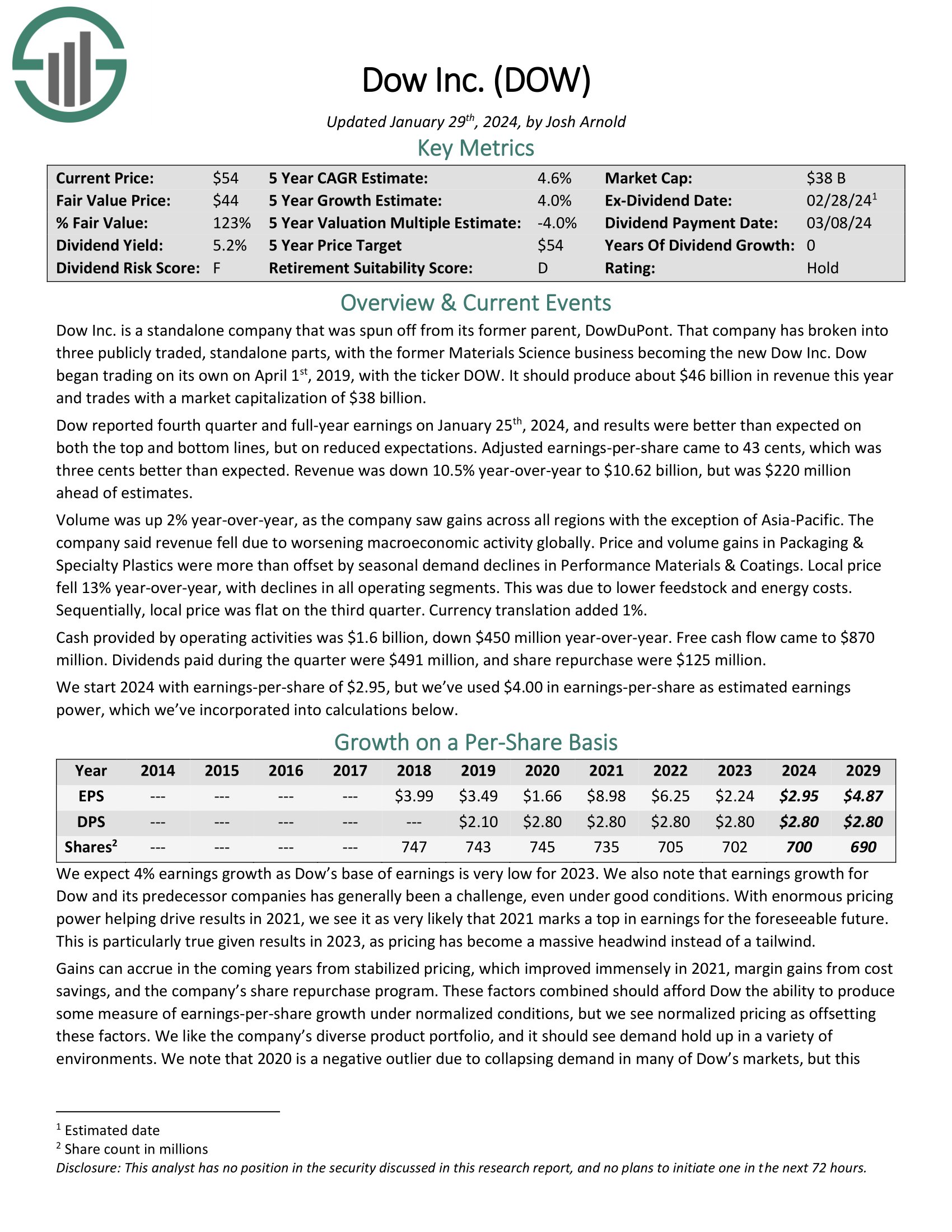

Dog of the Dow #3: Dow Inc. (DOW)

- Dividend Yield: 5.1%

Dow Inc. is a standalone company that was spun off from its former parent, DowDuPont. That company has broken into three publicly traded, standalone parts, with the former Materials Science business becoming the new Dow Inc. Dow began trading on its own on April 1st, 2019, with the ticker DOW. It should produce about $44 billion in revenue this year.

Dow reported fourth quarter and full-year earnings on January 25th, 2024, and results were better than expected on both the top and bottom lines, but on reduced expectations. Adjusted earnings-per-share came to 43 cents, which was three cents better than expected. Revenue was down 10.5% year-over-year to $10.62 billion, but was $220 million ahead of estimates.

Click here to download our most recent Sure Analysis report on Dow Inc. (DOW) (preview of page 1 of 3 shown below):

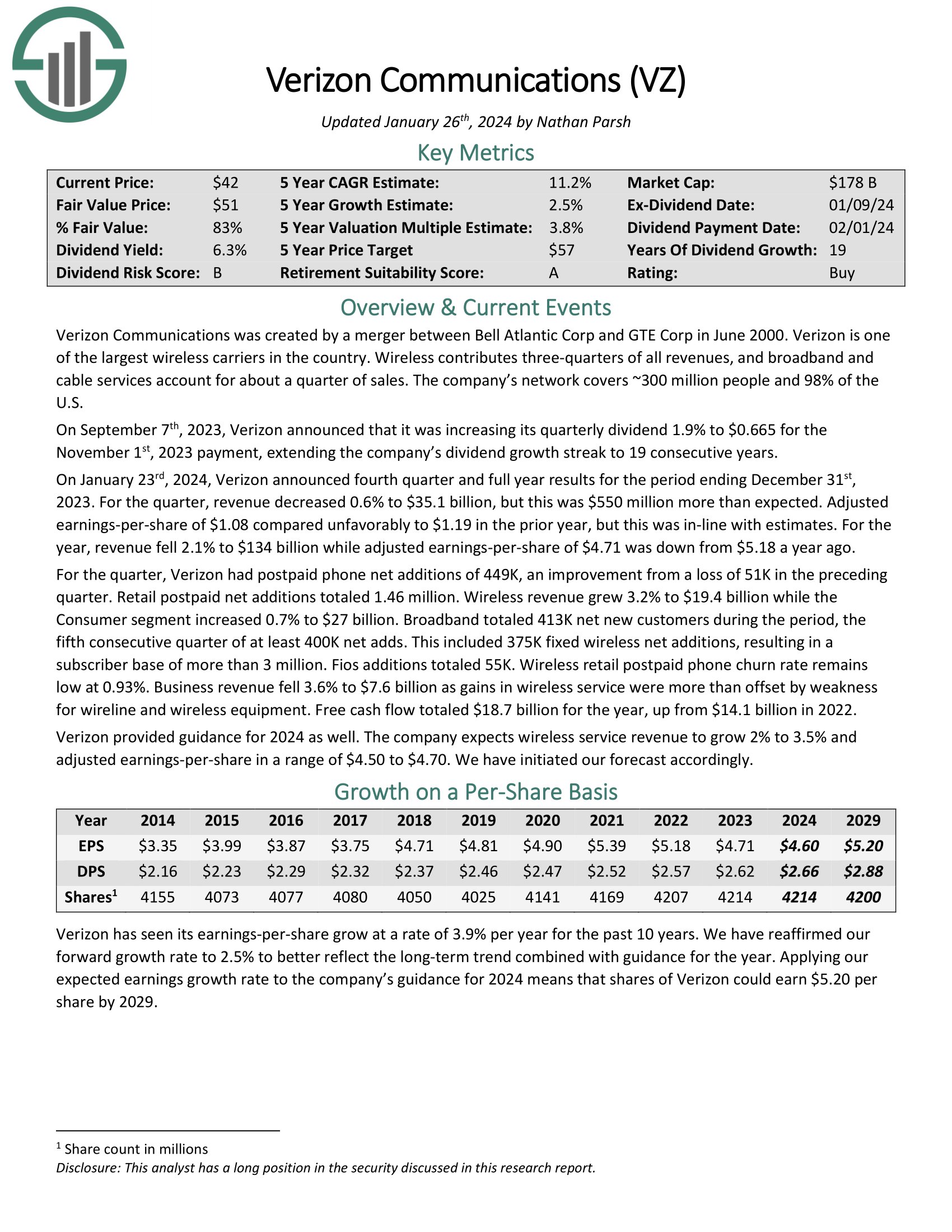

Dog of the Dow #2: Verizon Communications (VZ)

- Dividend Yield: 6.6%

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On January 23rd, 2024, Verizon announced fourth quarter and full year results for the period ending December 31st, 2023. For the quarter, revenue decreased 0.6% to $35.1 billion, but this was $550 million more than expected. Adjusted earnings-per-share of $1.08 compared unfavorably to $1.19 in the prior year, but this was in-line with estimates. For the year, revenue fell 2.1% to $134 billion while adjusted earnings-per-share of $4.71 was down from $5.18 a year ago.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

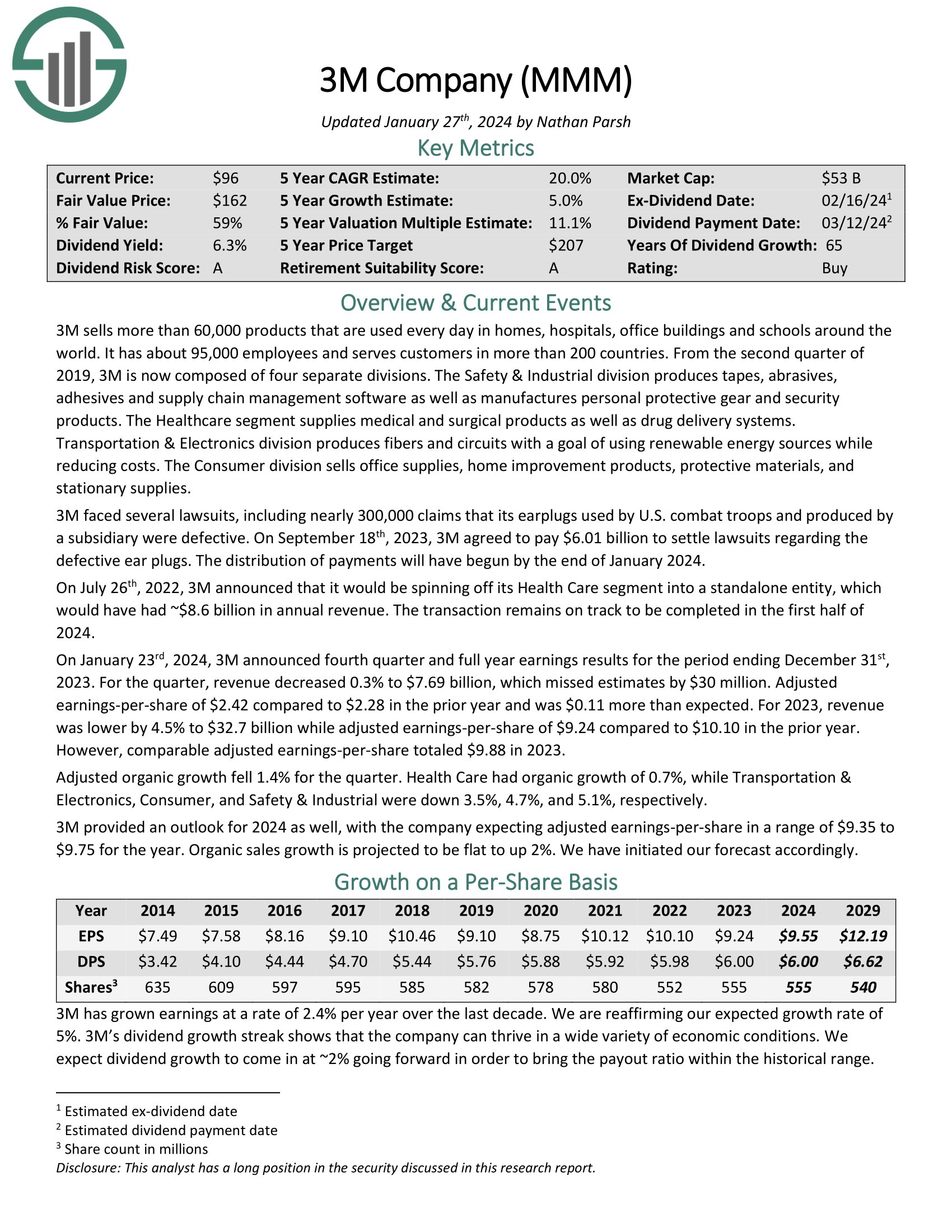

Dog of the Dow #1: 3M Company (MMM)

- Dividend Yield: 6.8%

3M is an industrial manufacturer that sells more than 60,000 products used daily in homes, hospitals, office buildings, and schools worldwide. It has about 95,000 employees and serves customers in more than 200 countries.

On January 23rd, 2024, 3M announced fourth quarter and full year earnings results for the period ending December 31st, 2023. For the quarter, revenue decreased 0.3% to $7.69 billion, which missed estimates by $30 million. Adjusted earnings-per-share of $2.42 compared to $2.28 in the prior year and was $0.11 more than expected.

For 2023, revenue was lower by 4.5% to $32.7 billion while adjusted earnings-per-share of $9.24 compared to $10.10 in the prior year. However, comparable adjusted earnings-per-share totaled $9.88 in 2023.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

Final Thoughts

Given the descriptions above, the Dogs of the Dow are clearly a very diverse group of blue-chip stocks that each enjoy significant competitive advantages and lengthy histories of paying rising dividends.

As a result, this investing strategy is a great, low-risk way for unsophisticated investors to approach dividend growth investing.

While it may not outperform the broader market every year, it is virtually guaranteed to provide investors with a combination of attractive current yield with steadily rising income over time.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 7 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more