Published on October 8th, 2024 by Aristofanis Papadatos

Paramount Resources (PRMRF) has two appealing investment characteristics:

#1: It is offering an above average dividend yield of 6.4%, which is more than five times the dividend yield of the S&P 500.

#2: It pays dividends monthly instead of quarterly.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The combination of an above average dividend yield and a monthly dividend render Paramount Resources appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Paramount Resources.

Business Overview

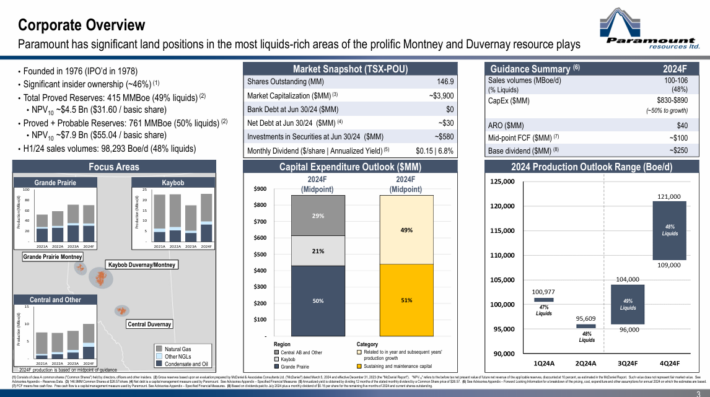

Paramount Resources explores for and produces oil and natural gas from conventional and unconventional fields in the Western Canadian Sedimentary Basin.

The company holds interests in the Karr and Wapiti Montney properties, which cover an area of 185,000 net acres located south of the city of Grande Prairie, Alberta. The company was founded in 1976 and is based in Calgary, Canada.

Paramount Resources has an average production rate of about 100,000 barrels per day and total proved reserves of 415 million barrels of oil equivalent, with oil and gas at a 49/51 ratio.

Source: Investor Presentation

It is also important to note that the company has 46% ownership by insiders. This is a remarkably high percent of ownership, which results in the alignment of interests between insiders and the other individual shareholders.

As an oil and gas producer, Paramount Resources is highly cyclical due to the dramatic swings of the prices of oil and gas. The company has reported losses in 5 of the last 10 years and resumed its dividend payments only in the summer of 2021, after 22 years without a dividend payment.

On the other hand, Paramount Resources has some advantages when compared to the well-known oil and gas producers. Most oil and gas producers have been struggling to replenish their reserves due to the natural decline of their producing wells.

On the contrary, Paramount Resources posted an exceptionally high reserve replacement ratio of 140% in 2023. As a result, the company expects its production in 2028 to be nearly 50% higher than its production in 2023.

The reserve replacement ratio is paramount in the oil and gas industry. Without a solid reserve replacement ratio, a producer cannot grow its earnings in a sustainable manner in the long run.

The price of natural gas has plunged due to abnormally warm winter weather for two years in a row. The price of oil has slumped nearly 50% off its peak in early 2022 but it has remained above average thanks to the sustained production cuts executed by OPEC and Russia.

As a result, Paramount Resources has posted earnings per share of $1.72 in the last 12 months. These earnings per share are 50% lower than the 7-year high earnings per share of the company in 2022 but they are above average.

Growth Prospects

Paramount Resources posted among the highest reserve replacement ratios in the oil and gas industry in 2022 and 2023.

Even better, the company has ample room for production growth thanks to the acceleration of its development efforts in its producing areas.

Source: Investor Presentation

Paramount Resources has a proven record of identifying key resource areas, with a low decline rate and more than 15 years of production.

On the other hand, as an oil and gas producer, Paramount Resources is highly sensitive to the cycles of the prices of oil and gas. This is clearly reflected in the performance record of the company, which has posted material losses in 5 of the last 10 years.

The price of oil has slumped nearly 50% off its peak in 2022. As a result, the company is likely to post much lower earnings per share this year.

Given the promising production growth prospects of Paramount Resources but also the highly cyclical nature of the oil and gas industry, we expect the earnings per share of Paramount Resources to grow by about 2.0% per year on average over the next five years, from an estimate of $1.50 this year to $1.66 in 2029.

Dividend & Valuation Analysis

Paramount Resources is currently offering an above average dividend yield of 6.4%, which is more than five times as much as the 1.2% yield of the S&P 500. The stock is thus an interesting candidate for income-oriented investors but the latter should be aware that the dividend is far from safe due to the dramatic cycles of the prices of oil and gas.

Paramount Resources has a decent payout ratio of 46%. In addition, the company has a strong balance sheet, with net debt of only $525 million.

As this amount is only 17% of the market capitalization of the stock, it is certainly manageable and will help the company endure the next downturn of the energy sector without any liquidity issues. It is also remarkable that Paramount Resources pays negligible interest expense every year.

However, it is critical to note that Paramount Resources reinstated its dividend only in mid-2021, after 22 years without a dividend payment.

The company failed to offer a dividend in the preceding years, as it incurred material losses in many of those years. Therefore, it is evident that the dividend of the company is far from safe.

In reference to the valuation, Paramount Resources is currently trading for 13.9 times its expected earnings per share of $1.50 this year.

Given the high cyclicality of the company, we assume a fair price-to-earnings ratio of 12.5, which is a typical mid-cycle valuation level for oil and gas producers.

Therefore, the current earnings multiple is higher than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will incur a -2.1% annualized drag in its returns. This drag will offset our expected 2.0% average annual growth of earnings per share over the next five years.

Taking into account the 2.0% annual growth of earnings per share, the 6.4% current dividend yield and a -2.1% annualized contraction of valuation level, Paramount Resources could offer a 5.8% average annual total return over the next five years.

The modest expected return signals that the stock is unattractive from a long-term perspective, as we have passed the peak of the cycle of the oil and gas industry. Therefore, investors should wait for a lower entry point.

Final Thoughts

Paramount Resources has been thriving since early 2022 thanks to the above average prices of oil and gas. The stock is offering an above average dividend yield of 6.4%, with a payout ratio of 46%. As a result, it is likely to entice some income-oriented investors.

However, the company has proved highly vulnerable to the cycles of the prices of oil and gas. As the price of oil has peaked and may have material downside, the stock is risky right now. Therefore, investors should wait for a more attractive entry point.

Moreover, Paramount Resources is characterized by below average trading volume. This means that it may be hard to establish or sell a large position in this stock.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more