Updated on November 19th, 2024 by Bob Ciura

Coal is the most burdensome form of energy for the environment. This has led numerous countries to coordinate efforts to phase out coal in favor of natural gas and renewable energy sources, such as solar and wind power.

As a result, coal production has steadily declined in the U.S. since the 2008 peak. Fortunately for domestic producers, exports have remained strong due to rising demand in emerging markets.

The price of coal is around ~$122 per ounce. Some coal stocks have become profitable, leading a few coal stocks to return cash to shareholders through dividends.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Coal stocks are a subset of the broader materials sector.

While many investors have concluded that coal stocks will soon become irrelevant, this may not be true.

In this article, we will analyze the two best coal stocks today.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

The top two coal stocks are ranked based on total expected returns over the next five years, from lowest to highest. These coal stocks collectively represent our top picks in the coal industry over the next five years.

Alliance Resource Partners (ARLP)

- 5-year expected annual returns: 8.3%

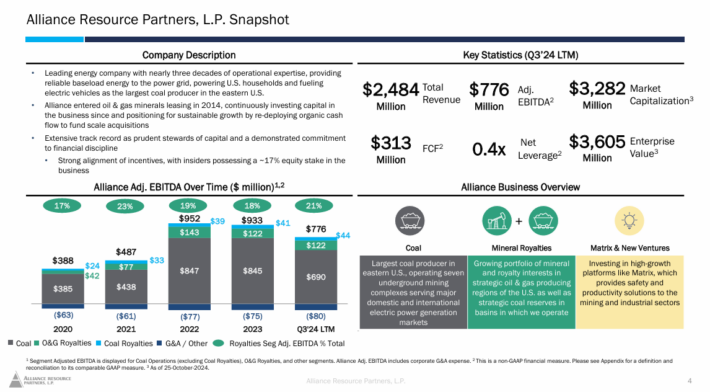

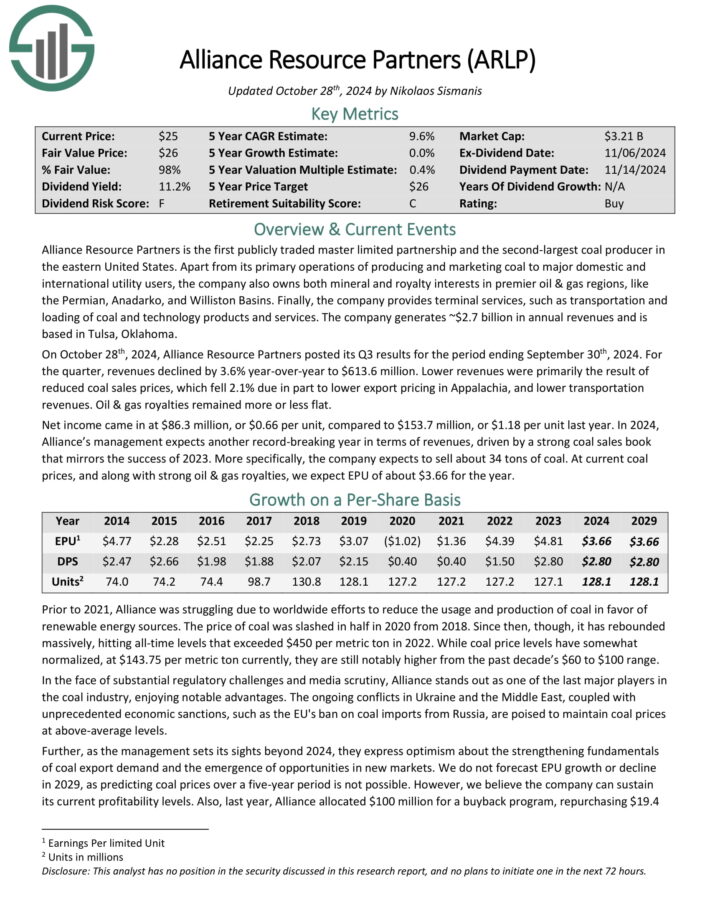

Alliance Resource Partners is the first publicly traded Master Limited Partnership and the second–largest coal producer in the eastern United States.

Apart from its primary operations of producing and marketing coal to major domestic and international utility users, the company also owns mineral and royalty interests in premier oil & gas regions, like the Permian, Anadarko, and Williston Basins.

Source: Investor Presentation

On October 28th, 2024, Alliance Resource Partners posted its Q3 results for the period ending September 30th, 2024. For the quarter, revenues declined by 3.6% year-over-year to $613.6 million.

Lower revenues were primarily the result of reduced coal sales prices, which fell 2.1% due in part to lower export pricing in Appalachia, and lower transportation revenues. Oil & gas royalties remained more or less flat.

Net income came in at $86.3 million, or $0.66 per unit, compared to $153.7 million, or $1.18 per unit last year. In 2024, Alliance’s management expects another record-breaking year in terms of revenues, driven by a strong coal sales book that mirrors the success of 2023.

Click here to download our most recent Sure Analysis report on Alliance Resource Partners (preview of page 1 of 3 shown below):

NACCO Industries (NC)

- 5-year expected annual returns: 10.2%

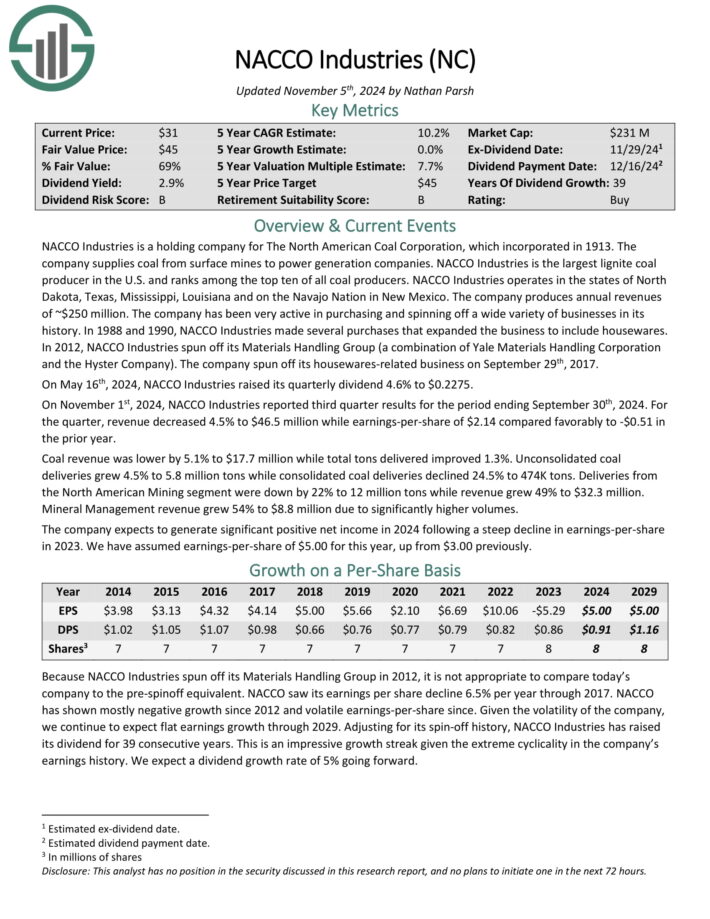

NACCO Industries is a holding company for The North American Coal Corporation, which was incorporated in 1913. The company supplies coal from surface mines to power generation companies.

NACCO Industries is the largest lignite coal producer in the U.S. and ranks among the top ten of all coal producers. NACCO Industries operates in the states of North Dakota, Texas, Mississippi, Louisiana and on the Navajo Nation in New Mexico.

Source: Investor Presentation

On November 1st, 2024, NACCO Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue decreased 4.5% to $46.5 million while earnings-per-share of $2.14 compared favorably to -$0.51 in the prior year.

Coal revenue was lower by 5.1% to $17.7 million while total tons delivered improved 1.3%. Unconsolidated coal deliveries grew 4.5% to 5.8 million tons while consolidated coal deliveries declined 24.5% to 474K tons.

Deliveries from the North American Mining segment were down by 22% to 12 million tons while revenue grew 49% to $32.3 million. Mineral Management revenue grew 54% to $8.8 million due to significantly higher volumes.

Click here to download our most recent Sure Analysis report on NACCO Industries (preview of page 1 of 3 shown below):

Final Thoughts

Coal stocks are highly cyclical and operate in an industry that has been suffering from a secular decline. Therefore, investors should consider the elevated risks of investing in such a troubled industry.

With that said, multiple coal stocks still pay dividends to shareholders and have reasonable valuations. As a result, the best coal stocks could still generate strong returns in the years ahead.

Overall, while risk-averse investors should avoid coal stocks in general, those comfortable with the risks might consider purchasing the above coal stocks.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks Now: The 20 monthly dividend stocks with the highest current yields.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.