Updated on December 18th, 2023 by Bob Ciura

The largest Canadian bank stocks have proven over the past decade that they not only endure times of economic duress, but that they can grow at high rates coming out of a recession as well.

Canadian bank stocks also pay higher dividends, making them attractive for income investors. Valuations have also remained quite low recently, boosting their respective total return profiles as a result.

In this article, we’ll take a look at the “Big 5” Canadian banks – Canadian Imperial Bank of Commerce (CM), Royal Bank of Canada (RY), The Bank of Nova Scotia (BNS), Bank of Montreal (BMO) and Toronto-Dominion Bank (TD) – and rank them in order of highest expected returns.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

The top 5 big banks in Canada are very shareholder-friendly, with attractive cash returns. With this in mind, we created a full list of financial stocks.

You can download the entire list (along with important financial metrics like dividend yields and price-to-earnings ratios) by clicking the link below:

More information can be found in the Sure Analysis Research Database, which ranks stocks based upon their dividend yield, earnings-per-share growth potential and valuation to compute total returns.

The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which Canadian bank is ranked highest in our Sure Analysis Research Database.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

- Canadian Bank Stock #5: Bank of Montreal (BMO)

- Canadian Bank Stock #4: Royal Bank of Canada (RY)

- Canadian Bank Stock #3: Canadian Imperial Bank of Commerce (CM)

- Canadian Bank Stock #2: Toronto-Dominion Bank (TD)

- Canadian Bank Stock #1: Bank of Nova Scotia (BNS)

The top 5 Canadian bank stocks are ranked based on total expected returns over the next five years, from lowest to highest.

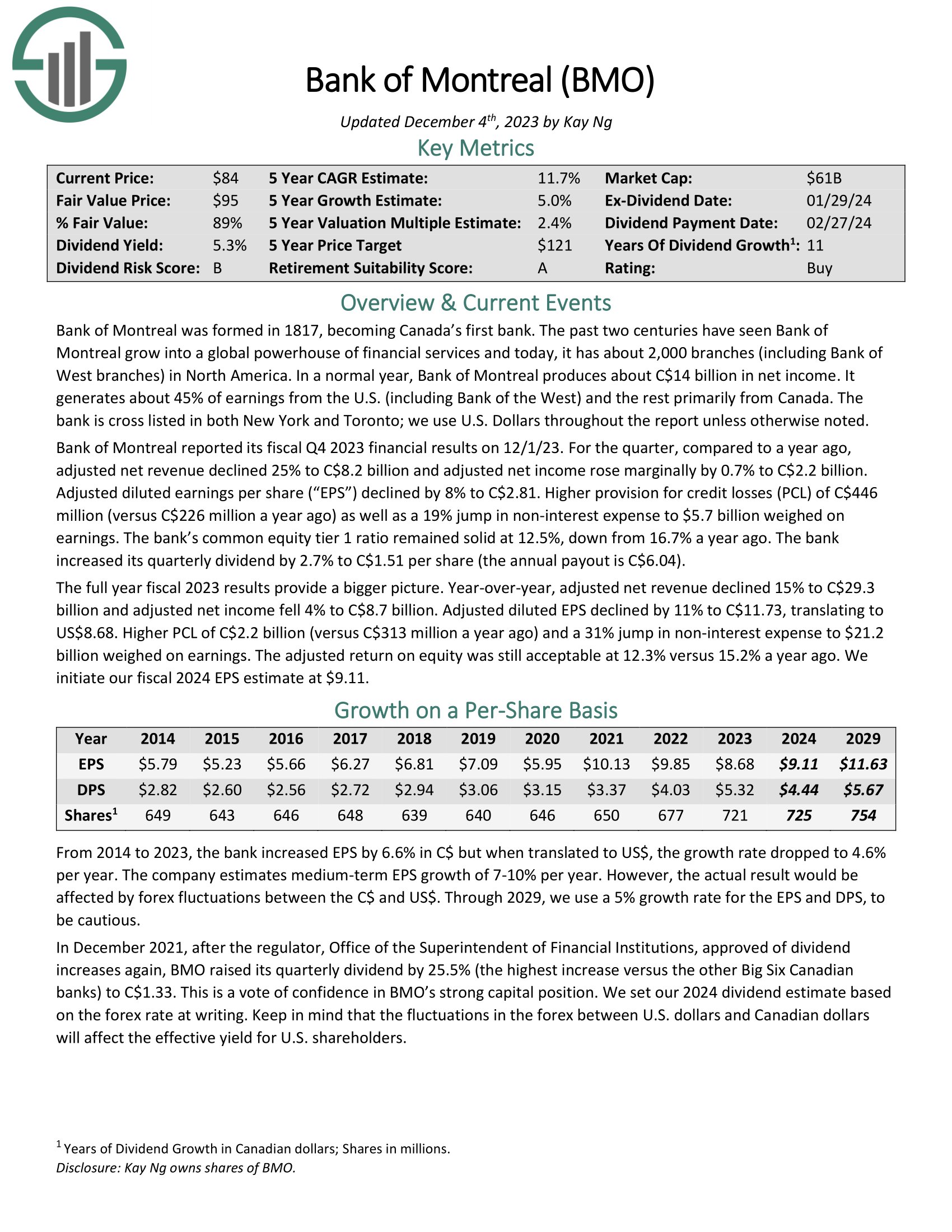

Canadian Bank Stock #5: Bank of Montreal (BMO)

- 5-year expected annual returns: 9.7%

Bank of Montreal was formed in 1817, becoming Canada’s first bank. The past two centuries have seen Bank of Montreal grow into a global powerhouse of financial services and today, it has about 1,400 branches in North America.

In addition to trading on the New York Stock Exchange, BMO stock trades on the Toronto Stock Exchange, as do the other stocks in this article.

You can download a full list of all TSX 60 stocks below:

Bank of Montreal generates about 64% of its adjusted revenue from Canada and about 36% from the U.S.

Bank of Montreal reported its fiscal Q4 2023 financial results on 12/1/23. For the quarter, adjusted net revenue declined 25% to C$8.2 billion and adjusted net income rose marginally by 0.7% year-over-year. Adjusted diluted earnings per share declined by 8% year-over-year.

Higher provision for credit losses of C$446 million (versus C$226 million a year ago) as well as a 19% jump in non-interest expense weighed on earnings. The bank’s common equity tier 1 ratio was 12.5%, down from 16.7% a year ago.

Click here to download our most recent Sure Analysis report on BMO (preview of page 1 of 3 shown below):

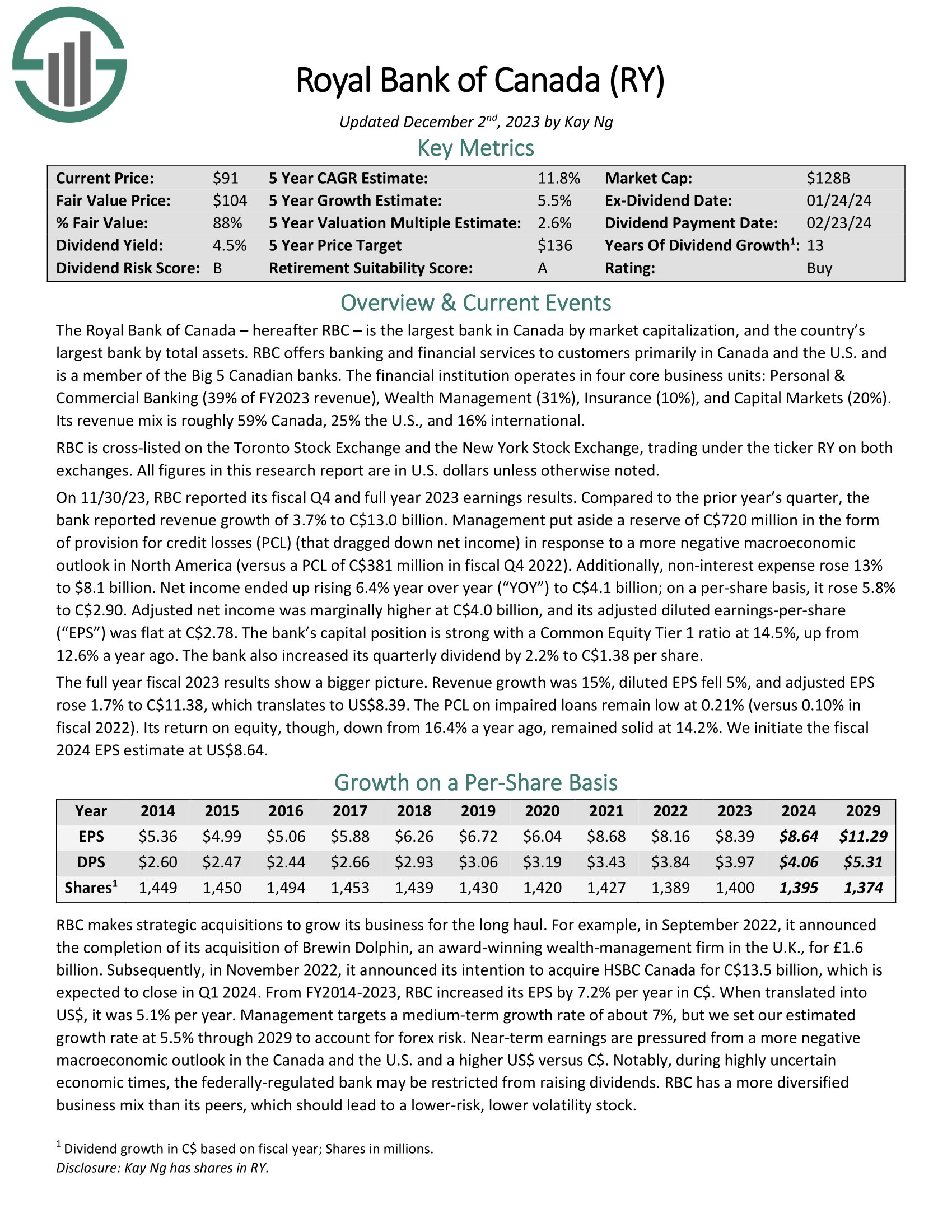

Canadian Bank Stock #4: Royal Bank of Canada (RY)

- 5-year expected returns: 10.2%

The Royal Bank of Canada is the largest bank in Canada by market capitalization, and by total assets. RBC offers banking and financial services to customers primarily in Canada and the U.S. The financial institution operates in four core business units: Personal & Commercial Banking (39% of FY2023 revenue), Wealth Management (31%), Insurance (10%), and Capital Markets (20%). Its revenue mix is roughly 59% Canada, 25% the U.S., and 16% international.

On 11/30/23, RBC reported its fiscal Q4 and full year 2023 earnings results. Compared to the prior year’s quarter, the bank reported revenue growth of 3.7% to C$13.0 billion. Management put aside a reserve of C$720 million in the form of provision for credit losses (PCL) (that dragged down net income) in response to a more negative macroeconomic outlook in North America (versus a PCL of C$381 million in fiscal Q4 2022).

Additionally, non-interest expense rose 13% to $8.1 billion. Net income ended up rising 6.4% year over year (“YOY”) to C$4.1 billion; on a per-share basis, it rose 5.8% to C$2.90.

Click here to download our most recent Sure Analysis report on RY (preview of page 1 of 3 shown below):

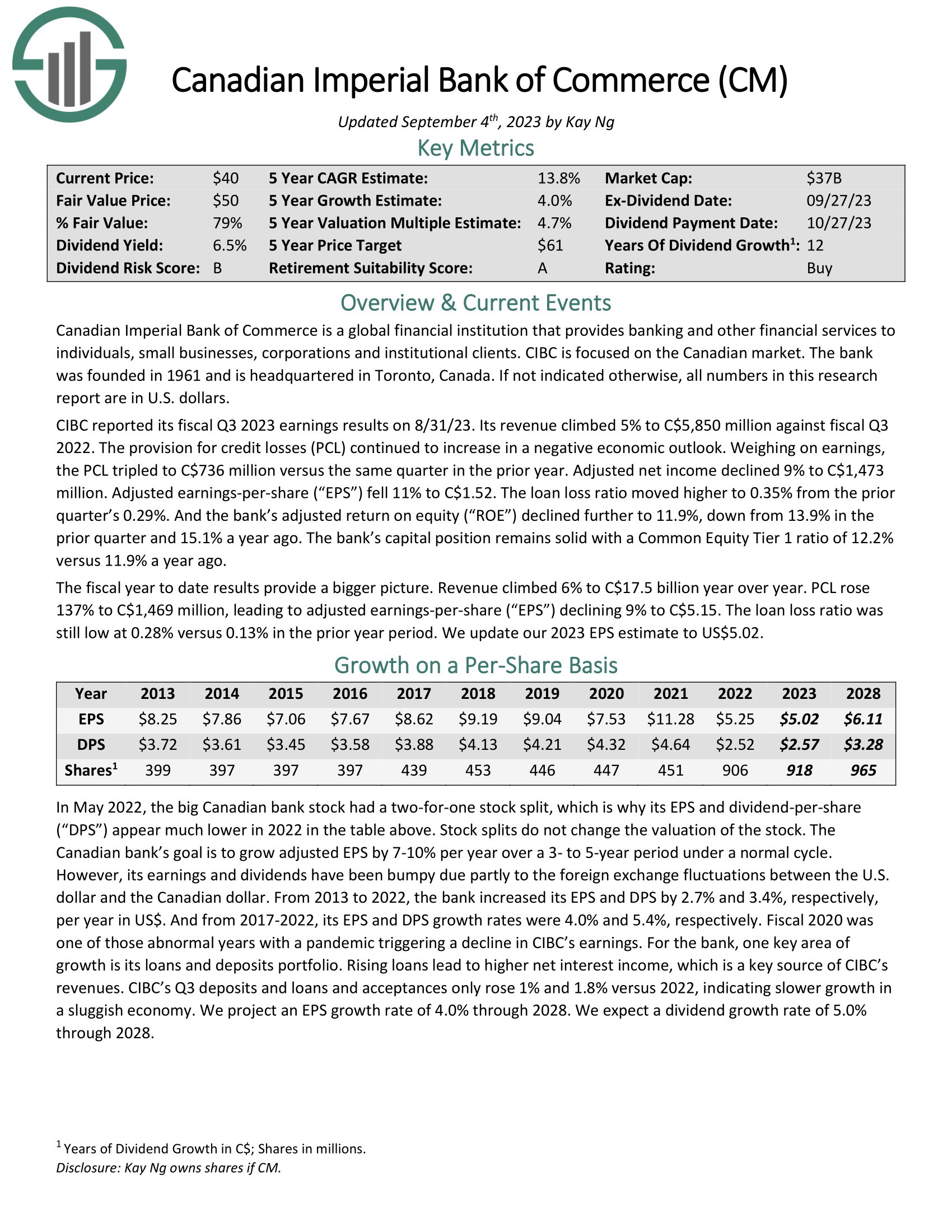

Canadian Bank Stock #3: Canadian Imperial Bank of Commerce (CM)

- 5-year expected returns: 10.7%

Canadian Imperial Bank of Commerce is a global financial institution that provides banking and other financial services to individuals, small businesses, corporations, and institutional clients. CIBC was founded in 1961 and is headquartered in Toronto, Canada.

CIBC reported its fiscal Q3 2023 earnings results on 8/31/23. Revenue climbed 5% against fiscal Q3 2022. The provision for credit losses continued to increase in a negative economic outlook. Weighing on earnings, the PCL tripled to C$736 million versus the same quarter in the prior year. Adjusted net income declined 9% to C$1,473 million. Adjusted earnings-per-share fell 11% to C$1.52.

The loan loss ratio moved higher to 0.35% from the prior quarter’s 0.29%. And the bank’s adjusted return on equity declined further to 11.9%, down from 13.9% in the prior quarter and 15.1% a year ago. The bank’s capital position remains solid with a Common Equity Tier 1 ratio of 12.2% versus 11.9% a year ago.

Click here to download our most recent Sure Analysis report on CM (preview of page 1 of 3 shown below):

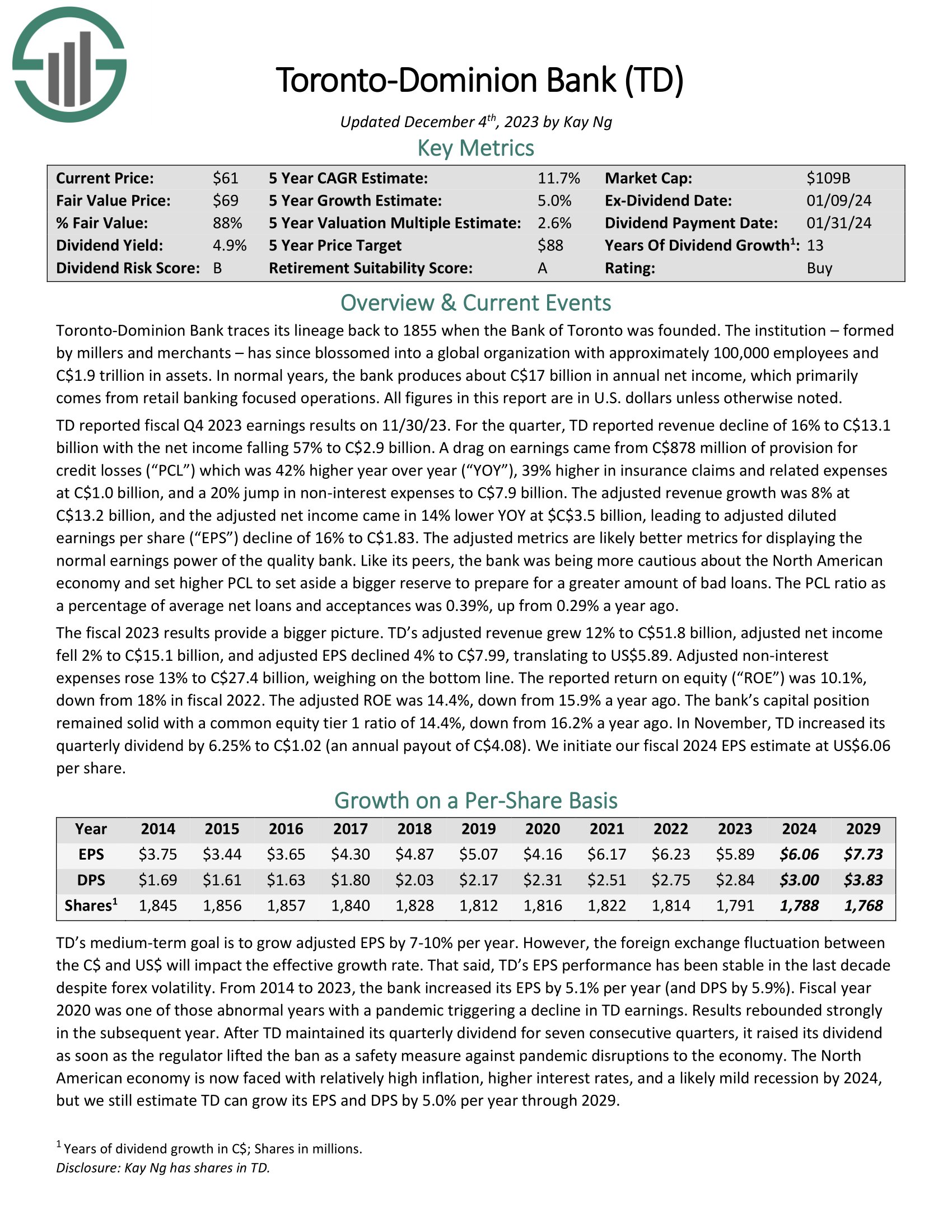

Canadian Bank Stock #2: Toronto-Dominion Bank (TD)

- 5-year expected annual returns: 11.1%

Toronto-Dominion Bank traces its lineage back to 1855 when the Bank of Toronto was founded. It is now a major bank with C$1.8 trillion in assets. The bank produces about C$14 billion in annual net income each year.

TD reported fiscal Q4 2023 earnings results on 11/30/23. For the quarter, TD reported revenue decline of 16% to C$13.1 billion with the net income falling 57% to C$2.9 billion. A drag on earnings came from C$878 million of provision for credit losses which was 42% higher year over year, 39% higher insurance claims and related expenses, and a 20% jump in non-interest expenses. The adjusted revenue growth was 8%, while adjusted net income came in 14% lower.

Click here to download our most recent Sure Analysis report on TD (preview of page 1 of 3 shown below):

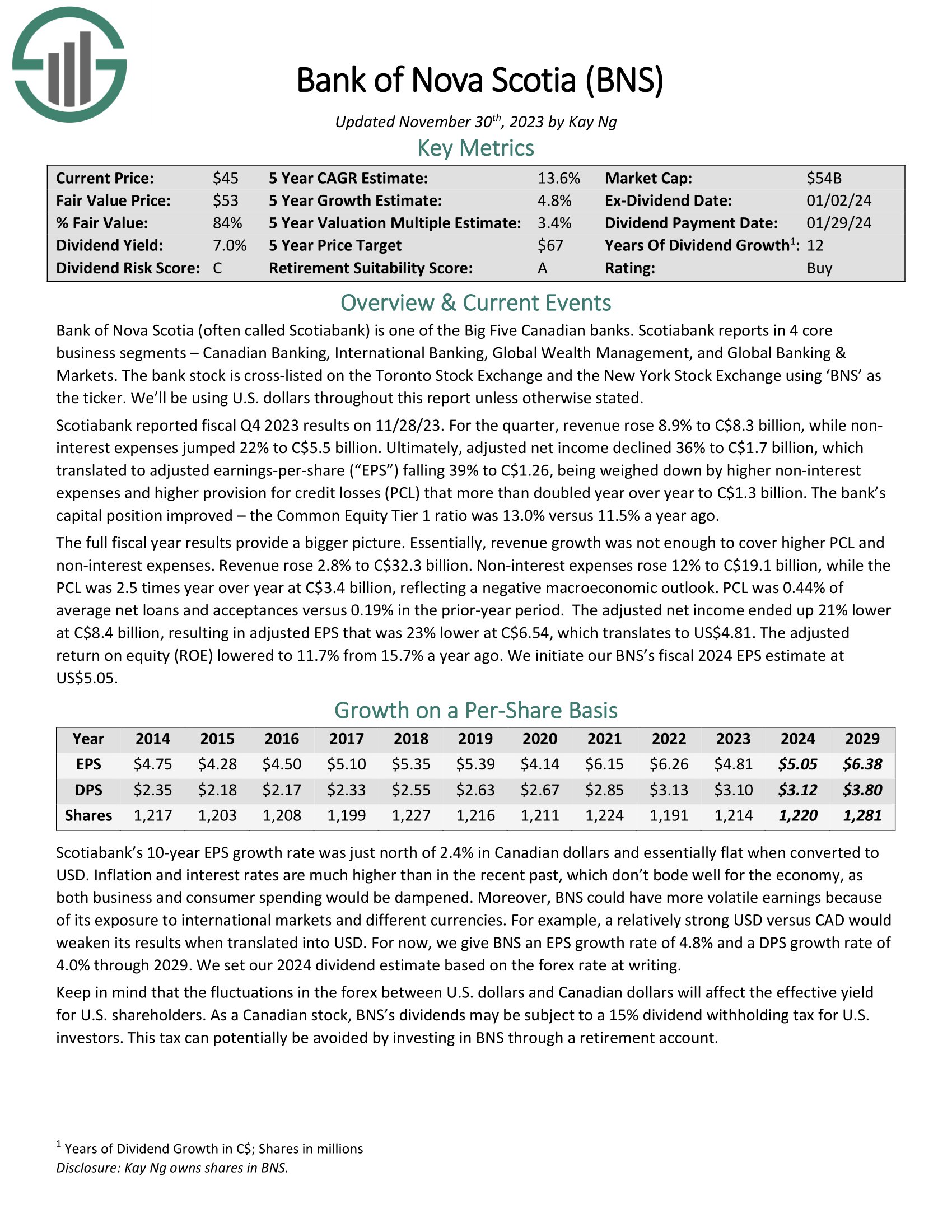

Canadian Bank Stock #1: Bank of Nova Scotia (BNS)

- 5-year expected annual returns: 12.8%

Bank of Nova Scotia (often called Scotiabank) is the fourth-largest financial institution in Canada behind the Royal Bank of Canada, the Toronto-Dominion Bank and Bank of Montreal. Scotiabank reports in four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Scotiabank reported fiscal Q4 2023 results on 11/28/23. For the quarter, revenue rose 8.9% to C$8.3 billion, while non interest expenses jumped 22%. Ultimately, adjusted net income declined 36%, which translated to adjusted earnings-per-share (“EPS”) falling 39% to C$1.26. Provision for credit losses more than doubled year over year . The bank’s capital position improved – the Common Equity Tier 1 ratio was 13.0% versus 11.5% a year ago.

Click here to download our most recent Sure Analysis report on BNS (preview of page 1 of 3 shown below):

Final Thoughts

Canadian bank stocks do not get nearly as much coverage as the major U.S. banks. However, income and value investors should pay attention to the big 5 Canadian bank stocks. Many have higher dividend yields and significantly lower valuations than their U.S. counterparts.

Royal Bank of Canada, TD Bank, Bank of Nova Scotia, Bank of Montreal, and Canadian Imperial Bank of Commerce are all highly profitable banks. And, all 5 have reasonable valuations with attractive dividend yields that are well above the U.S. bank stocks.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks