Published on March 29th, 2023 by Nikolaos Sismanis

Monthly dividend stocks pay out dividends every month instead of quarterly or annually.

This research report analyzes the 10 cheapest monthly dividend stocks based on their forward P/E ratios. The stocks have been arranged in descending order based on their forward P/Es.

There are just 86 companies that currently offer a monthly dividend payment. You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

Keep reading to see analysis on the cheapest monthly dividend stocks now.

Note: The ‘E’ in the P/E ratio depends on the company in question. We use whatever metric is most representative of earnings. For example, for many REITs, that would be funds-from-operations (FFO) instead of earnings.

Table of Contents

- Cheap Monthly Dividend Stock #10: Ellington Residential Mortgage REIT (EARN)

- Cheap Monthly Dividend Stock #9: Itaú Unibanco (ITUB)

- Cheap Monthly Dividend Stock #8: PermRock Royalty Trust (PRT)

- Cheap Monthly Dividend Stock #7: Banco Bradesco S.A. (BBD)

- Cheap Monthly Dividend Stock #6: San Juan Basin Royalty Trust (SJT)

- Cheap Monthly Dividend Stock #5: Hugoton Royalty Trust (HGTXU)

- Cheap Monthly Dividend Stock #4: Permianville Royalty Trust (PVL)

- Cheap Monthly Dividend Stock #3: ARMOUR Residential REIT, Inc. (ARR)

- Cheap Monthly Dividend Stock #2: AGNC Investment Corp. (AGNC)

- Cheap Monthly Dividend Stock #1: SL Green Realty Corp. (SLG)

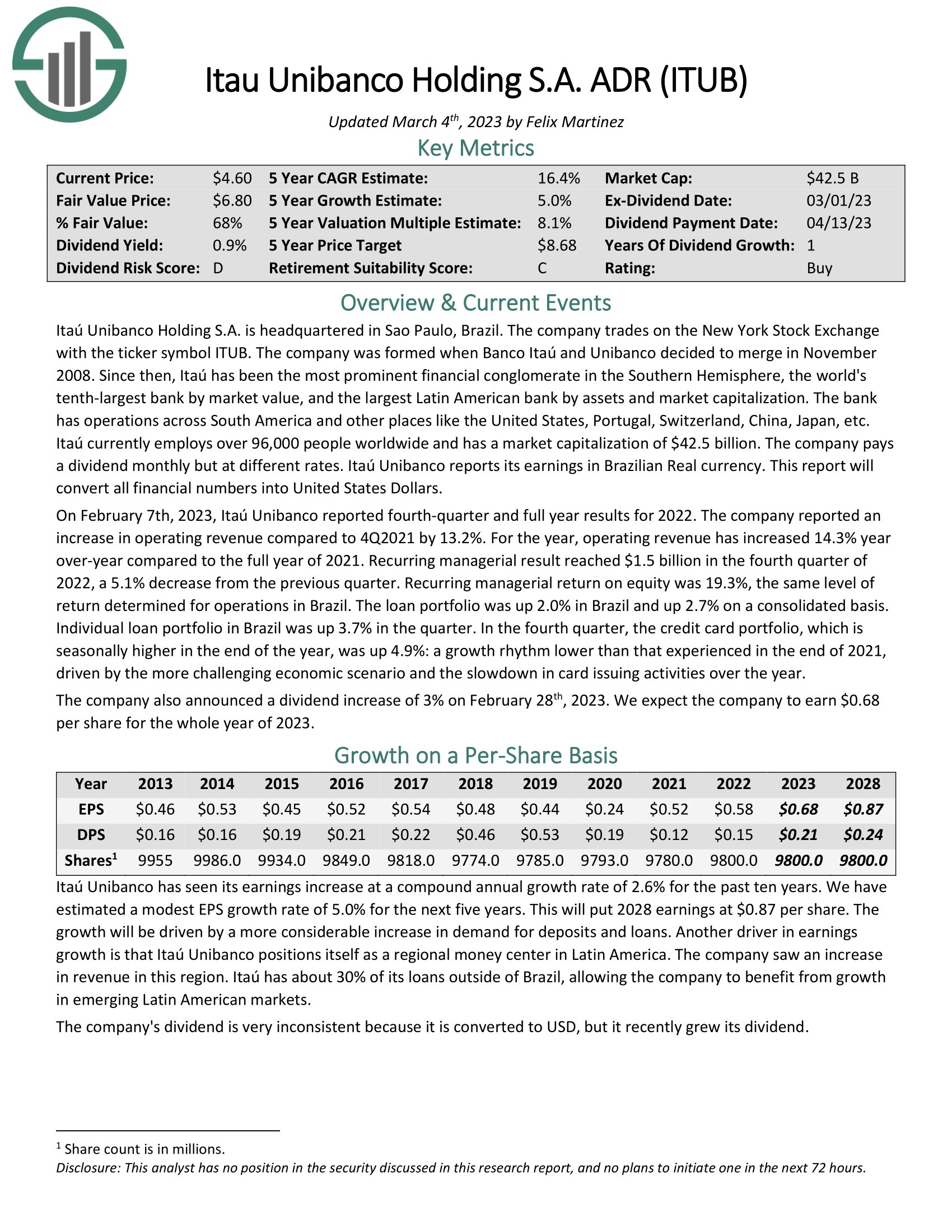

Cheap Monthly Dividend Stock #10: Ellington Residential Mortgage REIT (EARN)

- Forward P/E: 6.7

- Dividend Yield: 13.4%

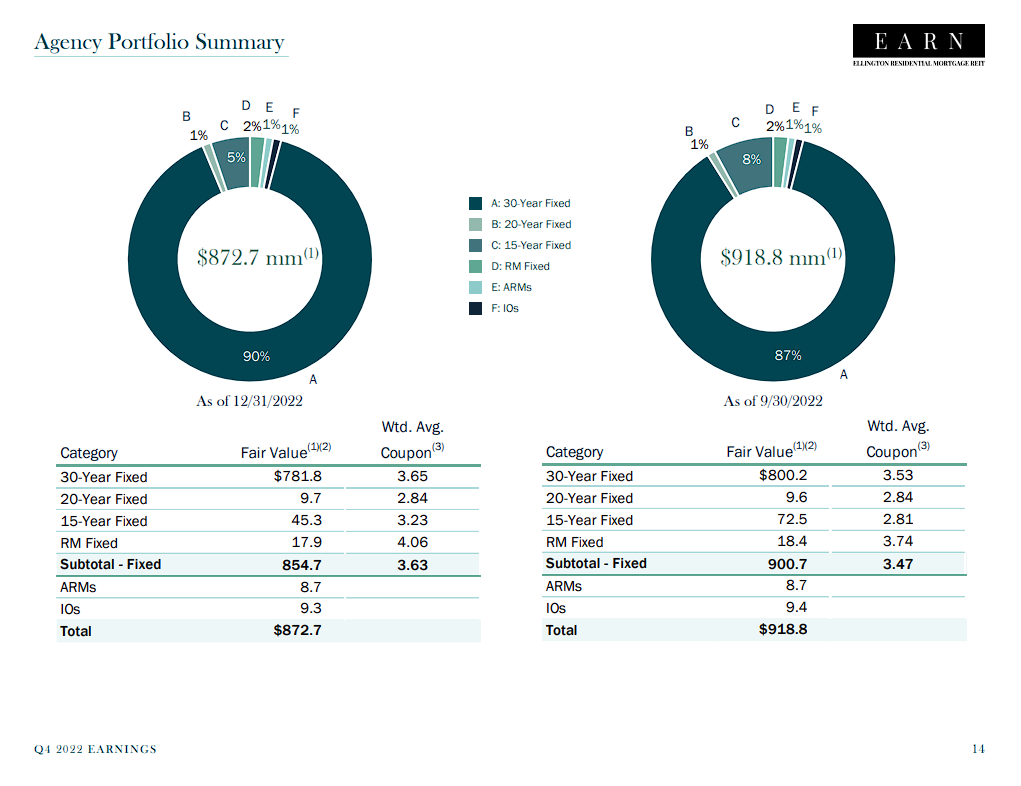

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and real estate-related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government-sponsored enterprise.

Ellington Residential is headquartered in Old Greenwich, Connecticut. It is a small-cap company with a market capitalization of only $98.6 million.

Ellington claims that their portfolio managers are among the most experienced in the MBS sector, and their analytics have been developed over the company’s 28-year history. Ellington Management Group is large, with $9 billion in assets under management. The group has been around since 1994 and has over 170 employees and 70 investment professionals.

Source: Investor Presentation

That said, Ellington’s financial performance has been rather disappointing over the years. The company has seen its core earnings per share shrink rather than grow for most of its history. In its first few years, the company held its share count consistent, but following 2016, the number of shares outstanding has grown, which can be another barrier to growing earnings on a per-share basis.

Consequently, Ellington’s dividend has been cut every single year (results from 2013 only account for half the year) in its history other than an increase in 2021. Along with that increase, the dividend schedule was adjusted to monthly over quarterly payments. Still, the dividend was once again cut by 20% last year to a monthly rate of $0.08.

Ellington’s enormous dividend yield and seemingly cheap valuation accurately reflect the rather worrisome risks attached to the company’s business model and financial performance.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

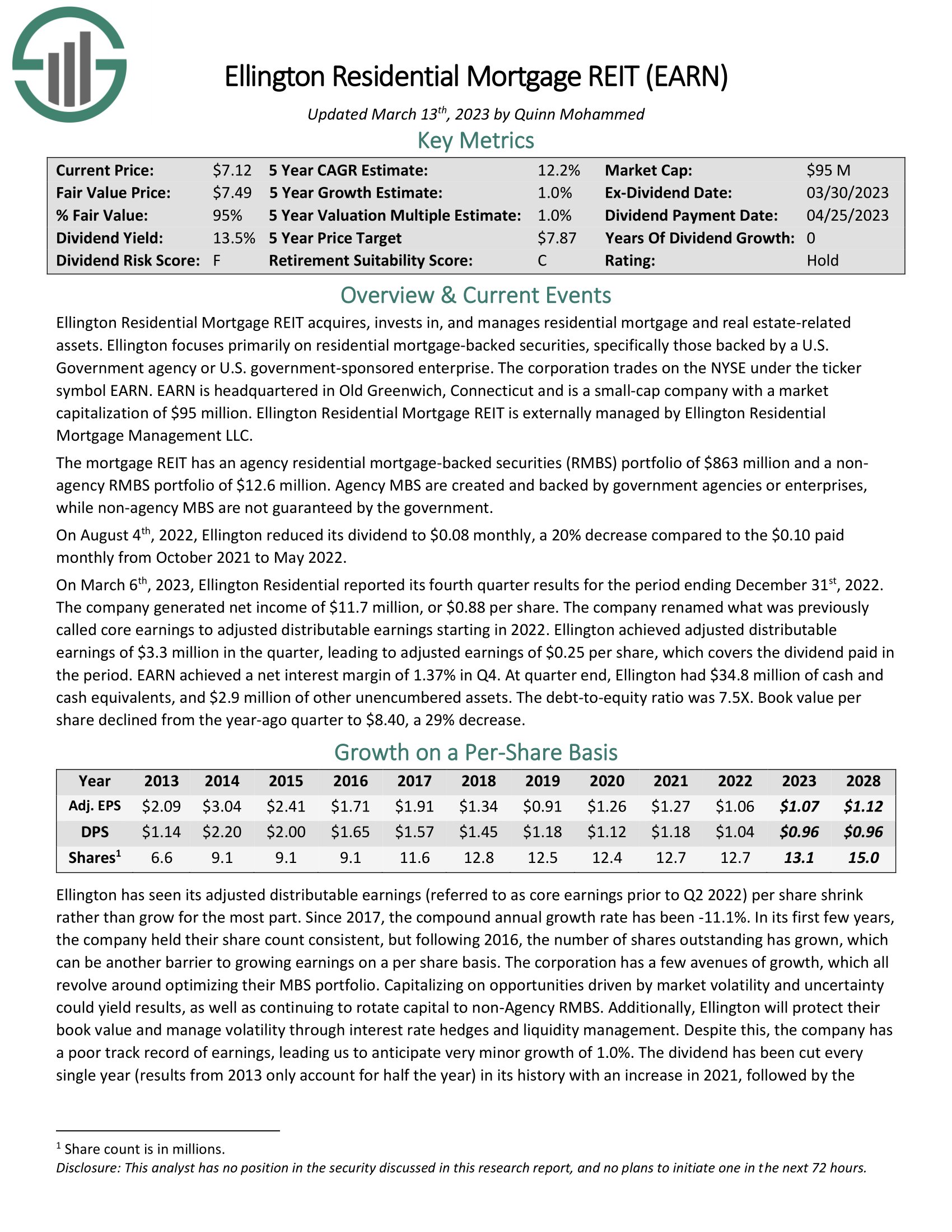

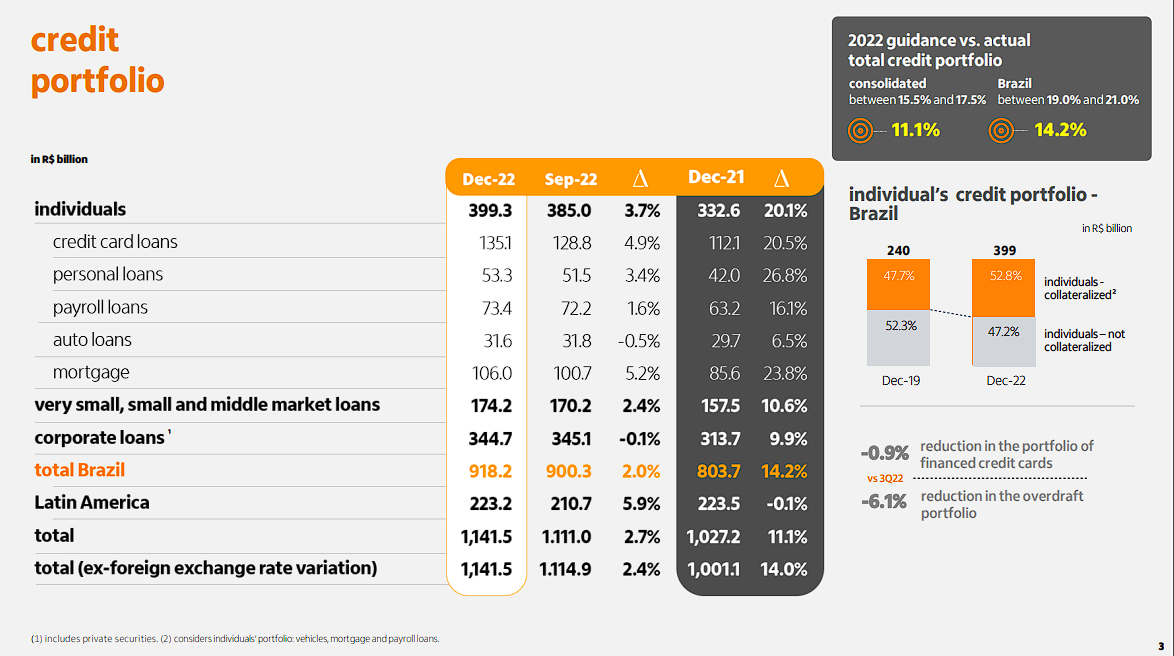

Cheap Monthly Dividend Stock #9: Itaú Unibanco (ITUB)

- Forward P/E: 6.6

- Dividend Yield: 4.6%

Itaú Unibanco is a very large bank that is headquartered in Brazil. ITUB is a large-cap stock with a market capitalization above $44 billion.

Itaú Unibanco conducts business in more than a dozen countries around the world, but the core of its business is in Brazil. It has significant operations in other Latin American countries and select businesses in Europe and the US.

Its scale is huge in relation to other Latin American banks. Itaú is the largest financial conglomerate in the Southern Hemisphere, the world’s 10th–largest bank by market value, and the largest Latin American bank by assets and market capitalization.

Source: Investor Presentation

It’s not uncommon for banks like Itaú Unibanco to try to cater to every type of consumer and business, just like major US banks have done by offering a range of services such as deposits, loans, insurance products, equity investing, and more, in order to attract customers. What sets Itaú Unibanco apart is its focus on emerging economies such as Brazil. However, emerging markets have struggled for many years. This is a cause for concern as economic growth is crucial for a bank’s expansion, and without it, Itaú Unibanco may face challenges in producing profit expansion.

Regarding its dividend, Itaú Unibanco has a conservative approach. The bank pays out dividends to shareholders based on its projected earnings and losses, with the goal being the ability to continue to pay the dividend under various economic conditions. Along with providing its recent quarterly results, the company also slightly increased its monthly dividend from $0.0033 per share to $0.0034 per share. Still, the yield is quite low at 0.83%. Thus, Itaú Unibanco isn’t a pure income stock by any means, as its yield is simply too small to be attractive to most income investors.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

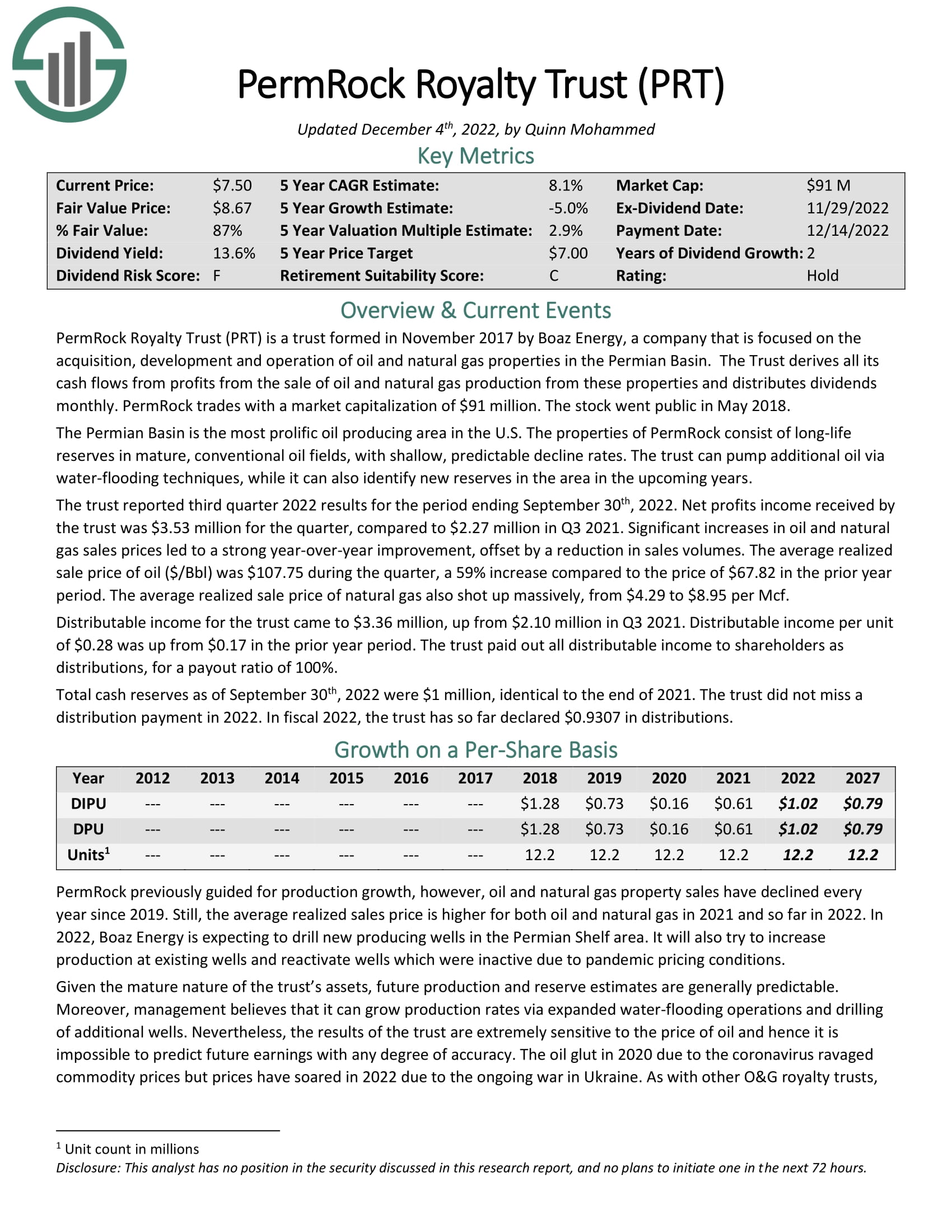

Cheap Monthly Dividend Stock #8: PermRock Royalty Trust (PRT)

- Forward P/E: 6.6

- Dividend Yield: 15.1%

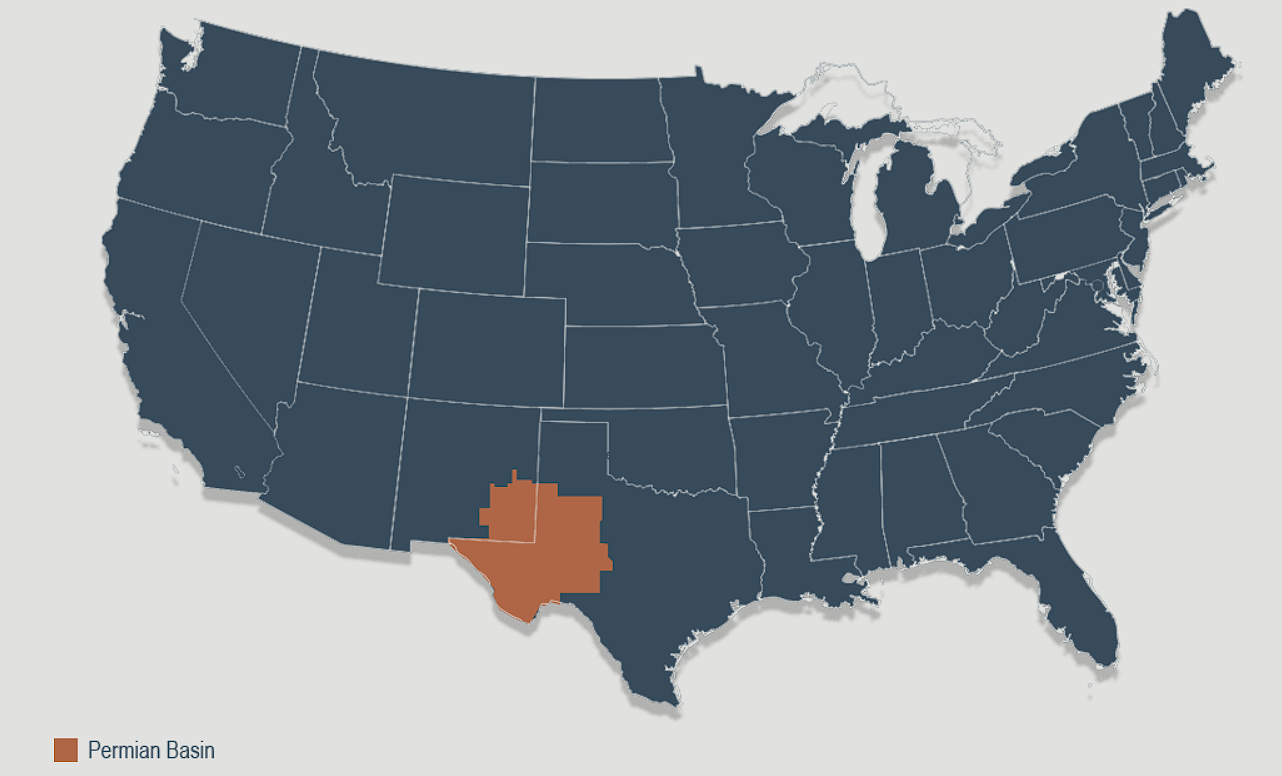

PermRock Royalty Trust is a trust formed in November 2017 by Boaz Energy, a company whose expertise is in acquiring, developing, and operating oil and natural gas properties in the Permian Basin.

The trust owns properties in the Permian Basin. It receives 80% of the net profits from the sale of oil and natural gas produced in its properties and distributes all those net profits in monthly dividends.

According to the EIA, Permian Basin is the most prolific oil-producing area in the U.S. This area extends over 75,000 square miles in West Texas and Southeastern New Mexico. Since its discovery in 1921, it has produced more than 30 billion barrels of oil and more than 75 Tcf of natural gas.

Source: Investor Relations

Royalty trusts like PermRock are essentially a bet on commodity prices. Whatever the trust earns based on the royalties received, which is in turn determined by the underlying oil and natural gas prices, is to be distributed out to shareholders. In 2022, the trust paid a total of $0.86 per share in dividends resulting in a double-digit yield for the year. This was due to the price of oil rallying to a 13-year high this year, primarily thanks to the invasion of Russia in Ukraine and the resultant sanctions of western countries on Russia.

Still, we note that it is prudent not to rely on PermRock to sustain or grow its distribution moving forward. Investors should expect highly variable payouts that can be swayed either way based on the underlying prices of oil and gas. In fiscal 2020, for instance, commodity prices in energy plunged as a result of the COVID-19 pandemic. Accordingly, PermRock saw its distributable income per unit, and thus distribution-per-share, decline to $0.16, compared to $0.73 in fiscal 2019.

Given the highly volatile earnings and distributions of PermRock, it’s important for investors to consider the stock’s P/E ratio and dividend yield within a broader context. In any case, this is not a stock for conservative, income-oriented investors that seek predictable payouts.

Click here to download our most recent Sure Analysis report on PRT (preview of page 1 of 3 shown below):

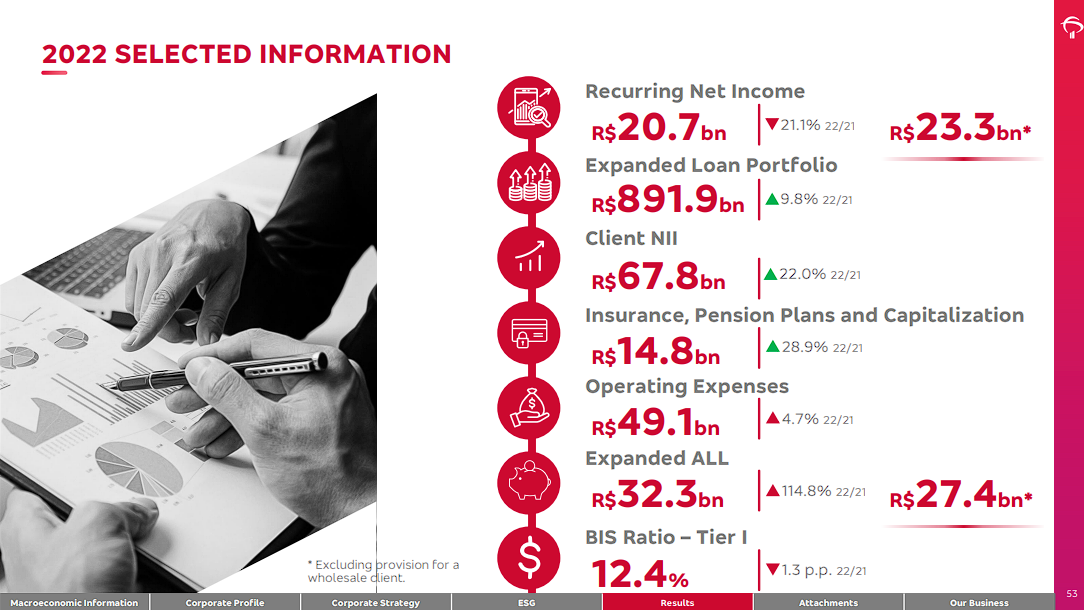

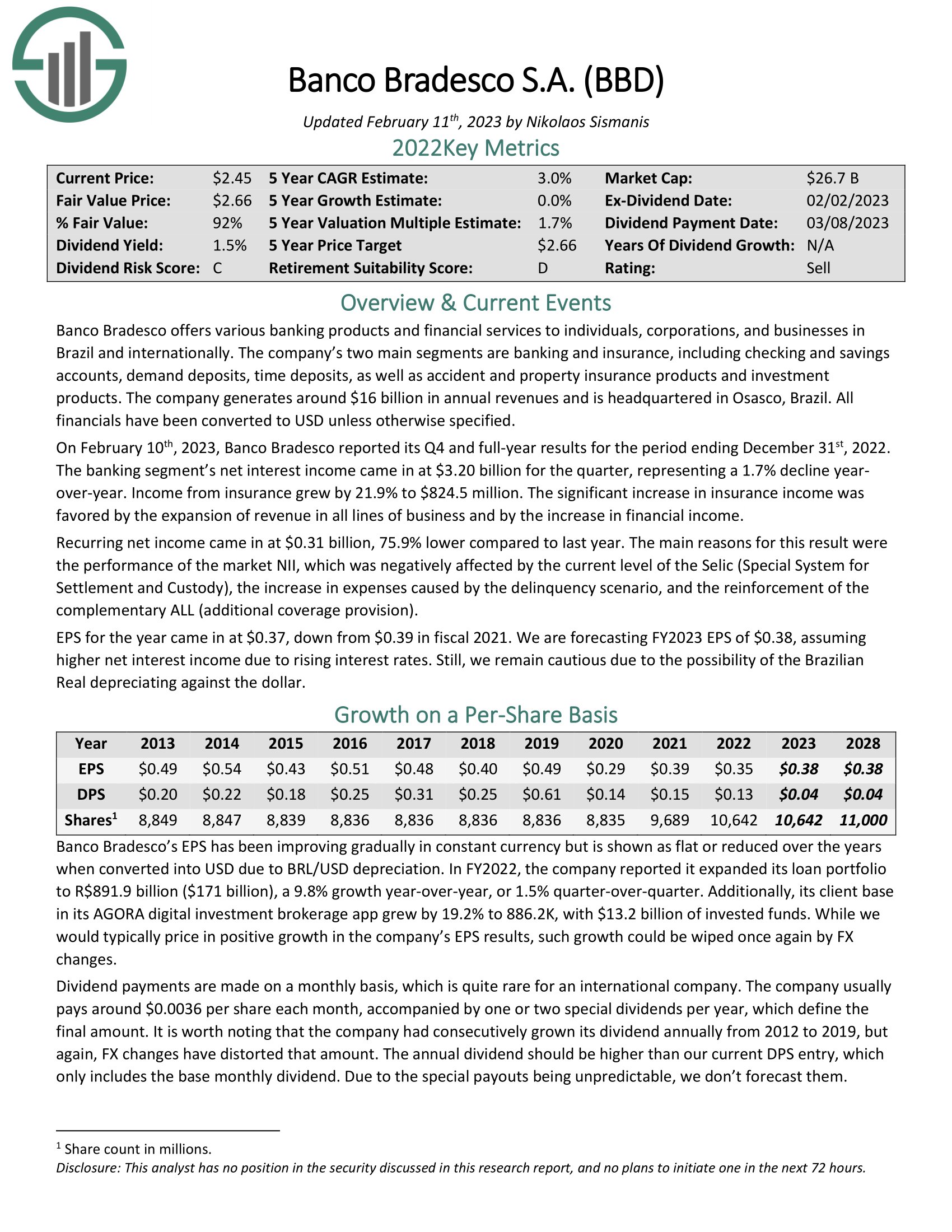

Cheap Monthly Dividend Stock #7: Banco Bradesco S.A. (BBD)

- Forward P/E: 6.5

- Dividend Yield: 1.6%

Banco Bradesco is a financial services company based in Brazil. It offers various banking products and financial services to individuals, corporations, and businesses in Brazil and internationally. The company’s two main segments are banking and insurance, including checking and savings accounts, demand deposits, and time deposits, as well as accident and property insurance products and investment products.

The 2020 COVID-19 pandemic year was very difficult for Banco Bradesco, as the global economy was negatively impacted by the coronavirus pandemic. Fortunately, the company has recovered notably during the past two years.

In FY2022, the company reported it expanded its loan portfolio to R$891.9 billion ($171 billion), a 9.8% growth year-over-year, or 1.5% quarter-over-quarter. Additionally, its client base in its AGORA digital investment brokerage app grew by 19.2% to 886.2K, with $13.2 billion of invested funds.

Source: Investor Presentation

While we would typically price in positive growth in the company’s EPS results based on its continuous product expansion, such growth could be wiped once again by FX changes. This has been a consistent theme for the company. Its EPS has been improving gradually in constant currency, but it is shown as flat or reduced over the years when converted into USD due to the BRL’s depreciation against the USD.

The company usually pays around $0.0036 per share each month, accompanied by one or two special dividends per year, which define the final amount. It is worth noting that the company had consecutively grown its dividend annually from 2012 to 2019, but again, FX changes have distorted that amount. The annual dividend should be higher than Banco Bradesco’s $0.04 annualized monthly dividend, as it only includes the base payouts. The company has a history of paying special dividends as well. Still, it’s almost impossible to forecast their value, especially given the FX factors involved.

Click here to download our most recent Sure Analysis report on BBD (preview of page 1 of 3 shown below):

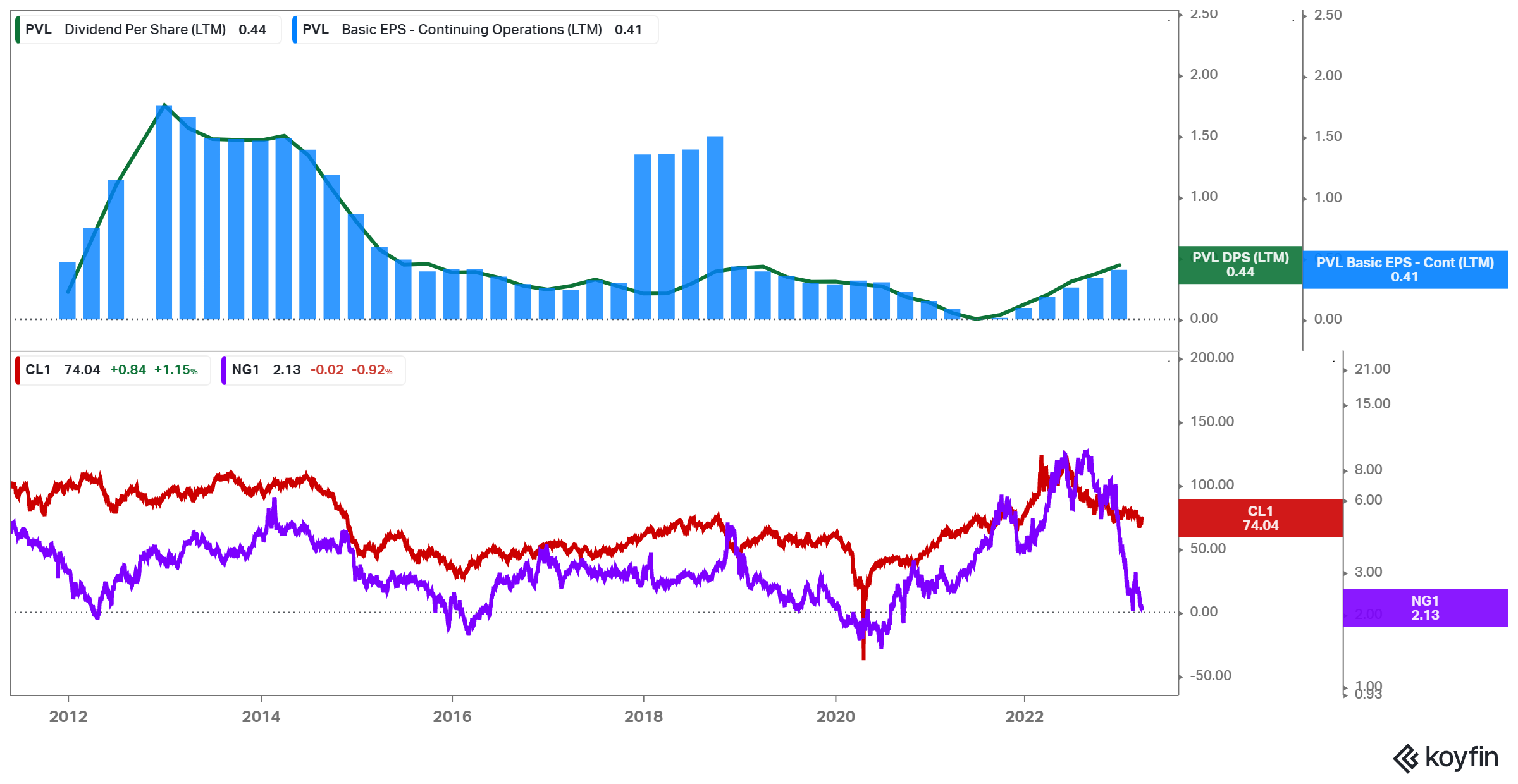

Cheap Monthly Dividend Stock #6: San Juan Basin Royalty Trust (SJT)

- Forward P/E: 6.4

- Dividend Yield: 15.7%

San Juan Basin is a royalty trust established in November 1980. The trust is entitled to a 75% royalty interest in various oil and gas properties across over 150,000 gross acres in the San Juan Basin of northwestern New Mexico.

On July 31st, 2017, Hilcorp San Juan LP completed its purchase of San Juan Basin assets from Burlington Resources Oil & Gas Company LP, a subsidiary of ConocoPhillips (COP).

More than 90% of the trust’s production is comprised of gas, with the remainder consisting of oil. The trust does not have a specified termination date. It will terminate if royalty income falls below $1,000,000 annually over a consecutive two-year period.

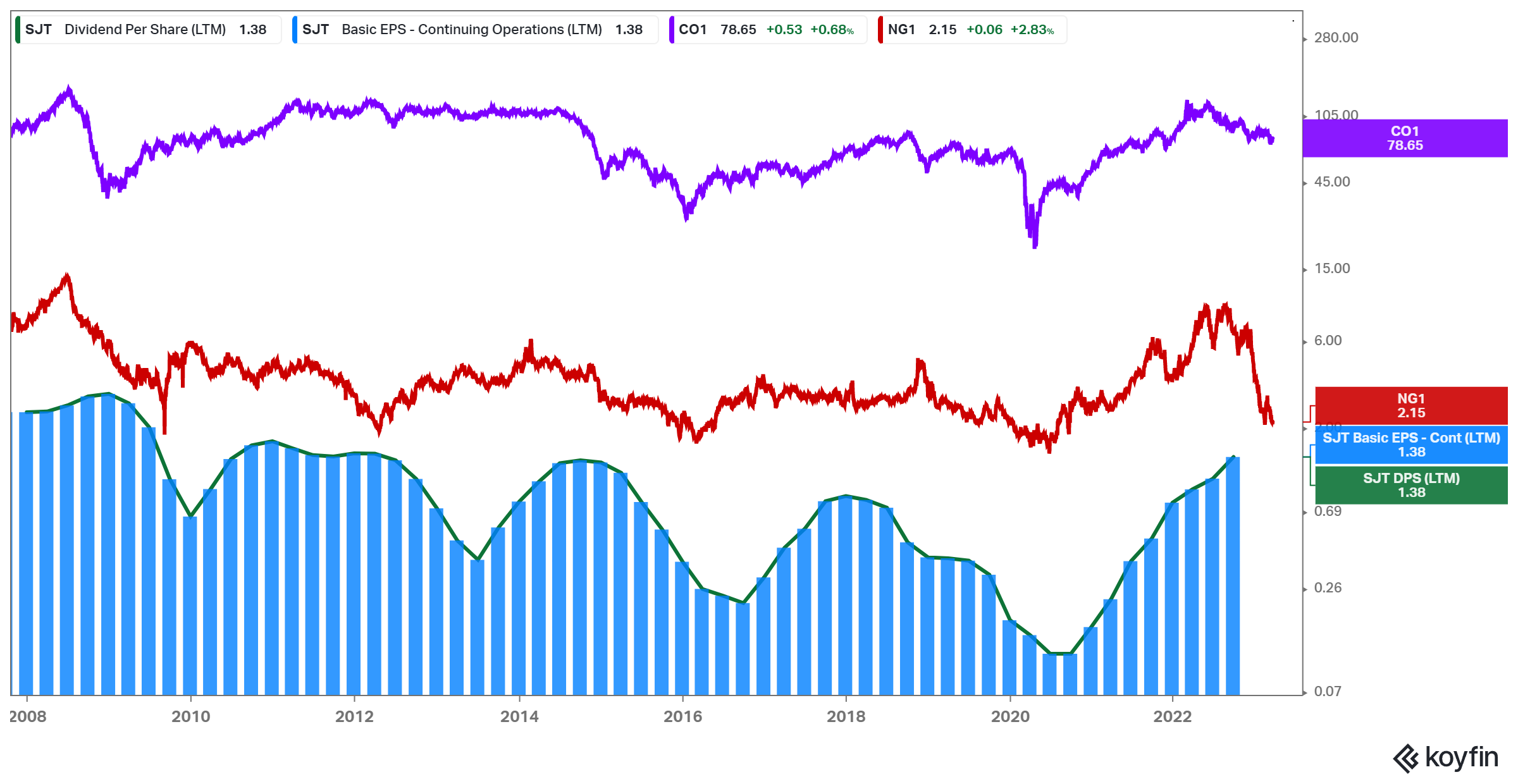

As we mentioned with regard to PermRock Royalty Trust, San Juan Basin’s earnings and distributions are entirely determined by the underlying prices of oil and gas. San Juan Basin faced a series of challenges between 2018 and 2020, primarily driven by the decline in oil and gas prices. As the coronavirus pandemic hit in 2020, prices were further driven down, exacerbating an already difficult situation. However, earnings and distributions have rebounded considerably since, in line with the underlying rally in commodity prices. The chart below illustrates the company’s earnings (blue) and distributions (green) relation to oil prices (purple) and natural gas prices (red).

Source: Koyfin

Similar to PermRock, investors should exercise caution when relying on San Juan Basin to sustain or increase its distribution in the future. Due to the volatile nature of the oil and gas market, payouts are subject to significant fluctuations in either direction. The stock’s P/E ratio and dividend yield should similarly be assessed within a broader context for this reason. Conservative, income-oriented investors seeking predictable payouts may want to consider alternative options.

Click here to download our most recent Sure Analysis report on SJT (preview of page 1 of 3 shown below):

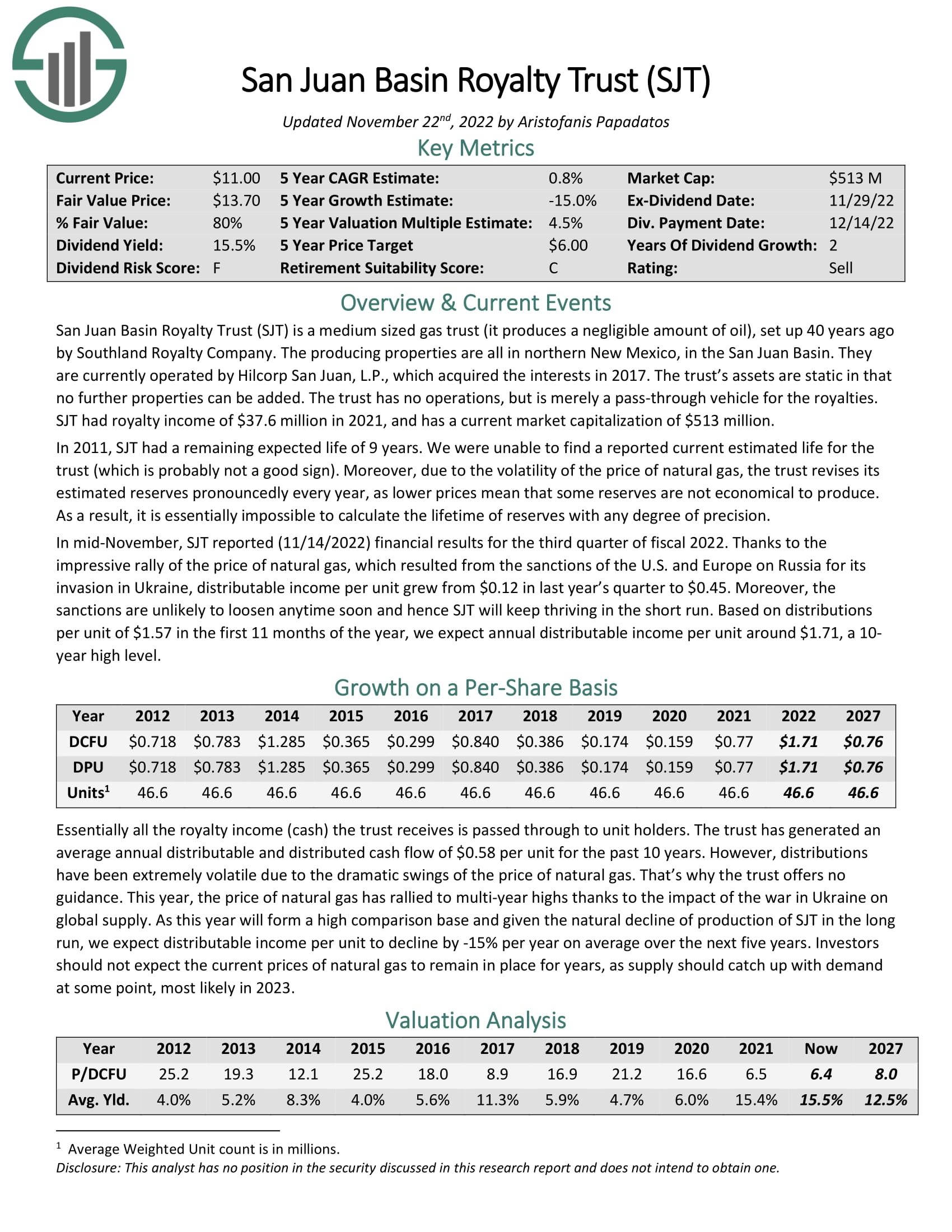

Cheap Monthly Dividend Stock #5: Hugoton Royalty Trust (HGTXU)

- Forward P/E: 6.3

- Dividend Yield: 15.9%

Hugoton Royalty Trust was formed on December 1, 1998, when XTO Energy conveyed 80% net profits interests in specific predominantly gas-producing properties in Kansas, Oklahoma, and Wyoming to the trust. Net profits are calculated by subtracting revenues from production, development, and labor costs.

Hugoton has a key difference from other well-known oil and gas trusts, such as PermRock Royalty Trust (PRM) and San Juan Basin Royalty Trust (SJT), as its interests are primarily tied to the production of natural gas. In 2021, gas comprised 88% of the production of Hugoton, while oil comprised the remaining 12%. In the first nine months of 2022, gas comprised 86% of the production of Hugoton, while oil comprised the remaining 14%. As a result, Hugoton is extremely sensitive to the gyrations of the price of natural gas.

In fact, with natural gas prices remaining at depressed levels between 2018 and 2021, the company paid no distributions, as its distributable cash flows were $0. That said, the trust is on track to post an 8-year high distributable cash flow per unit this year thanks to the natural gas prices soaring in 2022, which resulted from the sanctions of western countries on Russia. Hence, its distributions have already resumed. The chart below illustrates the company’s earnings (blue) and distributions (green) relation to natural gas prices (purple).

Source: Koyfin

Like PermRock and San Juan Basin, Hugoton Royalty Trust’s distributions cannot be relied upon by investors. The volatility of natural gas prices means that payouts can fluctuate wildly and even be suspended entirely. In light of this, it’s important to evaluate the stock’s P/E ratio and dividend yield in a wider context. Conservative investors who prioritize predictable payouts may want to explore other investment opportunities.

Click here to download our most recent Sure Analysis report on HGTXU (preview of page 1 of 3 shown below):

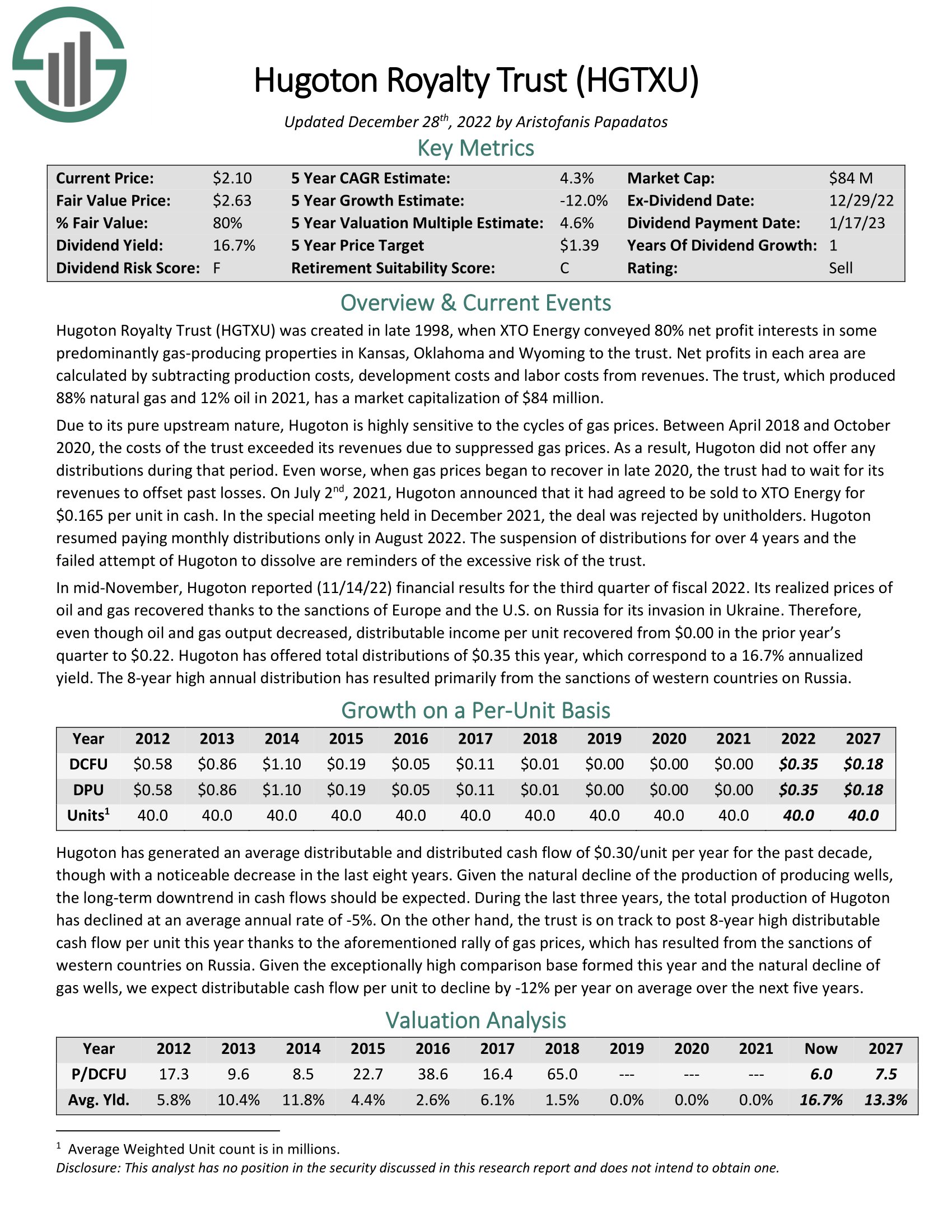

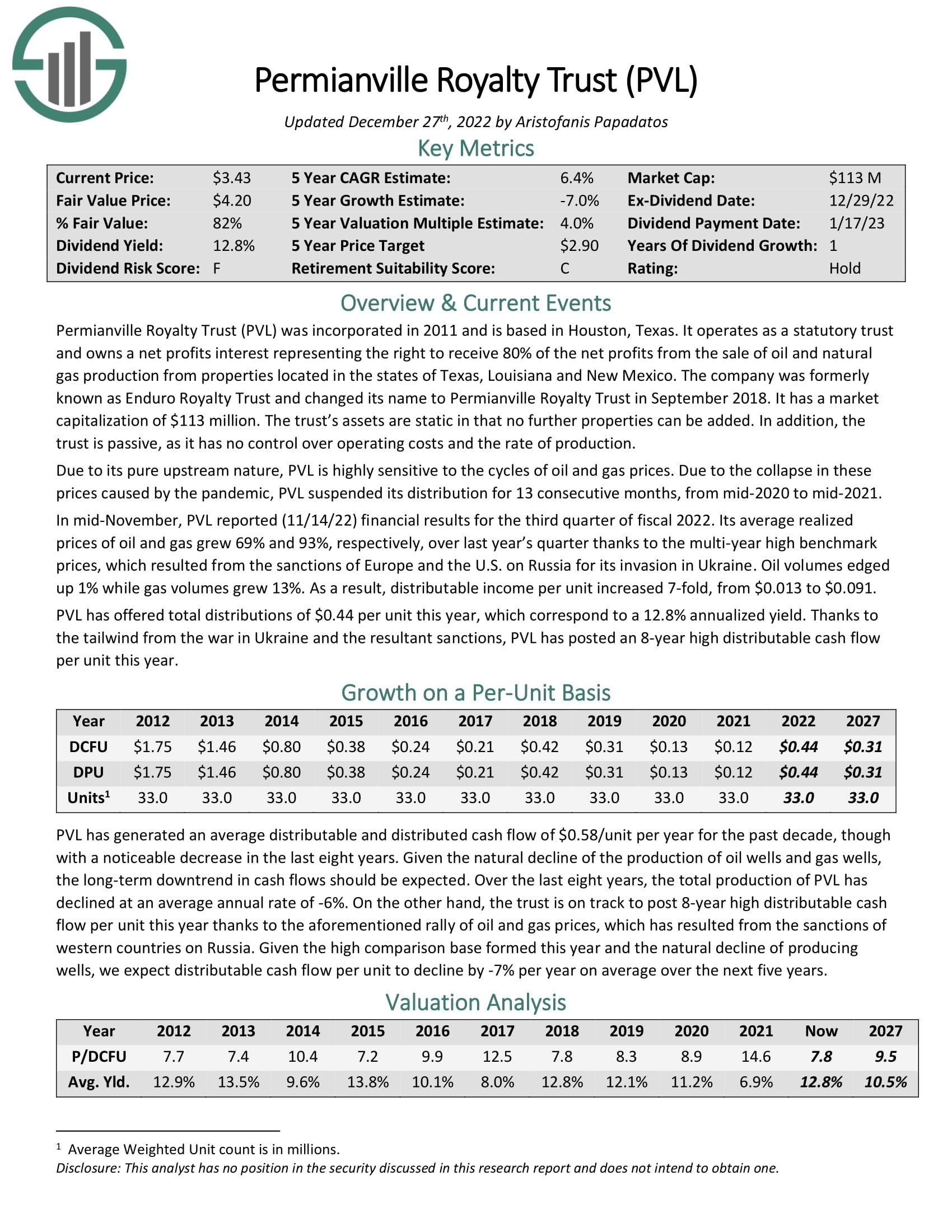

Cheap Monthly Dividend Stock #4: Permianville Royalty Trust (PVL)

- Forward P/E: 5.2

- Dividend Yield: 19.2%

Permianville Royalty Trust is a statutory trust that was formed in 2011 to own a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas production from properties in Texas, Louisiana, and New Mexico as well as the Permian and Haynesville basins.

The trust has the right to receive 80% of the net profits from the sale of oil and natural gas production from its properties. Each month, after all obligations and expenses are paid, unitholders receive the remaining proceeds. The trust is not subject to any preset termination provisions.

However, the trust could dissolve if at least 75% of outstanding units vote in favor of dissolution or the annual cash proceeds received by the trust are less than $2 million for each of any two consecutive years. The company’s business model and its performance’s correlation with the underlying prices of oil and gas follow the same rationale we have seen in the aforementioned royalty trusts. The chart below illustrates the company’s earnings (blue) and distributions (green) relation to oil (red) and natural gas prices (purple).

Source: Koyfin

Just like the royalty charts we’ve already presented, investors cannot depend on Permianville’s distributions due to the unpredictability of commodity prices. As a result, it is crucial to assess the stock’s P/E ratio and dividend yield within a broader framework. Those who value consistent payouts and exercise caution may wish to explore alternative investment options.

Click here to download our most recent Sure Analysis report on PVL (preview of page 1 of 3 shown below):

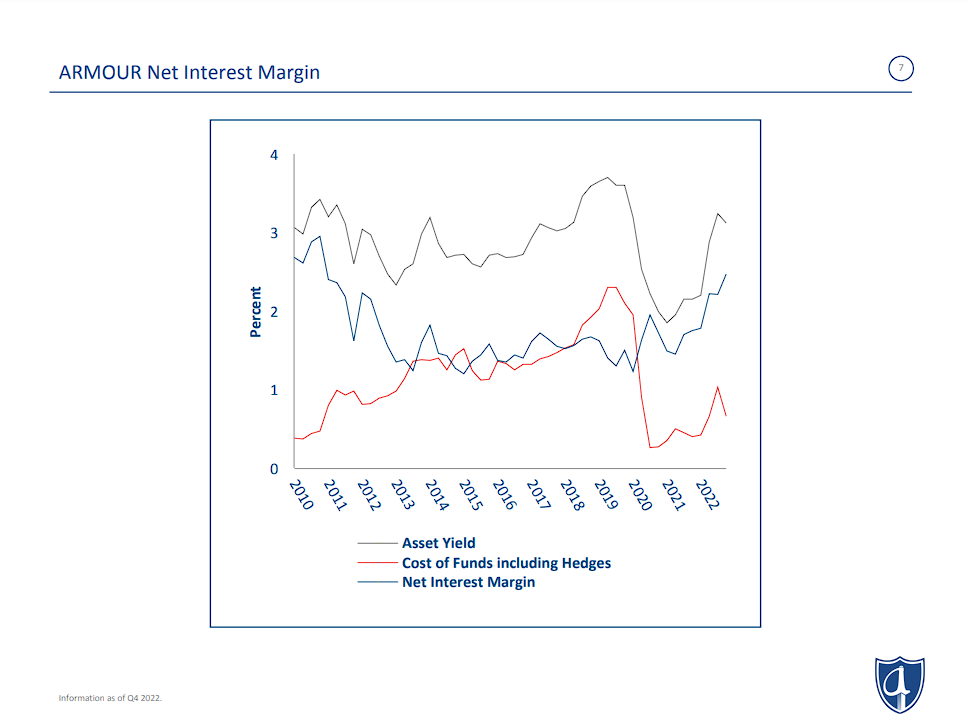

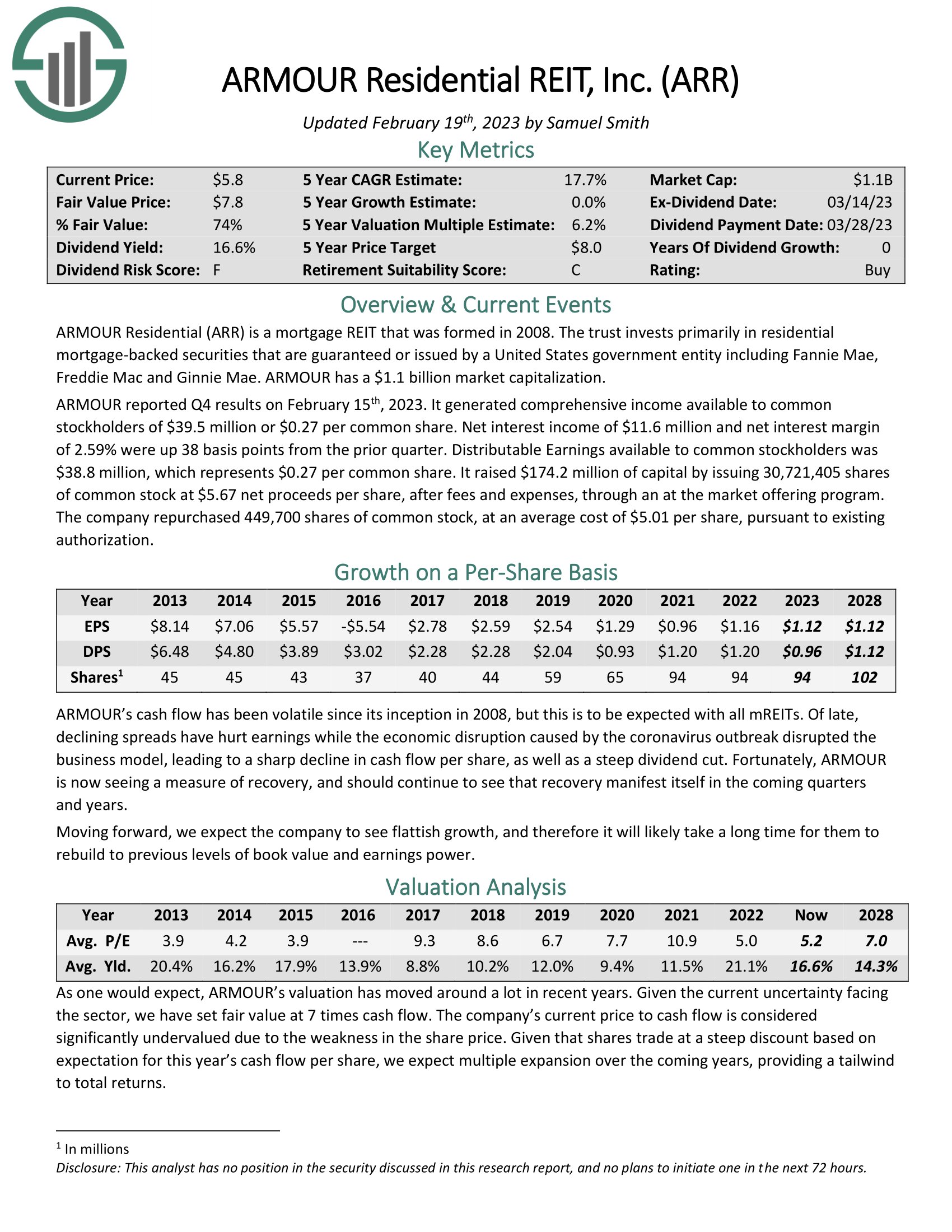

Cheap Monthly Dividend Stock #3: ARMOUR Residential REIT, Inc. (ARR)

- Forward P/E: 4.6

- Dividend Yield: 18.7%

As an mREIT, ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac. It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Other types of investments include unsecured notes and bonds issued by the GSE and the United States treasuries, money market instruments, as well as non-GSE or government agency-backed securities.

The trust makes money by raising capital through issuing debt as well as preferred and common equity and then reinvesting the proceeds into higher-yielding debt instruments. The spread (i.e., the difference between the cost of capital and the return on capital) is then largely returned to common shareholders via dividend payments, though the trust often retains a little bit of the profits to reinvest in the business.

ARMOUR’s cash flow has been volatile since its inception in 2008, but this is to be expected with all mREITs. Of late, declining spreads have hurt earnings while the economic disruption caused by the coronavirus outbreak disrupted the business model, leading to a sharp decline in cash flow per share, as well as a steep dividend cut in 2020.

Source: Investor Presentation

Fortunately, ARMOUR is now seeing a measure of recovery and should continue to see that recovery manifest itself in the coming quarters and years. Moving forward, we expect the company to grow slowly, though it will likely take a long time for them to rebuild to previous levels of book value and earnings power.

Click here to download our most recent Sure Analysis report on ARR (preview of page 1 of 3 shown below):

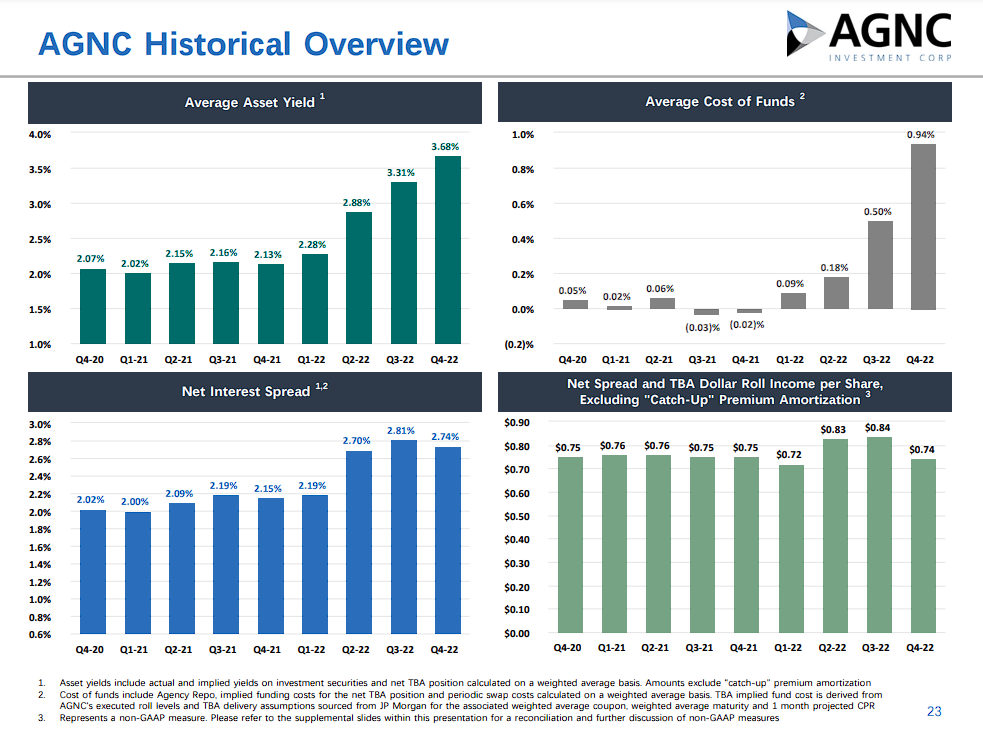

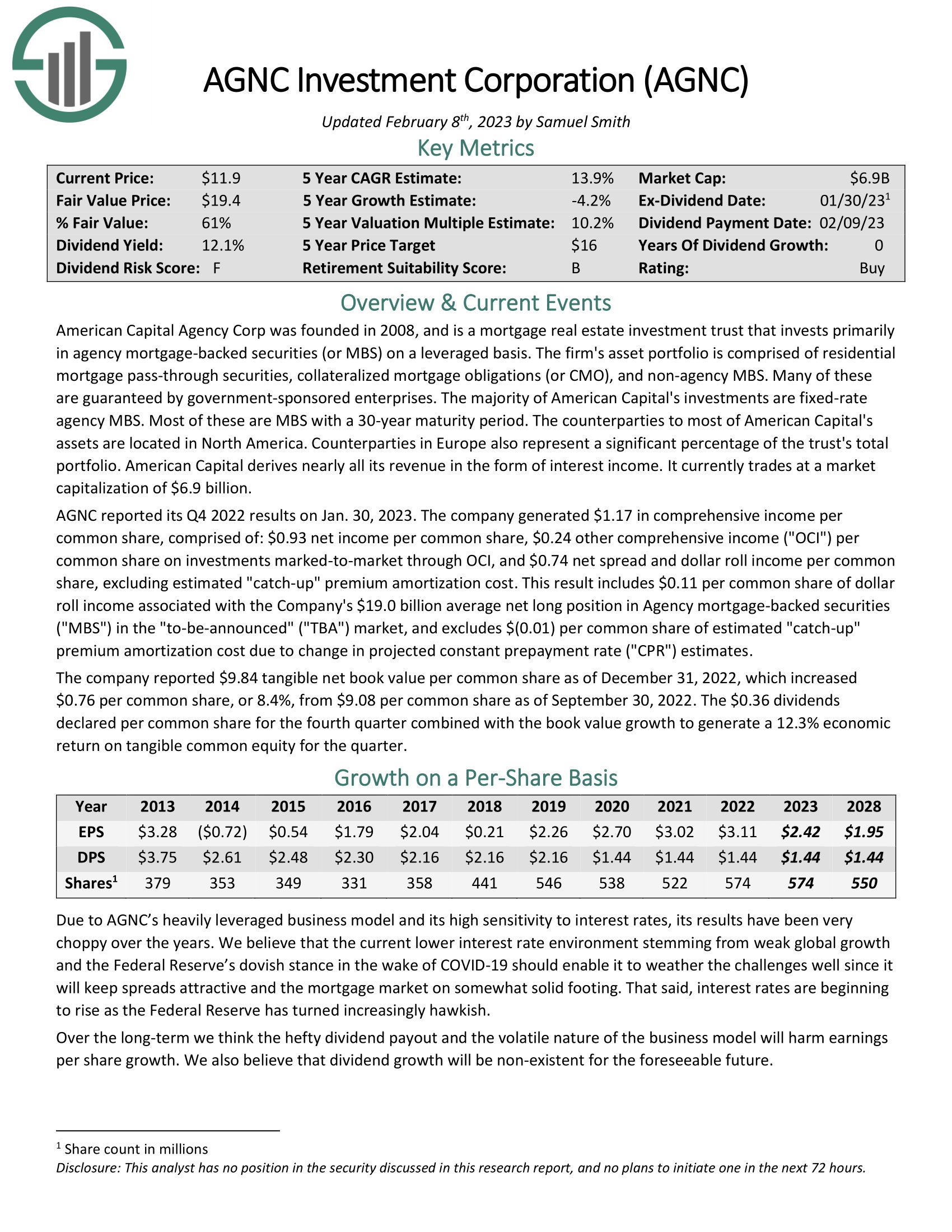

Cheap Monthly Dividend Stock #2: AGNC Investment Corp. (AGNC)

- Forward P/E: 4.1

- Dividend Yield: 14.6%

AGNC was founded in 2008 and is an internally-managed REIT. Whereas most REITs own physical properties that are leased to tenants, AGNC has a different business model. It operates in a niche of the REIT market: mortgage securities.

AGNC invests in agency mortgage-backed securities. It generates income by collecting interest on its invested assets minus borrowing costs. It also records gains or losses from its investments and hedging practices. Agency securities are those that have principal and interest payments guaranteed by either a government-sponsored entity or the government itself. They theoretically carry less risk than private mortgages.

The major drawback to mortgage REITs is that the business model is negatively impacted by rising interest rates. AGNC makes money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference. To amplify returns, mortgage REITs are also highly leveraged. Despite this, AGNC has managed to expand its net interest spreads, as its average yield on assets has expanded at a faster pace compared to its average cost of funds.

Source: Investor Presentation

Following a dividend cut in 2020, AGNC has declared monthly dividends of $0.12 per share since April 2020. This translates to an annualized payout of $1.44 per share, bringing AGNC’s dividend yield to an enormous 14.6% at the stock’s current price.

Such a high yield can be a sign of elevated risk. Indeed, AGNC’s dividend does carry significant risk. AGNC has reduced its dividend several times over the past decade, including as recently as two years ago. While we do not see a dividend cut as an imminent risk at this point, given that the payout ratio has somewhat improved, we don’t exclude the possibility of one if AGNC’s investment results were to take a sudden hit.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

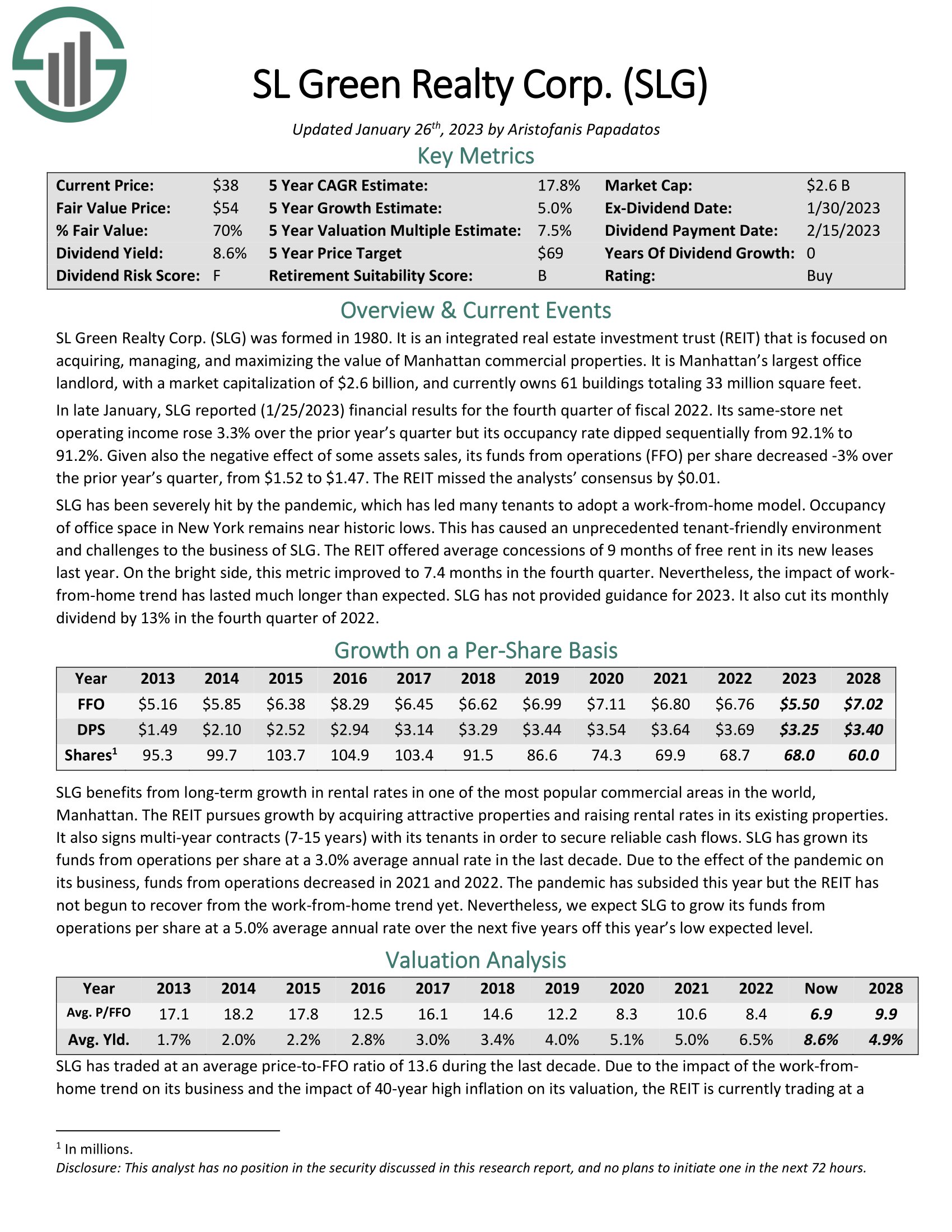

Cheap Monthly Dividend Stock #1: SL Green Realty Corp. (SLG)

- Forward P/E: 3.7

- Dividend Yield: 16.0%

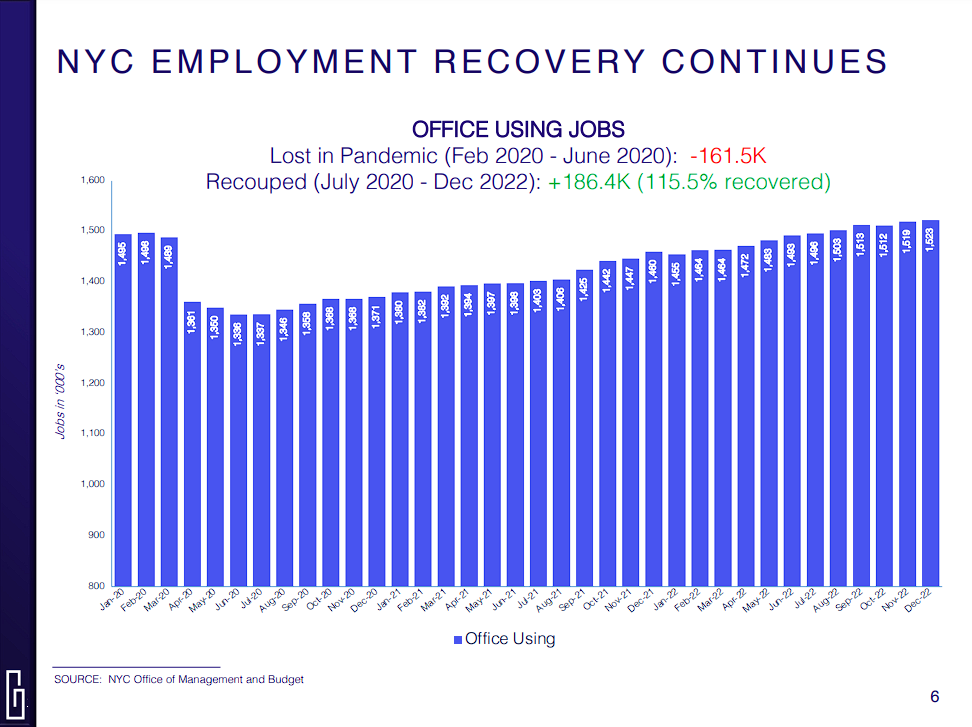

SL Green is a self-managed REIT that manages, acquires, develops, and leases office properties in the New York City Metropolitan area. In fact, the trust is the largest owner of office real estate in New York City, with the majority of properties in midtown Manhattan. The trust has a market capitalization of $2.2 billion and is Manhattan’s largest office landlord, with more than 40 buildings totaling close to 30 million square feet.

The location of properties benefits the trust as more technology and financial companies desire centrally located real estate in the area. While many think of San Francisco as the technology hub in the U.S., New York City is also one of the largest employers in the sector. This should allow SL Green an opportunity to capitalize on this growing field with its strategically located properties.

SL Green has been significantly affected by the coronavirus crisis, which has hurt several companies that are tenants of SLG. Occupancy of office space in New York is near historic lows as demand has waned, at least to some degree, due to increased working from home. However, with employment rates in New York City continuously recovering, the company expects demand for office space to rise moving forward.

Source: Investor Presentation

Further, SL Green benefits from its trophy assets, such as 450 Park Avenue and 245 Park Avenue, where the company can demand high rents from tenants and where demand is still high. The company’s regular asset sales of non-core assets seek to strengthen the portfolio further, which should help with demand and, thus, occupancy rates in the long run.

SL Green reduced its dividend by 12.9% in December 2022 to a monthly rate of $0.2708. Despite ongoing challenges from interest rates, the current payout appears to be manageable. In fact, we anticipate that SL Green will generate $5.40 in FFO-per-share in 2023, resulting in a projected dividend payout ratio of 60%.

Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below):

Final Thoughts

To sum up, although monthly dividend stocks may appear appealing for generating a steady income stream, it’s crucial to bear in mind that not all dividend stocks are created equal. Each stock carries its own set of risks, and the greater the risk, the more probable it is that shares will appear undervalued. The monthly dividend stocks featured in this article reflect this reasoning. Even though they may seem inexpensive at first glance, their earnings have been quite shaky historically, and all of them have previously reduced their dividends.

Whether it’s a risky mortgage REIT or a royalty trust with unpredictable results and distributions, investors should scrutinize the cheap valuation of monthly dividend stocks and comprehend the risks involved in each circumstance. Nevertheless, our list can serve as an excellent starting point for investors seeking potential opportunities for undervalued investments in the realm of monthly dividend stocks.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more