Updated on March 27th, 2024 by Bob Ciura

Abbott Laboratories (ABT) is a very well-known dividend growth stock, and for good reason. The company is a member of the exclusive Dividend Aristocrats, a group of elite dividend stocks with 25+ years of consecutive dividend increases.

We believe the Dividend Aristocrats are among the best dividend stocks to buy and hold for the long-term.

With this in mind, we created a full list of all 68 Dividend Aristocrats. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

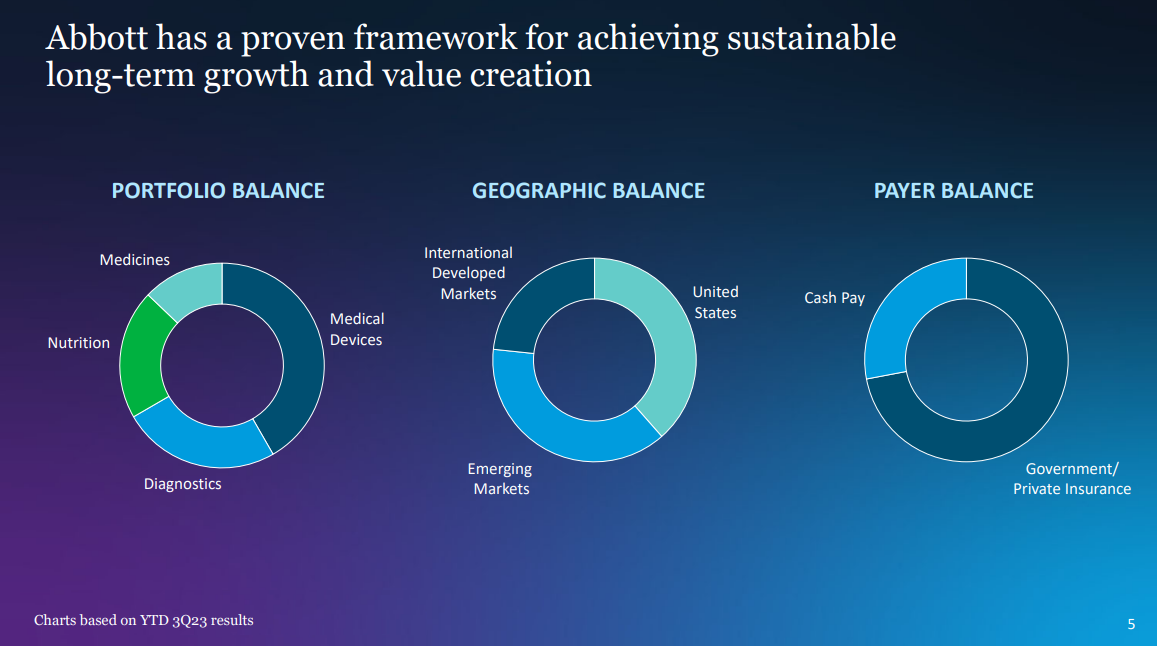

Abbott is diversified across multiple areas of health care, each of which has positive growth potential for the long term. This has fueled Abbott’s impressive history and will continue to do so in the years ahead.

This article will discuss the investment prospects of Abbott Laboratories in detail.

Business Overview

Abbott Laboratories is a diversified healthcare corporation with a market capitalization of $193 billion. The company was founded in 1888 and is headquartered in Lake Bluff, Illinois.

The company operates in four main segments: Nutritional Products, Established Pharmaceuticals, Diagnostics, and Medical Devices. Abbott enjoys a leadership position across product segments.

The company’s Nutrition Products segment is the #1 pediatric nutrition provider in the United States and some other geographies. Moreover, the segment’s performance has improved considerably in recent years as the operating margin has improved each and every year since 2011.

Abbott Laboratories’ last segment is the Medical Devices unit. This segment was significantly bolstered in recent times by the St. Jude Medical acquisition.

Source: Investor Presentation

On January 24th, 2024, Abbott Laboratories announced fourth quarter and full earnings results. For the quarter, the company generated $10.24 billion in sales (61.4% outside of the U.S.), representing a 1.4% increase compared to the fourth quarter of 2022. Adjusted earnings-per-share of $1.19 compared to $1.03 in the prior year.

Revenue was $50 million more than expected while adjusted earnings-per-share were in-line with estimates. For the year, revenue decreased 8.2% to $40.1 billion while adjusted earnings-per-share of $4.44 compared unfavorably to $5.34 in 2022, but matched the midpoint of the company’s guidance.

U.S. sales declined 14.8% while international was lower by 3.3%. Company-wide organic sales decreased 6.2%. However, excluding Covid-19 testing products, organic growth was 11.6%. Nutrition sales grew 13.9% organically as the company continues to see a recovery in market share of its infant formula business following a stoppage of production in 2022.

Growth Prospects

Over time, Abbott Laboratories has shown the capability to reliably grow its adjusted earnings-per-share. Abbott Laboratories spun off AbbVie (ABBV) in 2013, and both businesses have performed well since the spin-off.

Looking ahead, Abbott Laboratories has two major growth prospects that will help its business to become increasingly more profitable over the years to come.

The first is the aging population, both domestically and within the United States. In 2019, the percentage of the global population that exceeded the age of 65 was 9.1%. This proportion is expected to reach 16% in 2050.

The second broad tailwind that will benefit Abbott Laboratories is the company’s focus on emerging markets. This is particularly true for its Branded Generic Pharmaceuticals segment.

Many of the countries that this segment is focused on are spending a very small proportion of their overall GDP on healthcare, a rate that is expected to increase in the future.

The aging domestic population combined with the rather low focus on healthcare spending in emerging market countries should leave Abbott Laboratories plenty of room to grow for the foreseeable future.

We expect 7% annual EPS growth over the next five years for ABT.

Competitive Advantages & Recession Performance

Abbott Laboratories’ competitive advantage is two-fold. The first component is its remarkable brand recognition among its consumer medical products, particularly in its Nutrition segment. Led by noteworthy products like the Ensure meal replacement supplement, Abbott Laboratories brands allows its sales to stand strong through even the worst economic recessions.

The second component of Abbott’s competitive advantage is its focus on research and development. Its investment in research & development shows that the company is willing to play the long game, building out its product pipeline and improving its long-term business growth prospects.

As a large, diversified healthcare business, Abbott Laboratories is extraordinarily recession-resistant. The company actually managed to increase its adjusted earnings-per-share during each year of the 2007-2009 financial crisis.

- 2007 earnings-per-share of $2.84

- 2008 earnings-per-share of $3.03 (6.7% increase)

- 2009 earnings-per-share of $3.72 (22.8% increase)

- 2010 earnings-per-share of $4.17 (12.1% increase)

Remarkably, Abbott Laboratories managed to grow its earnings-per-share during the global financial crisis – one of the most economically difficult time periods on record. At the same time, the company’s share count increased. This means that Abbott Laboratories didn’t use share repurchases to grow earnings-per-share, they were simply more profitable during a tumultuous time.

We expect this recession-resistant Dividend Aristocrat to perform similarly well during future downturns in the business environment.

From a dividend perspective, Abbott Laboratories’ dividend also appears very safe. ABT has an expected dividend payout ratio slightly below 50% for 2024.

Valuation & Expected Total Returns

Abbott Laboratories is currently trading at ~$113 per share. Using the midpoint of the company’s guidance for the year gives the stock a price-to-earnings ratio of 24.6.

Abbott Laboratories’ price-to-earnings ratio has generally hovered between 20 and 25 over the past five years. The current valuation is on the high end of this range.

We feel that a fair price-to-earnings ratio of 20 is more appropriate in the current environment. If shares revert to our fair value estimate of 20 by 2029, then valuation would be a 4.1% drag to annual returns over this period of time.

The other major component of Abbott Laboratories’ future total returns will be the company’s earnings-per-share growth. We expect that this growth is likely to continue, and investors can reasonably expect 7% in annual adjusted earnings-per-share growth moving forward.

Lastly, Abbott’s total returns will receive a boost from the company’s dividend payments. Abbott Laboratories now has a dividend growth streak of 52 years, preserving its Dividend King status.

ABT stock has a current dividend yield of 2.0%. Overall, Abbott Laboratories’ expected total returns will be composed of:

- 7.0% earnings-per-share growth

- 2.0% dividend yield

- -4.1% multiple reversion

Total expected annual returns are forecasted at just 4.9% through 2029. This is a fairly low expected rate of return due to the overvaluation of the stock at the present time.

Final Thoughts

Abbott Laboratories has many of the characteristics of an appealing dividend investment. It has a recession-resistant business model that allows it to continue growing earnings-per-share through various economic environments. It also has a long history of steadily increasing dividend payments.

That said, we believe that the stock’s current valuation prevents it from offering strong return prospects in the coming years, which is why we rate Abbott Laboratories a hold right now.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List: considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: