Updated on April 19th, 2024 by Bob Ciura

Insurance can be a great business. Insurers collect revenue from policy premiums and make money by investing the accumulated premiums not paid out in claims, known as the float.

Even legendary investor Warren Buffet sees the value of insurance stocks –his investment conglomerate Berkshire Hathaway (BRK.A) (BRK.B) owns GEICO, General Re, and more.

High profitability allows many insurance companies to pay dividends to shareholders and raise their dividends over time. For example, Aflac (AFL), has increased its dividend for 42 years in a row.

This means the company qualifies as a Dividend Aristocrat – a group of 68 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

You can download a free list of all 68 Dividend Aristocrats, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

This article will take an inside look at Aflac’s business model and what drives its impressive dividend growth.

Business Overview

Aflac was formed in 1955 by three brothers: John, Paul, and Bill Amos. Together, they came up with the idea to sell insurance products that paid cash if a policyholder got sick or injured. In the mid-twentieth century, workplace injuries were common. And there was no insurance product at the time to cover this risk.

Today, Aflac has a wide range of product offerings. Some of these include accident, short-term disability, critical illness, hospital indemnity, dental, vision, and life insurance.

The company specializes in supplemental insurance, which pays out to policyholders if they are sick or injured and cannot work. Aflac operates in the U.S. and Japan, with Japan accounting for approximately ~70% of the company’s premium income. Because of this, investors are exposed to currency risk.

Aflac’s earnings will fluctuate based on exchange rates between the Japanese yen and the U.S. dollar. When the yen rises against the dollar, it helps Aflac because each yen earned becomes more valuable when it is reported in U.S. dollars.

Aflac’s strategy is to increase premium growth through new customers and increase sales to existing customers. It is also investing in expanding its distribution channels, including its digital footprint, in the U.S. and Japan.

Aflac continues to perform well overall. On January 31st, 2024, Aflac released fourth-quarter and full-year financial results. For the quarter, the company reported $3.8 billion in revenue, a 2.6% decrease compared to Q4 of 2022. Net earnings equaled $268 million, or $0.46 per share, compared to $196 billion, or $0.31 per share, in the prior year.

However, this includes investment gains which are excluded from adjusted earnings. On an adjusted basis, earnings-per-share equaled $1.25 versus $1.29 prior. Revenue was $20 million less than expected while adjusted earnings-per share was $0.20 below estimates.

For 2023, revenue fell 2.3% to $18.7 billion while adjusted earnings-per-share of $6.23 compared to $5.67 in the prior year.

Growth Prospects

From 2007 through 2020, Aflac grew earnings-per-share by an average compound rate of 8.8% per year, although part of that improvement is tax reform-related. Also, remember that the Yen was generally weakening against the dollar for a good amount of the last decade.

In Japan, Aflac wants to defend its strong core position, while further expanding and evolving to customer needs. To this point, Aflac Japan is expanding its “third-sector” product offerings. These include non-traditional products such as cancer insurance and medical and income support.

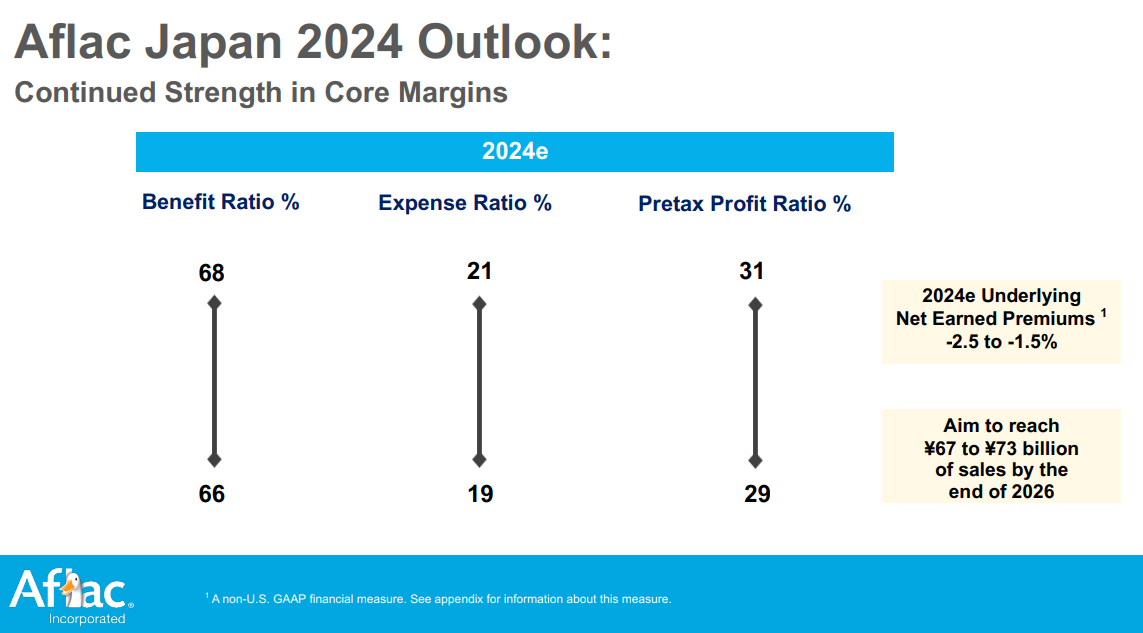

Source: Investor Presentation

Aflac has enjoyed strong demand in Japan for third-sector products due to the country’s aging population and declining birth rate.

Aflac has two sources of revenue: income from premiums and income from investments. On the premium side, this is generally sticky, with policy renewals making up the bulk of income. However, Aflac operates in two developed markets where we would not anticipate seeing outsized growth in the business.

The other lever available is on the investment side, where the vast majority of the portfolio is in bonds. In addition, the share repurchase program has been an important factor as well and we believe it will continue to drive earnings-per-share.

We are forecasting 6% annual growth rate over the next five years.

Competitive Advantages & Recession Performance

Aflac has many competitive advantages. First, it dominates its niche. It operates in supplemental insurance products and is the leading company in that category. Its business model has low capital expenditure requirements and sells a product that enjoys steady demand.

Aflac’s strong brand is a key competitive advantage. Competition is intense in the insurance industry, considering the commodity-like nature of the products. To retain customers and attract new customers, Aflac invests heavily in advertising.

Aflac is also a recession-resistant company. It remained profitable even during the Great Recession:

- 2007 earnings-per-share of $1.64

- 2008 earnings-per-share of $1.31 (-20% decline)

- 2009 earnings-per-share of $1.96 (49.6% increase)

- 2010 earnings-per-share of $2.57 (31.1% increase)

Notably, Aflac had a tough year in 2008, which is understandable given the deep recession at the time. However, its earnings-per-share came roaring back in 2009 and 2010.

Valuation & Expected Returns

Over the last decade, shares of Aflac have traded hands with an average P/E ratio of roughly 10x times earnings.

We believe this is more or less fair value for the security, considering that many insurers trade at a comparable multiple. This lower average valuation multiple allows for the robust share repurchase program to be more effective.

Ongoing owners are much better served if the company is buying out past partners at 10x times earnings as compared to, say, 15x- or 20x-times earnings.

Based on 2024 expected earnings-per-share of $6.45, shares are presently trading hands at 12.8x times earnings. As such, this implies a slight annual valuation headwind (-4.8%), should shares revert to 10 times earnings over the next five years.

In addition, the 6% growth rate and 2.4% starting dividend yield should aid in shareholder returns. When all three components are put together, this implies the potential for 3.6% annualized returns.

Aflac’s dividend appears very safe, with an expected dividend payout ratio of 31% for 2024. The dividend has room for future increases even if EPS growth slows.

Final Thoughts

Aflac is a high-quality company with a profitable business and a strong brand.

The company has increased its dividend for 42 years in a row. Thanks to a low payout ratio and future earnings growth, it should continue to do so.

Aflac is not a high-dividend stock, with a current yield at 2.3%. But it offers steady dividend increases and a highly sustainable payout.

However, shares are presently trading higher than the company’s historical valuation. This results in low single-digit total returns expected over the next five years. Therefore, the security earns a hold rating.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List: considered to be the best-of-the-best among dividend growth stocks, the Dividend Kings are a group of exceptional dividend stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: contains stocks on either the Dividend Achievers, Dividend Aristocrats, or Dividend Kings list.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: