Updated on March 12th, 2025 by Nathan Parsh

Each year, we review all of the Dividend Aristocrats. Attaining membership to this group is difficult: companies must be of a certain size, belong to the S&P 500 Index, and (most importantly) have at least 25 consecutive years of dividend growth.

There are just 69 Dividend Aristocrats, proving the exclusivity of the list.

You can download an Excel spreadsheet of all 69 Dividend Aristocrats, including important financial metrics such as P/E ratios and dividend yields, by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Albemarle Corporation (ALB) joined this exclusive list in 2020. The company is one of the most volatile names among the Dividend Aristocrats, but this makes its dividend growth streak even more impressive.

This article will review Albemarle’s investment prospects.

Business Overview

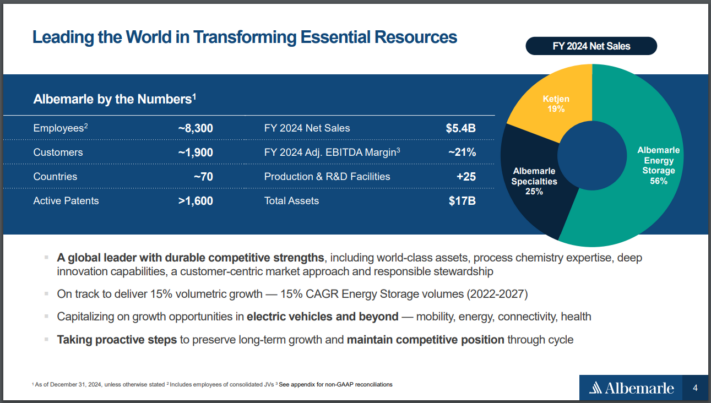

Albemarle is the largest producer of lithium and second-largest producer of bromine in the world. The two products account for the vast majority of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium. The company operates in nearly 100 countries.

Beginning January 1st, 2023, the company reorganized into the following segments: Energy Storage, Specialties, and Ketjen.

Albemarle produces annual sales above $5 billion.

Source: Investor Presentation

On February 12th, 2025, Albemarle announced fourth-quarter and full-year 2024 results. For the quarter, revenue declined 48% to $1.23 billion, which was $110 million less than expected. Adjusted earnings-per-share of -$1.09 compared very unfavorably to $1.85 in the prior year, which was $0.42 below estimates.

For the year, revenue declined 44% to $5.4 billion, while adjusted earnings-per-share were—$2.34 compared to $22.25 in 2023. It should be noted that the company had nearly $10 billion in sales in 2023, helping to illustrate that wide swings in the business can occur rapidly.

Lower lithium prices once again negatively impacted results. For the quarter, revenue for Energy Storage decreased 63.2% to $616.8 million. Volume declined 10%, while prices were down 53%.

Specialties revenues were lower by 2.0% to $332.9 million, as a 3% improvement in volume was offset by a price decrease. Ketjen sales of $245 million were down 17.4% from the prior year, as a slight price increase was more than offset by weakening volume.

Albemarle provided an outlook for 2025 as well, with the company expecting revenue in a range of $4.9 billion to $5.2 billion. The company is expected to produce earnings-per-share of -$0.80 in 2025. We believe that Albemarle has earnings power of $3.50.

Growth Prospects

Results are expected to be well above prior numbers, and Albemarle stands to benefit from the increased sales of electric vehicles, as the company’s lithium is used to provide the batteries.

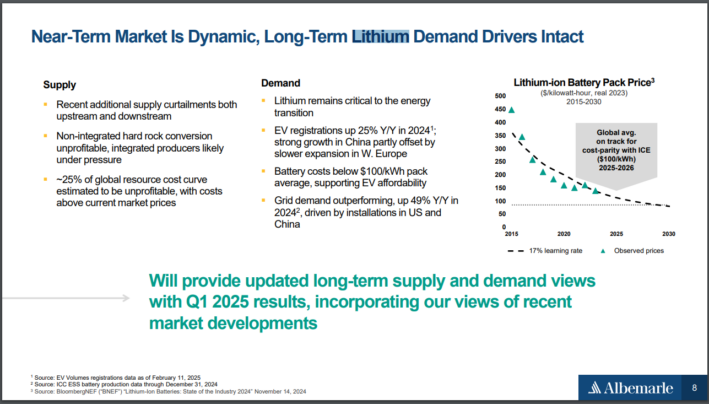

Lithium is expected to be a growth segment over the next five years due to increasing demand for a wide range of applications, including electric vehicles and consumer electronics.

Source: Investor Presentation

Demand for energy storage tends to fluctuate, but the future looks promising for electric vehicles as more consumers consider making that purchase. By 2035, electric vehicles are projected to account for 26% of all cars on the road in the U.S. Battery size is also expected to grow.

With this growth will come a significant increase in demand for lithium.

Due to its leadership positions in lithium and bromine, we believe the company can grow earnings per share at a rate of 7.5% annually for the next five years.

Competitive Advantages & Recession Performance

Despite being among global leaders in multiple businesses, Albemarle isn’t content to rest on its previous success. The company has been active in acquiring businesses that strengthen its market share.

Albemarle is not a recession-proof company. Listed below are the company’s earnings-per-share during and after the last recession:

- 2007 earnings-per-share of $2.41

- 2008 earnings-per-share of $2.40 (0.4% decrease)

- 2009 earnings-per-share of $1.94 (19% increase)

- 2010 earnings-per-share of $3.51 (45% increase)

The specialty chemical business is heavily reliant on customer demand. Lower demand results in lower pricing, which negatively impacts Albemarle’s performance. The company is likely to face a similar type of slowdown during the next recession.

That said, the company has durable competitive advantages. A key competitive advantage is that it ranks as the largest producer of lithium in the world. The metal is used in batteries for electric cars, pharmaceuticals, airplanes, mining, and other applications.

Albemarle is also a top producer of Bromine, which is used in the electronics, construction, and automotive industries. The company possesses a size and scale that others cannot match.

Investors interested in investing in Albemarle should understand that ownership of the stock comes with risks due to the nature of its industry.

Valuation & Expected Returns

Using our expected earnings power figure of $3.50 for the year, ALB shares have a price-to-earnings ratio of 20.9. Over the last decade, Albemarle has traded with an average price-to-earnings ratio of 21.3.

Our multiple target is 18x earnings, which we feel takes into account the demand for the company’s materials and the high volatility of lithium prices. If the stock were to trade with this target by 2030, then valuation would be a 2.9% headwind to annual returns over this time period.

In addition, the dividend yield of 2.2% will add to shareholder returns. The dividend payout is well-covered, as the projected payout ratio for the year is just 46% of our earnings power estimate.

Given the nature of its business, the company has been successful at prudently managing its dividend. Albemarle has raised its dividend for 29 consecutive years.

Therefore, we project that Albemarle will provide a total annual return of 6.6% over the next five years, stemming from 7.5% earnings growth and a starting yield of 2.2% that are offset by a low single-digit headwind from multiple contraction.

Final Thoughts

Reaching Dividend Aristocrat status is no small feat. Albemarle is the dominant player in the lithium industry. The company benefits from low-cost mines and its leadership position in multiple categories.

Albemarle is far from recession-proof and has experienced some significant earnings declines over the last decade, but this makes the company’s dividend growth track record even more impressive.

While the company’s business can be unpredictable, we rate Albemarle’s shares as a hold.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: