Updated on January 27th, 2024

Investors looking for high-quality dividend growth stocks should take a closer look at the Dividend Aristocrats, a group of 68 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

With this in mind, we created a list of all the Dividend Aristocrats.

You can download the full spreadsheet of all 68 Dividend Aristocrats, along with several important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

We review each of the Dividend Aristocrats annually, and the next stock in this year’s edition is consumer products giant Kimberly-Clark (KMB).

Kimberly-Clark has raised its dividend for 52 consecutive years. It is also a member of the even more exclusive Dividend Kings list.

The stock also currently has a 4% dividend yield, which is more than double the ~1.6% average dividend yield of the S&P 500 Index.

This article will discuss Kimberly-Clark’s business model, growth potential, and whether the stock is currently trading at an attractive valuation.

Business Overview

Kimberly-Clark traces its beginnings back to 1872. Four young businessmen, John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck, came up with $30,000 of start-up capital to form Kimberly, Clark and Co.

Today, Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating over $20 billion in annual revenue.

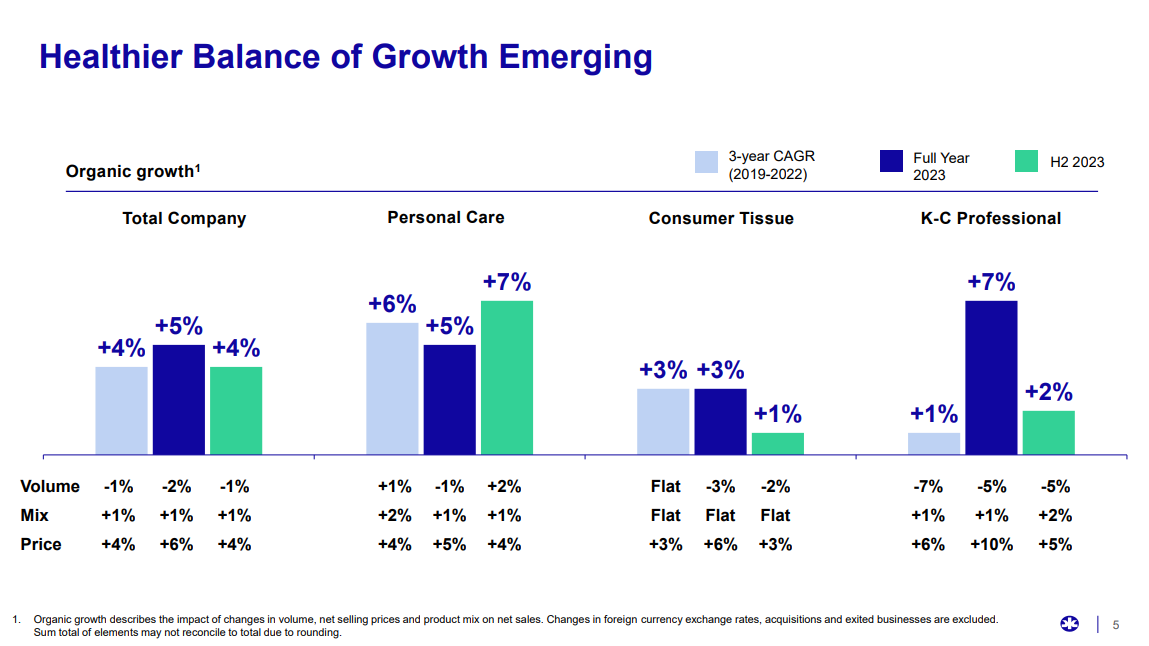

Source: Investor Presentation

Kimberly-Clark posted fourth quarter and full-year earnings on January 24th, 2024. Adjusted earnings-per-share came to $1.51, which was three cents light of estimates. Revenue was flat year-over-year at $4.97 billion. Organic sales were up 3% during the quarter, attributable to a 2% gain in pricing and a 1% tailwind from favorable product mix.

Growth Prospects

Kimberly-Clark has committed to elevating its core brands as one of the three pillars of growth in the coming years. It will do this by launching different product innovations via extensions of existing lines and entirely new products. The company will also continue to manage its revenue via pricing and mix as well as promotional strategies.

The second growth pillar is accelerating growth in its developing and emerging (D&E) markets, which comprise a significant portion of the company’s sales.

KMB will focus on its personal care and professional segments in particular, with its most significant opportunities coming from places where it has low category penetration and frequency of usage.

Kimberly-Clark also continues to pursue cost savings. Kimberly-Clark’s management team has continuously extended this initiative, aiming for another $1.5 billion of cumulative savings over a three-year period.

We expect 5% annual earnings growth in the years to come, as we expect volumes to remain largely steady.

Competitive Advantages & Recession Performance

Kimberly-Clark’s most important competitive advantages are its brands and global scale. The company enjoys a leadership position across its brand portfolio and, indeed, across the world.

It retains its competitive advantages through marketing and innovation. This allows the company to stay ahead of the competition. Given its commitment to its growth pillars, we expect this will only increase over time.

In addition, Kimberly-Clark’s global reach provides the company with the efficiency to keep costs low. The ongoing cost reduction program is an example of its ability to effectively manage costs, even as revenue grows.

Kimberly-Clark remains highly profitable, even during recessions. For example, it performed well through the Great Recession of 2007-2009. Its earnings-per-share through the Great Recession are shown below:

- 2007 earnings-per-share of $4.25

- 2008 earnings-per-share of $4.06 (4.5% decline)

- 2009 earnings-per-share of $4.52 (11% increase)

- 2010 earnings-per-share of $4.45 (1.5% decline)

As you can see, while Kimberly-Clark did see earnings decline in 2008 and 2010, it also registered a double-digit growth rate in 2009. The reason for its strong performance over the course of the recession is that the company sells products that consumers need regardless of economic conditions.

Consumers will always need personal care products, regardless of the condition of the economy. This gives Kimberly-Clark a certain level of product demand each year, even during recessions.

Valuation & Expected Returns

Based on adjusted earnings-per-share of $6.85 for 2024, Kimberly-Clark trades for a price-to-earnings ratio of 17.7.

Excluding outlier years, Kimberly-Clark has traded at an average price-to-earnings ratio of ~18 over the last decade. This is also our estimate of fair value for the stock. Therefore, shares appear to be slightly undervalued right now.

If the stock valuation expands from 17.7 to 18 over the next five years, it will boost annual returns by 0.3% per year.

In addition, future returns will be generated from earnings growth and dividends. Given the company’s strong brands and growth catalysts, average annual earnings growth of 5% is a reasonable expectation. The stock also has a 4.0% dividend yield.

In total, we see annual returns of 9.3% over the next five years. This is a solid expected rate of return, but is just below our buy threshold of 10%.

Final Thoughts

Kimberly-Clark is a high-quality company with a diverse portfolio of strong brands. It has positive growth prospects moving forward, and it is an extremely reliable dividend stock. Emerging markets, cost reductions, and share repurchases will highlight future earnings growth.

Kimberly-Clark has increased its dividend for over 50 years in a row and currently has a dividend yield of 4%. It, therefore, meets our definition of a blue-chip stock, and it should continue to deliver steady dividend increases each year.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: