Updated on April 26th, 2024 by Bob Ciura

We believe the Dividend Aristocrats are the “cream of the crop” of the U.S. stock market. The Dividend Aristocrats are a group of S&P 500 stocks that have increased their dividends for at least 25 years, among other requirements.

With this in mind, we created a list of all 68 Dividend Aristocrats, along with important financial metrics such as dividend yields and price-to-earnings ratios.

You can download your free list of all 68 Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

We review all the Dividend Aristocrats each year. Next up, we will review the food and beverage giant PepsiCo (PEP).

The stock offers a solid 2.9% dividend yield and has increased its dividend for over 50 years in a row. The company’s dividend is very safe, and the stock is suitable for risk-averse income investors.

PepsiCo’s valuation is not exactly a bargain right now, but it is rarely a cheap stock due to its excellent business model and steady growth. The company should have little trouble continuing to raise its dividend for many years.

Business Overview

Pepsi-Cola was created in the late 1890s by Caleb Bradham, a North Carolina pharmacist. Meanwhile, Frito-Lay, Inc. was formed in 1961 from the merger of Frito Company and the H. W. Lay Company. In its current form, PepsiCo came together as a result of the 1965 merger of Pepsi-Cola and Frito-Lay.

Today, PepsiCo is a global food and beverage giant. It has a market capitalization above $240 billion and generates approximately $80 billion of annual revenue.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

PepsiCo has a large portfolio and owns many popular brands. Some of the company’s major brands include Pepsi and Mountain Dew sodas and non-sparkling beverages like Pure Leaf, Tropicana, Gatorade, and bottled water.

In addition to PepsiCo’s core beverage brands, it also has a large snacks business under the Frito-Lay brand. The company has also built a portfolio of healthier foods, including Quaker, Naked, and Sabra.

On April 23rd, 2024, PepsiCo reported first-quarter results for the period ending March 31st, 2024. For the quarter, revenue increased 2.2% to $18.25 billion, which topped estimates by $140 million. Adjusted earnings-per-share of $1.61 compared favorably to $1.50 in the prior year and was $0.09 better than expected. Currency exchange reduced revenue by 0.5%.

Organic sales were up 2.7% for the first quarter, beating consensus estimates of 2.3%. Beverage volume was flat while and convenient foods volume declined 0.5%. PepsiCo Beverages North America’s revenue grew 1% organically as higher prices more than offset a 5% decrease in volume. Frito-Lay North America grew 2% even as volume declined 2%.

PepsiCo provided an updated outlook for 2024 as well, with the company now expecting adjusted earnings-per-share growth of at least 8% for the year, up from 7% previously. Organic sales are still projected to be up at least 4%.

Growth Prospects

PepsiCo has a long history of steady growth. Even in a challenging environment due to declining soda consumption, PepsiCo has continued its consistent growth.

We believe PepsiCo will generate 6% adjusted earnings-per-share growth per year over the next five years. Going forward, two of PepsiCo’s most promising catalysts are growth in healthier foods and beverages and emerging markets.

Large soda companies like PepsiCo have had to adapt to a more health-conscious consumer. To do this, PepsiCo has shifted its portfolio toward healthier foods that are resonating more strongly with changing consumer preferences.

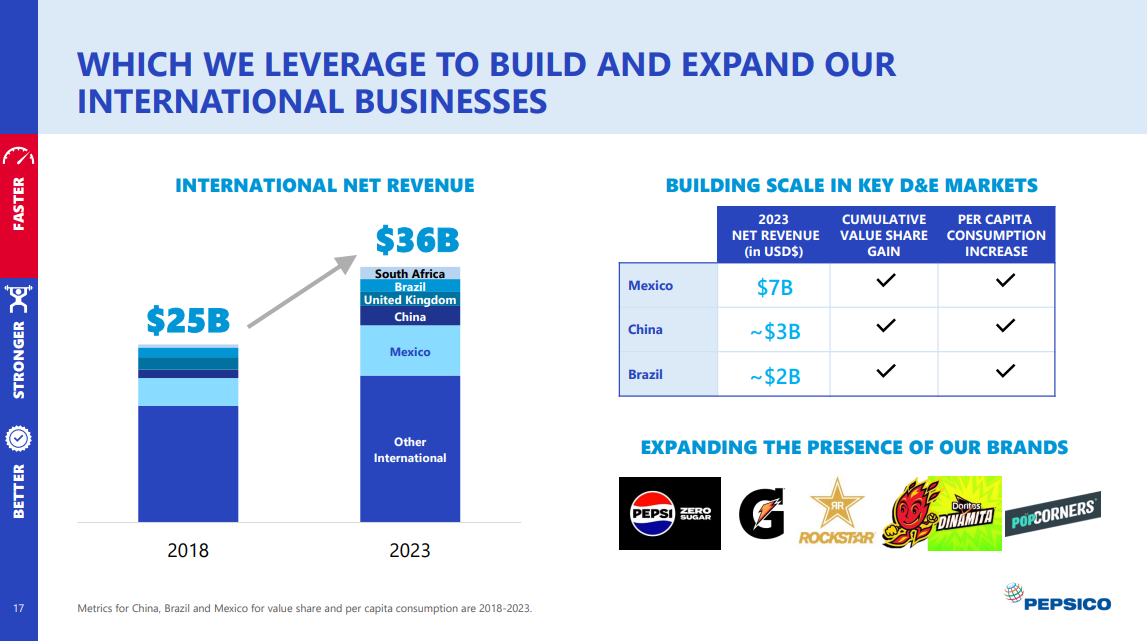

In addition, PepsiCo has a huge growth opportunity in emerging markets like China, Africa, India, and Latin America.

Source: Investor Presentation

These are under-developed regions of the world with large consumer populations and high economic growth rates.

International markets (an particularly emerging markets) were a growth driver once again in 2023, and in the 2024 first quarter.

Last quarter, revenue in Europe were up 10%, aided largely by a 7% increase beverage volume and a 2% improvement in food volume.

Revenue in Latin America increased 8%, Africa/Middle East/South Asia was up 7%, and the Asia Pacific/Australia/New Zealand/China region grew 11%.

Competitive Advantages & Recession Performance

PepsiCo has numerous competitive advantages. Among them are strong brands and a global scale. In all, PepsiCo has ~20 individual brands that each collect at least $1 billion in annual revenue. Strong brands give PepsiCo optimal shelf space at retailers, and give the company pricing power.

PepsiCo’s financial strength also allows the company to invest in research and development and advertising to retain its competitive advantages.

For example, PepsiCo invests billions each year in research and development to innovate new products and packaging designs. In addition, PepsiCo regularly spends more than $2 billion each year on advertising to maintain market share and build brand equity with consumers.

PepsiCo’s competitive advantages and strong brands make the company highly profitable, even during recessions. Food and beverages always retain a certain level of demand, which is why the company held up so well during the Great Recession.

PepsiCo’s earnings-per-share throughout the Great Recession of 2007-2009 are listed below:

- 2007 earnings-per-share of $3.34

- 2008 earnings-per-share of $3.21 (3.9% decline)

- 2009 earnings-per-share of $3.77 (17% increase)

- 2010 earnings-per-share of $3.91 (3.7% increase)

As you can see, PepsiCo’s earnings-per-share declined only modestly in 2008. The company proceeded to grow earnings by nearly 20% in 2009, which is very impressive. Earnings continued to grow once the recession ended.

The company reported strong growth in 2020 and 2021 when the coronavirus pandemic sent the U.S. economy into a recession. Therefore, PepsiCo is a recession-resistant business.

Valuation & Expected Returns

PepsiCo is expected to generate earnings-per-share of $8.23 for 2024. Based on this, the stock trades for a price-to-earnings ratio of 21.4. Our fair value estimate is a price-to-earnings ratio of 21.0. Therefore, PEP stock appears slightly overvalued. A declining price-to-earnings ratio could reduce annual returns by 0.4% each year over the next five years.

As a result, future returns will likely be comprised of earnings-per-share growth and dividends. We expect PepsiCo to grow earnings-per-share each year by 6%. In addition, PepsiCo also has a 2.9% current dividend yield.

Still, the overvaluation weighs on the stock’s expected returns. The combination of valuation changes, earnings growth, and dividends results in total expected returns of 8.5% per year over the next five years.

PepsiCo has a secure dividend, with a projected dividend payout ratio of about 66% for 2024. This gives PepsiCo enough room to continue increasing the dividend at a rate in-line with the growth rate of its adjusted EPS.

Few other companies in the consumer staples sector can match its dividend growth history. PepsiCo recently achieved Dividend King status in February 2022. As such, we continue to rate shares as a hold.

Final Thoughts

PepsiCo is a very strong business with a number of category-leading brands. Investing heavily in new products and acquisitions will likely continue growing sales and earnings for many years.

Shareholders should continue to benefit from PepsiCo’s strong business through annual dividend increases. The stock is overvalued, which means value investors should wait for a more attractive entry point before buying shares.

That said, PepsiCo remains a valuable holding for a dividend growth portfolio.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: