Updated on April 22nd, 2024 by Bob Ciura

The Dividend Aristocrats prove that when it comes to investing, boring isn’t always a bad thing. The Dividend Aristocrats are a group of 68 companies in the S&P 500 Index that have at least 25 consecutive years of dividend increases.

We are big fans of the Dividend Aristocrats and believe investors can generate superior returns from these high-quality dividend stocks.

For this reason, we created a full spreadsheet of all 68 Dividend Aristocrats–complete with important financial metrics that matter most to investors–which you can download by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

We review all 68 Dividend Aristocrats on a yearly basis. The next stock in the series is industrial manufacturer Pentair plc (PNR).

Pentair does not have an exciting business model. It most likely will not be featured as the next hot growth stock any time soon. Instead, it is a slow-and-steady dividend stock that has created substantial shareholder wealth over the past several decades.

Pentair has increased its dividend for 49 years in a row. The company’s dividend is also very safe. Pentair is a high-quality business, which provides investors with steady dividend growth.

Business Overview

Pentair is based in the U.K. but has large operations across Europe and in the U.S., among other international regions. The company was formed in 1966. In 1968, Pentair acquired Peavey Paper Mills, which gave it a top position in paper products. Paper fueled the company’s growth over the next decade, until management decided to diversify into other product categories.

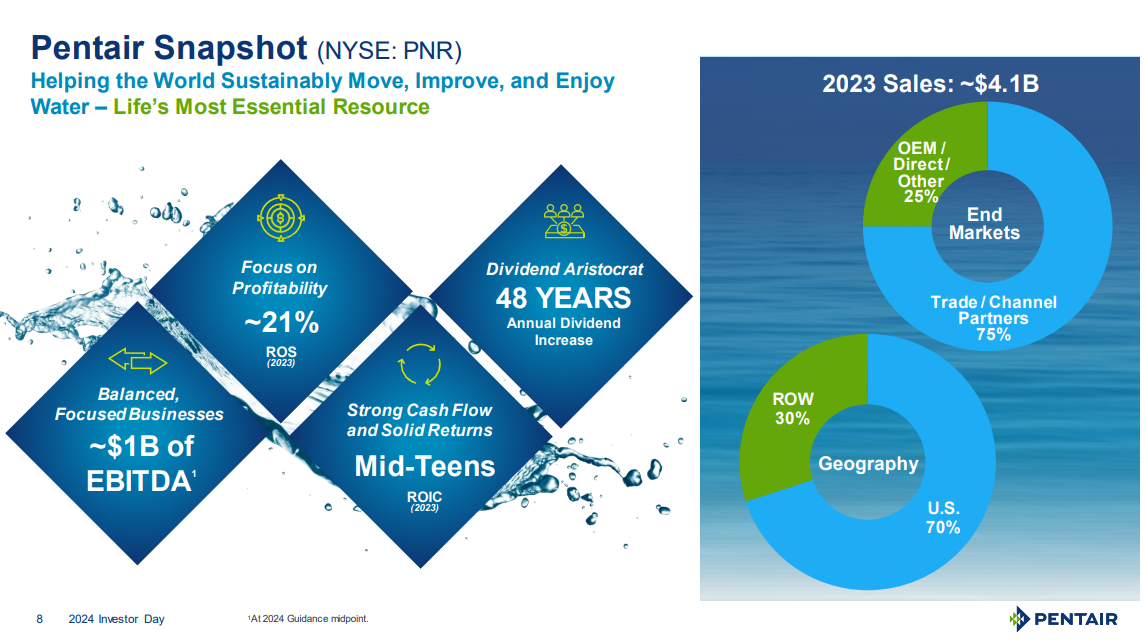

The company recently spun off its Technical Solutions business and now operates as a pure-play water solutions company. The pure-play water company now generates just over $4.1 billion in revenue and focuses on improving the availability and quality of water.

Source: Investor Presentation

After the 2018 spin-off of nVent Electric (NVT), Pentair now operates as a pure-play water solutions company that operates in 3 segments: Pool, Water Solutions, and Industrial & Flow Technologies.

Pentair reported its fourth quarter earnings results on January 30th. The company was able to generate revenues of $990 million during the quarter, which was 2% less than the company’s revenues during the previous year’s quarter, a result that still beat estimates easily.

Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were down 2% year over year as well, which was better than the core revenue growth rate during the previous quarter when core sales had declined by 7%.

Pentair recorded earnings-per-share of $0.87 for the fourth quarter, which was up 6% year-over-year. Pentair’s earnings-per-share beat the analyst consensus by $0.01. Pentair announced its guidance for the current year during the earnings report.

For fiscal 2024, Pentair is forecasting earnings-per-share of around $4.20, which indicates a substantial profit increase versus 2023, during which Pentair had earned $3.75 on a per-share basis. 2024 will be a year during which the company grows its revenues by around 3% according to management’s guidance.

Growth Prospects

Between 2008 and 2017 (before the nVent spin-off) Pentair grew its earnings-per-share by 5.5% annually. Adjusted for the impact of the last financial crisis – an unusually harsh recession which made Pentair’s earnings-per-share decline by slightly more than 30% between 2008 and 2009 – Pentair’s long-term earnings-per-share growth rate would have been even higher.

Pentair management believes that a long-term earnings-per-share growth rate of 10% is possible, but we are a bit more conservative. We believe it is better to expect a 6% earnings-per-share growth rate from Pentair over the coming years.

The company has many outlets for future growth.

Source: Investor Presentation

The company should be able to achieve this growth through rising revenues, which will be possible thanks to organic growth and acquisitions, and through tailwinds from margin expansion and share repurchases, which will lead to further declines in Pentair’s share count.

Pentair will benefit from a number of structural tailwinds, such as the aging water infrastructure in the U.S. Pentair continues to see very strong organic growth on a consolidated basis as Aquatic Systems performs well. Acquisitions will also help boost the company’s growth.

Competitive Advantages & Recession Performance

One of the competitive factors that has fueled Pentair’s impressive growth is its lean cost structure. This is no accident; Pentair has employed a strategy called Pentair Integrated Management System, or PIMS, which has enabled its high profit margins.

PIMS enables leaner manufacturing processes and drives efficiency throughout the company’s supply chain and distribution. Even though the effort is years old at this point, it continues to permeate the company’s strategy today. The impact is a culture and mindset with a relentless focus on cutting costs from its model.

The PIMS is an organization-wide system. It effects talent management by providing employees with the proper incentives and providing all employees with individual responsibility down to the operator level.

Within the PIMS system, the ‘Lean Enterprise’ system helps to increase profit margins. It drives margin expansion by increasing productivity at manufacturing sites and helps identify acquisition targets with the highest cost savings opportunities.

Its competitive advantages and high margins allowed the company to remain profitable during the Great Recession during 2007-2009:

- 2007 earnings-per-share of $2.08

- 2008 earnings-per-share of $2.20 (5.8% increase)

- 2009 earnings-per-share of $1.47 (33% decline)

- 2010 earnings-per-share of $2.00 (36% increase)

As a global industrial manufacturer, Pentair is not immune from recessions. However, it quickly bounced back. Pentair’s earnings-per-share reached a new high in 2011. Given that Pentair is now a pure-play water treatment company, we expect the next recession will have a milder impact on the company’s earnings.

Pentair is now focused on services that can be considered needs and not wants, so we believe the company’s recession resistance has improved in recent years.

Valuation & Expected Returns

Based on expected earnings-per-share of $4.20 for 2024, Pentair has a price-to-earnings ratio of 18.8. Our fair value estimate is a P/E of 17, which is below its 10-year average.

Given this, we see the stock as somewhat overvalued, and a decline in the price-to-earnings ratio could negatively impact shareholder returns by -2.0% annually through 2029. Additionally, EPS growth (estimated at 6% per year) and the 1.2% dividend yield will contribute to total returns.

In total, we see annual returns of 5.2% accruing to shareholders of Pentair, consisting of the 1.2% dividend yield, 6% earnings-per-share growth, as well as the -2.0% negative return from a contracting valuation multiple.

An expected return near 5.2% annually is satisfactory for a hold, but not high enough to warrant a buy rating.

Final Thoughts

Pentair has a strong business model, and competitive advantages. These qualities have fueled its steady dividend growth over the past four decades and we don’t see any reason to believe that won’t continue for many years to come.

However, Pentair shares are trading without a modest margin of safety given the elevated valuation multiple, culminating in estimated total annualized returns of 5.2%. The company should be able to continue increasing its dividend each year. As a result, we rate shares of Pentair a hold right now .

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

- The Complete List of Monthly Dividend Stocks: stocks that pay dividends each month, for 12 payments over the year.

- The Blue Chip Stocks List: this database contains stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: