Published on April 7th, 2023 by Felix Martinez

Pizza Pizza Royalty Corp. (PZRIF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 6.3% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render Pizza Pizza Royalty Corp. appealing to income-oriented investors. In addition, the company has a robust business model, with most of its revenues recurring. In this article, we will discuss the prospects of Pizza Pizza Royalty Corp.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Business Overview

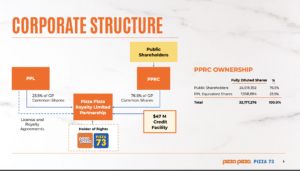

Pizza Pizza Royalty Corp is a Canadian company that operates in the restaurant industry, primarily through its two brands, Pizza Pizza and Pizza 73. Pizza Pizza Royalty Corp is a unique entity in the Canadian stock market, as it operates as a royalty-based income trust structure.

Pizza Pizza, founded in 1967, is a well-known and established pizza chain in Canada, with a strong presence in Ontario, where it originated. Pizza 73, founded in 1985, is a pizza delivery and takeout brand focusing on Western Canada, particularly Alberta and British Columbia.

As a royalty-based income trust, Pizza Pizza Royalty Corp does not operate the restaurants directly, but instead earns royalties from franchisees who operate Pizza Pizza and Pizza 73 locations. The company’s revenue is primarily generated from royalty payments based on a percentage of franchisee sales. This unique business model allows Pizza Pizza Royalty Corp to generate revenue without directly bearing the costs and risks associated with operating restaurants, such as labor, rent, and food costs.

Source: Investor Presentation

Pizza Pizza Royalty Corp’s revenue and profitability are directly tied to the performance of its franchisees. The company’s financial success depends on factors such as franchisee sales, the number of restaurants in operation, and overall consumer demand for pizza and fast-food offerings.

One of the notable features of Pizza Pizza Royalty Corp is its history of paying monthly dividends to its shareholders, which has made it an attractive investment for income-seeking investors. However, it’s important to note that dividend payments are not guaranteed and can be subject to change based on various factors, including the company’s financial performance and management decisions.

Growth Prospects

On March 7th, 2023, the company reported the fourth quarter and fiscal year results for 2022. The company sales increased by double-digits during the year while it also opened a record 45 new restaurants.

The company restaurants managed through inflationary pressures from both commodity and labor increases. The positive momentum throughout 2022 allowed for three dividend increases as walk-in and pickup sales increased significantly as pandemic restrictions were relaxed or removed.

The company is pleased to announce another dividend increase surpassing its pre-Covid dividend rate. The management team looks to continue the sales momentum by leveraging its marketing strengths while featuring its high-quality menu offerings. The announced dividend increase was 3.6% compared to the last dividend rate.

For the quarter, same-store sales increased 13.0% year-over-year (YOY). At the same time, adjusted earnings per share increased 11.1% YOY.

In terms of expansion, Pizza Pizza Royalty Corp has focused on growing its restaurant footprint primarily through franchising. The company has a history of selectively opening new locations and working with existing franchisees to renovate and upgrade existing restaurants to meet changing consumer demands and market trends.

However, it’s worth noting that the restaurant industry, like many other sectors, can be subject to challenges such as changing consumer preferences, competitive pressures, and economic fluctuations. Additionally, the franchise business model comes with risks related to the performance of individual franchisees, potential legal and regulatory changes, and other operational challenges.

Source: Investor Presentation

Dividend & Valuation Analysis

Pizza Pizza Royalty Corp. offers an exceptionally high dividend yield of 6.3%, four times the 1.6% yield of the S&P 500. The stock is thus an interesting candidate for income-oriented investors. However, U.S. investors should be aware that their dividend is affected by the prevailing exchange rate between the Canadian dollar and the USD.

The company’s policy is to distribute all available cash to maximize returns to shareholders over time after allowing for reasonable reserves. Despite seasonal variants inherent to the restaurant industry, the company’s policy is to make equal dividend payments to shareholders monthly to smooth out income to shareholders.

The company’s working capital reserve is $7.5 million, an increase of $0.5 million in the quarter due to the 93.8% payout ratio. With the increase in the monthly dividend in February, June, November of 2022, and March 2023, the company believes that there is sufficient cash flow to service the company’s obligations as they fall due while also increasing the monthly dividend above its pre-COVID levels.

The company has a very healthy balance sheet. The company has an interest coverage ratio of 27.1x, which is outstanding, and a Debt/Equity ratio of 0.2.

Regarding valuation, the company looks to be slightly overvalued because the current PE of 15.5x earnings is slightly higher than its ten years average PE of 14.6x. Based on 2023 earnings expectations of $0.67 per share, the company’s fair value price is $9.73 per share. Currently, the company is trading hands for $10.20 per share.

The current dividend yield of 6.3% is also lower than its five-year dividend yield average of 7.43%. Thus, based on the PE ratio and dividend yield average, the company looks to be slightly overvalued at the current price.

Source: Investor Presentation

Final Thoughts

In conclusion, Pizza Pizza Royalty Corp is a unique company in the Canadian restaurant industry, operating as a royalty-based income trust focusing on pizza brands. Its business model relies on generating revenue from royalty payments from franchisees, and it has a history of paying increasing monthly dividends to shareholders.

The company’s success is closely tied to the performance of its franchisees and overall consumer demand for pizza and fast-food offerings. As with any investment, conducting thorough research, reviewing financial statements, and consulting with a qualified financial professional is essential before making investment decisions related to Pizza Pizza Royalty Corp or any other company.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more