Updated on December 16th, 2024 by Bob Ciura

The goal of most investors is to either:

- Maximize returns given a fixed level of risk

- Minimize risk given a particularly level of desired returns

Perhaps the best metric for analyzing both risk and return is the Sharpe Ratio. With that in mind, we’ve compiled a list of the 100 stocks in the S&P 500 Index with the highest Sharpe Ratios.

You can download your free list (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Keep reading this article to learn more about using the Sharpe Ratio to analyze publicly-traded stocks.

Table Of Contents

The table of contents below provides for easy navigation of the article:

- What Is The Sharpe Ratio?

- How To Use The Sharpe Ratio Stocks List To Find Compelling Investment Ideas

- How To Manually Calculate Sharpe Ratios Using Yahoo! Finance

- The Top 10 Sharpe Ratio Stocks Today

- Final Thoughts

What Is The Sharpe Ratio?

The Sharpe ratio is the financial industry’s favorite measure of risk-adjusted returns. It tells investors whether they are being appropriately rewarded for the risks they’re assuming in their investments.

There are three components to the Sharpe Ratio calculation:

- Investment return

- Risk free rate of return

- Investment standard deviation

For most investors, a suitable Risk-free rate of return is the current yield on 10-year U.S. government bonds. For this article, we have used a risk free rate of 0, as interest rates have declined significantly.

For our purposes here, the Investment return can be either a historical return or an expected annual return. It is expressed using a decimal; for example, 0.51 would represent a 51% return.

Note: We use 252 instead of 365 – the number of days in a year – for a one-year period because there are approximately 252 trading days in an average calendar year, or we may employ 757 or a slight variant of that for a specific three-year period.

We employ the calculated Investment standard deviation, usually based on daily variations, to take into account periodic fluctuations in the investment due to such things as dividends and stock splits.

Determination of the Sharpe ratio can require a large number of repetitive calculations. This can be done easily and conveniently via a Microsoft Excel spreadsheet, as will be demonstrated later.

The Sharpe ratio is calculated with the following formula:

The risk free rate of return can be different depending on your use case. For risk-free rate of return = 0, the equation for the Sharpe ratio reduces to:

As you might imagine, numerous complex variants of this simplified formula have been developed and used for a variety of investment purposes.

Here, we are primarily interested in a maximum return with minimal associated risk. This can be indicated by values that are larger or smaller, or by figures that are either positive or negative.

Such numbers must be viewed with the benefit of considerable investor judgment; they are not meant to be taken absolutely.

How To Use The Sharpe Ratio Stocks List To Find Compelling Investment Ideas

Having an Excel document with the 100 highest Sharpe Ratios in the S&P 500 can be extremely useful.

The resource becomes even more powerful when combined with a rudimentary knowledge of how to use the filter function of Microsoft Excel to find investment ideas.

With that in mind, this section will show you step-by-step how to implement a particular investing screen using the Sharpe Ratio stocks list.

More specifically, we’ll show you how to screen for stocks with Sharpe Ratios above 1 and price-to-earnings ratios below 15.

Step 1: Download the Sharpe Ratio Stocks List by clicking here.

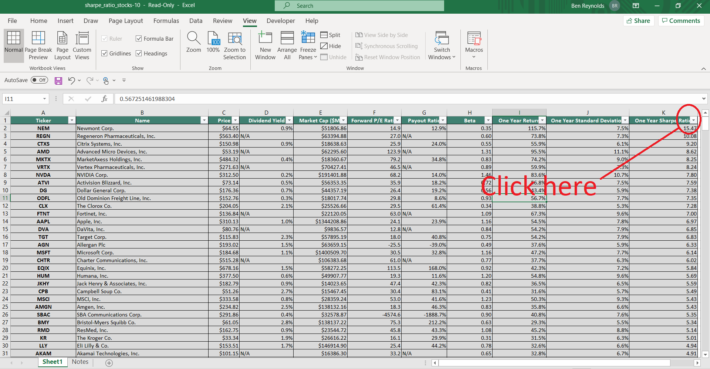

Step 2: Click the filter icon at the top of the Sharpe Ratio column, as shown below.

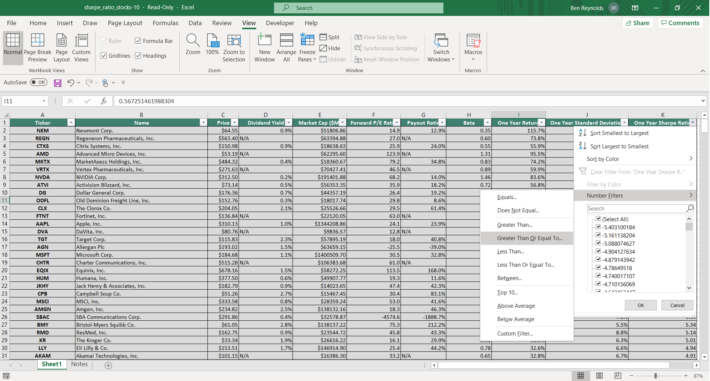

Step 3: Change the filter setting to “Greater Than Or Equal To”, input “1”, and click “OK”. This filters for S&P 500 stocks with Sharpe Ratios greater than or equal to 1.

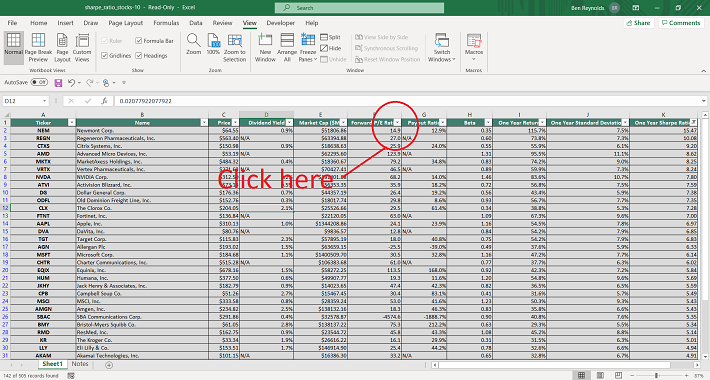

Step 4: Then, click the filter icon at the top of the P/E Ratio column, as shown below.

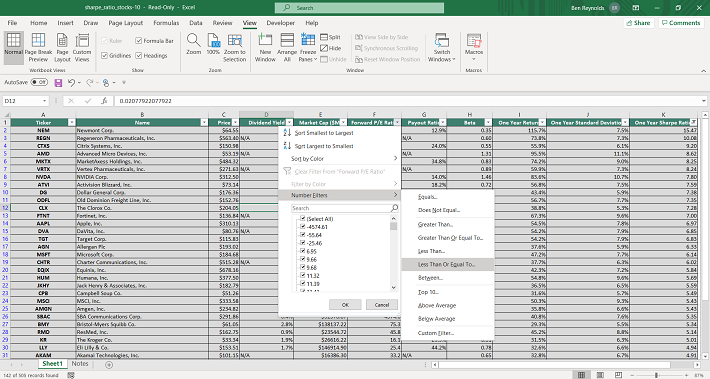

Step 5: Change the filter setting to “Less Than Or Equal To”, input “15”, and click “OK”. This filters for S&P 500 stocks with P/E ratios less than or equal to 15.

The remaining stocks in this Excel document are S&P 500 stocks with Sharpe Ratios higher than 1 and price-to-earnings ratios less than 15.

You now have a solid fundamental understanding of how to use the Sharpe Ratios list to find investment ideas.

The remainder of this article will provide more information on how to analyze stocks using the Sharpe Ratio.

How To Manually Calculate Sharpe Ratios Using Yahoo! Finance

At Sure Dividend, we use YCharts for much of our data analytics. YCharts requires a paid subscription that many of our readers do not have.

Accordingly, we want to show you how to manually calculate Sharpe Ratio for publicly-traded stocks over a given time period.

More specifically, this tutorial will show you how to calculate a 3-year Sharpe ratio for Apple, Inc (AAPL).

Step 1: Navigate to Yahoo! Finance. Type the ticker of your desired stock into the search bar at the top of the Yahoo! Finance bar. In our case, it’s AAPL for Apple Inc. (AAPL).

Step 2: Click on historical data, as shown below.

Step 3: Change the dates to get 3 years of data, and then click “Apply.” After that, click “Download” (which is just below the Apply button).

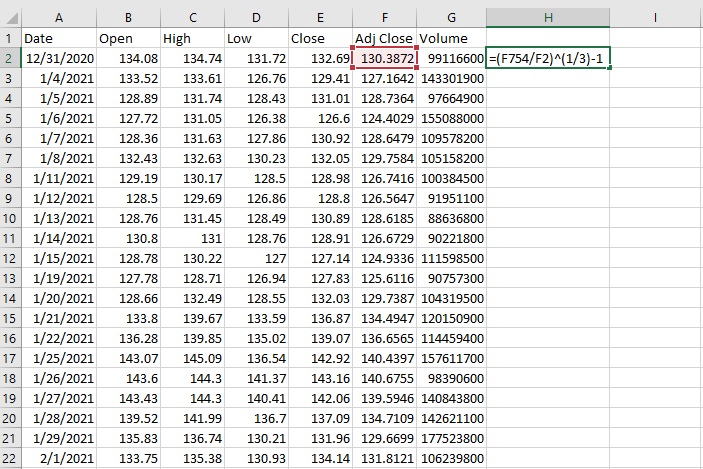

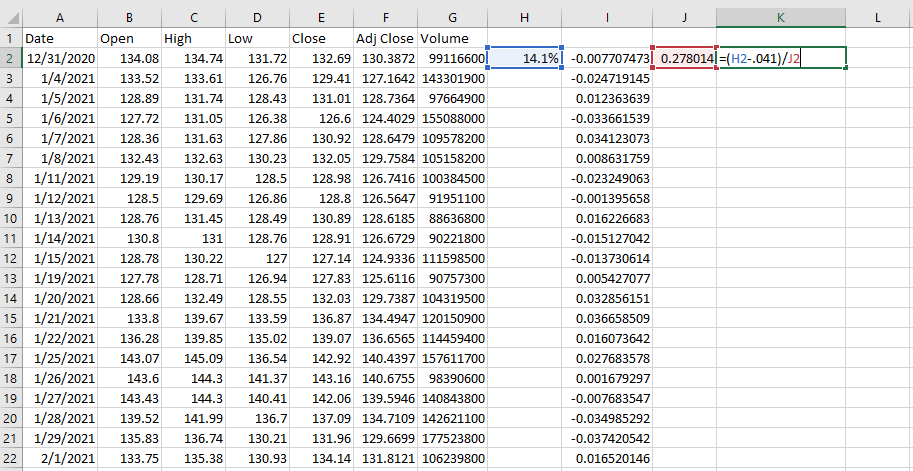

Step 4: The Excel document that will download as a result of your process so far will have six columns: Open, High, Low, Close, Adjusted Close (or “Adj Close” in the top row of the spreadsheet), and Volume. It’s Adjusted Close that we’re interested in, as this accounts for stock splits and dividend payments.

Using the adjusted close column, calculate the stock’s annualized returns during the time period under investigation.

In the example shown below, this is done by dividing the current price by the oldest price and then raising this to the inverse power of the number of years during the sample (3 in this case). The equation is shown below.

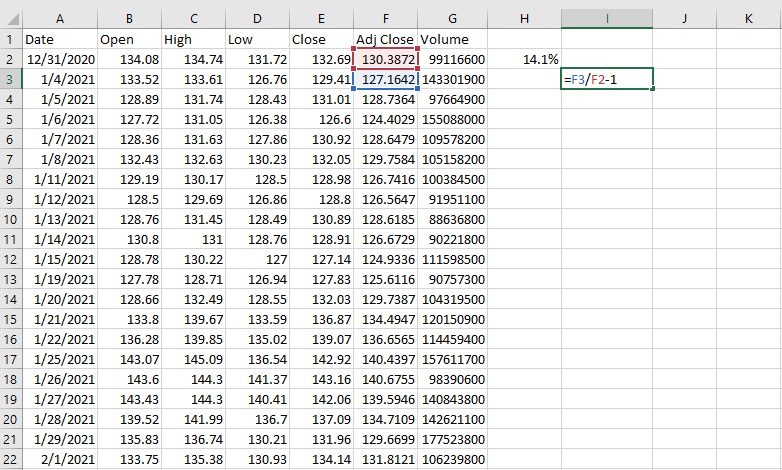

Step 5: Next, a time series of daily returns needs to be calculated. This is done in column I in the spreadsheet shown below. Do this by dividing “new day” adj. close price by “old day” adj. close price, as shown in the example below. Then drag or copy/paste the formula down to all cells.

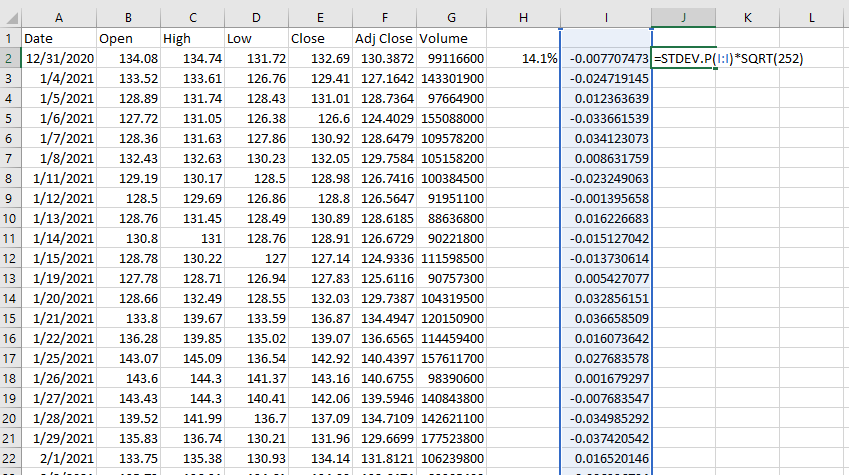

Step 6: Calculate the standard deviation of daily price returns using the STDEV.P() function, and then convert this number to an annualized figure by multiplying by the square root of 252. We use 252 instead of 365 (the number of days in a year) because there are approximately 252 trading days in an average calendar year. The formula to calculate the annualized standard deviation figure is shown below.

Step 7: Use the annualized return and annualized standard deviation data to calculate a Sharpe ratio. An example of how to do this is shown below, using 4.1% as the risk free rate of return (equal to the current 10-year U.S. Treasury yield).

The resulting number is the Sharpe ratio of the investment in question. In this case, Apple had a 3-year Sharpe ratio of 0.35 from when the example images were created.

The Top 10 Sharpe Ratio Stocks Today

The next section will list the top 10 Sharpe Ratio stocks now, according to 5-year annual expected returns.

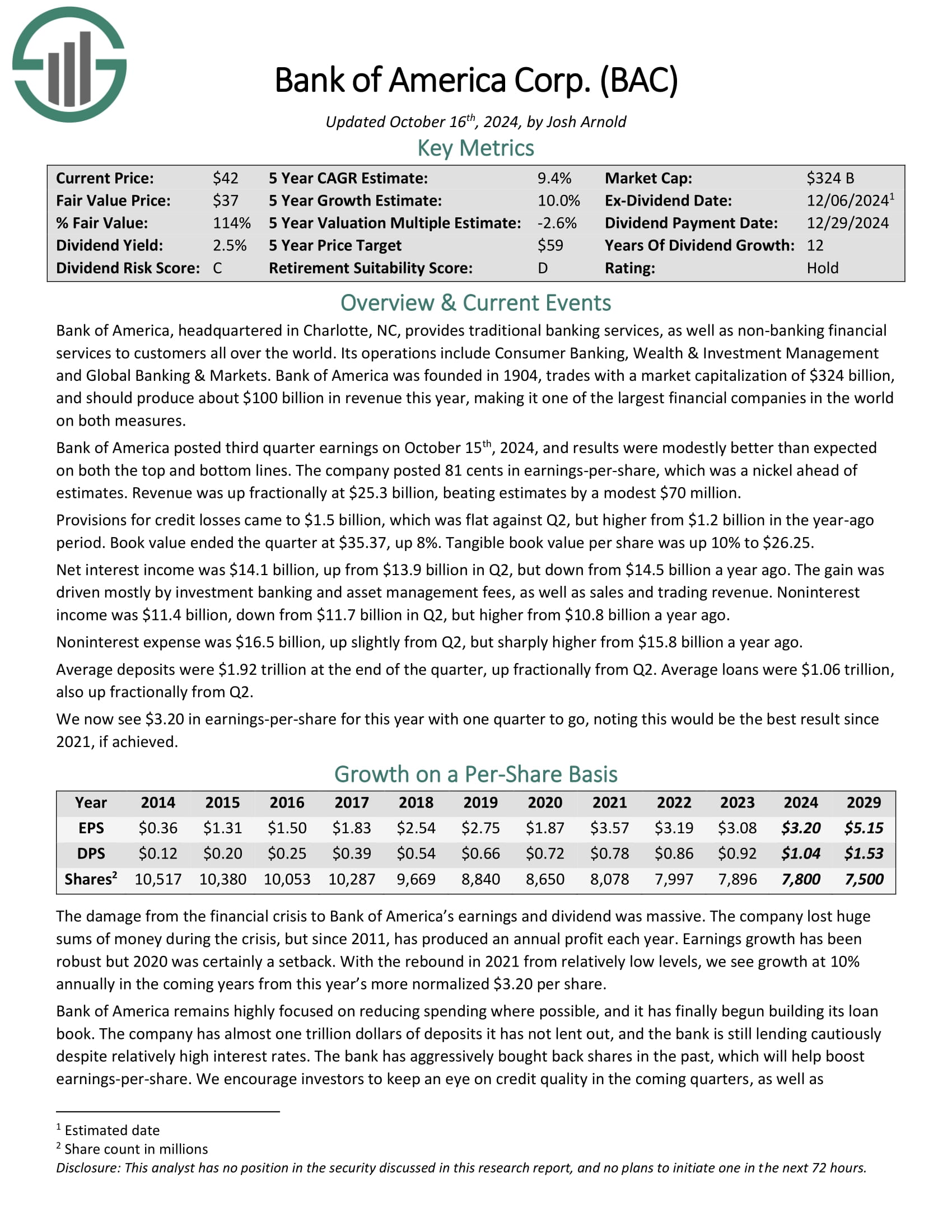

Sharpe Ratio Stock #10: Bank of America Corp. (BAC)

Bank of America, headquartered in Charlotte, NC, provides traditional banking services, as well as non–banking financial services to customers all over the world. Its operations include Consumer Banking, Wealth & Investment Management and Global Banking & Markets.

Bank of America posted third quarter earnings on October 15th, 2024, and results were modestly better than expected on both the top and bottom lines. The company posted 81 cents in earnings-per-share, which was a nickel ahead of estimates. Revenue was up fractionally at $25.3 billion, beating estimates by a modest $70 million.

Provisions for credit losses came to $1.5 billion, which was flat against Q2, but higher from $1.2 billion in the year-ago period. Book value ended the quarter at $35.37, up 8%. Tangible book value per share was up 10% to $26.25.

Click here to download our most recent Sure Analysis report on Bank of America (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #9: Allstate Corp. (ALL)

Allstate Corporation is an insurance company that offers property and casualty insurance. The company also sells life, accident, and health insurance products.

Its segments include Allstate Protection, Service Businesses, Allstate Life, Allstate Benefits, Allstate Annuities, etc. Allstate’s insurance brands include Allstate, Encompass, and Esurance.

Allstate reported third quarter 2024 results on October 30th, 2024. The company reported consolidated revenues of $16.6 billion for the quarter, a 14.7% year-over-year increase, largely due to higher Property-Liability earned premium.

Property-Liability insurance premiums earned totaled $13.7 billion, up 11.6% from $12.3 billion in the same period a year ago.

Adjusted net income per share of $3.91 was a significant improvement from $0.81 a year ago. Catastrophe losses amounted to $1.7 billion in the quarter, 44% higher than the same quarter last year.

Click here to download our most recent Sure Analysis report on ALL (preview of page 1 of 3 shown below):

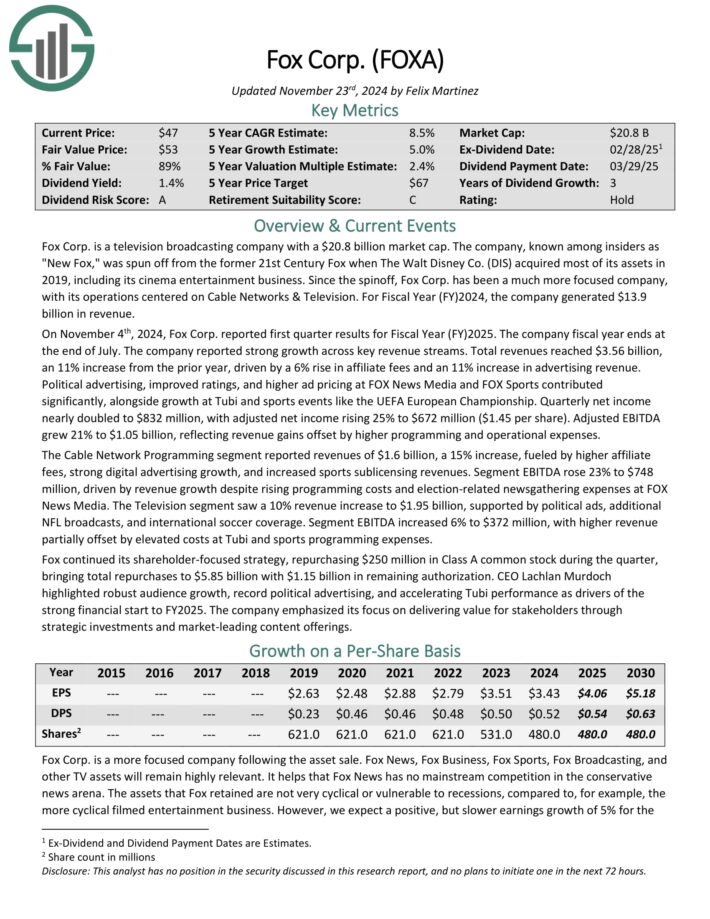

Sharpe Ratio Stock #8: Fox Corp. (FOXA)

Fox Corp. is a television broadcasting company. The company was spun off from the former 21st Century Fox when The Walt Disney Co. (DIS) acquired most of its assets in 2019, including its cinema entertainment business.

On November 4th, 2024, Fox Corp. reported first quarter results for Fiscal Year (FY) 2025. Total revenues reached $3.56 billion, an 11% increase from the prior year, driven by a 6% rise in affiliate fees and an 11% increase in advertising revenue.

Political advertising, improved ratings, and higher ad pricing at FOX News Media and FOX Sports contributed significantly, alongside growth at Tubi and sports events like the UEFA European Championship. Quarterly net income nearly doubled to $832 million, with adjusted net income rising 25% to $672 million ($1.45 per share).

Adjusted EBITDA grew 21% to $1.05 billion, reflecting revenue gains offset by higher programming and operational expenses. The Cable Network Programming segment reported revenues of $1.6 billion, a 15% increase, fueled by higher affiliate fees, strong digital advertising growth, and increased sports sublicensing revenues.

Click here to download our most recent Sure Analysis report on FOXA (preview of page 1 of 3 shown below):

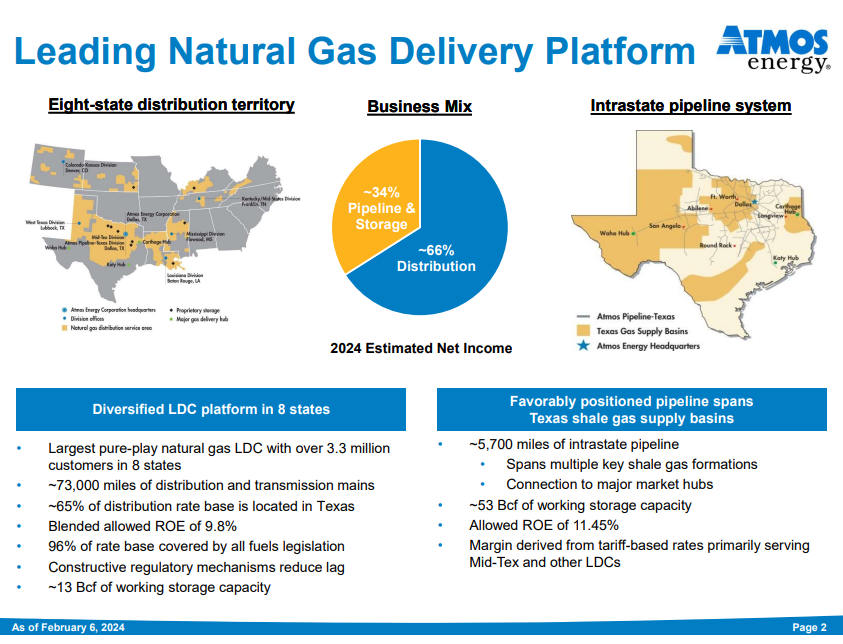

Sharpe Ratio Stock #7: Atmos Energy (ATO)

Atmos Energy can trace its beginnings all the way back to 1906 when it was formed in Texas. Since that time, it has grown both organically and through mergers.

The company distributes and stores natural gas in eight states, serves over 3 million customers, and should generate about $5 billion in revenue this year.

Source: Investor Presentation

Atmos has a 41-year history of raising dividends, putting it in rare company among dividend stocks.

Atmos posted fourth quarter and full-year earnings on November 6th, 2024, and results were largely in line with expectations. The company saw just over a billion dollars in net income for the year, and $134 million for the fourth quarter. On a per-share basis, earnings came to $6.83 and 86 cents, respectively.

For the quarter, distribution earnings came to $41 million, which was up from $38 million a year ago. Pipeline and storage earnings were $93 million, up from $81 million in last year’s Q4.

For the year, distribution earnings rose from $580 million to $671 million. Pipeline and storage full-year earnings were up sharply from $306 million to $372 million, helping to drive another year of record earnings for Atmos.

Click here to download our most recent Sure Analysis report on ATO (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #6: Corning Inc. (GLW)

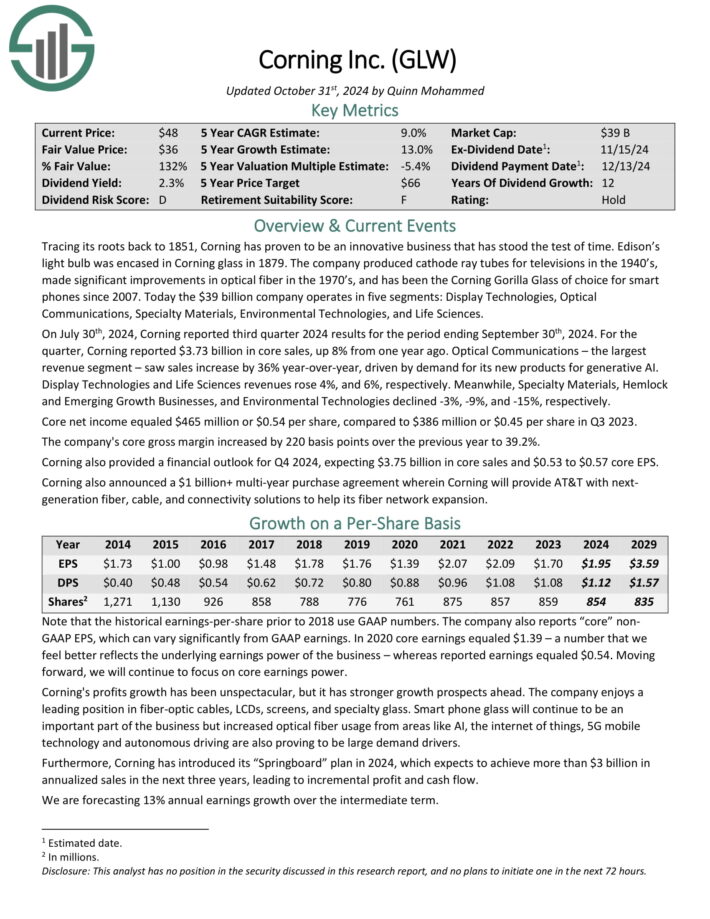

Corning operates in five segments: Display Technologies, Optical Communications, Specialty Materials, Environmental Technologies, and Life Sciences.

On October 30th, 2024, Corning reported third quarter 2024 results for the period ending September 30th, 2024. For the quarter, Corning reported $3.73 billion in core sales, up 8% from one year ago.

Optical Communications – the largest revenue segment – saw sales increase by 36% year-over-year, driven by demand for its new products for generative AI. Display Technologies and Life Sciences revenues rose 4%, and 6%, respectively.

Meanwhile, Specialty Materials, Hemlock and Emerging Growth Businesses, and Environmental Technologies declined -3%, -9%, and -15%, respectively.

Corning enjoys competitive advantages in its businesses due to its patented manufacturing process, cost advantages, elevated R&D spending, and leading relationships with the best technology firms on the planet.

Click here to download our most recent Sure Analysis report on GLW (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #5: The Hartford Financial Services Group (HIG)

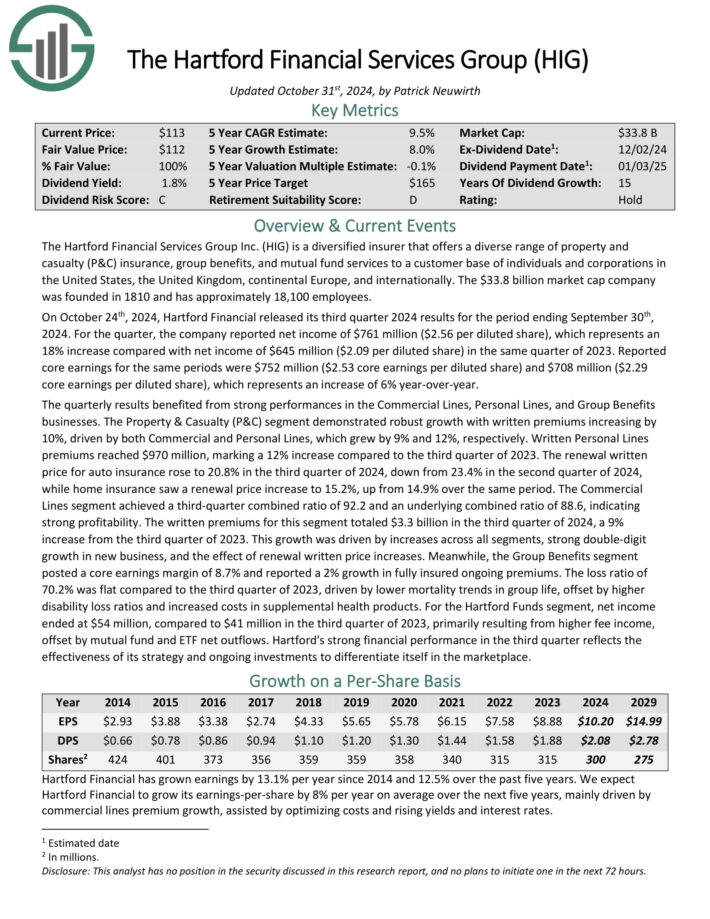

The Hartford Financial Services Group is a diversified insurer that offers a diverse range of property and casualty (P&C) insurance, group benefits, and mutual fund services to a customer base of individuals and corporations in the United States, the United Kingdom, continental Europe, and internationally.

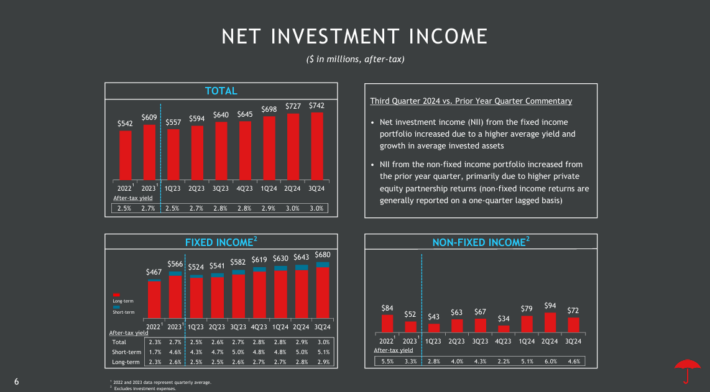

On October 24th, 2024, Hartford Financial released its third quarter 2024 results. For the quarter, the company reported net income of $761 million ($2.56 per diluted share), which represents an 18% increase compared with net income of $645 million ($2.09 per diluted share) in the same quarter of 2023.

Reported core earnings for the same periods were $752 million ($2.53 core earnings per diluted share) and $708 million ($2.29 core earnings per diluted share), which represents an increase of 6% year-over-year.

The quarterly results benefited from strong performances in the Commercial Lines, Personal Lines, and Group Benefits businesses. The Property & Casualty (P&C) segment demonstrated robust growth with written premiums increasing by 10%, driven by both Commercial and Personal Lines, which grew by 9% and 12%, respectively.

Click here to download our most recent Sure Analysis report on HIG (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #4: Automatic Data Processing Inc. (ADP)

Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers.

ADP posted first quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.33, which was 12 cents ahead of estimates.

Earnings were up from $2.08 in the year-ago period. Revenue was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.

Management noted revenue and margin performance exceeded expectations as the company benefited from new business bookings, strong revenue retention and higher client funds interest revenue.

Employer Services revenue was $3.26 billion, up 7% year-over-year while segment earnings grew 15% to $1.16 billion. That was good enough from pretax margin to rise from 33.1% of revenue to 35.7%.

PEO Services revenue was $1.57 billion, up 7% year-over-year, while segment earnings rose 1% to $226 million. Pretax margin was lower from 15.2% of revenue to 14.3%.

Click here to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #3: Bank of New York Mellon Corp. (BK)

Bank of New York Mellon has grown to more than $17 billion in annual revenue and a market capitalization of $54 billion. The bank is present in 35 countries around the world and acts as more of an investment manager than a traditional bank.

BNY posted third quarter earnings on October 11th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.52, which was 10 cents ahead of expectations. Revenue was up 5.2% year-over-year to $4.65 billion, which was $90 million ahead of estimates.

Provisions for credit losses came to just $23 million. Net interest income of $1.05 billion was ~$40 million higher than expected, and up from $1.03 billion in Q2. Fee revenue, which is the bulk of the bank’s total revenue, was $3.40 billion, flat to Q2.

Click here to download our most recent Sure Analysis report on BK (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #2: Citigroup Inc. (C)

Citigroup was founded in 1812, when it was known as the City Bank of New York. In the past 200+ years, the bank has grown into a global juggernaut in credit cards, commercial banking, trading, and a variety of other financial activities.

It has thousands of branches, produces about $80 billion in annual revenue.

Citigroup posted third quarter earnings on October 15th, 2024, and results were better than expected on both the top and bottom lines. Earnings-per-share came to $1.51, which was twenty cents ahead of estimates. Revenue was up fractionally year-over-year to $20.32 billion, but beat estimates by $500 million.

Revenue was up 3% on an organic basis, with the difference being the sale of the Taiwan consumer banking business. The gain in revenue was driven by growth across all of its segments.

Click here to download our most recent Sure Analysis report on Citigroup (preview of page 1 of 3 shown below):

Sharpe Ratio Stock #1: The Travelers Companies Inc. (TRV)

Travelers is an insurance stock and generates about $42 billion in annual revenue. The company offers a wide variety of protection products for auto, home, and business customers.

Travelers posted third quarter earnings on October 17th, 2024, and results were better than expected. Adjusted earnings-per-share came to $5.24, which was a staggering $1.65 ahead of estimates.

Source: Investor Presentation

Earnings soared from $2.51 in Q2, and just $1.95 from a year ago.

Revenue, as measured by earned premiums, rose 10.1% year-over-year to $10.7 billion, and beat expectations by $130 million. Total revenue was $11.9 billion, up from $10.6 billion a year ago, and $11.3 billion in Q2.

Click here to download our most recent Sure Analysis report on Travelers (preview of page 1 of 3 shown below):

Final Thoughts

Looking for stocks with strong historical Sharpe ratios is a useful way to find investment ideas.

With that said, this strategy is not the only way to find high-quality investments. To conclude this article, we’ll provide additional resources that you can use for your investment due diligence.

If you are looking for high-quality dividend growth stocks suitable for long-term investment, the following databases will be useful:

- The Dividend Aristocrats List: dividend stocks with 25+ years of consecutive dividend increases

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

You may also be looking for appealing stocks from a certain stock market sector to ensure appropriate diversification within your portfolio. If that is the case, you will find the following resources useful:

- The Complete List Of Utility Stocks

- The Complete List Of Healthcare Stocks

- The Complete List Of Technology Stocks

- The Complete List Of Communication Services Stocks

- The Complete List Of Materials Stocks

- The Complete List Of Industrial Stocks

- The Complete List Of Consumer Discretionary Stocks

- The Complete List Of Consumer Staples Stocks

- The Complete List Of Energy Stocks

- The Complete List Of Financial Stocks

You may also wish to consider other investments within the major market indices. Our downloadable list of small-cap U.S. stocks can be accessed below: