Updated on August 22nd, 2025 by Bob Ciura

Monthly dividend stocks pay out dividends every month instead of quarterly or annually.

This research report analyzes the 10 cheapest monthly dividend stocks based on their forward valuation multiples. The stocks have been arranged in order based on the 5-year annualized return from an expanding P/E multiple.

There are just 83 companies that currently offer a monthly dividend payment.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

Keep reading to see analysis on the cheapest monthly dividend stocks now.

Note: The ‘E’ in the P/E ratio depends on the company in question. We use whatever metric is most representative of earnings. For example, for many REITs, that would be funds-from-operations (FFO) instead of earnings.

Table of Contents

- Cheapest Monthly Dividend Stock #10: EPR Properties (EPR)

- Cheapest Monthly Dividend Stock #9: RioCan Real Estate Investment Trust (RIOCF)

- Cheapest Monthly Dividend Stock #8: Canadian Apartment Properties REIT (CDPYF)

- Cheapest Monthly Dividend Stock #7: Grupo Aval Acciones y Valores S.A. (AVAL)

- Cheapest Monthly Dividend Stock #6: Ellington Credit Co. (EARN)

- Cheapest Monthly Dividend Stock #5: Itau Unibanco Holding S.A. (ITUB)

- Cheapest Monthly Dividend Stock #4: Dynacor Group (DNGDF)

- Cheapest Monthly Dividend Stock #3: Dream Office REIT (DRETF)

- Cheapest Monthly Dividend Stock #2: Prospect Capital (PSEC)

- Cheapest Monthly Dividend Stock #1: Healthpeak Properties (DOC)

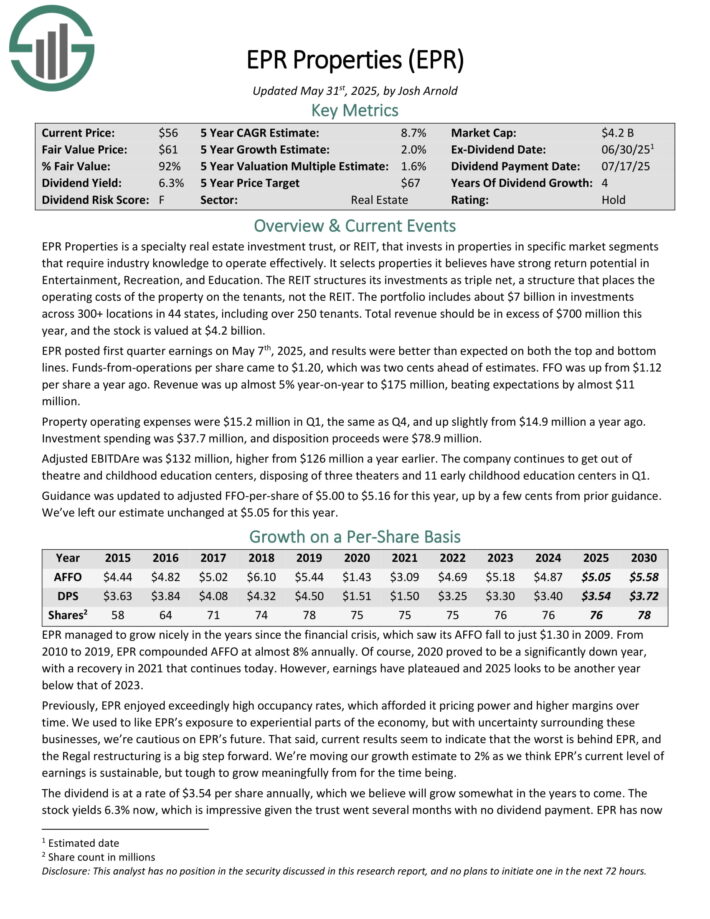

Cheapest Monthly Dividend Stock #10: EPR Properties (EPR)

- Annual Valuation Return: 2.5%

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively. It selects properties it believes have strong return potential in Entertainment, Recreation, and Education.

The REIT structures its investments as triple net, a structure that places the operating costs of the property on the tenants, not the REIT. The portfolio includes about $7 billion in investments across 300+ locations in 44 states, including over 250 tenants. Total revenue should be in excess of $700 million this year.

EPR posted first quarter earnings on May 7th, 2025, and results were better than expected on both the top and bottom lines. Funds-from-operations per share came to $1.20, which was two cents ahead of estimates. FFO was up from $1.12 per share a year ago. Revenue was up almost 5% year-on-year to $175 million, beating expectations by almost $11

million.

Property operating expenses were $15.2 million in Q1, the same as Q4, and up slightly from $14.9 million a year ago. Investment spending was $37.7 million, and disposition proceeds were $78.9 million. Adjusted EBITDAre was $132 million, higher from $126 million a year earlier.

The company continues to get out of theatre and childhood education centers, disposing of three theaters and 11 early childhood education centers in Q1. Guidance was updated to adjusted FFO-per-share of $5.00 to $5.16 for this year.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

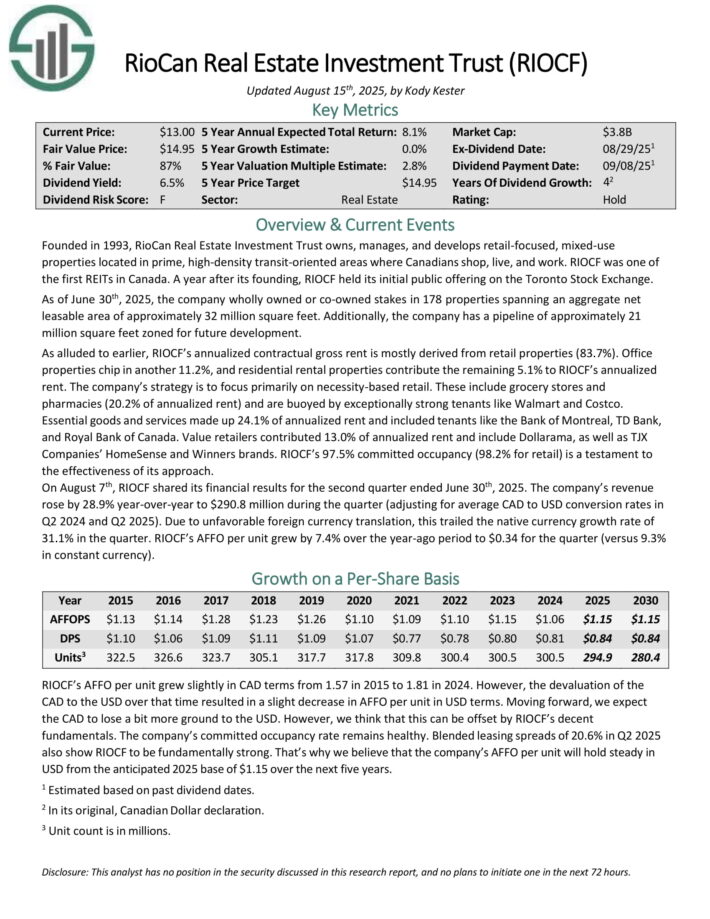

Cheapest Monthly Dividend Stock #9: RioCan Real Estate Investment Trust (RIOCF)

- Annual Valuation Return: 2.8%

RioCan Real Estate Investment Trust owns, manages, and develops retail-focused, mixed-use properties located in prime, high-density transit-oriented areas where Canadians shop, live, and work.

As of June 30th, 2025, the company wholly owned or co-owned stakes in 178 properties spanning an aggregate net leasable area of approximately 32 million square feet. Additionally, the company has a pipeline of approximately 21 million square feet zoned for future development.

RIOCF’s annualized contractual gross rent is mostly derived from retail properties (83.7%). Office properties chip in another 11.2%, and residential rental properties contribute the remaining 5.1% to RIOCF’s annualized rent.

The company’s strategy is to focus primarily on necessity-based retail. These include grocery stores and pharmacies (20.0% of annualized rent) and are buoyed by exceptionally strong tenants like Walmart and Costco.

Essential goods and services made up 24.0% of annualized rent and included tenants like the Bank of Montreal, TD Bank, and Royal Bank of Canada. Value retailers contributed 13.0% of annualized rent and include Dollarama, as well as TJX Companies’ HomeSense and Winners brands.

On August 7th, RIOCF shared its financial results for the second quarter ended June 30th, 2025. The company’s revenue rose by 28.9% year-over-year to $290.8 million during the quarter (adjusting for average CAD to USD conversion rates in Q2 2024 and Q2 2025).

Due to unfavorable foreign currency translation, this trailed the native currency growth rate of 31.1% in the quarter. RIOCF’s AFFO per unit grew by 7.4% over the year-ago period to $0.34 for the quarter (versus 9.3% in constant currency).

Click here to download our most recent Sure Analysis report on RIOCF (preview of page 1 of 3 shown below):

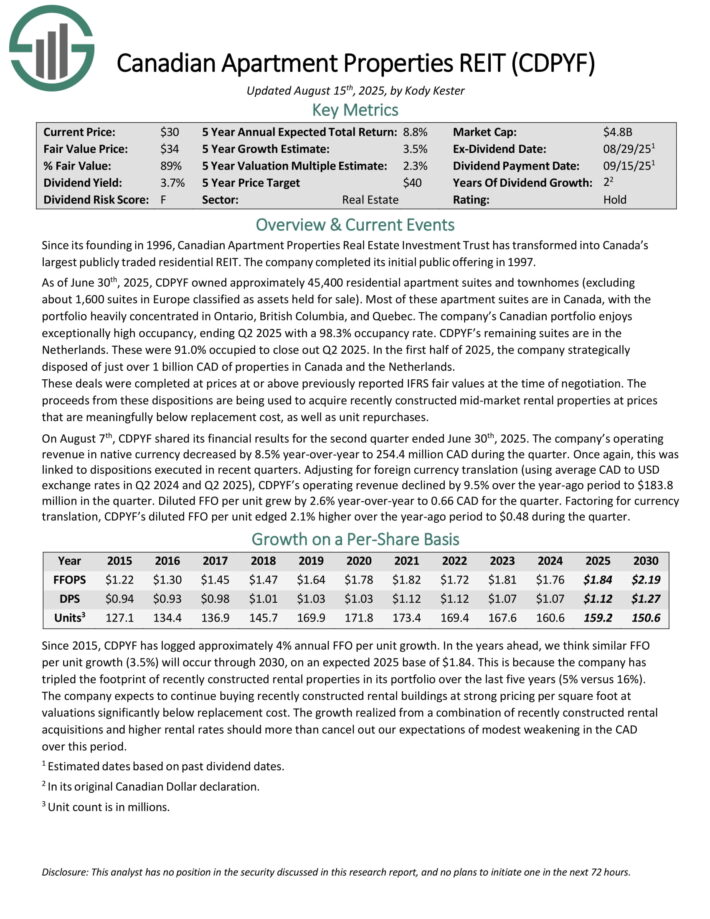

Cheapest Monthly Dividend Stock #8: Canadian Apartment Properties REIT (CDPYF)

- Annual Valuation Return: 2.8%

Since its founding in 1996, Canadian Apartment Properties Real Estate Investment Trust has transformed into Canada’s largest publicly traded residential REIT. The company completed its initial public offering in 1997.

As of June 30th, 2025, CDPYF owned approximately 45,400 residential apartment suites and townhomes (excluding about 1,600 suites in Europe classified as assets held for sale). Most of these apartment suites are in Canada, with the portfolio heavily concentrated in Ontario, British Columbia, and Quebec.

The company’s Canadian portfolio enjoys exceptionally high occupancy, ending Q2 2025 with a 98.3% occupancy rate. CDPYF’s remaining suites are in the Netherlands. These were 91.0% occupied to close out Q2 2025.

In the first half of 2025, the company strategically disposed of just over 1 billion CAD of properties in Canada and the Netherlands. These deals were completed at prices at or above previously reported IFRS fair values at the time of negotiation.

The proceeds from these dispositions are being used to acquire recently constructed mid-market rental properties at prices that are meaningfully below replacement cost, as well as unit repurchases.

On August 7th, CDPYF shared its financial results for the second quarter ended June 30th, 2025. The company’s operating revenue in native currency decreased by 8.5% year-over-year to 254.4 million CAD during the quarter. Once again, this was linked to dispositions executed in recent quarters.

Adjusting for foreign currency translation (using average CAD to USD exchange rates in Q2 2024 and Q2 2025), CDPYF’s operating revenue declined by 9.5% over the year-ago period to $183.8 million in the quarter. Diluted FFO per unit grew by 2.6% year-over-year to 0.66 CAD for the quarter.

Factoring for currency translation, CDPYF’s diluted FFO per unit edged 2.1% higher over the year-ago period to $0.48 during the quarter.

Click here to download our most recent Sure Analysis report on CDPYF (preview of page 1 of 3 shown below):

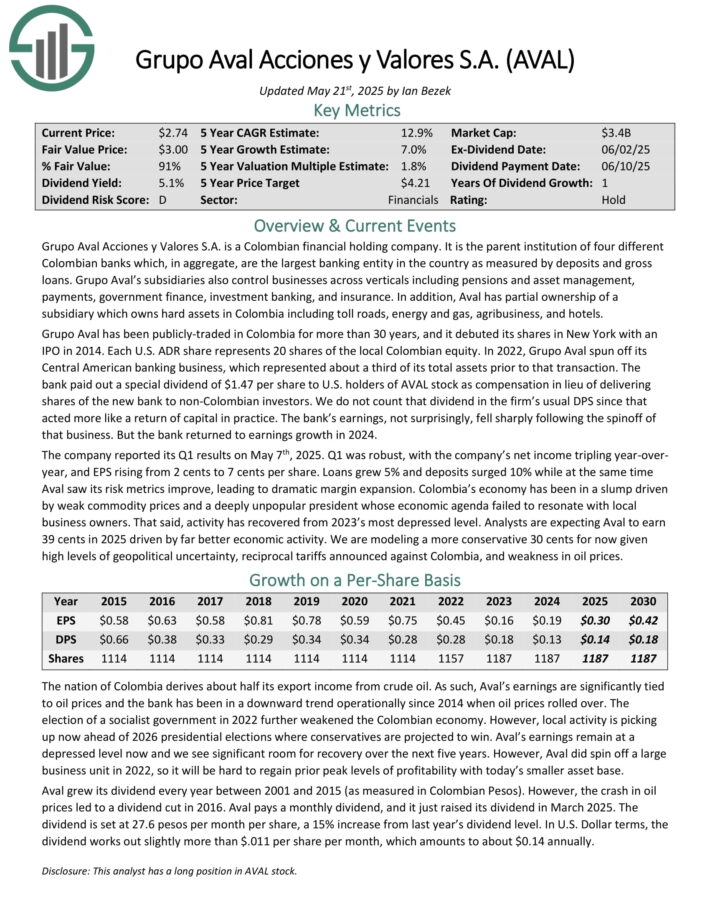

Cheapest Monthly Dividend Stock #7: Grupo Aval Acciones y Valores S.A. (AVAL)

- Annual Valuation Return: 3.0%

Grupo Aval Acciones y Valores S.A. is a Colombian financial holding company. It is the parent institution of four different Colombian banks which, in aggregate, are the largest banking entity in the country as measured by deposits and gross loans.

Grupo Aval’s subsidiaries also control businesses across verticals including pensions and asset management, payments, government finance, investment banking, and insurance.

In addition, Aval has partial ownership of a subsidiary which owns hard assets in Colombia including toll roads, energy and gas, agribusiness, and hotels.

The company reported its Q1 results on May 7th, 2025. Q1 was robust, with the company’s net income tripling year-over-year, and EPS rising from 2 cents to 7 cents per share.

Loans grew 5% and deposits surged 10% while at the same time Aval saw its risk metrics improve, leading to dramatic margin expansion. Analysts are expecting Aval to earn 39 cents in 2025 driven by far better economic activity.

Click here to download our most recent Sure Analysis report on AVAL (preview of page 1 of 3 shown below):

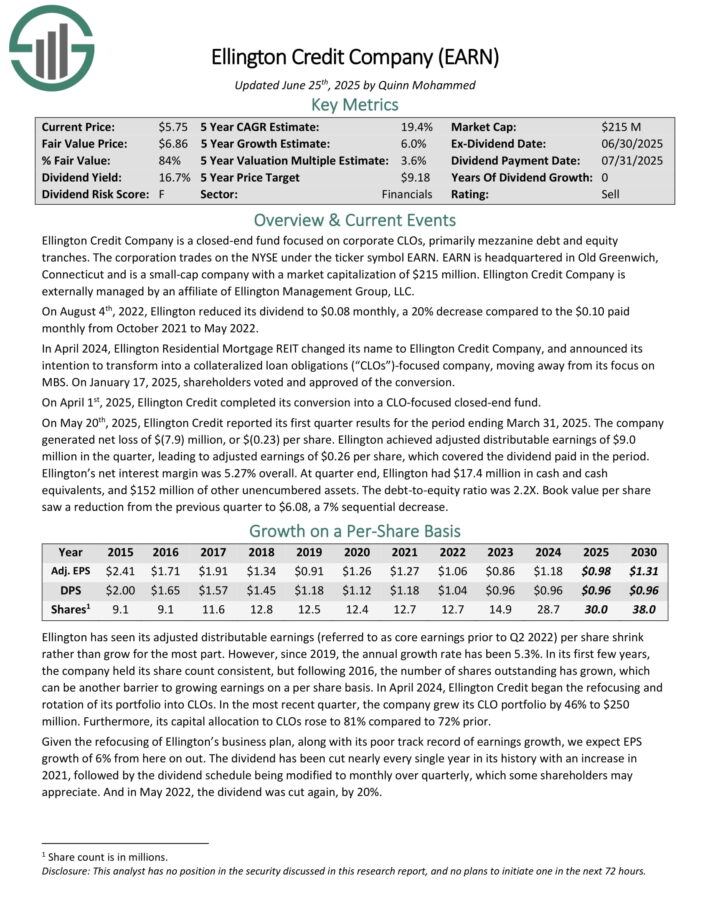

Cheapest Monthly Dividend Stock #6: Ellington Credit Co. (EARN)

- Annual Valuation Return: 3.3%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On May 20th, 2025, Ellington Credit reported its first quarter results for the period ending March 31, 2025. The company generated net loss of $(7.9) million, or $(0.23) per share.

Ellington achieved adjusted distributable earnings of $9.0 million in the quarter, leading to adjusted earnings of $0.26 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.27% overall. At quarter end, Ellington had $17.4 million in cash and cash equivalents, and $152 million of other unencumbered assets.

The debt-to-equity ratio was 2.2X. Book value per share saw a reduction from the previous quarter to $6.08, a 7% sequential decrease.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

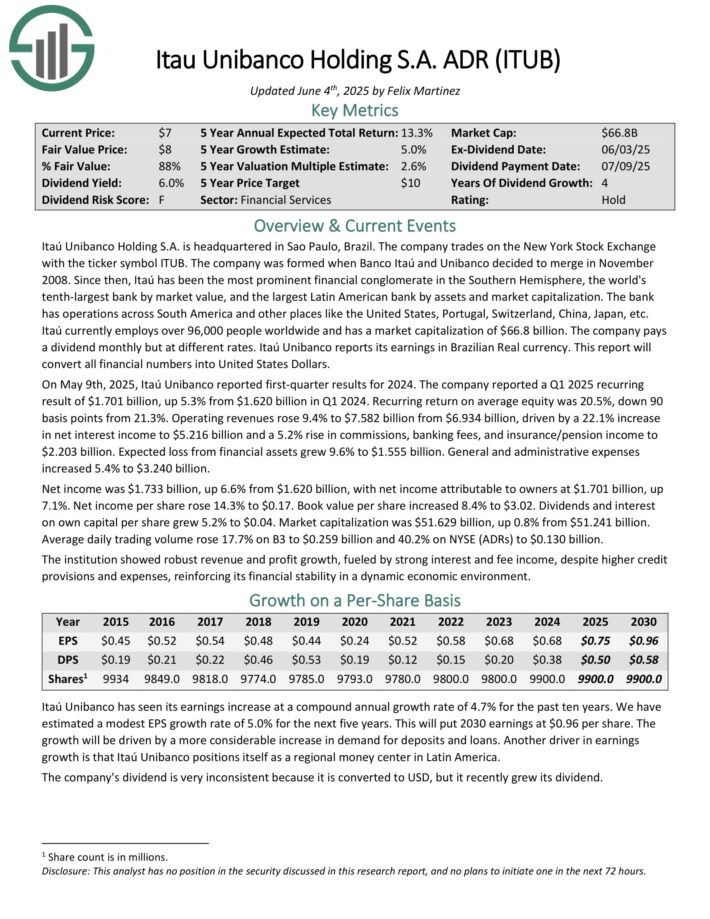

Cheapest Monthly Dividend Stock #5: Itau Unibanco Holding S.A. (ITUB)

- Annual Valuation Return: 3.8%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On May 9th, 2025, Itaú Unibanco reported first-quarter results for 2024. The company reported a Q1 2025 recurring result of $1.701 billion, up 5.3% from $1.620 billion in Q1 2024. Recurring return on average equity was 20.5%, down 90 basis points from 21.3%.

Operating revenues rose 9.4% to $7.582 billion from $6.934 billion, driven by a 22.1% increase in net interest income to $5.216 billion and a 5.2% rise in commissions, banking fees, and insurance/pension income to $2.203 billion. Expected loss from financial assets grew 9.6% to $1.555 billion.

Net income was $1.733 billion, up 6.6% from $1.620 billion, with net income attributable to owners at $1.701 billion, up 7.1%. Net income per share rose 14.3% to $0.17.

Book value per share increased 8.4% to $3.02. Dividends and interest on own capital per share grew 5.2% to $0.04.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

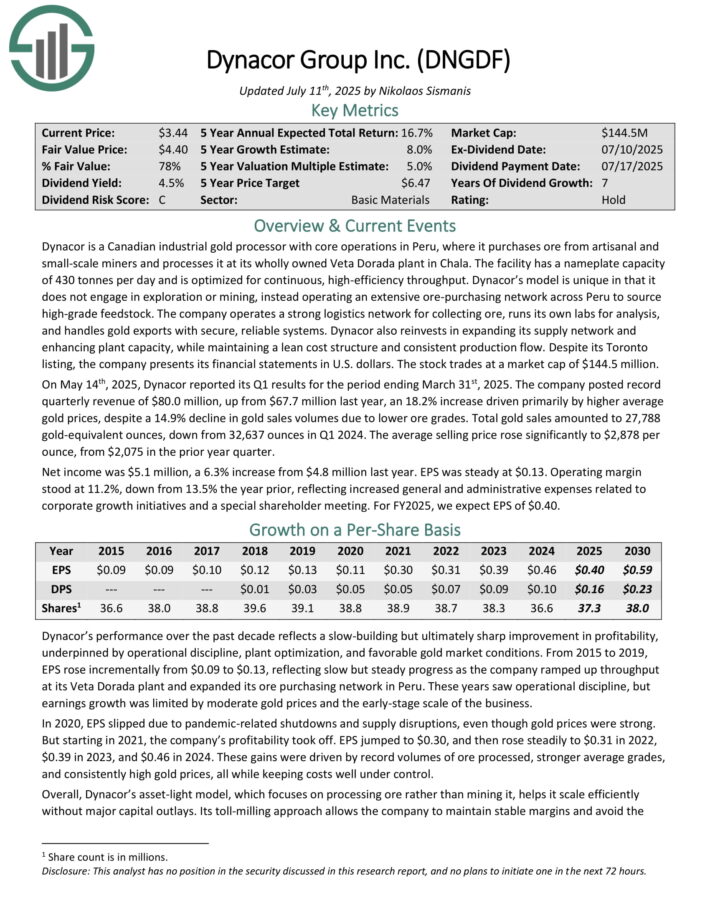

Cheapest Monthly Dividend Stock #4: Dynacor Group (DNGDF)

- Annual Valuation Return: 5.1%

Dynacor is a Canadian industrial gold processor with core operations in Peru, where it purchases ore from artisanal and small-scale miners and processes it at its wholly owned Veta Dorada plant in Chala.

The facility has a nameplate capacity of 430 tonnes per day and is optimized for continuous, high-efficiency throughput.

Dynacor’s model is unique in that it does not engage in exploration or mining, instead operating an extensive ore purchasing network across Peru to source high-grade feedstock.

The company operates a strong logistics network for collecting ore, runs its own labs for analysis, and handles gold exports with secure, reliable systems.

Dynacor also reinvests in expanding its supply network and enhancing plant capacity, while maintaining a lean cost structure and consistent production flow. Despite its Toronto listing, the company presents its financial statements in U.S. dollars.

On May 14th, 2025, Dynacor reported its Q1 results for the period ending March 31st, 2025. The company posted record quarterly revenue of $80.0 million, up from $67.7 million last year, an 18.2% increase driven primarily by higher average gold prices, despite a 14.9% decline in gold sales volumes due to lower ore grades.

Total gold sales amounted to 27,788 gold-equivalent ounces, down from 32,637 ounces in Q1 2024. The average selling price rose significantly to $2,878 per ounce, from $2,075 in the prior year quarter.

Click here to download our most recent Sure Analysis report on DNGDF (preview of page 1 of 3 shown below):

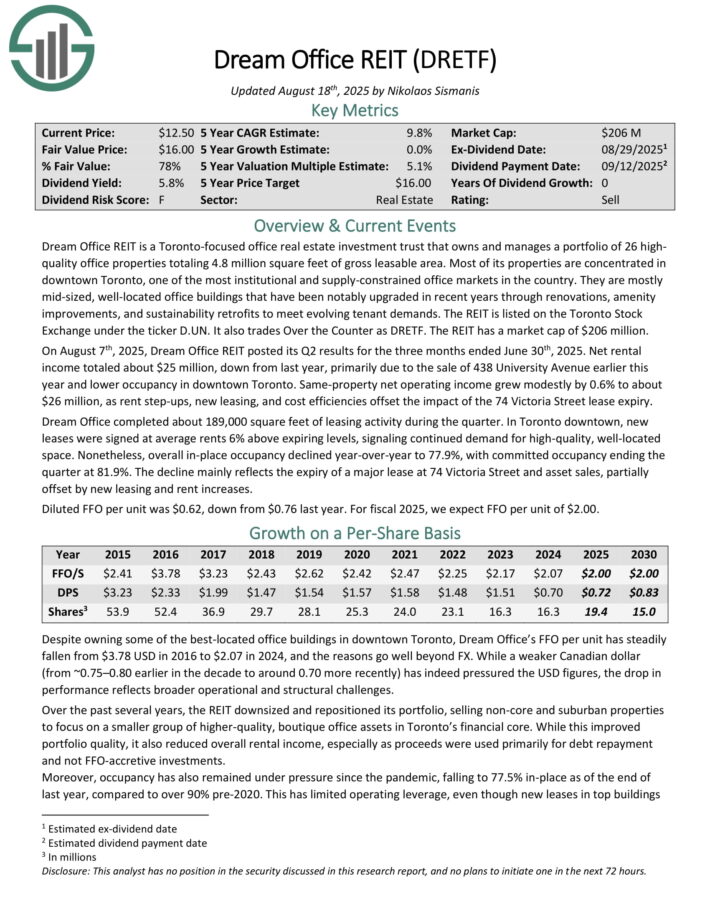

Cheapest Monthly Dividend Stock #3: Dream Office REIT (DRETF)

- Annual Valuation Return: 5.6%

Dream Office REIT is a Toronto-focused office real estate investment trust that owns and manages a portfolio of 26 high-quality office properties totaling 4.8 million square feet of gross leasable area. Most of its properties are concentrated in downtown Toronto, one of the most institutional and supply-constrained office markets in the country.

They are mostly mid-sized, well-located office buildings that have been notably upgraded in recent years through renovations, amenity improvements, and sustainability retrofits to meet evolving tenant demands.

On August 7th, 2025, Dream Office REIT posted its Q2 results for the three months ended June 30th, 2025. Net rental income totaled about $25 million, down from last year, primarily due to the sale of 438 University Avenue earlier this year and lower occupancy in downtown Toronto.

Same-property net operating income grew modestly by 0.6% to about $26 million, as rent step-ups, new leasing, and cost efficiencies offset the impact of the 74 Victoria Street lease expiry.

Dream Office completed about 189,000 square feet of leasing activity during the quarter. In Toronto downtown, new leases were signed at average rents 6% above expiring levels, signaling continued demand for high-quality, well-located space.

Nonetheless, overall in-place occupancy declined year-over-year to 77.9%, with committed occupancy ending the quarter at 81.9%. The decline mainly reflects the expiry of a major lease at 74 Victoria Street and asset sales, partially offset by new leasing and rent increases. Diluted FFO per unit was $0.62, down from $0.76 last year.

Click here to download our most recent Sure Analysis report on DRETF (preview of page 1 of 3 shown below):

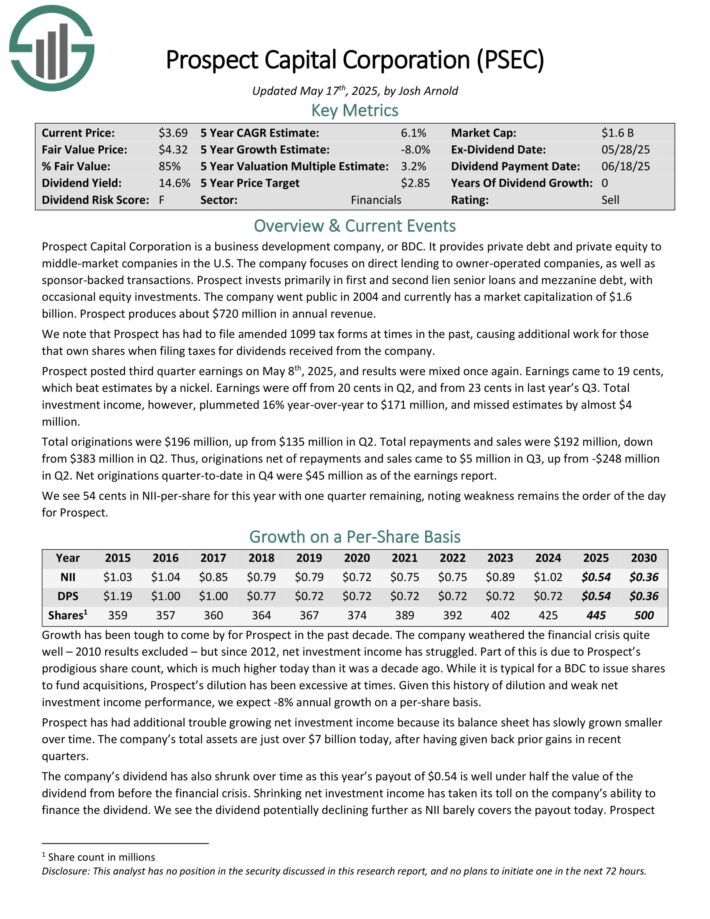

Cheapest Monthly Dividend Stock #2: Prospect Capital (PSEC)

- Annual Valuation Return: 8.4%

Prospect Capital Corporation is a business development company, or BDC. It provides private debt and private equity to middle-market companies in the U.S. The company focuses on direct lending to owner-operated companies, as well as sponsor-backed transactions.

Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted third quarter earnings on May 8th, 2025, and results were mixed once again. Earnings came to 19 cents, which beat estimates by a nickel. Earnings were off from 20 cents in Q2, and from 23 cents in last year’s Q3.

Total investment income, however, plummeted 16% year-over-year to $171 million, and missed estimates by almost $4

million.

Total originations were $196 million, up from $135 million in Q2. Total repayments and sales were $192 million, down from $383 million in Q2.

Originations net of repayments and sales came to $5 million in Q3, up from -$248 million in Q2. Net originations quarter-to-date in Q4 were $45 million as of the earnings report.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

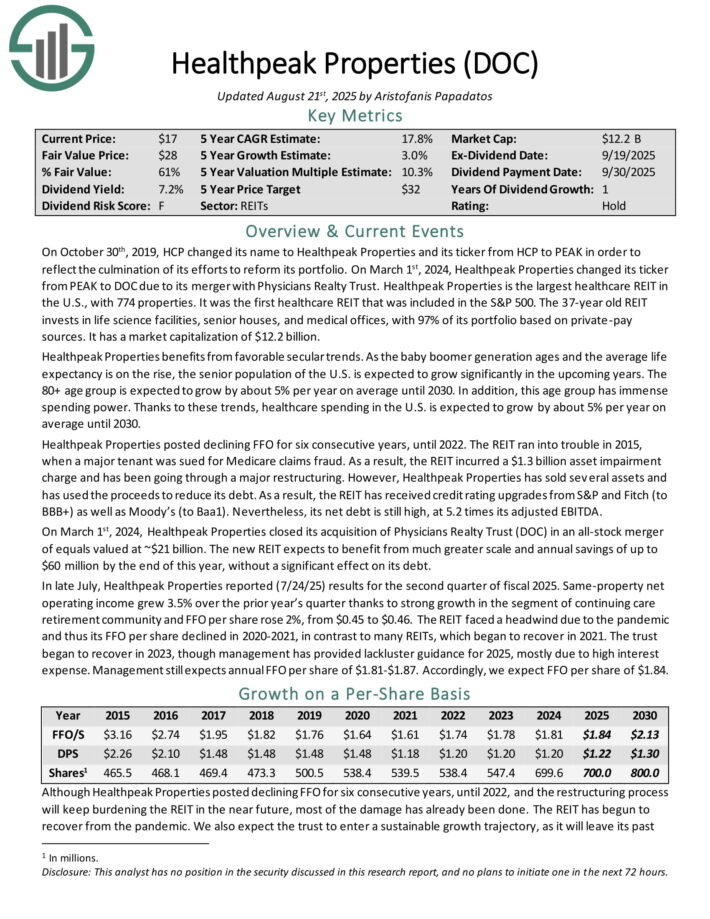

Cheapest Monthly Dividend Stock #1: Healthpeak Properties (DOC)

- Annual Valuation Return: 10.1%

Healthpeak Properties is the largest healthcare REIT in the U.S., with 774 properties. It was the first healthcare REIT that was included in the S&P 500. The 37-year old REIT invests in life science facilities, senior houses, and medical offices, with 97% of its portfolio based on private-pay sources. It has a market capitalization of $12 billion.

On July 24th 2025, the REIT reported second-quarter financial results. Quarterly revenue of $694.35 million was in-line with analyst estimates, and represented a year-over-year decline of 0.2%. Adjusted funds-from-operation (FFO) was $0.46 per share, up 2.2% from the same quarter last year. Adjusted FFO-per-share was also in-line with estimates. Same-store cash net operating income growth was 3.5% for the second quarter.

Investment activity for the quarter included two new development agreements with a combined projected cost of $148 million to support Northside Hospital’s continued outpatient expansion in the Atlanta market. Healthpeak Properties also sold one outpatient medical land parcel in June 2025 and two outpatient medical buildings in July 2025 for combined proceeds of approximately $35 million.

For 2025, Healthpeak Properties confirmed its forecast for adjusted diluted FFO-per-share to be in a range of $1.81 to $1.87. In addition, same-store cash (Adjusted) NOI growth is expected to be 3.0% to 4.0% for the full year.

Click here to download our most recent Sure Analysis report on DOC (preview of page 1 of 3 shown below):

Final Thoughts

Although monthly dividend stocks may appear appealing for generating a steady income stream, it’s crucial to bear in mind that not all dividend stocks are created equal.

Each stock carries its own set of risks, and the greater the risk, the more probable it is that shares will appear undervalued.

Investors should scrutinize the cheap valuation of monthly dividend stocks. Nevertheless, our list can serve as an excellent starting point for investors seeking potential opportunities for undervalued investments in the realm of monthly dividend stocks.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more