Updated on May 29th, 2024 by Nikolaos Sismanis

Founded in 2000 by Julian and Felix Baker, Baker Bros. Advisors is a private hedge fund based out of New York City. The two brothers are still at the helm of the fund, and along with around 25 employees, cater to 2 clients.

The fund has grown rapidly over the years due to its extraordinary returns and currently boasts approximately $22.0 billion of assets under management (AUM). The majority of its funds are allocated to publicly traded equities, with exclusive exposure to the healthcare sector.

Investors following the company’s 13F filings over the last 3 years (from mid-May 2021 through mid-May 2024) would have generated annualized total returns of -27.7%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 9.9% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Baker Brothers Advisors’ current 13F equity holdings below:

Keep reading this article to learn more about Baker Brothers Advisors.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Baker Brothers’ Philosophy and Strategy

- Baker Brothers’ Portfolio & 5 Largest Public-Equity Investments

- Final Thoughts

Baker Brothers’ Philosophy and Strategy

Brothers Julian and Felix Baker have earned their guru status on Wall Street, having delivered an exceptional track record of annualized returns over the years. Julian has a business background from Harvard, while Felix has a Ph.D. in Immunology from Stanford.

Together, they have combined their individual expertise to generate superior returns by focusing solely on the biotech industry. Assets under management grew from $250 million in 2003 to $22.0 billion as of May 15th, 2024.

The fund’s strategy includes utilizing a fundamentally-driven way of investing to come up with its investment decisions, also known as “bottom-up investing”. Unlike top-down investing, which suggests studying the bigger picture of economic factors to make investment decisions, bottom-up investing involves looking at the company-specific fundamentals.

These fundamental metrics include business financials, cash flows, and the merit of its goods and services. This is crucial when investing in the biotech industry, as each company is unique, requiring niche knowledge to understand its business model.

The fund’s philosophy stands in holding its investments ordinarily for three years, though its higher-conviction investments can be seen held for longer. Additionally, Baker Bros. don’t intend to dilute their status as a highly successful biotech investors, as they do not intend to ever allocate assets in other industries. Still, some minor stakes in the industrial sector had been reported in the past.

Finally, the two brothers don’t believe in diversifying the fund’s portfolio. Instead, they emphasize that focusing on specific companies, which they can analyze and understand deeply and place concentrated positions in their securities, can generate superior returns over the long term.

Baker Brothers Investments’ Portfolio & 5 Largest Public-Equity Investments

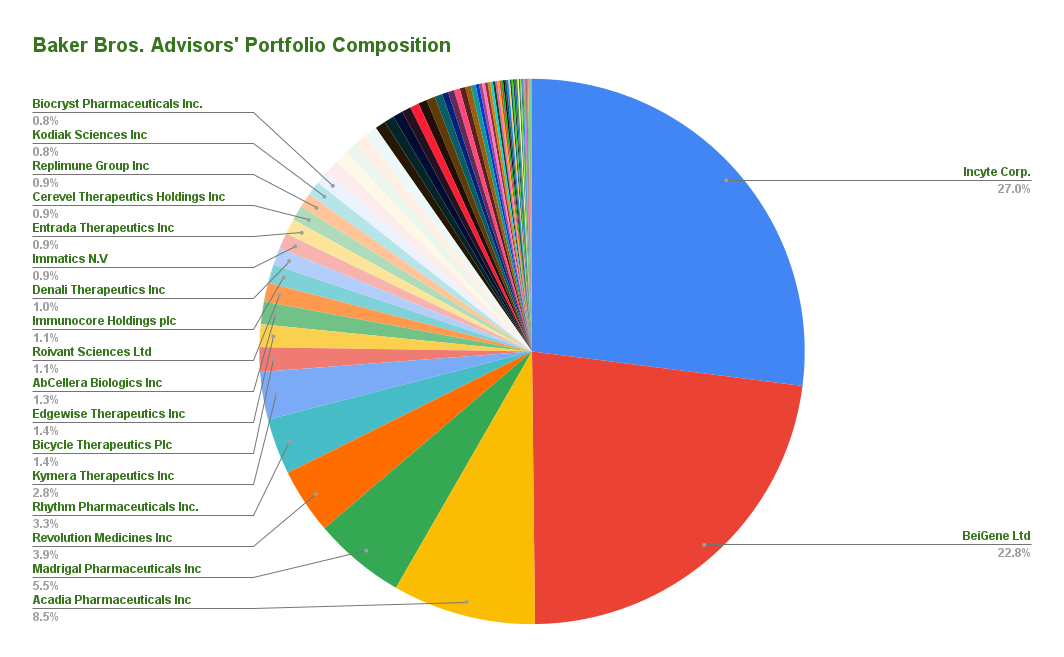

Upon looking at Baker Bros’ portfolio, one can see that it holds 86 individual stocks, questioning the fund’s disbelief in diversification. However, the fund’s investing philosophy does hold up, as the top five holdings account for around 68% of the total capital invested, confirming their inclination towards high-conviction investments. Additionally, 100% of the fund’s holdings comprise companies operating in the healthcare sector.

Source: 13F filing, Author

Incyte Corporation (INCY)

ncyte Corporation is a biopharmaceutical company headquartered in Wilmington, Delaware, United States. Established in 1991, it focuses on the discovery, development, and commercialization of innovative medicines, particularly in the field of oncology.

One of Incyte’s key areas of expertise lies in small molecule drug discovery and development. The company has brought several drugs to market, including Jakafi (ruxolitinib), which is approved for the treatment of certain blood disorders like myelofibrosis and polycythemia vera, and more recently for steroid-refractory acute graft-versus-host disease (GVHD). In addition to Jakafi, Incyte has a robust pipeline of investigational drugs targeting various cancers and other serious diseases.

Unlike many biotech companies, which are pre-revenue, Incyte has been growing its top and bottom line for years. Revenues have expanded from around $169 million in 2010 to $3.77 billion over the past four quarters. The stock is trading at a forward P/E ratio of ~12.2, which is a near-record low valuation multiple for the company.

EPS over the medium term is expected to grow by around 25% per annum since Incyte is an industry leader, having essentially monopolized its areas of treatment. In that regard, the valuation seems compressed. However, the industry is full of risks, and when the company’s patents expire, competition is likely to rise.

The fund owns around 16.1% of the company, with a market cap of $12.9 billion. The position was held stable in the previous quarter.

BeiGene (BGNE)

Founded in 2010, BeiGene has rapidly grown into a prominent player in the biopharmaceutical industry, strongly emphasizing cancer treatment. The company has a diverse pipeline of potential therapies, spanning both small molecules and biologics, targeting various cancers, including solid tumors and hematologic malignancies.

BeiGene’s portfolio includes both internally developed compounds and licensed products from other biopharmaceutical companies. It is the fund’s second-largest holding, occupying 22.8% of its total portfolio.

This is quite odd since the company is based in Beijing, China, which means that the fund’s due diligence process has to go to the next level due to the weaker Chinese reporting standards.

Despite the uncertainty surrounding BeiGene, the company has developed into a fully integrated global biotechnology company with operations in China, the United States, Europe, and Australia. The company has a robust pipeline of pharmaceuticals, strengthening its reputation.

Nonetheless, BeiGene produces miniature revenues against its $17.3 billion market cap, indicating that investors are betting heavily on the company’s long-term prospects. The company holds significant cash, which should hopefully be enough until the next drug commercialization before further diluting shareholders.

Baker Bros left its position unchanged last quarter, with the fund still owning nearly 10.3% of the company.

ACADIA Pharmaceuticals (ACAD)

Founded in 1993, ACADIA has garnered attention for its research efforts focused on neurological and psychiatric conditions. The company’s primary focus lies in the development of drugs that target the neurotransmitter system, particularly those involved in disorders such as Parkinson’s disease psychosis (PDP) and schizophrenia.

One of ACADIA’s key achievements is the development and commercialization of pimavanserin (known by its brand name NUPLAZID), the first and only FDA-approved treatment for hallucinations and delusions associated with Parkinson’s disease psychosis. NUPLAZID acts as a selective serotonin inverse agonist and has shown efficacy in reducing psychotic symptoms without worsening motor function in patients with Parkinson’s disease.

The company has experienced extraordinary revenue growth, with its 5-year CAGR standing at 26.7%. However, the bottom line has never been positive, with losses persisting even as sales are growing.

Back in March of 2021, Acadia announced deficiencies identified by the FDA regarding its marketing application for Pimavanserin in hallucinations and delusions associated with dementia-related psychosis. Shares plunged by a massive 45%, and they have yet to recover since then. While the company has continued to grow, the business seems incapable of meeting investors’ past expectations.

This is one of the fund’s highest conviction picks, as Baker Bros still owns just over 26% of the company’s shares, which have been held since 2010. While the fund has made great gains since the recent plunge, it has definitely compressed its unrealized gains, as the position was held stable once again.

Madrigal Pharmaceuticals (MDGL)

Madrigal Pharmaceuticals is a clinical-stage biopharmaceutical company pursuing novel therapeutics for nonalcoholic steatohepatitis (NASH). Given the encouraging outcomes presented thus far, Madrigal is firm in its conviction that resmethrin has the capacity to secure the distinction of being the inaugural approved medication for treating NASH patients.

This ailment, known as Non-Alcoholic Steatohepatitis, poses an escalating worldwide healthcare challenge across all geographical domains. In the United States alone, the number of individuals grappling with NASH is approximated to be 22 million, with an additional 8 million contending with NASH accompanied by notable liver fibrosis.

Despite its recent positive developments, the company’s losses have been widening while its share count has been increasing, which certainly doesn’t sound that encouraging.

Madrigal Pharmaceuticals is Baker Bros’ fourth-largest position, with the fund leaving its position unchanged in the previous quarter. The fund owns around 5.5% of the company’s outstanding shares.

Revolution Medicines (RVMD)

Revolution Medicines is a California-based biotech company that’s advancing innovative cancer treatments. They’re focused on developing drugs that target specific genetic weaknesses in cancer cells. One of their main targets is a gene called RAS, which is often mutated in cancer.

They aim to halt cancer growth by designing drugs that specifically block these mutated RAS proteins. Their leading candidate, RMC-4630, targets a protein called SHP2, which is involved in RAS signaling. This drug is being tested in clinical trials for various cancers driven by RAS mutations.

The company hasn’t produced meaningful revenues yet, with losses remaining elevated. Thus, investors should be wary of dilutive offerings in the future despite its hefty cash position.

Revolution Medicines is Baker Bros’ fifth-largest holding. The fund boosted its position in the stock by 47% during the previous quarter.

Final Thoughts

The Baker brothers have built a truly special hedge fund. Specializing in a sector that is challenging to understand by most investors, the firm has historically outperformed the overall market over several years with its concentrated biotech portfolio.

Performance over the past three years has lagged, but it could be a temporary phase for the fund, which, after all, focuses on long-term returns. Investors that are familiar with biotech companies are likely to find some hidden gems amongst their holdings.

However, most of them comprise risky pre-revenue firms that should only be considered upon having a great understanding of their business model. Retail investors should be wary of just “copying” the fund’s portfolio.

Additional Resources

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The 20 Highest Yielding Dividend Kings

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks

- The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: