Updated on October 24th, 2024 by Aristofanis Papadatos

H.B. Fuller (FUL) has increased its dividend for 55 years in a row. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years.

You can see the complete list of all 53 Dividend Kings here.

We have created a full list of all the Dividend Kings, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can access the spreadsheet by clicking on the link below:

H.B. Fuller has remained a relatively small company, trading at a market capitalization of just $4.2 billion. However, a small market cap is not a negative feature when investing; quite the contrary.

Despite its small size, H.B. Fuller has promising growth prospects thanks to the growth potential of the niche market in which it operates. The stock offers a 1.2% dividend yield, which is equal to the yield of the S&P 500.

However, there is ample room for many future dividend raises thanks to a low payout ratio and the company’s growth prospects.

Business Overview

H.B. Fuller is a global market leader in adhesives, sealants, and other specialty chemical products. It has 69 manufacturing facilities and 38 technology centers and sells its products in 125 countries.

Adhesives is an exceptionally attractive niche market. Adhesives are critical materials in numerous applications, but they comprise just a small expense for H.B. Fuller’s customers. Adhesives make up less than 1% of the cost of goods for most customers.

In addition, each adhesive has unique chemistry, with most product formulations including 3-10 chemicals. It is also uneconomical for customers to switch to another supplier.

Overall, H.B. Fuller’s customers have to use its essential products without paying much attention to their cost, which is minor compared to their other costs.

On September 25th, 2024, H.B. Fuller reported its results for the third quarter of 2024.

Source: Investor Presentation

Revenue grew 2% and organic revenue was essentially flat over the prior year’s quarter, as price adjustments almost offset volume growth. It was the second quarter of revenue growth after five consecutive quarters of declining sales amid de-stocking actions of customers and weak industrial demand.

In addition, gross margin improved from 30.0% to 30.4% and earnings per share grew 7%, from $1.06 to $1.13, thanks to material cost reductions.

On the other hand, due to slowing demand in some emerging markets, H.B. Fuller lowered its guidance for fiscal 2024 in its latest conference call. It now expects to grow its revenue by 2% (vs. 2%-4% previously) and lowered its guidance for earnings per share from $4.20-$4.45 to $4.10-$4.20.

H.B. Fuller has performed well over the past few years, with the company rebounding very strongly from the coronavirus crisis in 2020. The company earned $3.47 in adjusted earnings per share in 2021, which was an improvement over the company’s results even prior to the pandemic.

In 2022, adjusted earnings per share grew by another 15%, to a new all-time high of $4.00. In 2023, the company posted a 3% decline in earnings per share but it expects all-time high earnings per share this year.

Growth Prospects

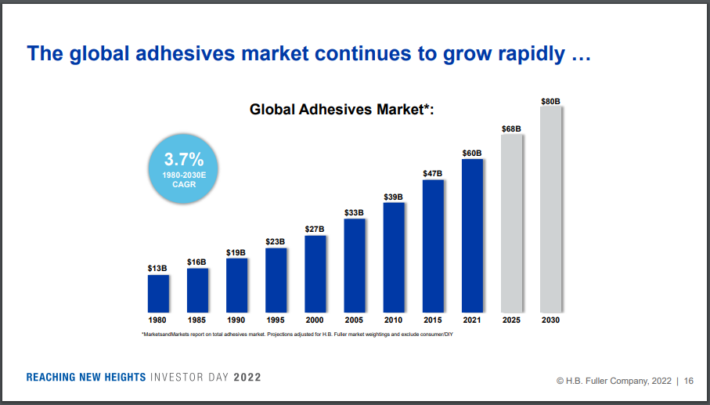

The adhesives market has exhibited a 3.7% average annual growth rate over the last 41 years. It has become a $60+ billion market that is highly fragmented, with the top companies generating less than 35% of the total sales.

Source: Investor Presentation

Thanks to the high fragmentation of this market, there is a significant growth potential for H.B. Fuller, which has consistently been the second-largest player in the market behind Henkel.

Moreover, H.B. Fuller enjoys economies of scale that its smaller competitors cannot match, while the latter also lack the global reach to compete directly with H.B. Fuller. As a result, H.B. Fuller is likely to keep growing by gaining market share from its small competitors over time.

H.B. Fuller is also likely to keep growing via significant acquisitions. In 2017, it acquired Royal Adhesives & Sealants for $1.6 billion. As the value of that acquisition is 38% of the current market capitalization of H.B. Fuller, it is evident that the merger, the largest in the company’s history, was critical.

The acquisition enhanced the product range of H.B. Fuller to more specialized adhesives and boosted its annual sales by about $735 million (32%).

Since the acquisition, H.B. Fuller has been reducing its debt load at a fast pace. When that process is complete, H.B. Fuller will shift its focus again to potential takeover targets. The company also acquired Adecol in late 2017 in order to enhance its growth potential in Brazil.

H.B. Fuller has grown its earnings per share at an average annual rate of 6.9% over the last seven years and at an average annual rate of 5.2% over the last five years. The company has emerged stronger from the pandemic and has provided guidance for an improvement of its adjusted EBITDA, from 17% to more than 20% over the next 3-5 years.

Overall, we expect H.B. Fuller to grow its earnings per share at a 6.0% average annual rate over the next five years, roughly in line with its historical growth pace.

Competitive Advantages & Recession Performance

H.B. Fuller’s customers manufacture a wide range of products. Consequently, the performance of H.B. Fuller greatly depends on the prevailing economic conditions, and thus, the company is vulnerable to recessions. In the Great Recession, its earnings per share plunged 79%, from $1.68 in 2007 to $0.36 in 2008, and the stock lost two-thirds of its market capitalization in less than six months.

Still, the wide range of applications of its adhesives provides some diversification. For example, during the pandemic, strong growth in the demand for health and hygiene products mostly offset the decrease in the demand for adhesives in other categories. As a result, earnings per share dipped only 3% in 2020, an admirable performance for an industrial company.

Moreover, H.B. Fuller is the #1 or #2 player in most of its markets, and thus, it can endure a downturn more readily than its small competitors, thanks to its economies of scale. It is also worth noting that its top 10 customers comprise a relatively small amount of its revenue, and thus, the company has limited risk from any specific customer.

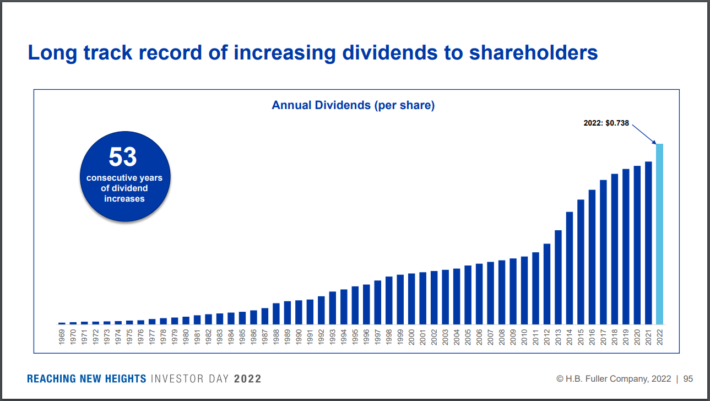

Finally, it is impressive that an industrial manufacturer closely tied to the underlying economic growth has raised its dividend for 55 consecutive years.

This is a testament to this niche market’s strong growth and the company’s excellent business execution. H.B. Fuller has achieved this exceptional dividend growth record partly thanks to its low payout ratio.

Source: Investor Presentation

The company has always targeted a payout ratio of around 25% and thus has been able to keep raising its dividend even in years when its earnings have temporarily plunged. Due to the low payout ratio, the dividend is safe, but the resultant 1.2% dividend yield is lackluster.

Valuation & Expected Returns

H.B. Fuller is currently trading at 18.1 times its expected earnings per share of $4.15 this year. While the historical earnings multiple of the stock is 17.1, we believe that a fair price-to-earnings ratio is 15.0 due to the cyclical nature of the stock. If the stock reaches our fair valuation level over the next five years, it will suffer a 3.7% annualized headwind in its returns.

Given 6% expected earnings-per-share growth, the 1.2% dividend, and a -3.7% impact of a contracting price-to-earnings multiple, we expect H.B. Fuller to offer a 3.4% average annual total return over the next five years. This rate of return renders the stock a “sell” at its current stock price of $75.

Final Thoughts

H.B. Fuller is highly vulnerable to recessions, but it proved markedly resilient during the pandemic, thanks to a strong increase in the demand for adhesives used in health and hygiene products.

Moreover, thanks to the reliable long-term growth of its niche market and its high fragmentation, H.B. Fuller is likely to grow its earnings per share at a mid-single digit rate in the upcoming years.

However, the company also appears to be somewhat richly valued, while the 1.2% dividend yield is lackluster. As a result, we advise investors to wait for a meaningful correction of H.B. Fuller before purchasing it.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks