Updated on November 18th, 2024 by Bob Ciura

Grocery stocks are in an uncertain position. Industry trends are changing as more consumers gravitate toward online shopping and grocery delivery, which accelerated during the coronavirus pandemic.

Meanwhile, competition among grocery stocks is heating up. E-commerce giant Amazon.com (AMZN) made a huge entry into grocery with its ~$14 billion acquisition of Whole Foods and is in the process of rolling out its cashier-less technology.

Many of these grocery stocks remain attractive for dividend growth investors. For example, Walmart and Target are both members of the Dividend Aristocrats.

The Dividend Aristocrats are a group of 66 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet of all 66 Dividend Aristocrats (with important financial metrics such as dividend yields and payout ratios) by clicking the link below:

Costco and Kroger are members of the Dividend Achievers list, a group of stocks with 10+ years of consecutive dividend growth.

You can see the entire list of all ~400 Dividend Achievers by clicking here.

These retailers are all making progress to better compete with Amazon, adapt to the changing consumer demands, and continue generating growth.

This article will discuss the top 7 grocery stocks ranked in order of expected total returns (ETRs).

Table of Contents

We have ranked the top 7 grocery stocks according to expected returns. The grocery stocks are listed from lowest to highest five-year expected total returns. You can use the following links to instantly jump to any specific stock:

- Best Grocery Stock #7: Costco Wholesale Corp. (COST)

- Best Grocery Stock #6: Kroger Co. (KR)

- Best Grocery Stock #5: Walmart Inc. (WMT)

- Best Grocery Stock #4: Albertsons Corporation (ACI)

- Best Grocery Stock #3: Target Corporation (TGT)

- Best Grocery Stock #2: SpartanNash Co. (SPTN)

- Best Grocery Stock #1: Dollar General Corp. (DG)

Best Grocery Stock #7: Costco Wholesale (COST)

- 5-year expected annual returns: 3.2%

Costco is a diversified warehouse retailer that operates more than 890 warehouses, collectively generating about $270 billion in annual sales.

Costco posted fourth quarter and full-year earnings on September 26th, 2024, and results were somewhat mixed, marking a departure from prior reports that were easy beats. Earnings-per-share for the quarter came to $5.29, which was 23 cents better than expected.

Revenue was $79.7 billion, up 1% year-over-year, but missing estimates by $340 million. Comparable sales rose 5.4% during the quarter, with the US posting 5.3% growth, 5.5% in Canada, and International markets up 5.7%. E-commerce sales were up 18.9% on a comparable basis.

Click here to download our most recent Sure Analysis report on Costco (preview of page 1 of 3 shown below):

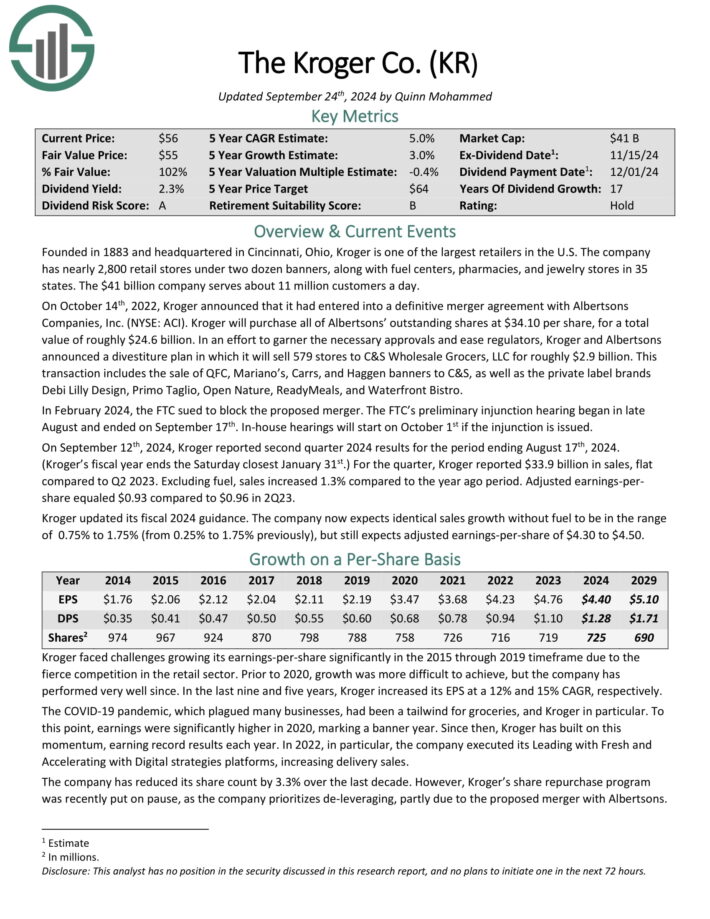

Best Grocery Stock #6: Kroger Co. (KR)

- 5-year expected annual returns: 4.6%

Founded in 1883, Kroger has nearly 2,800 retail stores under two dozen banners and fuel centers, pharmacies, and jewelry stores in 35 states. The company serves about 11 million customers a day.

On October 14th, 2022, Kroger announced that it had entered into a definitive merger agreement with Albertsons Companies. Kroger will purchase all of Albertsons’ outstanding shares at $34.10 per share, for a total value of roughly $24.6 billion.

On September 12th, 2024, Kroger reported second quarter 2024 results for the period ending August 17th, 2024. For the quarter, Kroger reported $33.9 billion in sales, flat compared to Q2 2023. Excluding fuel, sales increased 1.3% compared to the year ago period. Adjusted earnings-per-share equaled $0.93 compared to $0.96 in 2Q23.

Kroger updated its fiscal 2024 guidance. The company now expects identical sales growth without fuel to be in the range of 0.75% to 1.75%.

Click here to download our most recent Sure Analysis report on Kroger (preview of page 1 of 3 shown below):

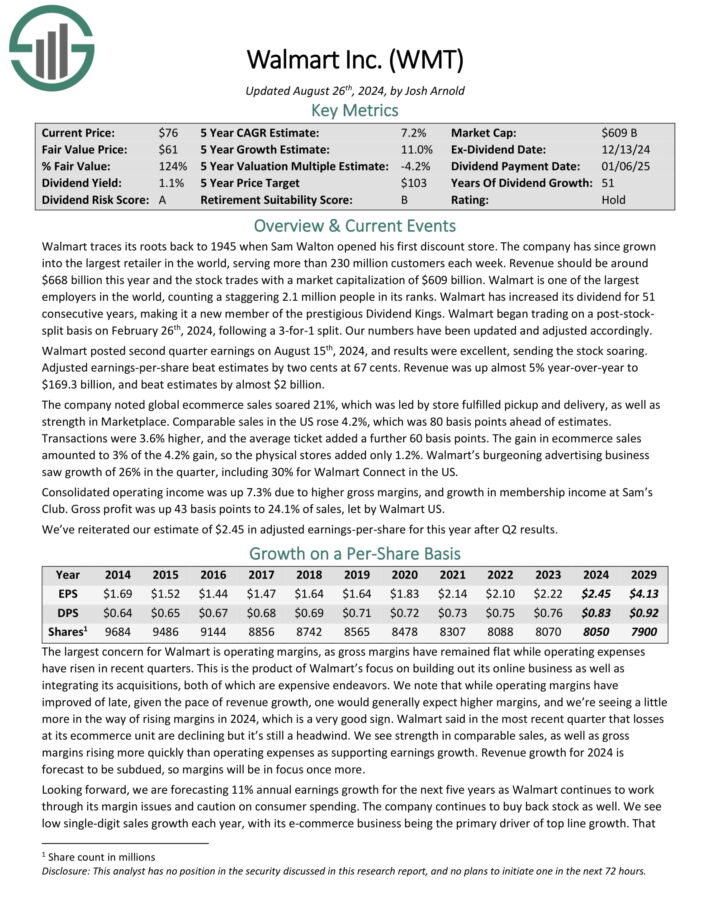

Best Grocery Stock #5: Walmart Inc. (WMT)

- 5-year expected annual returns: 4.9%

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into one of the largest retailers in the world, serving over 230 million customers each week. Revenue will likely be around $600 billion this year.

Walmart posted second quarter earnings on August 15th, 2024, and results were excellent, sending the stock soaring. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Revenue was up almost 5% year-over-year to $169.3 billion, and beat estimates by almost $2 billion.

Source: Investor Presentation

The company noted global e-commerce sales soared 21%, which was led by store fulfilled pickup and delivery, as well as strength in Marketplace.

Comparable sales in the US rose 4.2%, which was 80 basis points ahead of estimates. Transactions were 3.6% higher, and the average ticket added a further 60 basis points.

Click here to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below):

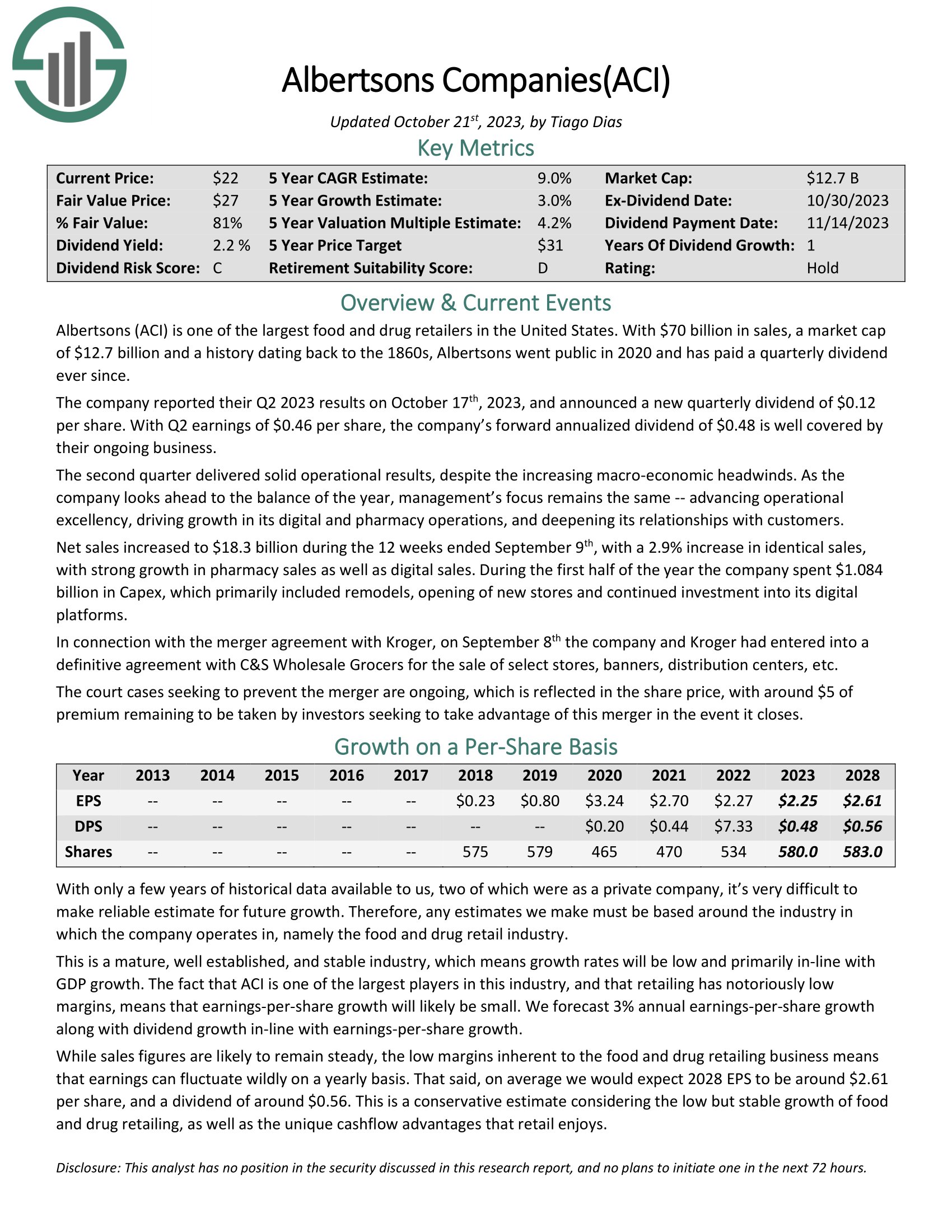

Best Grocery Stock #4: Albertsons Corporation (ACI)

- 5-year expected annual returns: 12.5%

Albertsons (ACI) is one of the largest food and drug retailers in the United States. It generates approximately $70 billion in annual sales, with an operating a history dating back to the 1860s. However, Albertsons only went public in 2020 and has paid a quarterly dividend since.

The company reported its Q2 2024 results on October 15th, 2024, and announced a quarterly dividend of $0.12 per share. With Q2 earnings of $0.25 per share, the company’s forward annualized dividend of $0.48 is well covered by their ongoing business.

During the second quarter, investments in the company’s “Customers for Life” strategy drove strong growth in digital sales and pharmacy operations. But as the management team looks forward to the full year, they expect to see continuing headwinds related to investments in associate wages and benefits, an increasing mix of the pharmacy and digital businesses which carry lower margins, and an increasingly competitive backdrop.

Management expects these headwinds to be partially offset by new and ongoing productivity initiatives.

Click here to download our most recent Sure Analysis report on Albertsons (preview of page 1 of 3 shown below):

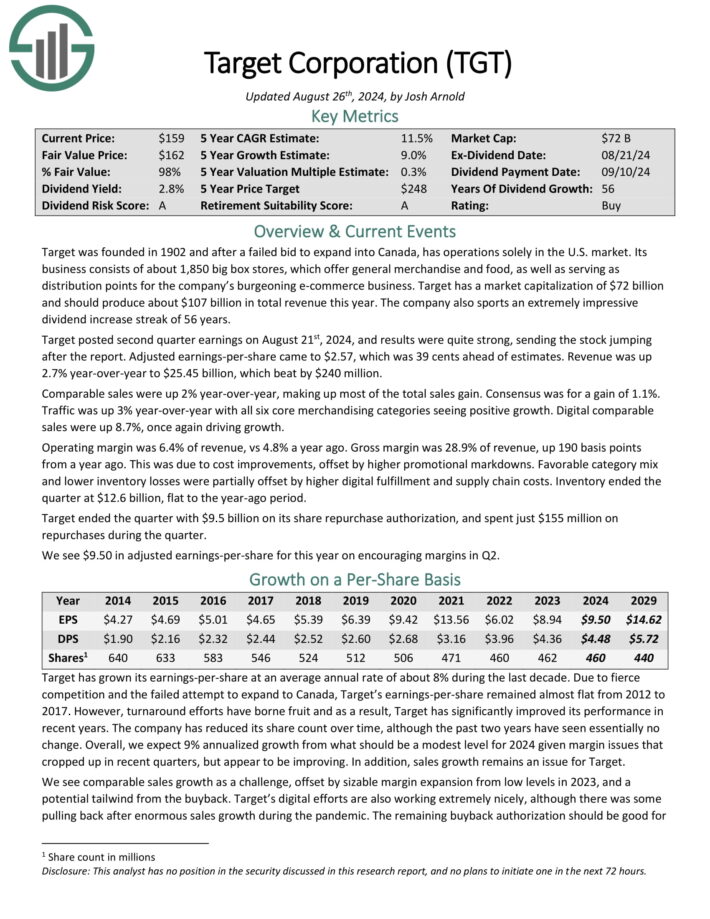

Best Grocery Stock #3: Target (TGT)

- 5-year expected annual returns: 12.6%

Target is a discount retail operations solely in the U.S. market. Its business consists of about 2,000 big box stores offering general merchandise and food and serving as distribution points for its burgeoning e-commerce business.

Target posted second quarter earnings on August 21st, 2024, and results were quite strong, sending the stock jumping after the report. Adjusted earnings-per-share came to $2.57, which was 39 cents ahead of estimates. Revenue was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Source: Investor Presentation

Comparable sales were up 2% year-over-year, making up most of the total sales gain. Consensus was for a gain of 1.1%. Traffic was up 3% year-over-year with all six core merchandising categories seeing positive growth. Digital comparable sales were up 8.7%, once again driving growth.

Operating margin was 6.4% of revenue, vs 4.8% a year ago. Gross margin was 28.9% of revenue, up 190 basis points from a year ago.

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

Best Grocery Stock #2: SpartanNash Co. (SPTN)

- 5-year expected annual returns: 12.7%

SpartanNash is a value-added wholesale grocery distributor and retailer. The corporation supplies 2,100 independent grocery retail locations in the United States.

The company itself also owns 147 supermarkets in nine states. SpartanNash operates under retail banners such as Dan’s Supermarket, D&W Fresh Market, Econofoods, Family Fare, Forest Hill Foods, No Frills, Supermercardo Nuestra Familia, and more. The company is also a distributor of grocery products to U.S. military commissaries.

SpartanNash reported second quarter 2024 results on August 15th, 2024. Net sales of $2.23 billion was a 3.5% decrease from $2.31 billion in the same prior year period. Adjusted earnings from continuing operations decreased by 9% year-over-year to $0.59 per share and Adjusted EBITDA declined by 2.4% to $64.5 million.

The company’s net long-term debt to adjusted EBITDA ratio declined sequentially from 2.4X to 2.2X during the quarter. Leadership maintained its guidance for fiscal 2024, expecting total net sales of approximately $9.60 billion, from $9.73 billion in 2023.

Click here to download our most recent Sure Analysis report on SpartanNash (preview of page 1 of 3 shown below):

Best Grocery Stock #1: Dollar General Corp. (DG)

- 5-year expected annual returns: 13.1%

Dollar General Corporation is the leading U.S. “dollar store”. About 80% of its items are offered at $5 or less. Dollar General sells a wide variety of merchandise in four categories: consumables, seasonal, home products, and apparel. About 77% of sales are from consumables.

Dollar General operated 20,345 stores as of August 2, 2024. Most stores are located in towns with 20,000 or fewer people and are about 7,400 sq. ft. Total sales were $38.7B in FY 2023.

Dollar General reported Q2 FY2024 results on August 29th, 2024. After excellent performance during and immediately after the COVID-19 pandemic, the company is experiencing significant weakness.

However, Dollar General is still growing albeit more slowly because of new store openings, offset by lower organic sales and store closures. But high inflation is affecting input costs, especially compensation, pressuring margins and earnings per share.

Net sales increased 4.2% to $10,210.4M from $9,796.2M on a year-over-year basis as organic sales fell 0.5% and new stores opened offset by store closures and lower average transactions.

Click here to download our most recent Sure Analysis report on DG (preview of page 1 of 3 shown below):

Final Thoughts

The grocery industry is changing like never before. Now that Amazon has acquired Whole Foods, the company will likely accelerate its push into the grocery industry even further, especially with new technologies such as cashier-less stores.

That said, the top grocery stocks have decades of experience in the retail industry. They have proven the ability to navigate difficult conditions before and adapt when necessary.

Broadly speaking, the grocery industry is attractive for investors right now. Investors looking to buy grocery stocks should focus on those with durable competitive advantages and the financial strength to continue investing in growth.

Target and Walmart have the longest histories of annual dividend increases, while Kroger, Costco, SpartanNash, and Dollar General also have meaningful dividend growth histories.

Additional Resources

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly: