Updated on September 25th, 2024 by Bob Ciura

Mortgage Real Estate Investment Trusts (i.e., “REITs”) – often referred to as “mREITs” – can provide a very attractive source of income for investors.

This is because they invest in mortgages that are typically backed by hard assets (commercial and/or residential real estate) with fairly conservative loan-to-value ratios.

Mortgage REITs finance these portfolios with a mixture of equity (that they raise by selling shares to investors) and debt that they generally raise at an interest cost that is meaningfully lower than the interest rates they can command on their real estate mortgage investments.

The result is significant and stable cash flow for the mREIT.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Moreover, as REITs they are exempt from having to pay corporate taxes on their net interest income and are required to pay out at least 90% of their taxable income to shareholders via dividends.

This generally means that mREIT shareholders earn very high dividend yields, making mREIT shares an exceptional source of passive income.

Of course, due to their significant amount of leverage, mortgage REITs come with risks that occasionally lead to dividend cuts.

As a result, investors need to be prudent when selecting which mREITs to invest in.

This article will list the 10 highest yielding mortgage REITs in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- #10: New York Mortgage Trust (NYMT)

- #9: Sachem Capital (SACH)

- #8: Dynex Capital (DX)

- #7: Annaly Capital Management (NLY)

- #6: Two Harbors Investment Corp. (TWO)

- #5: Ares Commercial Real Estate Corporation (ACRE)

- #4: Ellington Credit Co. (EARN)

- #3: AGNC Investment Corporation (AGNC)

- #2: ARMOUR Residential REIT (ARR)

- #1: Orchid Island Capital, Inc. (ORC)

#10: New York Mortgage Trust (NYMT)

- Dividend Yield: 12.0%

New York Mortgage Trust acquires, invests in, finances, and manages mortgage-related assets and other financial assets. The trust doesn’t own physical real estate, but rather seeks to manage a portfolio of investments that are real estate related.

The trust invests in residential mortgage loans, multi family CMBS, preferred equity, and joint venture equity.

NYMT posted second quarter earnings on July 31st, 2024, and results were quite weak once again. Adjusted earnings-per-share came to a loss of 25 cents, which missed estimates for a profit of a dime by 35 cents. Total net interest income was $19.04 million, which was up 26% year-over-year, but still missed estimates by over $4 million.

Management noted that recent interest rate market activity was indicative of falling inflation and a slowing economy, with the two-year Treasury falling 29 basis points from its 2024 peak.

Click here to download our most recent Sure Analysis report on NYMT (preview of page 1 of 3 shown below):

#9: Sachem Capital (SACH)

- Dividend Yield: 12.1%

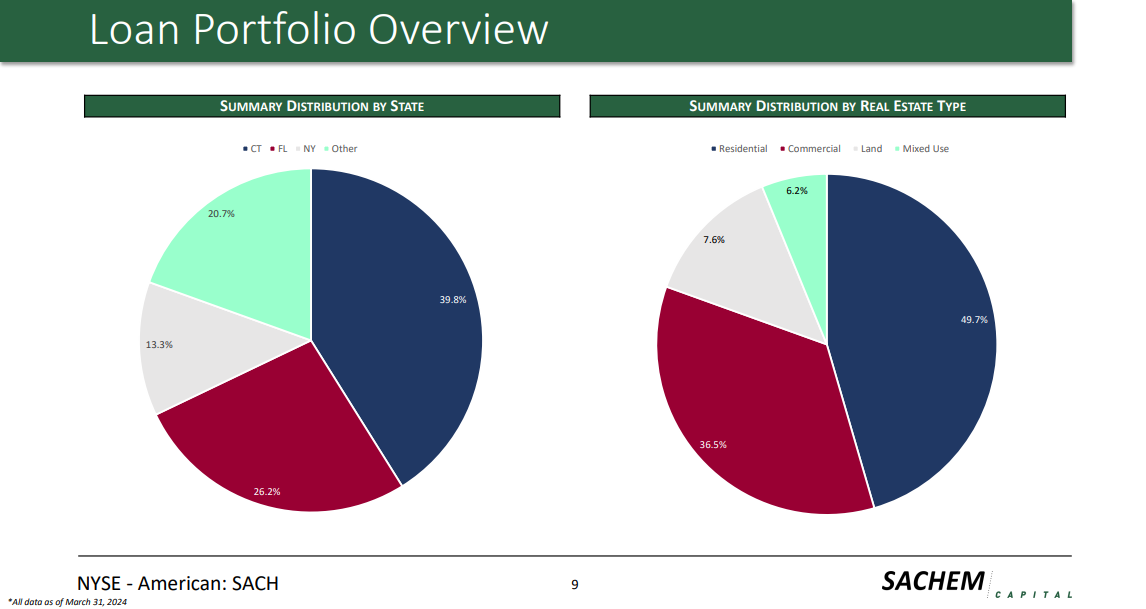

Sachem Capital Corp is a Connecticut-based real estate finance company that specializes in originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or less) loans secured by first mortgage liens on real property located primarily in Connecticut.

Each of Sachem’s loans is personally guaranteed by the principal(s) of the borrower, which is typically collaterally secured by a pledge of the guarantor’s interest in the borrower. Sachem generates around $65 million in total revenues.

Source: Investor Presentation

On August 14th, 2024, Sachem Capital posted its Q2 results for the period ending June 30th, 2024. Total revenues for the quarter came in at $15.2 million, down 7% compared to Q2-2023.

The decrease in interest income was due to lower number of loans originated, modified or extended in compared to last year. As a result, fee income from loans, primarily made up of origination fees, were down about 37.2% year-over-year.

Click here to download our most recent Sure Analysis report on SACH (preview of page 1 of 3 shown below):

#8: Dynex Capital (DX)

- Dividend Yield: 12.4%

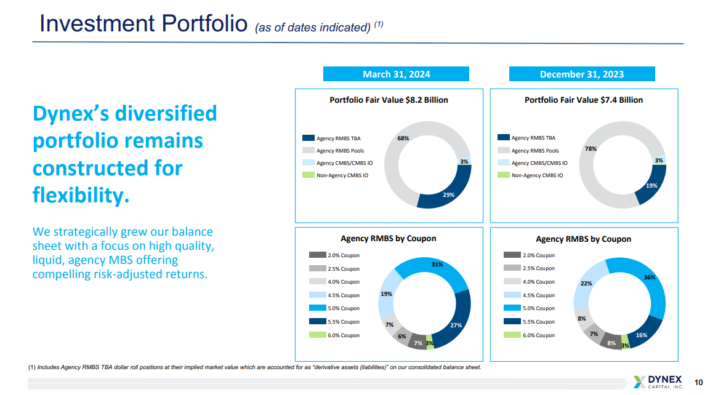

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor Presentation

In the first quarter of 2024, the company demonstrated solid financial performance with a total economic return of $0.28 per common share, equivalent to 2.1% of the beginning book value. Book value per common share stood at $13.20 as of March 31, 2024.

Comprehensive income amounted to $0.35 per common share, with net income reaching $0.65 per common share. Dividends declared for the quarter amounted to $0.39 per common share.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

#7: Annaly Capital Management (NLY)

- Dividend Yield: 12.6%

Annaly Capital Management, Inc. is an mREIT that invests in residential and commercial mortgages. The trust’s investments include agency mortgage-backed securities, non-agency residential mortgage assets, residential mortgage loans, commercial mortgage loans, securities, and other commercial real estate investments.

Annaly operates as a broker-dealer, financing middle-market businesses backed by private equity.

On July 24, 2024, Annaly announced its financial results for the quarter ending June 30, 2024. The company reported a GAAP net loss of $0.09 per average common share, while earnings available for distribution (EAD) were $0.68 per average common share for the quarter. The company achieved an economic return of 0.9% for the second quarter and 5.7% for the first half of 2024.

Book value per common share at the end of the quarter was $19.25. Annaly’s GAAP leverage ratio increased to 7.1x, up from 6.7x in the prior quarter, while economic leverage rose to 5.8x from 5.6x. The company declared a quarterly common stock cash dividend of $0.65 per share.

Click here to download our most recent Sure Analysis report on NLY (preview of page 1 of 3 shown below):

#6: Two Harbors Investment Corp. (TWO)

- Dividend Yield: 13.0%

Two Harbors Investment Corp. is a residential mortgage real estate investment trust (mREIT). As such, it focuses on residential mortgage-backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and commercial real estate.

The trust derives nearly all of its revenue in the form of interest through available-for-sale securities.

Two Harbors Investment Corp. (TWO) reported its second-quarter 2024 financial results, showing earnings per share (EPS) of $0.17, missing estimates by $0.27. Revenue for the quarter was -$38.25 million, down 8.48% year-over-year, missing expectations by $328,000.

Despite the challenging market conditions, the company delivered stable results, maintaining a book value of $15.19 per common share and declaring a second-quarter common stock dividend of $0.45 per share. For the first six months of 2024, Two Harbors generated a 5.8% total economic return on book value.

The company generated comprehensive income of $0.5 million, or $0.00 per weighted average basic common share, and repurchased $10.0 million in convertible senior notes due 2026.

Click here to download our most recent Sure Analysis report on TWO (preview of page 1 of 3 shown below):

#5: Ares Commercial Real Estate Corporation (ACRE)

- Dividend Yield: 13.6%

Ares Commercial Real Estate Corporation is a specialty finance company primarily engaged in originating and investing in commercial real estate (“CRE”) loans and related investments. ACRE generated around $198.6 million in interest income last year.

In terms of geographical diversification, ACRE’s exposure features a healthy mix between the Southeast, West, and Midwest.

On August 6th, 2024, ACRE reported its Q2 results for the period ending June 30th, 2024. Interest income came in at $40.8 million, 21% lower year-over-year.

The decline was due to the company’s loans struggling to perform as higher rates of inflation and certain cultural shifts such as work-from-home trends continue to impact the operating performance and the economic values of commercial real estate.

In the meantime, interest expense rose by 2% to about $27.5 million. Thus, total revenues (interest income – interest expenses + $3.43 million in revenue from ACRE’s own real estate) fell by 33% to roughly $16.8 million.

Click here to download our most recent Sure Analysis report on ACRE (preview of page 1 of 3 shown below):

#4: Ellington Credit Co. (EARN)

- Dividend Yield: 13.7%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On May 14th, 2024, Ellington Residential reported its first quarter results for the period ending March 31st, 2024. The company generated net income of $4.0 million, or $0.20 per share.

Ellington achieved adjusted distributable earnings of $5.3 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 3.03% overall. At quarter end, Ellington had $22.4 million of cash and cash equivalents, and $57.1 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

#3: AGNC Investment Corporation (AGNC)

- Dividend Yield: 13.8%

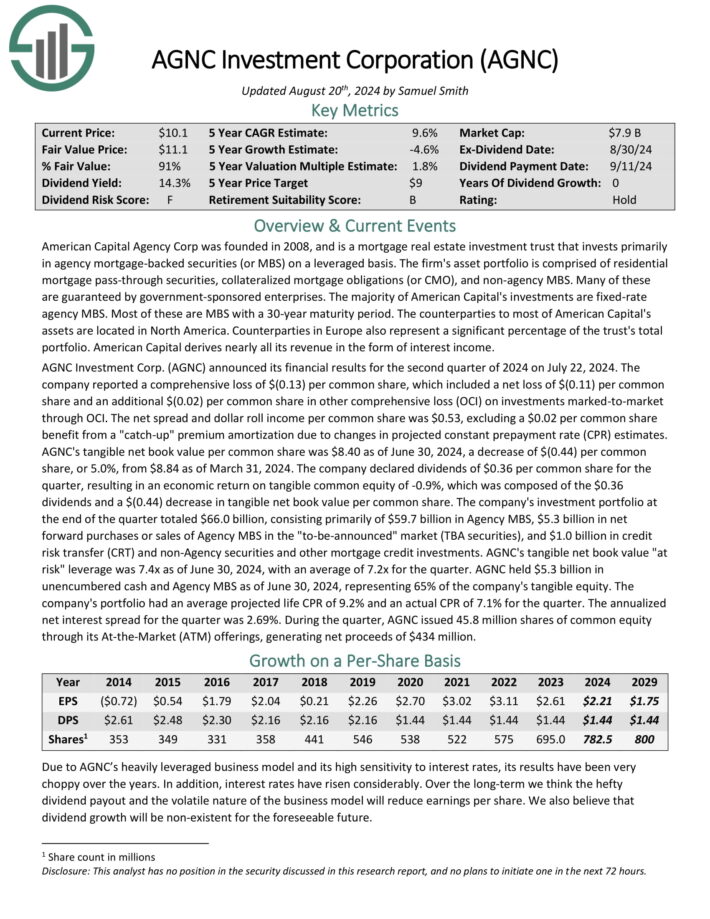

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

AGNC Investment Corp. (AGNC) announced its financial results for the second quarter of 2024 on July 22, 2024. The company reported a comprehensive loss of $(0.13) per common share, which included a net loss of $(0.11) per common share and an additional $(0.02) per common share in other comprehensive loss (OCI) on investments marked-to market through OCI.

The net spread and dollar roll income per common share was $0.53, excluding a $0.02 per common share benefit from a “catch-up” premium amortization due to changes in projected constant prepayment rate (CPR) estimates.

AGNC’s tangible net book value per common share was $8.40 as of June 30, 2024, a decrease of $(0.44) per common share, or 5.0%, from $8.84 as of March 31, 2024.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

#2: ARMOUR Residential REIT (ARR)

- Dividend Yield: 14.1%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

ARR reported its unaudited second-quarter 2024 financial results and financial position as of June 30, 2024. The company announced a GAAP net loss related to common stockholders of $(51.3) million or $(1.05) per common share.

The company generated net interest income of $7.0 million and distributable earnings available to common stockholders of $52.5 million, equating to $1.08 per common share.

ARMOUR paid common stock dividends of $0.24 per share per month, totaling $0.72 per share for the second quarter. The average interest income on interest-earning assets was 5.00%, while the interest cost on average interest-bearing liabilities was 5.52%. The economic interest income was 4.74%, with an economic net interest spread of 2.05%.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

#1: Orchid Island Capital, Inc. (ORC)

- Dividend Yield: 17.8%

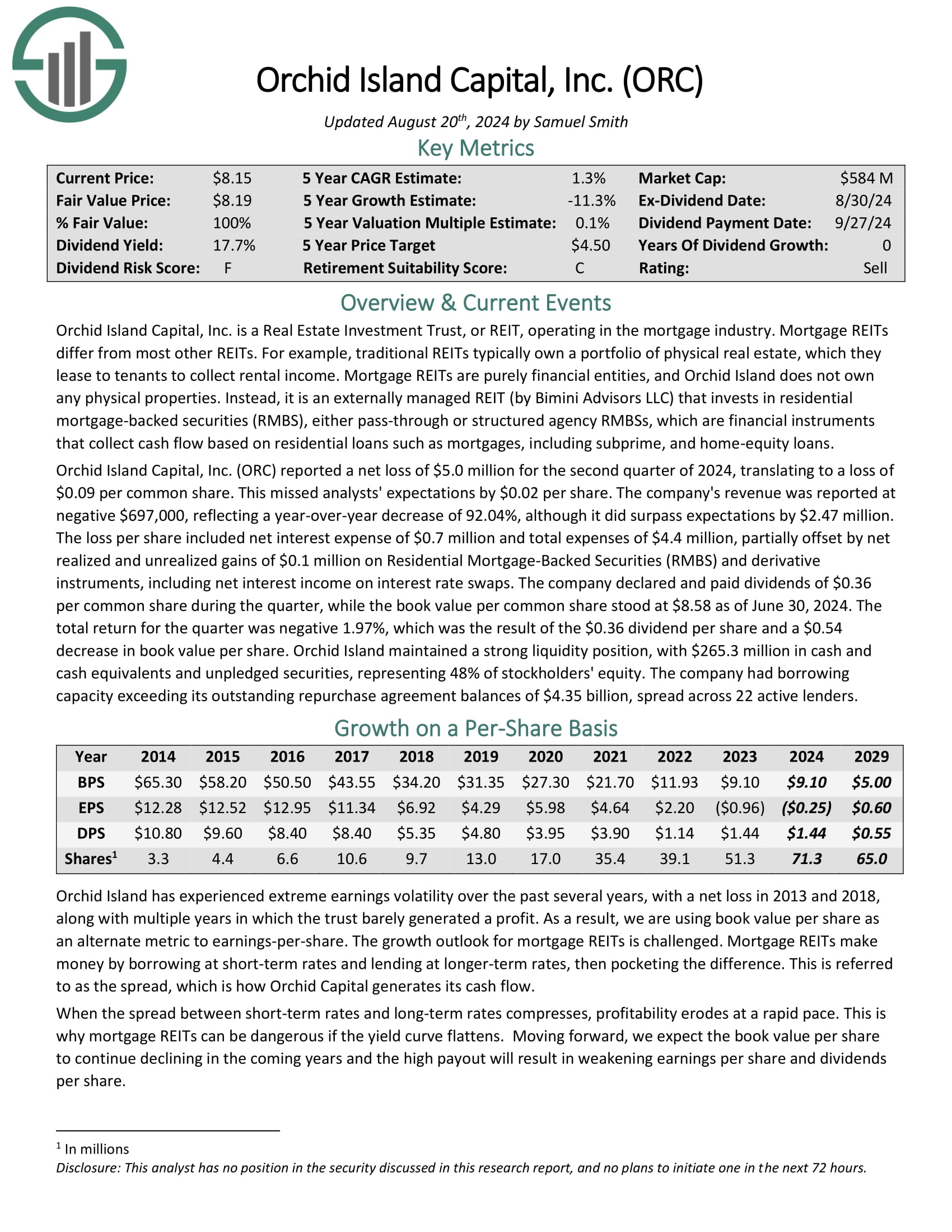

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Orchid Island reported a net loss of $5.0 million for the second quarter of 2024, translating to a loss of $0.09 per common share. This missed analysts’ expectations by $0.02 per share. The company’s revenue was reported at negative $697,000, reflecting a year-over-year decrease of 92.04%, although it did surpass expectations by $2.47 million.

The loss per share included net interest expense of $0.7 million and total expenses of $4.4 million, partially offset by net realized and unrealized gains of $0.1 million on Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including net interest income on interest rate swaps.

The company declared and paid dividends of $0.36 per common share during the quarter, while the book value per common share stood at $8.58 as of June 30, 2024.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Conclusion

As you can see from the dividend yields offered by the ten stocks discussed in this article, mREITs can be powerful passive income generators.

However, investors need to be careful before investing in this sector, given that dividend cuts can be common during periods of economic stress. As a result, diversification and a focus on quality are essential.

You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments:

- Dividend Kings List: Dividend Stocks With 50+ Years of Rising Dividends

- The Highest Yielding Dividend Kings List: The 20 Dividend Kings with the highest current yields.

- Dividend Aristocrats List: 25+ Years of Rising Dividends

- The Highest Yielding Dividend Aristocrats List: The 20 Dividend Aristocrats with the highest current yields.

- Blue Chip Stocks List: Stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

- Dividend Champions List: 25+ years of rising dividends, that do not qualify as Dividend Aristocrats

- Dividend Achievers List: NASDAQ stocks with 10+ years of dividend increases

Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors.

By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise.

To that end, Sure Dividend has created the following two articles:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends: